Global E-SIM Card Market: Snapshot

The global E-SIM card market is rising steadily due to the several advantages of E-SIM card over conventional SIM cards. E-SIM card allows changing mobile network operator at a few clicks, a feature distinct to them. For instance, ability to switch network providers over the air in machine to machine systems such as smart meters and connected cars has substantial advantages in terms of reducing logistics and operational costs.

The compact design of E-SIM and standardization of technical specifications for Embedded SIM technology is another distinct feature that sets E-SIM cards apart from conventional SIM cards. This is because Embedded SIM technology is standardized by Groupe Speciale Mobile Association, which comprises more than 800 mobile operators worldwide. Further, compact design of E-SIM cards is advantageous to original equipment manufacturers for increasing the battery size or to provide additional storage in electronic devices.

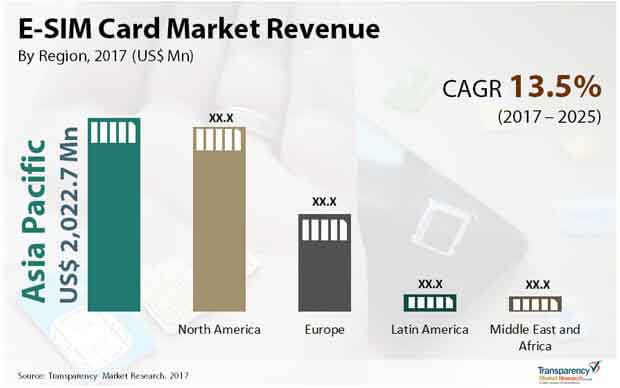

A report by Transparency Market Research predicts the global E-SIM card market to rise at a healthy 13.5% CAGR between 2017 and 2025. Progressing at this rate, the market is anticipated to display an opportunity of US$14,613.1 mn by 2025 increasing from US$4,095.6 mn in 2016.

Smartphones Application Segment to Display Leading CAGR until 2025

In terms of application, the global E-SIM card market has been segmented into machine to machine (M2M), wearable and companion devices, smartphones, and tablets and laptops. The segment of M2M, among these, contributed the leading revenue contribution in 2016. M2M is further sub-segmented into connected cars, utility, and others. Of them, connected cars is expected to expand at a CAGR of over 15% between 2017 and 2025 backed by the rising adoption of E-SIM card in the automotive industry for weather information and infotainment.

The commercialization of Embedded SIM for smartphones is expected in 2019. The segment is expected to rise at a robust CAGR of 26.3%between 2019 and 2025.

Asia Pacific to Exhibit Leading CAGR between 2017 and 2025

The key segments into which the global E-SIM card is divided based on geography are North America, Asia Pacific, Europe, Middle East and Africa, and South America. In 2016, Europe stood as the leading revenue generation region and is expected to display substantial CAGR over the forecast period. The supremacy of the region is due to the favorable government initiatives for the implementation of “Industry 4.0” technology and solutions. The U.K., France, and Germany are the leading revenue contributors to the Europe E-SIM card market.

North America held the second-leading revenue share in the global market in 2016 with the U.S. contributing the leading revenue. The region is expected to display significant growth over the forecast period. The increased adoption of technology as well as home to key industry players is driving the growth of this regional market.

Asia Pacific, amongst all, is expected to rise with the leading CAGR over the forecast period. The growth of this region is backed by the rising adoption of embedded SIM technology in M2M devices across several countries such as China and Japan.

South Africa and Gulf Cooperation Council are the leading revenue generating regions in the Middle East and Africa. The E-SIM card market in South America is driven by the rising adoption of embedded SIM in utilities to provide smart metering solutions. Brazil is the leading revenue contributing domestic market to the E-SIM card market in the region.

Some prominent players operating in the global E-SIM card market profiled in this report are Apple Inc., Samsung, Gemalto N.V., Giesecke & Devrient GmbH, NTT DOCOMO Inc., OT-Morpho, Telefonica S.A., Deutsche Telekom AG, Sierra Wireless Inc., and ST Microelectronics.

Benefits over Traditional SIM Cards to Paint Strokes of Growth across Global E-SIM Card Market

The E-SIM card market expects to expand at a promising CAGR during the assessment period of 2017-2025. The overwhelming benefits offered by these SIM cards as compared to traditional SIM cards will prove to be a prominent growth factor for the E-SIM card market.

The E-SIM Card Market is studied from 2017 – 2025

E-SIM Card Market to expand at a CAGR of 13.5% during the forecast period 2025

Asia Pacific is growing at the highest CAGR over 2017- 2025

Some prominent players operating in the global E-SIM card market profiled in this report are Apple Inc., Samsung, Gemalto N.V., Giesecke & Devrient GmbH, NTT DOCOMO Inc., OT-Morpho, Telefonica S.A., Deutsche Telekom AG, Sierra Wireless Inc., and ST Microelectronics.

