Path-breaking innovations in multi-purpose communications are steering growth of the distributed antenna system (DAS) market. Since sports is one of the key sources of entertainment for individuals, manufacturers in the market for distributed antenna systems are increasing efficacy in multi-standard and multi-technology resources to give rise to technologically-sound stadiums. Currently, stadiums & arenas segment dominate the highest revenue among all end users in the distributed antenna system market. This end user segment is expected to reach a value of ~US$ 2.3 Bn by the end of 2020. Hence, manufacturers are increasing R&D to deploy high-density Wi-Fi mobile coverage to enhance fan experience.

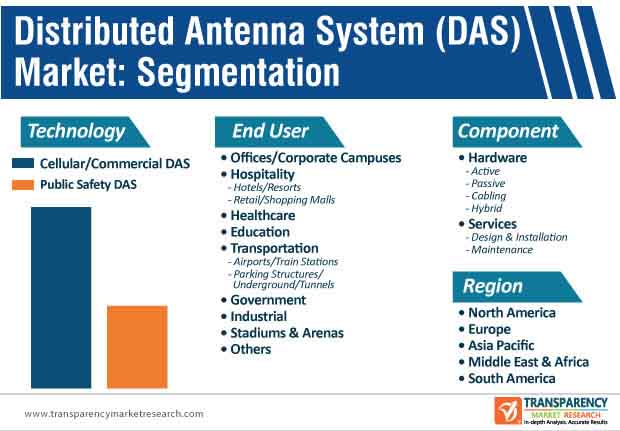

Companies in the distributed antenna system (DAS) market are deploying multi-operator and multi-technology resources in building designs to accommodate various elements of the mobile operator’s equipment. Thus, vendors are making this possible by increasing the availability of hybrid active/passive distributed antenna systems.

The distributed antenna system (DAS) market is witnessing change with the introduction of cloud collaboration. For instance, in April 2019, in-building equipment and services provider Advanced RF Technologies, Inc., announced a cloud collaboration with heterogeneous network planning specialist Ranplan Wireless, through the Collaboration-Hub platform. Cloud collaboration is an innovative concept in the market for distributed antenna systems, which helps companies to gain greater control over their IP (Intellectual Property). Thus, access over network modeling and design software becomes easier for network engineers.

The trend of cloud collaboration is helping to strengthen public safety, especially in the transportation sector. As such, public safety DAS is projected for exponential growth during the forecast period. The public safety DAS segment of the distributed antenna system (DAS) market is estimated to reach a value of ~US$ 6.6 Bn by 2027. Manufacturers in the distributed antenna system (DAS) market are increasing the availability of wireless connectivity to unlock the potential of LTE and 5G systems. Proliferation of 5G and integration of IoT for in-building designs are key drivers that are catalyzing market growth.

An increase of passengers has triggered the demand for distributed antenna systems. Growing demand for seamless mobile connectivity is another key driver for the growth of the distributed antenna system (DAS) market. Manufacturers are increasing their production capacities to meet the requirements of passengers at airports and train stations. Among end users, the transportation segment of the distributed antenna system market is estimated to reach a value of ~US$ 2.4 Bn by the end of 2024.

Growing need for wireless connectivity to meet voice, data, and text messaging is catalyzing the demand for distributed antenna systems. Moreover, robust cellular coverage is becoming increasingly mainstream in developed economies of North America. In addition, this trend is gaining popularity in countries of Asia Pacific, since the region is anticipated for exponential growth during the forecast period. Solid cellular coverage plays a vital role in ensuring public safety. Hence, government organizations are increasingly installing DAS for various modes of public transportation.

Wireless communications have become a necessity in several end markets. In order to meet the needs of growing users that rely on wireless connectivity, manufacturers in the distributed antenna system (DAS) market are increasing their efficacy in multi-antenna communications. The market is largely consolidated with six leading players accounting to more than ~60% of the market share. This poses as a challenge for emerging players to innovate in multi-antenna communications due to the lack of capital and expertise in the domain.

