Analysts’ Viewpoint on Dura Substitute Market Scenario

Healthcare providers in the dura substitute market are increasing efforts to improve the quality of life for patients with musculoskeletal disorders amid the ongoing coronavirus pandemic. It has been found that xenografts could cause complications such as graft disintegration, encapsulation, and scarring in patients. Hence, healthcare companies should increase R&D in regenerative medicine to overcome complications of xenografts.

Manufacturers are increasing the production of FDA-approved degradable materials such as biomimetic patch made of poly-L-lactic acid, which holds promising potentials to improve patient outcomes. Researchers have attempted to employ various synthetic polymers to make dural substitutes in order to minimize the spread of diseases caused by the use of allogeneic or xenogeneic materials for increasing clinical effectiveness and reduce costs.

The high prevalence of CNS (Central Nervous System) tumors caused by neurological disorders is emerging as a driver for companies in the dura substitute market. Chiari malformation and spinal cord related neurosurgery procedures are fuelling the demand for dura substitutes.

The rise in the number of neurological treatments, such as duraplasty, is triggering the demand for dura substitutes. It has been found that in 2018, more than half of all dural substitutes were utilized in cranial and spine tumor surgeries.

Healthcare services have been affected due to the ongoing coronavirus pandemic. Elective procedures have been postponed indefinitely in the dura substitute market. Neurosurgeons are being redeployed to treat COVID-19 patients. Recent cases of the Omicron variant are creating concerns for healthcare providers. Since coronavirus affects the brain of individuals, participants in the dura substitute market are improving their healthcare services to enable better patient outcomes.

There is a requirement of compulsory training to the neurosurgeon community to understand the symptoms of the novel infection. As such, participants in the market are increasing the availability of biological grafts & synthetic grafts to ensure continuity in healthcare services. They are increasing efforts to revive R&D activities to gain proficiency in neurosurgical and spinal surgeries.

Complications associated with dura substitute materials are affecting market growth. For instance, autologous tissue is generally preferred for commercialized dura replacements as it reduces the chances of infection and rejection. However, if there is insufficient local replacement tissue of sufficient quality to heal the dural defect, surgeons may avoid autografts. Hence, investments in R&D for materials and government initiatives to promote regenerative medicine hold promising potentials to improve surgical procedures.

Since governments across the world are realizing the importance of regenerative medicine, such trends are translating into revenue opportunities for companies in the dura substitute market.

Government funding for the treatment of various diseases is increasing globally due to the formulation and adoption of supporting legislation & policies. Such trends are contributing to expansion of the regenerative medicine sector in the dura substitute market.

Healthcare companies are drawing significant expenditure in regenerative medicines such as the establishment of centers of excellence, manufacturing infrastructure, and research networks, among others. The NIH (National Institutes of Health) Common Fund facilitated the establishment of the NIH Center for Regenerative Medicine in 2010 with the purpose of serving as a national resource for stem cell sciences. Such developments are helping to accelerate the development of novel medical applications and cell-based therapeutics.

Dural repair materials are transitioning from animal tissue-derived materials to synthetic materials as well as from inert to absorbable properties. Such findings are bringing a significant change in the global dura substitute market.

Biomimetic patch is a new dural repair product that provides functional properties similar to alternate therapies. This patch has a 3 dimensional (3D) non-woven microfiber structure that is both mechanically strong and biocompatible. The animal investigation revealed that the biomimetic patch and commercially synthesized material groups demonstrated new subdural regeneration after 90 days, with low inflammatory response and minimal to no adhesion development at each stage. It has been found that the biomimetic structure and proper rate of degradation of the new absorbable dura replacement can lead significant regeneration of the dura mater.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 175.6 Mn |

|

Market Forecast Value in 2031 |

US$ 328.6 Mn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

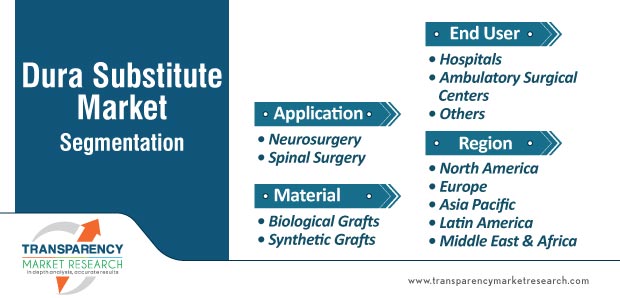

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Dura substitute market is expected to reach the value of US$ 328.6 Mn by the end of 2031

Dura substitute market is estimated to expand at a CAGR of 5.9% from 2021 to 2031

