Analysts’ Viewpoint on Edge Computing Market

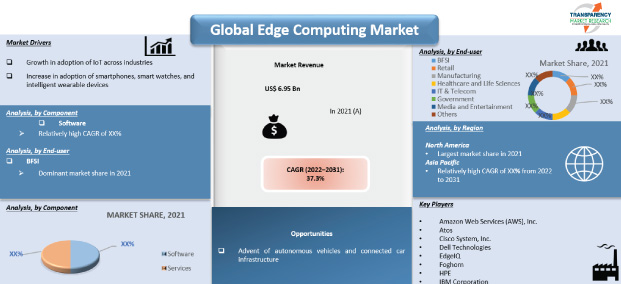

Edge computing is a new technology that is built on a distributed computing system. This essentially implies that many users can access data from different linked devices. Edge computing solutions are used to minimize network burden and decrease the operation time to milliseconds. Development of the Internet of Things (IoT) technology is one of the primary factors driving the global edge computing market. Technological advancements and increase in usage of 2G, 3G, and 4G long-term evolution (LTE) wireless networks are fueling the demand for IoT edge computing solutions. Furthermore, rise in demand for IoT security solutions to improve security and flexibility of online communications is augmenting the global edge computing market.

Edge computing helps improve cloud computing systems by processing data at the network's edge, close to the source of the data. Widespread usage and acceptance of IoT, which causes cloud foundation overload, is a key factor driving the edge computing market. Transmission of big amount of data places a significant strain on the network. Edge computing examines all data at the source's edge, analyzing it and communicating only important information on it, rather than frequently broadcasting data over the network. Edge computing architecture is built on existing open-source technologies and security. Many telecommunication service providers are adopting edge computing in order to modernize their networks. Thus, the global edge computing market is expected to grow at a decent pace during the forecast period.

Rise in number of connected devices and growth of IoT have resulted in a significant increase in data. This is driving the demand for efficient data access and evaluation. Companies are increasingly relying on centralized cloud computing and storage solutions. For instance, according to Accenture, IIoT is projected to contribute US$ 14.2 Trn to the global economy by 2030. Migrating the complete IT infrastructure to the cloud raises concerns about latency and cost feasibility. As a result, enterprises that use IoT sensors, actuators, and other IoT devices are increasingly interested in edge computing solutions such as edge nodes, devices, and hyper-localized data centers. Furthermore, edge computing augments the existing cloud paradigm by bringing data processing closer to the data source, thus allowing enterprises to make faster decisions. For instance, the Purdue University collaborated with an edge computing solution provider to research and optimize plant growth and food production processes using IoT sensors and devices. The partnership allows the university to use wireless and edge computing technology to gather, collate, process, and communicate massive amounts of data generated by the sensors. The technology helps the university save time and expense by accelerating and improving the accuracy of their research and allowing for faster communication. Thus, growth in adoption of IoT across industries is one of the key factors that is likely to boost the demand for edge computing during the forecast period.

Rise in customer demand and different technology breakthroughs have resulted in the expansion of infrastructure for autonomous and connected vehicles. Autonomous vehicles provide weather, light, and road conditions; and use that information to navigate, control, and drive. Several companies have begun to reinvent edge cloud computing to facilitate autonomous and connected automobile technologies. In April 2021, Honda and Verizon announced a research agreement to investigate how a new connected safety technology uses 5G and multi-access edge computing or mobile edge computing to enable quick, reliable communication between road infrastructure and automobiles in order to prevent road collisions. The companies aim to deliver rapid, dependable, and low-latency data transfer at the edge, which is critical for connected vehicles.

Edge computing in autonomous cars can provide more accurate and faster data usage, allowing edge data centers to dump non-critical data while retaining crucial data within the vehicle. Edge computing, when combined with Artificial Intelligence (AI) and Machine Learning (ML), may also help attain situational awareness in a fraction of time by providing local processing capacity to accelerate the processing of massive data created by autonomous vehicles. Thus, smart driving can efficiently avoid traffic bottlenecks and help reduce road accidents. Several autonomous vehicle manufacturers are projected to invest in the technology in the near future due to the benefits of edge computing. This is likely to bolster the edge computing market.