Companies in the distributed antenna system (DAS) market are adopting optimal transit strategies to ensure uninterrupted wireless connectivity. However, the issue of per-antenna power constraints in point-to-point multiple-input single-output (MISO) and multiple-input multiple-output (MIMO) channels with joint sum poses as a challenge for manufacturers. Hence, companies are experimenting with efficient iterative algorithms to overcome the limitations of power constraints in practical systems.

Moreover, manufacturers are tapping into opportunities to integrate 5G networks with IoT in smart city environments. Paradigm shifts in urban ecosystems with rural population transitioning toward suburban and urban areas is another driver for market growth.

The collaboration between OEMs and RF (Radio Frequency) design tools is playing a crucial role in designing modern multi-layer systems. Companies in the distributed antenna system (DAS) market are increasing their efforts to enable mobile connections in challenging environments such as in high-speed trains and underground stations.

However, issues involving 5G-based IoT applications in smart city environments pose as a hurdle for manufacturers. Hence, manufacturers should employ simplicity and homogeneity in 5G IoT systems to establish well-equipped connected environments. Apart from stadiums and transportation, manufacturers should invest in developing advanced DAS to support growing hospitality, healthcare, corporate campuses, and education sectors.

Distributed Antenna System (DAS) Market: Overview

Key Drivers of Distributed Antenna System (DAS) Market

Distributed Antenna System (DAS) Market – Competition Landscape

Distributed Antenna System (DAS) Market - Company Profiles Snapshot

CommScope Inc. provides infrastructure solutions for communication networks worldwide. The company’s CommScope Connectivity Solutions segment offers optical fiber and twisted pair structured cable solutions, intelligent infrastructure software, and network rack and cabinet enclosures under the SYSTIMAX, AMP NETCONNECT, and Uniprise brands. CommScope Inc. provides DAS solutions under its mobility solutions segment.

Corning Incorporated is one of the world’s leading innovators in material science. The company provides distributed antenna system (DAS) solutions to ensure five-bar cellular coverage and adequate cellular data capacity for smartphones and enterprise networks. The company’s indoor and outdoor DAS solutions/technologies are designed to flexibly deliver licensed radio frequencies, public safety, and to ensure adequate network coverage in venues such as stadiums and arenas.

Cobham Wireless, is part of Cobham plc and operates at the component and subsystem level. The company is one of the significant global players, providing advanced wireless coverage and mobile communication systems. The company’s portfolio includes public safety solutions, development and test tools, wireless coverage, mobile communications systems, DAS solutions, and mobile and IP networks.

Other major players operating in the distributed antenna system (DAS) market and profiled in the report include

The distributed antenna system (das) market is studied from 2019 - 2027

The distributed antenna system (das) market is expected to reach $20.4 billion by 2027

The distributed antenna system (das) market is growing at a CAGR of 11% over the next five years

The top companies holding the market share in the global distributed antenna system (das) market report include American Tower Corporation, AT&T Inc., Bird Technologies, Boingo Wireless, Inc., Cobham Wireless, CommScope Inc., Corning Incorporated, Dali Wireless, SOLiD, Inc., and TESSCO Technologies, Inc.

The distributed antenna system (DAS) market in North America is expected to hold a dominant share of 36% of the global market by the end of 2019

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Distributed Antenna System (DAS) Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Market Indicators

4.3.1. Adoption of Portable Devices

4.4. Global Distributed Antenna System (DAS) Market Analysis and Forecasts, 2016 - 2027

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Active Market Participants (Manufacturers/ Retailer/ Distributors/ Vendors)

