Analysts’ Viewpoint on Market Scenario

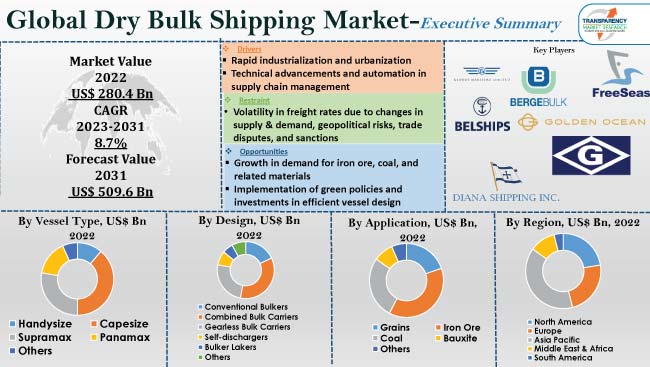

The dry bulk shipping market size is driven by rapid industrialization and urbanization worldwide. Technical advancements and automation in supply chain management are also expected to boost market expansion during the forecast period.

Growth in demand for iron ore, coal, and related materials is likely to offer lucrative opportunities for vendors in the global dry bulk shipping industry. Implementation of green policies has prompted vendors to invest in efficient vessel design. They are also using alternative fuels such as LNG and biofuels.

The COVID-19 pandemic adversely impacted the dry bulk shipping market growth due to a sluggish activity during the shutdown in China - one of the world's largest producers of marine commodities including grain, coal, and iron ore. However, the post-pandemic recovery of the economy of China is likely to lead to boost the demand for bulk transportation in the near future.

In the dry bulk shipping business, bulk carriers are used to transport enormous quantities of dry goods, including minerals, iron ore, coal, grains, and cement, around the world. Dry bulk carriers are specialized vessels built to transport these items in huge quantities. They frequently come with cranes and conveyor belts for loading and unloading.

Dry bulk shipping plays a key role in the global trade of raw materials and finished goods. Commodities such as iron ore and coal are necessary for manufacturing steel, while grain and other agricultural products are crucial components of the global food supply chain. Most of the materials that make up dry bulk are raw and intended for use in global industrial and manufacturing processes. The dry bulk shipping business plays a significant role in the international trade of these goods between producers and consumers.

Demand for dry bulk transportation of raw resources, including iron ore, coal, and grain, is significantly influenced by the amount of global economic activity. Rise in need for steel in the construction sector is expected to fuel the dry bulk shipping market progress in the near future.

Coal and iron ore are the most frequently traded dry bulk commodities globally. Major countries in Asia Pacific, such as India, China, and Japan, are some of the largest importers of coal to meet the energy sector needs. The COVID-19 pandemic has had a significant impact on global trade trends at sea, as the dry bulk cargo market for all types of vessels bottomed out and there was a corresponding decline in cargo movements due to the suspension or contraction of economic activity. However, several countries implemented measures to progressively loosen the lockdown, while also restarting economic activity as circumstances began to normalize. Economic recovery in China is expected to surge freight rates in the second half of 2023, thereby augmenting the dry bulk shipping market value.

The dry bulk shipping business is progressively implementing digitalization and automation technologies to increase productivity and reduce costs. Automated cargo handling systems, digital platforms for booking and tracking dry bulk freight, and data analytics tools for improving vessel performance are some of these technologies. Technical advancements, such as the ability to track and identify individual components of shipping cargo, are projected to drive the dry bulk shipping market statistics in the next few years.

According to the latest dry bulk shipping market trends, the capesize vessel type segment is expected to hold largest share from 2023 to 2031. Growth of the segment can be ascribed to increase in the transportation of steel, iron ore, and other basic commodities. Capesize vessels are widely employed to transport iron ore.

Both major and small bulks can be shipped in dry bulk. Major dry bulk commodities include grain, coal, and iron ore. Nearly two-thirds of all dry bulk trade worldwide comprises these big bulks. Cement, sugar, and steel goods are examples of minor bulks, which account for the final third of dry bulk trade globally.

Iron ore shipments are benefiting the most from the economic recovery of China. Growth in investments in infrastructure development and construction projects is keeping iron ore demand afloat. Demand for coal in Asia Pacific is expected to be strong during the forecast period.

