Analysts’ Viewpoint

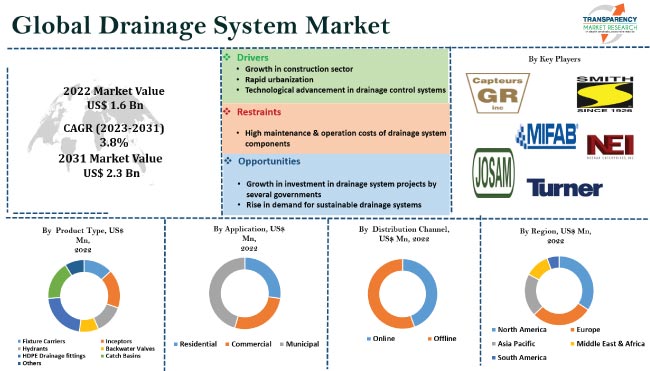

Demand for drainage systems is being driven by rapid growth in the construction industry, rise in urbanization, and increase in investment in drainage projects. Moreover, climate change, improved wastewater management, and technological advancements in drainage control systems are also contributing to drainage system market development. Rise in number of smart city development projects across the world is augmenting drainage system market demand.

Key companies are developing advanced drainage systems and investing in R&D activities to gain incremental drainage system market opportunities. Leading participants in the global market are focusing on the development of sustainable urban drainage systems (SuDS), which are a series of installations designed to drain surface water in a sustainable and environmentally responsible way.

Drainage systems are interconnected channels that prevent water from accumulating and are used to drain stormwater and wastewater. Water containing industrial and sewage wastes can be highly toxic. Therefore, they must undergo a primary treatment in order to be released into water bodies. A surface drainage system transports runoff into an organized system that consists of trench drains, catch basins, and storm sewers.

Surface drainage aids in the controlled removal of surface runoff due to irrigation, precipitation, spring thaw, irrigation, or any other factor that causes surface water buildup. It consists of pipelines, ditches, culverts, and other drainage control structures. Slope drains have pipes that are installed at a marginal inclination so that water can flow naturally through them and away from the structure.

A building downspout is connected to the gutter system and transfers rainwater from the roof to the ground. In a transition toward a circular economy, urban water management presents opportunities to provide water supply and sanitation services by using a systematic approach in a more sustainable, inclusive, efficient, and resilient way.

The drainage system industry is witnessing expansion due to rapid urbanization, growth in construction industry, and rise in government investment in drainage infrastructure. Increase in need for housing options and infrastructure development in urban areas are key factors contributing to the growth of the construction industry. The need for water disposal systems is also being driven by increased investments in both commercial as well as residential drainage systems installation.

Municipal drinking water systems are constantly in danger of back siphonage due to backflow or the reverse of the usual flow of water in a system. Market players are focusing on developing solutions for backflow protection for municipal water systems, houses, and buildings.

Governments and local organizations around the world are working to enhance drainage and sanitation in residential, municipal, and commercial units, which is projected to raise water management systems market demand. Moreover, expansion of the construction sector is boosting the demand for wastewater management.

Large-scale initiatives aimed at constructing a dense network of subterranean water supply pipelines by several regional authorities across the world are propelling drainage system industry share. For instance, the Dubai Deep Tunnel Storm Water System (DTSWS) project, which would drain about 40% of Dubai's whole urban area, was started in order to meet this need in the future. A deepwater drainage tunnel would assist in managing stormwater and reduce the risk of flooding.

Demand for high-density polyethylene (HDPE) and polyvinyl chloride (PVC) piping materials is considerably high among utilities. Plastic water and wastewater pipes are widely used due to improvements in materials as well as numerous advantages offered by plastic materials such as portability and simple installation.

Electrical installation, portable water supply and distribution, flood irrigation, drip irrigation, and drainage pipes are just a few of the numerous uses for HDPE pipes. They are also suitable for sewage and industrial effluent disposal. Extreme weather patterns as well as the rebuilding and maintenance of old plumbing systems are increasing the requirement for HVAC systems.