4.6.2. Forward – Backward Integration Scenario

4.7. Market Outlook

5. Global Distributed Antenna System (DAS) Market Analysis and Forecasts, by Component

5.1. Overview & Definitions

5.2. Key Trends

5.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

5.3.1. Hardware

5.3.1.1. Active

5.3.1.1.1. Head- end and Remotes

5.3.1.1.2. Trays

5.3.1.1.3. Antennas

5.3.1.1.4. Others

5.3.1.2. Passive

5.3.1.2.1. Donor Antennas

5.3.1.2.2. Trays

5.3.1.2.3. Repeaters

5.3.1.2.4. Others

5.3.1.3. Cabling

5.3.1.3.1. Coaxial

5.3.1.3.2. Optical Fiber

5.3.1.3.3. CAT5

5.3.1.3.4. Others

5.3.1.4. Hybrid

5.3.1.4.1. Head- end and Remotes

5.3.1.4.2. Repeaters

5.3.2. Service

5.3.2.1. Design and Installation

5.3.2.2. Maintenance

5.4. Component Comparison Matrix

5.5. Market Attractiveness by Component

6. Global Distributed Antenna System (DAS) Market Analysis and Forecasts, by Technology

6.1. Overview & Definition

6.2. Key Trends

6.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

6.3.1. Cellular/Commercial DAS

6.3.2. Public Safety DAS

6.4. Technology Comparison Matrix

6.5. Market Attractiveness by Technology

7. Global Distributed Antenna System (DAS) Market Analysis and Forecasts, by End-user

7.1. Overview & Definition

7.2. Key Trends

7.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

7.3.1. Offices/Corporate Campus

7.3.2. Hospitality

7.3.2.1. Hotels/Resorts

7.3.2.2. Retail/Shopping Malls

7.3.3. Health Care

7.3.4. Education

7.3.5. Transportation

7.3.5.1. Airport/Train Stations

7.3.5.2. Parking Structures/Underground/ Tunnels

7.3.6. Government

7.3.7. Industrial

7.3.8. Stadiums and Arenas

7.3.9. Others

7.4. End-user Comparison Matrix

7.5. Market Attractiveness by End-user

8. Global Distributed Antenna System (DAS) Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Region, 2017 - 2027

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. South America

8.4. Market Attractiveness by Country/Region

9. North America Distributed Antenna System (DAS) Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

9.3.1. Hardware

9.3.1.1. Active

9.3.1.1.1. Head- end and Remotes

9.3.1.1.2. Trays

9.3.1.1.3. Antennas

9.3.1.1.4. Others

9.3.1.2. Passive

9.3.1.2.1. Donor Antennas

9.3.1.2.2. Trays

9.3.1.2.3. Repeaters

9.3.1.2.4. Others

9.3.1.3. Cabling

9.3.1.3.1. Coaxial

9.3.1.3.2. Optical Fiber

9.3.1.3.3. CAT5

9.3.1.3.4. Others

9.3.1.4. Hybrid

9.3.1.4.1. Head- end and Remotes

9.3.1.4.2. Repeaters

9.3.2. Service

9.3.2.1. Design and Installation

9.3.2.2. Maintenance

9.4. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

9.4.1. Cellular/Commercial DAS

9.4.2. Public Safety DAS

9.5. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

9.5.1. Offices/Corporate Campus

9.5.2. Hospitality

9.5.2.1. Hotels/Resorts

9.5.2.2. Retail/Shopping Malls

9.5.3. Health Care

9.5.4. Education

9.5.5. Transportation

9.5.5.1. Airport/Train Stations

9.5.5.2. Parking Structures/Underground/ Tunnels

9.5.6. Government

9.5.7. Industrial

9.5.8. Stadiums and Arenas

9.5.9. Others

9.6. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Country/Sub-region, 2017 - 2027

