The global digital commerce platform industry is at an important juncture on its journey to attaining a sustainable revenue mark. The presence of a sound e-commerce industry complements digital commerce, creating a bilateral pathway for revenue generation and profit sharing. Development of robust e-commerce channels has given increased confidence to the masses to conduct all their commerce operations across virtual channels. The trend of virtual shopping has gained momentum as sellers provide quality assurance to the end-users. Furthermore, the busy lifestyles of a large population leave little room for offline shopping. In this scenario, online shopping has emerged as sound and effective mode of buying and subscribing to services.

Online shopping experiences are enhanced through improved user experiences and user interfaces across buying platforms. Therefore, digital sellers are focusing on driving ease in buying across online or virtual channels. This has also played a central role in market expansion.

The global digital commerce platform market is currently being driven by the rise in use of consumer electronics and internet connectivity, which is the primary factor facilitating the growth of digital media and the ecommerce sector. The global digital commerce platform market is also finding a massive scope of growth due to the evolving cloud computing services that are making it easier and faster for consumers to avail digital content. The players in this market are also focusing on Asia Pacific for a greater scope of opportunities due to the current digital revolution in this region, coupled with the giant consumer electronics users in China. However, the global digital commerce platform market is being restricted by factors such as a lack of marketing skills shown by players due to the nascent stage of the market, and the growing safety and security concerns regarding the use of spyware and malware.

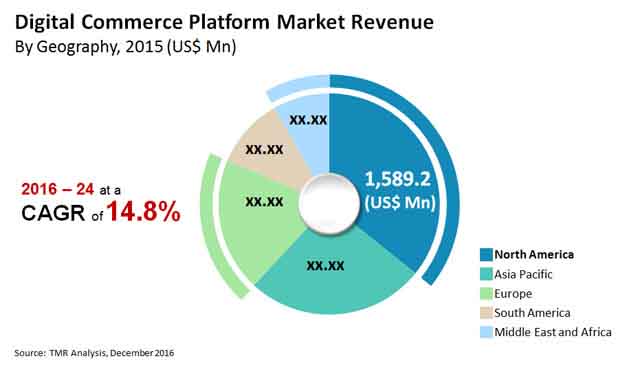

The global digital commerce platform market was valued at US$4.44 bn in 2015. After expanding at a CAGR of 14.8% within a forecast period from 2016 to 2024, this market is expected to reach US$15.30 bn by the end of 2024.

The global digital commerce platform market can be segmented on the basis of regions, into North America, Europe, Asia Pacific, The Middle East and Africa, and Latin America. Of these, North America provided the market with the leading demand volume as well as revenue generation for 2015. The market for digital commerce platforms in North America is projected at a CAGR of 13.7% within a forecast period from 2016 to 2024. This region owes its lead to a massive existing base of digital media users, powered by a high use of smartphones and high-speed data networks and internet services. This region is currently showing a phenomenal growth within the global digital commerce platform market in its B2B business model segment, while the North American retail segment has already been a prominent source of revenue for the market players.

In 2015, Asia Pacific came second in terms of revenue generation in the global digital commerce platform market, followed by Europe, South America, and the Middle East and Africa respectively. The digital commerce platform market in Asia Pacific is growing at a very fast pace due to changing consumer preferences and improved path to purchase due to the growing use of digital commerce platforms by its urban populace. Asia Pacific is also expected to maintain its growth due to a growing demand for advanced digital commerce technologies.

Based on business model, the global digital commerce platform market is segmented into business to consumer, consumer to business, business to business, and consumer to consumer. In 2015, business to consumer segment was a highly preferred business model in digital commerce and accounted for close to 68.5% of the total market’s revenue. Based on deployment models, the market for digital commerce platform is segmented into on-premise, software as a service, fully managed and open source. In 2015, the on-premise segment held the leading share of 68.2% of the total revenue. This segment is also expected to retain its lead over the coming years. Software as a service is expected to show a high grade of promise in the global digital commerce platform market and is likely to continue expanding at the leading CAGR in terms of revenue from 2016 to 2024.

