Analysts’ Viewpoint

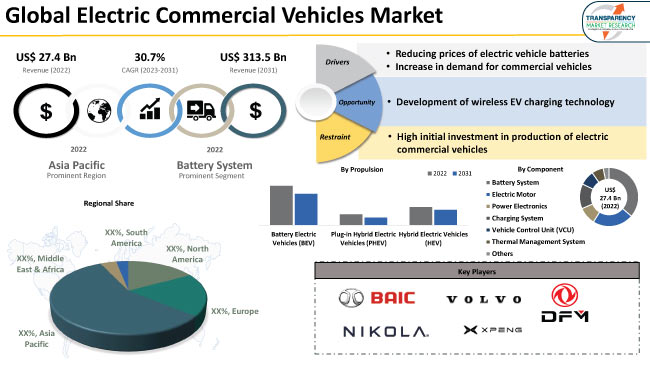

Increase in demand for commercial vehicles and decrease in prices of EV batteries are significantly boosting the global electric commercial vehicles market. Rise in adoption of electric vehicles due to increase in concerns about climate change and air pollution is also contributing to market growth. Several companies are embracing sustainability goals and incorporating electric commercial vehicles (ECVs) into their fleets as part of corporate social responsibility initiatives. This is creating value-grab electric commercial vehicles market opportunities for these companies.

Manufacturers are focusing on offering advanced ECVs to their customers. Furthermore, technological advancement in batteries is driving the ECV market. Improvement in charging infrastructure and faster-charging capabilities are making electric commercial vehicles more practical and convenient for businesses. Advancements in autonomous driving technology and connectivity are expected to further enhance the value proposition of ECVs.

Electric commercial vehicle refers to a type of vehicle that is designed for commercial or business purposes and is powered by electricity instead of the traditional internal combustion engine (ICE). These vehicles utilize electric motors and battery packs to provide the necessary power for propulsion.

Various types of electric commercial vehicles are available in the market These include light commercial vehicles and heavy commercial vehicles. Demand for electric commercial trucks is increasing at a rapid pace in several regions.

Electric goods vehicles are specifically designed to meet the requirements of commercial operations such as transportation of products and people. These vehicles offer several advantages over their traditional gasoline or diesel counterparts, including reduced emissions, lower operating costs, and quieter operation. Applications of electric commercial vehicles are rising in several industries.

The electric drivetrain of commercial vehicles typically consists of an electric motor, a set of batteries to store electrical energy, and a power control system. The motor converts electrical energy from batteries into mechanical energy, which drives the vehicle's wheels. Batteries are charged by plugging the vehicle into a power source such as an electric charging station.

Governments of various countries around the world are implementing stringent emission standards and regulations to combat climate change and air pollution. These regulations often favor the adoption of electric vehicles (EVs) over traditional internal combustion engine (ICE) vehicles.

Electric vehicles, including electric commercial vehicles, offer significant advantages in terms of operating costs and maintenance compared to conventional vehicles. The upfront purchase cost of electric vehicles is generally higher; however, decrease in energy and maintenance costs over the vehicle's lifetime can result in a lower total cost of ownership. This cost-effectiveness makes electric commercial vehicles an attractive option for fleet operators, logistics companies, and businesses that rely on transportation services. In turn, this is fueling electric commercial vehicles market demand.

Several companies are actively prioritizing sustainability and incorporating environmental considerations into their corporate strategies. The switch toward electric commercial vehicles is in line with their CSR (Corporate Social Responsibility) initiatives, as it demonstrates a commitment to reducing carbon footprint and promoting a greener future.

Thus, rise in demand for commercial vehicles among such companies is leading to a substantial increase in electric commercial vehicles market revenue.

Lower battery prices make electric commercial vehicles more cost-competitive compared to traditional internal combustion engine vehicles. The upfront price of an electric vehicle decreases as the cost of battery reduces. This narrows down the price gap between EVs and conventional vehicles, thereby making electric commercial vehicles a more viable and economically attractive option for fleet operators.

Lower battery prices incentivize the development of charging infrastructure for electric vehicles, including charging stations for commercial fleets. Businesses and governments are willing to invest in charging infrastructure to support the adoption of electric commercial vehicles due to the reduction in price of batteries. This, in turn, promotes the growth of the ECV market by alleviating range anxiety and providing convenient charging solutions for fleet operators.

Electric commercial vehicles can cover greater distances with more efficient batteries. Therefore, they are more versatile and suitable for various business operations. Battery technology advancements coupled with reduced prices have led to an improvement in energy density and increase in range of electric commercial vehicles.

As per the latest electric commercial vehicles market analysis, the battery system component segment dominated the global industry in 2022. It is likely to lead the global landscape during the forecast period.