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. by Country

9.7.2. by Component

9.7.3. by Technology

9.7.4. by End-user

10. Europe Distributed Antenna System (DAS) Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

10.3.1. Hardware

10.3.1.1. Active

10.3.1.1.1. Head- end and Remotes

10.3.1.1.2. Trays

10.3.1.1.3. Antennas

10.3.1.1.4. Others

10.3.1.2. Passive

10.3.1.2.1. Donor Antennas

10.3.1.2.2. Trays

10.3.1.2.3. Repeaters

10.3.1.2.4. Others

10.3.1.3. Cabling

10.3.1.3.1. Coaxial

10.3.1.3.2. Optical Fiber

10.3.1.3.3. CAT5

10.3.1.3.4. Others

10.3.1.4. Hybrid

10.3.1.4.1. Head- end and Remotes

10.3.1.4.2. Repeaters

10.3.2. Service

10.3.2.1. Design and Installation

10.3.2.2. Maintenance

10.4. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

10.4.1. Cellular/Commercial DAS

10.4.2. Public Safety DAS

10.5. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

10.5.1. Offices/Corporate Campus

10.5.2. Hospitality

10.5.2.1. Hotels/Resorts

10.5.2.2. Retail/Shopping Malls

10.5.3. Health Care

10.5.4. Education

10.5.5. Transportation

10.5.5.1. Airport/Train Stations

10.5.5.2. Parking Structures/Underground/ Tunnels

10.5.6. Government

10.5.7. Industrial

10.5.8. Stadiums and Arenas

10.5.9. Others

10.6. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Country/Sub-region, 2017 - 2027

10.6.1. Germany

10.6.2. France

10.6.3. U.K.

10.6.4. Italy

10.6.5. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. by Country

10.7.2. by Component

10.7.3. by Technology

10.7.4. by End-user

11. Asia Pacific Distributed Antenna System (DAS) Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

11.3.1. Hardware

11.3.1.1. Active

11.3.1.1.1. Head- end and Remotes

11.3.1.1.2. Trays

11.3.1.1.3. Antennas

11.3.1.1.4. Others

11.3.1.2. Passive

11.3.1.2.1. Donor Antennas

11.3.1.2.2. Trays

11.3.1.2.3. Repeaters

11.3.1.2.4. Others

11.3.1.3. Cabling

11.3.1.3.1. Coaxial

11.3.1.3.2. Optical Fiber

11.3.1.3.3. CAT5

11.3.1.3.4. Others

11.3.1.4. Hybrid

11.3.1.4.1. Head- end and Remotes

11.3.1.4.2. Repeaters

11.3.2. Service

11.3.2.1. Design and Installation

11.3.2.2. Maintenance

11.4. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

11.4.1. Cellular/Commercial DAS

11.4.2. Public Safety DAS

11.5. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

11.5.1. Offices/Corporate Campus

11.5.2. Hospitality

11.5.2.1. Hotels/Resorts

11.5.2.2. Retail/Shopping Malls

11.5.3. Health Care

11.5.4. Education

11.5.5. Transportation

11.5.5.1. Airport/Train Stations

11.5.5.2. Parking Structures/Underground/ Tunnels

11.5.6. Government

11.5.7. Industrial

11.5.8. Stadiums and Arenas

11.5.9. Others

11.6. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Country/Sub-region, 2017 - 2027

