Analyst Viewpoint

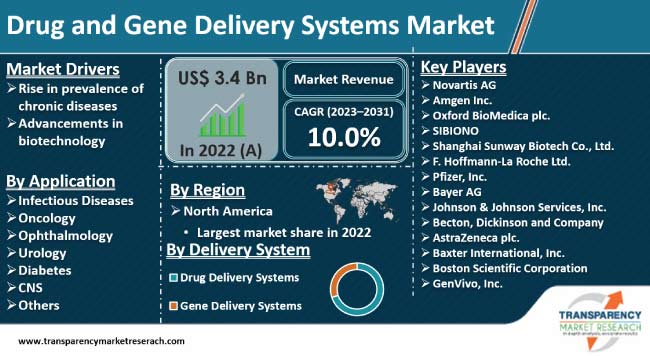

Rise in prevalence of chronic diseases is propelling the drug and gene delivery systems market size. Increase in work-related stress and geriatric population has led to rise in cases of cardiovascular diseases, diabetes, and asthma, globally. Drug and gene delivery systems improve efficiency and safety standards for the treatment of chronic diseases, especially for auto-immune disorders and several cancers including brain, lung, pancreatic, and liver.

Prominent players operating in the drug and gene delivery systems sector are investing in the R&D of advanced delivery systems to combat long term sickness. Advancements in fields of genomics, biotechnology, and nanotechnology are boosting the drug and gene delivery systems market progress.

Gene delivery systems are used to introduce foreign genetic materials, such as DNA and RNA, into a host cell. Gene delivery is critical to gene therapy. It can manipulate gene materials by either silencing a gene component or integrating with it. The approach is employed for the treatment of several diseases inherited disorders, certain types of cancer, and viral infections.

Drug delivery systems improve efficacy of treatment by carrying drugs into or throughout the body. They are applied in regenerative medicine to introduce therapeutic proteins against degeneration if controlled access is achievable. Advancements in the field of genomics and drug delivery coupled with rise in cases of cardiovascular diseases, asthma, and diabetes are fueling the drug and gene delivery systems market value.

Rapid unplanned urbanization, unhealthy habits, work stress, and ageing population are some of the major factors contributing to the surge in prevalence of chronic diseases worldwide. As per the World Health Organization, diabetes, cardiovascular diseases, cancer, and respiratory illnesses are expected to account for a staggering 86% of the 90 million deaths per year by 2050. Hence, increase in prevalence of chronic diseases is propelling the drug and gene delivery systems market development.

Gene therapy that relies on drug delivery platforms is revolutionary for chronic disease treatment as it allows healthcare providers to treat an illness at its microscopic source in a safe and accessible way. Drug and gene delivery systems improve efficiency and safety standards for chronic disease treatment, especially for auto-immune disorders and several cancers including brain, lung, pancreatic, and liver.

Advancements in nanotechnology and biotechnology enable the development and manufacture of novel drugs that apply more personalized and precise drug and gene delivery systems. Ongoing research in the field of genomics and investment by pharmaceutical companies to improve their drug delivery systems is expected to spur the drug and gene delivery systems market growth in the near future.

As per reports by Statista, biotechnology firms in Germany spent over US$ 4.6 Bn on research and development. Pharmaceutical companies spend around 20% of their revenue on the development of new products and the numbers are set to only go upwards during the forecast period.

According to the latest drug and gene delivery systems market analysis, North America held largest share in 2022. Surge in cases of chronic diseases and increase in healthcare expenditure are augmenting the market dynamics of the region. As per the Centers for Disease Control and Prevention (CDC), more than half of the adults in the U.S. suffer from at least one chronic disease. Moreover, the geriatric population in the country is set to make up 40% of the population by 2040, enhancing the burden on healthcare system.

According to the latest drug and gene delivery systems market forecast, the industry in Asia Pacific is projected to grow at a steady pace from 2023 to 2031. Rise in prevalence of HIV and cancer in developing economies is propelling the market statistics in the region.

