Analysts’ Viewpoint

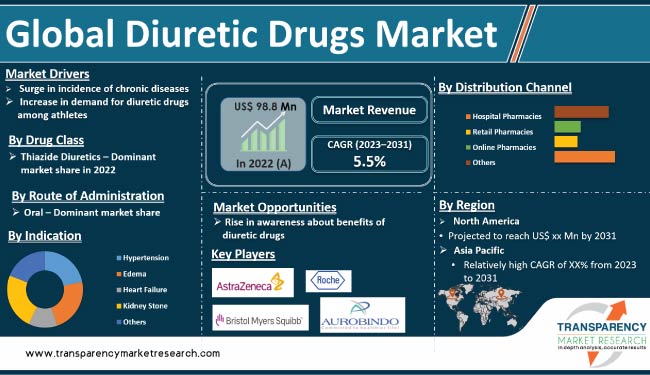

Increase in prevalence of chronic diseases, including heart diseases, stroke, diabetes, hypertension, and cancer, is projected to augment diuretic drugs market value in the near future. Rise in demand for diuretic drugs among athletes is also fueling market progress. Growth in awareness about benefits of diuretic drugs among those suffering from various chronic disorders is expected to boost the global diuretic drugs market scope during the forecast period.

Rise in aging population, increase in adoption of unhealthy lifestyle, and surge in rate of obesity are also driving market dynamics. Growth in adoption of diuretic drugs in emerging economies is creating lucrative opportunities for market players. Companies in the global market are introducing new medications to treat several chronic diseases.

Diuretics, sometimes known as water pills or fluid pills, are medications that increase urine production. The body uses urination to eliminate extra salt and water. This helps reduce blood pressure in addition to relieving symptoms such as ankle swelling.

Carbonic anhydrase inhibitors, loop diuretics, potassium-sparing diuretics, and thiazide diuretics are some of the common types of diuretic drugs. Thiazides are the most common diuretics for hypertension. Heart failure is often treated with loop diuretics. These medications include bumetanide, torsemide (demadex), and furosemide (lasix).

Potassium is an essential nutrient that lowers the amount of fluid in the body. Potassium-sparing diuretics may be administered to people who are at the risk of low potassium levels, including those who take other drugs that deplete potassium.

Some athletes use diuretics to lose weight quickly, especially in sports that emphasize weight classes or body appearances, such as wrestling, boxing, and bodybuilding. Diuretics are substances that increase the amount of urine produced by the body, leading to a rapid loss of water weight. Athletes may use diuretics to achieve a certain weight class or enhance their muscle definition by reducing water retention and bloating.

However, the usage of diuretics for weight loss is considered a deceitful practice in sports. It is banned by most athletic organizations. Diuretics are classified as masking agents; they can be used to hide the presence of other banned substances in the body.

Diuretics are commonly used in the treatment of chronic diseases such as heart failure, kidney disease, and liver cirrhosis. The usage of diuretics in chronic diseases is aimed at managing symptoms and complications associated with these conditions, such as fluid overload, edema, and high blood pressure.

In patients with heart failure, diuretics are often prescribed to reduce fluid buildup in the lungs and other tissues, which can cause shortness of breath, coughing, and fatigue. Diuretics can help reduce the workload on the heart and improve cardiac function, thus leading to better overall health outcomes.

In patients with kidney diseases, diuretics can help reduce fluid overload and manage edema, a common complication of chronic kidney disease. However, the usage of diuretics in kidney disease patients requires close monitoring of the kidney function, electrolyte levels, and blood pressure in order to avoid further damage to the kidneys and other complications.

In patients with cirrhosis of the liver, diuretics can help reduce ascites, a condition where fluid builds up in the abdomen, thus causing discomfort and increased risk of infection.

Diuretics can be effective in managing symptoms and complications of chronic diseases. However, they are not without risks. Common side-effects of diuretics include dehydration, electrolyte imbalances, and low blood pressure, which can be particularly dangerous in patients with chronic diseases.

In terms of drug class, the global market has been classified into carbonic anhydrase inhibitors, loop diuretics, miscellaneous diuretics, potassium-sparing diuretics, and thiazide diuretics. The thiazide diuretics segment accounted for major share in 2022.

Thiazide diuretics are less effective at causing diuresis and natriuresis than loop diuretics drugs, as the sodium chloride transporter in the distal tubule typically reabsorbs just around 5.0% of filtered salt. Nevertheless, they are potent enough to address a variety of therapeutic requirements for a diuretic.

