Analysts’ Viewpoint on Disaster Recovery as a Service (DRaaS) Market Scenario

Increase in adoption of cloud services among industry verticals such as BFSI and IT & telecom has created the need for cost-effective and faster data recovery solutions such as DRaaS. Natural calamities, technical variations, and human errors result in loss of data, revenue, and employee productivity. Rise in regulatory compliance, advancements in IT infrastructure, cybersecurity issues, need for business continuity, improved RPO, and need for data protection as a service and backup facility are expected to drive the adoption of disaster as a service (DRaaS) among businesses in the near future. During the COVID-19 pandemic, most companies chose to work remotely as a safety precaution in affected countries across the globe. This has led to a rise in security breaches and cyberattack incidents, thereby driving the demand for DRaaS solutions.

In the past, businesses found it difficult to afford off-site disaster recovery solutions. As a result, end-user organizations were less likely to spend on a second (mirror) data center that is rarely used. Nowadays, technological innovations have overcome the issue with the emergence of disaster recovery as a service (DraaS), which helps in replicating and hosting servers on a third-party vendor site. Disaster recovery as a service (DRaaS) is a service model that allows an enterprise to back up data and IT infrastructure in a third-party cloud environment and prevent damage from natural disasters such as floods, wildfires, earthquakes; equipment failures, power outages & cyberattacks; and other operational disasters. The number of cybercrimes is increasing rapidly with the rising penetration of smartphones and the Internet of Things. This has led to a rise in demand for disaster recovery as a service (DRaaS) solutions to perform recovery tasks to secure data centers or servers owned and operated by an organization. Disaster recovery as a service (DRaaS) solution can be used to monitor disasters in business operations, secure backup, and achieve recovery point objective (RPO) and recovery time objective (RTO). Backup and disaster recovery appliances are gaining popularity in organizations in developing countries to protect their data. Organizations are regularly testing and updating DRaaS to protect operational data in a secure and safe manner to avoid losses and prevent downtime.

The security of companies with a data center can suffer due to various threats that have a significant impact on business continuity and IT infrastructure. Natural disasters such as earthquakes and floods; human threats that comprise network attacks, including ransomware attacks and unauthorized access to confidential information; and lastly, environmental interruptions such as long-term power failure and exposure to pollution or chemical substances interrupt data center operations. These interruptions are known as downtime, which operators are most concerned about in their day-to-day data center operations. Interruption or halt in operations can occur in any size of business, from small and medium enterprises (SMEs) to large enterprises and even MNCs. This downtime may cause data loss, loss of revenue, and loss of customers, which is expected to have a severe impact on the operations of enterprises.

Rise in usage of cost-effective backup and disaster recovery services, especially among SMEs, leads to reduced operational risks and continual business operations. Other benefits of DRaaS include scalability as per increasing/decreasing requirements; pay-per-use model; geographic redundancy, wherein departments can spread backed-up resources across multiple geographic regions and maximize their availability; and faster restoration of server/data. This is projected to smoothen business operations in any disaster condition and help reduce downtime.

Increase in adoption of operational recovery goals such as recovery point objective (RPO), which refers to the length of time taken by business operations to restore data; and recovery time objective (RTO), which refers to the amount of time between backups, plays an important role in reducing the downtime to restore business operations. According to Acronis’ Cyber Protection Week Global Report published in 2021, 76% of organizations experienced downtime and data loss issues in 2021 due to system crashes, human errors, and cyberattacks.

Increase in adoption of digital technologies across various industry verticals leads to risks associated with cybersecurity, which disrupts enterprise operations, and may have a severe impact on the business. This generates the need for data backup and disaster recovery solutions and services. Rise in cyberattacks as well as ransomware attacks generates the need to secure data centers by adopting hosted backup and disaster recovery-as-a-service (DRaaS) solutions to protect end-user systems, cloud applications, and enterprise infrastructure from cyber threats. Increase in number of data centers in the U.S., Canada, and Germany has attracted cybercriminals, leading to the risk of cyberattack incidents. This is expected to create significant demand for the adoption of data protection and recovery solutions among various end-users during the forecast period. According to Cloudscene, a total of 2,793 data centers are present in the U.S. alone. This leads to the risk of a large number of cyberattacks in the country.