In terms of revenue, North America is anticipated to hold prominent share of the global market by the end of 2022. The convergence of IIoT and edge computing is creating ideal conditions for firms in the U.S. to transition to link manufacturing. Several companies have started providing platforms for building edge-enabled solutions. Telus Communications and MobiledgeX, Inc. worked together to create the MobiledgeX Early Access Program. The initiative has enabled developers to create, test, and evaluate the usefulness of edge-enabled apps in a low-latency environment.

Rise in usage of connected devices such as smartphones, tablets, and iPad is driving the demand for edge computing solutions in North America. Key players in the region are focusing on launching edge computing solutions to gain a competitive advantage in the market. In May 2020, IBM Corporation and Red Hat, Inc. launched new edge computing solutions, such as IBM Edge Application Manager and IBM Telco Network Cloud Manager, for various organizations in the 5G era. These solutions help enterprises accelerate their transition to edge computing.

Asia Pacific is likely to demonstrate robust growth in the market, led the presence of prominent industry players such as ADLINK Technology Inc., Huawei Technologies Co., Ltd., and Samsung. These leading players are concentrating on new product development in order to expand their product range.

The global edge computing market is consolidated, with a few large-scale vendors controlling a majority of the share. Most of the firms are spending significantly on comprehensive research and development activities, primarily to introduce innovative products. Expansion of product portfolios and mergers and acquisitions are the main strategies adopted by key players. Amazon Web Services (AWS), Inc., Atos, Cisco System, Inc., Dell Technologies, EdgeIQ, Foghorn, HPE, Huawei, IBM Corporation, Litmus Automation, Microsoft Corporation, and Nokia are the prominent entities operating in this market.

Each of these players has been profiled in the edge computing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 6.95 Bn |

|

Market Forecast Value in 2031 |

US$ 161.66 Bn |

|

Growth Rate (CAGR) |

37.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The edge computing market is expected to reach US$ 161.66 Bn By 2031.

The edge computing market is estimated to grow at a CAGR of 37.3% during the forecast period.

Growth in adoption of IoT across industries is set to drive the global edge computing market.

North America is a more attractive region for vendors in the edge computing market.

Amazon Web Services (AWS), Inc., Atos, Cisco Systems, Inc., Dell Technologies, EdgeIQ, Foghorn, HPE, Huawei, IBM Corporation, Litmus Automation, Microsoft Corporation, and Nokia.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Edge Computing Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Edge Computing Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Application

4.5.3. By End-user

5. Global Edge Computing Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Edge Computing Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Edge Computing Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global Edge Computing Market Analysis, by Application

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Edge Computing Market Size (US$ Bn) Forecast, by Application, 2018 - 2031

7.3.1. Smart Cities

7.3.2. Augmented Reality (AR) and Virtual Reality (VR)

7.3.3. Industrial Internet of Things (IIoT)

7.3.4. Remote Monitoring

7.3.5. Others (Autonomous Vehicles and Gaming)

8. Global Edge Computing Market Analysis, by End-user

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Edge Computing Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.3.1. BFSI

8.3.2. Retail

8.3.3. Manufacturing

8.3.4. Healthcare and Life Sciences

8.3.5. IT & Telecom

8.3.6. Government

8.3.7. Media and Entertainment

8.3.8. Others (Energy & Utilities and Transportation & Logistics)

9. Global Edge Computing Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Edge Computing Market Analysis and Forecast

10.1. Regional Outlook

10.2. Edge Computing Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Application

10.2.3. By End-user

10.3. Edge Computing Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Edge Computing Market Analysis and Forecast

11.1. Regional Outlook

11.2. Edge Computing Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Application

11.2.3. By End-user

11.3. Edge Computing Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Edge Computing Market Analysis and Forecast

12.1. Regional Outlook

12.2. Edge Computing Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Application

12.2.3. By End-user

12.3. Edge Computing Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Edge Computing Market Analysis and Forecast

13.1. Regional Outlook

13.2. Edge Computing Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Application

13.2.3. By End-user

13.3. Edge Computing Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. The United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Edge Computing Market Analysis and Forecast

14.1. Regional Outlook

14.2. Edge Computing Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Application

14.2.3. By End-user

14.3. Edge Computing Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. Amazon Web Services (AWS), Inc.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership

