Analyst Viewpoint

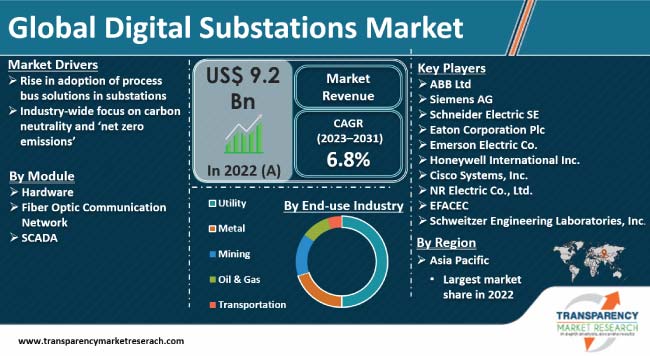

Rise in adoption of the process bus technology in substations is a prominent factor that is augmenting the digital substations market size. Digital substations help increase asset adaptability and maintain system reliability, while lowering labor and material costs. Industry-wide focus on carbon neutrality and ‘net zero emissions’ is also fostering market progress.

Governments of various countries are focusing on generating larger amount of renewable energy to ease the strain on existing power systems. The usage of digital components to effectively manage and distribute higher power loads is expected to dominate digital substations market trends through 2031. Manufacturers of digital substations are investing substantially in cyber-secure digital substation architecture to expand their global customer base.

Substation is a component of an electric power system. It is made up of high-voltage apparatus developed and scaled for the operating voltage of the substation (known as the primary system) and low-voltage equipment (referred to as the secondary system).

Usage of distributed intelligent electronic devices (IEDs) for substations linked via communications networks is the preferred method for the governance of digital substations.

Electricity networks are under severe pressure to perform effectively. Power generation is becoming more dynamic, with dispersed and renewable technologies coming online at a rapid pace. As the number of power sources grows, so does the impact of intermittent or unexpected generation, to which the grid must respond.

The digital substations market analysis reveals that a key challenge for intelligent substations is to strike a balance between increasing asset flexibility and preserving system dependability, while lowering material and labor costs. A shrinking trained workforce adds to the complication. Many of these difficulties may be solved by a digital substation.

Process bus solution is executed in the switchyard by inserting additional equipment, known as Merging Units (MU), near the primary equipment. The merging unit receives the instrument transformer output values, transforms them into digital signals, and delivers them to the secondary equipment (BCU, protection relays) via sampling values (SV) over an Ethernet-based connection.

This method eliminates the need for extra hardware such as hardwired connections between the IED and the instrument transformer. Process bus technology is designed in accordance with the international standard for substation communication IEC 61850-9-2, which enables compatibility between main and secondary equipment for quick and flexible system update and expansion.

There are several advantages of adopting the process bus solution technology in smart grid substations. Usage of standard hardware according to industry standards makes maintenance of these systems simpler, faster, and more reliable.

Substation automation also provides real-time advanced monitoring and control in substations for diagnosis of faults and errors. This enables faster recovery from downtimes across the connected systems.

Process bus setups in digital substations also improve voltage measurement accuracy by shortening the distance between CT/VTs to the signal processor, thus leading to lower electrical failure ratings. Finally, process bus solutions improve workplace safety by achieving electrical isolation of systems, which is especially crucial in times of grid failures.

The global energy environment is quickly changing, with greater emphasis on renewable energy sources and carbon-neutral targets. Power networks must become more flexible and efficient to meet these changes.

Novel substation designs are capable of integrating intermittent renewable energy sources while maintaining a stable and resilient power supply. As a result, demand for smart grid digital substation solutions is rising across the globe.

According to a research by the Pacific Northwest National Laboratory, digital grid technologies have the potential to cut electricity-related carbon dioxide (CO2) emissions in the U.S. by up to 12% by 2030. On a worldwide scale, this would imply a reduction of 2 billion tons of CO2 per year by the end of this decade.

Easy incorporation with environmentally-friendly electricity efforts is a key advantage of digital substations that is augmenting the global digital substations market. The usage of distributed energy resources (DERs) to minimize carbon emissions is gathering momentum across the globe. As a result, digital substations are projected to be at the forefront of 'net zero' power generating activities.

The digital substations industry is also projected to benefit from 70% decrease in copper protection and control cables. This would reduce capital and transportation expenses, as well as production efforts, all of which will help lower the carbon footprint.