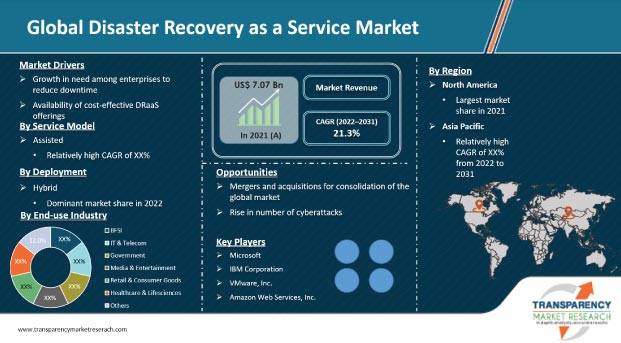

North America held major share of the overall disaster recovery as a service (DRaaS) market, followed by Europe, in 2021. These two regions are expected to retain their positions throughout the forecast period due to the increase in digital transformation in BFSI, IT & telecom, government, and media & entertainment, telecommunication, among other sectors. Increase in demand for best disaster recovery as a service (DRaaS) solutions can be ascribed to the rise in risk of data loss and downtime leading to business losses. Rise in demand for DRaaS in North America and Europe can be ascribed to the growth in need to secure data and accelerate restoration in data centers, especially in the U.S. and U.K.

The Asia Pacific market is projected to grow at the fastest CAGR during the forecast period. China and India are the major disaster recovery service provider countries in Asia Pacific, offering vast scope for disaster recovery companies operating in the market. The popularity of DRaaS in Asia Pacific can be ascribed to the increase in natural calamities such as floods, earthquakes, and human errors, which in turn lead to data leaks. This is estimated to drive the DRaaS market in the region during the forecast period.

The disaster recovery as a service (DRaaS) market is highly fragmented, and vendors are looking for ways to successfully tap growth opportunities and strengthen their presence in the market. Disaster recovery as a service (DRaaS) providers are expanding their product portfolio and market reach through mergers and acquisitions, new product developments, and partnerships with leading players. The next few years are expected to offer scope for the establishment of disaster recovery as a service (DRaaS) in untapped markets. Many retailers and IT companies are focusing on adopting disaster recovery as a service (DRaaS) solutions to provide better customer experiences and unhindered access. Microsoft, IBM Corporation, VMware, Inc., Amazon Web Services, Inc., and iland are some of the leading companies profiled in the disaster recovery as a service (DRaaS) market research report.

Each of these players has been profiled in global disaster recovery as a service (DRaaS) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.07 Bn |

|

Market Forecast Value in 2031 |

US$ 47.06 Bn |

|

Growth Rate (CAGR) |

21.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, ecosystem analysis, and COVID-19 impact analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The disaster recovery as a service (DRaaS) market stood at US$ 7.07 Bn in 2021.

The disaster recovery as a service market is estimated to grow at a CAGR of 21.3% during the forecast period.

Growth in need among enterprises to reduce downtime and the availability of cost-effective DRaaS offerings.

The assisted segment is expected to account for the highest CAGR in the disaster recovery as a service market during the forecast period.

North America is a more attractive region for vendors in the disaster recovery as a service market.

Microsoft, IBM Corporation, VMware, Inc., Amazon Web Services, Inc., Acronis International GmbH, iland, Sungard Availability Services LP, Axcient, Unitrends, Infrascale, Inc., Cloudian, Nutanix, Carbonite, Inc., phoenixNAP, and Recovery Point Systems, Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Disaster Recovery as a Service Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Disaster Recovery as a Service Market

4.4.2. End-use Industry Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.5.1. By Service Model

4.5.2. By Deployment

4.5.3. By End-use Industry

5. Global Disaster Recovery as a Service Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/Price Trend Analysis

6. Global Disaster Recovery as a Service Market Analysis, by Service Model

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Service Model, 2018 - 2031

6.3.1. Managed

6.3.2. Self-service

6.3.3. Assisted

7. Global Disaster Recovery as a Service Market Analysis, by Deployment

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

7.3.1. Public Cloud

7.3.2. Private Cloud

7.3.3. Hybrid Cloud

8. Global Disaster Recovery as a Service Market Analysis, by End-use Industry

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by End-use Industry, 2018 - 2031

8.3.1. BFSI

8.3.2. IT & Telecom

8.3.3. Government

8.3.4. Media & Entertainment

8.3.5. Retail & Consumer Goods

8.3.6. Government & Lifesciences

8.3.7. Others (Manufacturing, Energy & Utilities, and Transportation & Logistics)

9. Global Disaster Recovery as a Service Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Disaster Recovery as a Service Market Analysis and Forecast

