Iraq Edible Oils & Fats Market: Snapshot

The Iraq edible oils and fats market is surging on the back of several favorable factors. Firstly, rising demand for high quality edible oils has led product manufacturers to develop products that have high nutritional content and high smoking points. High quality edible oils are rich in vitamin E, monounsaturated and polyunsaturated fat, and omega-3. The increasing consumption of processed food that are oil based is also fuelling the Iraq edible oils and fats market.

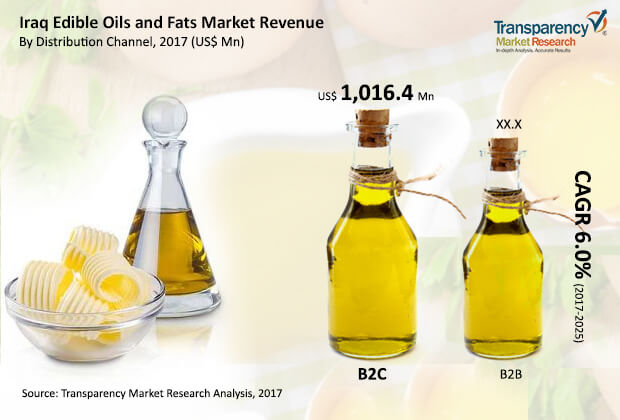

However, factors such as decades of war and political instability leading to weak economic growth is challenging the growth of this market. Nevertheless, with economic revival and growth of the tourism sector, the Iraq edible oils and fats market is predicted to receive a boost. Considering a number of favorable factors, the Iraq edible oils & fats market is expected to clock a CAGR of 6.0% between 2017 and 2025.

Vegetable and Seed Oil Product Segment to Remain at Fore

The Iraq edible oils and fats market is segmented on the basis of product type, distribution channel, and region. Depending upon product type, vegetable and seed oil, spreadable oils and fats, cooking fats, and other are the segments into which the Iraq edible oils and fats market is divided. Of them, vegetable and seed oil dominated the overall market in the past years; the segment is predicted to hold the leading share in the near future. The vegetable and seed oil segment is further sub-segmented into soybean, sunflower oil, palm oil, corn oil, and canola oil. Vis-à-vis revenue and volume, sunflower oil is expected to retain dominance through 2025.

Spreadable oils and fats segment is anticipated to display a marked increase in its market share between 2017 and 2025. The spreadable oils and fats segment is bifurcated into butter and margarine; of the two, butter currently holds the leading market share.

Vis-à-vis revenue, cooking fats segment of the market is anticipated to be valued at US$385.0 million by the end of 2025. Cooking fats segment has been bifurcated into animal ghee and vegetable ghee, where the latter holds dominance in terms of both revenue and volume.

In terms of distribution channel, B2B and B2C are the segments into which the Iraq edible oils and fats market is divided. Of the two, B2C leads in terms of revenue contribution to the overall market. The sub-segments of B2B include HoReCa and others. On the other hand, the sub-segments of B2C include PDS and others.

Substantial GDP Makes Baghdad Leading Region

Region-wise, the Iraq edible oils and fats market has been bifurcated into Babil, Basra, Baghdad, Dhi Qar, Al- Qadisiyyah, Diyala, Maysan, Karbala, Najaf, Muthanna, Wasit, Arbil, Kirkuk, Sulaymania, and others. Baghdad is anticipated to account for the leading revenue contribution to the Iraq edible oils and fats market through 2025. Baghdad being the largest city along with high population and substantial GDP are key factors behind the growth of Baghdad edible oils and fats segment. Sulaymania, Basra, and Babil are other key regions to account for significant share of the Iraq edible oils & fats market.

Leading companies in the Iraq edible oils and fats market to name are Marsan Gida San Ve Tic A.S., Anadolu Group, Aves A.S., Keskinoglu, Altunkaya Group of Companies, Yildiz Holding, and Zer Group among others.

Iraq Edible Oils and Fats Market to Gain Impetus Owing to Rising Inclination towards Healthy Food Intake

The rise in inclination towards the adoption of a healthy lifestyle is prognosticated to aid in expansion of the Iraq edible oils and fats market. Edible oils with high quality consists of high nutrients such as omega-3, polyunsaturated fatty acids, vitamin E, and monounsaturated fats. The smoking point of such oils is high that helps to maintain the nutritional value of the food cooked in it despite the high temperatures. In order to suffice to the increasing demand of major companies operating in the edible oil sector are investing heavily on research and development of better oil quality and high nutritional value. This will help the respective players gain a significant position in the overall market in Iraq.