According to the recent drug and gene delivery systems market trends, prominent manufacturers are investing heavily in the development of gene delivery platforms and drug delivery technologies to combat chronic diseases and offer advanced precise treatment options.

Novartis AG, Amgen Inc., Oxford BioMedica plc., SIBIONO, Shanghai Sunway Biotech Co., Ltd., F. Hoffmann-La Roche Ltd., Pfizer, Inc., Bayer AG, Johnson & Johnson Services, Inc., Becton, Dickinson and Company, AstraZeneca plc., Baxter International, Inc., Boston Scientific Corporation, and GenVivo, Inc. are key manufacturers of drug and gene delivery systems.

The drug and gene delivery systems market report covers these companies in terms of parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 3.4 Bn |

| Market Forecast Value in 2031 | US$ 7.8 Bn |

| Growth Rate (CAGR) | 10.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players – Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 3.4 Bn in 2022

It is projected to advance at a CAGR of 10.0% from 2023 to 2031

Rise in prevalence of chronic diseases and advancements in biotechnology

The drug delivery systems segment held the largest share in 2022

North America was the leading region in 2022

Novartis AG, Amgen Inc., Oxford BioMedica plc., SIBIONO, Shanghai Sunway Biotech Co., Ltd., F. Hoffmann-La Roche Ltd., Pfizer, Inc., Bayer AG, Johnson & Johnson Services, Inc., Becton, Dickinson and Company, AstraZeneca plc., Baxter International, Inc., Boston Scientific Corporation, and GenVivo, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Drug and Gene Delivery Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Delivery System Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Drug and Gene Delivery Systems Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Delivery System/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Drug and Gene Delivery Systems Market Analysis and Forecast, by Delivery System

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Delivery System, 2017–2031

6.3.1. Drug Delivery Systems

6.3.1.1. Intrauterine Implants

6.3.1.2. Prodrug Implants

6.3.1.3. Polymeric Drug Delivery

6.3.1.4. Targeted Drug Delivery

6.3.2. Gene Delivery Systems

6.3.2.1. Viral Gene Delivery

6.3.2.1.1. Adenovirus Vector

6.3.2.1.2. Lentivirus Vector

6.3.2.1.3. Retrovirus Vector

6.3.2.1.4. Adeno-associated Virus Vector

6.3.2.1.5. Sendai Virus Vector

6.3.2.1.6. Herpes Simplex Virus Vector

6.3.2.1.7. Others

6.3.2.2. Non-viral Gene Delivery

6.3.2.2.1. Natural Organic Compounds

6.3.2.2.2. Physical Methods

6.3.2.2.3. Chemical Methods

6.3.2.3. Combined Hybrid System

6.4. Market Attractiveness Analysis, by Delivery System

7. Global Drug and Gene Delivery Systems Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2031

7.3.1. Oral

7.3.2. Injectable

7.3.3. Inhalation

7.3.4. Transdermal

7.3.5. Ocular

7.3.6. Nasal

7.3.7. Topical

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Drug and Gene Delivery Systems Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Infectious Diseases

8.3.2. Oncology

8.3.3. Ophthalmology

8.3.4. Urology

8.3.5. Diabetes

8.3.6. CNS

8.3.7. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Drug and Gene Delivery Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Drug and Gene Delivery Systems Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Delivery System, 2017–2031

