Analysts’ Viewpoint

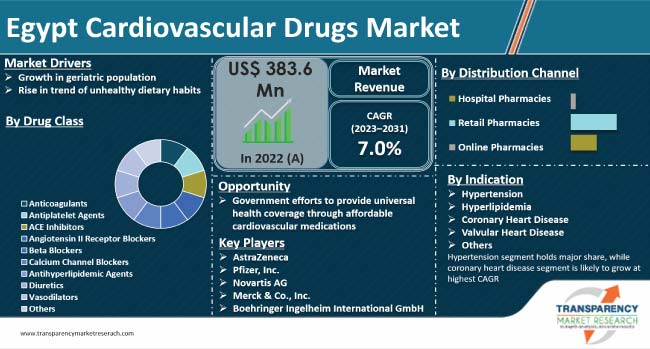

Rise in geriatric population and increase in trend of unhealthy dietary habits are key factors augmenting the Egypt cardiovascular drugs market size. Growth in obesity, diabetes, and sedentary lifestyle is leading to an increase in cardiovascular diseases such as heart attack and stroke. This is another factor fostering market progress. Furthermore, rise in age-related heart conditions, due to increase in life expectancy, is expected to fuel the cardiovascular drugs market demand in the near future.

Growth in need for related drug therapies, such as antiplatelet and anticoagulant therapies, due to the surge in cardiovascular procedures and interventional treatments is likely to boost market statistics. The Government of Egypt is striving to provide universal health coverage through more affordable and easily accessible cardiovascular medications. This is likely to offer lucrative cardiovascular drugs market opportunities to industry players.

Any substance that is used to treat the function of the heart and blood arteries is referred to as a cardiovascular drug. Hypertension (high blood pressure), angina pectoris (chest pain caused by insufficient blood flow through coronary arteries to the heart muscle), heart failure (inadequate output of the heart muscle in relation to the needs of the rest of the body), and arrhythmias (disturbances of cardiac rhythm) are some of disorders that may be treated with such drugs.

High prevalence of cardiovascular diseases, increase in awareness about health, and rise in insurance coverage are likely to positively impact Egypt cardiovascular drugs market value during the forecast period.

Aging is one of the key factors responsible for the increase in incidence of chronic diseases such as hypertension and high blood cholesterol. Egypt is the most populous country in the Middle East and the third-most populous country on the African continent. Gradual increase in both the absolute and relative numbers of older individuals in Egypt is projected to boost the demand for cardiovascular drugs in the country in the near future.

The Egyptian census is conducted every 10 years. According to the census data, the percentage of people aged 60 and above stood at 4.4% in 1976, 5.66% in 1986, 5.75% in 1996, and 6.27% in 2006. It is estimated to have reached 8.1% in 2016 and 9.2% in 2021. Furthermore, it is likely to rise to 20.8% in 2050.

Elderly population is more prone to obesity, which is a significant risk factor for hypertension and diabetes. Furthermore, inactivity and smoking are co-factors for hypercholesterolemia, a leading cause of atherosclerosis and vascular diseases. These are considered major risk factors for cardiovascular diseases in Egypt. Thus, increase in cardiovascular diseases is likely to boost the Egypt cardiovascular drugs market dynamics in the near future.

Rise in incidence of cardiovascular diseases, especially among the youth, owing to the growth in trend of unhealthy lifestyle is bolstering market expansion in Egypt.

Atherosclerotic cardiovascular diseases (ASCVD) pose a significant public health issue in Egypt, with notable social and economic implications in terms of healthcare demands, lost efficiency, and early death.

Decrease in cereal consumption over the last 20 years, increase in consumption of animal protein and trans fat, and low intake of omega-3 fat may be co-factors for hypercholesterolemia, a leading cause of atherosclerosis and vascular diseases.

Rise in overweight and obesity rates among Egyptians is a risk factor for hypertension. Increase in consumption of animal protein, combined with inadequate dietary intake of calcium and magnesium, is likely to contribute to early development of hypertension in Egyptians.

As per the Egypt cardiovascular drugs market analysis, the antihyperlipidemic agents drug class segment accounted for major share of around 25.0% in the country in 2022. Prevalence of hypercholesterolemia was estimated at 46.0% among Egyptian adults, according to a national health survey.

The risk of heart attack and stroke rises significantly with elevated cholesterol levels. This is leading to higher demand for antihyperlipidemic agents. Statins dominated the antihyperlipidemic drugs market in Egypt with more than 50% share in 2022.

Based on indication, the hypertension segment holds the largest Egypt cardiovascular drugs market share. It is estimated to anticipated to continue its dominance during the forecast period.