Demand for electric vehicles, including commercial vehicles, is increasing across the globe due to the rise in environmental concerns and government regulations. This is fueling the need for advanced battery systems to power these vehicles.

Ongoing advancements in battery technology are enhancing the performance and efficiency of electric vehicle batteries. Research and development activities are being carried out to improve battery energy density, charging speed, and overall lifespan, thus making electric commercial vehicles more practical and viable for various applications.

Expansion of the charging infrastructure is crucial for widespread adoption of electric vehicles, especially commercial vehicles. Governments, private companies, and utilities are investing in charging networks, including fast-charging stations, to support the electrification of transportation. This infrastructure development is further augmenting the demand for battery systems in ECVs.

According to the electric commercial vehicles market forecast, Asia Pacific is anticipated to dominate the global landscape during the forecast period.

Several countries in Asia Pacific have implemented favorable policies and incentives to promote the adoption of electric vehicles (EVs), including commercial vehicles. These policies include subsidies, tax benefits, and infrastructure development plans, which have encouraged businesses to transition to electric commercial vehicles. This is positively impacting market expansion in the region.

Increase in awareness about environmental issues, such as air pollution and climate change, has led to a growth in demand for cleaner transportation solutions in Asia Pacific. Electric commercial vehicles play a vital role in reducing emissions and achieving sustainability goals.

Continuous advancements in battery technology in Asia Pacific have led to improved performance, longer ranges, and reduced charging times for electric vehicles. Growth in adoption of EVs across various industries is further fueling market progress in the region.

The global landscape is highly competitive, with the presence of several prominent players that control majority of the electric commercial vehicles market share.

Key players operating in the global electric commercial vehicles market are Anhui Jianghuai Automobile Group (JAC), Arrival, Ashok Leyland, BAIC Group, Bollinger Motors, BYD, Chanje Energy, Daimler (Mercedes-Benz), Dongfeng Motor Corporation, EMOSS, Fisker, Ford, Hino Motors, Kamaz, Lion Electric, Mahindra Electric, Mitsubishi Fuso Truck and Bus Corporation, Navistar International Corp., Nikola Motor Company, NIO, Proterra, Renault, Rivian, Shenzhen Wuzhoulong Motors, Tesla, Volkswagen Group, Volvo Group, Workhorse Group, and Xpeng Motors. These companies are following the latest electric commercial vehicles market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the electric commercial vehicles market report based on parameters such as product portfolio, company overview, business segments, latest developments, financial overview, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 27.4 Bn |

|

Market Forecast Value in 2031 |

US$ 313.5 Bn |

|

Growth Rate (CAGR) |

30.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 27.4 Bn in 2022

It is likely to advance at a CAGR of 30.7% by 2031

It would be worth US$ 313.5 Bn in 2031

Decrease in prices of EV batteries and increase in demand for commercial vehicles

The battery system component segment accounted for major share in 2022

Asia Pacific is anticipated to be the most lucrative region during the forecast period

Anhui Jianghuai Automobile Group (JAC), Arrival, Ashok Leyland, BAIC Group, Bollinger Motors, BYD, Chanje Energy, Daimler (Mercedes-Benz), Dongfeng Motor Corporation, EMOSS, Fisker, Ford, Hino Motors, Kamaz, Lion Electric, Mahindra Electric, Mitsubishi Fuso Truck and Bus Corporation, Navistar International Corp., Nikola Motor Company, NIO, Proterra, Renault, Rivian, Shenzhen Wuzhoulong Motors, Tesla, Volkswagen Group, Volvo Group, Workhorse Group, and Xpeng Motors

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Electric Commercial Vehicles Market, By Component

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

3.2.1. Battery System

3.2.2. Electric Motor

3.2.3. Power Electronics

3.2.3.1. Inverter

3.2.3.2. DC-DC Converter

3.2.4. Charging System

3.2.5. Vehicle Control Unit (VCU)

3.2.6. Thermal Management System

3.2.6.1. Cooling System

3.2.6.2. Heating System

3.2.7. Others

4. Global Electric Commercial Vehicles Market, By Battery Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

4.2.1. Lithium-Iron-Phosphate (LFP)

4.2.2. Nickel-Manganese-Cobalt (NMC)

4.2.3. Solid-state

4.2.4. Others

5. Global Electric Commercial Vehicles Market, By Battery Capacity

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

5.2.1. Less than 100 kWh

5.2.2. 100 kWh - 300 kWh

5.2.3. 301 kWh - 600 kWh

5.2.4. More than 600 kWh

6. Global Electric Commercial Vehicles Market, By Power Output

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

6.2.1. Less than 100 kW

6.2.2. 100 kW - 250 kW

6.2.3. More than 250 kW

7. Global Electric Commercial Vehicles Market, By Range

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

7.2.1. Less than 150 Miles

7.2.2. 150 Miles - 300 Miles

7.2.3. More than 300 Miles

8. Global Electric Commercial Vehicles Market, By Construction

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

8.2.1. Integrated

8.2.2. Semi-integrated

8.2.3. Full Size

9. Global Electric Commercial Vehicles Market, By Vehicle Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.2.1. Light Commercial Vehicles

