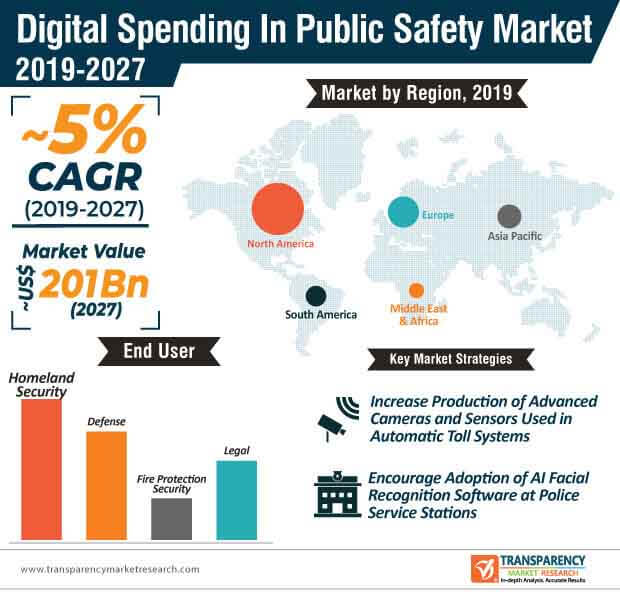

Governments of various developed and developing economies are increasing capabilities for digital spending in public safety. These efforts are seen prominent in creating a safer road transport infrastructure in high growth regions such as Asia Pacific, Middle East & Africa, and South America.

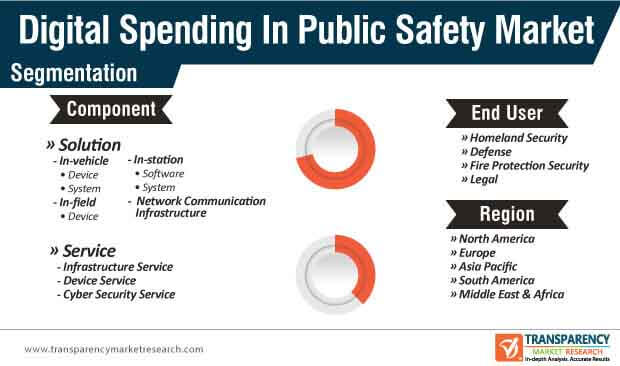

The in-vehicle solution sub-segment of the digital spending in public safety market is estimated to reach a value of ~US$ 68 Bn by the end of 2027. Hence, manufacturers are increasing their efficacy in in-vehicle technology, since the segment is projected for aggressive growth during the forecast period.

Companies in the digital spending in public safety market are increasing the availability of anti collision sensor technology, smart topographs, and other automated systems to make sure that vehicles become much safer. Emergence of autonomous vehicles and flying taxis are some of the key drivers contributing to the growth of the digital spending in public safety market. Moreover, integration of cloud computing and digital-first consumer experience offer growth opportunities for digital technology manufacturers.

Government organizations are on a transformational journey toward the adoption of digital technologies to improve interactions with citizens. Apart from North America and Europe, companies are tapping into opportunities in South America and Middle East & Africa, owing to the region’s high growth potential in the coming years.

Cloud computing, AI, and machine learning are key techniques used by manufacturers in the digital spending in public safety market to help defense organizations maintain transparency in internal processes. The trend of cloud computing is increasingly winning the trust of individuals, as pupils are notified about how their government is taking steps to manage taxes and other funds.

Defense organizations are aiming at establishing paper-less ecosystems to bolster their credibility credentials. This trend is translating into revenue opportunities for companies in the market for digital spending in public safety. AI and machine learning are helping defense organizations to boost productivity that support public safety and national security.

High risks in public safety and growing incidences of terrorist attacks on individuals have triggered the need for digital spending in public safety. Adoption of digital technology can help police officers to keep ahead of criminals. However, modernizing police service organizations requires significant amount of time and commitment. The global digital spending in public safety market is largely consolidated with three major players accounting to ~30-50% of the market stake. This poses as a challenge for prominent and emerging players to increase uptake of digital technology in police service stations.

The revenue of in-station solution sub-segment of the digital spending in public safety market is anticipated to reach a value of ~US$ 19 Bn by 2027. However, outdated document organization systems and struggle with information silos pose as a barrier for manufacturers. Hence, companies in the market for digital spending in public safety are encouraging police organizations to adopt AI-driven facial recognition software to identify suspects faster.