In 2015, the leaders of the global warehouse management systems market included IBM Corporation, Hybris AG, Oracle Corporation, Magento, Inc., Demandware, Inc., CloudCraze Software LLC, Digital River, Inc., NetSuite Inc., Apttus Corporation, and Elastic Path Software Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Digital Commerce Platform Market

4. Digital Commerce Platform market Analysis, 2014 – 2024 (US$ Mn)

4.1. Introduction

4.1.1. Definition

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Digital Commerce Platform Market Analysis and Forecasts, 2014 – 2024

4.3.1. Market Revenue Projections (US$ Mn)

4.4. Market Outlook

5. Global Digital Commerce Platform Market Analysis and Forecast By Business Model

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Global Digital Commerce Platform Market Size (US$ Mn) and Forecast By Business Model, 2014 – 2024

5.3.1. Business-to-Consumer (B2C)

5.3.2. Business-to-Business (B2B)

5.3.3. Consumer-to-Business (C2B)

5.3.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

5.4. Market Attractiveness By Business Model

6. Global Digital Commerce Platform Market Analysis and Forecast By Deployment Model

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Digital Commerce Platform Market Size (US$ Mn) and Forecast By Deployment Model, 2014 – 2024

6.3.1. On-premises

6.3.2. Software as a service (SaaS)

6.3.3. Fully Managed

6.3.4. Open Source Technology Comparison Matrix

6.4. Market Attractiveness By Deployment Model

7. Global Digital Commerce Platform Market Analysis and Forecast By End-users

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Digital Commerce Platform Market Size (US$ Mn) and Forecast By End-users, 2014 – 2024

7.3.1. BFSI

7.3.2. Retail

7.3.3. IT and Telecommunication

7.3.4. Airline and Travel

7.3.5. Others

7.4. Market Attractiveness By End-users

8. Global Digital Commerce Platform Market Analysis and Forecast By Region

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Digital Commerce Platform Market Size (US$ Mn) and Forecast By region, 2014 – 2024

