Global Digital Therapeutic Devices Market: Snapshot

In a highly competitive global digital therapeutic devices market, savvy players are focused on collaborations and partnerships to improve their technical expertise for competitive gains. Established players are also tapping into the emerging economies of Asia Pacific that have vast growth potential in the digital therapeutic devices space.

The global digital therapeutic devices market is primarily driven by the rising use of technology for treating medical conditions. The demand for technologically advanced products for treating medical conditions coupled with rising disposable incomes is positively influencing the global digital therapeutic devices market. Several governments are also supporting the adoption of digital therapeutic devices that marks a significant change from traditional healthcare practices.

On the downside, the high price factor and risk of data breach are slowing the adoption of digital therapeutic devices.

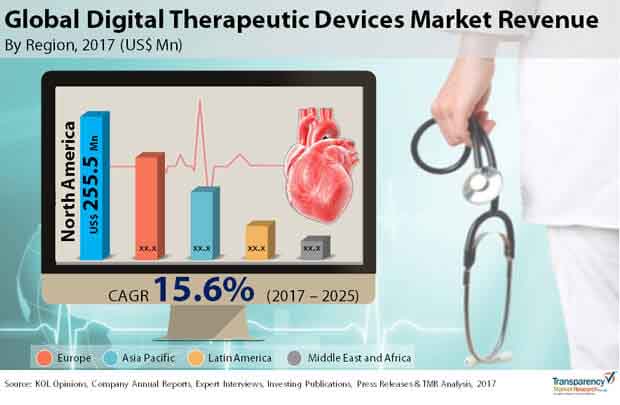

According to projections by Transparency Market Research (TMR), the global digital therapeutic devices market will expand at impressive CAGR of 15.6% during the 2017-2025 forecast period. At this pace, the market will attract a revenue valuation of US$2,082.3 mn by the end of 2025 from US$590.8 mn in 2016.

Treatment/Care Application Segment to Remain Attractive through 2025

Based on product, the global digital therapeutic devices market has been segmented into pain management devices, respiratory therapy devices, rehabilitation devices, and insulin pumps. Among them, the segment of insulin pumps constituted the leading market share in 2016 due to the increasing prevalence of diabetes. In terms of application, the digital therapeutic devices market has been segmented into preventive and treatment/care. Of the two, treatment/care is anticipated to hold the leading share and display a significant growth rate over the forecast period.

The segments of the global digital therapeutic devices market depending upon end user are B2C and B2B. While B2C is further segmented into patients and caregivers, B2B is sub-segmented into providers, payers, employers, pharmaceutical companies, and others. B2B held the leading market share in 2016 on the back of increasing adoption of digital therapeutic devices by employers and health insurance companies for ease of processing medical claims.

Popularity of Growth Funding Initiatives Make North America Leader

Geographically, the report gauges the potential of digital therapeutic devices market in the regions of North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. In 2016, North America accounted for the leading share in the global digital therapeutic devices market. The early adoption of technology coupled with increasing investment in digital therapeutic devices companies through government funding, venture capitalists, and mergers and acquisitions are supporting the growth of this regional market. For example, in March 2017, Livongo Health – the developer of an app for diabetes management and the developer of a cellular-connected blood glucose meter raised US$52.5 million by growth funding.

The Europe market for digital therapeutic devices market is predominantly led by Germany, France, Spain, the U.K., and Italy. Amongst them, the U.K. and Germany constituted the leading share in this regional market. Increasing prevalence of chronic diseases such as cancer, diabetes, and obesity and government initiatives for adoption of technology for treating medical conditions are contributing to the growth of Europe digital therapeutic devices market.

However, Asia Pacific is expected to display the leading growth rate over the forecast period. Increasing penetration of smartphone and government initiatives to promote the adoption of technology for treating medical conditions is likely to propel the growth of this regional market.