Based on route of administration, the global industry has been bifurcated into oral and parenteral. The oral segment accounted for major share in 2022. The segment is estimated to maintain its share throughout the forecast period, as per the latest diuretic drugs market forecast analysis.

According to the latest diuretic drugs market trends, oral administration of diuretic drugs is a commonly used method. It is more convenient than parenteral administration. It is the most prescribed route of drug administration, as it is easy to administer and provides a predictable absorption of the medication.

Based on indication, the global market has been divided into hypertension, edema, heart failure, kidney stone, and others. According to the latest diuretic drugs market analysis, the hypertension segment accounted for major share of the global market in 2022. The segment is likely to dominate the global landscape in the next few years.

Diuretics are one of the first-line treatments for hypertension, and are commonly prescribed in combination with other antihypertensive medications.

In terms of distribution channel, the global market has been segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment accounted for the largest share in 2022. It is expected to lead the market in the near future. Increase in availability of prescribed oral drugs in retail pharmacies is a key factor augmenting the segment.

North America constituted major diuretic drugs market share in 2022. The region is anticipated to maintain its dominance throughout the forecast period. The diuretic drugs market size is projected to increase in North America during the forecast period, owing to the rise in prevalence of chronic diseases in the region.

According to the Centers for Disease Control and Prevention, every six in 10 adults are suffering from chronic diseases in North America. Chronic diseases such as diabetes, cancer, and heart diseases are considered to be the major causes of mortality and disability in the U.S. Increase in healthcare expenditure is also fueling market statistics in the region.

The market in Asia Pacific is likely to grow at a rapid pace from 2023 to 2031. According to the World Health Organization (WHO), 41 million people die from noncommunicable diseases (NCDs) every year, accounting for 74.0% of all deaths worldwide. Rise in incidence of NCDs is fueling the demand for diuretic drugs in the region.

As per the latest diuretic drugs market research report, the global industry is fragmented, with the presence of large number of local as well as international players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players.

Prominent players in the global market are AstraZeneca, Aurobindo Pharma, Bayer AG, Bristol-Myers Squibb Company, Cipla Ltd, F. Hoffmann-La Roche Ltd, Fresenius Kabi AG, GSK plc, Hikma Pharmaceuticals PLC, Mylan, Novartis Pharmaceuticals Corporation, Pfizer, Sanofi, and Teva Pharmaceutical Industries Ltd.

Key players have been profiled in the diuretic drugs market report based on parameters such as company overview, recent developments, product portfolio, financial overview, business segments, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 98.8 Mn |

|

Market Forecast Value in 2031 |

US$ 157.2 Mn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 98.8 Mn in 2022

It is projected to reach more than US$ 157.2 Mn by 2031

The CAGR is anticipated to be 5.5% from 2023 to 2031

Surge in prevalence of chronic diseases and rise in awareness about benefits of diuretic drugs

North America is expected to account for major share during the forecast period

AstraZeneca, Aurobindo Pharma, Bayer AG, Bristol-Myers Squibb Company, Cipla Ltd, F. Hoffmann-La Roche Ltd, Fresenius Kabi AG, GSK plc, Hikma Pharmaceuticals PLC, Mylan, Novartis Pharmaceuticals Corporation, Pfizer, Sanofi, Teva Pharmaceutical Industries Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diuretic Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Diuretic Drugs Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

5.3. Regulatory Scenario by Region/globally

5.4. Disease Prevalence & Incidence Rate Globally with Key Countries

5.5. Pipeline Analysis

6. Global Diuretic Drugs Market Analysis and Forecast, By Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Drug Class, 2017-2031

6.3.1. Carbonic Anhydrase Inhibitors

6.3.2. Loop Diuretics

6.3.3. Miscellaneous Diuretics

6.3.4. Potassium-sparing Diuretics

6.3.5. Thiazide Diuretics

6.4. Market Attractiveness By Drug Class

7. Global Diuretic Drugs Market Analysis and Forecast, By Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Route of Administration, 2017-2031

7.3.1. Oral

7.3.2. Parenteral

7.4. Market Attractiveness By Route of Administration

8. Global Diuretic Drugs Market Analysis and Forecast, By Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Indication, 2017-2031

8.3.1. Hypertension

8.3.2. Heart Failure

8.3.3. Kidney Stone

8.3.4. Edema

8.3.5. Others

8.4. Market Attractiveness By Indication

9. Global Diuretic Drugs Market Analysis and Forecast, By Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness By Distribution Channel

10. Global Diuretic Drugs Market Analysis and Forecast, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Diuretic Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Drug Class, 2017-2031