11.6.1. China

11.6.2. Japan

11.6.3. Australia

11.6.4. South Korea

11.6.5. India

11.6.6. Indonesia

11.6.7. New Zealand

11.6.8. Singapore

11.6.9. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. by Country

11.7.2. by Component

11.7.3. by Technology

11.7.4. by End-user

12. Middle East & Africa (MEA) Distributed Antenna System (DAS) Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

12.3.1. Hardware

12.3.1.1. Active

12.3.1.1.1. Head- end and Remotes

12.3.1.1.2. Trays

12.3.1.1.3. Antennas

12.3.1.1.4. Others

12.3.1.2. Passive

12.3.1.2.1. Donor Antennas

12.3.1.2.2. Trays

12.3.1.2.3. Repeaters

12.3.1.2.4. Others

12.3.1.3. Cabling

12.3.1.3.1. Coaxial

12.3.1.3.2. Optical Fiber

12.3.1.3.3. CAT5

12.3.1.3.4. Others

12.3.1.4. Hybrid

12.3.1.4.1. Head- end and Remotes

12.3.1.4.2. Repeaters

12.3.2. Service

12.3.2.1. Design and Installation

12.3.2.2. Maintenance

12.4. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

12.4.1. Cellular/Commercial DAS

12.4.2. Public Safety DAS

12.5. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

12.5.1. Offices/Corporate Campus

12.5.2. Hospitality

12.5.2.1. Hotels/Resorts

12.5.2.2. Retail/Shopping Malls

12.5.3. Health Care

12.5.4. Education

12.5.5. Transportation

12.5.5.1. Airport/Train Stations

12.5.5.2. Parking Structures/Underground/ Tunnels

12.5.6. Government

12.5.7. Industrial

12.5.8. Stadiums and Arenas

12.5.9. Others

12.6. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Country/Sub-region, 2017 - 2027

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. South Africa

12.6.4. Rest of MEA

12.7. Market Attractiveness Analysis

12.7.1. by Country

12.7.2. by Component

12.7.3. by Technology

12.7.4. by End-user

13. South America Distributed Antenna System (DAS) Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Component, 2017 - 2027

13.3.1. Hardware

13.3.1.1. Active

13.3.1.1.1. Head- end and Remotes

13.3.1.1.2. Trays

13.3.1.1.3. Antennas

13.3.1.1.4. Others

13.3.1.2. Passive

13.3.1.2.1. Donor Antennas

13.3.1.2.2. Trays

13.3.1.2.3. Repeaters

13.3.1.2.4. Others

13.3.1.3. Cabling

13.3.1.3.1. Coaxial

13.3.1.3.2. Optical Fiber

13.3.1.3.3. CAT5

13.3.1.3.4. Others

13.3.1.4. Hybrid

13.3.1.4.1. Head- end and Remotes

13.3.1.4.2. Repeaters

13.3.2. Service

13.3.2.1. Design and Installation

13.3.2.2. Maintenance

13.4. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Technology, 2017 - 2027

13.4.1. Cellular/Commercial DAS

13.4.2. Public Safety DAS

13.5. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by End-user, 2017 - 2027

13.5.1. Offices/Corporate Campus

13.5.2. Hospitality

13.5.2.1. Hotels/Resorts

13.5.2.2. Retail/Shopping Malls

13.5.3. Health Care

13.5.4. Education

13.5.5. Transportation

13.5.5.1. Airport/Train Stations

13.5.5.2. Parking Structures/Underground/ Tunnels

13.5.6. Government

13.5.7. Industrial

13.5.8. Stadiums and Arenas

13.5.9. Others

13.6. Distributed Antenna System (DAS) Market Size (US$ Mn) Forecast by Country/Sub-region, 2017 - 2027

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. by Country

13.7.2. by Component

13.7.3. by Technology

13.7.4. by End-user

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Share Analysis by Company (2019)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