The route to net zero energy includes a digital overhaul of the power generation network. Irrespective of the shape the energy landscape takes, a decarbonized economy and adoption of digital technologies is likely to continue to fuel market expansion in the near future.

As per digital substations market research, Asia Pacific accounted for significant share of the global landscape in 2022. This can be ascribed to the presence of several well-established market players in the region.

Increase in demand for energy among local industrial bodies is also boosting the market dynamics of Asia Pacific. Furthermore, rise in number of manufacturing units in India and China is augmenting the market statistics of the region.

According to the latest digital substations market forecast, North America is also expected to constitute key share of the sector in the near future, led by the high availability of modernized grid infrastructure in the region. Rise in investments in the power sector by the governments of the U.S. and Canada is also bolstering the digital substations industry growth in North America.

As per digital substations market insights, manufacturers of digital substations are investing substantially in improvement of transmission efficiency of power cables to ensure an uninterrupted supply to power stations.

They are also carrying out research and development activities to introduce smart grid technologies in order to modernize their grid systems. ABB Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation Plc, Emerson Electric Co., Honeywell International Inc., Cisco Systems, Inc., NR Electric Co., Ltd., EFACEC, and Schweitzer Engineering Laboratories, Inc. are the leading players operating in the global digital substations market.

These companies have been summarized in the digital substations market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 9.2 Bn |

| Market Forecast (Value) in 2031 | US$ 16.6 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 9.2 Bn in 2022

It is likely to grow at a CAGR of 6.8% from 2023 to 2031

Rise in adoption of process bus technology in substations and industry-wide focus on carbon neutrality and ‘net zero emissions’

Asia Pacific was the leading region in 2022

The utility segment commands a bulk of the share

ABB Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation Plc, Emerson Electric Co., Honeywell International Inc., Cisco Systems, Inc., NR Electric Co., Ltd., EFACEC, and Schweitzer Engineering Laboratories, Inc.

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Digital Substations Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Digital Substations Market Analysis, by Module

5.1. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

5.1.1. Hardware

5.1.2. Fiber Optic Communication Network

5.1.3. SCADA

5.2. Market Attractiveness Analysis, by Module

6. Global Digital Substations Market Analysis, by Type

6.1. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

6.1.1. Transmission Substations

6.1.2. Distribution Substations

6.2. Market Attractiveness Analysis, by Type

7. Global Digital Substations Market Analysis, by Voltage

7.1. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

7.1.1. Up to 220 kV

7.1.2. 220-550 kV

7.1.3. Above 500 kV

7.2. Market Attractiveness Analysis, by Voltage

8. Global Digital Substations Market Analysis, by End-use Industry

8.1. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

8.1.1. Utility

8.1.2. Metal

8.1.3. Mining

8.1.4. Oil & Gas

8.1.5. Transportation

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Digital Substations Market Analysis and Forecast, by Region

9.1. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Region, 2023–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Digital Substations Market Analysis and Forecast

10.1. Market Snapshot

10.2. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

10.2.1. Hardware

10.2.2. Fiber Optic Communication Network

10.2.3. SCADA

10.3. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

10.3.1. Transmission Substations

10.3.2. Distribution Substations

10.4. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

10.4.1. Up to 220 kV

10.4.2. 220-550 kV

10.4.3. Above 500 kV

10.5. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

10.5.1. Utility

10.5.2. Metal

10.5.3. Mining

10.5.4. Oil & Gas

10.5.5. Transportation

10.6. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Country, 2023–2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Module

10.7.2. By Type

10.7.3. By Voltage

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe Digital Substations Market Analysis and Forecast

11.1. Market Snapshot

11.2. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

11.2.1. Hardware

11.2.2. Fiber Optic Communication Network

11.2.3. SCADA

11.3. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

11.3.1. Transmission Substations

11.3.2. Distribution Substations

11.4. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

11.4.1. Up to 220 kV

11.4.2. 220-550 kV

11.4.3. Above 500 kV

11.5. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

11.5.1. Utility

11.5.2. Metal

11.5.3. Mining

11.5.4. Oil & Gas

11.5.5. Transportation

11.6. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Module

11.7.2. By Type

11.7.3. By Voltage

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific Digital Substations Market Analysis and Forecast

