Analyst Viewpoint

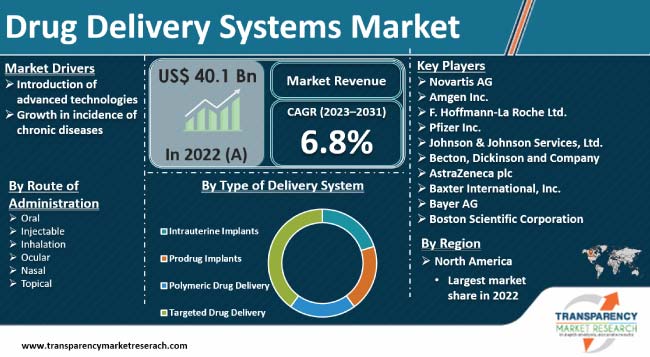

Rise in incidence of chronic diseases and introduction of advanced technologies are boosting the drug delivery systems market size. Drug delivery system is the process of precise administration of a pharmaceutical compound to achieve a therapeutic effect.

Surge in geriatric population is also driving the need for drug delivery systems with integrated connectivity, as the elderly population is more prone to chronic ailments.

Key players in the global drug delivery systems market are working on devising AI-enabled sensors that can encompass simplicity and precision in administration of dosages.

In line with the latest drug delivery systems industry trends, they are introducing novel drug delivery systems and smart drug delivery systems for targeted therapy to increase their industry share.

Drug delivery systems are devices that facilitate controlled administration of drug in the body in terms of time, rate, and place of release. These devices include syringes, injectable drug delivery solutions, and auto-injectors.

Key participants of the drug delivery systems market distribute their systems/devices/products to pharmaceutical companies or end-users through online, hospital, and retail pharmacies.

They are launching new devices abreast with better dosing features for complementing drug treatment outcomes. For instance, Ypsomed introduced YpsoMate, the first auto-injector for prefilled syringes with connectivity, in November 2021.

Biocompatible drug transporters include polysaccharides (dextran, starch, chitosan, etc.) and proteins (albumin, gelatin, collagen, etc.). Introduction of nanoparticles for drug delivery is creating lucrative drug delivery systems market opportunities for companies operating in the sector.

Inorganic nanocarriers such as gold, magnetic, and silica and nanoparticles such as dendrimers are being explored for encapsulating and delivering drugs to the target sites in the body.

Increase in number of product recalls is a prominent factor that is hampering drug delivery systems market growth. As per an article published by Drugwatch dated 2021, around 4500 drugs and devices witness recall from the shelves of the U.S. every year.

In June 2021, Smiths Medical initiated class I recall of Jelco Hypodermic Needle-Pro Fixed Needle Insulin Syringe due to improper graduated markings. These manufacturing defects can result in underdose or overdose of insulin.

Patients are increasingly preferring advanced drug delivery systems owing to reduced variability with respect to drug concentrations along with ability of delivering a drug in a more selective manner to the site with higher precision.

Such features of drug delivery systems have prompted patients to opt for self-administered devices. For instance, in May 2021, Gerresheimer AG presented an on-body drug delivery platform that is capable of delivering biologics.

Digitization of medical devices also provides benefits such as controlled dosage, needle-free injection, and better flexibility of self-administration. In December 2022, Biocorp received approval from the U.S. FDA for Mallya, its smart sensor, which connects with insulin devices on direct basis.

The sensor collects data and transmits it to a dedicated application. Better handling of medical data is thus raising the bar for the market.

As per the WHO, chronic diseases such as Chronic Obstructive Pulmonary Disease (COPD), asthma, diabetes, and cancer account for more than 30% of fatalities across the globe.

Usage of smart drug delivery systems for targeted therapy is likely to help reduce these fatalities.

Aging population is more prone to chronic diseases. As per the United Health Foundation, the global population aged 65 and above rose by 16.9% in 2022.

Usage of effective drug delivery devices would help in managing chronic diseases with the desired accuracy.

Digitization in the healthcare sector has opened up various personalized options related to drug delivery. In other words, the same route of administration might not suit every age group.

Technology combined with requirement is thus fostering drug delivery systems market development.

As per drug delivery systems market analysis, North America accounted for large share of the global landscape in 2022. It is likely to remain the dominant region during the forecast period.

High share of North America can be ascribed to proactive measures undertaken by the U.S. Government such as the increase in COVID-19 vaccination drives during the peak of the pandemic.

As per an article published by CIHI dated April 2021, the year 2019-20 witnessed 3 million acute inpatient hospitalizations in Canada alone.

Furthermore, rise in adoption of novel drug delivery systems such as metered-dose inhalers and sensor-embedded devices for treating chronic diseases is augmenting the drug delivery systems market share of North America.

Europe also holds key share of the drug delivery systems business, led by high awareness regarding the importance of adopting advanced drug delivery devices among the geriatric population in the region.

Improvement in healthcare infrastructure in countries such as India and China is likely to fuel the market dynamics of Asia Pacific during the forecast period.