9.2.1.1. Vans

9.2.1.2. Pickup Trucks

9.2.2. Medium and Heavy Commercial Vehicles

9.2.3. Buses and Coaches

10. Global Electric Commercial Vehicles Market, By Propulsion

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

10.2.1. Battery Electric Vehicles (BEV)

10.2.2. Plug-in Hybrid Electric Vehicles (PHEV)

10.2.3. Hybrid Electric Vehicles (HEV)

11. Global Electric Commercial Vehicles Market, By End-user

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

11.2.1. Last Mile Delivery

11.2.2. Distribution Services

11.2.3. Field Services

11.2.4. Long Haul Services

11.2.5. Refuse Trucks

12. Global Electric Commercial Vehicles Market, By Ownership

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

12.2.1. Fleet-owned

12.2.2. Owner-operated

13. Global Electric Commercial Vehicles Market, By Region

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Region

13.2.1. North America

13.2.2. Europe

13.2.3. Asia Pacific

13.2.4. Middle East & Africa

13.2.5. South America

14. North America Electric Commercial Vehicles Market

14.1. Market Snapshot

14.2. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

14.2.1. Battery System

14.2.2. Electric Motor

14.2.3. Power Electronics

14.2.3.1. Inverter

14.2.3.2. DC-DC Converter

14.2.4. Charging System

14.2.5. Vehicle Control Unit (VCU)

14.2.6. Thermal Management System

14.2.6.1. Cooling System

14.2.6.2. Heating System

14.2.7. Others

14.3. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

14.3.1. Lithium-Iron-Phosphate (LFP)

14.3.2. Nickel-Manganese-Cobalt (NMC)

14.3.3. Solid-state

14.3.4. Others

14.4. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

14.4.1. Less than 100 kWh

14.4.2. 100 kWh - 300 kWh

14.4.3. 301 kWh - 600 kWh

14.4.4. More than 600 kWh

14.5. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

14.5.1. Less than 100 kW

14.5.2. 100 kW - 250 kW

14.5.3. More than 250 kW

14.6. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

14.6.1. Less than 150 Miles

14.6.2. 150 Miles - 300 Miles

14.6.3. More than 300 Miles

14.7. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

14.7.1. Integrated

14.7.2. Semi-integrated

14.7.3. Full Size

14.8. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.8.1. Light Commercial Vehicles

14.8.1.1. Vans

14.8.1.2. Pickup Trucks

14.8.2. Medium and Heavy Commercial Vehicles

14.8.3. Buses and Coaches

14.9. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

14.9.1. Battery Electric Vehicles (BEV)

14.9.2. Plug-in Hybrid Electric Vehicles (PHEV)

14.9.3. Hybrid Electric Vehicles (HEV)

14.10. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

14.10.1. Last Mile Delivery

14.10.2. Distribution Services

14.10.3. Field Services

14.10.4. Long Haul Services

14.10.5. Refuse Trucks

14.11. North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

14.11.1. Fleet-owned

14.11.2. Owner-operated

14.12. Key Country Analysis - North America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Mexico

15. Europe Electric Commercial Vehicles Market

15.1. Market Snapshot

15.2. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

15.2.1. Battery System

15.2.2. Electric Motor

15.2.3. Power Electronics

15.2.3.1. Inverter

15.2.3.2. DC-DC Converter

15.2.4. Charging System

15.2.5. Vehicle Control Unit (VCU)

15.2.6. Thermal Management System

15.2.6.1. Cooling System

15.2.6.2. Heating System

15.2.7. Others

15.3. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

15.3.1. Lithium-Iron-Phosphate (LFP)

15.3.2. Nickel-Manganese-Cobalt (NMC)

15.3.3. Solid-state

15.3.4. Others

15.4. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

15.4.1. Less than 100 kWh

15.4.2. 100 kWh - 300 kWh

15.4.3. 301 kWh - 600 kWh

15.4.4. More than 600 kWh

15.5. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

15.5.1. Less than 100 kW

15.5.2. 100 kW - 250 kW

15.5.3. More than 250 kW

15.6. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

15.6.1. Less than 150 Miles

15.6.2. 150 Miles - 300 Miles

15.6.3. More than 300 Miles

15.7. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

15.7.1. Integrated

15.7.2. Semi-integrated

15.7.3. Full Size

15.8. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.8.1. Light Commercial Vehicles