14.3.1. American Tower Corporation

14.3.1.1. Market Presence, by Segment and Geography

14.3.1.2. Revenue and Operating Profits

14.3.1.3. Strategy and Historical Roadmap

14.3.1.4. SWOT Analysis

14.3.2. AT&T Inc.

14.3.2.1. Market Presence, by Segment and Geography

14.3.2.2. Revenue and Operating Profits

14.3.2.3. Strategy and Historical Roadmap

14.3.2.4. SWOT Analysis

14.3.3. Bird Technologies

14.3.3.1. Market Presence, by Segment and Geography

14.3.3.2. Revenue and Operating Profits

14.3.3.3. Strategy and Historical Roadmap

14.3.3.4. SWOT Analysis

14.3.4. Boingo Wireless, Inc.

14.3.4.1. Market Presence, by Segment and Geography

14.3.4.2. Revenue and Operating Profits

14.3.4.3. Strategy and Historical Roadmap

14.3.4.4. SWOT Analysis

14.3.5. Cobham Wireless

14.3.5.1. Market Presence, by Segment and Geography

14.3.5.2. Revenue and Operating Profits

14.3.5.3. Strategy and Historical Roadmap

14.3.5.4. SWOT Analysis

14.3.6. CommScope Inc.

14.3.6.1. Market Presence, by Segment and Geography

14.3.6.2. Revenue and Operating Profits

14.3.6.3. Strategy and Historical Roadmap

14.3.6.4. SWOT Analysis

14.3.7. Corning Incorporated

14.3.7.1. Market Presence, by Segment and Geography

14.3.7.2. Revenue and Operating Profits

14.3.7.3. Strategy and Historical Roadmap

14.3.7.4. SWOT Analysis

14.3.8. Dali Wireless

14.3.8.1. Market Presence, by Segment and Geography

14.3.8.2. Revenue and Operating Profits

14.3.8.3. Strategy and Historical Roadmap

14.3.8.4. SWOT Analysis

14.3.9. SOLiD, Inc.

14.3.9.1. Market Presence, by Segment and Geography

14.3.9.2. Revenue and Operating Profits

14.3.9.3. Strategy and Historical Roadmap

14.3.9.4. SWOT Analysis

14.3.10. TESSCO Technologies, Inc

14.3.10.1. Market Presence, by Segment and Geography

14.3.10.2. Revenue and Operating Profits

14.3.10.3. Strategy and Historical Roadmap

14.3.10.4. SWOT Analysis

15. Key Takeaways

List of Tables

Table 1: Global Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 2: Global Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 3: Global Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 4: Global Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 5: Global Distributed Antenna System Market Size and Forecast, by Hardware, by Cabling, 2017 – 2027 (US$ Mn)

Table 6: Global Distributed Antenna System Market Size and Forecast, by by Hardware, Hybrid DAS, 2017 – 2027 (US$ Mn)

Table 7: Global Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 8: Global Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 9: Global Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 10: Global Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 11: Global Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 12: Global Distributed Antenna System Market Size and Forecast, by Region, 2017 – 2027 (US$ Mn)

Table 13: North America Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 14: North America Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 15: North America Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 16: North America Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 17: North America Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid DAS, 2017 – 2027 (US$ Mn)

Table 18: North America Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid, 2017 – 2027 (US$ Mn)

Table 19: North America Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 20: North America Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 21: North America Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 22: North America Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 23: North America Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 24: North America Distributed Antenna System Market Size and Forecast, by Country, 2017 – 2027 (US$ Mn)

Table 25: Europe Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 26: Europe Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 27: Europe Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 28: Europe Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 29: Europe Distributed Antenna System Market Size and Forecast, by Hardware, by Cabling, 2017 – 2027 (US$ Mn)

Table 30: Europe Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid, 2017 – 2027 (US$ Mn)

Table 31: Europe Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 32: Europe Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 33: Europe Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 34: Europe Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 35: Europe Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 36: Europe Distributed Antenna System Market Size and Forecast, by Country, 2017 – 2027 (US$ Mn)

Table 37: Asia Pacific Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 38: Asia Pacific Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 39: Asia Pacific Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 40: Asia Pacific Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 41: Asia Pacific Distributed Antenna System Market Size and Forecast, by Hardware, by Cabling, 2017 – 2027 (US$ Mn)

Table 42: Asia Pacific Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid, 2017 – 2027 (US$ Mn)

Table 43: Asia Pacific Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 44: Asia Pacific Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 45: Asia Pacific Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 46: Asia Pacific Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 47: Asia Pacific Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 48: Asia Pacific Distributed Antenna System Market Size and Forecast, by Country, 2017 – 2027 (US$ Mn)

Table 49: MEA Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 50: MEA Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 51: MEA Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 52: MEA Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 53: MEA Distributed Antenna System Market Size and Forecast, by Hardware, by Cabling, 2017 – 2027 (US$ Mn)

Table 54: MEA Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid, 2017 – 2027 (US$ Mn)

Table 55: MEA Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 56: MEA Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 57: MEA Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 58: MEA Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 59: MEA Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 60: MEA Distributed Antenna System Market Size and Forecast, by Country, 2017 – 2027 (US$ Mn)

Table 61: South America Distributed Antenna System Market Size and Forecast, by Component, 2017 – 2027 (US$ Mn)