12.1. Market Snapshot

12.2. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

12.2.1. Hardware

12.2.2. Fiber Optic Communication Network

12.2.3. SCADA

12.3. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

12.3.1. Transmission Substations

12.3.2. Distribution Substations

12.4. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

12.4.1. Up to 220 kV

12.4.2. 220-550 kV

12.4.3. Above 500 kV

12.5. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

12.5.1. Utility

12.5.2. Metal

12.5.3. Mining

12.5.4. Oil & Gas

12.5.5. Transportation

12.6. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Module

12.7.2. By Type

12.7.3. By Voltage

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East & Africa Digital Substations Market Analysis and Forecast

13.1. Market Snapshot

13.2. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

13.2.1. Hardware

13.2.2. Fiber Optic Communication Network

13.2.3. SCADA

13.3. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

13.3.1. Transmission Substations

13.3.2. Distribution Substations

13.4. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

13.4.1. Up to 220 kV

13.4.2. 220-550 kV

13.4.3. Above 500 kV

13.5. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

13.5.1. Utility

13.5.2. Metal

13.5.3. Mining

13.5.4. Oil & Gas

13.5.5. Transportation

13.6. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Module

13.7.2. By Type

13.7.3. By Voltage

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America Digital Substations Market Analysis and Forecast

14.1. Market Snapshot

14.2. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Module, 2023–2031

14.2.1. Hardware

14.2.2. Fiber Optic Communication Network

14.2.3. SCADA

14.3. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Type, 2023–2031

14.3.1. Transmission Substations

14.3.2. Distribution Substations

14.4. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Voltage, 2023–2031

14.4.1. Up to 220 kV

14.4.2. 220-550 kV

14.4.3. Above 500 kV

14.5. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2023–2031

14.5.1. Utility

14.5.2. Metal

14.5.3. Mining

14.5.4. Oil & Gas

14.5.5. Transportation

14.6. Digital Substations Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Module

14.7.2. By Type

14.7.3. By Voltage

14.7.4. By End-use Industry

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Digital Substations Market Competition Matrix - a Dashboard View

15.1.1. Global Digital Substations Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. ABB Ltd.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Siemens AG

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Schneider Electric SE

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Eaton Corporation Plc

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Emerson Electric Co.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Honeywell International Inc.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Cisco Systems, Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. NR Electric Co. Ltd.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. EFACEC

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Schweitzer Engineering Laboratories, Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 2: Global Digital Substations Market Forecast, by Module, 2023‒2031

Table 3: Global Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 4: Global Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 5: Global Digital Substations Market Value (US$ Mn) Forecast, by Region, 2023‒2031

Table 6: Global Digital Substations Market Forecast, by Region, 2023‒2031

Table 7: North America Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 8: North America Digital Substations Market Forecast, by Module, 2023‒2031

Table 9: North America Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 10: North America Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 11: North America Digital Substations Market Value (US$ Mn) Forecast, by Country, 2023‒2031

Table 12: North America Digital Substations Market Forecast, by Country, 2023‒2031

Table 13: Europe Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 14: Europe Digital Substations Market Forecast, by Module, 2023‒2031

Table 15: Europe Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 16: Europe Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 17: Europe Digital Substations Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023‒2031

Table 18: Europe Digital Substations Market Forecast, by Country and Sub-region, 2023‒2031

Table 19: Asia Pacific Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 20: Asia Pacific Digital Substations Market Forecast, by Module, 2023‒2031

Table 21: Asia Pacific Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 22: Asia Pacific Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 23: Asia Pacific Digital Substations Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023‒2031

Table 24: Asia Pacific Digital Substations Market Forecast, by Country and Sub-region, 2023‒2031

Table 25: Middle East & Africa Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 26: Middle East & Africa Digital Substations Market Forecast, by Module, 2023‒2031

Table 27: Middle East & Africa Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 28: Middle East & Africa Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 29: Middle East & Africa Digital Substations Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023‒2031

Table 30: Middle East & Africa Digital Substations Market Forecast, by Country and Sub-region, 2023‒2031

Table 31: South America Digital Substations Market Value (US$ Mn) Forecast, by Module, 2023‒2031

Table 32: South America Digital Substations Market Forecast, by Module, 2023‒2031

Table 33: South America Digital Substations Market Value (US$ Mn) Forecast, by Type, 2023‒2031

Table 34: South America Digital Substations Market Value (US$ Mn) Forecast, by Voltage, 2023‒2031

Table 35: South America Digital Substations Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023‒2031

Table 36: South America Digital Substations Market Forecast, by Country and Sub-region, 2023‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Digital Substations Market