Companies in the digital spending in public safety market are eyeing business expansion opportunities in countries of Asia Pacific. This is evident since Finance Minister of Singapore Heng Swee Keat announced investments to support the state’s defense, security, and diplomacy efforts. As such, the defense end user segment of the digital spending in public safety market is expected to reach a value of ~US$ 42 Bn by 2021.

Physical threats to individuals and malicious cyber activities have compelled governments to increase digital spending in public safety. Hence, manufacturers in the digital spending in public safety market are introducing advanced technologies and software systems that create an efficient connected ecosystem for cities. New concept of smart cities and smart nations has catalyzed the adoption IoT to establish connected networks. Digital technologies are increasingly helping defense organizations to improve their efficacy in sophisticated tactics against attackers with ease and greater intensity.

Augmented reality (AR) is projected to electrify growth in the digital spending in public safety market. AR will help improve driver’s safety, as manufacturers make available technology that helps a driver to ‘see through’ traffic. Moreover, companies are encouraging police service organizations to adopt tracking technology to easily manage and track critical assets.

However, there is a need to solve problems related to road transportation safety. Hence, companies should innovate in the in-vehicle technology to make processes more time and cost efficient in the road transportation sector. Manufacturers should tap into opportunities in autonomous vehicles, since there has been an increase in the number of these vehicles in recent years.

Digital Spending In Public Safety Market: Overview

Digital Spending In Public Safety Market - Definition

North America Digital Spending In Public Safety Market to Witness Significant Growth

Key Growth Driver of Digital Spending in Public Safety Market

Key Challenges Faced by Digital Spending In Public Safety Market Players

Digital Spending In Public Safety Market – Key Developments

Digital Spending In Public Safety Market - Company Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Digital Spending In Public Safety Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. Global ICT Spending (US$ Mn), 2013, 2019, 2027

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Eco system Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.3.5. Technology Roadmap

4.4. Regulations and Policies

4.5. Global Digital Spending In Public Safety Market Analysis and Forecast, 2013 – 2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2013-2017