Table 62: South America Distributed Antenna System Market Size and Forecast, by Hardware, 2017 – 2027 (US$ Mn)

Table 63: South America Distributed Antenna System Market Size and Forecast, by Hardware, by Active DAS, 2017 – 2027 (US$ Mn)

Table 64: South America Distributed Antenna System Market Size and Forecast, by Hardware, by Passive DAS, 2017 – 2027 (US$ Mn)

Table 65: South America Distributed Antenna System Market Size and Forecast, by Hardware, by Cabling, 2017 – 2027 (US$ Mn)

Table 66: South America Distributed Antenna System Market Size and Forecast, by Hardware, by Hybrid, 2017 – 2027 (US$ Mn)

Table 67: South America Distributed Antenna System Market Size and Forecast, by Services, 2017 – 2027 (US$ Mn)

Table 68: South America Distributed Antenna System Market Size and Forecast, by Technology, 2017 – 2027 (US$ Mn)

Table 69: South America Distributed Antenna System Market Size and Forecast, by End-user, 2017 – 2027 (US$ Mn)

Table 70: South America Distributed Antenna System Market Size and Forecast, by End-user, by Hospitality, 2017 – 2027 (US$ Mn)

Table 71: South America Distributed Antenna System Market Size and Forecast, by End-user, by Transportation, 2017 – 2027 (US$ Mn)

Table 72: South America Distributed Antenna System Market Size and Forecast, by Country, 2017 – 2027 (US$ Mn)

List of Figures

Figure 1: Global Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2016 – 2027

Figure 2: Global Distributed Antenna System Market Y-o-Y Growth (Value %) Forecast, 2016 – 2027

Figure 3: Global Distributed Antenna System Market Value Share, by End-user, 2019

Figure 4: Global Distributed Antenna System Market Value Share, by Component, 2019

Figure 5: Global Distributed Antenna System Market Value Share, by Technology, 2019

Figure 6: Global Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 7: Global Distributed Antenna System Market Value Share Analysis, by Hardware

Figure 8: Global Distributed Antenna System Market Value Share Analysis, by Services

Figure 9: Global Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 10: Global Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 11: Global Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 12: Global Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 13: Global Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid DAS, 2019 and 2027

Figure 14: Global Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 15: Global Distributed Antenna System Market Value Share Analysis, by Design & Installation Services

Figure 16: Global Distributed Antenna System Market Value Share Analysis, by Maintenance Services

Figure 17: Global Distributed Antenna System Comparison Matrix, by Component

Figure 18: Global Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 19: Global Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 20: Global Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 21: Global Distributed Antenna System Market Value Share Analysis, by Cellular/Commercial DAS

Figure 22: Global Distributed Antenna System Market Value Share Analysis, by Public Safety

Figure 23: Global Distributed Antenna System Comparison Matrix, by Technology

Figure 24: Global Distributed Antenna System Market Attractiveness Analysis, by Technology

Figure 25: Global Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 26: Global Distributed Antenna System Market Value Share Analysis, by Offices/Corporate Campus

Figure 27: Global Distributed Antenna System Market Value Share Analysis, by Hospitality

Figure 28: Global Distributed Antenna System Market Value Share Analysis, by Healthcare

Figure 29: Global Distributed Antenna System Market Value Share Analysis, by Education

Figure 30: Global Distributed Antenna System Market Value Share Analysis, by Transportation

Figure 31: Global Distributed Antenna System Market Value Share Analysis, by Government

Figure 32: Global Distributed Antenna System Market Value Share Analysis, by Industrial

Figure 33: Global Distributed Antenna System Market Value Share Analysis, by Stadiums and Arenas

Figure 34: Global Distributed Antenna System Market Value Share Analysis, by Others

Figure 35: Global Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 36: Global Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 37: Global Distributed Antenna System Comparison Matrix by End-user

Figure 38: Global Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 39: Global Distributed Antenna System Market Value Share Analysis, by Region, 2019 and 2027

Figure 40: Global Distributed Antenna System Market Attractiveness Analysis, by Region