10.3.1. Drug Delivery Systems

10.3.1.1. Intrauterine Implants

10.3.1.2. Prodrug Implants

10.3.1.3. Polymeric Drug Delivery

10.3.1.4. Targeted Drug Delivery

10.3.2. Gene Delivery Systems

10.3.2.1. Viral Gene Delivery

10.3.2.1.1. Adenovirus Vector

10.3.2.1.2. Lentivirus Vector

10.3.2.1.3. Retrovirus Vector

10.3.2.1.4. Adeno-associated Virus Vector

10.3.2.1.5. Sendai Virus Vector

10.3.2.1.6. Herpes Simplex Virus Vector

10.3.2.1.7. Others

10.3.2.2. Non-viral Gene Delivery

10.3.2.2.1. Natural Organic Compounds

10.3.2.2.2. Physical Methods

10.3.2.2.3. Chemical Methods

10.3.2.3. Combined Hybrid System

10.4. Market Value Forecast, by Route of Administration, 2017–2031

10.4.1. Oral

10.4.2. Injectable

10.4.3. Inhalation

10.4.4. Transdermal

10.4.5. Ocular

10.4.6. Nasal

10.4.7. Topical

10.5. Market Value Forecast, by Application, 2017–2031

10.5.1. Infectious Diseases

10.5.2. Oncology

10.5.3. Ophthalmology

10.5.4. Urology

10.5.5. Diabetes

10.5.6. CNS

10.5.7. Others

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Delivery System

10.7.2. By Route of Administration

10.7.3. By Application

10.7.4. By Country

11. Europe Drug and Gene Delivery Systems Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Delivery System, 2017–2031

11.3.1. Drug Delivery Systems

11.3.1.1. Intrauterine Implants

11.3.1.2. Prodrug Implants

11.3.1.3. Polymeric Drug Delivery

11.3.1.4. Targeted Drug Delivery

11.3.2. Gene Delivery Systems

11.3.2.1. Viral Gene Delivery

11.3.2.1.1. Adenovirus Vector

11.3.2.1.2. Lentivirus Vector

11.3.2.1.3. Retrovirus Vector

11.3.2.1.4. Adeno-associated Virus Vector

11.3.2.1.5. Sendai Virus Vector

11.3.2.1.6. Herpes Simplex Virus Vector

11.3.2.1.7. Others

11.3.2.2. Non-viral Gene Delivery

11.3.2.2.1. Natural Organic Compounds

11.3.2.2.2. Physical Methods

11.3.2.2.3. Chemical Methods

11.3.2.3. Combined Hybrid System

11.4. Market Value Forecast, by Route of Administration, 2017–2031

11.4.1. Oral

11.4.2. Injectable

11.4.3. Inhalation

11.4.4. Transdermal

11.4.5. Ocular

11.4.6. Nasal

11.4.7. Topical

11.5. Market Value Forecast, by Application, 2017–2031

11.5.1. Infectious Diseases

11.5.2. Oncology

11.5.3. Ophthalmology

11.5.4. Urology

11.5.5. Diabetes

11.5.6. CNS

11.5.7. Others

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Delivery System

11.7.2. By Route of Administration

11.7.3. By Application

11.7.4. By Country/Sub-region

12. Asia Pacific Drug and Gene Delivery Systems Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Delivery System, 2017–2031

12.3.1. Drug Delivery Systems

12.3.1.1. Intrauterine Implants

12.3.1.2. Prodrug Implants

12.3.1.3. Polymeric Drug Delivery

12.3.1.4. Targeted Drug Delivery

12.3.2. Gene Delivery Systems

12.3.2.1. Viral Gene Delivery

12.3.2.1.1. Adenovirus Vector

12.3.2.1.2. Lentivirus Vector

12.3.2.1.3. Retrovirus Vector

12.3.2.1.4. Adeno-associated Virus Vector

12.3.2.1.5. Sendai Virus Vector

12.3.2.1.6. Herpes Simplex Virus Vector

12.3.2.1.7. Others

12.3.2.2. Non-viral Gene Delivery

12.3.2.2.1. Natural Organic Compounds

12.3.2.2.2. Physical Methods

12.3.2.2.3. Chemical Methods

12.3.2.3. Combined Hybrid System

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Oral

12.4.2. Injectable

12.4.3. Inhalation

12.4.4. Transdermal

12.4.5. Ocular

12.4.6. Nasal

12.4.7. Topical

12.5. Market Value Forecast, by Application, 2017–2031

12.5.1. Infectious Diseases

12.5.2. Oncology

12.5.3. Ophthalmology

12.5.4. Urology

12.5.5. Diabetes

12.5.6. CNS

12.5.7. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Delivery System

12.7.2. By Route of Administration

12.7.3. By Application

12.7.4. By Country/Sub-region

13. Latin America Drug and Gene Delivery Systems Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Delivery System, 2017–2031