According to the latest dry bulk shipping market forecast, Asia Pacific is anticipated to account for largest share from 2023 to 2031, followed by Europe. Growth in trade activities in China and India is driving the dry bulk shipping market share of the region.

China has strengthened its position as the dominant player in bulk shipping, with imports of iron ore and coal accounting for a major share. Surge in demand for agricultural products, expansion in construction and industrial sectors, and increase in production of chemicals are also fueling market dynamics in Asia Pacific.

The global industry is highly concentrated in nature due to the presence of a few prominent vendors of dry bulk shipping including Belships ASA, Berge Bulk Singapore Pte., Diana Shipping, Inc., Freeseas Inc., Genco Shipping & Trading Limited, Globus Maritime Limited, Golden Ocean Group, Gulf Agency Company Ltd., Star Bulk Management Inc., and Western Bulk Management AS.

Key players in the global dry bulk shipping market report have been profiled based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 280.4 Bn |

|

Market Forecast Value in 2031 |

US$ 509.6 Bn |

|

Growth Rate (CAGR) |

8.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 280.4 Bn in 2022

It is estimated to be 8.7% during 2023 to 2031

Rapid industrialization and urbanization along with technical advancements and automation in supply chain management

The capsize vessel type segment accounted for largest share in 2022

Asia Pacific is likely to record the highest demand during the forecast period

Belships ASA, Berge Bulk Singapore Pte., Diana Shipping, Inc., Freeseas Inc., Genco Shipping & Trading Limited, Globus Maritime Limited, Golden Ocean Group, Gulf Agency Company Ltd., Star Bulk Management Inc., and Western Bulk Management AS

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Shipping Industry Overview

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technology Overview

5.10. Global Dry Bulk Shipping Market Analysis and Forecast, 2017-2031

5.10.1. Market Value Projections (US$ Bn)

6. Global Dry Bulk Shipping Market Analysis and Forecast, by Vessel Type

6.1. Global Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

6.1.1. Handysize

6.1.2. Capesize

6.1.3. Supramax

6.1.4. Panamax

6.1.5. Others (Post-panamax, Kamsarmax, etc.)

6.2. Incremental Opportunity, by Vessel Type

7. Global Dry Bulk Shipping Market Analysis and Forecast, by Design

7.1. Global Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

7.1.1. Conventional Bulkers

7.1.2. Combined Bulk Carriers

7.1.3. Gearless Bulk Carriers

7.1.4. Self-dischargers

7.1.5. Bulker Lakers

7.1.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

7.2. Incremental Opportunity, by Design

8. Global Dry Bulk Shipping Market Analysis and Forecast, by Application

8.1. Global Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

8.1.1. Grains

8.1.2. Iron Ore

8.1.3. Coal

8.1.4. Bauxite

8.1.5. Others (Wood Chips, Cement, Chemicals, etc.)

8.2. Incremental Opportunity, by Application

9. Global Dry Bulk Shipping Market Analysis and Forecast, by Region

9.1. Global Dry Bulk Shipping Market Size (US$ Bn) by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Middle East & Africa

9.1.4. Asia Pacific

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Dry Bulk Shipping Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Shipping Providers Analysis

10.3. COVID-19 Impact Analysis

10.4. Key Trends Analysis

10.4.1. Supply Side

10.4.2. Demand Side

10.5. Dry Bulk Freight Rates Analysis

10.6. Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

10.6.1. Handysize

10.6.2. Capesize

10.6.3. Supramax

10.6.4. Panamax

10.6.5. Others (Post-panamax, Kamsarmax, etc.)

10.7. Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

10.7.1. Conventional Bulkers

10.7.2. Combined Bulk Carriers

10.7.3. Gearless Bulk Carriers

10.7.4. Self-dischargers

10.7.5. Bulker Lakers

10.7.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

10.8. Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

10.8.1. Grains

10.8.2. Iron Ore

10.8.3. Coal

10.8.4. Bauxite

10.8.5. Others (Wood Chips, Cement, Chemicals, etc.)

10.9. Dry Bulk Shipping Market Size (US$ Bn) Forecast, by Country, 2017-2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Dry Bulk Shipping Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Shipping Providers Analysis