E-SIM Card Market is expected to rise to US$14613.1 Mn by 2025

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global E-SIM Card Market

4. Market Overview

4.1. Introduction

4.1.1. Key Industry Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends

4.4. Market Indicators

4.5. Global E-SIM Card Market Analysis and Forecasts, 2015 – 2025

4.5.1. Market Revenue Projections (US$ Mn)

4.6. Porter’s Five Force Model

4.7. E-SIM Basic Architecture

4.8. Ecosystem Analysis

4.9. Market Outlook

5. Global E-SIM Card Market Analysis and Forecasts, By Application

5.1. Overview & Definitions

5.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

5.2.1. Machine to machine (M2M)

5.2.1.1. Connected Cars

5.2.1.2. Utility

5.2.1.3. Others

5.2.2. Tablets

5.2.3. Smartphones

5.2.4. Wearable

5.2.5. Others

5.3. Market Attractiveness By Application

6. Global E-SIM Card Market Analysis and Forecasts, By Region

6.1. Key Findings

6.2. Market Size (US$ Mn) Forecast By Region, 2015 – 2025

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Attractiveness By Country/Region

7. North America E-SIM Card Market Analysis and Forecast

7.1. Key Findings

7.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

7.2.1. Machine to machine (M2M)

7.2.1.1. Connected Cars

7.2.1.2. Utility

7.2.1.3. Others

7.2.2. Tablets

7.2.3. Smartphones

7.2.4. Wearable

7.2.5. Others

7.3. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

7.3.1. The U.S.

7.3.2. Canada

7.3.3. Rest of North America

7.4. Market Attractiveness Analysis

7.4.1. By Country

7.4.2. By Application

8. Europe E-SIM Card Market Analysis and Forecast

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

8.2.1. Machine to machine (M2M)

8.2.1.1. Connected Cars

8.2.1.2. Utility

8.2.1.3. Others

8.2.2. Tablets

8.2.3. Smartphones

8.2.4. Wearable

8.2.5. Others

8.3. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

8.3.1. The U.K.

8.3.2. Germany

8.3.3. France

8.3.4. Rest of Europe

8.4. Market Attractiveness Analysis

8.4.1. By Country

8.4.2. By Application

9. Asia Pacific E-SIM Card Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

9.2.1. Machine to machine (M2M)

9.2.1.1. Connected Cars

9.2.1.2. Utility

9.2.1.3. Others

9.2.2. Tablets

9.2.3. Smartphones

9.2.4. Wearable

9.2.5. Others

9.3. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

9.3.1. Japan

9.3.2. China

9.3.3. Rest of Asia Pacific

9.4. Market Attractiveness Analysis

9.4.1. By Country

9.4.2. By Application

10. Middle East and Africa (MEA) E-SIM Card Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

10.2.1. Machine to machine (M2M)

10.2.1.1. Connected Cars

10.2.1.2. Utility

10.2.1.3. Others

10.2.2. Tablets

10.2.3. Smartphones

10.2.4. Wearable

10.2.5. Others

10.3. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

10.3.1. GCC

10.3.2. South Africa

10.3.3. Rest of MEA

10.4. Market Attractiveness Analysis

10.4.1. By Country

10.4.2. By Application

11. South America E-SIM Card Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

11.2.1. Machine to machine (M2M)

11.2.1.1. Connected Cars

11.2.1.2. Utility

11.2.1.3. Others

11.2.2. Tablets

11.2.3. Smartphones

11.2.4. Wearable

11.2.5. Others

11.3. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

11.3.1. Brazil

11.3.2. Rest of South America

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Application

12. Competition Landscape

12.1. Market Player – Competition Matrix

12.2. Market Share Analysis By Company (2016)

12.3. Company Profiles (Details – Overview, Financials, Recent Developments, SWOT, Strategy)

12.3.1. Apple Inc.

12.3.2. Samsung

12.3.3. Gemalto NV

12.3.4. Giesecke & Devrient GmbH

12.3.5. NTT DOCOMO, INC.

12.3.6. OT-Morpho

12.3.7. Telefónica S.A.

12.3.8. Sierra Wireless, Inc.

12.3.9. STMicroelectronics

12.3.10. Deutsche Telekom AG

13. Key Takeaways

List of Tables

Table 01: Global E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 02: Global E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 03: Global E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 04: Global E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 05: Global E-SIM Card Market Size (US$ Mn) Forecast, By Region, 2015–2025

Table 06: Global E-SIM Card Market Size (US$ Mn) Forecast, By Region, 2015–2025

Table 07: North America E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 08: North America E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 09: North America E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 10: North America E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 11: North America E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 12: North America E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 13: Europe E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 14: Europe E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 15: Europe E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 16: Europe E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 17: Europe E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 18: Europe E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 19: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 20: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 21: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 22: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 23: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 24: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 25: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 26: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 27: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 28: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 29: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 30: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 31: South America E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 32: South America E-SIM Card Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 33: South America E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 34: South America E-SIM Card Market Size (US$ Mn) Forecast, By M2M Application, 2015–2025

