Analysts’ Viewpoint

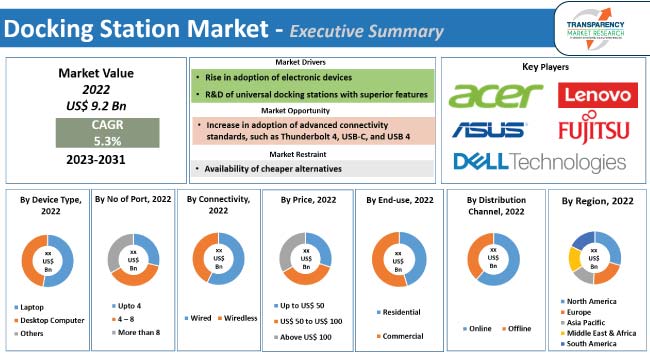

Increase in number of handheld devices is a major factor boosting the docking station market size. Docking stations are widely employed to connect multiple devices in offices and homes. R&D of universal docking stations with superior features is likely to offer lucrative opportunities to vendors in the market.

Rise in adoption of advanced connectivity standards, such as Thunderbolt 4, USB-C, and USB 4, is expected to spur the global docking station industry growth in the near future. Key players are offering extensive-size multiple-device connector stations to expand their product portfolio. These stations provide access to devices, such as digital cameras or large flat-panel monitors, that are usually incompatible with mobile devices. Manufacturers are also collaborating with other companies to increase their docking station market share.

Docking station is a hardware device that allows portable computers to connect with other devices. These stations enable users with a laptop to convert it into a desktop computer at the office or home. Docking stations add extra, varied connectors for those who need additional functionality in their personal laptops. These stations also make it possible for individual users to customize their system by allowing them to connect their preferred set of keyboard and mouse, or perhaps even another display monitor. Many laptop manufacturers build custom docking stations that are specifically designed for their own laptops.

The COVID-19 pandemic accelerated the shift to remote work and hybrid work models. Many individuals now rely on laptops and tablets for their work. Docking stations have become essential tools for creating productive home office setups. Additionally, many organizations have embraced BYOD policies, allowing employees to use their personal electronic devices for work.

Docking stations enable the connection of external devices to various electronic devices such as smartphones, notebooks, and PCs. These stations allow users to attach extra peripherals to electronic devices making them more comfortable and useful for professional work. This is one of the most significant advantages of docking stations for mobile device users. Thus, increase in adoption of electronic devices is propelling the docking station market value.

Most laptops are designed with 2-3 USB ports. This limits the usability of a laptop if the user intends to connect more than three devices to the laptop. By using a docking station, the user is required to make only one connection as the other devices such as a scanner, printer, or mouse are connected through the docking station, to convert it into a desktop computer. This helps users maintain the portability of such devices between their office and home.

Docking stations provide access to devices that are usually incompatible with mobile devices. Laptops and smartphones are not always compatible with external devices such as digital cameras or large flat-panel monitors. Docking stations enable the connection between such incompatible devices, thereby increasing their usability.

A wide range of docking stations is available in the market. Several docking station manufacturers offer proprietary ports; this means the user can connect only the company’s devices to a port. For instance, HP docks support only HP laptops and notebooks and not the laptops or notebooks manufactured by other companies.

Docking stations differ in terms of connecting ports, signaling, and uses. These docking stations are often designed to work only with a specific device or model of portable devices. Thus, R&D of universal docking stations with superior features is anticipated to spur the docking station market growth in the next few years. Such features help turn the USB port of the computer into a docking station connector. They also let IT administrators standardize one docking station throughout an organization. Such a docking station can be employed with laptops, ultrabooks, MacBooks, and tablets.

Sakar International, Inc., Targus Group International Inc., and Kensington Computer Products Group Inc. are some key manufacturers of universal docks. Regardless of their shapes, universal docks provide connectors for networking, video and audio, and a bunch of USB ports to connect peripheral devices such as keyboards, mice, DVD drives, and memory drives.

According to the latest docking station market forecast, North America is expected to account for largest share from 2023 to 2031, followed by Europe. Rise in adoption of electronic devices is fueling the market dynamics of the region.

Rise in usage of computer peripherals in commercial and residential sectors is propelling the docking station market revenue in Europe. Vendors in the region are increasingly selling their products through their online portals and e-commerce websites.

The industry in Asia Pacific is anticipated to grow at the fastest pace during the forecast period. China is one of the major markets and manufacturing hubs for docking stations. Several vendors have set up their production facilities in China for large-scale manufacturing of docking stations.

