Analysts’ Viewpoint on Market Scenario

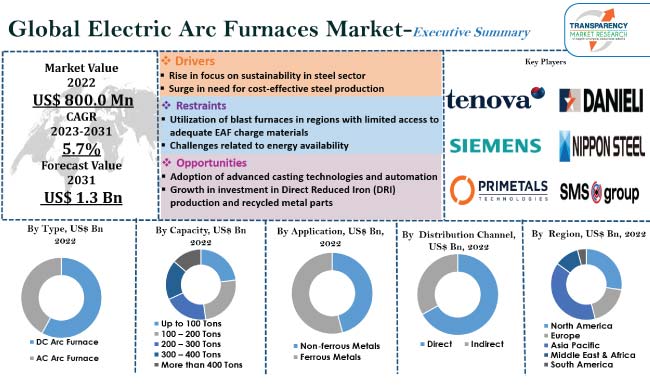

The global electric arc furnaces market size is fueled by rise in need for steel and aluminum in various end-use industries and surge in investment in the development of power infrastructure. Electric arc furnaces offer various benefits such as lesser negative environmental effects and lower cost of raw materials than blast furnaces.

Rise in investment in Direct Reduced Iron (DRI) production and increase in demand for recycled metal parts are likely to spur the electric arc furnaces market growth in the next few years. The global steel sector is seeking new approaches to address CO2 emissions.

Stakeholders in the steel sector are adopting sustainable business practices along with automation to lower capital expenditure and boost productivity. These initiatives are projected to offer lucrative opportunities for vendors in the global electric arc furnaces industry. Major players in the industry are launching hybrid products to increase their electric arc furnaces market share.

Electric arc furnace consists of a dome-shaped roof, a cylindrical shell, and a spherical hearth. The electric arc is created by the flow of electricity through an air gap within two conducting electrodes. It generates heat, which is then transferred either through direct radiation or reflected off the furnace's interior lining. Metal melting furnaces are primarily utilized to melt or extract ferrous or non-ferrous metals that need a high-temperature operation. Electric arc furnaces offer an arc temperature between 3000 °C and 3500 °C on L.T. (Low Tension) operation.

Electric arc furnaces are a great substitute for the popular BF-BOF (blast furnace) method and are frequently employed in the steel sector. They are also utilized in mini-mills that recycle iron scrap and play a critical part in iron and steel recycling processes. Electric arc melting furnaces can melt various charge compositions, from 100% scrap to 100% DRI/HBI, and all combinations between the two. Direct (DC) and alternating (AC) electric currents can both be utilized in electric arc heating furnaces.

The modern steel sector utilizes electric arc furnaces to substantially reduce carbon emissions during steel production. Electric arc furnaces help meet various needs of the sector and increase the flexibility of production methods. These furnaces utilize Maximum Achievable Control Technology (MACT) and Best Available Control Technology (BACT) to capture, control, and lower emissions during steel manufacturing. Thus, surge in demand for sustainable steel production is driving the electric arc furnaces market expansion.

Electric arc furnaces facilitate sustainable steelmaking as most of the energy needed to run the process is provided by electricity, thereby avoiding the need to use a significant amount of non-renewable resources. According to the Steel Manufacturers Association, electric arc furnaces are employed to sustainably create more than 70% of the steel produced in the U.S. As per the independent research of steelmakers undertaken by CRU Group, the carbon intensity of steel produced by electric arc furnace steelmakers in the U.S. is approximately 75% lower than that of traditional blast furnace steelmakers.

Adoption of electric arc furnaces leads to less capital investment for a given output of steel as compared to the BF-BOF route. Mini mills make steel primarily from scrap steel as their main raw material. Large-scale manufacturing needs to achieve economies of scale and produce steel at a cost-effective rate due to the significant investment associated with integrated steel facilities to ensure coking coal transportation, storage, and processing.

Implementation of new laws, such as the European Union's (EU) Carbon Border Adjustment Mechanism (CBAM) to support the current EU Emissions Trading Scheme (ETS), is likely to increase the cost of high-carbon steel production for importers. Thus, increase in need for cost-effective steel production is fueling the electric arc furnaces market statistics.

According to the latest electric arc furnaces market trends, the DC arc furnace type segment is expected to dominate the industry during the forecast period. DC arc furnaces are more modern and advanced than AC arc furnaces.

DC furnaces are smaller, easier to maintain, and take up less room as they only have one electrode. In a DC arc furnace, the temperature in the furnace is distributed evenly. Therefore, the arc is stable and concentrated and the corrosion of the furnace lining is minimal. The DC electric arc furnace produces half as much voltage fluctuation and flickers as an AC electric arc furnace of equivalent capacity. It is also superior to the AC arc in terms of stability and unidirectionality, thereby offering significant advantages for heat transfer in metallurgical processes.