Table 35: South America E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 36: South America E-SIM Card Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

List of Figures

Figure 01: Global number of connected devices (Billions Units)

Figure 02: Figure 2: Global Car shipments (Million Units)

Figure 03: E-SIM Basic Architecture

Figure 04: E-SIM Card Ecosystem Analysis

Figure 05: Global E-SIM Card Market Size (US$ Mn) Forecast, 2015 - 2025

Figure 06: Global E-SIM Card Market Y-o-Y Growth (Value %) Forecast, 2016 - 2025

Figure 07: Global E-SIM Card Market Revenue (US$ Mn) Growth Analysis By Application, 2017-2025

Figure 08: Global E-SIM Card Market Revenue Share Analysis By Region, 2017-2025

Figure 09: Global E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 10: Global E-SIM Card Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 11: Global E-SIM Card Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 12: Global E-SIM Card Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 13: Global E-SIM Card Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 14: Global E-SIM Card Market Attractiveness Analysis By Application

Figure 15: Global E-SIM Card Market Attractiveness Analysis By Region

Figure 16: North America E-SIM Card Market Size (US$ Mn) Forecast, 2015–2025

Figure 17: North America E-SIM Card Market Size Y-o-Y Growth Projections, 2016–2025

Figure 18: North America E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 19: North America E-SIM Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 20: North America E-SIM Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 21: North America E-SIM Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 22: North America E-SIM Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 23: North America E-SIM Card Market Revenue Share Analysis, By Country/Region, 2019 and 2025

Figure 24: North America E-SIM Card Market Attractiveness Analysis By Country

Figure 25: North America E-SIM Card Market Attractiveness Analysis By Application

Figure 26: Europe E-SIM Card Market Size (US$ Mn) Forecast, 2015–2025

Figure 27: Europe E-SIM Card Market Size Y-o-Y Growth Projections, 2016–2025

Figure 28: Europe E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 29: Europe E-SIM Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 30: Europe E-SIM Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 31: Europe E-SIM Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 32: Europe E-SIM Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 33: Europe E-SIM Card Market Revenue Share Analysis, By Country/Region, 2019 and 2025

Figure 34: Europe E-SIM Card Market Attractiveness Analysis By Country

Figure 35: Europe E-SIM Card Market Attractiveness Analysis By Application

Figure 36: Asia Pacific E-SIM Card Market Size (US$ Mn) Forecast, 2015–2025

Figure 37: Asia Pacific E-SIM Card Market Size Y-o-Y Growth Projections, 2016–2025

Figure 38: Asia Pacific E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 39: Asia Pacific E-SIM Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 40: Asia Pacific E-SIM Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 41: Asia Pacific E-SIM Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 42: Asia Pacific E-SIM Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 43: Asia Pacific E-SIM Card Market Revenue Share Analysis, By Country/Region, 2019 and 2025

Figure 44: Asia Pacific E-SIM Card Market Attractiveness Analysis By Country

Figure 45: Asia Pacific E-SIM Card Market Attractiveness Analysis By Application

Figure 46: Middle East and Africa E-SIM Card Market Size (US$ Mn) Forecast, 2015–2025

Figure 47: Middle East and Africa E-SIM Card Market Size Y-o-Y Growth Projections, 2016–2025

Figure 48: Middle East and Africa E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 49: Middle East and Africa E-SIM Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 50: Middle East and Africa E-SIM Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 51: Middle East and Africa E-SIM Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 52: Middle East and Africa E-SIM Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 53: Middle East and Africa E-SIM Card Market Revenue Share Analysis, By Country/Region, 2019 and 2025

Figure 54: Middle East and Africa E-SIM Card Market Attractiveness Analysis By Country

Figure 55: Middle East and Africa E-SIM Card Market Attractiveness Analysis By Application

Figure 56: South America E-SIM Card Market Size (US$ Mn) Forecast, 2015–2025

Figure 57: South America E-SIM Card Market Size Y-o-Y Growth Projections, 2016–2025

Figure 58: South America E-SIM Card Market Revenue Share Analysis, By Application, 2019 and 2025

Figure 59: South America E-SIM Market Revenue (US$ Mn) Growth Analysis Machine to Machine (M2M) Application, 2017-2025

Figure 60: South America E-SIM Market Revenue (US$ Mn) Growth Analysis By Wearable & Companion Devices Application, 2017-2025

Figure 61: South America E-SIM Market Revenue (US$ Mn) Growth Analysis By Smartphones Application, 2017-2025

Figure 62: South America E-SIM Market Revenue (US$ Mn) Growth Analysis By Tablets & Laptops Application, 2017-2025

Figure 63: South America E-SIM Card Market Revenue Share Analysis, By Country/Region, 2019 and 2025

Figure 64: South America E-SIM Card Market Attractiveness Analysis By Country

Figure 65: South America E-SIM Card Market Attractiveness Analysis By Application

Figure 66: E-SIM Card Market Share Analysis By Company (2016)