11.2.1. Carbonic Anhydrase Inhibitors

11.2.2. Loop Diuretics

11.2.3. Miscellaneous Diuretics

11.2.4. Potassium-sparing Diuretics

11.2.5. Thiazide Diuretics

11.3. Market Value Forecast By Route of Administration, 2017-2031

11.3.1. Oral

11.3.2. Parenteral

11.4. Market Value Forecast By Indication, 2017-2031

11.4.1. Hypertension

11.4.2. Heart Failure

11.4.3. Kidney Stone

11.4.4. Edema

11.4.5. Others

11.5. Market Value Forecast By Distribution Channel, 2017-2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast By Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Route of Administration

11.7.3. By Indication

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Diuretic Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Drug Class, 2017-2031

12.2.1. Carbonic Anhydrase Inhibitors

12.2.2. Loop Diuretics

12.2.3. Miscellaneous Diuretics

12.2.4. Potassium-sparing Diuretics

12.2.5. Thiazide Diuretics

12.3. Market Value Forecast By Route of Administration, 2017-2031

12.3.1. Oral

12.3.2. Parenteral

12.4. Market Value Forecast By Indication, 2017-2031

12.4.1. Hypertension

12.4.2. Heart Failure

12.4.3. Kidney Stone

12.4.4. Edema

12.4.5. Others

12.5. Market Value Forecast By Distribution Channel, 2017-2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast By Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug Class

12.7.2. By Route of Administration

12.7.3. By Indication

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Diuretic Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Drug Class, 2017-2031

13.2.1. Carbonic Anhydrase Inhibitors

13.2.2. Loop Diuretics

13.2.3. Miscellaneous Diuretics

13.2.4. Potassium-sparing Diuretics

13.2.5. Thiazide Diuretics

13.3. Market Value Forecast By Route of Administration, 2017-2031

13.3.1. Oral

13.3.2. Parenteral

13.4. Market Value Forecast By Indication, 2017-2031

13.4.1. Hypertension

13.4.2. Heart Failure

13.4.3. Kidney Stone

13.4.4. Edema

13.4.5. Others

13.5. Market Value Forecast By Distribution Channel, 2017-2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast By Country/Sub-region, 2017-2031

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug Class

13.7.2. By Route of Administration

13.7.3. By Indication

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Diuretic Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Drug Class, 2017-2031

14.2.1. Carbonic Anhydrase Inhibitors

14.2.2. Loop Diuretics

14.2.3. Miscellaneous Diuretics

14.2.4. Potassium-sparing Diuretics

14.2.5. Thiazide Diuretics

14.3. Market Value Forecast By Route of Administration, 2017-2031

14.3.1. Oral

14.3.2. Parenteral

14.4. Market Value Forecast By Indication, 2017-2031

14.4.1. Hypertension

14.4.2. Heart Failure

14.4.3. Kidney Stone

14.4.4. Edema

14.4.5. Others

14.5. Market Value Forecast By Distribution Channel, 2017-2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast By Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug Class

14.7.2. By Route of Administration

14.7.3. By Indication

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Diuretic Drugs Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Drug Class, 2017-2031

15.2.1. Carbonic Anhydrase Inhibitors

15.2.2. Loop Diuretics

15.2.3. Miscellaneous Diuretics

15.2.4. Potassium-sparing Diuretics

15.2.5. Thiazide Diuretics

15.3. Market Value Forecast By Route of Administration, 2017-2031

15.3.1. Oral

15.3.2. Parenteral

15.4. Market Value Forecast By Indication, 2017-2031

15.4.1. Hypertension

15.4.2. Heart Failure

15.4.3. Kidney Stone

15.4.4. Edema

15.4.5. Others

15.5. Market Value Forecast By Distribution Channel, 2017-2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast By Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug Class

15.7.2. By Route of Administration

15.7.3. By Indication

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share/Ranking Analysis By Company (2022)