On the other hand, Latin America and Middle East & Africa are likely to constitute noticeable market share during the forecast period owing to the rise in number of asthmatic and diabetic patients in these regions.

Companies operating in the global drug delivery systems landscape are focusing on new product launches and expansion of manufacturing capacities to increase their market share.

In January 2023, Nemera inaugurated a novel manufacturing facility in Poland with the objective of expanding its production capacity of drug delivery solutions. Furthermore, in September 2022, Becton, Dickinson and Company introduced BD Effivax, the next-generation pre-fillable vaccine syringe.

Novartis AG, Amgen Inc., F. Hoffmann-La Roche Ltd., Pfizer Inc., Johnson & Johnson Services, Ltd., Becton, Dickinson and Company, AstraZeneca plc, Baxter International, Inc., Bayer AG, and Boston Scientific Corporation are the leading companies functioning in the global drug delivery systems landscape.

These companies have been profiled in the drug delivery systems market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 40.1 Bn |

| Market Forecast (Value) in 2031 | US$ 71.6 Bn |

| Market Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 40.1 Bn in 2022

It is projected to grow at a CAGR of 6.8% from 2023 to 2031

Introduction of advanced technologies and growth in incidence of chronic diseases

The targeted drug delivery segment accounted for the largest share in 2022

North America was the dominant region in 2022

Novartis AG, Amgen Inc., F. Hoffmann-La Roche Ltd., Pfizer Inc., Johnson & Johnson Services, Ltd., Becton, Dickinson and Company, AstraZeneca plc, Baxter International, Inc., Bayer AG, and Boston Scientific Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Drug Delivery Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Drug Delivery Systems Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Drug Delivery Systems Market Analysis and Forecast, by Type of Delivery System

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type of Delivery System, 2017–2031

6.3.1. Intrauterine Implants

6.3.2. Prodrug Implants

6.3.3. Polymeric Drug Delivery

6.3.4. Targeted Drug Delivery

6.4. Market Attractiveness Analysis, by Type of Delivery System

7. Global Drug Delivery Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Infectious Diseases

7.3.2. Oncology

7.3.3. Ophthalmology

7.3.4. Urology

7.3.5. Diabetes

7.3.6. CNS

7.3.7. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Drug Delivery Systems Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Oral

8.3.2. Injectable

8.3.3. Inhalation

8.3.4. Ocular

8.3.5. Nasal

8.3.6. Topical

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Drug Delivery Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Drug Delivery Systems Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Type of Delivery System, 2017–2031

10.3.1. Intrauterine Implants

10.3.2. Prodrug Implants

10.3.3. Polymeric Drug Delivery

10.3.4. Targeted Drug Delivery

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Infectious Diseases

10.4.2. Oncology

10.4.3. Ophthalmology

10.4.4. Urology

10.4.5. Diabetes

10.4.6. CNS

10.4.7. Others

10.5. Market Value Forecast, by Route of Administration, 2017–2031

10.5.1. Oral

10.5.2. Injectable

10.5.3. Inhalation

10.5.4. Ocular

10.5.5. Nasal

10.5.6. Topical

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Type of Delivery System

10.7.2. By Application

10.7.3. By Route of Administration

10.7.4. By Country

11. Europe Drug Delivery Systems Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Type of Delivery System, 2017–2031

11.3.1. Intrauterine Implants

11.3.2. Prodrug Implants

11.3.3. Polymeric Drug Delivery

11.3.4. Targeted Drug Delivery

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Infectious Diseases

11.4.2. Oncology

11.4.3. Ophthalmology

11.4.4. Urology

11.4.5. Diabetes

11.4.6. CNS

11.4.7. Others

11.5. Market Value Forecast, by Route of Administration, 2017–2031

11.5.1. Oral

11.5.2. Injectable

11.5.3. Inhalation

11.5.4. Ocular

11.5.5. Nasal

11.5.6. Topical

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Type of Delivery System

11.7.2. By Application

11.7.3. By Route of Administration

11.7.4. By Country/Sub-region

12. Asia Pacific Drug Delivery Systems Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Type of Delivery System, 2017–2031

12.3.1. Intrauterine Implants

12.3.2. Prodrug Implants

12.3.3. Polymeric Drug Delivery

12.3.4. Targeted Drug Delivery

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Infectious Diseases

12.4.2. Oncology

12.4.3. Ophthalmology

12.4.4. Urology

12.4.5. Diabetes

12.4.6. CNS

12.4.7. Others

12.5. Market Value Forecast, by Route of Administration, 2017–2031

12.5.1. Oral

12.5.2. Injectable

12.5.3. Inhalation

12.5.4. Ocular

12.5.5. Nasal

12.5.6. Topical

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Type of Delivery System

12.7.2. By Application

12.7.3. By Route of Administration

12.7.4. By Country/Sub-region

13. Latin America Drug Delivery Systems Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Type of Delivery System, 2017–2031

