The unprecedented demand for disinfectants and surfactants during the coronavirus pandemic has led to business opportunities for manufacturers in the disinfectants market. Manufacturers have been producing disinfectants at break-neck speeds to meet the demand of users in hospitals, commercial, and domestic settings. Since the World Health Organization (WHO) has recommended the use of disinfectants, retailers have witnessed a sudden spike in product sales.

It has been found that disinfectants are effective in containing the spread of COVID-19. According to the researchers from Ruhr-Universitat Bochum (RUB) in Germany, their main components such as isopropanol and alcohol ethanol are found to show adequate inactivation of the virus. Companies in the disinfectants market are increasing their production capabilities in alcohol-based hand disinfectants that are effective against the novel coronavirus.

The COVID-19 pandemic has led to increased use of disinfectants. However, exposure to stronger concentration of hypochlorite has the potential to cause serious damage to multiple organs, especially with the use of disinfectant tunnel. A study from the Postgraduate Institute of Medical Education and Research (PGIMER), Chandigarh, has shed light on the side effects of using the disinfectant tunnel wherein sodium hypochlorite is sprayed to prevent the spread of COVID-19. Hence, manufacturers in the disinfectants market are focusing on critical applications in healthcare facilities to keep economies running during the ongoing pandemic.

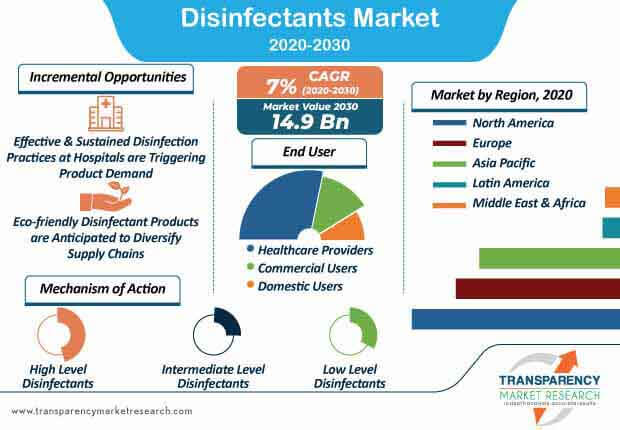

Hospital-grade eco-friendly disinfectants are growing popular in the market landscape. Analysts at the Transparency Market Research (TMR) opine that eco-friendly disinfection will pave the way for innovations in products post the COVID-19 pandemic. Manufacturers in the disinfectants market are boosting their output capacities in eco-friendly solutions that establish targeted killing of organisms without affecting the surfaces upon which they are applied.

Eco-friendly disinfectants are emerging as a potential threat to the sales of liquids made from alcohols, aldehydes, and ammonium compounds. Hence, manufacturers in the disinfectants market should increase their R&D and expand their product portfolio of eco-friendly disinfectants to capitalize on incremental opportunities. Even consumers have become cognizant about the harmful effects of chemical disinfectants on the environment. Manufacturers in the disinfectants market are focusing on business expansion opportunities keeping in mind healthcare providers, as these end users are likely to dictate the highest revenue during the forecast period.

The disinfectants market is projected to advance at a favorable CAGR of ~7% during the assessment period. Cutting-edge industrial disinfection technologies are translating into revenue opportunities for manufacturers. Manufacturers are increasing efforts to meet the demand for industrial scale disinfection technologies such as electrochemically activated solution disinfection (ECAS), owing to the coronavirus pandemic. They are increasing the availability for non-toxic and effective products that can be used in food and industrial cleaning applications. Effective and sustained disinfection practices at public places and hospitals are establishing stable and long-term revenue streams for manufacturers.

The coronavirus pandemic has led to several business avenues for companies in the disinfectants market. The newly introduced foot-operated, height adjustable, hands-free sanitizer dispenser stand and applications in the hospitality industry are generating value grab opportunities for manufacturers in the disinfectants market. Vehicle disinfectant bays are being highly publicized for automatically disinfecting vehicles.