According to the latest electric arc furnaces market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Expansion in the steel sector is boosting market dynamics in the region. China and India are experiencing substantial growth in the steel sector. China exports steel to more than 200 countries and territories and produces more than half of the world's steel.

The industry in Europe is estimated to grow at a steady pace in the near future. Rise in concerns regarding carbon emissions and increase in focus on sustainable steel production are fueling market progress in the region.

The global industry is fragmented due to the existence of numerous established players who hold a sizable market share. Electric arc furnace manufacturers are concentrating on innovation and product development to broaden their customer base.

Danieli & C. S.p.A., Electrotherm Limited, Nippon Steel Corp., Primetals Technologies Ltd., Saint-Gobain, Siemens AG, Sinosteel Midwest Group, SMS Group GmbH, Tenova S.p.A., and Whiting Equipment Canada, Inc. are leading players operating in this industry.

Key players in the electric arc furnaces market report have been profiled based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 800.0 Mn |

|

Market Forecast Value in 2031 |

US$ 1.3 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn/Bn for Value and Units for Volume |

|

Market Analysis |

It includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 800.0 Mn in 2022

It is estimated to be 5.7% from 2023 to 2031

Rise in focus on sustainability in steel sector and surge in need for cost-effective steel production

The DC arc furnace type segment held largest share in 2022

Asia Pacific is expected to record the largest demand during the forecast period

Danieli & C. S.p.A., Electrotherm Limited, Nippon Steel Corp., Primetals Technologies Ltd., Saint-Gobain, Siemens AG, Sinosteel Midwest Group, SMS Group GmbH, Tenova S.p.A., and Whiting Equipment Canada, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Furnaces Industry Overview

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technology Overview

5.10. Global Electric Arc Furnaces Market Analysis and Forecast, 2017-2031

5.10.1. Market Value Projection (US$ Bn)

5.10.2. Market Volume Projection (Units)

6. Global Electric Arc Furnaces Market Analysis and Forecast, by Type

6.1. Global Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

6.1.1. DC Arc Furnace

6.1.2. AC Arc Furnace

6.2. Incremental Opportunity, by Type

7. Global Electric Arc Furnaces Market Analysis and Forecast, by Capacity

7.1. Global Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

7.1.1. Up to 100 Tons

7.1.2. 100 -200 Tons

7.1.3. 200 -300 Tons

7.1.4. 300 -400 Tons

7.1.5. More than 400 Tons

7.2. Incremental Opportunity, by Capacity

8. Global Electric Arc Furnaces Market Analysis and Forecast, by Application

8.1. Global Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

8.1.1. Non-ferrous Metals

8.1.2. Ferrous Metals

8.2. Incremental Opportunity, by Application

9. Global Electric Arc Furnaces Market Analysis and Forecast, by Distribution Channel

9.1. Global Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Distribution Channel

10. Global Electric Arc Furnaces Market Analysis and Forecast, by Region

10.1. Global Electric Arc Furnaces Market Size (US$ Bn) (Units) by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Middle East & Africa

10.1.4. Asia Pacific

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Electric Arc Furnaces Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Manufacturers Analysis

11.3. COVID-19 Impact Analysis

11.4. Key Trends Analysis

11.4.1. Supply Side

11.4.2. Demand Side

11.5. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

11.5.1. DC Arc Furnace

11.5.2. AC Arc Furnace

11.6. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

11.6.1. Up to 100 Tons

11.6.2. 100 -200 Tons

11.6.3. 200 -300 Tons

11.6.4. 300 -400 Tons

11.6.5. More than 400 Tons

11.7. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

11.7.1. Non-ferrous Metals

11.7.2. Ferrous Metals

11.8. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

11.8.1. Direct

11.8.2. Indirect

11.9. Electric Arc Furnaces Market Size (US$ Bn) (Units) Forecast, by Country, 2017-2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Electric Arc Furnaces Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Manufacturers Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.4.1. Supply Side

12.4.2. Demand Side

12.5. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

12.5.1. DC Arc Furnace

12.5.2. AC Arc Furnace

12.6. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

12.6.1. Up to 100 Tons

12.6.2. 100 -200 Tons

12.6.3. 200 -300 Tons

12.6.4. 300 -400 Tons

12.6.5. More than 400 Tons

12.7. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

12.7.1. Non-ferrous Metals

12.7.2. Ferrous Metals

12.8. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

12.8.1. Direct

12.8.2. Indirect

12.9. Electric Arc Furnaces Market Size (US$ Bn) (Units) (Thousand Units) Forecast, by Country, 2017-2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Electric Arc Furnaces Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Manufacturers Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply Side