Most firms are investing significantly in the R&D of new products to expand their product portfolio. Acer Inc., ASUSTeK Computer Inc., Dell Technologies Inc., Fujitsu Limited, Hewlett Packard Enterprise, Kensington, Lenovo Group Limited, Samsung Group, Sony Corporation, and The Targus Corporation are key entities operating in this market.

Each of these players has been profiled in the global docking station market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 9.2 Bn |

| Market Forecast Value in 2031 | US$ 14.7 Bn |

| Growth Rate (CAGR) | 5.3% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

| Region Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 9.2 Bn in 2022

It is projected to reach US$ 14.7 Bn by the end of 2031

It is estimated to grow at a CAGR of 5.3% from 2023 to 2031

Rise in adoption of electronic devices and R&D of universal docking stations with superior features

The laptop device type segment held largest share in 2022

North America is projected to record the highest demand during the forecast period

Acer Inc., ASUSTeK Computer Inc., Dell Technologies Inc., Fujitsu Limited, Hewlett Packard Enterprise, Kensington, Lenovo Group Limited, Samsung Group, Sony Corporation, and The Targus Corporation

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Technological Overview Analysis

5.8. Global Docking Station Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projection (US$ Bn)

5.8.2. Market Volume Projection (Thousand Units)

6. Global Docking Station Market Analysis and Forecast, by Device Type

6.1. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

6.1.1. Laptop

6.1.2. Desktop Computer

6.1.3. Others (Mobile Phone, Tablet, etc.)

6.2. Incremental Opportunity, by Device Type

7. Global Docking Station Market Analysis and Forecast, by No. of Ports

7.1. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

7.1.1. Up to 4

7.1.2. 4 – 8

7.1.3. More than 8

7.2. Incremental Opportunity, by No. of Ports

8. Global Docking Station Market Analysis and Forecast, by Connectivity

8.1. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

8.1.1. Wired

8.1.2. Wireless

8.2. Incremental Opportunity, by Connectivity

9. Global Docking Station Market Analysis and Forecast, by Price

9.1. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

9.1.1. Up to US$ 50

9.1.2. US$ 50 to US$ 100

9.1.3. Above US$ 100

9.2. Incremental Opportunity, by Price

10. Global Docking Station Market Analysis and Forecast, by End-use

10.1. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

10.1.1. Residential

10.1.2. Commercial

10.2. Incremental Opportunity, by End-use

11. Global Docking Station Market Analysis and Forecast, by Distribution Channel

11.1. Docking Station Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. Company-owned Websites

11.1.1.2. E-commerce Websites

11.1.2. Offline

11.1.2.1. Supermarkets/Hypermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Other Retail Stores

11.2. Incremental Opportunity, by Distribution Channel

12. Global Docking Station Market Analysis and Forecast, by Region

12.1. Docking Station Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Docking Station Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

13.6.1. Laptop

13.6.2. Desktop Computer

13.6.3. Others (Mobile Phone, Tablet, etc.)

13.7. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

13.7.1. Up to 4

13.7.2. 4 – 8

13.7.3. More than 8

13.8. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

13.8.1. Wired

13.8.2. Wireless

13.9. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

13.9.1. Up to US$ 50

13.9.2. US$ 50 to US$ 100

13.9.3. Above US$ 100

13.10. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

13.10.1. Residential

13.10.2. Commercial

13.11. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.1.1. Company-owned Websites

13.11.1.2. E-commerce Websites

13.11.2. Offline

13.11.2.1. Supermarkets/Hypermarkets

13.11.2.2. Specialty Stores

13.11.2.3. Other Retail Stores

13.12. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.12.1. U.S.

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Docking Station Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

14.6.1. Laptop

14.6.2. Desktop Computer

14.6.3. Others (Mobile Phone, Tablet, etc.)

14.7. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

14.7.1. Up to 4

14.7.2. 4 – 8

14.7.3. More than 8

14.8. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

14.8.1. Wired

14.8.2. Wireless

14.9. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

14.9.1. Up to US$ 50

14.9.2. US$ 50 to US$ 100

14.9.3. Above US$ 100

14.10. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

14.10.1. Residential

14.10.2. Commercial

14.11. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Online

14.11.1.1. Company-owned Websites

14.11.1.2. E-commerce Websites

14.11.2. Offline

14.11.2.1. Supermarkets/Hypermarkets

14.11.2.2. Specialty Stores

14.11.2.3. Other Retail Stores

14.12. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.12.1. Germany

14.12.2. U.K.

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Docking Station Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trend Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