Leading companies in the global digital therapeutic devices market include Proteus Digital Health, WellDoc Inc., Noom Inc., Propeller Health, BiogeniQ Inc., Claritas MindSciences, Jintronix Inc., Zest Health LLC, HealthMine Inc., BioTelemetry Inc., Digital Twine health Inc., Firstbeat Technologies Ltd, Big Health, Dthera Sciences, Virta Health Corp, Pear Therapeutics Inc., Blue Mesa, Meru Health Inc., Canary Health, Glooko Inc., Nanobiosys Inc., Digital Therapeutics, Omada Health Inc., Ginger. Io Inc., Livongo Health, and 2Morrow Inc.

Efficacy for treatment of host of Medical Conditions boosts Digital Therapeutic Devices Market

Exponential rise in demand for technologically advanced medical services is creating opportunities in the digital therapeutic devices market. Digital therapeutic devices are available for a host of medical conditions with a product range, which includes pain management devices, rehabilitation devices, respiratory therapy devices, and insulin pumps. Among them, insulin pumps accounts for leading share in the digital therapeutic devices market.

Rising burden on healthcare institutions to serve large number of patients with chronic conditions is resulting in adoption of digital therapeutic devices. The use of digital therapeutic devices reduces dependency on human personnel to provide medical care through the course of treatment.

Emergence of super specialty and multispecialty healthcare institutions in developing countries is boosting the digital therapeutic devices market. Due to substantial funding from private trusts that run these healthcare institutions, these institutions are usually equipped with technologically advanced medical devices and boast state-of-the-art infrastructure. This indirectly fuels the digital therapeutic devices market.

Digital therapeutic devices are primarily used for preventive care and for treatment purpose. Of the two, treatment application segment holds larger share in the digital therapeutic devices market. Meanwhile, digital therapeutic devices find use for B2B and B2C end-use segments; the former is sub-segmented into providers, employers, payers, pharmaceutical companies, and others, and the latter is divided into patients and caregivers.

North America is the leading region among other key regions in the digital therapeutic devices. Early adoption of technology and increasing investment of governments for adoption of digital therapeutic devices in public healthcare institutions is favorable to the digital therapeutic devices market in the region. The region being home to some large players in the digital therapeutic devices market that are engaged in R&D and business collaborations further creates opportunities in the digital therapeutic devices market in North America.

Powered by the U.K. and Germany, Europe holds significant share in the digital therapeutic devices market.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2 Assumptions and Research Methodology