Dura substitute market is driven by rise in the number of road accidents and sports injuries

The end-use segments in dura substitute market are hospitals and ambulatory surgical centers

Key players operating in the global market include Cook Medical LLC, B. Braun Melsungen AG, Integra LifeSciences, Cousin Surgery, W. L. Gore & Associates, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Dura Substitute Market

4. Market Overview

4.1. Introduction

4.1.1. Material Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dura Substitute Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.3. Pricing Analysis

5.4. Product /Brand Analysis, by Application

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Dura Substitute Market Analysis and Forecast, by Material

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Material, 2017–2031

6.3.1. Biological Grafts

6.3.1.1. Autografts

6.3.1.2. Allografts

6.3.1.3. Xenografts

6.3.1.3.1. Collagen

6.3.1.3.2. Decellularized Pericardium

6.3.1.3.3. Small Intestine Submucosa

6.3.2. Synthetic

6.3.2.1. Polytetrafluoroethylene (PTFE)

6.3.2.2. Others

6.4. Market Attractiveness Analysis, by Material

7. Global Dura Substitute Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Neurosurgery

7.3.2. Spinal Surgery

7.4. Market Attractiveness Analysis, by Application

8. Global Dura Substitute Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Dura Substitute Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Dura Substitute Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Material, 2017–2031

10.2.1. Biological Grafts

10.2.1.1. Autografts

10.2.1.2. Allografts

10.2.1.3. Xenografts

10.2.1.3.1. Collagen

10.2.1.3.2. Decellularized Pericardium

10.2.1.3.3. Small Intestine Submucosa

10.2.2. Synthetic

10.2.2.1. Polytetrafluoroethylene (PTFE)

10.2.2.2. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Neurosurgery

10.3.2. Spinal Surgery

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Material

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. U.S Dura Substitute Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Material, 2017–2031

11.2.1. Biological Grafts

11.2.2. Synthetic

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Neurosurgery

11.3.2. Spinal Surgery

11.4. Market Attractiveness Analysis

11.4.1. By Material

11.4.2. By Application

12. Canada Dura Substitute Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Material, 2017–2031

12.2.1. Biological Grafts

12.2.2. Synthetic

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Neurosurgery

12.3.2. Spinal Surgery

12.4. Market Attractiveness Analysis

12.4.1. By Material

12.4.2. By Application

13. Europe Dura Substitute Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Material, 2017–2031

13.2.1. Biological Grafts

13.2.1.1. Autografts

13.2.1.2. Allografts

13.2.1.3. Xenografts

13.2.1.3.1. Collagen

13.2.1.3.2. Decellularized Pericardium

13.2.1.3.3. Small Intestine Submucosa

13.2.2. Synthetic

13.2.2.1. Polytetrafluoroethylene (PTFE)

13.2.2.2. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Neurosurgery

13.3.2. Spinal Surgery

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Germany

13.5.2. U.K

13.5.3. France

13.5.4. Italy

13.5.5. Spain

13.5.6. Denmark

13.5.7. Sweden

13.5.8. Finland

13.5.9. Iceland

13.5.10. Norway

13.5.11. Rest of Europe

13.6. Market Attractiveness Analysis

13.6.1. By Material

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Germany Dura Substitute Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Material, 2017–2031