13.4.2. Demand Side

13.5. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

13.5.1. DC Arc Furnace

13.5.2. AC Arc Furnace

13.6. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

13.6.1. Up to 100 Tons

13.6.2. 100 -200 Tons

13.6.3. 200 -300 Tons

13.6.4. 300 -400 Tons

13.6.5. More than 400 Tons

13.7. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

13.7.1. Non-ferrous Metals

13.7.2. Ferrous Metals

13.8. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

13.8.1. Direct

13.8.2. Indirect

13.9. Electric Arc Furnaces Market Size (US$ Bn) (Units) (Thousand Units) Forecast, by Country, 2017-2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Electric Arc Furnaces Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Manufacturers Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply Side

14.4.2. Demand Side

14.5. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

14.5.1. DC Arc Furnace

14.5.2. AC Arc Furnace

14.6. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

14.6.1. Up to 100 Tons

14.6.2. 100 -200 Tons

14.6.3. 200 -300 Tons

14.6.4. 300 -400 Tons

14.6.5. More than 400 Tons

14.7. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

14.7.1. Non-ferrous Metals

14.7.2. Ferrous Metals

14.8. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

14.8.1. Direct

14.8.2. Indirect

14.9. Electric Arc Furnaces Market Size (US$ Bn) (Units) (Thousand Units) Forecast, by Country, 2017-2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Electric Arc Furnaces Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Manufacturers Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.4.1. Supply Side

15.4.2. Demand Side

15.5. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Type, 2017-2031

15.5.1. DC Arc Furnace

15.5.2. AC Arc Furnace

15.6. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Capacity, 2017-2031

15.6.1. Up to 100 Tons

15.6.2. 100 -200 Tons

15.6.3. 200 -300 Tons

15.6.4. 300 -400 Tons

15.6.5. More than 400 Tons

15.7. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Application, 2017-2031

15.7.1. Non-ferrous Metals

15.7.2. Ferrous Metals

15.8. Electric Arc Furnaces Market Size (US$ Bn) (Units) by Distribution Channel, 2017-2031

15.8.1. Direct

15.8.2. Indirect

15.9. Electric Arc Furnaces Market Size (US$ Bn) (Units) (Thousand Units) Forecast, by Country, 2017-2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2020)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. Danieli & C. S.p.A.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. Electrotherm Limited

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Nippon Steel Corp.

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Primetals Technologies Ltd.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. Saint-Gobain

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Siemens AG

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. Sinosteel Midwest Group

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. SMS Group GmbH

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. Tenova S.p.A.

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. Whiting Equipment Canada, Inc.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. Financial Information, (Subject to Data Availability)

16.3.11.4. Business Strategies / Recent Developments

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Prevailing Market Risks

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 2: Global Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 3: Global Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 4: Global Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 5: Global Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 6: Global Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 7: Global Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 8: Global Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 9: Global Electric Arc Furnaces Market, by Region, Units, 2017-2031

Table 10: Global Electric Arc Furnaces Market, by Region, US$ Bn, 2017-2031

Table 11: North America Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 12: North America Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 13: North America Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 14: North America Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 15: North America Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 16: North America Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 17: North America Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 18: North America Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 19: North America Electric Arc Furnaces Market, by Country, Units, 2017-2031

Table 20: North America Electric Arc Furnaces Market, by Country, US$ Bn, 2017-2031

Table 21: Europe Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 22: Europe Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 23: Europe Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 24: Europe Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 25: Europe Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 26: Europe Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 27: Europe Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 28: Europe Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 29: Europe Electric Arc Furnaces Market, by Country, Units, 2017-2031

Table 30: Europe Electric Arc Furnaces Market, by Country, US$ Bn, 2017-2031

Table 31: Asia Pacific Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 32: Asia Pacific Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 33: Asia Pacific Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 34: Asia Pacific Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 35: Asia Pacific Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 36: Asia Pacific Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 37: Asia Pacific Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 38: Asia Pacific Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 39: Asia Pacific Electric Arc Furnaces Market, by Country, Units, 2017-2031

Table 40: Asia Pacific Electric Arc Furnaces Market, by Country, US$ Bn, 2017-2031

Table 41: Middle East & Africa Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 42: Middle East & Africa Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 43: Middle East & Africa Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 44: Middle East & Africa Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 45: Middle East & Africa Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 46: Middle East & Africa Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 47: Middle East & Africa Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 48: Middle East & Africa Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 49: Middle East & Africa Electric Arc Furnaces Market, by Country, Units, 2017-2031

Table 50: Middle East & Africa Electric Arc Furnaces Market, by Country, US$ Bn, 2017-2031