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East and Africa

8.3.5. South America

8.4. Market Attractiveness By Region

9. North America Digital Commerce Platform Market Analysis, 2014 – 2024 (US$ Mn)

9.1. Key Findings

9.2. North America Digital Commerce Platform Market Analysis, By Business Model, 2014 – 2024 (US$ Mn)

9.2.1. Business-to-Consumer (B2C)

9.2.2. Business-to-Business (B2B)

9.2.3. Consumer-to-Business (C2B)

9.2.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

9.3. North America Digital Commerce Platform Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

9.3.1. On-premises

9.3.2. Software as a service (SaaS)

9.3.3. Fully Managed

9.3.4. Open Source Technology Comparison Matrix

9.4. North America Digital Commerce Platform Market Analysis, By End-users, 2014 – 2024 (US$ Mn)

9.4.1. BFSI

9.4.2. Retail

9.4.3. IT and Telecommunication

9.4.4. Airline and Travel

9.4.5. Others

9.5. North America Digital Commerce Platform Market Analysis, By Country, 2014 – 2024 (US$ Mn)

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By country

9.6.2. By Business Model

9.6.3. By Deployment Model

9.6.4. By End-users

10. Europe Digital Commerce Platform Market Analysis, 2014 – 2024 (US$ Mn)

10.1. Key Findings

10.2. Europe Digital Commerce Platform Market Analysis, By Business Model, 2014 – 2024 (US$ Mn)

10.2.1. Business-to-Consumer (B2C)

10.2.2. Business-to-Business (B2B)

10.2.3. Consumer-to-Business (C2B)

10.2.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

10.3. Europe Digital Commerce Platform Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

10.3.1. On-premises

10.3.2. Software as a service (SaaS)

10.3.3. Fully Managed

10.3.4. Open Source Technology Comparison Matrix

10.4. Europe Digital Commerce Platform Market Analysis, By End-users, 2014 – 2024 (US$ Mn)

10.4.1. BFSI

10.4.2. Retail

10.4.3. IT and Telecommunication

10.4.4. Airline and Travel

10.4.5. Others

10.5. Europe Digital Commerce Platform Market Analysis, By Country, 2014 – 2024 (US$ Mn)

10.5.1. Germany

10.5.2. France

10.5.3. UK

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By country

10.6.2. By Business Model

10.6.3. By Deployment Model

10.6.4. By End-users

11. Asia Pacific Digital Commerce Platform Market Analysis, 2014 – 2024 (US$ Mn)

11.1. Key Findings

11.2. Asia Pacific Digital Commerce Platform Market Analysis, By Business Model, 2014 – 2024 (US$ Mn)

11.2.1. Business-to-Consumer (B2C)

11.2.2. Business-to-Business (B2B)

11.2.3. Consumer-to-Business (C2B)

11.2.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

11.3. Asia Pacific Digital Commerce Platform Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

11.3.1. On-premises

11.3.2. Software as a service (SaaS)

11.3.3. Fully Managed

11.3.4. Open Source Technology Comparison Matrix

11.4. Asia Pacific Digital Commerce Platform Market Analysis, By End-users, 2014 – 2024 (US$ Mn)

11.4.1. BFSI

11.4.2. Retail

11.4.3. IT and Telecommunication

11.4.4. Airline and Travel

11.4.5. Others

11.5. Asia Pacific Digital Commerce Platform Market Analysis, By Country, 2014 – 2024 (US$ Mn)

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. Australia

11.5.5. Rest of Asia-pacific

11.6. Market Attractiveness Analysis

11.6.1. By country

11.6.2. By Business Model

11.6.3. By Deployment Model

11.6.4. By End-users

12. Middle-East and Africa (MEA) Digital Commerce Platform Market Analysis, 2014 – 2024 (US$ Mn)

12.1. Key Findings

12.2. Middle East and Africa Digital Commerce Platform Market Analysis, By Business Model, 2014 – 2024 (US$ Mn)

12.2.1. Business-to-Consumer (B2C)

12.2.2. Business-to-Business (B2B)

12.2.3. Consumer-to-Business (C2B)

12.2.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

12.3. Middle East and Africa Digital Commerce Platform Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

12.3.1. On-premises

12.3.2. Software as a service (SaaS)

12.3.3. Fully Managed

12.3.4. Open Source Technology Comparison Matrix

12.4. Middle East and Africa Digital Commerce Platform Market Analysis, By End-users, 2014 – 2024 (US$ Mn)

12.4.1. BFSI

12.4.2. Retail

12.4.3. IT and Telecommunication

12.4.4. Airline and Travel

12.4.5. Others

12.5. MEA Digital Commerce Platform Market Analysis, By Country, 2014 – 2024 (US$ Mn)

12.5.1. UAE

12.5.2. Saudi Arabia

12.5.3. South Africa

12.5.4. Rest of MEA

12.6. Market Attractiveness Analysis

12.6.1. By country

12.6.2. By Business Model

12.6.3. By Deployment Model

12.6.4. By End-users

13. South America Digital Commerce Platform Market Analysis, 2014 – 2024 (US$ Mn)

13.1. Key Findings

13.2. South America Digital Commerce Platform Market Analysis, By Business Model, 2014 – 2024 (US$ Mn)

13.2.1. Business-to-Consumer (B2C)

13.2.2. Business-to-Business (B2B)

13.2.3. Consumer-to-Business (C2B)

13.2.4. Consumer-to-Consumer (C2C) also known as Peer-to-Peer or (P2P)

13.3. South America Digital Commerce Platform Market Analysis, By Deployment Model, 2014 – 2024 (US$ Mn)

13.3.1. On-premises

13.3.2. Software as a service (SaaS)

13.3.3. Fully Managed

13.3.4. Open Source Technology Comparison Matrix

13.4. South America Digital Commerce Platform Market Analysis, By End-users, 2014 – 2024 (US$ Mn)

13.4.1. BFSI

13.4.2. Retail

13.4.3. IT and Telecommunication

13.4.4. Airline and Travel

13.4.5. Others

13.5. South America Digital Commerce Platform Market Analysis, By Country, 2014 – 2024 (US$ Mn)

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By country

13.6.2. By Business Model

13.6.3. By Deployment Model

13.6.4. By End-users

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Share Analysis By Company (2015)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy and SWOT Analysis)

14.3.1. IBM Corporation

14.3.1.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.1.2. Market Presence, By Segment and Geography

14.3.1.3. Revenue and Operating Profits

14.3.1.4. Strategy and Historical Roadmap

14.3.1.5. SWOT Analysis

14.3.2. Oracle Corporation

14.3.2.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.2.2. Market Presence, By Segment and Geography

14.3.2.3. Revenue and Operating Profits

14.3.2.4. Strategy and Historical Roadmap

14.3.2.5. SWOT Analysis

14.3.3. Hybris AG

14.3.3.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.3.2. Market Presence, By Segment and Geography

14.3.3.3. Revenue and Operating Profits

14.3.3.4. Strategy and Historical Roadmap

14.3.3.5. SWOT Analysis

14.3.4. Demandware, Inc.

14.3.4.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.4.2. Market Presence, By Segment and Geography

