Global Digital Certificates and Public Key Infrastructure Market: Snapshot

The global market for digital certificates and public key infrastructure has been witnessing a healthy rise, thanks to the improved operational efficiency at reduced costs and the enhanced security and controlled workflow associated with digital certificates and public key infrastructure. Over the coming years, the global digital certificates and public key infrastructure market is likely to witness substantial rise, expanding at an exponential CAGR of 23.60% between 2017 and 2025. The opportunity in this market is projected to rise from US$1.95 bn in 2016 to US$12.90 bn by the end of 2025.

Although, the market’s future looks bright but the lack of awareness and technical competency linked with digital certificates may limit its growth over the next few years. The incompatibility among various formulation techniques, dearth of standardization, and the various ambiguities in regulations are also expected to deter the market from progressing steadily in the near future.

Software Solutions to Continue Reporting Strong Demand

Hardware and software are the two main types of technical solutions provided in the worldwide digital certificates and public key infrastructure market. Software solutions, which provide content validation to the electronic documents, have been leading the global market and are expected to remain on the top over the forthcoming years. With the increasing uptake of such software solutions, this segment is anticipated to witness substantial growth in the near future, ensuring its dominance.

Digital certificates and public key infrastructure services are deployed predominantly on-premise or on cloud. Currently, on-premise deployment model is much popular than the cloud-based model. However, with the growing internet penetration, the letter, in which cloud-hosting signing services are utilized to sign the documents digitally, is expected to overtake the former over the forthcoming years.

Continued Dominance of North America to be Witnessed in Future

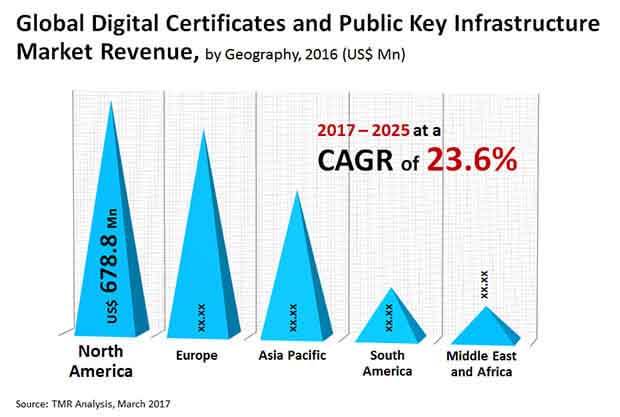

North America, Asia Pacific, Europe, the Middle East and Africa, and South America are the prominent regional markets for digital certificates and public key infrastructure across the world. North America emerged as the dominant regional market among these in 2016 with a contribution of US$678.8 mn to the overall revenue generated in this market that year. Researchers expect this regional market to continue its dominance over the next few years. The presence of a large pool of leading players, such as Verisign and Comodo, and major browser makers, such as Apple and Google, in this region is likely to influence the North America market for digital certificates and public key infrastructure substantially in the near future. The U.S. and Canada have surfaced as the key domestic markets for digital certificates and public key infrastructure in North America.

Among other regional markets, Europe is expected to witness a significantly higher progress in terms of size as well as revenue over the forthcoming years, thanks to the rising number of certificate authorities and the growing Internet penetration in this region. Germany, France, the U.K., and advanced economies of Western Europe are expected to boost the Europe market for digital certificates and public key infrastructure considerably in the years to come on the grounds of the increasing number of web domains and certification authorities in this region.

GMO GlobalSign Inc., GoDaddy Group, Verisign Inc., Gemalto N.V., Comodo Group Inc., Signix Inc., Ascertia, Secured Signing Ltd., Docusign Inc., Identrust Inc., Kofax Ltd., Entrust Datacard Corp. are some of the key players operating in the global digital certificates and public key infrastructure market.

Rise in the Number of Remote Workers due to Covid-19 to Boost Digital Certificates and Public Key Infrastructure Market

The industry is expected to expand due to rising consumer demand for digital certificates that enable businesses to secure records through encryption, validate users through these certificates, and digitally sign certificates. The growing need for digital security to protect enterprise networks has stemmed from increasing digitalization throughout multiple sectors. The growing industry demand to cut the price of authentication across numerous industries, such as e-commerce, healthcare, and banking is likely to drive the global digital certificates and public key infrastructure market in near future.

The ongoing COVID-19 epidemic raised the number of remote workers using their end-point computers to access business infrastructure. The growing need to secure business resources from illegal access is likely to have a positive effect on the growth of the global digital certificates and public key infrastructure market in near future.

Cloud-based Technology Holds Immense Promise in the Future Despite Current Huge Popularity of On-premise System

Cyber attacks on multiple confidential healthcare data have become more vulnerable as the number of linked healthcare devices has grown. Every year, medical system flaws cause major losses in the healthcare industry. Through protecting the authentication of individuals, applications, and computers, public key encryption technologies is likely to play an important role in aiding the healthcare industry. Rising demand from the healthcare industry is anticipated to foster development of the global digital certificates and public key infrastructure market in near future.