4.5.1.2. Forecast Trends, 2018-2027

4.6. Market Opportunity Assessment – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.6.1. By Component

4.6.2. By Solution

4.6.3. By End-user

4.6.4. By Region / Country

4.7. Competitive Scenario and Trends

4.7.1. Digital Spending In Public Safety Market Concentration Rate

4.7.1.1. List of New Entrants

4.7.2. Mergers & Acquisitions, Expansions

4.8. Market Outlook

5. Global Digital Spending In Public Safety Market Analysis and Forecast, By Component

5.1. Overview & Definitions

5.2. Key Segment Analysis

5.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 – 2027

5.3.1. Solution

5.3.1.1. In Vehicle

5.3.1.2. In Field

5.3.1.3. In Station

5.3.1.4. Network Communication Infrastructure

5.3.2. Services

5.3.2.1. Infrastructure service

5.3.2.2. Device Service

5.3.2.3. Cyber security Service

5.4. Global Digital Spending In Public Safety Market Analysis and Forecast, By Component, By Solution

5.5. Overview

5.6. Key Segment Analysis

5.7. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 – 2027

5.7.1. In vehicle

5.7.1.1. Device

5.7.1.1.1. Central Computer

5.7.1.1.2. Light Detection and Ranging (LIDAR)

5.7.1.1.3. Sensor(Ultrasonic, Radar)

5.7.1.1.4. Dedicated Short-Range Communications-Based Receiver

5.7.1.1.5. License-plate reader

5.7.1.2. System

5.7.1.2.1. Global Positioning System (GPS)

5.7.1.2.2. Computer Aided Dispatch (CAD) system

5.7.1.2.3. Automated Vehicle Location (AVL) systems

5.7.2. In field

5.7.2.1. Device

5.7.2.1.1. Light Detection and Ranging (LIDAR)

5.7.2.1.2. Wearable Sensor

5.7.2.1.3. Tough PAD/PC

5.7.2.1.4. Microphone

5.7.2.1.5. Cameras

5.7.2.1.6. Drones

5.7.2.1.7. Smartphones

5.7.2.1.8. Robots

5.7.3. In station

5.7.3.1. Software

5.7.3.1.1. Big data analytics

5.7.3.1.2. Fleet management

5.7.3.1.3. Route planning software

5.7.3.1.4. video analytics

5.7.3.2. System

5.7.3.2.1. Business Intelligence System (CBI)

5.7.3.2.2. Drive Safe Enforcement Systems

5.7.3.2.3. Violation Processing System

5.7.3.2.4. Inspection automation system

5.7.3.2.5. Vehicle Passenger Detection System

5.7.4. Network Communication Infrastructure

6. Global Digital Spending In Public Safety Market Analysis and Forecast, By End-user

6.1. Overview

6.2. Key Segment Analysis

6.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

6.3.1. Homeland security

6.3.2. Defense

6.3.3. Fire protection security

6.3.4. Legal

7. Global Digital Spending In Public Safety Market Analysis and Forecast, By Region

7.1. Overview

7.2. Key Finding

7.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, by Region, 2016 - 2027

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

8. North America Digital Spending In Public Safety Market Analysis and Forecast

8.1. Key Findings

8.2. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 – 2027

8.2.1. Solution

8.2.1.1. In Vehicle

8.2.1.2. In Field

8.2.1.3. In Station

8.2.1.4. Network Communication Infrastructure

8.2.2. Services

8.2.2.1. Infrastructure service

8.2.2.2. Device Service

8.2.2.3. Cyber security Service

8.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 – 2027

8.3.1. In vehicle

8.3.1.1. Device

8.3.1.1.1. Central Computer

8.3.1.1.2. Light Detection and Ranging (LIDAR)

8.3.1.1.3. Sensor ( Ultrasonic, Radar )

8.3.1.1.4. Dedicated Short-Range Communications-Based Receiver

8.3.1.1.5. License-plate reader

8.3.1.2. System

8.3.1.2.1. Global Positioning System (GPS)

8.3.1.2.2. Computer Aided Dispatch (CAD) system

8.3.1.2.3. Automated Vehicle Location (AVL) systems

8.3.2. In field

8.3.2.1. Device

8.3.2.1.1. Light Detection and Ranging (LIDAR)

8.3.2.1.2. Wearable Sensor

8.3.2.1.3. Tough PAD/PC

8.3.2.1.4. Microphone

8.3.2.1.5. Cameras

8.3.2.1.6. Drones

8.3.2.1.7. Smartphones

8.3.2.1.8. Robots

8.3.3. In station

8.3.3.1. Software

8.3.3.1.1. Big data analytics

8.3.3.1.2. Fleet management

8.3.3.1.3. Route planning software

8.3.3.1.4. video analytics

8.3.3.2. System

8.3.3.2.1. Business Intelligence System (CBI)

8.3.3.2.2. Drive Safe Enforcement Systems

8.3.3.2.3. Violation Processing System