Cost and time efficiency attributes of vehicle disinfectant bays are grabbing the attention of stakeholders in various commercial sectors. The growing number of state borders and check-posts are using vehicle disinfectant bays to complete the disinfection process of cars in a very short time without much effort. Foot-operated, height adjustable hands-free sanitizer dispenser stands are gaining visibility in residential, commercial, and industrial applications.

Analysts’ Viewpoint

Since toxic chemicals in disinfectants can cause respiratory and central nervous system disorders, manufacturers are increasing the availability of eco-friendly disinfectants during the ongoing COVID-19 crisis. The disinfectants market is expected to reach US$ 14.9 Bn by 2030. However, alternate cleaning technologies such as pulsed UV (ultraviolet) light technology and high intensity ultrasound are emerging as a stiff competition to the sales of chemical- and alcohol-based disinfectants. Hence, manufacturers should innovate in eco-friendly disinfectant products to diversify their supply chains and expand business opportunities. They should increase their R&D for electrochemically activated solution, which uses powerful biocidal liquid capable of killing germs and bacteria.

The global disinfectants market was worth US$ 6.9 Bn and is projected to reach a value of US$ 14.9 Bn by the end of 2030

Disinfectants market is anticipated to grow at a CAGR of 7% during the forecast period

North America accounted for a major share of the global disinfectants market

Global disinfectants market is driven by increase in number of hospital-acquired/associated infections (HAI)

Key players in the global disinfectants market include 3M, BD, Cardinal Health, Inc., STERIS plc, Kimberly-Clark Corporation, Reckitt Benckiser Group plc, Getinge AB, Kimberly-Clark Corporation, Ecolab, Inc., The Clorox Company, and Cantel Medical Corp.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Disinfectants Market

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Product Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

Chapter 5. Key Insights

5.1. Global Disinfectants Market - Key Industry Events

5.2. COVID-19 Impact Analysis (demand for its use in research, supply chain, etc.)

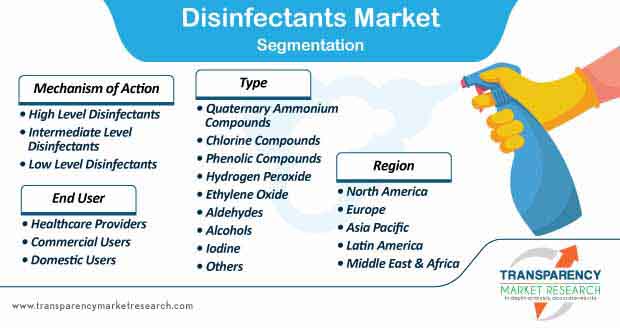

Chapter 6. Global Disinfectants Market Analysis and Forecast, by Type

6.1. Key Findings / Developments

6.2. Introduction & Definition

6.3. Global Disinfectants Market Value Forecast, by Type , 2018–2030

6.3.1. Quaternary Ammonium Compounds

6.3.2. Chlorine Compounds

6.3.3. Phenolic Compounds

6.3.4. Hydrogen Peroxide

6.3.5. Ethylene Oxide

6.3.6. Aldehydes

6.3.7. Alcohols

6.3.8. Iodine

6.3.9. Others

6.4. Global Disinfectants Market Attractiveness Analysis, by Type

Chapter 7. Global Disinfectants Market Analysis and Forecast, by Mechanism of Action

7.1. Key Findings / Developments

7.2. Introduction & Definition

7.3. Global Disinfectants Market Value Forecast, by End-user, 2018–2030

7.3.1. High Level Disinfectants

7.3.2. Intermediate Level Disinfectants

7.3.3. Low Level Disinfectants

7.4. Global Disinfectants Market Attractiveness Analysis, by End-user

Chapter 8. Global Disinfectants Market Analysis and Forecast, by End-user

8.1. Key Findings / Developments

8.2. Introduction & Definition

8.3. Global Disinfectants Market Value Forecast, by End-user, 2018–2030

8.3.1. Health Care Providers

8.3.2. Domestic Users

8.3.3. Commercial Users

8.4. Global Disinfectants Market Attractiveness Analysis, by End-user

Chapter 9. Global Disinfectants Market Analysis and Forecast, by Geography/Region