Figure 02: Porter Five Forces Analysis – Global Digital Substations Market

Figure 03: Technology Road Map - Global Digital Substations Market

Figure 04: Global Digital Substations Market, Value (US$ Mn), 2023-2031

Figure 05: Global Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 06: Global Digital Substations Market Projections, by Module, Value (US$ Mn), 2023‒2031

Figure 07: Global Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 08: Global Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 09: Global Digital Substations Market Projections, by Type, Value (US$ Mn), 2023‒2031

Figure 10: Global Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 11: Global Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 12: Global Digital Substations Market Projections, by Voltage, Value (US$ Mn), 2023‒2031

Figure 13: Global Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 14: Global Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 15: Global Digital Substations Market Projections, by Region, Value (US$ Mn), 2023‒2031

Figure 16: Global Digital Substations Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Digital Substations Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Digital Substations Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 19: North America Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 20: North America Digital Substations Market Projections, by Module Value (US$ Mn), 2023‒2031

Figure 21: North America Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 22: North America Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 23: North America Digital Substations Market Projections, by Type (US$ Mn), 2023‒2031

Figure 24: North America Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 25: North America Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 26: North America Digital Substations Market Projections, by Voltage Value (US$ Mn), 2023‒2031

Figure 27: North America Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 28: North America Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 29: North America Digital Substations Market Projections, by Country, Value (US$ Mn), 2023‒2031

Figure 30: North America Digital Substations Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 31: North America Digital Substations Market Share Analysis, by Country, 2023 and 2031

Figure 32: Europe Digital Substations Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 33: Europe Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 34: Europe Digital Substations Market Projections, by Module Value (US$ Mn), 2023‒2031

Figure 35: Europe Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 36: Europe Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 37: Europe Digital Substations Market Projections, by Type, Value (US$ Mn), 2023‒2031

Figure 38: Europe Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 39: Europe Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 40: Europe Digital Substations Market Projections, by Voltage, Value (US$ Mn), 2023‒2031

Figure 41: Europe Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 42: Europe Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 43: Europe Digital Substations Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 44: Europe Digital Substations Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Digital Substations Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Digital Substations Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 47: Asia Pacific Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 48: Asia Pacific Digital Substations Market Projections, by Module Value (US$ Mn), 2023‒2031

Figure 49: Asia Pacific Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 50: Asia Pacific Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 51: Asia Pacific Digital Substations Market Projections, by Type, Value (US$ Mn), 2023‒2031

Figure 52: Asia Pacific Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 53: Asia Pacific Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 54: Asia Pacific Digital Substations Market Projections, by Voltage, Value (US$ Mn), 2023‒2031

Figure 55: Asia Pacific Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 56: Asia Pacific Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 57: Asia Pacific Digital Substations Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 58: Asia Pacific Digital Substations Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Digital Substations Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Digital Substations Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 61: Middle East & Africa Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 62: Middle East & Africa Digital Substations Market Projections, by Module Value (US$ Mn), 2023‒2031

Figure 63: Middle East & Africa Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 64: Middle East & Africa Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 65: Middle East & Africa Digital Substations Market Projections, by Type, Value (US$ Mn), 2023‒2031

Figure 66: Middle East & Africa Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 67: Middle East & Africa Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 68: Middle East & Africa Digital Substations Market Projections, by Voltage Value (US$ Mn), 2023‒2031

Figure 69: Middle East & Africa Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 70: Middle East & Africa Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 71: Middle East & Africa Digital Substations Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 72: Middle East & Africa Digital Substations Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Digital Substations Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Digital Substations Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 75: South America Digital Substations Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 76: South America Digital Substations Market Projections, by Module Value (US$ Mn), 2023‒2031

Figure 77: South America Digital Substations Market, Incremental Opportunity, by Module, 2023‒2031

Figure 78: South America Digital Substations Market Share Analysis, by Module, 2023 and 2031

Figure 79: South America Digital Substations Market Projections, by Type, Value (US$ Mn), 2023‒2031

Figure 80: South America Digital Substations Market, Incremental Opportunity, by Type, 2023‒2031

Figure 81: South America Digital Substations Market Share Analysis, by Type, 2023 and 2031

Figure 82: South America Digital Substations Market Projections, by Voltage Value (US$ Mn), 2023‒2031

Figure 83: South America Digital Substations Market, Incremental Opportunity, by Voltage, 2023‒2031

Figure 84: South America Digital Substations Market Share Analysis, by Voltage, 2023 and 2031

Figure 85: South America Digital Substations Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 86: South America Digital Substations Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America Digital Substations Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Digital Substations Market Competition

Figure 89: Global Digital Substations Market Company Share Analysis