Based on application, the global market segmentation comprises municipal, commercial, and residential. The municipal segment is projected to account for a major share of the global market during the forecast period.

Residential drainage systems guard against flooding and structural damage brought on by excess water from residential areas such as driveways, rooftops, and walkways. They also provide backyard drainage system solutions. Surface water management is important, as water collecting could potentially result in flooding issues in a region that experiences heavy precipitation. This can be done to direct water away from walkways, driveways, and buildings.

According to the drainage system market analysis, North America is anticipated to dominate the global market during the forecast period. North America accounted for major drainage systems market share, followed by Asia Pacific and Europe, in 2022. This can be attributed to rise in demand for drainage systems in commercial, municipal, and residential applications.

The drainage system market size in Asia Pacific is anticipated to increase during the forecast period, owing to urbanization, population growth, and expansion of the construction industry in the region.

Moreover, several government initiatives to develop drainage system projects are also contributing to the drainage system market dynamics. For instance, The Storm Water Management Model (SWMM) from the United States Environmental Protection Agency (EPA) is used globally for planning, analysis, and design relating to stormwater runoff. It can also be used for combined & sanitary sewers and other drainage systems.

Development of SWMM is aimed to support regional, state, and federal stormwater management goals to lessen runoff through infiltration and retention and to lessen discharges that harm waterbodies. SWMM has been extensively used in the U.S., Canada, and other parts of the world for the analysis of complex hydraulic, hydrologic, and water quality issues related to urban drainage.

As per the drainage system market forecast report, the global industry is highly competitive due to the presence of numerous international and regional players. Major players are implementing various strategies, such as expanding their product portfolio and geographical reach, to consolidate their position in the market.

Atlantis Corporation Australia Pty Ltd, Capteurs GR., Hydrotec Technologies AG, Jay R. Smith Mfg. Co., Inc.., Josam Company, MIFAB, Inc., Neenah Enterprises, Inc., Neodrain Technologies, Turner Company, and US Trench Drain are the key players operating the global drainage system industry.

Key players have been profiled in the global drainage system market research report based on parameters such as business strategies, financial overview, business segments, company overview, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 1.6 Bn |

|

Market Forecast Value in 2031 |

US$ 2.3 Bn |

|

Growth Rate (CAGR) |

3.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 1.6 Bn in 2022.

The CAGR is estimated to be 3.8% during 2023-2031.

Increase in urbanization, growth in construction industry, and rise in investment in drainage projects.

The HDPE drainage fittings product type segment accounted for highest share in 2022.

North America is likely to be the most lucrative region for vendors during the forecast period.

Atlantis Corporation Australia Pty Ltd, Capteurs GR., Hydrotec Technologies AG, Jay R. Smith Mfg. Co., Inc., Josam Company, MIFAB, Inc., Neenah Enterprises, Inc., Neodrain Technologies, Turner Company, and US Trench Drain.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Standards and Regulations