10.1. Regional Outlook

10.2. Disaster Recovery as a Service Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

10.2.1. By Service Model

10.2.2. By Deployment

10.2.3. By End-use Industry

10.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Disaster Recovery as a Service Market Analysis and Forecast

11.1. Regional Outlook

11.2. Disaster Recovery as a Service Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

11.2.1. By Service Model

11.2.2. By Deployment

11.2.3. By End-use Industry

11.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Disaster Recovery as a Service Market Analysis and Forecast

12.1. Regional Outlook

12.2. Disaster Recovery as a Service Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Service Model

12.2.2. By Deployment

12.2.3. By End-use Industry

12.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Disaster Recovery as a Service Market Analysis and Forecast

13.1. Regional Outlook

13.2. Disaster Recovery as a Service Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Service Model

13.2.2. By Deployment

13.2.3. By End-use Industry

13.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Disaster Recovery as a Service Market Analysis and Forecast

14.1. Regional Outlook

14.2. Disaster Recovery as a Service Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Service Model

14.2.2. By Deployment

14.2.3. By End-use Industry

14.3. Disaster Recovery as a Service Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent, and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. Microsoft

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership

16.1.6. Merger & Acquisition

16.1.7. Business Expansion

16.1.8. New Product Launch

16.1.9. Innovation, etc.

16.2. IBM Corporation

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership

16.2.6. Merger & Acquisition

16.2.7. Business Expansion

16.2.8. New Product Launch

16.2.9. Innovation, etc.

16.3. VMware, Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership

16.3.6. Merger & Acquisition

16.3.7. Business Expansion

16.3.8. New Product Launch

16.3.9. Innovation, etc.

16.4. Amazon Web Self-Service, Inc.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership

16.4.6. Merger & Acquisition

16.4.7. Business Expansion

16.4.8. New Product Launch

16.4.9. Innovation, etc.

16.5. Acronis International GmbH

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership

16.5.6. Merger & Acquisition

16.5.7. Business Expansion

16.5.8. New Product Launch

16.5.9. Innovation, etc.

16.6. iland

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership

16.6.6. Merger & Acquisition

16.6.7. Business Expansion

16.6.8. New Product Launch

16.6.9. Innovation, etc.

16.7. Sungard Availability Self-Service LP

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership

16.7.6. Merger & Acquisition

16.7.7. Business Expansion

16.7.8. New Product Launch

16.7.9. Innovation, etc.

16.8. Axcient

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership

16.8.6. Merger & Acquisition

16.8.7. Business Expansion

16.8.8. New Product Launch

16.8.9. Innovation, etc.

16.9. Unitrends

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership

16.9.6. Merger & Acquisition

16.9.7. Business Expansion

16.9.8. New Product Launch

16.9.9. Innovation, etc.

16.10. Infrascale, Inc.

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership

16.10.6. Merger & Acquisition

16.10.7. Business Expansion

16.10.8. New Product Launch

16.10.9. Innovation, etc.

16.11. Cloudian

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership

16.11.6. Merger & Acquisition

16.11.7. Business Expansion

16.11.8. New Product Launch

16.11.9. Innovation, etc.

16.12. Nutanix

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership

16.12.6. Merger & Acquisition

16.12.7. Business Expansion

16.12.8. New Product Launch

16.12.9. Innovation, etc.

16.13. Carbonite, Inc.

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership

16.13.6. Merger & Acquisition

16.13.7. Business Expansion

16.13.8. New Product Launch

16.13.9. Innovation, etc.

16.14. phoenixNAP

16.14.1. Business Overview

16.14.2. Company Revenue

16.14.3. Product Portfolio

16.14.4. Geographic Footprint

16.14.5. Strategic Partnership

16.14.6. Merger & Acquisition

16.14.7. Business Expansion

16.14.8. New Product Launch

16.14.9. Innovation, etc.

16.15. Recovery Point Systems, Inc.

16.15.1. Business Overview

16.15.2. Company Revenue

16.15.3. Product Portfolio

16.15.4. Geographic Footprint

16.15.5. Strategic Partnership

16.15.6. Merger & Acquisition

16.15.7. Business Expansion

16.15.8. New Product Launch

16.15.9. Innovation, etc.

16.16. Others

16.16.1. Business Overview

16.16.2. Company Revenue

16.16.3. Product Portfolio

16.16.4. Geographic Footprint

16.16.5. Strategic Partnership

16.16.6. Merger & Acquisition

16.16.7. Business Expansion

16.16.8. New Product Launch

16.16.9. Innovation, etc.

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Disaster Recovery as a Service Market