15.6.1. Laptop

15.6.2. Desktop Computer

15.6.3. Others (Mobile Phone, Tablet, etc.)

15.7. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

15.7.1. Up to 4

15.7.2. 4 – 8

15.7.3. More than 8

15.8. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

15.8.1. Wired

15.8.2. Wireless

15.9. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

15.9.1. Up to US$ 50

15.9.2. US$ 50 to US$ 100

15.9.3. Above US$ 100

15.10. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

15.10.1. Residential

15.10.2. Commercial

15.11. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.1.1. Company-owned Websites

15.11.1.2. E-commerce Websites

15.11.2. Offline

15.11.2.1. Supermarkets/Hypermarkets

15.11.2.2. Specialty Stores

15.11.2.3. Other Retail Stores

15.12. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

15.12.1. China

15.12.2. India

15.12.3. Japan

15.12.4. Rest of Asia Pacific

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Docking Station Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trend Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Selling Price (US$)

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

16.6.1. Laptop

16.6.2. Desktop Computer

16.6.3. Others (Mobile Phone, Tablet, etc.)

16.7. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

16.7.1. Up to 4

16.7.2. 4 – 8

16.7.3. More than 8

16.8. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

16.8.1. Wired

16.8.2. Wireless

16.9. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

16.9.1. Up to US$ 50

16.9.2. US$ 50 to US$ 100

16.9.3. Above US$ 100

16.10. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

16.10.1. Residential

16.10.2. Commercial

16.11. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.1.1. Company-owned Websites

16.11.1.2. E-commerce Websites

16.11.2. Offline

16.11.2.1. Supermarkets/Hypermarkets

16.11.2.2. Specialty Stores

16.11.2.3. Other Retail Stores

16.12. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Incremental Opportunity Analysis

17. South America Docking Station Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Trend Analysis

17.3. Price Trend Analysis

17.3.1. Weighted Average Selling Price (US$)

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Docking Station Market (US$ Bn and Thousand Units), by Device Type, 2017 - 2031

17.6.1. Laptop

17.6.2. Desktop Computer

17.6.3. Others (Mobile Phone, Tablet, etc.)

17.7. Docking Station Market (US$ Bn and Thousand Units), by No. of Ports, 2017 - 2031

17.7.1. Up to 4

17.7.2. 4 – 8

17.7.3. More than 8

17.8. Docking Station Market (US$ Bn and Thousand Units), by Connectivity, 2017 - 2031

17.8.1. Wired

17.8.2. Wireless

17.9. Docking Station Market (US$ Bn and Thousand Units), by Price, 2017 - 2031

17.9.1. Up to US$ 50

17.9.2. US$ 50 to US$ 100

17.9.3. Above US$ 100

17.10. Docking Station Market (US$ Bn and Thousand Units), by End-use, 2017 - 2031

17.10.1. Residential

17.10.2. Commercial

17.11. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

17.11.1. Online

17.11.1.1. Company-owned Websites

17.11.1.2. E-commerce Websites

17.11.2. Offline

17.11.2.1. Supermarkets/Hypermarkets

17.11.2.2. Specialty Stores

17.11.2.3. Other Retail Stores

17.12. Docking Station Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

17.12.1. Brazil

17.12.2. Rest of South America

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Revenue Share Analysis (%), (2022)

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Acer Inc.

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. ASUSTeK Computer Inc.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Dell Technologies Inc.

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Fujitsu Limited

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Hewlett Packard Enterprise

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Kensington

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Lenovo Group Limited

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Samsung Group

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. Sony Corporation

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. The Targus Corporation

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Other Key Players

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 2: Global Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 3: Global Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 4: Global Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 5: Global Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 6: Global Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 7: Global Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 8: Global Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 9: Global Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 10: Global Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 11: Global Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 12: Global Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 13: Global Docking Station Market Volume (Thousand Units) Share, by Region, 2017-2031

Table 14: Global Docking Station Market Value (US$ Bn) Share, by Region, 2017-2031

