Analysts’ Viewpoint on Drone Services Market Scenario

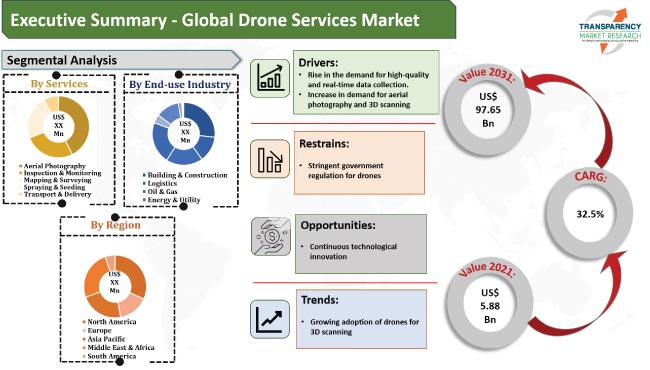

Companies operating in the drone services market are focusing on high-growth end use industry such as agriculture, media & entertainment, and building & construction to keep their businesses growing post the COVID-19 pandemic. Accordingly, the market is estimated to advance significantly during the forecast period, owing to rise in the demand for high-quality and real-time data collection and Introduction of advanced technologies. Several businesses have been hiring drone services at their site for monitoring, inspection, surveying, and mapping for the last few years, which is another factor that contributes to growth of the drone services market size. Technology is evolving faster than ever before. Drones are becoming smaller and less expensive as technology advances. In fact, a drone can now fit in the palm of hand. Reduction in their size has meant that drones are currently being used in diverse ways by various companies. Some companies offer drones for photography, surveying, while others provide search and rescue drone service. Furthermore, manufacturers should tap into incremental opportunities in drone services to broaden their revenue streams.

Drone services, also known as unmanned aerial vehicle (UAV) services, is a growing market for services centered on flying robots that can be remotely controlled via software-controlled flight plans in their embedded systems. Commercial drone services are developing UAV services to assist industries such as agriculture, construction, search and rescue, package delivery, industrial inspection, insurance, and videography with tasks such as imagery and measurement collection, event management, and broadcasting. Consistent advances in drone technology are positively impacting daily lives in numerous fields such as construction, art, defense, and security; it would not be long before drone technology is applied in other aspects of society.

Analysis of the global drone market report predicts prominent growth during the forecast period of 2022 to 2031 owing to increased usage of drones in several sectors including agricultural, landscaping, and military & defense.

Advancement of technology has enabled drones to map, scan, and gather data like never before. Consequently, presently, drones can provide inexpensive and highly effective aerial drone photography and drone videography services for businesses.

Drones are being used in the filmmaking industry not only to capture high-quality video content, but also to film action scenes. Drone filming has thus become a very common practice in several Hollywood films. From a filmmaking standpoint, it's quite simple to film a scene using a drone because the setup process is quick and simple.

Prior to drones, aerial footage was typically taken from an airplane or helicopter, which was usually lower quality and much more expensive. However, drones can overcome all of the issues associated with higher costs and quality of photography and provide users with higher quality images and video.

Aerial photos and videos are the best way to highlight commercial or real-estate property, particularly the exteriors. The most important reason why drones are good for real-estate is that they enable the agent to provide an aerial picture of the entire property. Therefore, rise in demand for high quality drone services is anticipated to drive the drone services market.

Drones have been used to collect data by the military and government organizations for the last few decades; however, their use in the private sector is much more recent. Once drone technology became more affordable, the private and commercial sectors rapidly adopted it to improve operations and increase efficiency.

Drones have effectively disrupted business and operating models in key sectors including agriculture, urban development, traffic management, disaster management, forest and wildlife, healthcare, security, and mining. They have empowered organizations and enabled them to capture real-time, highly accurate data, and that too in the most cost-effective manner. Increased usage of drone services in the commercial sector, including logistics, retail and marketing, real estate, education institutes, is estimated to propel the market in the next few years.