2.1 Research Methodology

Section 3 Executive Summary

3.1 Global Digital Therapeutic Devices Market Snapshot

3.2 Global Digital Therapeutic Devices Market Size ($ Mn) and Distribution, by Geography, 2017 and 2025

Section 4 Market Overview

4.1 Overview

4.2 Global Digital Therapeutic Devices Market: Porter's Analysis

4.3 Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, 2015–2025

4.4 Global Digital Therapeutic Devices Market Outlook

Section 5 Market Dynamic

5.1 Drivers

5.1.1 Increasing Government Initiatives

5.1.2 Strategic Acquisitions enable Product Distribution in Other Regions, and also strengthening their Presence

5.1.3 Rising incidence of Diabetes, Cardiovascular Diseases and other Chronic Diseases

5.1.4 Increasing Collaborations between Companies for Technological Advancements

5.1.5 Increasing Adoption of Digital Therapeutic Devices Product by Health Care Providers

5.2 Restrains

5.2.1 High Costs Associated with Installation

5.2.2 Cyber Threat

5.3 Opportunities

5.3.1 Adoption of cloud-based systems by health care organization and hospitals

5.3.2 Penetration of smartphones in the health care sector & increase in demand for mobile apps

5.4 Trends

5.4.1 Increasing adoption of cloud-based systems

5.4.2 Virtualization technologies and technological advancements add new dimension to health care IT

5.5 Digital Therapeutics Business, Opportunities and Entry Barriers for New Market Entrants - 2016

5.6 Qualitative Information on Business Models in Digital Therapeutic Devices Market

5.7 Traditional Business Models: Challenges to Traditional Business models

5.8 New Digital Therapeutic Devices Business Models

5.9 Adoption of Digital Therapeutic Devicescare by End-users

5.10 Impact Factors for Digital Therapeutics Demand

5.11 Global Health Care Expenditure, by Major Countries

5.12 Digital Medicine Business Model

5.13 Factors Increasing Traction of Digital Therapeutics Products

5.13.1 Health Care Costs

5.13.2 Value-based Payment Models

5.13.3 Venture Funding

5.13.4 Others

Section 6 Global Digital Therapeutic Devices Market Analysis, by Product

6.1 Introduction

6.2 Global Digital Therapeutic Devices Market Value Share Analysis, by Product

6.3 Digital Therapeutic Devices Market Analysis, by Product

6.3.1 Pain management devices

6.3.2 Rehabilitation devices

6.3.3 Respiratory therapy devices

6.3.4 Insulin Pumps

6.4 Global Digital Therapeutic Devices Market Attractiveness Analysis, by Product

Section 7 Global Digital Therapeutic Devices (Digital Therapeutic Devices) Market Analysis, by Application