Vendors are trying to enter into collaborative agreements with other companies operating in the food and food products sector so as to gain a competitive edge in the overall competitive landscape. Besides this, players are also indulging in the development of better marketing strategies for edible oil emphasizing on their nutritional value so as to help expand their brand presence across the entire nation.

The expanding utilization of prepared food which is primarily oil based has likewise been a vital factor behind the development of this market. Changing way of life and changing dietary patterns are fuelling demand for prepared to-eat bundled food. This is in preference to the development of this national market.

The development of the travel industry area holds potential for the development of Iraq edible oils and fats market. Because of many years of war, shut systems, and repetitive political flimsiness the Iraqi the travel industry area is right now immature and dismissed. In any case, as political security and financial advancement acquires force, Iraq can possibly arise as a worldwide vacationer location. Since quite a while ago viewed as an objective for travelers, recreation the travel industry is pacing up but in low numbers. This is probably going to by implication advantage the edible oils and fats market in the long run.

Chapter 1 Iraq Edible Oils and Fats Market: Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Scope

1.4 Research Methodology

Chapter 2 Iraq Edible Oils and Fats Market: Executive Summary

Chapter 3 Iraq Edible Oils and Fats Market: Production Analysis, 2010-2025

3.1 Existing Production Capacity Analysis

3.2. Expected Production Capacity Analysis

Chapter 4 Iraq Edible Oils and Fats Market : Market Overview, 2010-2025

4.1 Introduction

4.2. Market Dynamics

4.2.1 Market Drivers

4.2.2. Market Restraints

4.2.3 Market Opportunities

4.3. Key Trend Analysis

Chapter 5 Iraq Edible Oils and Fats Market: Industry Analysis, by Product Type, 2010 2025

5.1. Overview

5.2. Vegetable Oils and Seeds Market, Revenue and Volume Forecast

5.3. Spreadable Oils and Fats Market, Revenue and Volume Forecast

5.4. Cooking Fats Market, Revenue and Volume Forecast

5.5. Others Market, Revenue and Volume Forecast

Chapter 6 Iraq Edible Oils and Fats Market: Competitive Landscape

6.1. Market Share by Key Players

6.2. Brand Share by key Players

Chapter 7 Iraq Edible Oils and Fats Market: Price Trend Analysis

7.1. Price Trend Analysis

Chapter 8 Iraq Edible Oils and Fats Market: Distribution Channel Analysis, 2010-2025

8.1. Overview

8.2. Distribution Channel Analysis, Revenue Forecast and Historical Data

8.3. Distribution Channel Analysis, B2B Breakdown, Revenue Forecast and Historical Data

8.4. Distribution Channel Analysis, B2C Breakdown, Revenue Forecast and Historical Data

8.5. Distribution Channel Analysis, Volume Forecast and Historical Data

8.6. Distribution Channel Analysis, B2B Breakdown, Volume Forecast and Historical Data

8.7. Distribution Channel Analysis, B2C Breakdown, Volume Forecast and Historical Data

Chapter 9 Iraq Edible Oils and Fats Market: Import and Export Analysis and Forecast

9.1. Import and Export Analysis for Vegetable Oils and Seeds, 2015

9.2. Import and Export Analysis for Spreadable Oils and Fats, 2015

9.3. Import and Export Analysis for Cooking Fats, 2015

9.4. Import and Export Analysis for Others, 2015

9.5. Import and Export Analysis, Edible Oils and Fats Market, Forecast,

Chapter 10 Iraq Edible Oils and Fats Market: Industry Analysis, by Region, 2010-2025