15.8.1.1. Vans

15.8.1.2. Pickup Trucks

15.8.2. Medium and Heavy Commercial Vehicles

15.8.3. Buses and Coaches

15.9. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

15.9.1. Battery Electric Vehicles (BEV)

15.9.2. Plug-in Hybrid Electric Vehicles (PHEV)

15.9.3. Hybrid Electric Vehicles (HEV)

15.10. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

15.10.1. Last Mile Delivery

15.10.2. Distribution Services

15.10.3. Field Services

15.10.4. Long Haul Services

15.10.5. Refuse Trucks

15.11. Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

15.11.1. Fleet-owned

15.11.2. Owner-operated

15.12. Key Country Analysis - Europe Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031

15.12.1. Germany

15.12.2. U. K.

15.12.3. France

15.12.4. Italy

15.12.5. Spain

15.12.6. Nordic Countries

15.12.7. Russia & CIS

15.12.8. Rest of Europe

16. Asia Pacific Electric Commercial Vehicles Market

16.1. Market Snapshot

16.2. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

16.2.1. Battery System

16.2.2. Electric Motor

16.2.3. Power Electronics

16.2.3.1. Inverter

16.2.3.2. DC-DC Converter

16.2.4. Charging System

16.2.5. Vehicle Control Unit (VCU)

16.2.6. Thermal Management System

16.2.6.1. Cooling System

16.2.6.2. Heating System

16.2.7. Others

16.3. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

16.3.1. Lithium-Iron-Phosphate (LFP)

16.3.2. Nickel-Manganese-Cobalt (NMC)

16.3.3. Solid-state

16.3.4. Others

16.4. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

16.4.1. Less than 100 kWh

16.4.2. 100 kWh - 300 kWh

16.4.3. 301 kWh - 600 kWh

16.4.4. More than 600 kWh

16.5. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

16.5.1. Less than 100 kW

16.5.2. 100 kW - 250 kW

16.5.3. More than 250 kW

16.6. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

16.6.1. Less than 150 Miles

16.6.2. 150 Miles - 300 Miles

16.6.3. More than 300 Miles

16.7. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

16.7.1. Integrated

16.7.2. Semi-integrated

16.7.3. Full Size

16.8. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

16.8.1. Light Commercial Vehicles

16.8.1.1. Vans

16.8.1.2. Pickup Trucks

16.8.2. Medium and Heavy Commercial Vehicles

16.8.3. Buses and Coaches

16.9. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

16.9.1. Battery Electric Vehicles (BEV)

16.9.2. Plug-in Hybrid Electric Vehicles (PHEV)

16.9.3. Hybrid Electric Vehicles (HEV)

16.10. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

16.10.1. Last Mile Delivery

16.10.2. Distribution Services

16.10.3. Field Services

16.10.4. Long Haul Services

16.10.5. Refuse Trucks

16.11. Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

16.11.1. Fleet-owned

16.11.2. Owner-operated

16.12. Key Country Analysis - Asia Pacific Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. ASEAN Countries

16.12.5. South Korea

16.12.6. ANZ

16.12.7. Rest of Asia Pacific

17. Middle East & Africa Electric Commercial Vehicles Market

17.1. Market Snapshot

17.2. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

17.2.1. Battery System

17.2.2. Electric Motor

17.2.3. Power Electronics

17.2.3.1. Inverter

17.2.3.2. DC-DC Converter

17.2.4. Charging System

17.2.5. Vehicle Control Unit (VCU)

17.2.6. Thermal Management System

17.2.6.1. Cooling System

17.2.6.2. Heating System

17.2.7. Others

17.3. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

17.3.1. Lithium-Iron-Phosphate (LFP)

17.3.2. Nickel-Manganese-Cobalt (NMC)

17.3.3. Solid-state

17.3.4. Others

17.4. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

17.4.1. Less than 100 kWh

17.4.2. 100 kWh - 300 kWh

17.4.3. 301 kWh - 600 kWh

17.4.4. More than 600 kWh

17.5. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

17.5.1. Less than 100 kW

17.5.2. 100 kW - 250 kW

17.5.3. More than 250 kW

17.6. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

17.6.1. Less than 150 Miles

17.6.2. 150 Miles - 300 Miles

17.6.3. More than 300 Miles

17.7. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

17.7.1. Integrated

17.7.2. Semi-integrated

17.7.3. Full Size

17.8. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

17.8.1. Light Commercial Vehicles

17.8.1.1. Vans

17.8.1.2. Pickup Trucks

17.8.2. Medium and Heavy Commercial Vehicles

17.8.3. Buses and Coaches

17.9. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

17.9.1. Battery Electric Vehicles (BEV)

17.9.2. Plug-in Hybrid Electric Vehicles (PHEV)

17.9.3. Hybrid Electric Vehicles (HEV)

17.10. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