Table 2: North America Disaster Recovery as a Service Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 3: Europe Disaster Recovery as a Service Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 4: Asia Pacific Disaster Recovery as a Service Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 5: Middle East & Africa Disaster Recovery as a Service Market Revenue Analysis, by Country, 2021 and 2031 (US$ Mn)

Table 6: South America Disaster Recovery as a Service Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 7: Impact Analysis of Drivers & Restraints

Table 8: Global Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 9: Global Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 10: Global Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 11: Global Disaster Recovery as a Service Market Volume (US$ Mn) Forecast, by Region, 2018 – 2031

Table 12: North America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 13: North America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 14: North America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 15: North America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 16: U.S. Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Canada Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Mexico Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Europe Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 20: Europe Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 21: Europe Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 22: Europe Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 23: Germany Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: U.K. Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: France Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Spain Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Italy Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Asia Pacific Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 29: Asia Pacific Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 30: Asia Pacific Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 31: Asia Pacific Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 32: China Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: India Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Japan Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: ASEAN Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Middle East & Africa Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 37: Middle East & Africa Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 38: Middle East & Africa Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 39: Middle East & Africa Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 40: Saudi Arabia Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: U.A.E. Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: South Africa Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: South America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Service Model, 2018 – 2031

Table 44: South America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 45: South America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by End-use Industry, 2018 – 2031

Table 46: South America Disaster Recovery as a Service Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 47: Brazil Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 48: Argentina Disaster Recovery as a Service Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: Mergers & Acquisitions, Expansions (1/4)

Table 50: Mergers & Acquisitions, Expansions (2/4)

Table 51: Mergers & Acquisitions, Expansions (3/4)

Table 52: Mergers & Acquisitions, Expansions (4/4)

List of Figures

Figure 1: Global Disaster Recovery as a Service Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global Disaster Recovery as a Service Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Disaster Recovery as a Service Market

Figure 4: Global Disaster Recovery as a Service Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Disaster Recovery as a Service Market Attractiveness Assessment, by Service Model

Figure 6: Global Disaster Recovery as a Service Market Attractiveness Assessment, by Deployment

Figure 7: Global Disaster Recovery as a Service Market Attractiveness Assessment, by End-use Industry

Figure 8: Global Disaster Recovery as a Service Market Attractiveness Assessment, by Region

Figure 9: Global Disaster Recovery as a Service Market Revenue (US$ Mn) Historic Trends, 2016 - 2020

Figure 10: Global Disaster Recovery as a Service Market Revenue Opportunity (US$ Mn) Historic Trends, 2016 - 2020

Figure 11: Global Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 12: Global Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 13: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed, 2022 – 2031

Figure 14: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-Service, 2022 – 2031

Figure 15: Global Disaster Recovery as a Service Market Value Share Analysis, by Assisted, 2021

Figure 16: Global Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 17: Global Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 18: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 19: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 20: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 21: Global Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 22: Global Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 23: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 24: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 25: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 26: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 27: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 28: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & Lifesciences2022 – 2031

Figure 29: Global Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 30: Global Disaster Recovery as a Service Market Value Share Analysis, by Region, 2031

Figure 31: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 32: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 33: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 34: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 35: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 36: North America Disaster Recovery as a Service Revenue Opportunity Share, by Service Model

Figure 37: North America Disaster Recovery as a Service Revenue Opportunity Share, by Deployment

Figure 38: North America Disaster Recovery as a Service Revenue Opportunity Share, by End-use Industry

Figure 39: North America l Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 40: North America Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 41: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed, 2022 – 2031

Figure 42: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-service, 2022 – 2031

Figure 43: North America Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2021

Figure 44: North America Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 45: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 46: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 47: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 48: North America Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2021

Figure 49: North America Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 50: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 51: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 52: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 53: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 54: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 55: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & LifesciencesGoods, 2022 – 2031

Figure 56 North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 57: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Country, 2022 – 2031

Figure 58: North America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Country, 2022 – 2031

Figure 59: Mexico Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 60: Europe Disaster Recovery as a Service Revenue Opportunity Share, by Service Model

Figure 61: Europe Disaster Recovery as a Service Revenue Opportunity Share, by Deployment