13.3.1. Drug Delivery Systems

13.3.1.1. Intrauterine Implants

13.3.1.2. Prodrug Implants

13.3.1.3. Polymeric Drug Delivery

13.3.1.4. Targeted Drug Delivery

13.3.2. Gene Delivery Systems

13.3.2.1. Viral Gene Delivery

13.3.2.1.1. Adenovirus Vector

13.3.2.1.2. Lentivirus Vector

13.3.2.1.3. Retrovirus Vector

13.3.2.1.4. Adeno-associated Virus Vector

13.3.2.1.5. Sendai Virus Vector

13.3.2.1.6. Herpes Simplex Virus Vector

13.3.2.1.7. Others

13.3.2.2. Non-viral Gene Delivery

13.3.2.2.1. Natural Organic Compounds

13.3.2.2.2. Physical Methods

13.3.2.2.3. Chemical Methods

13.3.2.3. Combined Hybrid System

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Oral

13.4.2. Injectable

13.4.3. Inhalation

13.4.4. Transdermal

13.4.5. Ocular

13.4.6. Nasal

13.4.7. Topical

13.5. Market Value Forecast, by Application, 2017–2031

13.5.1. Infectious Diseases

13.5.2. Oncology

13.5.3. Ophthalmology

13.5.4. Urology

13.5.5. Diabetes

13.5.6. CNS

13.5.7. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Delivery System

13.7.2. By Route of Administration

13.7.3. By Application

13.7.4. By Country/Sub-region

14. Middle East & Africa Drug and Gene Delivery Systems Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Delivery System, 2017–2031