7.1 Introduction

7.2 Global Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

7.3 Global Digital Therapeutic Devices (Digital Therapeutic Devices) Market Analysis, by Application

7.3.1 Preventive

7.3.1.1 Pre diabetes

7.3.1.2 Obesity

7.3.1.3 Smoking Cessation

7.3.1.4 Others

7.3.2 Treatment/Care

7.3.2.1 Diabetes

7.3.2.2 Cardiovascular Diseases

7.3.2.3 Central Nervous System Disease

7.3.2.4 Respiratory Diseases

7.3.2.5 Musculoskeletal Diseases

7.3.2.6 Medication Adherence

7.3.2.7 Others

Section 8 Global Digital Therapeutic Devices Market Analysis, by End-user

8.1 Introduction

8.2 Global Digital Therapeutic Devices Market Value Share Analysis, by End-user

8.3 Global Digital Therapeutic Devices Market Analysis, by End-user

8.3.1 B2C

8.3.1.1 Patients

8.3.1.2 Caregivers

8.3.2 B2B

8.3.2.1 Providers

8.3.2.2 Payers

8.3.2.3 Employers

8.3.2.4 Pharmaceutical Companies

8.3.2.5 Others

8.4 Global Digital Therapeutic Devices Market Attractiveness Analysis, by End-user

Section 9 Global Digital Therapeutic Devices Market Analysis, by Region

9.1 Global Digital Therapeutic Devices Market Snapshot, by Country

9.2 Global Digital Therapeutic Devices Market Value Share Analysis, by Region

9.3 Digital Therapeutic Devices Market Forecast, by Region

9.4 Digital Therapeutic Devices Market Attractiveness Analysis, by Region

Section 10 North America Digital Therapeutic Devices Market Analysis

10.1 Key Findings

10.2 North America Digital Therapeutic Devices Market Overview

10.3 North America Digital Therapeutic Devices Market Value Share Analysis, by Product

10.4 North America Market Size (US$ Mn) Forecast, by Product, 2017–2025

10.4.1 Pain management devices

10.4.2 Rehabilitation devices

10.4.3 Respiratory therapy devices

10.4.4 Insulin Pumps

10.5 North America Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

10.6 North America Market Size (US$ Mn) Forecast, by Application (Digital Therapeutic Devices) 2017–2025

10.6.1 Preventive

10.6.1.1 Pre diabetes

10.6.1.2 Obesity

10.6.1.3 Smoking Cessation

10.6.1.4 Others

10.6.2 Treatment/Care

10.6.2.1 Diabetes

10.6.2.2 Cardiovascular Diseases

10.6.2.3 Central Nervous System Disease

10.6.2.4 Respiratory Diseases

10.6.2.5 Musculoskeletal Diseases

10.6.2.6 Medication Adherence

10.6.2.7 Others

10.7 North America Digital Therapeutic Devices Market Value Share Analysis, by End-user

10.8 North America Market Size (US$ Mn) Forecast, by End-user 2017–2025

10.8.1 B2C

10.8.1.1 Patients

10.8.1.2 Caregivers

10.8.2 B2B

10.8.2.1 Providers

10.8.2.2 Payers

10.8.2.3 Employers

10.8.2.4 Pharmaceutical Companies

10.8.2.5 Others

10.9 North America Market Value Share Analysis, by Country

10.10 North America Market Size (US$ Mn) Forecast, by Country, 2017–2025

10.10.1 U.S.

10.10.2 Canada

10.11 Market Attractiveness Analysis

10.11.1 By Product

10.11.2 By Application

10.11.3 By End User

10.11.4 By Country

Section 11 Europe Digital Therapeutic Devices Market Analysis

11.1 Key Findings

11.2 Europe Digital Therapeutic Devices Market Overview

11.3 Europe Digital Therapeutic Devices Market Value Share Analysis, by Product

11.4 Europe Market Size (US$ Mn) Forecast, by Product, 2017–2025

11.4.1 Pain management devices

11.4.2 Rehabilitation devices

11.4.3 Respiratory therapy devices

11.4.4 Insulin Pumps

11.5 Europe Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

11.6 Europe Market Size (US$ Mn) Forecast, by Application (Digital Therapeutic Devices) 2017–2025

11.6.1 Preventive

11.6.1.1 Pre diabetes

11.6.1.2 Obesity

11.6.1.3 Smoking Cessation

11.6.1.4 Others

11.6.2 Treatment/Care

11.6.2.1 Diabetes

11.6.2.2 Cardiovascular Diseases

11.6.2.3 Central Nervous System Disease

11.6.2.4 Respiratory Diseases

11.6.2.5 Musculoskeletal Diseases

11.6.2.6 Medication Adherence

11.6.2.7 Others

11.7 Europe Digital Therapeutic Devices Market Value Share Analysis, by End-user

11.8 Europe Market Size (US$ Mn) Forecast, by End-user 2017–2025

11.8.1 B2C

11.8.1.1 Patients