Some of the major players in the market provides end-to-end commercial drone services, such as Arch Aerial LLC who is an FAA-approved commercial unmanned aerial systems (UAS) operator and hardware manufacturer in the U.S. The company provides inspection drones for pipeline inspection, pipeline construction, and construction progress documentation in the form of 3D modelling, infrared inspection, and laser scanning in the energy and construction sectors.

In terms of services, the global drone services market has been segregated into aerial photography, inspection & monitoring, mapping & surveying, spraying & seeding, and transport & delivery. The aerial photography segment held the highest share of the market in 2021.

Drone photography provides excellent photo and video quality at every angle. Furthermore, aerial photography provides a unique bird's eye view, whether it's an area, an object, or a subject. Real estate drone photography emphasizes the image's main focal point, such as a house for sale or a business's physical location, while also emphasizing the surrounding area.

Some of the major market participants provide aerial photography services and contribute to the market growth. For instance, Dronegenuity provides a wide range of aerial services including photography, drone surveying and mapping, drone inspection services, and drone thermal imaging. The company also provides drone based consulting services to commercial and residential areas.

In terms of end-use industry, the global drone services market has been classified into building & construction, logistics, oil & gas, energy & utility, agriculture, mining, tourism, media & entertainment, aerospace & defense, and others. Use of drones in agriculture is growing rapidly due to the numerous advantages they offer over other forms of data collection, such as satellites and other airborne instruments. Drones can help farmers with crop spraying and monitoring, aerial photography, and field surveillance.

This service can provide farmers with real-time images of their crops, which can be used for various purposes such as pest control, disease outbreak monitoring, and water usage efficiency. Furthermore, drone analytics can be used to interpret collected data such as soil moisture, temperature, wind speed, and precipitation. Increased usage of aerial services in the agricultural sectors is one of the major factors that drives the demand for drone services across the globe.

In terms of value, North America held the largest share of the global drone services market in 2021 owing to the presence of major service providers in this region and early adoption of high-end technologies in drone services. Furthermore, rise in demand for aerial photography in the real estate and construction sectors is driving the market in the region. Based on country, the U.S. is a prominent market for drone services in North America, and the country accounted for a major share of the market in the region.

The drone services market in Asia Pacific and Europe is anticipated to grow at a rapid pace during the forecast period owing to increased demand for drone services in the agriculture and construction sectors in these regions.

Middle East & Africa is a larger market for drone services as compared to Latin America; however, the market in Latin America is estimated to expand at a rapid pace as compared to the market in Middle East & Africa.

The global drone services market is consolidated with a small number of large-scale vendors controlling a majority of the market share. A majority of the firms are spending significantly on comprehensive research and development, and new product development. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Aerial Drone Services Inc., Aerodyne Group, Arch Aerial LLC, AUAV, CYBERHAWK, Drone Services Canada Inc., Dronegenuity, FLIGHTS Inc., FlyGuys, NADAR Drone Company, Phoenix Drone Services LLC, TERRA DRONE CORPORATION, and Wing Aviation LLC are the prominent entities operating in this market.

Each of these players has been profiled in the drone services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 5.88 Bn |

|

Market Forecast Value in 2031 |

US$ 97.65 Bn |

|

Growth Rate (CAGR) |

32.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global drone services market stood at US$ 5.88 Bn in 2021.

The global drone services market is expected to advance at a CAGR of 32.5% by 2031.

The global drone services market is expected to reach a value of US$ 97.65 Bn in 2031.

Aerial Drone Services Inc., Aerodyne Group, Arch Aerial LLC, AUAV, CYBERHAWK, Drone Services Canada Inc., Dronegenuity, FLIGHTS Inc., FlyGuys, NADAR Drone Company, Phoenix Drone Services LLC, TERRA DRONE CORPORATION, and Wing Aviation LLC.