14.2.1. Biological Grafts

14.2.2. Synthetic

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Neurosurgery

14.3.2. Spinal Surgery

14.4. Market Attractiveness Analysis

14.4.1. By Material

14.4.2. By Application

15. U.K Dura Substitute Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Material, 2017–2031

15.2.1. Biological Grafts

15.2.2. Synthetic

15.3. Market Value Forecast, by Application, 2017–2031

15.3.1. Neurosurgery

15.3.2. Spinal Surgery

15.4. Market Attractiveness Analysis

15.4.1. By Material

15.4.2. By Application

16. France Dura Substitute Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Material, 2017–2031

16.2.1. Biological Grafts

16.2.2. Synthetic

16.3. Market Value Forecast, by Application, 2017–2031

16.3.1. Neurosurgery

16.3.2. Spinal Surgery

16.4. Market Attractiveness Analysis

16.4.1. By Material

16.4.2. By Application

17. Italy Dura Substitute Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast, by Material, 2017–2031

17.2.1. Biological Grafts

17.2.2. Synthetic

17.3. Market Value Forecast, by Application, 2017–2031

17.3.1. Neurosurgery

17.3.2. Spinal Surgery

17.4. Market Attractiveness Analysis

17.4.1. By Material

18. Competition Landscape

18.1. Market Player - Competition Matrix (by tier and size of companies)

18.2. Market Share Analysis, by Company, 2020

18.3. Company Profiles

18.3.1. Cook Medical LLC

18.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.1.2. Product Portfolio

18.3.1.3. SWOT Analysis

18.3.1.4. Strategic Overview

18.3.2. B. Braun Melsungen AG

18.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.2.2. Product Portfolio

18.3.2.3. SWOT Analysis

18.3.2.4. Strategic Overview

18.3.3. Integra LifeSciences

18.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.3.2. Product Portfolio

18.3.3.3. SWOT Analysis

18.3.3.4. Strategic Overview

18.3.4. Cousin Surgery

18.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.4.2. Product Portfolio

18.3.4.3. SWOT Analysis

18.3.4.4. Strategic Overview

18.3.5. W. L. Gore & Associates, Inc.

18.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.5.2. Product Portfolio

18.3.5.3. SWOT Analysis

18.3.5.4. Strategic Overview

18.3.6. Biosynth Lifesciences

18.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.6.2. Product Portfolio

18.3.6.3. SWOT Analysis

18.3.6.4. Strategic Overview

18.3.7. Acera Surgical, Inc.

18.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.7.2. Product Portfolio

18.3.7.3. SWOT Analysis

18.3.7.4. Strategic Overview

18.3.8. Medprin

18.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.8.2. Product Portfolio

18.3.8.3. SWOT Analysis

18.3.8.4. Strategic Overview

18.3.9. Medtronic

18.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.9.2. Product Portfolio

18.3.9.3. SWOT Analysis

18.3.9.4. Strategic Overview

18.3.10. Stryker

18.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.10.2. Product Portfolio

18.3.10.3. SWOT Analysis

18.3.10.4. Strategic Overview

18.3.11. DePuy Synthes

18.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.11.2. Product Portfolio

18.3.11.3. SWOT Analysis

18.3.11.4. Strategic Overview

18.3.12. Gunze Limited

18.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.12.2. Product Portfolio

18.3.12.3. SWOT Analysis

18.3.12.4. Strategic Overview

18.3.13. Baxter

18.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.13.2. Product Portfolio

18.3.13.3. SWOT Analysis

18.3.13.4. Strategic Overview

18.3.14. Bennett Health, Inc.

18.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.14.2. Product Portfolio

18.3.14.3. SWOT Analysis

18.3.14.4. Strategic Overview

18.3.15. RTI Surgical

18.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.15.2. Product Portfolio

18.3.15.3. SWOT Analysis

18.3.15.4. Strategic Overview

18.3.16. Natus Medical Incorporated

18.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

18.3.16.2. Product Portfolio

18.3.16.3. SWOT Analysis

18.3.16.4. Strategic Overview

List of Tables

Table 01: Global Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 02: Global Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 03: Global Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 04: Global Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 05: Global Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: Global Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Global Dura Substitute Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Dura Substitute Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 09: North America Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 10: North America Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 11: North America Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 12: North America Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 13: North America Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: North America Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: U.S Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 16: U.S Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Canada Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 18: Canada Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 21: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 22: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 23: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 24: Europe Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Europe Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Germany Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 27: Germany Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: U.K. Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 29: U.K Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: France Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 31: France Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 32: Spain Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 33: Spain Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 34: Italy Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 35: Italy Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Denmark Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 37: Denmark Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 38: Sweden Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 39: Sweden Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 40: Finland Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 41: Finland Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 42: Iceland Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 43: Iceland Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 44: Norway Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 45: Norway Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 46: Rest of Europe Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 47: Rest of Europe Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 48: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 49: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 50: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 51: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 52: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 53: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 54: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 55: China Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 56: China Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 57: Japan Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 58: Japan Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 59: India Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 60: India Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 61: South Korea Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 62: South Korea Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 63: Australia Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 64: Australia Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 65: Rest of Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 66: Rest of Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 67: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 68: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 69: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 70: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 71: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 72: Latin America Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 73: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 74: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by Biological Grafts, 2017–2031

Table 75: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by Xenografts, 2017–2031

Table 76: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by Synthetic, 2017–2031

Table 77: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 78: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Dura Substitute Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Dura Substitute Market Value Share, by Material, 2020

Figure 03: Global Dura Substitute Market Value Share, by Application, 2020

Figure 04: Global Dura Substitute Market Value Share, by End-user, 2020

Figure 05: Global Dura Substitute Market Value Share, by Region, 2020

Figure 06: Global Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 07: Global Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 08: Global Dura Substitute Market Value (US$ Mn), by Biological Grafts, 2017–2031