8.3.3.2.4. Inspection automation system

8.3.3.2.5. Vehicle Passenger Detection System

8.3.4. Network Communication Infrastructure

8.4. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

8.4.1. Homeland security

8.4.2. Defense

8.4.3. Fire protection security

8.4.4. Legal

8.5. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016 - 2027

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

9. Europe Digital Spending In Public Safety Market Analysis and Forecast

9.1. Key Findings

9.2. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 – 2027

9.2.1. Solution

9.2.1.1. In Vehicle

9.2.1.2. In Field

9.2.1.3. In Station

9.2.1.4. Network Communication Infrastructure

9.2.2. Services

9.2.2.1. Infrastructure service

9.2.2.2. Device Service

9.2.2.3. Cyber security Service

9.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 – 2027

9.3.1. In vehicle

9.3.1.1. Device

9.3.1.1.1. Central Computer

9.3.1.1.2. Light Detection and Ranging (LIDAR)

9.3.1.1.3. Sensor ( Ultrasonic, Radar )

9.3.1.1.4. Dedicated Short-Range Communications-Based Receiver

9.3.1.1.5. License-plate reader

9.3.1.2. System

9.3.1.2.1. Global Positioning System (GPS)

9.3.1.2.2. Computer Aided Dispatch (CAD) system

9.3.1.2.3. Automated Vehicle Location (AVL) systems

9.3.2. In field

9.3.2.1. Device

9.3.2.1.1. Light Detection and Ranging (LIDAR)

9.3.2.1.2. Wearable Sensor

9.3.2.1.3. Tough PAD/PC

9.3.2.1.4. Microphone

9.3.2.1.5. Cameras

9.3.2.1.6. Drones

9.3.2.1.7. Smartphones

9.3.2.1.8. Robots

9.3.3. In station

9.3.3.1. Software

9.3.3.1.1. Big data analytics

9.3.3.1.2. Fleet management

9.3.3.1.3. Route planning software

9.3.3.1.4. video analytics

9.3.3.2. System

9.3.3.2.1. Business Intelligence System (CBI)

9.3.3.2.2. Drive Safe Enforcement Systems

9.3.3.2.3. Violation Processing System

9.3.3.2.4. Inspection automation system

9.3.3.2.5. Vehicle Passenger Detection System

9.3.4. Network Communication Infrastructure

9.4. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

9.4.1. Homeland security

9.4.2. Defense

9.4.3. Fire protection security

9.4.4. Legal

9.5. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016 - 2027

9.5.1. Germany

9.5.2. France

9.5.3. The U.K.

9.5.4. Rest of Europe

10. Asia Pacific Digital Spending In Public Safety Market Analysis and Forecast

10.1. Key Findings

10.2. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 – 2027

10.2.1. Solution

10.2.1.1. In Vehicle

10.2.1.2. In Field

10.2.1.3. In Station

10.2.1.4. Network Communication Infrastructure

10.2.2. Services

10.2.2.1. Infrastructure service

10.2.2.2. Device Service

10.2.2.3. Cyber security Service

10.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 – 2027

10.3.1. In vehicle

10.3.1.1. Device

10.3.1.1.1. Central Computer

10.3.1.1.2. Light Detection and Ranging (LIDAR)

10.3.1.1.3. Sensor ( Ultrasonic, Radar )

10.3.1.1.4. Dedicated Short-Range Communications-Based Receiver

10.3.1.1.5. License-plate reader

10.3.1.2. System

10.3.1.2.1. Global Positioning System (GPS)

10.3.1.2.2. Computer Aided Dispatch (CAD) system

10.3.1.2.3. Automated Vehicle Location (AVL) systems

10.3.2. In field

10.3.2.1. Device

10.3.2.1.1. Light Detection and Ranging (LIDAR)

10.3.2.1.2. Wearable Sensor

10.3.2.1.3. Tough PAD/PC

10.3.2.1.4. Microphone

10.3.2.1.5. Cameras

10.3.2.1.6. Drones

10.3.2.1.7. Smartphones

10.3.2.1.8. Robots

10.3.3. In station

10.3.3.1. Software

10.3.3.1.1. Big data analytics

10.3.3.1.2. Fleet management

10.3.3.1.3. Route planning software

10.3.3.1.4. video analytics

10.3.3.2. System

10.3.3.2.1. Business Intelligence System (CBI)

10.3.3.2.2. Drive Safe Enforcement Systems

10.3.3.2.3. Violation Processing System

10.3.3.2.4. Inspection automation system

10.3.3.2.5. Vehicle Passenger Detection System

10.3.4. Network Communication Infrastructure

10.4. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

10.4.1. Homeland security

10.4.2. Defense

10.4.3. Fire protection security

10.4.4. Legal

10.5. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Country/Sub-region, 2016 - 2027