9.1. Geographical Representation

9.2. Global Disinfectants Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Disinfectants Market Attractiveness Analysis, by Region

Chapter 10. North America Disinfectants Market Analysis and Forecast

10.1. North America Disinfectants Market Value Forecast, by Country, 2018–2030

10.1.1. U.S.

10.1.2. Canada

10.2. North America Disinfectants Market Value Forecast, by Type , 2018–2030

10.3. North America Disinfectants Market Value Forecast, by Mechanism of Action, 2018-2030

10.4. North America Disinfectants Market Value Forecast, by End-user, 2018–2030

10.5. North America Horseradish Peroxidase Market Attractiveness Analysis, 2020–2030

10.5.1. By Country

10.5.2. By Type

10.5.3. By Mechanism of Action

10.5.4. By End-user

Chapter 11. Europe Disinfectants Market Analysis and Forecast

11.1. Europe Disinfectants Market Value Forecast, by Country/Sub-region, 2018–2030

11.1.1. Germany

11.1.2. France

11.1.3. U.K.

11.1.4. Spain

11.1.5. Italy

11.1.6. Rest of Europe

11.2. Europe Disinfectants Market Value Forecast, by Type , 2018–2030

11.3. Europe Disinfectants Market Value Forecast, by Mechanism of Action, 2018-2030

11.4. Europe Disinfectants Market Value Forecast, by End-user, 2018–2030

11.5. Europe Disinfectants Market Attractiveness Analysis, 2020–2030

11.5.1. By Country/Sub-region

11.5.2. By Type

11.5.3. By Mechanism of Action

11.5.4. By End-user

Chapter 12. Asia Pacific Disinfectants Market Analysis and Forecast

12.1. Asia Pacific Disinfectants Market Value Forecast, by Country/Sub-region, 2018–2030

12.1.1. Japan

12.1.2. China

12.1.3. India

12.1.4. Australia & New Zealand

12.1.5. Rest of Asia Pacific

12.2. Asia Pacific Disinfectants Market Value Forecast, by Type , 2018–2030

12.3. Asia Pacific Disinfectants Market Value Forecast, by Mechanism of Action, 2018–2030

12.4. Asia Pacific Disinfectants Market Value Forecast, by End-user, 2018–2030

12.5. Asia Pacific Disinfectants Market Attractiveness Analysis, 2020–2030

12.5.1. By Country/Sub-region

12.5.2. By Type

12.5.3. By Mechanism of Action

12.5.4. By End-user

Chapter 13. Latin America Disinfectants Market Analysis and Forecast

13.1. Latin America Disinfectants Market Value Forecast, by Country/Sub-region, 2018–2030

13.1.1. Brazil

13.1.2. Mexico

13.1.3. Rest of Latin America

13.2. Latin America Disinfectants Market Value Forecast, by Type , 2018–2030

13.3. Latin America Disinfectants Market Value Forecast, by Mechanism of Action, 2018–2030

13.4. Latin America Disinfectants Market Value Forecast, by End-user, 2018–2030

13.5. Latin America Disinfectants Market Attractiveness Analysis, 2020–2030

13.5.1. By Country/Sub-region

13.5.2. By Type

13.5.3. By Mechanism of Action

13.5.4. By End-user

Chapter 14. Middle East & Africa Disinfectants Market Analysis and Forecast

14.1. Middle East & Africa Disinfectants Market Value Forecast, by Country/Sub-region, 2018–2030

14.1.1. GCC Countries

14.1.2. South Africa

14.1.3. Rest of Middle East & Africa

14.2. Middle East & Africa Disinfectants Market Value Forecast, by Type , 2018–2030

14.3. Middle East & Africa Disinfectants Market Value Forecast, by Mechanism of Action, 2018–2030

14.4. Middle East & Africa Disinfectants Market Value Forecast, by End-user, 2018–2030

14.5. Middle East & Africa Disinfectants Market Attractiveness Analysis, 2020–2030

14.5.1. By Country/Sub-region

14.5.2. By Type

14.5.3. By Mechanism of Action

14.5.4. By End-user

Chapter 15. Competitive Landscape

15.1. Market Share Analysis, by Company, 2019

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, Strategy)