13.3.1. Intrauterine Implants

13.3.2. Prodrug Implants

13.3.3. Polymeric Drug Delivery

13.3.4. Targeted Drug Delivery

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Infectious Diseases

13.4.2. Oncology

13.4.3. Ophthalmology

13.4.4. Urology

13.4.5. Diabetes

13.4.6. CNS

13.4.7. Others

13.5. Market Value Forecast, by Route of Administration, 2017–2031

13.5.1. Oral

13.5.2. Injectable

13.5.3. Inhalation

13.5.4. Ocular

13.5.5. Nasal

13.5.6. Topical

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Type of Delivery System

13.7.2. By Application

13.7.3. By Route of Administration

13.7.4. By Country/Sub-region

14. Middle East & Africa Drug Delivery Systems Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Type of Delivery System, 2017–2031

14.3.1. Intrauterine Implants

14.3.2. Prodrug Implants

14.3.3. Polymeric Drug Delivery

14.3.4. Targeted Drug Delivery

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Infectious Diseases

14.4.2. Oncology

14.4.3. Ophthalmology

14.4.4. Urology

14.4.5. Diabetes

14.4.6. CNS

14.4.7. Others

14.5. Market Value Forecast, by Route of Administration, 2017–2031

14.5.1. Oral

14.5.2. Injectable

14.5.3. Inhalation

14.5.4. Ocular

14.5.5. Nasal

14.5.6. Topical

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Type of Delivery System

14.7.2. By Application

14.7.3. By Route of Administration

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Novartis AG

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Amgen Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. F. Hoffmann-La Roche Ltd.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Pfizer Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Johnson & Johnson Services, Ltd.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Becton, Dickinson and Company

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. AstraZeneca plc

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Baxter International, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Bayer AG

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Boston Scientific Corporation

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 02: Global Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 04: Global Drug Delivery Systems Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 07: North America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 09: Europe Drug Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 11: Europe Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 13: Asia Pacific Drug Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 15: Asia Pacific Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 17: Latin America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 19: Latin America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 21: Middle East & Africa Drug Delivery Systems Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Drug Delivery Systems Market Size (US$ Mn) Forecast, by Type of Delivery System, 2017–2031

Table 23: Middle East & Africa Drug Delivery Systems Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Drug Delivery Systems Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

List of Figures

Figure 01: Global Drug Delivery Systems Market Size (US$ Mn) and Distribution (%), by Region, 2022–2031

Figure 02: Global Drug Delivery Systems Market Revenue (US$ Mn), by Type of Delivery System, 2022

Figure 03: Global Drug Delivery Systems Market Value Share, by Type of Delivery System, 2022

Figure 04: Global Drug Delivery Systems Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Drug Delivery Systems Market Value Share, by Application, 2022

Figure 06: Global Drug Delivery Systems Market Revenue (US$ Mn), by Route of Administration, 2022

Figure 07: Global Drug Delivery Systems Market Value Share, by Route of Administration, 2022

Figure 08: Global Drug Delivery Systems Market Value Share, by Region, 2022

Figure 09: Global Drug Delivery Systems Market Value (US$ Mn) Forecast, 2023–2031

Figure 10: Global Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 11: Global Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023-2031

Figure 12: Global Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 13: Global Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 14: Global Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 15: Global Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 16: Global Drug Delivery Systems Market Value Share Analysis, by Region, 2022–2031

Figure 17: Global Drug Delivery Systems Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Drug Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Drug Delivery Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Drug Delivery Systems Market Value Share Analysis, by Country, 2022–2031

Figure 21: North America Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 22: North America Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 23: North America Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 24: North America Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023–2031

Figure 25: North America Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 26: North America Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 27: Europe Drug Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Drug Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Drug Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022–2031

Figure 30: Europe Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 31: Europe Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 32: Europe Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 33: Europe Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023–2031

Figure 34: Europe Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 35: Europe Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 36: Asia Pacific Drug Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Drug Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Drug Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022–2031

Figure 39: Asia Pacific Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 40: Asia Pacific Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 41: Asia Pacific Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 42: Asia Pacific Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023–2031

Figure 43: Asia Pacific Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 44: Asia Pacific Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 45: Latin America Drug Delivery Systems Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Drug Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Drug Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022–2031

Figure 48: Latin America Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 49: Latin America Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 50: Latin America Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 51: Latin America Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023–2031

Figure 52: Latin America Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 53: Latin America Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 54: Middle East & Africa Drug Delivery Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Drug Delivery Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Drug Delivery Systems Market Value Share Analysis, by Country/Sub-region, 2022–2031

Figure 57: Middle East & Africa Drug Delivery Systems Market Value Share Analysis, by Type of Delivery System, 2022–2031

Figure 58: Middle East & Africa Drug Delivery Systems Market Value Share Analysis, by Application, 2022–2031

Figure 59: Middle East & Africa Drug Delivery Systems Market Value Share Analysis, by Route of Administration, 2022–2031

Figure 60: Middle East & Africa Drug Delivery Systems Market Attractiveness Analysis, by Type of Delivery System, 2023–2031

Figure 61: Middle East & Africa Drug Delivery Systems Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Middle East & Africa Drug Delivery Systems Market Attractiveness Analysis, by Route of Administration, 2023–203