High prevalence of hypertension in Egypt – it is estimated to affect over 25.0% of adults – presents a vast patient population base that requires long-term medication. Established drugs such as ACE inhibitors, calcium channel blockers, and diuretics are available at low costs. Furthermore, ongoing health initiatives are focused on improving hypertension control rate in Egypt.

According to the Egypt cardiovascular drugs market forecast, the coronary heart disease segment is anticipated to grow at a rapid pace during the forecast period. Incidence of heart attacks and coronary artery diseases is rising in the country due to the growth in adoption of unhealthy lifestyle.

Increasing number of people are developing heart diseases at younger age owing to associated risk factors such as obesity, diabetes and smoking. Growth in advanced treatments involving antiplatelets, anticoagulants, and statins to prevent secondary complications is driving the coronary heart disease segment.

Improvement in diagnostic capabilities and availability of robust healthcare infrastructure are enabling coronary heart disease patients to access effective medications and management easily. This is also boosting the coronary heart disease segment in Egypt.

The cardiovascular drugs landscape in Egypt is consolidated, with few key players accounting for major market share.

New product advancements and mergers & acquisitions are key strategies adopted by the leading players to expand their client base. AstraZeneca, Bayer AG, Novartis AG, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Pfizer, Inc., and Sanofi are some of the companies operating in the Egypt cardiovascular drugs market.

These leading players have been summarized in the cardiovascular drugs market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 383.6 Mn |

| Market Forecast Value in 2031 | US$ 698.9 Mn |

| Growth Rate | 7.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes cross-segment as well regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape | Market share analysis, by company (2022) Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials. |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 383.6 Mn in 2022

It is projected to reach US$ 698.9 Mn by 2031

The CAGR was 4.0% from 2017 to 2022

It is anticipated to be 7.0% from 2023 to 2031

Rise in geriatric population and increase in unhealthy dietary habits

The antihyperlipidemic agents segment held more than 25.0% share in 2022

AstraZeneca, Bayer AG, Novartis AG, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Pfizer, Inc., and Sanofi

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Egypt Cardiovascular Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Egypt Cardiovascular Drugs Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projection (US$ Mn)

5. Key Insights

5.1. Disease Epidemiology

5.2. Pipeline Analysis

5.3. Regulatory Scenario

5.4. Covid-19 Impact Analysis

6. Egypt Cardiovascular Drugs Market Analysis and Forecast, By Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast By Drug Class, 2017 - 2031

6.3.1. Anticoagulants

6.3.2. Antiplatelet Agents

6.3.3. ACE Inhibitors

6.3.4. Angiotensin II Receptor Blockers

6.3.5. Beta Blockers

6.3.6. Calcium Channel Blockers

6.3.7. Antihyperlipidemic Agents

6.3.8. Diuretics

6.3.9. Vasodilators

6.3.10. Others

6.4. Market Attractiveness By Drug Class

7. Egypt Cardiovascular Drugs Market Analysis and Forecast, By Indication

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, By Indication, 2017 - 2031

7.3.1. Hypertension

7.3.2. Hyperlipidemia

7.3.3. Coronary Heart Disease

7.3.4. Valvular Heart Disease

7.3.5. Others

7.4. Market Attractiveness By Indication

8. Egypt Cardiovascular Drugs Market Analysis and Forecast, By Drug Classification

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, By Drug Classification, 2017 - 2031

8.3.1. Branded Drugs

8.3.2. Generic Drugs

8.4. Market Attractiveness By Drug Classification

9. Egypt Cardiovascular Drugs Market Analysis and Forecast, By Route of Administration

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast By Route of Administration, 2017 - 2031

9.3.1. Oral

9.3.2. Parenteral

9.3.3. Others

9.4. Market Attractiveness By Route of Administration

10. Egypt Cardiovascular Drugs Market Analysis and Forecast, By Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, By Distribution Channel, 2017 - 2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness By Distribution Channel