11.3. COVID-19 Impact Analysis

11.4. Key Trends Analysis

11.4.1. Supply Side

11.4.2. Demand Side

11.5. Dry Bulk Freight Rates Analysis

11.6. Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

11.6.1. Handysize

11.6.2. Capesize

11.6.3. Supramax

11.6.4. Panamax

11.6.5. Others (Post-panamax, Kamsarmax, etc.)

11.7. Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

11.7.1. Conventional Bulkers

11.7.2. Combined Bulk Carriers

11.7.3. Gearless Bulk Carriers

11.7.4. Self-dischargers

11.7.5. Bulker Lakers

11.7.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

11.8. Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

11.8.1. Grains

11.8.2. Iron Ore

11.8.3. Coal

11.8.4. Bauxite

11.8.5. Others (Wood Chips, Cement, Chemicals, etc.)

11.9. Dry Bulk Shipping Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

11.9.1. U.K.

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Dry Bulk Shipping Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Shipping Providers Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.4.1. Supply Side

12.4.2. Demand Side

12.5. Dry Bulk Freight Rates Analysis

12.6. Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

12.6.1. Handysize

12.6.2. Capesize

12.6.3. Supramax

12.6.4. Panamax

12.6.5. Others (Post-panamax, Kamsarmax, etc.)

12.7. Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

12.7.1. Conventional Bulkers

12.7.2. Combined Bulk Carriers

12.7.3. Gearless Bulk Carriers

12.7.4. Self-dischargers

12.7.5. Bulker Lakers

12.7.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

12.8. Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

12.8.1. Grains

12.8.2. Iron Ore

12.8.3. Coal

12.8.4. Bauxite

12.8.5. Others (Wood Chips, Cement, Chemicals, etc.)

12.9. Dry Bulk Shipping Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Dry Bulk Shipping Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Shipping Providers Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply Side

13.4.2. Demand Side

13.5. Dry Bulk Freight Rates Analysis

13.6. Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

13.6.1. Handysize

13.6.2. Capesize

13.6.3. Supramax

13.6.4. Panamax

13.6.5. Others (Post-panamax, Kamsarmax, etc.)

13.7. Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

13.7.1. Conventional Bulkers

13.7.2. Combined Bulk Carriers

13.7.3. Gearless Bulk Carriers

13.7.4. Self-dischargers

13.7.5. Bulker Lakers

13.7.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

13.8. Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

13.8.1. Grains

13.8.2. Iron Ore

13.8.3. Coal

13.8.4. Bauxite

13.8.5. Others (Wood Chips, Cement, Chemicals, etc.)

13.9. Dry Bulk Shipping Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Dry Bulk Shipping Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Shipping Providers Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply Side

14.4.2. Demand Side

14.5. Dry Bulk Freight Rates Analysis

14.6. Dry Bulk Shipping Market Size (US$ Bn) by Vessel Type, 2017-2031

14.6.1. Handysize

14.6.2. Capesize

14.6.3. Supramax

14.6.4. Panamax

14.6.5. Others (Post-panamax, Kamsarmax, etc.)

14.7. Dry Bulk Shipping Market Size (US$ Bn) by Design, 2017-2031

14.7.1. Conventional Bulkers

14.7.2. Combined Bulk Carriers

14.7.3. Gearless Bulk Carriers

14.7.4. Self-dischargers

14.7.5. Bulker Lakers

14.7.6. Others (Bulk-In, Bags Out [BIBO], Open Hatch Bulk Carriers/Forest Product Carriers, etc.)

14.8. Dry Bulk Shipping Market Size (US$ Bn) by Application, 2017-2031

14.8.1. Grains

14.8.2. Iron Ore

14.8.3. Coal

14.8.4. Bauxite

14.8.5. Others (Wood Chips, Cement, Chemicals, etc.)

14.9. Dry Bulk Shipping Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2020)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. Belships ASA

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information, (Subject to Data Availability)

15.3.1.4. Business Strategies / Recent Developments

15.3.2. Berge Bulk Singapore Pte.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information, (Subject to Data Availability)

15.3.2.4. Business Strategies / Recent Developments

15.3.3. Diana Shipping, Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information, (Subject to Data Availability)

15.3.3.4. Business Strategies / Recent Developments

15.3.4. Freeseas Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information, (Subject to Data Availability)

15.3.4.4. Business Strategies / Recent Developments

15.3.5. Genco Shipping & Trading Limited

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information, (Subject to Data Availability)