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. Rest of Asia Pacific

11. Middle East & Africa (MEA) Digital Spending In Public Safety Market Analysis and Forecast

11.1. Key Findings

11.2. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 - 2027

11.2.1. Solution

11.2.1.1. In Vehicle

11.2.1.2. In Field

11.2.1.3. In Station

11.2.1.4. Network Communication Infrastructure

11.2.2. Services

11.2.2.1. Infrastructure service

11.2.2.2. Device Service

11.2.2.3. Cyber security Service

11.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 - 2027

11.3.1. In vehicle

11.3.1.1. Device

11.3.1.1.1. Central Computer

11.3.1.1.2. Light Detection and Ranging (LIDAR)

11.3.1.1.3. Sensor ( Ultrasonic, Radar )

11.3.1.1.4. Dedicated Short-Range Communications-Based Receiver

11.3.1.1.5. License-plate reader

11.3.1.2. System

11.3.1.2.1. Global Positioning System (GPS)

11.3.1.2.2. Computer Aided Dispatch (CAD) system

11.3.1.2.3. Automated Vehicle Location (AVL) systems

11.3.2. In field

11.3.2.1. Device

11.3.2.1.1. Light Detection and Ranging (LIDAR)

11.3.2.1.2. Wearable Sensor

11.3.2.1.3. Tough PAD/PC

11.3.2.1.4. Microphone

11.3.2.1.5. Cameras

11.3.2.1.6. Drones

11.3.2.1.7. Smartphones

11.3.2.1.8. Robots

11.3.3. In station

11.3.3.1. Software

11.3.3.1.1. Big data analytics

11.3.3.1.2. Fleet management

11.3.3.1.3. Route planning software

11.3.3.1.4. video analytics

11.3.3.2. System

11.3.3.2.1. Business Intelligence System (CBI)

11.3.3.2.2. Drive Safe Enforcement Systems

11.3.3.2.3. Violation Processing System

11.3.3.2.4. Inspection automation system

11.3.3.2.5. Vehicle Passenger Detection System

11.3.4. Network Communication Infrastructure

11.4. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

11.4.1. Homeland security

11.4.2. Defense

11.4.3. Fire protection security

11.4.4. Legal

11.5. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Country/Sub-region, 2016 - 2027

11.5.1. UAE & Saudi Arabia

11.5.2. South Africa

11.5.3. Rest of MEA

12. South America Digital Spending In Public Safety Market Analysis and Forecast

12.1. Key Findings

12.2. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, 2016 - 2027

12.2.1. Solution

12.2.1.1. In Vehicle

12.2.1.2. In Field

12.2.1.3. In Station

12.2.1.4. Network Communication Infrastructure

12.2.2. Services

12.2.2.1. Infrastructure service

12.2.2.2. Device Service

12.2.2.3. Cyber security Service

12.3. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Component, By Solution, 2016 - 2027

12.3.1. In vehicle

12.3.1.1. Device

12.3.1.1.1. Central Computer

12.3.1.1.2. Light Detection and Ranging (LIDAR)

12.3.1.1.3. Sensor ( Ultrasonic, Radar )

12.3.1.1.4. Dedicated Short-Range Communications-Based Receiver

12.3.1.1.5. License-plate reader

12.3.1.2. System

12.3.1.2.1. Global Positioning System (GPS)

12.3.1.2.2. Computer Aided Dispatch (CAD) system

12.3.1.2.3. Automated Vehicle Location (AVL) systems

12.3.2. In field

12.3.2.1. Device

12.3.2.1.1. Light Detection and Ranging (LIDAR)

12.3.2.1.2. Wearable Sensor

12.3.2.1.3. Tough PAD/PC

12.3.2.1.4. Microphone

12.3.2.1.5. Cameras

12.3.2.1.6. Drones

12.3.2.1.7. Smartphones

12.3.2.1.8. Robots

12.3.3. In station

12.3.3.1. Software

12.3.3.1.1. Big data analytics

12.3.3.1.2. Fleet management

12.3.3.1.3. Route planning software

12.3.3.1.4. video analytics

12.3.3.2. System

12.3.3.2.1. Business Intelligence System (CBI)

12.3.3.2.2. Drive Safe Enforcement Systems

12.3.3.2.3. Violation Processing System

12.3.3.2.4. Inspection automation system

12.3.3.2.5. Vehicle Passenger Detection System

12.3.4. Network Communication Infrastructure

12.4. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By End-user, 2016 - 2027

12.4.1. Homeland security

12.4.2. Defense

12.4.3. Fire protection security

12.4.4. Legal

12.5. Digital Spending In Public Safety Market Size (US$ Mn) Forecast, By Country/Sub-region, 2016 - 2027

12.5.1. Brazil

12.5.2. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Share Analysis (%), by Company (2017)