14.3.1. Drug Delivery Systems

14.3.1.1. Intrauterine Implants

14.3.1.2. Prodrug Implants

14.3.1.3. Polymeric Drug Delivery

14.3.1.4. Targeted Drug Delivery

14.3.2. Gene Delivery Systems

14.3.2.1. Viral Gene Delivery

14.3.2.1.1. Adenovirus Vector

14.3.2.1.2. Lentivirus Vector

14.3.2.1.3. Retrovirus Vector

14.3.2.1.4. Adeno-associated Virus Vector

14.3.2.1.5. Sendai Virus Vector

14.3.2.1.6. Herpes Simplex Virus Vector

14.3.2.1.7. Others

14.3.2.2. Non-viral Gene Delivery

14.3.2.2.1. Natural Organic Compounds

14.3.2.2.2. Physical Methods

14.3.2.2.3. Chemical Methods

14.3.2.3. Combined Hybrid System

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Oral

14.4.2. Injectable

14.4.3. Inhalation

14.4.4. Transdermal

14.4.5. Ocular

14.4.6. Nasal

14.4.7. Topical

14.5. Market Value Forecast, by Application, 2017–2031

14.5.1. Infectious Diseases

14.5.2. Oncology

14.5.3. Ophthalmology

14.5.4. Urology

14.5.5. Diabetes

14.5.6. CNS

14.5.7. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Delivery System

14.7.2. By Route of Administration

14.7.3. By Application

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Novartis AG

15.3.1.1. Company Overview

15.3.1.2. Delivery System Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Amgen Inc.

15.3.2.1. Company Overview

15.3.2.2. Delivery System Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Oxford BioMedica plc.

15.3.3.1. Company Overview

15.3.3.2. Delivery System Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. SIBIONO

15.3.4.1. Company Overview

15.3.4.2. Delivery System Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Shanghai Sunway Biotech Co., Ltd.

15.3.5.1. Company Overview

15.3.5.2. Delivery System Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. F. Hoffmann-La Roche Ltd.

15.3.6.1. Company Overview

15.3.6.2. Delivery System Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Pfizer, Inc.

15.3.7.1. Company Overview

15.3.7.2. Delivery System Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Bayer AG

15.3.8.1. Company Overview

15.3.8.2. Delivery System Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Johnson & Johnson Services, Inc.

15.3.9.1. Company Overview

15.3.9.2. Delivery System Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Becton, Dickinson and Company

15.3.10.1. Company Overview

15.3.10.2. Delivery System Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. AstraZeneca plc

15.3.11.1. Company Overview

15.3.11.2. Delivery System Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Baxter International, Inc.

15.3.12.1. Company Overview

15.3.12.2. Delivery System Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Boston Scientific Corporation

15.3.13.1. Company Overview

15.3.13.2. Delivery System Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. GenVivo, Inc.

15.3.14.1. Company Overview

15.3.14.2. Delivery System Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

List of Tables

Table 01: Global Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 02: Global Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 03: Global Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 07: North America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 08: North America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 09: Europe Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 11: Europe Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 12: Europe Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 13: Asia Pacific Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 15: Asia Pacific Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 16: Asia Pacific Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Latin America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 19: Latin America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 20: Latin America Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Middle East & Africa Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Delivery System, 2017–2031

Table 23: Middle East & Africa Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 24: Middle East & Africa Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

List of Figures

Figure 01: Global Drug and Gene Delivery Systems Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Drug and Gene Delivery Systems Market Revenue (US$ Mn), by Delivery System, 2022

Figure 03: Global Drug and Gene Delivery Systems Market Value Share, by Delivery System, 2022

Figure 04: Global Drug and Gene Delivery Systems Market Revenue (US$ Mn), by Route of Administration, 2022

Figure 05: Global Drug and Gene Delivery Systems Market Value Share, by Route of Administration, 2022

Figure 06: Global Drug and Gene Delivery Systems Market Revenue (US$ Mn), by Application, 2022

Figure 07: Global Drug and Gene Delivery Systems Market Value Share, by Application, 2022

Figure 08: Global Drug and Gene Delivery Systems Market Value Share, by Region, 2022

Figure 09: Global Drug and Gene Delivery Systems Market Value (US$ Mn) Forecast, 2023–2031

Figure 10: Global Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 11: Global Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023-2031

Figure 12: Global Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 13: Global Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 14: Global Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 15: Global Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2022-2031

Figure 16: Global Drug and Gene Delivery Systems Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Drug and Gene Delivery Systems Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Drug and Gene Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Drug and Gene Delivery Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 22: North America Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 23: North America Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 24: North America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023–2031

Figure 25: North America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 26:North America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 27: Europe Drug and Gene Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Drug and Gene Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Drug and Gene Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 31: Europe Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 32: Europe Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: Europe Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023–2031

Figure 34: Europe Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 35: Europe Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 36: Asia Pacific Drug and Gene Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Drug and Gene Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Drug and Gene Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 40: Asia Pacific Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 41: Asia Pacific Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: Asia Pacific Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023–2031

Figure 43: Asia Pacific Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 44: Asia Pacific Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 45: Latin America Drug and Gene Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Drug and Gene Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 49: Latin America Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 50: Latin America Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 51: Latin America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023–2031

Figure 52: Latin America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 53: Latin America Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 54: Middle East & Africa Drug and Gene Delivery Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Drug and Gene Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Drug and Gene Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Drug and Gene Delivery Systems Market Value Share Analysis, by Delivery System, 2022 and 2031

Figure 58: Middle East & Africa Drug and Gene Delivery Systems Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 59: Middle East & Africa Drug and Gene Delivery Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 60: Middle East & Africa Drug and Gene Delivery Systems Market Attractiveness Analysis, by Delivery System, 2023–2031

Figure 61: Middle East & Africa Drug and Gene Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 62: Middle East & Africa Drug and Gene Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031