16.1.6. Merger & Acquisition

16.1.7. Business Expansion

16.1.8. New Product Launch

16.1.9. Innovation etc.

16.2. Atos

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership

16.2.6. Merger & Acquisition

16.2.7. Business Expansion

16.2.8. New Product Launch

16.2.9. Innovation etc.

16.3. Cisco System, Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership

16.3.6. Merger & Acquisition

16.3.7. Business Expansion

16.3.8. New Product Launch

16.3.9. Innovation etc.

16.4. Dell Technologies

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership

16.4.6. Merger & Acquisition

16.4.7. Business Expansion

16.4.8. New Product Launch

16.4.9. Innovation etc.

16.5. EdgeIQ

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership

16.5.6. Merger & Acquisition

16.5.7. Business Expansion

16.5.8. New Product Launch

16.5.9. Innovation etc.

16.6. Foghorn

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership

16.6.6. Merger & Acquisition

16.6.7. Business Expansion

16.6.8. New Product Launch

16.6.9. Innovation etc.

16.7. HPE

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership

16.7.6. Merger & Acquisition

16.7.7. Business Expansion

16.7.8. New Product Launch

16.7.9. Innovation etc.

16.8. Huawei

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership

16.8.6. Merger & Acquisition

16.8.7. Business Expansion

16.8.8. New Product Launch

16.8.9. Innovation etc.

16.9. IBM Corporation

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership

16.9.6. Merger & Acquisition

16.9.7. Business Expansion

16.9.8. New Product Launch

16.9.9. Innovation etc.

16.10. Litmus Automation

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership

16.10.6. Merger & Acquisition

16.10.7. Business Expansion

16.10.8. New Product Launch

16.10.9. Innovation etc.

16.11. Microsoft Corporation

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership

16.11.6. Merger & Acquisition

16.11.7. Business Expansion

16.11.8. New Product Launch

16.11.9. Innovation etc.

16.12. Nokia

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership

16.12.6. Merger & Acquisition

16.12.7. Business Expansion

16.12.8. New Product Launch

16.12.9. Innovation etc.

16.13. Others

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership

16.13.6. Merger & Acquisition

16.13.7. Business Expansion

16.13.8. New Product Launch

16.13.9. Innovation etc.

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Edge Computing Market

Table 2: North America Edge Computing Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 3: Europe Edge Computing Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 4: Asia Pacific Edge Computing Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 5: Middle East & Africa Edge Computing Market Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America Edge Computing Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10 : List of Companies, Transactions Per Second (TPS), Features, and Pricing

Table 11: List of Companies, Transactions Per Second (TPS), Features, and Pricing

Table 12: Global Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 13: Global Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 14: Global Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 15: Global Edge Computing Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 16: North America Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 17: North America Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 18: North America Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 19: North America Edge Computing Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 20: U.S. Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Canada Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: Mexico Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Europe Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 24: Europe Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 25: Europe Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 26: Europe Edge Computing Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 27: Germany Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: UK Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: France Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Italy Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: Spain Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Asia Pacific Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 33: Asia Pacific Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 34: Asia Pacific Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 35: Asia Pacific Edge Computing Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 36: China Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: India Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Japan Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: ASEAN Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: Middle East & Africa Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 41: Middle East & Africa Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 42: Middle East & Africa Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 43: Middle East & Africa Edge Computing Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 44: Saudi Arabia Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: The United Arab Emirates Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: South Africa Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 47: South America Edge Computing Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 48: South America Edge Computing Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 49: South America Edge Computing Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 50: South America Edge Computing Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 51: Brazil Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 52: Argentina Edge Computing Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: Mergers & Acquisitions, Partnerships (1/2)

Table 54: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Edge Computing Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Edge Computing Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Edge Computing Market

Figure 4: Global Edge Computing Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: GDP (US$ Bn), Top Economies (2015-2020)

Figure 6: Gross Domestic Product (GDP) per Capita; Analysis (US$), By Major Countries, 2015-2020

Figure 7: Global Edge Computing Market Attractiveness Assessment, by Component

Figure 8: Global Edge Computing Market Attractiveness Assessment, by Application

Figure 9: Global Edge Computing Market Attractiveness Assessment, by End-user

Figure 10: Global Edge Computing Market Attractiveness Assessment, by Region

Figure 11: Global Edge Computing Market Revenue (US$ Bn) Historic Trends, 2016 - 2020

Figure 12: Global Edge Computing Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2020

Figure 13: Global Edge Computing Market Value Share Analysis, by Component, 2021

Figure 14: Global Edge Computing Market Value Share Analysis, by Component, 2031

Figure 15: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 15: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 16: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 17: Global Edge Computing Market Value Share Analysis, by Application, 2021