14. Company Profiles (Details – Business Overview, Geographical Presence, Yearly Revenue Growth, and Strategy)

14.1.1. Samsung Electronics Co., Ltd.

14.1.1.1. Business Overview

14.1.1.2. Geographical Presence

14.1.1.3. Yearly Revenue Growth

14.1.1.4. Strategy

14.1.2. Motorola Solutions, Inc.

14.1.2.1. Business Overview

14.1.2.2. Geographical Presence

14.1.2.3. Yearly Revenue Growth

14.1.2.4. Strategy

14.1.3. Microsoft Corporation

14.1.3.1. Business Overview

14.1.3.2. Geographical Presence

14.1.3.3. Yearly Revenue Growth

14.1.3.4. Strategy

14.1.4. Nokia Corporation

14.1.4.1. Business Overview

14.1.4.2. Geographical Presence

14.1.4.3. Yearly Revenue Growth

14.1.4.4. Strategy

14.1.5. Cisco Systems, Inc.

14.1.5.1. Business Overview

14.1.5.2. Geographical Presence

14.1.5.3. Yearly Revenue Growth

14.1.5.4. Strategy

14.1.6. Huawei Technologies Co., Ltd.

14.1.6.1. Business Overview

14.1.6.2. Geographical Presence

14.1.6.3. Yearly Revenue Growth

14.1.6.4. Strategy

14.1.7. Esri

14.1.7.1. Business Overview

14.1.7.2. Geographical Presence

14.1.7.3. Yearly Revenue Growth

14.1.7.4. Strategy

14.1.8. Telefonaktiebolaget LM Ericsson

14.1.8.1. Business Overview

14.1.8.2. Geographical Presence

14.1.8.3. Yearly Revenue Growth

14.1.8.4. Strategy

14.1.9. IBM Corporation

14.1.9.1. Business Overview

14.1.9.2. Geographical Presence

14.1.9.3. Yearly Revenue Growth

14.1.9.4. Strategy

15. Key Takeaways

List of Tables

Table 01: List of Vendors

Table 02: Acquisition/Merger/Expansion in Digital Spending In Public Safety Market

Table 03: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 04: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 05: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 06: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 07: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 08: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 09: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 10: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 11: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 12: Global Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Region, 2016 – 2027

Table 13: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 14: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 15: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 16: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 17: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 18: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 19: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 20: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 21: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 22: North America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Country, 2016 – 2027

Table 23: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 24: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 25: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 26: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 27: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 28: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 29: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 30: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 31: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 32: Europe Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Country, 2016 – 2027

Table 33: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 34: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 35: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 36: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 37: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 38: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 39: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 40: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 41: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 42: Asia Pacific Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Country, 2016 – 2027

Table 43: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 44: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 45: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 46: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 47: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 48: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 49: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 50: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 51: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 52: Middle East & Africa Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Country, 2016 – 2027

Table 53: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 54: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Component, 2016 – 2027

Table 55: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 56: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 57: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 58: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 59: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 60: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Solution, 2016 – 2027

Table 61: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by End User, 2016 – 2027

Table 62: South America Digital Spending In Public Safety Market Value (US$ Bn) and Forecast, by Country, 2016 – 2027

List of Figures

Figure 1: Global Digital Spending In Public Safety Market Size (US$ Bn) Forecast, 2017 - 2027

Figure 2: Global Digital Spending In Public Safety Market Value (US$ Bn) Opportunity Assessment, by Region

Figure 3: Top Segment Analysis

Figure 4: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 5: Top Economies GDP Landscape, 2018

Figure 7: Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure 6: Global ICT Spending (%), by Region, 2019

Figure 8: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure 9: Global ICT Spending (%), by Type, 2019

Figure 10: Global Digital Spending In Public Safety Market Historic Growth Trends (US$ Bn), 2013 – 2017

Figure 11: Global Digital Spending In Public Safety Market Y-o-Y Growth (Value %), 2013 – 2017

Figure 12: Global Digital Spending In Public Safety Market Forecast Trends (US$ Bn), 2017 - 2027

Figure 13: Global Digital Spending In Public Safety Market Y-o-Y Growth (Value %), 2017 - 2027

Figure 14: Global Digital Spending In Public Safety Market Opportunity Assessment, by Component

Figure 15: Global Digital Spending In Public Safety Market Attractiveness Rating, by Component

Figure 16: Global Digital Spending In Public Safety Market Opportunity Assessment, by Solution

Figure 17: Global Digital Spending In Public Safety Market Attractiveness Rating, by Solution

Figure 18: Global Digital Spending In Public Safety Market Opportunity Assessment, by End User

Figure 19: Global Digital Spending In Public Safety Market Attractiveness Rating, by End User

Figure 20: Global Digital Spending In Public Safety Market Opportunity Assessment, by Region

Figure 21: Global Digital Spending In Public Safety Market Attractiveness Rating, by Region

Figure 22: Global Digital Spending In Public Safety Market, Component CAGR (%) (2019 – 2027)

Figure 23: Global Digital Spending In Public Safety Market, Service CAGR (%) (2019 – 2027)