5.8. Technology Overview

5.9. Global Drainage System Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

6. Global Drainage System Market Analysis and Forecast, by Product Type

6.1. Global Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

6.1.1. Fixture Carriers

6.1.2. Inceptors

6.1.3. Hydrants

6.1.4. Backwater Valves

6.1.5. HDPE Drainage fittings

6.1.6. Catch Basins

6.1.7. Others

6.2. Incremental Opportunity, by Product Type

7. Global Drainage System Market Analysis and Forecast, by Application

7.1. Global Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

7.1.1. Residential

7.1.1.1. Surface

7.1.1.2. Subsurface

7.1.1.3. Slope

7.1.1.4. Downspout/Gutter

7.1.2. Commercial

7.1.2.1. Parking Lot Drainage

7.1.2.2. Landscape Drainage

7.1.2.3. Roadway Drainage

7.1.2.4. Others

7.1.3. Municipal

7.1.3.1. Storm Drainage System

7.1.3.2. Sanitary Drainage System

7.2. Incremental Opportunity, by Application

8. Global Drainage System Market Analysis and Forecast, by Distribution Channel

8.1. Global Drainage System Market Size (US$ Bn), By Distribution Channel, 2017 - 2031

8.1.1. Online

8.1.1.1. Company-owned Websites

8.1.1.2. E-commerce Websites

8.1.2. Offline

8.1.2.1. Direct

8.1.2.2. Indirect

8.2. Incremental Opportunity, by Distribution Channel

9. Global Drainage System Market Analysis and Forecast, Region

9.1. Global Drainage System Market Size (US$ Bn), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Drainage System Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Brand Analysis

10.4. Demographic Overview

10.5. Consumer Buying Behavior Analysis

10.6. Key Trends Analysis

10.6.1. Demand Side Analysis

10.6.2. Supply Side Analysis

10.7. Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

10.7.1. Fixture Carriers

10.7.2. Inceptors

10.7.3. Hydrants

10.7.4. Backwater Valves

10.7.5. HDPE Drainage fittings

10.7.6. Catch Basins

10.7.7. Others

10.8. Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

10.8.1. Residential

10.8.1.1. Surface

10.8.1.2. Subsurface

10.8.1.3. Slope

10.8.1.4. Downspout/Gutter

10.8.2. Commercial

10.8.2.1. Parking Lot Drainage

10.8.2.2. Landscape Drainage

10.8.2.3. Roadway Drainage

10.8.2.4. Others

10.8.3. Municipal

10.8.3.1. Storm Drainage System

10.8.3.2. Sanitary Drainage System

10.9. Drainage System Market Size (US$ Bn) Forecast, by Distribution Channel, 2017 - 2031

10.9.1. Online

10.9.1.1. Company-owned Websites

10.9.1.2. E-commerce Websites

10.9.2. Offline

10.9.2.1. Direct

10.9.2.2. Indirect

10.10. Drainage System Market Size (US$ Bn), By Country, 2017 - 2031

10.10.1. The U.S.

10.10.2. Canada

10.10.3. Rest of North America

10.11. Incremental Opportunity Analysis

11. Europe Drainage System Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Brand Analysis

11.4. Demographic Overview

11.5. Consumer Buying Behavior Analysis

11.6. Key Trends Analysis

11.6.1. Demand Side Analysis

11.6.2. Supply Side Analysis

11.7. Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

11.7.1. Fixture Carriers

11.7.2. Inceptors

11.7.3. Hydrants

11.7.4. Backwater Valves

11.7.5. HDPE Drainage fittings

11.7.6. Catch Basins

11.7.7. Others

11.8. Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

11.8.1. Residential

11.8.1.1. Surface

11.8.1.2. Subsurface

11.8.1.3. Slope

11.8.1.4. Downspout/Gutter

11.8.2. Commercial

11.8.2.1. Parking Lot Drainage

11.8.2.2. Landscape Drainage

11.8.2.3. Roadway Drainage

11.8.2.4. Others

11.8.3. Municipal

11.8.3.1. Storm Drainage System

11.8.3.2. Sanitary Drainage System

11.9. Drainage System Market Size (US$ Bn) Forecast, by Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. Company-owned Websites