Figure 18: Global Edge Computing Market Value Share Analysis, by Application, 2031

Figure 19: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 20: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 20: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 20: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 20: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 21: Global Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 22: Global Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 23: Global Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 24: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 25: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Manufacturing, 2021 – 2031

Figure 26: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 27: Global Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 28: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 29: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 30: Global Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Energy & Utilities and Transportation & Logistics) , 2021 – 2031

Figure 31: Global Edge Computing Market Opportunity (US$ Bn), by Region

Figure 32: Global Edge Computing Market Opportunity Share (%), by Region, 2021 – 2031

Figure 33: Global Edge Computing Market Size (US$ Bn), by Region, 2021 & 2031

Figure 34: Global Edge Computing Market Value Share Analysis, by Region, 2021

Figure 35: Global Edge Computing Market Value Share Analysis, by Region, 2031

Figure 36: North America Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 37: Europe Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 38: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 39: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 40: South America Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 31: Global Edge Computing Market Opportunity (US$ Bn), by Region

Figure 32: Global Edge Computing Market Opportunity Share (%), by Region, 2021–2031

Figure 33: Global Edge Computing Market Size (US$ Bn), by Region, 2021 & 2031

Figure 34: Global Edge Computing Market Value Share Analysis, by Region, 2021

Figure 35: Global Edge Computing Market Value Share Analysis, by Region, 2031

Figure 36: North America Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 37: Europe Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 38: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 39: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 40: South America Edge Computing Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 41: North America Edge Computing Revenue Opportunity Share, by Component

Figure 42: North America Edge Computing Revenue Opportunity Share, by Application

Figure 43: North America Edge Computing Revenue Opportunity Share, by End-user

Figure 44: North America Edge Computing Revenue Opportunity Share, by Country

Figure 45: North America Edge Computing Market Value Share Analysis, by Component, 2021

Figure 46: North America Edge Computing Market Value Share Analysis, by Component, 2031

Figure 47: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 47: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 48: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 49: North America Edge Computing Market Value Share Analysis, by Application, 2021

Figure 50: North America Edge Computing Market Value Share Analysis, by Application, 2031

Figure 51: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 52: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 52: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 52: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 52: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 53: North America Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 54: North America Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 55: North America Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 56: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 57: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Manufacturing, 2021 – 2031

Figure 58: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 59: North America Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 60: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 61: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 62: North America Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Energy & Utilities and Transportation & Logistics), 2021 – 2031

Figure 63: North America Edge Computing Market Value Share Analysis, by Country, 2021

Figure 64: North America Edge Computing Market Value Share Analysis, by Country, 2031

Figure 65: U.S. Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 66: Canada Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 67: Mexico Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 68: Europe Edge Computing Revenue Opportunity Share, by Component

Figure 69: Europe Edge Computing Revenue Opportunity Share, by Application

Figure 70: Europe Edge Computing Revenue Opportunity Share, by End-user

Figure 71: Europe Edge Computing Revenue Opportunity Share, by Country

Figure 72: Europe Edge Computing Market Value Share Analysis, by Component, 2021

Figure 73: Europe Edge Computing Market Value Share Analysis, by Component, 2031

Figure 74: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 74: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 75: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 76: Europe Edge Computing Market Value Share Analysis, by Application, 2021

Figure 77: Europe Edge Computing Market Value Share Analysis, by Application, 2031

Figure 78: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 79: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 79: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 79: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 79: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 80: Europe Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 81: Europe Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 82: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 83: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 84: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Manufacturing, 2021 – 2031

Figure 85: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 86: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 87: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 88: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 89: Europe Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Energy & Utilities and Transportation & Logistics), 2021 – 2031

Figure 90: Europe Edge Computing Market Value Share Analysis, by Country, 2021

Figure 91: Europe Edge Computing Market Value Share Analysis, by Country, 2031

Figure 92: Germany Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 93: UK Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 94: France Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 95: Italy Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 96: Spain Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 97: Asia Pacific Edge Computing Revenue Opportunity Share, by Component

Figure 98: Asia Pacific Edge Computing Revenue Opportunity Share, by Application

Figure 99: Asia Pacific Edge Computing Revenue Opportunity Share, by End-user

Figure 100: Asia Pacific Edge Computing Revenue Opportunity Share, by Country

Figure 101: Asia Pacific Edge Computing Market Value Share Analysis, by Component, 2021