10.1. Overview

10.1.1. Edible Oils and Fats Market: Revenue Forecast, by Region

10.1.2. Edible Oils and Fats Market, Historical Data, Revenue, by Region

10.1.3. Edible Oils and Fats Market, Volume Forecast, by Region

10.1.4. Edible Oils and Fats Market, Historical Data, Volume, by Region

Chapter 11 Company Profiles

11.1. Aves A.S.

11.1.1. Company Details (HQ, Foundation Year, Employee Strength)

11.1.2. Market Presence, (by Segment, by Geography)

11.1.3. Key Developments

11.1.4. Strategy and Historical Roadmap

11.1.5. Revenue and Operating Income

11.2. Keskinoglu

11.2.1. Company Details (HQ, Foundation Year, Employee Strength)

11.2.2. Market Presence, (by Segment, by Geography)

11.2.3. Key Developments

11.2.4. Strategy and Historical Roadmap

11.2.5. Revenue and Operating Income

11.3. Anadolu Grubu

11.3.1. Company Details (HQ, Foundation Year, Employee Strength)

11.3.2. Market Presence, (by Segment, by Geography)

11.3.3. Key Developments

11.3.4. Strategy and Historical Roadmap

11.3.5. Revenue and Operating Income

11.4. Yildiz Holding

11.4.1. Company Details (HQ, Foundation Year, Employee Strength)

11.4.2. Market Presence, (by Segment, by Geography)

11.4.3. Key Developments

11.4.4. Strategy and Historical Roadmap

11.4.5. Revenue and Operating Income

11.5. Altunkaya Group of Companies

11.5.1. Company Details (HQ, Foundation Year, Employee Strength)

11.5.2. Market Presence, (by Segment, by Geography)

11.5.3. Key Developments

11.5.4. Strategy and Historical Roadmap

11.5.5. Revenue and Operating Income

List of Table

TABLE 1: Iraq Edible Oils and Fats Market: Production Capacity Analysis (Existing)

TABLE 2: Iraq Edible Oils and Fats Market: Production Capacity Analysis (Expected)

TABLE 3: Iraq Vegetable and Seed Oil Market: Revenue Forecast, by Product Type

TABLE 4: Iraq Vegetable and Seed Oil Market: Revenue, Historical Data, By Product TABLE 5: Iraq Vegetable and Seed Oil Market: Volume Forecast, by Product Type

TABLE 6: Iraq Vegetable and Seed Oil Market: Volume, Historical Data, by Product Type

TABLE 7: Spreadable Oils and Fats Market, Revenue Forecast, by Product Type

TABLE 8: Spreadable Oils and Fats Market, Revenue, Historical Data, by Product Type

TABLE 9: Spreadable Oils and Fats Market, Volume, Historical Data, by Product Type

TABLE 10: Spreadable Oils and Fats Market, Volume Forecast, by Product Type

TABLE 11: Cooking Fats Market, Revenue Forecast, by Product Type

TABLE 12: Cooking Fats Market, Revenue, Historical Data, By Product Type

TABLE 13: Cooking Fats Market, Volume, Historical Data, By Product Type

TABLE 14: Cooking Fats Market, Volume Forecast, by Product Type

TABLE 15: Iraq Edible Oils and Fats Market, Price Trend Analysis (USD)

TABLE 16: Distribution Channel Analysis, Historical Data and Revenue Forecast, 2010-2025

TABLE 17: Distribution Channel Analysis, B2B Breakdown, Historical Data and Revenue Forecast,2010-2025

TABLE 18: Distribution Channel Analysis, B2C Breakdown, Historical Data and Revenue Forecast, 2010-2025

TABLE 19: Distribution Channel Analysis, Historical Data and Volume Forecast, 2010-2025

TABLE 20: Distribution Channel Analysis, B2B Breakdown, Historical Data and Volume Forecast, 2010-2025

TABLE 21: Distribution Channel Analysis, B2C Breakdown, Historical Data and Volume Forecast, 2010-2025

TABLE 22: Import and Export Analysis, Vegetable Oils and Seeds, Revenue and Volume, 2015

TABLE 23: Import and Export Analysis, Spreadable Oils and Fats, Revenue and Volume, 2015

TABLE 24: Import and Export Analysis, Cooking Fats, Revenue and Volume, 2015

TABLE 25: Import and Export Analysis, Others, Revenue and Volume, 2015

TABLE 26: Edible Oils and Fats Market: Revenue Forecast, By Region (USD Million)

TABLE 27: Edible Oils and Fats Market: Historical Data, Revenue, By Region (USD Million)

TABLE 28: Edible Oils and Fats Market: Volume Forecast, By Product Type (Thousand Tons)

TABLE 29: Edible Oils and Fats Market: Historical Data, Volume, By Region (Thousand Tons)

List of Figures

FIG 1: Iraq Edible Oils and Fats Market, Revenue Share, 2010 and 2015 (%)

FIG 2: Iraq Edible Oils and Fats Market, Sub-Segment Bi-Furcation, Revenue Share, 2010 & 2025 (%)

FIG 3: Iraq Vegetable Oils and Seeds Market, Revenue and Volume Forecast, 2010-2025 (USD Million and Thousand Tons)

FIG 4: Iraq Spreadable Oils and Fats Market, Revenue and Volume Forecast, 2010-2025(USD Million and Thousand Tons)

FIG 5: Iraq Cooking Fats Market, Revenue and Volume Forecast, 2010-2025 (USD Million and Thousand Tons)

FIG 6: Iraq Others Market, Revenue and Volume Forecast, 2010-2025 (USD Million and Thousand Tons)

FIG 7: Market Share by Key Players, 2013 to 2015 (%)

FIG 8: Brand Share by Key Players, 2013 to 2015 (%)

FIG 9: Iraq Edible Oils and Fats Market, Revenue Share, by Region, 2010-2025 (%)