17.10.1. Last Mile Delivery

17.10.2. Distribution Services

17.10.3. Field Services

17.10.4. Long Haul Services

17.10.5. Refuse Trucks

17.11. Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

17.11.1. Fleet-owned

17.11.2. Owner-operated

17.12. Key Country Analysis - Middle East & Africa Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Turkey

17.12.4. Rest of Middle East & Africa

18. South America Electric Commercial Vehicles Market

18.1. Market Snapshot

18.2. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Component

18.2.1. Battery System

18.2.2. Electric Motor

18.2.3. Power Electronics

18.2.3.1. Inverter

18.2.3.2. DC-DC Converter

18.2.4. Charging System

18.2.5. Vehicle Control Unit (VCU)

18.2.6. Thermal Management System

18.2.6.1. Cooling System

18.2.6.2. Heating System

18.2.7. Others

18.3. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Type

18.3.1. Lithium-Iron-Phosphate (LFP)

18.3.2. Nickel-Manganese-Cobalt (NMC)

18.3.3. Solid-state

18.3.4. Others

18.4. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Battery Capacity

18.4.1. Less than 100 kWh

18.4.2. 100 kWh - 300 kWh

18.4.3. 301 kWh - 600 kWh

18.4.4. More than 600 kWh

18.5. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Power Output

18.5.1. Less than 100 kW

18.5.2. 100 kW - 250 kW

18.5.3. More than 250 kW

18.6. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Range

18.6.1. Less than 150 Miles

18.6.2. 150 Miles - 300 Miles

18.6.3. More than 300 Miles

18.7. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Construction

18.7.1. Integrated

18.7.2. Semi-integrated

18.7.3. Full Size

18.8. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

18.8.1. Light Commercial Vehicles

18.8.1.1. Vans

18.8.1.2. Pickup Trucks

18.8.2. Medium and Heavy Commercial Vehicles

18.8.3. Buses and Coaches

18.9. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Propulsion

18.9.1. Battery Electric Vehicles (BEV)

18.9.2. Plug-in Hybrid Electric Vehicles (PHEV)

18.9.3. Hybrid Electric Vehicles (HEV)

18.10. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By End-user

18.10.1. Last Mile Delivery

18.10.2. Distribution Services

18.10.3. Field Services

18.10.4. Long Haul Services

18.10.5. Refuse Trucks

18.11. South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031, By Ownership

18.11.1. Fleet-owned

18.11.2. Owner-operated

18.12. Key Country Analysis - South America Electric Commercial Vehicles Market Size Analysis & Forecast, 2017-2031

18.12.1. Brazil

18.12.2. Argentina

18.12.3. Rest of South America

19. Competitive Landscape

19.1. Company Share Analysis/ Brand Share Analysis, 2022

19.2. Pricing Comparison Among Key Players

19.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

20. Company Profile/ Key Players

20.1. Anhui Jianghuai Automobile Group (JAC)

20.1.1. Company Overview

20.1.2. Company Footprints

20.1.3. Production Locations

20.1.4. Product Portfolio

20.1.5. Competitors & Customers

20.1.6. Subsidiaries & Parent Organization

20.1.7. Recent Developments

20.1.8. Financial Analysis

20.1.9. Profitability

20.1.10. Revenue Share

20.2. Arrival

20.2.1. Company Overview

20.2.2. Company Footprints

20.2.3. Production Locations

20.2.4. Product Portfolio

20.2.5. Competitors & Customers

20.2.6. Subsidiaries & Parent Organization

20.2.7. Recent Developments

20.2.8. Financial Analysis

20.2.9. Profitability

20.2.10. Revenue Share

20.3. Ashok Leyland

20.3.1. Company Overview

20.3.2. Company Footprints

20.3.3. Production Locations

20.3.4. Product Portfolio

20.3.5. Competitors & Customers

20.3.6. Subsidiaries & Parent Organization

20.3.7. Recent Developments

20.3.8. Financial Analysis

20.3.9. Profitability

20.3.10. Revenue Share

20.4. BAIC Group

20.4.1. Company Overview

20.4.2. Company Footprints

20.4.3. Production Locations

20.4.4. Product Portfolio

20.4.5. Competitors & Customers

20.4.6. Subsidiaries & Parent Organization

20.4.7. Recent Developments

20.4.8. Financial Analysis

20.4.9. Profitability

20.4.10. Revenue Share

20.5. Bollinger Motors

20.5.1. Company Overview

20.5.2. Company Footprints

20.5.3. Production Locations

20.5.4. Product Portfolio

20.5.5. Competitors & Customers

20.5.6. Subsidiaries & Parent Organization

20.5.7. Recent Developments

20.5.8. Financial Analysis

20.5.9. Profitability

20.5.10. Revenue Share

20.6. BYD

20.6.1. Company Overview

20.6.2. Company Footprints

20.6.3. Production Locations

20.6.4. Product Portfolio

20.6.5. Competitors & Customers