Figure 102: Asia Pacific Edge Computing Market Value Share Analysis, by Component, 2031

Figure 103: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 103: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 104: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 105: Asia Pacific Edge Computing Market Value Share Analysis, by Application, 2021

Figure 106: Asia Pacific Edge Computing Market Value Share Analysis, by Application, 2031

Figure 107: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 108: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 108: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 108: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 108: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 109: Asia Pacific Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 110: Asia Pacific Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 111: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 112: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 113: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Manufacturing, 2021 – 2031

Figure 114: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 115: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 116: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 117: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 118: Asia Pacific Edge Computing Market Absolute Opportunity (US$ Bn), by Others(Energy & Utilities and Transportation & Logistics), 2021 – 2031

Figure 119: Asia Pacific Edge Computing Market Value Share Analysis, by Country, 2021

Figure 120: Asia Pacific Edge Computing Market Value Share Analysis, by Country, 2031

Figure 121: China Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 122: India Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 123: Japan Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 124: Australia Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 125: Middle East & Africa Edge Computing Revenue Opportunity Share, by Component

Figure 126: Middle East & Africa Edge Computing Revenue Opportunity Share, by Application

Figure 127: Middle East & Africa Edge Computing Revenue Opportunity Share, by End-user

Figure 128: Middle East & Africa Edge Computing Revenue Opportunity Share, by Country

Figure 129: Middle East & Africa Edge Computing Market Value Share Analysis, by Component, 2021

Figure 130: Middle East & Africa Edge Computing Market Value Share Analysis, by Component, 2031

Figure 131: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 131: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 132: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 133: Middle East & Africa Edge Computing Market Value Share Analysis, by Application, 2021

Figure 134: Middle East & Africa Edge Computing Market Value Share Analysis, by Application, 2031

Figure 135: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 136: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 135: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 135: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 135: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 137: Middle East & Africa Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 138: Middle East & Africa Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 139: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 140: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 141: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 142: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 143: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 144: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 145: Middle East & Africa Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Energy & Utilities and Transportation & Logistics), 2021 – 2031

Figure 146: Middle East & Africa Edge Computing Market Value Share Analysis, by Country, 2021

Figure 147: Middle East & Africa Edge Computing Market Value Share Analysis, by Country, 2031

Figure 148: Saudi Arabia Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 149: The United Arab Emirates Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 150: South Africa Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 151: South America Edge Computing Revenue Opportunity Share, by Component

Figure 152: South America Edge Computing Revenue Opportunity Share, by Application

Figure 153: South America Edge Computing Revenue Opportunity Share, by End-user

Figure 154: South America Edge Computing Revenue Opportunity Share, by Country

Figure 155: South America Edge Computing Market Value Share Analysis, by Component, 2021

Figure 156: South America Edge Computing Market Value Share Analysis, by Component, 2031

Figure 157: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Hardware, 2021 – 2031

Figure 157: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 158: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 159: South America Edge Computing Market Value Share Analysis, by Application, 2021

Figure 160: South America Edge Computing Market Value Share Analysis, by Application, 2031

Figure 161: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Smart Cities, 2021 – 2031

Figure 162: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Augmented Reality (AR) and Virtual Reality (VR), 2021 – 2031

Figure 161: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Industrial Internet of Things (IIoT), 2021 – 2031

Figure 161: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Remote Monitoring, 2021 – 2031

Figure 161: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Autonomous Vehicles and Gaming), 2021 – 2031

Figure 163: South America Edge Computing Market Value Share Analysis, by End-user, 2021

Figure 164: South America Edge Computing Market Value Share Analysis, by End-user, 2031

Figure 165: South America Edge Computing Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 166: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Retail, 2021 – 2031

Figure 167: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Manufacturing, 2021 – 2031

Figure 168: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Healthcare & Life Sciences, 2021 – 2031

Figure 169: South America Edge Computing Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 170: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 171: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Media and Entertainment, 2021 – 2031

Figure 172: South America Edge Computing Market Absolute Opportunity (US$ Bn), by Others (Energy & Utilities and Transportation & Logistics), 2021 – 2031

Figure 173: South America Edge Computing Market Value Share Analysis, by Country, 2021

Figure 174: South America Edge Computing Market Value Share Analysis, by Country, 2031

Figure 175: Brazil Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 176: Argentina Edge Computing Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031