Table 15: North America Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 16: North America Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 17: North America Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 18: North America Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 19: North America Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 20: North America Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 21: North America Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 22: North America Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 23: North America Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 24: North America Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 25: North America Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 26: North America Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 27: North America Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 28: North America Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Table 29: Europe Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 30: Europe Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 31: Europe Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 32: Europe Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 33: Europe Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 34: Europe Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 35: Europe Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 36: Europe Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 37: Europe Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 38: Europe Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 39: Europe Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 40: Europe Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 41: Europe Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 42: Europe Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Table 43: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 44: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 45: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 46: Asia Pacific Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 47: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 48: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 49: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 50: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 51: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 52: Asia Pacific Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 53: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 54: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 55: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 56: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Table 57: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 58: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 59: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 60: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 61: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 62: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 63: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 64: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 65: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 66: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 67: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 68: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 69: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 70: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Table 71: South America Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Table 72: South America Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Table 73: South America Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Table 74: South America Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Table 75: South America Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Table 76: South America Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Table 77: South America Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Table 78: South America Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Table 79: South America Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Table 80: South America Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 81: South America Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 82: South America Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 83: South America Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 84: South America Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

List of Figures

Figure 1: Global Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 2: Global Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 3: Global Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 4: Global Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 5: Global Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 6: Global Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 7: Global Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 8: Global Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 9: Global Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 10: Global Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Figure 11: Global Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Figure 12: Global Docking Station Market Incremental Opportunity (US$ Bn), by Price, 2017-2031

Figure 13: Global Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 14: Global Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 15: Global Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 16: Global Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 17: Global Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 18: Global Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 19: Global Docking Station Market Volume (Thousand Units) Share, by Region, 2017-2031

Figure 20: Global Docking Station Market Value (US$ Bn) Share, by Region, 2017-2031

Figure 21: Global Docking Station Market Incremental Opportunity (US$ Bn), by Region, 2017-2031

Figure 22: North America Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 23: North America Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 24: North America Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 25: North America Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 26: North America Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 27: North America Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 28: North America Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 29: North America Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 30: North America Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 31: North America Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 32: North America Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 33: North America Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 34: North America Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 35: North America Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 36: North America Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 37: North America Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 38: North America Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 39: North America Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 40: North America Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 41: North America Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 42: North America Docking Station Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 43: Europe Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 44: Europe Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 45: Europe Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 46: Europe Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 47: Europe Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 48: Europe Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 49: Europe Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 50: Europe Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 51: Europe Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 52: Europe Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Figure 53: Europe Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Figure 54: Europe Docking Station Market Incremental Opportunity (US$ Bn), by Price, 2017-2031

Figure 55: Europe Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 56: Europe Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 57: Europe Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 58: Europe Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 59: Europe Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 60: Europe Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 61: Europe Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 62: Europe Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 63: Europe Docking Station Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 64: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 65: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 66: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 67: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 68: Asia Pacific Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 69: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 70: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 71: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 72: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 73: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Figure 74: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Figure 75: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by Price, 2017-2031

Figure 76: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 77: Asia Pacific Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 78: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 79: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 80: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 81: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 82: Asia Pacific Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 83: Asia Pacific Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 84: Asia Pacific Docking Station Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 85: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 86: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 87: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 88: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 89: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 90: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 91: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 92: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 93: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 94: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Figure 95: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Figure 96: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by Price, 2017-2031

Figure 97: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 98: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 99: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 100: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 101: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 102: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 103: Middle East & Africa Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 104: Middle East & Africa Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 105: Middle East & Africa Docking Station Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 106: South America Docking Station Market Volume (Thousand Units) Share, by Device Type, 2017-2031

Figure 107: South America Docking Station Market Value (US$ Bn) Share, by Device Type, 2017-2031

Figure 108: South America Docking Station Market Incremental Opportunity (US$ Bn), by Device Type, 2017-2031

Figure 109: South America Docking Station Market Volume (Thousand Units) Share, by No. of Ports, 2017-2031

Figure 110: South America Docking Station Market Value (US$ Bn) Share, by No. of Ports, 2017-2031

Figure 111: South America Docking Station Market Incremental Opportunity (US$ Bn), by No. of Ports, 2017-2031

Figure 112: South America Docking Station Market Volume (Thousand Units) Share, by Connectivity, 2017-2031

Figure 113: South America Docking Station Market Value (US$ Bn) Share, by Connectivity, 2017-2031

Figure 114: South America Docking Station Market Incremental Opportunity (US$ Bn), by Connectivity, 2017-2031

Figure 115: South America Docking Station Market Volume (Thousand Units) Share, by Price, 2017-2031

Figure 116: South America Docking Station Market Value (US$ Bn) Share, by Price, 2017-2031

Figure 117: South America Docking Station Market Incremental Opportunity (US$ Bn), by Price, 2017-2031

Figure 118: South America Docking Station Market Volume (Thousand Units) Share, by End-use, 2017-2031

Figure 119: South America Docking Station Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 120: South America Docking Station Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 121: South America Docking Station Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 122: South America Docking Station Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 123: South America Docking Station Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 124: South America Docking Station Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 125: South America Docking Station Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 126: South America Docking Station Market Incremental Opportunity (US$ Bn), by Country, 2017-2031