11.9.1.2. E-commerce Websites

11.9.2. Offline

11.9.2.1. Direct

11.9.2.2. Indirect

11.10. Drainage System Market Size (US$ Bn), By Country, 2017 - 2031

11.10.1. The U.K.

11.10.2. Germany

11.10.3. France

11.10.4. Rest of Europe

11.11. Incremental Opportunity Analysis

12. Asia Pacific Drainage System Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Brand Analysis

12.4. Demographic Overview

12.5. Consumer Buying Behavior Analysis

12.6. Key Trends Analysis

12.6.1. Demand Side Analysis

12.6.2. Supply Side Analysis

12.7. Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

12.7.1. Fixture Carriers

12.7.2. Inceptors

12.7.3. Hydrants

12.7.4. Backwater Valves

12.7.5. HDPE Drainage fittings

12.7.6. Catch Basins

12.7.7. Others

12.8. Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

12.8.1. Residential

12.8.1.1. Surface

12.8.1.2. Subsurface

12.8.1.3. Slope

12.8.1.4. Downspout/Gutter

12.8.2. Commercial

12.8.2.1. Parking Lot Drainage

12.8.2.2. Landscape Drainage

12.8.2.3. Roadway Drainage

12.8.2.4. Others

12.8.3. Municipal

12.8.3.1. Storm Drainage System

12.8.3.2. Sanitary Drainage System

12.9. Drainage System Market Size (US$ Bn) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. Company-owned Websites

12.9.1.2. E-commerce Websites

12.9.2. Offline

12.9.2.1. Direct

12.9.2.2. Indirect

12.10. Drainage System Market Size (US$ Bn), By Country, 2017 - 2031

12.10.1. China

12.10.2. India

12.10.3. Japan

12.10.4. Rest of Asia Pacific

12.11. Incremental Opportunity Analysis

13. Middle East & Africa Drainage System Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Brand Analysis

13.4. Demographic Overview

13.5. Consumer Buying Behavior Analysis

13.6. Key Trends Analysis

13.6.1. Demand Side Analysis

13.6.2. Supply Side Analysis

13.7. Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

13.7.1. Fixture Carriers

13.7.2. Inceptors

13.7.3. Hydrants

13.7.4. Backwater Valves

13.7.5. HDPE Drainage fittings

13.7.6. Catch Basins

13.7.7. Others

13.8. Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

13.8.1. Residential

13.8.1.1. Surface

13.8.1.2. Subsurface

13.8.1.3. Slope

13.8.1.4. Downspout/Gutter

13.8.2. Commercial

13.8.2.1. Parking Lot Drainage

13.8.2.2. Landscape Drainage

13.8.2.3. Roadway Drainage

13.8.2.4. Others

13.8.3. Municipal

13.8.3.1. Storm Drainage System

13.8.3.2. Sanitary Drainage System

13.9. Drainage System Market Size (US$ Bn) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. Company-owned Websites

13.9.1.2. E-commerce Websites

13.9.2. Offline

13.9.2.1. Direct

13.9.2.2. Indirect

13.10. Drainage System Market Size (US$ Bn), By Country, 2017 - 2031

13.10.1. GCC

13.10.2. South Africa

13.10.3. Rest of Middle East & Africa

13.11. Incremental Opportunity Analysis

14. South America Drainage System Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Brand Analysis

14.4. Demographic Overview

14.5. Consumer Buying Behavior Analysis

14.6. Key Trends Analysis

14.6.1. Demand Side Analysis

14.6.2. Supply Side Analysis

14.7. Drainage System Market Size (US$ Bn) Forecast, by Product Type, 2017 - 2031

14.7.1. Fixture Carriers

14.7.2. Inceptors

14.7.3. Hydrants

14.7.4. Backwater Valves

14.7.5. HDPE Drainage fittings

14.7.6. Catch Basins

14.7.7. Others

14.8. Drainage System Market Size (US$ Bn) Forecast, by Application, 2017 - 2031

14.8.1. Residential

14.8.1.1. Surface

14.8.1.2. Subsurface

14.8.1.3. Slope

14.8.1.4. Downspout/Gutter

14.8.2. Commercial

14.8.2.1. Parking Lot Drainage

14.8.2.2. Landscape Drainage

14.8.2.3. Roadway Drainage

14.8.2.4. Others

14.8.3. Municipal

14.8.3.1. Storm Drainage System

14.8.3.2. Sanitary Drainage System

14.9. Drainage System Market Size (US$ Bn) Forecast, by Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. Company-owned Websites