16.3. Company Profiles

16.3.1. AstraZeneca

16.3.1.1. Company Overview

16.3.1.2. Drug Class Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Strategic Overview

16.3.2. Aurobindo Pharma

16.3.2.1. Company Overview

16.3.2.2. Drug Class Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Strategic Overview

16.3.3. Bayer AG

16.3.3.1. Company Overview

16.3.3.2. Drug Class Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Strategic Overview

16.3.4. Bristol-Myers Squibb Company

16.3.4.1. Company Overview

16.3.4.2. Drug Class Portfolio

16.3.4.3. SWOT Analysis

16.3.4.4. Strategic Overview

16.3.5. Cipla Ltd

16.3.5.1. Company Overview

16.3.5.2. Drug Class Portfolio

16.3.5.3. SWOT Analysis

16.3.5.4. Strategic Overview

16.3.6. F. Hoffmann-La Roche Ltd

16.3.6.1. Company Overview

16.3.6.2. Drug Class Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Strategic Overview

16.3.7. Fresenius Kabi AG

16.3.7.1. Company Overview

16.3.7.2. Drug Class Portfolio

16.3.7.3. SWOT Analysis

16.3.7.4. Strategic Overview

16.3.8. GSK plc

16.3.8.1. Company Overview

16.3.8.2. Drug Class Portfolio

16.3.8.3. SWOT Analysis

16.3.8.4. Strategic Overview

16.3.9. Hikma Pharmaceuticals PLC

16.3.9.1. Company Overview

16.3.9.2. Drug Class Portfolio

16.3.9.3. SWOT Analysis

16.3.9.4. Strategic Overview

16.3.10. Mylan

16.3.10.1. Company Overview

16.3.10.2. Drug Class Portfolio

16.3.10.3. SWOT Analysis

16.3.10.4. Strategic Overview

16.3.11. Novartis Pharmaceuticals Corporation

16.3.11.1. Company Overview

16.3.11.2. Drug Class Portfolio

16.3.11.3. SWOT Analysis

16.3.11.4. Strategic Overview

16.3.12. Pfizer

16.3.12.1. Company Overview

16.3.12.2. Drug Class Portfolio

16.3.12.3. SWOT Analysis

16.3.12.4. Strategic Overview

16.3.13. Sanofi

16.3.13.1. Company Overview

16.3.13.2. Drug Class Portfolio

16.3.13.3. SWOT Analysis

16.3.13.4. Strategic Overview

16.3.14. Teva Pharmaceutical Industries Ltd

16.3.14.1. Company Overview

16.3.14.2. Drug Class Portfolio

16.3.14.3. SWOT Analysis

16.3.14.4. Strategic Overview

List of Tables

Table 01: Global Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 02: Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 03: Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 04: Global Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 05: Global Diuretic Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Diuretic Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 08: North America Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 09: North America Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 10: North America Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 11: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 12: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 13: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 14: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 15: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 18: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 19: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 20: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 23: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 24: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 25: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 26: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 28: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 29: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 30: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Diuretic Drugs Market Value Share, by Drug Class, 2022

Figure 03: Global Diuretic Drugs Market Value Share, by Route of Administration, 2022

Figure 04: Global Diuretic Drugs Market Value Share, by Indication, 2022

Figure 05: Global Diuretic Drugs Market Value Share, by Distribution Channel, 2022

Figure 06 Global Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 07: Global Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 08: Global Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 09: Global Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 10: Global Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 11: Global Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 12: Global Diuretic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 13: Global Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 14: Global Diuretic Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 15: Global Diuretic Drugs Market Attractiveness Analysis, by Region, 2023-2031

Figure 16: North America Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 17: North America Diuretic Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 18: North America Diuretic Drugs Market Attractiveness Analysis, by Country, 2023-2031

Figure 19: North America Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 20: North America Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 21: North America Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 22: North America Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 23: North America Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 24: North America Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 25: North America Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 26: North America Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 27: Europe Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Europe Diuretic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 29: Europe Diuretic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 30: Europe Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 31: Europe Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 32: Europe Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 33: Europe Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 34: Europe Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 35: Europe Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 36: Europe Diuretic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 37: Europe Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 38: Asia Pacific Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific Diuretic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 40: Asia Pacific Diuretic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 41: Asia Pacific Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 42: Asia Pacific Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 43: Asia Pacific Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 44: Asia Pacific Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 45: Asia Pacific Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 46: Asia Pacific Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 47: Asia Pacific Diuretic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 48: Asia Pacific Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 49: Latin America Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America Diuretic Drugs Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 51: Latin America Diuretic Drugs Market Attractiveness Analysis, by Country/Sub-Region, 2022-2031

Figure 52: Latin America Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 53: Latin America Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 54: Latin America Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 55: Latin America Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 56: Latin America Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 57: Latin America Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 58: Latin America Diuretic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 59: Latin America Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 60: Middle East & Africa Diuretic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Middle East & Africa Diuretic Drugs Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 62: Middle East & Africa Diuretic Drugs Market Attractiveness Analysis, by Country/Sub-Region, 2022-2031

Figure 63: Middle East & Africa Diuretic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 64: Middle East & Africa Diuretic Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 65: Middle East & Africa Diuretic Drugs Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 66: Middle East & Africa Diuretic Drugs Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 67: Middle East & Africa Diuretic Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 68: Middle East & Africa Diuretic Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 69: Middle East & Africa Diuretic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 70: Middle East & Africa Diuretic Drugs Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 71: Company Share Analysis, 2022