11.8.1.2 Caregivers

11.8.2 B2B

11.8.2.1 Providers

11.8.2.2 Payers

11.8.2.3 Employers

11.8.2.4 Pharmaceutical Companies

11.8.2.5 Others

11.9 Europe Market Value Share Analysis, by Country

11.10 Europe Market Size (US$ Mn) Forecast, by Country, 2017–2025

11.10.1 U.K.

11.10.2 Germany

11.10.3 France

11.10.4 Italy

11.10.5 Spain

11.10.6 Rest of Europe

11.11 Market Attractiveness Analysis

11.11.1 By Product

11.11.2 By Application

11.11.3 By End User

11.11.4 By Country

Section 12 Asia Pacific Digital Therapeutic Devices Market Analysis

12.1 Key Findings

12.2 Asia Pacific Digital Therapeutic Devices Market Overview

12.3 Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by Product

12.4 Asia Pacific Market Size (US$ Mn) Forecast, by Product, 2017–2025

12.4.1 Pain management devices

12.4.2 Rehabilitation devices

12.4.3 Respiratory therapy devices

12.4.4 Insulin Pumps

12.5 Asia Pacific Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

12.6 Asia Pacific Market Size (US$ Mn) Forecast, by Application (Digital Therapeutic Devices) 2017–2025

12.6.1 Preventive

12.6.1.1 Pre diabetes

12.6.1.2 Obesity

12.6.1.3 Smoking Cessation

12.6.1.4 Others

12.6.2 Treatment/Care

12.6.2.1 Diabetes

12.6.2.2 Cardiovascular Diseases

12.6.2.3 Central Nervous System Disease

12.6.2.4 Respiratory Diseases

12.6.2.5 Musculoskeletal Diseases

12.6.2.6 Medication Adherence

12.6.2.7 Others

12.7 Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by End-user

12.8 Asia Pacific Market Size (US$ Mn) Forecast, by End-user 2017–2025

12.8.1 B2C

12.8.1.1 Patients

12.8.1.2 Caregivers

12.8.2 B2B

12.8.2.1 Providers

12.8.2.2 Payers

12.8.2.3 Employers

12.8.2.4 Pharmaceutical Companies

12.8.2.5 Others

12.9 Asia Pacific Market Value Share Analysis, by Country

12.10 Asia Pacific Market Size (US$ Mn) Forecast, by Country, 2017–2025

12.10.1 China

12.10.2 Japan

12.10.3 Rest of Asia Pacific

12.11 Market Attractiveness Analysis

12.11.1 By Product

12.11.2 By Application

12.11.3 By End User

12.11.4 By Country

Section 13 Latin America Digital Therapeutic Devices Market Analysis

13.1 Key Findings

13.2 Latin America Digital Therapeutic Devices Market Overview

13.3 Latin America Digital Therapeutic Devices Market Value Share Analysis, by Product

13.4 Latin America Market Size (US$ Mn) Forecast, by Product, 2017–2025

13.4.1 Pain management devices

13.4.2 Rehabilitation devices

13.4.3 Respiratory therapy devices

13.4.4 Insulin Pumps

13.5 Latin America Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

13.6 Latin America Market Size (US$ Mn) Forecast, by Application (Digital Therapeutic Devices) 2017–2025

13.6.1 Preventive

13.6.1.1 Pre diabetes

13.6.1.2 Obesity

13.6.1.3 Smoking Cessation

13.6.1.4 Others

13.6.2 Treatment/Care

13.6.2.1 Diabetes

13.6.2.2 Cardiovascular Diseases

13.6.2.3 Central Nervous System Disease

13.6.2.4 Respiratory Diseases

13.6.2.5 Musculoskeletal Diseases

13.6.2.6 Medication Adherence

13.6.2.7 Others

13.7 Latin America Digital Therapeutic Devices Market Value Share Analysis, by End-user

13.8 Latin America Market Size (US$ Mn) Forecast, by End-user 2017–2025

13.8.1 B2C

13.8.1.1 Patients

13.8.1.2 Caregivers

13.8.2 B2B

13.8.2.1 Providers

13.8.2.2 Payers

13.8.2.3 Employers

13.8.2.4 Pharmaceutical Companies

13.8.2.5 Others

13.9 Market Attractiveness Analysis

13.9.1 By Product

13.9.2 By Application

13.9.3 By End User

Section 14 Middle East & Africa Digital Therapeutic Devices Market Analysis

14.1 Key Findings

14.2 Middle East & Africa Digital Therapeutic Devices Market Overview

14.3 Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by Product

14.4 Middle East & Africa Market Size (US$ Mn) Forecast, by Product, 2017–2025

14.4.1 Pain management devices

14.4.2 Rehabilitation devices

14.4.3 Respiratory therapy devices

14.4.4 Insulin Pumps

14.5 Middle East & Africa Digital Therapeutic Devices (Digital Therapeutic Devices) Market Value Share Analysis, by Application