The majority of digital certificates and public key infrastructure systems are implemented on the cloud system or on-premises. As of now, on-premise deployment is much more common as compared to cloud deployment. However, as the internet becomes more widely used, the cloud-based model, which uses cloud-based signature platforms to digitally sign papers, is expected to replace the on premise system in the coming years. While the prospects of the global digital certificates and public key infrastructure market appear promising, the shortage of knowledge and technological competency associated with digital certificates could limit its development. Numerous regulatory ambiguities, lack of standardization, and Incompatibility between different formulation processes are all likely to slow the market's growth in the foreseeable future.

Digital certificates and public key infrastructure market is expected to reach US$12.90 bn by the end of 2025

Digital certificates and public key infrastructure market will rise at a remarkable CAGR of 23.60% from 2017 to 2025

Digital certificates and public key infrastructure market is driven by growing industry demand to cut the price of authentication across numerous industries, such as e-commerce, healthcare, and banking

North America accounted for a major share of the global digital certificates and public key infrastructure market

Key players in the global digital certificates and public key infrastructure market include GMO GlobalSign Inc., GoDaddy Group, Verisign Inc., Gemalto N.V., Comodo Group Inc., Signix Inc., Ascertia, Secured Signing Ltd.

1. Preface

1.1. Report Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Digital Certificates and Public Key Infrastructure Market

4. Market Overview

4.1. Key Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Global Digital Certificates and Public Key Infrastructure Market Analysis and Forecasts, 2015 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Key Findings

4.6. Key Trends

4.7. Porter’s Five Force Analysis

4.8. Market Outlook

5. Global Digital Certificates and Public Key Infrastructure Market Analysis and Forecasts, By Solution

5.1. Definition

5.2. Market Size (US$ Mn) Forecast By Deployment Model 2015 – 2025

5.2.1. Hardware

5.2.2. Software

6. Global Digital Certificates and Public Key Infrastructure Market Analysis and Forecasts, By Deployment Model

6.1. Definition

6.2. Market Size (US$ Mn) Forecast By Deployment Model 2015 – 2025

6.2.1. Cloud-based

6.2.2. On-premise

7. Global Digital Certificates and Public Key Infrastructure Market Analysis and Forecasts, By Application

7.1. Market Size (US$ Mn) Forecast By Application 2015 – 2025

7.1.1. Banking, Financial Services, and Insurance (BFSI)

7.1.2. Real Estate

7.1.3. Education and Research

7.1.4. Healthcare and Life Sciences

7.1.5. Human Resources

7.1.6. Legal

7.1.7. Manufacturing

7.1.8. Government and Defense

7.1.9. Others

8. Global Digital Certificates and Public Key Infrastructure Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Key Trends