20.6.6. Subsidiaries & Parent Organization

20.6.7. Recent Developments

20.6.8. Financial Analysis

20.6.9. Profitability

20.6.10. Revenue Share

20.7. Chanje Energy

20.7.1. Company Overview

20.7.2. Company Footprints

20.7.3. Production Locations

20.7.4. Product Portfolio

20.7.5. Competitors & Customers

20.7.6. Subsidiaries & Parent Organization

20.7.7. Recent Developments

20.7.8. Financial Analysis

20.7.9. Profitability

20.7.10. Revenue Share

20.8. Daimler (Mercedes-Benz)

20.8.1. Company Overview

20.8.2. Company Footprints

20.8.3. Production Locations

20.8.4. Product Portfolio

20.8.5. Competitors & Customers

20.8.6. Subsidiaries & Parent Organization

20.8.7. Recent Developments

20.8.8. Financial Analysis

20.8.9. Profitability

20.8.10. Revenue Share

20.9. Dongfeng Motor Corporation

20.9.1. Company Overview

20.9.2. Company Footprints

20.9.3. Production Locations

20.9.4. Product Portfolio

20.9.5. Competitors & Customers

20.9.6. Subsidiaries & Parent Organization

20.9.7. Recent Developments

20.9.8. Financial Analysis

20.9.9. Profitability

20.9.10. Revenue Share

20.10. EMOSS

20.10.1. Company Overview

20.10.2. Company Footprints

20.10.3. Production Locations

20.10.4. Product Portfolio

20.10.5. Competitors & Customers

20.10.6. Subsidiaries & Parent Organization

20.10.7. Recent Developments

20.10.8. Financial Analysis

20.10.9. Profitability

20.10.10. Revenue Share

20.11. Fisker

20.11.1. Company Overview

20.11.2. Company Footprints

20.11.3. Production Locations

20.11.4. Product Portfolio

20.11.5. Competitors & Customers

20.11.6. Subsidiaries & Parent Organization

20.11.7. Recent Developments

20.11.8. Financial Analysis

20.11.9. Profitability

20.11.10. Revenue Share

20.12. Ford

20.12.1. Company Overview

20.12.2. Company Footprints

20.12.3. Production Locations

20.12.4. Product Portfolio

20.12.5. Competitors & Customers

20.12.6. Subsidiaries & Parent Organization

20.12.7. Recent Developments

20.12.8. Financial Analysis

20.12.9. Profitability

20.12.10. Revenue Share

20.13. Hino Motors

20.13.1. Company Overview

20.13.2. Company Footprints

20.13.3. Production Locations

20.13.4. Product Portfolio

20.13.5. Competitors & Customers

20.13.6. Subsidiaries & Parent Organization

20.13.7. Recent Developments

20.13.8. Financial Analysis

20.13.9. Profitability

20.13.10. Revenue Share

20.14. Xpeng Motors

20.14.1. Company Overview

20.14.2. Company Footprints

20.14.3. Production Locations

20.14.4. Product Portfolio

20.14.5. Competitors & Customers

20.14.6. Subsidiaries & Parent Organization

20.14.7. Recent Developments

20.14.8. Financial Analysis

20.14.9. Profitability

20.14.10. Revenue Share

20.15. Kamaz

20.15.1. Company Overview

20.15.2. Company Footprints

20.15.3. Production Locations

20.15.4. Product Portfolio

20.15.5. Competitors & Customers

20.15.6. Subsidiaries & Parent Organization

20.15.7. Recent Developments

20.15.8. Financial Analysis

20.15.9. Profitability

20.15.10. Revenue Share

20.16. Lion Electric

20.16.1. Company Overview

20.16.2. Company Footprints

20.16.3. Production Locations

20.16.4. Product Portfolio

20.16.5. Competitors & Customers

20.16.6. Subsidiaries & Parent Organization

20.16.7. Recent Developments

20.16.8. Financial Analysis

20.16.9. Profitability

20.16.10. Revenue Share

20.17. Mahindra Electric

20.17.1. Company Overview

20.17.2. Company Footprints

20.17.3. Production Locations

20.17.4. Product Portfolio

20.17.5. Competitors & Customers

20.17.6. Subsidiaries & Parent Organization

20.17.7. Recent Developments

20.17.8. Financial Analysis

20.17.9. Profitability

20.17.10. Revenue Share

20.18. Mitsubishi Fuso Truck and Bus Corporation

20.18.1. Company Overview

20.18.2. Company Footprints

20.18.3. Production Locations

20.18.4. Product Portfolio

20.18.5. Competitors & Customers

20.18.6. Subsidiaries & Parent Organization

20.18.7. Recent Developments

20.18.8. Financial Analysis

20.18.9. Profitability

20.18.10. Revenue Share

20.19. Navistar International Corp.

20.19.1. Company Overview

20.19.2. Company Footprints

20.19.3. Production Locations

20.19.4. Product Portfolio

20.19.5. Competitors & Customers

20.19.6. Subsidiaries & Parent Organization

20.19.7. Recent Developments

20.19.8. Financial Analysis

20.19.9. Profitability

20.19.10. Revenue Share

20.20. Nikola Motor Company

20.20.1. Company Overview

20.20.2. Company Footprints

20.20.3. Production Locations

20.20.4. Product Portfolio

20.20.5. Competitors & Customers

20.20.6. Subsidiaries & Parent Organization