11. Competition Landscape

11.1. Market Player – Competition Matrix (By Tier and Size of companies)

11.2. Market Share Analysis By Company (2022)

11.3. Company Profiles

11.3.1. AstraZeneca

11.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. SWOT Analysis

11.3.1.5. Strategic Overview

11.3.2. Pfizer, Inc.

11.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.2.2. Product Portfolio

11.3.2.3. Financial Overview

11.3.2.4. SWOT Analysis

11.3.2.5. Strategic Overview

11.3.3. Novartis AG

11.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.3.2. Product Portfolio

11.3.3.3. Financial Overview

11.3.3.4. SWOT Analysis

11.3.3.5. Strategic Overview

11.3.4. Merck & Co., Inc.

11.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.4.2. Product Portfolio

11.3.4.3. Financial Overview

11.3.4.4. SWOT Analysis

11.3.4.5. Strategic Overview

11.3.5. Bristol-Myers Squibb Company

11.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.5.2. Product Portfolio

11.3.5.3. Financial Overview

11.3.5.4. SWOT Analysis

11.3.5.5. Strategic Overview

11.3.6. Bayer AG

11.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.6.2. Product Portfolio

11.3.6.3. Financial Overview

11.3.6.4. SWOT Analysis

11.3.6.5. Strategic Overview

11.3.7. Sanofi

11.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.7.2. Product Portfolio

11.3.7.3. Financial Overview

11.3.7.4. SWOT Analysis

11.3.7.5. Strategic Overview

11.3.8. Johnson & Johnson Services, Inc.

11.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.8.2. Product Portfolio

11.3.8.3. Financial Overview

11.3.8.4. SWOT Analysis

11.3.8.5. Strategic Overview

11.3.9. Cipla Limited

11.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.9.2. Product Portfolio

11.3.9.3. Financial Overview

11.3.9.4. SWOT Analysis

11.3.9.5. Strategic Overview

11.3.10. Boehringer Ingelheim International GmbH

11.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.10.2. Product Portfolio

11.3.10.3. Financial Overview

11.3.10.4. SWOT Analysis

11.3.10.5. Strategic Overview

11.3.11. Gilead Sciences, Inc.

11.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.11.2. Product Portfolio

11.3.11.3. Financial Overview

11.3.11.4. SWOT Analysis

11.3.11.5. Strategic Overview

11.3.12. Takeda Pharmaceutical Company Limited

11.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.12.2. Product Portfolio

11.3.12.3. Financial Overview

11.3.12.4. SWOT Analysis

11.3.12.5. Strategic Overview

11.3.13. Astellas Pharma Inc.

11.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.13.2. Product Portfolio

11.3.13.3. Financial Overview

11.3.13.4. SWOT Analysis

11.3.13.5. Strategic Overview

11.3.14. Eli Lilly and Company

11.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.14.2. Product Portfolio

11.3.14.3. Financial Overview

11.3.14.4. SWOT Analysis

11.3.14.5. Strategic Overview

11.3.15. Otsuka Pharmaceutical Co., Ltd. (Otsuka Holdings Co., Ltd.)

11.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.15.2. Product Portfolio

11.3.15.3. Financial Overview

11.3.15.4. SWOT Analysis

11.3.15.5. Strategic Overview

List of Tables

Table 01: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, by Drug Classification, 2017–2031

Table 04: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 05: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Egypt Cardiovascular Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Cardiovascular Drugs Market Value Share, by Drug Class, 2022

Figure 03: Cardiovascular Drugs Market Value Share, by Indication, 2022

Figure 04: Cardiovascular Drugs Market Value Share, by Drug Classification, 2022

Figure 05: Cardiovascular Drugs Market Value Share, by Route of Administration, 2022

Figure 06: Cardiovascular Drugs Market Value Share, by Distribution Channel, 2022

Figure 07: Egypt Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 08: Egypt Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 09: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Anticoagulants, 2017–2031

Figure 10: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Antiplatelet Agents, 2017–2031

Figure 11: Egypt Cardiovascular Drugs Market Value (US$ Mn), by ACE Inhibitors, 2017–2031

Figure 12: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Angiotensin II Receptor Blockers, 2017–2031

Figure 13: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Beta Blockers, 2017–2031

Figure 14: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Calcium Channel Blockers, 2017–2031

Figure 15: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Antihyperlipidemic Agents, 2017–2031

Figure 16: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Diuretics, 2017–2031

Figure 17: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Vasodilators, 2017–2031

Figure 18: Egypt Cardiovascular Drugs Market Value (US$ Mn), by Others, 2017–2031

Figure 19: Egypt Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 20: Egypt Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 21: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Hypertension, 2017–2031

Figure 22: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Hyperlipidemia, 2017–2031

Figure 23: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Coronary Heart Disease, 2017–2031

Figure 24: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Valvular Heart Disease, 2017–2031

Figure 25: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Others, 2017–2031

Figure 26: Egypt Cardiovascular Drugs Market Value Share Analysis, by Drug Classification, 2022 and 2031

Figure 27: Egypt Cardiovascular Drugs Market Attractiveness Analysis, by Drug Classification, 2023–2031

Figure 28: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Branded Drugs, 2017–2031

Figure 29: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Generic Drugs, 2017–2031

Figure 30: Egypt Cardiovascular Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 31: Egypt Cardiovascular Drugs Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 32: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Oral, 2017–2031

Figure 33: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Parenteral, 2017–2031

Figure 34: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Others, 2017–2031

Figure 35: Egypt Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 36: Egypt Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 37: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 38: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 39: Egypt Cardiovascular Drugs Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031