The U.S. accounted for approximately 28% share of the drone services market in 2021.

The aerial photography segment is estimated to hold around 28% share of the drone services market in 2021.

Rise in adoption of drones for 3D scanning is the prominent trend in the drone services market.

North America is more lucrative region of the drone services market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Drone Services Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Unmanned Aerial Vehicle Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Drone Services Market Analysis, by Services

5.1. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

5.1.1. Aerial Photography

5.1.2. Inspection & Monitoring

5.1.3. Mapping & Surveying

5.1.4. Spraying & Seeding

5.1.5. Transport & Delivery

5.2. Market Attractiveness Analysis, by Services

6. Drone Services Market Analysis, by End-use Industry

6.1. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

6.1.1. Building & Construction

6.1.2. Logistics

6.1.3. Oil & Gas

6.1.4. Energy & Utility

6.1.5. Agriculture

6.1.6. Mining

6.1.7. Tourism

6.1.8. Media & Entertainment

6.1.9. Aerospace & Defense

6.1.10. Others

6.2. Market Attractiveness Analysis, by End-use Industry

7. Drone Services Market Analysis and Forecast, by Region

7.1. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Drone Services Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

8.3.1. Aerial Photography

8.3.2. Inspection & Monitoring

8.3.3. Mapping & Surveying

8.3.4. Spraying & Seeding

8.3.5. Transport & Delivery

8.4. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

8.4.1. Building & Construction

8.4.2. Logistics

8.4.3. Oil & Gas

8.4.4. Energy & Utility

8.4.5. Agriculture

8.4.6. Mining

8.4.7. Tourism

8.4.8. Media & Entertainment

8.4.9. Aerospace & Defense

8.4.10. Others

8.5. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Services

8.6.2. By End-use Industry

8.6.3. By Country & Sub-region

9. Europe Drone Services Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

9.3.1. Aerial Photography

9.3.2. Inspection & Monitoring

9.3.3. Mapping & Surveying

9.3.4. Spraying & Seeding

9.3.5. Transport & Delivery

9.4. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

9.4.1. Building & Construction

9.4.2. Logistics

9.4.3. Oil & Gas

9.4.4. Energy & Utility

9.4.5. Agriculture

9.4.6. Mining

9.4.7. Tourism

9.4.8. Media & Entertainment

9.4.9. Aerospace & Defense

9.4.10. Others

9.5. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Services

9.6.2. By End-use Industry

9.6.3. By Country & Sub-region

10. Asia Pacific Drone Services Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

10.3.1. Aerial Photography

10.3.2. Inspection & Monitoring

10.3.3. Mapping & Surveying

10.3.4. Spraying & Seeding

10.3.5. Transport & Delivery

10.4. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.4.1. Building & Construction

10.4.2. Logistics

10.4.3. Oil & Gas

10.4.4. Energy & Utility

10.4.5. Agriculture

10.4.6. Mining

10.4.7. Tourism

10.4.8. Media & Entertainment

10.4.9. Aerospace & Defense

10.4.10. Others

10.5. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Services

10.6.2. By End-use Industry

10.6.3. By Country & Sub-region

11. Middle East & Africa Drone Services Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

11.3.1. Aerial Photography

11.3.2. Inspection & Monitoring

11.3.3. Mapping & Surveying

11.3.4. Spraying & Seeding

11.3.5. Transport & Delivery

11.4. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.4.1. Building & Construction