14.6 Middle East & Africa Market Size (US$ Mn) Forecast, by Application (Digital Therapeutic Devices) 2017–2025

14.6.1 Preventive

14.6.1.1 Pre diabetes

14.6.1.2 Obesity

14.6.1.3 Smoking Cessation

14.6.1.4 Others

14.6.2 Treatment/Care

14.6.2.1 Diabetes

14.6.2.2 Cardiovascular Diseases

14.6.2.3 Central Nervous System Disease

14.6.2.4 Respiratory Diseases

14.6.2.5 Musculoskeletal Diseases

14.6.2.6 Medication Adherence

14.6.2.7 Others

14.7 Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by End-user

14.8 Middle East & Africa Market Size (US$ Mn) Forecast, by End-user 2017–2025

14.8.1 B2C

14.8.1.1 Patients

14.8.1.2 Caregivers

14.8.2 B2B

14.8.2.1 Providers

14.8.2.2 Payers

14.8.2.3 Employers

14.8.2.4 Pharmaceutical Companies

14.8.2.5 Others

14.9 Market Attractiveness Analysis

14.9.1 By Product

14.9.2 By Application

14.9.3 By End User

Section 15 Company Profiles

15.1 Company Share Analysis

15.2 Company Profiles

15.2.1 Proteus Digital Therapeutic Devices

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Revenue Model

15.2.1.3. Product Portfolio

15.2.1.4. SWOT Analysis

15.2.1.5. Strategic Overview

15.2.1.6. Funding Overview

15.2.2 Omada Health, Inc.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Revenue Model

15.2.2.3. Product Portfolio

15.2.2.4. SWOT Analysis

15.2.2.5. Strategic Overview

15.2.2.6. Funding Overview

15.2.3 WellDoc, Inc.

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. SWOT Analysis

15.2.3.4. Strategic Overview

15.2.4 Livongo Health

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. SWOT Analysis

15.2.4.4. Strategic Overview

15.2.4.5. Funding Overview

15.2.5 Noom, Inc.

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. SWOT Analysis

15.2.5.4. Strategic Overview

15.2.5.5. Funding Overview

15.2.6 Ginger.io, Inc.

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. SWOT Analysis

15.2.6.4. Strategic Overview

15.2.7 Propeller Health

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Product Portfolio

15.2.7.3. SWOT Analysis

15.2.7.4. Strategic Overview

15.2.7.5. Funding Overview

15.2.8 2Morrow, Inc.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. SWOT Analysis

15.2.8.4. Strategic Overview

15.2.9 Canary Health

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. SWOT Analysis

15.2.9.4. Strategic Overview

15.2.10 Mango Health

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Product Portfolio

15.2.10.3. SWOT Analysis

15.2.10.4. Strategic Overview

15.2.10.5. Funding Overview

15.2.11 BiogeniQ Inc.

15.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.11.2. Product Portfolio

15.2.11.3. SWOT Analysis

15.2.11.4. Strategic Overview

15.2.12 Twine Health, Inc.

15.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.12.2. Product Portfolio

15.2.12.3. SWOT Analysis

15.2.12.4. Strategic Overview

15.2.13 Glooko, Inc.

15.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.13.2. Product Portfolio

15.2.13.3. SWOT Analysis

15.2.13.4. Strategic Overview

15.2.13.5. Funding Overview

15.2.14 Firstbeat Technologies Ltd

15.2.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.14.2. Product Portfolio

15.2.14.3. SWOT Analysis

15.2.14.4. Strategic Overview

15.2.15 Claritas MindSciences

15.2.15.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.15.2. Product Portfolio

15.2.15.3. SWOT Analysis

15.2.15.4. Strategic Overview

15.2.16 Big Health

15.2.16.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.16.2. Product Portfolio

15.2.16.3. SWOT Analysis

15.2.16.4. Strategic Overview

15.2.16.5. Revenue Model

15.2.17 Nanobiosym, Inc.

15.2.17.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.17.2. Product Portfolio

15.2.17.3. SWOT Analysis

15.2.17.4. Strategic Overview

15.2.18 Dthera Sciences

15.2.17.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.17.2. Financial Overview

15.2.17.3. Product Portfolio

15.2.17.4. SWOT Analysis

15.2.17.5. Strategic Overview

15.2.19 Jintronix, Inc.

15.2.19.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.19.2. Product Portfolio

15.2.19.3. SWOT Analysis

15.2.19.4. Strategic Overview

15.2.19.5. Funding Overview

15.2.20 Virta Health Corp

15.2.20.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.20.2. Product Portfolio

15.2.20.3. SWOT Analysis

15.2.20.4. Strategic Overview

15.2.21 Zest Health, LLC

15.2.21.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.21.2. Product Portfolio

15.2.21.3. SWOT Analysis

15.2.21.4. Strategic Overview

15.2.21.5. Funding Overview

15.2.22 Meru Health, Inc.

15.2.22.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.22.2. Product Portfolio

15.2.22.3. SWOT Analysis

15.2.22.4. Strategic Overview

15.2.22.5. Funding Overview

15.2.23 HealthMine, Inc.

15.2.23.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.23.2. Product Portfolio

15.2.23.3. SWOT Analysis

15.2.23.4. Strategic Overview

15.2.23.5. Funding Overview

15.2.24 Pear Therapeutics, Inc.

15.2.24.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.24.2. Product Portfolio

15.2.24.3. SWOT Analysis

15.2.24.4. Strategic Overview

15.2.24.5. Funding Overview

15.2.25 BioTelemetry, Inc.

15.2.25.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.25.2. Financial Overview

15.2.25.3. Product Portfolio

15.2.25.4. SWOT Analysis

15.2.25.5. Strategic Overview

15.2.26 Blue Mesa Health

15.2.27.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.27.2. Financial Overview

15.2.27.3. Product Portfolio

15.2.27.4. SWOT Analysis

15.2.27.5. Strategic Overview

15.2.27 Digital Therapeutics

15.2.27.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.27.2. Financial Overview