Figure 41: North America Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2017 – 2027

Figure 42: North America Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 43: North America Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 44: North America Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 45: North America Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 46: North America Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 47: North America Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid DAS, 2019 and 2027

Figure 48: North America Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 49: North America Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 50: North America Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 51: North America Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 52: North America Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 53: North America Distributed Antenna System Market Value Share Analysis, by Country, 2019 and 2027

Figure 54: North America Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 55: North America Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 56: North America Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 57: North America Distributed Antenna System Market Attractiveness Analysis, by Country

Figure 58: Europe Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2017 – 2027

Figure 59: Europe Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 60: Europe Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 61: Europe Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 62: Europe Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 63: Europe Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 64: Europe Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid, 2019 and 2027

Figure 65: Europe Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 66: Europe Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 67: Europe Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 68: Europe Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 69: Europe Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 70: Europe Distributed Antenna System Market Value Share Analysis, by Country, 2019 and 2027

Figure 71: Europe Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 72: Europe Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 73: Europe Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 74: Europe Distributed Antenna System Market Attractiveness Analysis, by Country

Figure 75: Asia Pacific Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2017 – 2027

Figure 76: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 77: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 78: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 79: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 80: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 81: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid, 2019 and 2027

Figure 82: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 83: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 84: Asia Pacific Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 85: Asia Pacific Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 86: Asia Pacific Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 87: Asia Pacific Distributed Antenna System Market Value Share Analysis, by Country, 2019 and 2027

Figure 88: Asia Pacific Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 89: Asia Pacific Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 90: Asia Pacific Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 91: Asia Pacific Distributed Antenna System Market Attractiveness Analysis, by Country

Figure 92: MEA Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2017 – 2027

Figure 93: MEA Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 94: MEA Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 95: MEA Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 96: MEA Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 97: MEA Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 98: MEA Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid, 2019 and 2027

Figure 99: MEA Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 100: MEA Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 101: MEA Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 102: MEA Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 103: MEA Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 104: MEA Distributed Antenna System Market Value Share Analysis, by Country, 2019 and 2027

Figure 105: MEA Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 106: MEA Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 107: MEA Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 108: MEA Distributed Antenna System Market Attractiveness Analysis, by Country

Figure 109: South America Distributed Antenna System Market Analysis and Forecast (US$ Mn), 2017 – 2027

Figure 110: South America Distributed Antenna System Market Value Share Analysis, by Component, 2019 and 2027

Figure 111: South America Distributed Antenna System Market Value Share Analysis, by Hardware, 2019 and 2027

Figure 112: South America Distributed Antenna System Market Value Share Analysis, by Hardware, by Active DAS, 2019 and 2027

Figure 113: South America Distributed Antenna System Market Value Share Analysis, by Hardware, by Passive DAS, 2019 and 2027

Figure 114: South America Distributed Antenna System Market Value Share Analysis, by Hardware, by Cabling, 2019 and 2027

Figure 115: South America Distributed Antenna System Market Value Share Analysis, by Hardware, by Hybrid, 2019 and 2027

Figure 116: South America Distributed Antenna System Market Value Share Analysis, by Services, 2019 and 2027

Figure 117: South America Distributed Antenna System Market Value Share Analysis, by Technology, 2019 and 2027

Figure 118: South America Distributed Antenna System Market Value Share Analysis, by End-user, 2019 and 2027

Figure 119: South America Distributed Antenna System Market Value Share Analysis, by End-user, by Hospitality, 2019 and 2027

Figure 120: South America Distributed Antenna System Market Value Share Analysis, by End-user, by Transportation, 2019 and 2027

Figure 121: South America Distributed Antenna System Market Value Share Analysis, by Country, 2019 and 2027

Figure 122: South America Distributed Antenna System Market Attractiveness Analysis, by Hardware

Figure 123: South America Distributed Antenna System Market Attractiveness Analysis, by Services

Figure 124: South America Distributed Antenna System Market Attractiveness Analysis, by End-user

Figure 125: South America Distributed Antenna System Market Attractiveness Analysis, by Country