14.3.4.3. Revenue and Operating Profits

14.3.4.4. Strategy and Historical Roadmap

14.3.4.5. SWOT Analysis

14.3.5. Magento, Inc.

14.3.5.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.5.2. Market Presence, By Segment and Geography

14.3.5.3. Revenue and Operating Profits

14.3.5.4. Strategy and Historical Roadmap

14.3.5.5. SWOT Analysis

14.3.6. Digital River, Inc.

14.3.6.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.6.2. Market Presence, By Segment and Geography

14.3.6.3. Revenue and Operating Profits

14.3.6.4. Strategy and Historical Roadmap

14.3.6.5. SWOT Analysis

14.3.7. CloudCraze Software LLC

14.3.7.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.7.2. Market Presence, By Segment and Geography

14.3.7.3. Revenue and Operating Profits

14.3.7.4. Strategy and Historical Roadmap

14.3.7.5. SWOT Analysis

14.3.8. Apttus Corporation

14.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.8.2. Market Presence, By Segment and Geography

14.3.8.3. Revenue and Operating Profits

14.3.8.4. Strategy and Historical Roadmap

14.3.8.5. SWOT Analysis

14.3.9. NetSuite Inc.

14.3.9.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.9.2. Market Presence, By Segment and Geography

14.3.9.3. Revenue and Operating Profits

14.3.9.4. Strategy and Historical Roadmap

14.3.9.5. SWOT Analysis

14.3.10. Elastic Path Software Inc.

14.3.10.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.10.2. Market Presence, By Segment and Geography

14.3.10.3. Revenue and Operating Profits

14.3.10.4. Strategy and Historical Roadmap

14.3.10.5. SWOT Analysis

List of Tables

Table 1: Global Digital Commerce Platform Market Forecast, By Business Model, 2014–2024 (US$ Mn)

Table 2: Global Digital Commerce Platform Market Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 3: Global Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 4: Global Digital Commerce Platform Market Forecast, By Region, 2014–2024 (US$ Mn)

Table 5: North America Digital Commerce Platform Market Size Forecast, By Business Model, 2014–2024 (US$ Mn)

Table 6: North America Digital Commerce Platform Market Size Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 7: North America Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 8: Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 9: Europe Digital Commerce Platform Market Size Forecast, By Business Model, 2014–2024 (US$ Mn)

Table 10: Europe Digital Commerce Platform Market Size Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 11: Europe Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 12: Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 13: Asia Pacific Digital Commerce Platform Market Size Forecast, By Business Model, 2014–2024 (US$ Mn)

Table 14: Asia Pacific Digital Commerce platform Market Size Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 15: Asia Pacific Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 16: Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 17: MEA Digital Commerce Platform Market Size Forecast, By Business Model, 2014–2024 (US$ Mn)

Table 18: MEA Digital Commerce Platform Market Size Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 19: MEA Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 20: Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 21: South America Digital Commerce Platform Market Size Forecast, By Business model, 2014–2024 (US$ Mn)

Table 22: South America Digital Commerce Platform Market Size Forecast, By Deployment Model, 2014–2024 (US$ Mn)

Table 23: South America Digital Commerce Platform Market Size Forecast, By End-users, 2014–2024 (US$ Mn)

Table 24: Market Size (US$ Mn) Forecast by Country, 2014 - 2024

List of Figures

Figure 1: Market Revenue Projections, 2014 - 2024 (US$ Mn)

Figure 2: Global Digital Commerce Platform Market Value Share Analysis, By Business Model, 2016 and 2024

Figure 3: Digital Commerce Platform Market Attractiveness Analysis, By Business Model

Figure 4: Global Digital Commerce Platform Market Value Share Analysis, By Deployment Model, 2016 and 2024

Figure 5: On-premise Graph

Figure 6: Software as a service Graph

Figure 7: Fully Managed Services Graph

Figure 8: Digital Commerce Platform Market Attractiveness Analysis, By Deployment Model

Figure 9: Global Digital Commerce Platform Market Value Share Analysis, By End-users, 2016 and 2024

Figure 10: Hotel Graph

Figure 11: System Catering Graph

Figure 12: Hotel Graph

Figure 13: System Catering Graph

Figure 14: Hotel Graph

Figure 15: Refrigerated Counter Market Attractiveness Analysis, By End-user

Figure 16: Refrigerated Counter Market Attractiveness Analysis, By Region

Figure 17: North America Refrigerated Counter Market Revenue (US$ Mn) Forecast, 2016 – 2024