15.2.27.3. Product Portfolio

15.2.27.4. SWOT Analysis

15.2.27.5. Strategic Overview

15.3 M&A Deals - Digital Health

15.3.1 M&A Deals in the Digital Therapeutic Devices Market (2015)

15.3.2 M&A Deals in the Digital Therapeutic Devices Market (2016)

15.3.3 M&A Deals in the Digital Therapeutic Devices Market (2015)

15.4 Funding Deals - Digital Health

15.4.1 Funding Deals in the Digital Therapeutic Devices Market (2015)

15.4.2 Funding Deals in the Digital Therapeutic Devices Market (2016)

15.4.3 Funding Deals in the Digital Therapeutic Devices Market (2015)

List of Tables

Table 01: Diabetes Prevalence

Table 02: Data Security Breach

Table 03: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 04: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 05: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application (Preventive), 2015–2025

Table 06: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application (Treatment/Care),

Table 07: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 08: Global B2C Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 09: Global B2B Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 10: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 11: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 12: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 13: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 14: North America Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Preventive, 2015–2025

Table 15: North America Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Treatment/Care, 2015–2025

Table 16: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 17: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2C), 2015–2025

Table 18: North America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2B), 2015–2025

Table 19: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 20: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 21: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 22: Europe Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Preventive, 2015–2025

Table 23: Europe Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Treatment/Care, 2015–2025

Table 24: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 25: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2C), 2015–2025

Table 26: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2B), 2015–2025

Table 27: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 28: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 29: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 30: Asia Pacific Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Preventive, 2015–2025

Table 31: Asia Pacific Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Treatment/Care, 2015–2025

Table 32: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 33: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2C), 2015–2025

Table 34: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2B), 2015–2025

Table 35: Latin America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 36: Latin America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 37: Latin America Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Preventive, 2015–2025

Table 38: Latin America Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Treatment/Care, 2015–2025

Table 39: Latin America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 40: Latin America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2C), 2015–2025

Table 41: Latin America Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2B), 2015–2025

Table 42: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 43: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 44: Middle East & Africa Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Preventive, 2015–2025

Table 45: Middle East & Africa Digital Therapeutic Devices Application Market Size (US$ Mn) Forecast, by Treatment/Care, 2015–2025

Table 46: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 47: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2C), 2015–2025

Table 48: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, by End-user (B2B), 2015–2025

List of Figures

Figure 01: Global Digital Therapeutic Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 02: Market Value Share, by Product (2016)

Figure 03: Market Value Share, by Application (2016)

Figure 04: Market Value Share, by End-user (2016)

Figure 05: Market Value Share, by Region (2016)

Figure 06: Global Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 07: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Pain Management Devices, 2015–2025

Figure 08: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Rehabilitation Devices, 2015–2025

Figure 09: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Respiratory Therapy Devices, 2015–2025

Figure 10: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Insulin Pumps, 2015–2025

Figure 11: Global Wearable Devices Market Attractiveness Analysis, by Digital Therapeutic Devices, 2017–2025

Figure 12: Global Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 13: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Preventive, 2015–2025

Figure 14: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Treatment/Care, 2015–2025

Figure 15: Global Digital Therapeutic Devices Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 16: Global Digital Therapeutic Devices Market Value Share Analysis, by Application (Treatment/Care), 2017 and 2025

Figure 17: Global Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 18: Global Digital Therapeutic Devices Market Attractiveness Analysis, by Preventive, 2017–2025

Figure 19: Global Digital Therapeutic Devices Market Attractiveness Analysis, by Treatment/Care, 2017–2025

Figure 20: Global Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 21: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by B2C, 2015–2025

Figure 22: Global Digital Therapeutic Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by B2B, 2015–2025

Figure 23: Global B2C Market Value Share Analysis, by End-user, 2017 and 2025

Figure 24: Global B2B Market Value Share Analysis, by End-user, 2017 and 2025

Figure 25: Global Digital Therapeutic Devices Market Attractiveness Analysis, by End-user, 2017–2025