14.9.1.2. E-commerce Websites

14.9.2. Offline

14.9.2.1. Direct

14.9.2.2. Indirect

14.10. Drainage System Market Size (US$ Bn), By Country, 2017 - 2031

14.10.1. Brazil

14.10.2. Rest of South America

14.11. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), 2022

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

15.3.1. Atlantis Corporation Australia Pty Ltd

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Size Portfolio

15.3.2. Capteurs GR.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Size Portfolio

15.3.3. Hydrotec Technologies AG

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Size Portfolio

15.3.4. Jay R. Smith Mfg. Co., Inc.

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Size Portfolio

15.3.5. Josam Company

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Size Portfolio

15.3.6. MIFAB, Inc.

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Size Portfolio

15.3.7. Neenah Enterprises, Inc.

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Size Portfolio

15.3.8. Neodrain Technologies

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Size Portfolio

15.3.9. Turner Company

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Size Portfolio

15.3.10. US Trench Drain

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Size Portfolio

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. Application

16.1.3. Distribution Channel

16.1.4. Geography

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 2: Global Drainage System Market, by Application, US$ Bn, 2017-2031

Table 3: Global Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 4: Global Drainage System Market, by Region, US$ Bn, 2017-2031

Table 5: North America Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 6: North America Drainage System Market, by Application, US$ Bn, 2017-2031

Table 7: North America Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 8: North America Drainage System Market, by Country, US$ Bn, 2017-2031

Table 9: Europe Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 10: Europe Drainage System Market, by Application, US$ Bn, 2017-2031

Table 11: Europe Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 12: Europe Drainage System Market, by Country, US$ Bn, 2017-2031

Table 13: Asia Pacific Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 14: Asia Pacific Drainage System Market, by Application, US$ Bn, 2017-2031

Table 15: Asia Pacific Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 16: Asia Pacific Drainage System Market, by Country, US$ Bn, 2017-2031

Table 17: Middle East & Africa Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 18: Middle East & Africa Drainage System Market, by Application, US$ Bn, 2017-2031

Table 19: Middle East & Africa Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 20: Middle East & Africa Drainage System Market, by Country, US$ Bn, 2017-2031

Table 21: South America Drainage System Market, by Product Type, US$ Bn, 2017-2031

Table 22: South America Drainage System Market, by Application, US$ Bn, 2017-2031

Table 23: South America Drainage System Market, by Distribution Channel, US$ Bn, 2017-2031

Table 24: South America Drainage System Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 2: Global Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 3: Global Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 4: Global Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 5: Global Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 6: Global Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 7: Global Drainage System Market Projections by Region, US$ Bn, 2017-2031

Figure 8: Global Drainage System Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 9: North America Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 10: North America Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 11: North America Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 12: North America Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 13: North America Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 14: North America Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 15: North America Drainage System Market Projections by Country, US$ Bn, 2017-2031

Figure 16: North America Drainage System Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 17: Europe Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 18: Europe Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 19: Europe Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 20: Europe Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 21: Europe Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 22: Europe Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 23: Europe Drainage System Market Projections by Country, US$ Bn, 2017-2031

Figure 24: Europe Drainage System Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 25: Asia Pacific Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 26: Asia Pacific Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 27: Asia Pacific Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 28: Asia Pacific Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 29: Asia Pacific Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 30: Asia Pacific Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 31: Asia Pacific Drainage System Market Projections by Country, US$ Bn, 2017-2031

Figure 32: Asia Pacific Drainage System Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 33: Middle East & Africa Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 34: Middle East & Africa Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 35: Middle East & Africa Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 36: Middle East & Africa Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 37: Middle East & Africa Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 38: Middle East & Africa Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 39: Middle East & Africa Drainage System Market Projections by Country, US$ Bn, 2017-2031

Figure 40: Middle East & Africa Drainage System Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 41: South America Drainage System Market Projections by Product Type, US$ Bn, 2017-2031

Figure 42: South America Drainage System Market, Incremental Opportunity, by Product Type, US$ Bn, 2017-2031

Figure 43: South America Drainage System Market Projections by Application, US$ Bn, 2017-2031

Figure 44: South America Drainage System Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 45: South America Drainage System Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 46: South America Drainage System Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 47: South America Drainage System Market Projections by Country, US$ Bn, 2017-2031

Figure 48: South America Drainage System Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031