Figure 18: North America Refrigerated Counter Market Revenue and Y-O-Y Growth Projection, 2016 – 2024

Figure 19: North America Digital Commerce Platform Market Revenue Share Analysis, By Business Model, 2016 and 2024

Figure 20: North America Digital Commerce Platform Market Value Share Analysis, By Deployment Model, 2016 and 2024

Figure 21: North America Digital Commerce Platform Market Value Share Analysis, By End-users, 2016 and 2024

Figure 22: North America Digital Commerce Platform Market Attractiveness Analysis, By Business Model

Figure 23: North America Digital Commerce Platform Market Attractiveness Analysis, By End-user

Figure 24: North America Digital Commerce Platform Market Attractiveness Analysis, By Country

Figure 25: Europe Digital Commerce Platform Market Revenue (US$ Mn) Forecast, 2016 – 2024

Figure 26: Europe Digital Commerce Platform Market Revenue Y-o-Y Growth Projection, 2016 – 2024

Figure 27: Europe Digital Commerce Platform Market Revenue Share Analysis, By Business Model, 2016 and 2024

Figure 28: Europe Digital Commerce Platform Market Revenue Share Analysis, By Deployment Model, 2016 and 2024

Figure 29: Europe Digital Commerce Platform Market Value Share Analysis, By End-users, 2016 and 2024

Figure 30: Europe Digital Commerce Platform Market Attractiveness Analysis, By Business Model

Figure 31: Europe Digital Commerce Platform Market Attractiveness Analysis, By End-users

Figure 32: Europe Digital Commerce Platform Market Attractiveness Analysis, By Country

Figure 33: Asia Pacific Digital Commerce Platform Market Revenue (US$ Mn) Forecast, 2016 – 2024

Figure 34: Asia Pacific Digital Commerce Platform Market Revenue Y-o-Y Growth Projection, 2016 – 2024

Figure 35: Asia Pacific Digital Commerce Market Revenue Share Analysis, By Business model, 2016 and 2024

Figure 36: Asia Pacific Digital Commerce Platform Market Value Share Analysis, By Deployment Model, 2016 and 2024

Figure 37: Asia Pacific Refrigerated Counter Market Value Share Analysis, By End-user, 2016 and 2024

Figure 38: Asia Pacific Digital Commerce Platform Market Attractiveness Analysis, By Business Model

Figure 39: Asia Pacific Digital Commerce Platform Market Attractiveness Analysis, By End-user

Figure 40: Asia Pacific Digital Commerce Platform Market Attractiveness Analysis, By Country

Figure 41: MEA Digital Commerce Platform Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2016 – 2024

Figure 42: MEA Digital Commerce platform Market Revenue and Volume Y-o-Y Growth Projection, 2016 – 2024

Figure 43: MEA Digital Commerce Platform Market Revenue Share Analysis, By Business Model, 2016 and 2024

Figure 44: MEA Digital Commerce Platform Market Value Share Analysis, By Deployment Model, 2016 and 2024

Figure 45: MEA Digital Commerce Platform Market Value Share Analysis, By End-users, 2016 and 2024

Figure 46: MEA Digital Commerce Platform Market Attractiveness Analysis, By Business model

Figure 47: MEA Digital Commerce Platform Market Attractiveness Analysis, By End-user

Figure 48: MEA Digital Commerce Market Attractiveness Analysis, By Country

Figure 49: South America Digital Commerce Platform Market Revenue (US$ Mn) Forecast, 2016 – 2024

Figure 50: South America Digital Commerce Platform Market Revenue Y-o-Y Growth Projection, 2016 – 2024

Figure 51: South America Refrigerated Counter Market Revenue Share Analysis, By Product, 2016 and 2024

Figure 52: South America Digital Commerce Platform Market Revenue Share Analysis, By Deployment Model 2016 and 2024

Figure 53: South America Refrigerated Counter Market Value Share Analysis, By End-user, 2016 and 2024

Figure 54: South America Refrigerated Counter Market Attractiveness Analysis, By Product

Figure 55: South America Refrigerated Counter Market Attractiveness Analysis, By Industry End-user

Figure 56: South America Refrigerated Counter Market Attractiveness Analysis, By Country

Figure 57: Global Digital Commerce Platform Market Share Analysis (2015)