Figure 26: Global B2C Market Attractiveness Analysis, by End-user, 2017–025

Figure 27: Global B2B Market Attractiveness Analysis, by End-user, 2017–2025

Figure 28: Global Digital Therapeutic Devices Market Value Share Analysis, by Region, 2017 and 2025

Figure 29: Global Digital Therapeutic Devices Market Attractiveness Analysis, by Region, 2017–2025

Figure 30: North America Digital Therapeutic Devices Market Size

Figure 31: North America Market Attractiveness Analysis,

Figure 32: North America Market Value Share Analysis, by Country, 2017 and 2025

Figure 33: North America Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 34: North America Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 35: North America Digital Therapeutic Devices Application Market Value Share Analysis, by Treatment/Care, 2017 and 2025

Figure 36: North America Digital Therapeutic Devices Application Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 37: North America Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 38: North America Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2C), 2017 and 2025

Figure 39: North America Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2B), 2017 and 2025

Figure 40: North America Digital Therapeutic Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 41: North America Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 42: North America Digital Therapeutic Devices Market Attractiveness Analysis, by End User, 2017–2025

Figure 43: Europe Digital Therapeutic Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 44: Europe Digital Therapeutic Devices Market Attractiveness Analysis, by Country, 2017–2025

Figure 45: Europe Digital Therapeutic Devices Market Value Share Analysis by Country, 2017 and 2025

Figure 46: Europe Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 47: Europe Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 48: Europe Digital Therapeutic Devices Application Market Value Share Analysis, by Treatment/Care, 2017 and 2025

Figure 49: Europe Digital Therapeutic Devices Application Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 50: Europe Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 51: Europe Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2C), 2017 and 2025

Figure 52: Europe Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2B), 2017 and 2025

Figure 53: Europe Digital Therapeutic Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 54: Europe Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 55: Europe Digital Therapeutic Devices Market Attractiveness Analysis, by End User, 2017–2025

Figure 56: Asia Pacific Digital Therapeutic Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 57: Asia Pacific Market Attractiveness Analysis, by Country, 2017–2025

Figure 58: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by Country, 2017 and 2025

Figure 59: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 60: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 61: Asia Pacific Digital Therapeutic Devices Application Market Value Share Analysis, by Treatment/Care, 2017 and 2025

Figure 62: Asia Pacific Digital Therapeutic Devices Application Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 63: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 64: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2C), 2017 and 2025

Figure 65: Asia Pacific Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2B), 2017 and 2025

Figure 66: Asia Pacific Digital Therapeutic Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 67: Asia Pacific Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 68: Asia Pacific Digital Therapeutic Devices Market Attractiveness Analysis, by End User, 2017–2025

Figure 69: Latin America Digital Therapeutic Devices Market Size

Figure 70: Latin America Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 71: Latin America Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 72: Latin America Digital Therapeutic Devices Application Market Value Share Analysis, by Treatment/Care, 2017 and 2025

Figure 73: Latin America Digital Therapeutic Devices Application Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 74: Latin America Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 75: Latin America Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2C), 2017 and 2025

Figure 76: Latin America Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2B), 2017 and 2025

Figure 77: Latin America Digital Therapeutic Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 78: Latin America Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 79: Latin America Digital Therapeutic Devices Market Attractiveness Analysis, by End User, 2017–2025

Figure 80: Middle East & Africa Digital Therapeutic Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 81: Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by Product, 2017 and 2025

Figure 82: Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by Application, 2017 and 2025

Figure 83: Middle East & Africa Digital Therapeutic Devices Application Market Value Share Analysis, by Treatment/Care, 2017 and 2025

Figure 84: Middle East & Africa Digital Therapeutic Devices Application Market Value Share Analysis, by Preventive, 2017 and 2025

Figure 85: Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by End-user, 2017 and 2025

Figure 86: Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2C), 2017 and 2025

Figure 87: Middle East & Africa Digital Therapeutic Devices Market Value Share Analysis, by End-user (B2B), 2017 and 2025

Figure 88: Middle East & Africa Digital Therapeutic Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 89: Middle East & Africa Digital Therapeutic Devices Market Attractiveness Analysis, by Application, 2017–2025

Figure 90: Middle East & Africa Digital Therapeutic Devices Market Attractiveness Analysis, by End User, 2017–2025