20.20.7. Recent Developments

20.20.8. Financial Analysis

20.20.9. Profitability

20.20.10. Revenue Share

20.21. NIO

20.21.1. Company Overview

20.21.2. Company Footprints

20.21.3. Production Locations

20.21.4. Product Portfolio

20.21.5. Competitors & Customers

20.21.6. Subsidiaries & Parent Organization

20.21.7. Recent Developments

20.21.8. Financial Analysis

20.21.9. Profitability

20.21.10. Revenue Share

20.22. Proterra

20.22.1. Company Overview

20.22.2. Company Footprints

20.22.3. Production Locations

20.22.4. Product Portfolio

20.22.5. Competitors & Customers

20.22.6. Subsidiaries & Parent Organization

20.22.7. Recent Developments

20.22.8. Financial Analysis

20.22.9. Profitability

20.22.10. Revenue Share

20.23. Renault

20.23.1. Company Overview

20.23.2. Company Footprints

20.23.3. Production Locations

20.23.4. Product Portfolio

20.23.5. Competitors & Customers

20.23.6. Subsidiaries & Parent Organization

20.23.7. Recent Developments

20.23.8. Financial Analysis

20.23.9. Profitability

20.23.10. Revenue Share

20.24. Rivian

20.24.1. Company Overview

20.24.2. Company Footprints

20.24.3. Production Locations

20.24.4. Product Portfolio

20.24.5. Competitors & Customers

20.24.6. Subsidiaries & Parent Organization

20.24.7. Recent Developments

20.24.8. Financial Analysis

20.24.9. Profitability

20.24.10. Revenue Share

20.25. Shenzhen Wuzhoulong Motors

20.25.1. Company Overview

20.25.2. Company Footprints

20.25.3. Production Locations

20.25.4. Product Portfolio

20.25.5. Competitors & Customers

20.25.6. Subsidiaries & Parent Organization

20.25.7. Recent Developments

20.25.8. Financial Analysis

20.25.9. Profitability

20.25.10. Revenue Share

20.26. Tesla

20.26.1. Company Overview

20.26.2. Company Footprints

20.26.3. Production Locations

20.26.4. Product Portfolio

20.26.5. Competitors & Customers

20.26.6. Subsidiaries & Parent Organization

20.26.7. Recent Developments

20.26.8. Financial Analysis

20.26.9. Profitability

20.26.10. Revenue Share

20.27. Volkswagen Group

20.27.1. Company Overview

20.27.2. Company Footprints

20.27.3. Production Locations

20.27.4. Product Portfolio

20.27.5. Competitors & Customers

20.27.6. Subsidiaries & Parent Organization

20.27.7. Recent Developments

20.27.8. Financial Analysis

20.27.9. Profitability

20.27.10. Revenue Share

20.28. Volvo Group

20.28.1. Company Overview

20.28.2. Company Footprints

20.28.3. Production Locations

20.28.4. Product Portfolio

20.28.5. Competitors & Customers

20.28.6. Subsidiaries & Parent Organization

20.28.7. Recent Developments

20.28.8. Financial Analysis

20.28.9. Profitability

20.28.10. Revenue Share

20.29. Workhorse Group

20.29.1. Company Overview

20.29.2. Company Footprints

20.29.3. Production Locations

20.29.4. Product Portfolio

20.29.5. Competitors & Customers

20.29.6. Subsidiaries & Parent Organization

20.29.7. Recent Developments

20.29.8. Financial Analysis

20.29.9. Profitability

20.29.10. Revenue Share

20.30. Others

20.30.1. Company Overview

20.30.2. Company Footprints

20.30.3. Production Locations

20.30.4. Product Portfolio

20.30.5. Competitors & Customers

20.30.6. Subsidiaries & Parent Organization

20.30.7. Recent Developments

20.30.8. Financial Analysis

20.30.9. Profitability

20.30.10. Revenue Share

List of Tables

Table 1: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 2: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 3: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 4: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 5: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 6: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 7: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 8: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 9: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 10: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 11: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 12: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 13: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 14: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 15: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 16: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 17: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 18: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 19: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 20: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 21: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Region, 2017-2031