15.2.1. STERIS plc

15.2.1.1. Company Details

15.2.1.2. Company Description

15.2.1.3. Business Overview

15.2.1.4. SWOT Analysis

15.2.1.5. Financial Analysis

15.2.1.6. Strategic Overview

15.2.2. Cardinal Health, Inc.

15.2.2.1. Company Details

15.2.2.2. Company Description

15.2.2.3. Business Overview

15.2.2.4. SWOT Analysis

15.2.2.5. Strategic Overview

15.2.3. 3M

15.2.3.1. Company Details

15.2.3.2. Company Description

15.2.3.3. Business Overview

15.2.3.4. SWOT Analysis

15.2.3.5. Strategic Overview

15.2.4. Reckitt Benckiser Group plc.

15.2.4.1. Company Details

15.2.4.2. Company Description

15.2.4.3. Business Overview

15.2.4.4. SWOT Analysis

15.2.4.5. Strategic Overview

15.2.5. Getinge AB

15.2.5.1. Company Details

15.2.5.2. Company Description

15.2.5.3. Business Overview

15.2.5.4. SWOT Analysis

15.2.5.5. Financial Analysis

15.2.5.6. Strategic Overview

15.2.6. BD

15.2.6.1. Company Details

15.2.6.2. Company Description

15.2.6.3. Business Overview

15.2.6.4. SWOT Analysis

15.2.6.5. Financial Analysis

15.2.6.6. Strategic Overview

15.2.7. Kimberly-Clark Corporation

15.2.7.1. Company Details

15.2.7.2. Company Description

15.2.7.3. Business Overview

15.2.7.4. SWOT Analysis

15.2.7.5. Financial Analysis

15.2.7.6. Strategic Overview

15.2.8. Ecolab, Inc.

15.2.8.1. Company Details

15.2.8.2. Company Description

15.2.8.3. Business Overview

15.2.8.4. SWOT Analysis

15.2.8.5. Financial Analysis

15.2.8.6. Strategic Overview

15.2.9. The Clorox Company

15.2.9.1. Company Details

15.2.9.2. Company Description

15.2.9.3. Business Overview

15.2.9.4. SWOT Analysis

15.2.9.5. Financial Analysis

15.2.9.6. Strategic Overview

15.2.10. Cantel Medical Corp.

15.2.10.1. Company Details

15.2.10.2. Company Description

15.2.10.3. Business Overview

15.2.10.4. SWOT Analysis

15.2.10.5. Financial Analysis

15.2.10.6. Strategic Overview

List of Tables

Table 01: Global Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 02: Global Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 03: Global Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 04: Global Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 05: Global Disinfectants Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 06: North America Disinfectants Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 07: North America Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 08: North America Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 09: North America Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 10: North America Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 11: Europe Disinfectants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 12: Europe Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 13: Europe Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 14: Europe Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 15: Europe Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 16: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 17: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 18: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 19: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 20: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 21: Asia Pacific DisinfectantsDiagnostic Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 22: Latin America Disinfectants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 23: Latin America Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 24: Latin America Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 25: Latin America Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 26: Latin America Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 27: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 28: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (1/2)

Table 29: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, by Type, 2018–2030 (2/2)

Table 30: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, by Mechanism of Action, 2018–2030

Table 31: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 02: Global Disinfectants Market Value Share, by Type, 2019