11.4.2. Logistics

11.4.3. Oil & Gas

11.4.4. Energy & Utility

11.4.5. Agriculture

11.4.6. Mining

11.4.7. Tourism

11.4.8. Media & Entertainment

11.4.9. Aerospace & Defense

11.4.10. Others

11.5. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Services

11.6.2. By End-use Industry

11.6.3. By Country & Sub-region

12. South America Drone Services Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

12.3.1. Aerial Photography

12.3.2. Inspection & Monitoring

12.3.3. Mapping & Surveying

12.3.4. Spraying & Seeding

12.3.5. Transport & Delivery

12.4. Drone Services Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.4.1. Building & Construction

12.4.2. Logistics

12.4.3. Oil & Gas

12.4.4. Energy & Utility

12.4.5. Agriculture

12.4.6. Mining

12.4.7. Tourism

12.4.8. Media & Entertainment

12.4.9. Aerospace & Defense

12.4.10. Others

12.5. Drone Services Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Services

12.6.2. By End-use Industry

12.6.3. By Country & Sub-region

13. Competition Assessment

13.1. Global Drone Services Market Competition Matrix - a Dashboard View

13.1.1. Global Drone Services Market Company Share Analysis, by Value (2021)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Aerial Drone Services Inc.

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Aerodyne Group

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Arch Aerial LLC

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. AUAV

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. CYBERHAWK

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Drone Services Canada Inc.

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Dronegenuity

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. FLIGHTS Inc.

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. FlyGuys

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. NADAR Drone Company

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Phoenix Drone Services LLC

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. TERRA DRONE CORPORATION

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. Wing Aviation LLC

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Services

15.1.2. By End-use Industry

15.1.3. By Region

List of Tables

Table 01: Global Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 02: Global Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 03: Global Drone Services Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 04: North America Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 05: North America Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 06: North America Drone Services Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 07: Europe Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 08: Europe Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 09: Europe Drone Services Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 10: Asia Pacific Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 11: Asia Pacific Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 12: Asia Pacific Drone Services Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 13: Middle East & Africa Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 14: Middle East & Africa Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 15: Middle East & Africa Drone Services Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 16: South America Drone Services Market Value (US$ Bn) Forecast, by Services, 2017‒2031

Table 17: South America Drone Services Market Value (US$ Bn) Forecast, by End-use Industry, 2017‒2031

Table 18: South America Drone Services Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 02: Global Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 03: Global Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 04: Global Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 05: Global Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 06: Global Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 07: Global Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 08: Global Drone Services Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Figure 09: Global Drone Services Market Attractiveness, by Region, Value (US$ Bn), 2022‒2031

Figure 10: Global Drone Services Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 11: North America Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 12: North America Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 13: North America Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 14: North America Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 15: North America Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 16: North America Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 17: North America Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 18: North America Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 19: North America Drone Services Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 20: North America Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 21: Europe Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 22: Europe Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 23: Europe Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 24: Europe Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 25: Europe Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 26: Europe Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 27: Europe Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 28: Europe Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 29: Europe Drone Services Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 30: Europe Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 31: Asia Pacific Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 32: Asia Pacific Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 33: Asia Pacific Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 34: Asia Pacific Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 35: Asia Pacific Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 36: Asia Pacific Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 37: Asia Pacific Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 38: Asia Pacific Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 39: Asia Pacific Drone Services Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 40: Asia Pacific Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 41: Middle East & Africa Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 42: Middle East & Africa Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 43: Middle East & Africa Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 44: Middle East & Africa Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 45: Middle East & Africa Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 46: Middle East & Africa Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 47: Middle East & Africa Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 48: Middle East & Africa Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 49: Middle East & Africa Drone Services Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 50: Middle East & Africa Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 51: South America Drone Services Market, Value (US$ Bn), 2017‒2031

Figure 52: South America Drone Services Market Projections, by Services, Value (US$ Bn), 2017‒2031

Figure 53: South America Drone Services Market, Incremental Opportunity, by Services, Value (US$ Bn), 2022‒2031

Figure 54: South America Drone Services Market Share, by Services, Value (US$ Bn), 2022‒2031

Figure 55: South America Drone Services Market Projections, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 56: South America Drone Services Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 57: South America Drone Services Market Share, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 58: South America Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 59: South America Drone Services Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 60: South America Drone Services Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031