Table 22: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 23: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 24: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 25: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 26: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 27: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 28: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 29: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 30: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 31: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 32: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 33: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 34: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 35: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 36: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 37: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 38: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 39: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 40: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 41: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 42: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 43: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Table 44: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 45: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 46: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 47: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 48: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 49: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 50: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 51: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 52: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 53: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 54: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 55: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 56: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 57: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 58: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 59: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 60: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 61: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 62: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 63: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 64: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 65: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Table 66: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 67: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 68: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 69: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 70: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 71: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 72: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 73: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 74: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 75: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 76: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 77: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 78: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 79: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 80: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 81: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 82: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 83: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 84: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 85: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 86: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 87: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Table 88: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 89: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 90: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 91: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 92: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 93: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 94: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 95: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 96: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 97: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 98: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 99: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 100: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 101: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 102: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 103: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 104: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 105: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 106: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 107: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 108: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 109: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Table 110: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 111: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Table 112: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Table 113: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Table 114: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Table 115: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Table 116: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Table 117: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Table 118: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Table 119: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Table 120: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Table 121: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Table 122: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Table 123: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 124: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 125: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 126: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 127: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Table 128: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Table 129: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 130: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 131: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Table 132: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 2: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 3: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 4: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 5: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 6: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 7: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 8: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 9: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 10: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 11: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 12: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 13: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Figure 14: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Figure 15: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Range, Value (US$ Bn), 2023-2031

Figure 16: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Figure 17: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Figure 18: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 19: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 22: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 23: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 24: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 25: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Figure 26: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Figure 27: Global Electric Commercial Vehicles Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 28: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 29: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 30: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 31: Global Electric Commercial Vehicles Market Volume (Units) Forecast, by Region, 2017-2031

Figure 32: Global Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 33: Global Electric Commercial Vehicles Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 34: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 35: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 36: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 37: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 38: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 39: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 40: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 41: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 42: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 43: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 44: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 45: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 46: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Figure 47: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Figure 48: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Range, Value (US$ Bn), 2023-2031

Figure 49: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Figure 50: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Figure 51: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 52: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 56: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 57: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 58: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Figure 59: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Figure 60: North America Electric Commercial Vehicles Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 61: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 62: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 63: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 64: North America Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Figure 65: North America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 66: North America Electric Commercial Vehicles Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 67: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 68: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 69: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 70: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 71: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 72: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 73: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 74: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 75: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 76: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 77: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 78: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 79: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Figure 80: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Figure 81: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Range, Value (US$ Bn), 2023-2031

Figure 82: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Figure 83: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Figure 84: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 85: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 88: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 89: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 90: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 91: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Figure 92: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Figure 93: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 94: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 95: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 96: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 97: Europe Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Figure 98: Europe Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 99: Europe Electric Commercial Vehicles Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 100: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 101: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 102: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 103: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 104: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 105: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 106: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 107: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 108: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 109: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 110: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 111: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 112: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Figure 113: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Figure 114: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Range, Value (US$ Bn), 2023-2031

Figure 115: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Figure 116: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Figure 117: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 118: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 119: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 120: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 121: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 122: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 123: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 124: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Figure 125: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Figure 126: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 127: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 128: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 129: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 130: Asia Pacific Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Figure 131: Asia Pacific Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 132: Asia Pacific Electric Commercial Vehicles Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 133: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 134: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 135: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 136: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 137: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 138: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 139: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 140: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 141: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 142: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 143: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 144: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 145: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031

Figure 146: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Range, 2017-2031

Figure 147: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Range, Value (US$ Bn), 2023-2031

Figure 148: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Construction, 2017-2031

Figure 149: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Construction, 2017-2031

Figure 150: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Construction, Value (US$ Bn), 2023-2031

Figure 151: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 152: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 153: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 154: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 155: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 156: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 157: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by End-user, 2017-2031

Figure 158: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by End-user, 2017-2031

Figure 159: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 160: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 161: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 162: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 163: Middle East & Africa Electric Commercial Vehicles Market Volume (Units) Forecast, by Country, 2017-2031

Figure 164: Middle East & Africa Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 165: Middle East & Africa Electric Commercial Vehicles Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 166: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Component, 2017-2031

Figure 167: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Component, 2017-2031

Figure 168: South America Electric Commercial Vehicles Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 169: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Type, 2017-2031

Figure 170: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Type, 2017-2031

Figure 171: South America Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2023-2031

Figure 172: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Battery Capacity, 2017-2031

Figure 173: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Battery Capacity, 2017-2031

Figure 174: South America Electric Commercial Vehicles Market, Incremental Opportunity, by Battery Capacity, Value (US$ Bn), 2023-2031

Figure 175: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Power Output, 2017-2031

Figure 176: South America Electric Commercial Vehicles Market Revenue (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 177: South America Electric Commercial Vehicles Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 178: South America Electric Commercial Vehicles Market Volume (Units) Forecast, by Range, 2017-2031