Figure 09: Global Dura Substitute Market Value (US$ Mn), by Synthetic, 2017–2031

Figure 10: Global Dura Substitute Market Value (US$ Mn), by Xenografts, 2017–2031

Figure 11: Global Dura Substitute Market Value (US$ Mn), by Autografts, 2017–2031

Figure 12: Global Dura Substitute Market Value (US$ Mn), by Allografts, 2017–2031

Figure 13: Global Dura Substitute Market Value (US$ Mn), by Trichomoniasis, 2017–2031

Figure 14: Global Dura Substitute Market Value (US$ Mn), by Others, 2017–2031

Figure 15: Global Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 16: Global Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 17: Global Dura Substitute Market Value (US$ Mn), by Neurosurgery, 2017–2031

Figure 18: Global Dura Substitute Market Value (US$ Mn), by Spinal Surgery, 2017–2031

Figure 19: Global Dura Substitute Market Value (US$ Mn), by Others, 2017–2031

Figure 20: Global Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 21: Global Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 22: Global Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031

Figure 23: Global Dura Substitute Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 24: Global Dura Substitute Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 25: Global Dura Substitute Market Value (US$ Mn), by Others, 2017–2031

Figure 26: Global Dura Substitute Market Analysis, 2020 and 2031

Figure 27: Global Dura Substitute Market Attractiveness Analysis, by Region, 2021–2031

Figure 28: North America Dura Substitute Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: North America Dura Substitute Market Value Share, by Country/Sub-region, 2020–2031

Figure 30: North America Dura Substitute Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 31: North America Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 32: North America Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 33: North America Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 34: North America Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 35: North America Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 36: North America Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031

Figure 37: U.S Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 38: U.S Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 39: U.S Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 40: U.S Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 41: Canada Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 42: Canada Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 43: Canada Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 44: Canada Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 45: Europe Dura Substitute Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 46: Europe Dura Substitute Market Value Share, by Country/Sub-region, 2020–2031

Figure 47: Europe Dura Substitute Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 48: Europe Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 49: Europe Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 50: Europe Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 51: Europe Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031

Figure 52: Germany Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 53: Germany Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 54: Germany Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 55: Germany Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 56: U.K. Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 57: U.K. Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 58: U.K. Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 59: U.K. Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 60: France Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 61: France Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 62: France Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 63: France Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 64: Spain Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 65: Spain Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 66: Spain Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 67: Spain Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 68: Italy Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 69: Italy Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 70: Italy Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 71: Italy Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 72: Denmark Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 73: Denmark Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 74: Denmark Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 75: Denmark Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 76: Sweden Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 77: Sweden Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 78: Sweden Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 79: Sweden Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 80: Finland Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 81: Finland Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 82: Finland Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 83: Finland Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 84: Iceland Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 85: Iceland Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 86: Iceland Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 87: Iceland Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 88: Norway Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 89: Norway Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 90: Norway Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 91: Norway Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 92: Rest of Europe Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 93: Rest of Europe Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 94: Rest of Europe Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 95: Rest of Europe Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 96: Asia Pacific Dura Substitute Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 97: Asia Pacific Dura Substitute Market Value Share, by Country/Sub-region, 2020–2031

Figure 98: Asia Pacific Dura Substitute Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 99: Asia Pacific Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 100: Asia Pacific Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 101: Asia Pacific Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 102: Asia Pacific Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 103: Asia Pacific Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 104: Asia Pacific Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031

Figure 105: China Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 106: China Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 107: China Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 108: China Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 109: Japan Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 110: Japan Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 111: Japan Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 112: Japan Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 113: India Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 114: India Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 115: India Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 116: India Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 117: South Korea Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 118: South Korea Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 119: South Korea Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 120: South Korea Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 121: Australia Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 122 Australia Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 123: Australia Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 124: Australia Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 125: Rest of Asia Pacific Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 126: Rest of Asia Pacific Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 127: Rest of Asia Pacific Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 128: Rest of Asia Pacific Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 129: Latin America Dura Substitute Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 130: Latin America Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 131: Latin America Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 132: Latin America Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 133: Latin America Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 134: Latin America Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 135: Latin America Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031

Figure 136: Middle East & Africa Dura Substitute Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 137: Middle East & Africa Dura Substitute Market Value Share Analysis, by Material, 2020 and 2031

Figure 138: Middle East & Africa Dura Substitute Market Attractiveness Analysis, by Material, 2021–2031

Figure 139: Middle East & Africa Dura Substitute Market Value Share Analysis, by Application, 2020 and 2031

Figure 140: Middle East & Africa Dura Substitute Market Attractiveness Analysis, by Application, 2021–2031

Figure 141: Middle East & Africa Dura Substitute Market Value Share Analysis, by End-user, 2020 and 2031

Figure 142: Middle East & Africa Dura Substitute Market Attractiveness Analysis, by End-user, 2021–2031