15.3.5.4. Business Strategies / Recent Developments

15.3.6. Globus Maritime Limited

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information, (Subject to Data Availability)

15.3.6.4. Business Strategies / Recent Developments

15.3.7. Golden Ocean Group

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information, (Subject to Data Availability)

15.3.7.4. Business Strategies / Recent Developments

15.3.8. Gulf Agency Company Ltd.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information, (Subject to Data Availability)

15.3.8.4. Business Strategies / Recent Developments

15.3.9. Star Bulk Management Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information, (Subject to Data Availability)

15.3.9.4. Business Strategies / Recent Developments

15.3.10. Western Bulk Management AS

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information, (Subject to Data Availability)

15.3.10.4. Business Strategies / Recent Developments

15.3.11. Other Key Players

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information, (Subject to Data Availability)

15.3.11.4. Business Strategies / Recent Developments

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Prevailing Market Risks

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 2: Global Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 3: Global Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 4: Global Dry Bulk Shipping Market, by Region, US$ Bn, 2017-2031

Table 5: North America Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 6: North America Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 7: North America Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 8: North America Dry Bulk Shipping Market, by Country, US$ Bn, 2017-2031

Table 9: Europe Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 10: Europe Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 11: Europe Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 12: Europe Dry Bulk Shipping Market, by Country, US$ Bn, 2017-2031

Table 13: Asia Pacific Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 14: Asia Pacific Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 15: Asia Pacific Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 16: Asia Pacific Dry Bulk Shipping Market, by Country, US$ Bn, 2017-2031

Table 17: Middle East & Africa Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 18: Middle East & Africa Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 19: Middle East & Africa Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 20: Middle East & Africa Dry Bulk Shipping Market, by Country, US$ Bn, 2017-2031

Table 21: South America Dry Bulk Shipping Market, by Vessel Type, US$ Bn, 2017-2031

Table 22: South America Dry Bulk Shipping Market, by Design, US$ Bn, 2017-2031

Table 23: South America Dry Bulk Shipping Market, by Application, US$ Bn, 2017-2031

Table 24: South America Dry Bulk Shipping Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 2: Global Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 3: Global Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 4: Global Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 5: Global Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 6: Global Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 7: Global Dry Bulk Shipping Market Projections, by Region, US$ Bn, 2017-2031

Figure 8: Global Dry Bulk Shipping Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 9: North America Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 10: North America Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 11: North America Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 12: North America Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 13: North America Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 14: North America Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 15: North America Dry Bulk Shipping Market Projections, by Country, US$ Bn, 2017-2031

Figure 16: North America Dry Bulk Shipping Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 17: Europe Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 18: Europe Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 19: Europe Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 20: Europe Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 21: Europe Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 22: Europe Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 23: Europe Dry Bulk Shipping Market Projections, by Country, US$ Bn, 2017-2031

Figure 24: Europe Dry Bulk Shipping Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 25: Asia Pacific Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 26: Asia Pacific Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 27: Asia Pacific Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 28: Asia Pacific Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 29: Asia Pacific Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 30: Asia Pacific Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 31: Asia Pacific Dry Bulk Shipping Market Projections, by Country, US$ Bn, 2017-2031

Figure 32: Asia Pacific Dry Bulk Shipping Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 33: Middle East & Africa Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 34: Middle East & Africa Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 35: Middle East & Africa Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 36: Middle East & Africa Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 37: Middle East & Africa Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 38: Middle East & Africa Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 39: Middle East & Africa Dry Bulk Shipping Market Projections, by Country, US$ Bn, 2017-2031

Figure 40: Middle East & Africa Dry Bulk Shipping Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 41: South America Dry Bulk Shipping Market Projections, by Vessel Type, US$ Bn, 2017-2031

Figure 42: South America Dry Bulk Shipping Market, Incremental Opportunity, by Vessel Type, US$ Bn, 2017-2031

Figure 43: South America Dry Bulk Shipping Market Projections, by Design, US$ Bn, 2017-2031

Figure 44: South America Dry Bulk Shipping Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 45: South America Dry Bulk Shipping Market Projections, by Application, US$ Bn, 2017-2031

Figure 46: South America Dry Bulk Shipping Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 47: South America Dry Bulk Shipping Market Projections, by Country, US$ Bn, 2017-2031

Figure 48: South America Dry Bulk Shipping Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031