Figure 62: Europe Disaster Recovery as a Service Revenue Opportunity Share, by End-use Industry

Figure 63: Europe Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 64: Europe Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 65: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed , 2022 – 2031

Figure 66: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-service, 2022 – 2031

Figure 67: Europe Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2021

Figure 68: Europe Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 69: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 70: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 71: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 72: Europe Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2021

Figure 73: Europe Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 74: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 75: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 76: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 77: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 78: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 79: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & Lifesciences, 2022 – 2031

Figure 81: Europe Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 82: Europe Disaster Recovery as a Service Market Value Share Analysis, by Country, 2021

Figure 83: Europe Disaster Recovery as a Service Market Value Share Analysis, by Country, 2031

Figure 84: Germany Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 85: U.K. Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 86: France Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 87: Italy Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 88: Spain Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 89: Asia Pacific Disaster Recovery as a Service Revenue Opportunity Share, by Service Model

Figure 90: Asia Pacific Disaster Recovery as a Service Revenue Opportunity Share, by Deployment

Figure 91: Asia Pacific Disaster Recovery as a Service Revenue Opportunity Share, by End-use Industry

Figure 92: Asia Pacific l Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 93: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 94: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed , 2022 – 2031

Figure 95: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-service, 2022 – 2031

Figure 96: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2021

Figure 97: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 98: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 99: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 100: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 101: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2021

Figure 102: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 103: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 105: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 106: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 107: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 108: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 106: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & Lifesciences, 2022 – 2031

Figure 107: Asia Pacific Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 108: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by Country, 2021

Figure 110: Asia Pacific Disaster Recovery as a Service Market Value Share Analysis, by Country, 2031

Figure 111: China Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 112: India Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 113: Japan Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 114: ASEAN Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 115: Middle East & Africa Disaster Recovery as a Service Revenue Opportunity Share, by Service Model

Figure 116: Middle East & Africa Disaster Recovery as a Service Revenue Opportunity Share, by Deployment

Figure 117: Middle East & Africa Disaster Recovery as a Service Revenue Opportunity Share, by End-use Industry

Figure 118: Middle East & Africa l Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 119: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 120: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed (SIP) Trunking, 2022 – 2031

Figure 121: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-service, 2022 – 2031

Figure 122: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2021

Figure 123: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 124: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 125: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 126: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 127: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2021

Figure 128: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 129: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 130: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 131: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 132: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 133: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 134: Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & Lifesciences, 2022 – 2031

Figure 135 Middle East & Africa Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 136: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by Country, 2021

Figure 137: Middle East & Africa Disaster Recovery as a Service Market Value Share Analysis, by Country, 2031

Figure 138: Saudi Arabia Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 139: U.A.E. Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 140: South Africa Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 141: South America Disaster Recovery as a Service Revenue Opportunity Share, by Service Model

Figure 142: South America Disaster Recovery as a Service Revenue Opportunity Share, by Deployment

Figure 143: South America Disaster Recovery as a Service Revenue Opportunity Share, by End-use Industry

Figure 144: South America Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2021

Figure 145: South America Disaster Recovery as a Service Market Value Share Analysis, by Service Model, 2031

Figure 146: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Managed, 2022 – 2031

Figure 147: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Self-service, 2022 – 2031

Figure 149: South America Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2021

Figure 150: South America Disaster Recovery as a Service Market Value Share Analysis, by Deployment, 2031

Figure 151: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Public, 2022 – 2031

Figure 152: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Private, 2022 – 2031

Figure 153: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Hybrid, 2022 – 2031

Figure 154: South America Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2021

Figure 155: South America Disaster Recovery as a Service Market Value Share Analysis, by End-use Industry, 2031

Figure 156: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by BFSI, 2022 – 2031

Figure 157: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2022 – 2031

Figure 158: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Government, 2022 – 2031

Figure 159: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2022 – 2031

Figure 160: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Retail & Consumer Goods, 2022 – 2031

Figure 161: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Healthcare & Lifesciences, 2022 – 2031

Figure 162: South America Disaster Recovery as a Service Market Absolute Opportunity (US$ Mn), by Others, 2022 – 2031

Figure 163: South America Disaster Recovery as a Service Market Value Share Analysis, by Country, 2021

Figure 164: South America Disaster Recovery as a Service Market Value Share Analysis, by Country, 2031

Figure 165: Brazil Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 166: Argentina Disaster Recovery as a Service Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031