Figure 03: Global Disinfectants Market Value Share, by Mechanism of Action, 2019

Figure 04: Global Disinfectants Market Value Share, by End-user, 2019

Figure 05: Global Disinfectants Market Value Share, by Region, 2019

Figure 06: Global Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 07: Global Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 08: Global Disinfectants Market Value (US$ Mn), by Quaternary Ammonium Compounds, 2018–2030

Figure 09: Global Disinfectants Market Value (US$ Mn), by Chlorine Compounds, 2018–2030

Figure 10: Global Disinfectants Market Value (US$ Mn), by Phenolic Compounds, 2018–2030

Figure 11: Global Disinfectants Market Value (US$ Mn), by Hydrogen Peroxide, 2018–2030

Figure 12: Global Disinfectants Market Value (US$ Mn), by Ethylene Oxide, 2018–2030

Figure 13: Global Disinfectants Market Value (US$ Mn), by Aldehydes, 2018–2030

Figure 14: Global Disinfectants Market Value (US$ Mn), by Alcohols, 2018–2030

Figure 15: Global Disinfectants Market Value (US$ Mn), Iodine, 2018–2030

Figure 16: Global Disinfectants Market Value (US$ Mn), by Others, 2018–2030

Figure 17: Global Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 18: Global Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 19: Global Disinfectants Market Value (US$ Mn), by High Level Disinfectants, 2018–2030

Figure 20: Global Disinfectants Market Value (US$ Mn), by Intermediate Level Disinfectants, 2018–2030

Figure 21: Global Disinfectants Market Value (US$ Mn), by Low Level Disinfectants, 2018–2030

Figure 22: Global Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 23: Global Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 24: Global Disinfectants Market Value (US$ Mn), by Health Care Providers, 2018–2030

Figure 25: Global Disinfectants Market Value (US$ Mn), by Commercial Users, 2018–2030

Figure 26: Global Disinfectants Market Value (US$ Mn), by Domestic Users, 2018–2030

Figure 27: Global Disinfectants Market Value Share Analysis, by Region, 2019 and 2030

Figure 28: Global Disinfectants Market Attractiveness Analysis, by Region, 2020–2030

Figure 29: North America Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 30: North America Disinfectants Market Value Share Analysis, by Country, 2019 and 2030

Figure 31: North America Disinfectants Market Attractiveness Analysis, by Country, 2020–2030

Figure 32: North America Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 33: North America Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 34: North America Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 35: North America Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 36: North America Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 37: North America Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 38: Europe Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 39: Europe Disinfectants Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 40: Europe Disinfectants Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 41: Europe Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 42: Europe Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 43: Europe Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 44: Europe Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 45: Europe Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 46: Europe Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 47: Asia Pacific Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 48: Asia Pacific Disinfectants Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 49: Asia Pacific Disinfectants Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 50: Asia Pacific Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 51: Asia Pacific Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 52: Asia Pacific Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 53: Asia Pacific Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 54: Asia Pacific Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 55: Asia Pacific Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 56: Latin America Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 57: Latin America Disinfectants Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 58: Latin America Disinfectants Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 59: Latin America Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 60: Latin America Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 61: Latin America Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 62: Latin America Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 63: Latin America Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 64: Latin America Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 65: Middle East & Africa Disinfectants Market Value (US$ Mn) Forecast, 2018–2030

Figure 66: Middle East & Africa Disinfectants Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 67: Middle East & Africa Disinfectants Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 68: Middle East & Africa Disinfectants Market Value Share Analysis, by Type, 2019 and 2030

Figure 69: Middle East & Africa Disinfectants Market Attractiveness Analysis, by Type, 2020–2030

Figure 70: Middle East & Africa Disinfectants Market Value Share Analysis, by Mechanism of Action, 2019 and 2030

Figure 71: Middle East & Africa Disinfectants Market Attractiveness Analysis, by Mechanism of Action, 2020–2030

Figure 72: Middle East & Africa Disinfectants Market Value Share Analysis, by End-user, 2019 and 2030

Figure 73: Middle East & Africa Disinfectants Market Attractiveness Analysis, by End-user, 2020–2030

Figure 74: Global Disinfectants Market: Company Share Analysis, 2019