Figure 24: Global Digital Spending In Public Safety Market, Solution CAGR (%) (2019 – 2027)

Figure 25: Global Digital Spending In Public Safety Market, End-Use Industry CAGR (%) (2019 – 2027)

Figure 26: Global Digital Spending In Public Safety Market, Region CAGR (%) (2019 – 2027)

Figure 27: Global Digital Spending In Public Safety Market, by Component (2019)

Figure 28: Global Digital Spending In Public Safety Market, by Component (2027)

Figure 29: Global Digital Spending In Public Safety Market, by Solution (2019)

Figure 30: Global Digital Spending In Public Safety Market, by Solution (2027)

Figure 31: Global Digital Spending In Public Safety Market, by End-user (2019)

Figure 32: Global Digital Spending In Public Safety Market, by End-user (2027)

Figure 33: Global Digital Spending In Public Safety Market, by Region (2019)

Figure 34: Global Digital Spending In Public Safety Market, by Region (2027)

Figure 35: North America Digital Spending In Public Safety Market, by Component (2019)

Figure 36: North America Digital Spending In Public Safety Market, by Component (2027)

Figure 37: North America Digital Spending In Public Safety Market, by Solution (2019)

Figure 38: North America Digital Spending In Public Safety Market, by Solution (2027)

Figure 39: North America Digital Spending In Public Safety Market, by End-user (2019)

Figure 40: North America Digital Spending In Public Safety Market, by End-user (2027)

Figure 41: North America Digital Spending In Public Safety Market, by Country (2019)

Figure 42: North America Digital Spending In Public Safety Market, by Country (2027)

Figure 43: Europe Digital Spending In Public Safety Market, by Component (2019)

Figure 44: Europe Digital Spending In Public Safety Market, by Component (2027)

Figure 45: Europe Digital Spending In Public Safety Market, by Solution (2019)

Figure 46: Europe Digital Spending In Public Safety Market, by Solution (2027)

Figure 47: Europe Digital Spending In Public Safety Market, by End-user (2019)

Figure 48: Europe Digital Spending In Public Safety Market, by End-user (2027)

Figure 49: Europe Digital Spending In Public Safety Market, by Country (2019)

Figure 50: Europe Digital Spending In Public Safety Market, by Country (2027)

Figure 51: Asia Pacific Digital Spending In Public Safety Market, by Component (2019)

Figure 52: Asia Pacific Digital Spending In Public Safety Market, by Component (2027)

Figure 53: Asia Pacific Digital Spending In Public Safety Market, by Solution (2019)

Figure 54: Asia Pacific Digital Spending In Public Safety Market, by Solution (2027)

Figure 55: Asia Pacific Digital Spending In Public Safety Market, by End-user (2019)

Figure 56: Asia Pacific Digital Spending In Public Safety Market, by End-user (2027)

Figure 57: Asia Pacific Digital Spending In Public Safety Market, by Country (2019)

Figure 58: Asia Pacific Digital Spending In Public Safety Market, by Country (2027)

Figure 59: Middle East & Africa Digital Spending In Public Safety Market, by Component (2019)

Figure 60: Middle East & Africa Digital Spending In Public Safety Market, by Component (2027)

Figure 61: Middle East & Africa Digital Spending In Public Safety Market, by Solution (2019)

Figure 62: Middle East & Africa Digital Spending In Public Safety Market, by Solution (2027)

Figure 63: Middle East & Africa Digital Spending In Public Safety Market, by End-user (2019)

Figure 64: Middle East & Africa Digital Spending In Public Safety Market, by End-user (2027)

Figure 65: Middle East & Africa Digital Spending In Public Safety Market, by Country (2019)

Figure 66: Middle East & Africa Digital Spending In Public Safety Market, by Country (2027)

Figure 67: South America Digital Spending In Public Safety Market, by Component (2019)

Figure 68: South America Digital Spending In Public Safety Market, by Component (2027)

Figure 69: South America Digital Spending In Public Safety Market, by Solution (2019)

Figure 70: South America Digital Spending In Public Safety Market, by Solution (2027)

Figure 71: South America Digital Spending In Public Safety Market, by End-user (2019)

Figure 72: South America Digital Spending In Public Safety Market, by End-user (2027)

Figure 73: South America Digital Spending In Public Safety Market, by Country (2019)

Figure 74: South America Digital Spending In Public Safety Market, by Country (2027)