Table 51: South America Electric Arc Furnaces Market, by Type, Units, 2017-2031

Table 52: South America Electric Arc Furnaces Market, by Type, US$ Bn, 2017-2031

Table 53: South America Electric Arc Furnaces Market, by Capacity, Units, 2017-2031

Table 54: South America Electric Arc Furnaces Market, by Capacity, US$ Bn, 2017-2031

Table 55: South America Electric Arc Furnaces Market, by Application, Units, 2017-2031

Table 56: South America Electric Arc Furnaces Market, by Application, US$ Bn, 2017-2031

Table 57: South America Electric Arc Furnaces Market, by Distribution Channel, Units, 2017-2031

Table 58: South America Electric Arc Furnaces Market, by Distribution Channel, US$ Bn, 2017-2031

Table 59: South America Electric Arc Furnaces Market, by Country, Units, 2017-2031

Table 60: South America Electric Arc Furnaces Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 2: Global Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 3: Global Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 4: Global Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 5: Global Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 6: Global Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 7: Global Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 8: Global Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 9: Global Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 10: Global Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 11: Global Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 12: Global Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 13: Global Electric Arc Furnaces Market Projections by Region, Units, 2017-2031

Figure 14: Global Electric Arc Furnaces Market Projections by Region, US$ Bn, 2017-2031

Figure 15: Global Electric Arc Furnaces Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 16: North America Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 17: North America Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 18: North America Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 19: North America Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 20: North America Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 21: North America Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 22: North America Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 23: North America Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 24: North America Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 25: North America Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 26: North America Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 27: North America Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 28: North America Electric Arc Furnaces Market Projections by Country, Units, 2017-2031

Figure 29: North America Electric Arc Furnaces Market Projections by Country, US$ Bn, 2017-2031

Figure 30: North America Electric Arc Furnaces Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 31: Europe Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 32: Europe Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 33: Europe Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 34: Europe Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 35: Europe Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 36: Europe Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 37: Europe Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 38: Europe Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 39: Europe Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 40: Europe Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 41: Europe Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 42: Europe Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 43: Europe Electric Arc Furnaces Market Projections by Country, Units, 2017-2031

Figure 44: Europe Electric Arc Furnaces Market Projections by Country, US$ Bn, 2017-2031

Figure 45: Europe Electric Arc Furnaces Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 46: Asia Pacific Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 47: Asia Pacific Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 48: Asia Pacific Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 49: Asia Pacific Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 50: Asia Pacific Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 51: Asia Pacific Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 52: Asia Pacific Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 53: Asia Pacific Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 54: Asia Pacific Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 55: Asia Pacific Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 56: Asia Pacific Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 57: Asia Pacific Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 58: Asia Pacific Electric Arc Furnaces Market Projections by Country, Units, 2017-2031

Figure 59: Asia Pacific Electric Arc Furnaces Market Projections by Country, US$ Bn, 2017-2031

Figure 60: Asia Pacific Electric Arc Furnaces Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 61: Middle East & Africa Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 62: Middle East & Africa Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 63: Middle East & Africa Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 64: Middle East & Africa Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 65: Middle East & Africa Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 66: Middle East & Africa Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 67: Middle East & Africa Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 68: Middle East & Africa Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 69: Middle East & Africa Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 70: Middle East & Africa Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 71: Middle East & Africa Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 72: Middle East & Africa Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Electric Arc Furnaces Market Projections by Country, Units, 2017-2031

Figure 74: Middle East & Africa Electric Arc Furnaces Market Projections by Country, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Electric Arc Furnaces Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 76: South America Electric Arc Furnaces Market Projections by Type, Units, 2017-2031

Figure 77: South America Electric Arc Furnaces Market Projections by Type, US$ Bn, 2017-2031

Figure 78: South America Electric Arc Furnaces Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 79: South America Electric Arc Furnaces Market Projections by Capacity, Units, 2017-2031

Figure 80: South America Electric Arc Furnaces Market Projections by Capacity, US$ Bn, 2017-2031

Figure 81: South America Electric Arc Furnaces Market, Incremental Opportunity, by Capacity, US$ Bn, 2017-2031

Figure 82: South America Electric Arc Furnaces Market Projections by Application, Units, 2017-2031

Figure 83: South America Electric Arc Furnaces Market Projections by Application, US$ Bn, 2017-2031

Figure 84: South America Electric Arc Furnaces Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 85: South America Electric Arc Furnaces Market Projections by Distribution Channel, Units, 2017-2031

Figure 86: South America Electric Arc Furnaces Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 87: South America Electric Arc Furnaces Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 88: South America Electric Arc Furnaces Market Projections by Country, Units, 2017-2031

Figure 89: South America Electric Arc Furnaces Market Projections by Country, US$ Bn, 2017-2031

Figure 90: South America Electric Arc Furnaces Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031