8.3. Market Size (US$ Mn) Forecast By Region, 2015 – 2025

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East and Africa

8.3.5. South America

8.4. Market Attractiveness

8.4.1. By Solution

8.4.2. By Deployment Model

8.4.3. By Application

8.4.4. By Region

9. North America Digital Certificates and Public Key Infrastructure Market Analysis and Forecast

9.1. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

9.1.1. Hardware

9.1.2. Software

9.2. Market Size (US$ Mn) Forecast By Deployment Model, 2015 – 2025

9.2.1. Cloud-based

9.2.2. On-premise

9.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

9.3.1. Banking, Financial Services, and Insurance (BFSI)

9.3.2. Real Estate

9.3.3. Education and Research

9.3.4. Healthcare and Life Sciences

9.3.5. Human Resources

9.3.6. Legal

9.3.7. Manufacturing

9.3.8. Government and Defense

9.3.9. Others

9.4. Market Size (US$ Mn) Forecast By Country, 2017 – 2025

9.4.1. United States

9.4.2. Canada

9.4.3. Rest of North America

9.5. Market Attractiveness Analysis

9.5.1. By Solution

9.5.2. By Deployment Model

9.5.3. By Application

9.5.4. By Country

10. Europe Digital Certificates and Public Key Infrastructure Market Analysis and Forecast

10.1. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

10.1.1. Hardware

10.1.2. Software

10.2. Market Size (US$ Mn) Forecast By Deployment Model, 2015 – 2025

10.2.1. Cloud-based

10.2.2. On-premise

10.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

10.3.1. Banking, Financial Services, and Insurance (BFSI)

10.3.2. Real Estate

10.3.3. Education and Research

10.3.4. Healthcare and Life Sciences

10.3.5. Human Resources

10.3.6. Legal

10.3.7. Manufacturing

10.3.8. Government and Defense

10.3.9. Others

10.4. Market Size (US$ Mn) Forecast By Country, 2017 – 2025

10.4.1. Germany

10.4.2. France

10.4.3. United Kingdom

10.4.4. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Solution

10.5.2. By Deployment Model

10.5.3. By Application

10.5.4. By Country

11. Asia Pacific Digital Certificates and Public Key Infrastructure Market Analysis and Forecast

11.1. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

11.1.1. Hardware

11.1.2. Software

11.2. Market Size (US$ Mn) Forecast By Deployment Model, 2015 – 2025

11.2.1. Cloud-based

11.2.2. On-premise

11.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

11.3.1. Banking, Financial Services, and Insurance (BFSI)

11.3.2. Real Estate

11.3.3. Education and Research

11.3.4. Healthcare and Life Sciences

11.3.5. Human Resources

11.3.6. Legal

11.3.7. Manufacturing

11.3.8. Government and Defense

11.3.9. Others

11.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

11.4.1. China

11.4.2. Japan

11.4.3. Australia

11.4.4. Rest of APAC

11.5. Market Attractiveness Analysis

11.5.1. By Solution

11.5.2. By Deployment Model

11.5.3. By Application

11.5.4. By Country

12. Middle East And Africa Digital Certificates and Public Key Infrastructure Market Analysis and Forecast

12.1. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

12.1.1. Hardware

12.1.2. Software

12.2. Market Size (US$ Mn) Forecast By Deployment Model, 2015 – 2025

12.2.1. Cloud-based

12.2.2. On-premise

12.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

12.3.1. Banking, Financial Services, and Insurance (BFSI)

12.3.2. Real Estate

12.3.3. Education and Research

12.3.4. Healthcare and Life Sciences

12.3.5. Human Resources

12.3.6. Legal

12.3.7. Manufacturing

12.3.8. Government and Defence

12.3.9. Others

12.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

12.4.1. UAE

12.4.2. South Africa

12.4.3. Saudi Arabia

12.4.4. Rest of Middle East

12.5. Market Attractiveness Analysis

12.5.1. By Solution

12.5.2. By Deployment Model

12.5.3. By Application

12.5.4. By Country

13. South America Digital Certificates and Public Key Infrastructure Market Analysis and Forecast

13.1. Market Size (US$ Mn) Forecast By Solution, 2015 – 2025

13.1.1. Hardware

13.1.2. Software

13.2. Market Size (US$ Mn) Forecast By Deployment Model, 2015 – 2025

13.2.1. Cloud-based

13.2.2. On-premise

13.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

13.3.1. Banking, Financial Services, and Insurance (BFSI)

13.3.2. Real Estate

13.3.3. Education and Research

13.3.4. Healthcare and Life Sciences

13.3.5. Human Resources

13.3.6. Legal

13.3.7. Manufacturing

13.3.8. Government and Defense

13.3.9. Others

13.4. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

13.4.1. Brazil

13.4.2. Argentina

13.4.3. Rest of South America

13.5. Market Attractiveness Analysis

13.5.1. By Solution

13.5.2. By Deployment Model Industry

13.5.3. By Application

13.5.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles

14.3.1. GMO GlobalSign, Inc.

14.3.1.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.1.2. Market Presence, By Segment.

14.3.1.3. Strategy

14.3.1.4. Revenue and Operating Profits

14.3.1.5. SWOT Analysis

14.3.2. GoDaddy Group

14.3.2.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.2.2. Market Presence, By Segment.

14.3.2.3. Strategy

14.3.2.4. Revenue and Operating Profits

14.3.2.5. SWOT Analysis

14.3.3. Verisign, Inc.

14.3.3.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.3.2. Market Presence, By Segment.

14.3.3.3. Strategy

14.3.3.4. Revenue and Operating Profits

14.3.3.5. SWOT Analysis

14.3.4. Gemalto N.V.

14.3.4.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.4.2. Market Presence, By Segment.

14.3.4.3. Strategy

14.3.4.4. Revenue and Operating Profits

14.3.4.5. SWOT Analysis

14.3.5. Comodo Group, Inc.

14.3.5.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.5.2. Market Presence, By Segment.

14.3.5.3. Strategy

14.3.5.4. Revenue and Operating Profits

14.3.5.5. SWOT Analysis

14.3.6. Signix, Inc.

14.3.6.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.6.2. Market Presence, By Segment.

14.3.6.3. Strategy

14.3.6.4. Revenue and Operating Profits

14.3.6.5. SWOT Analysis

14.3.7. Ascertia

14.3.7.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.7.2. Market Presence, By Segment.

14.3.7.3. Strategy

14.3.7.4. Revenue and Operating Profits

14.3.7.5. SWOT Analysis

14.3.8. Secured Signing Limited

14.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.8.2. Market Presence, By Segment.

14.3.8.3. Strategy

14.3.8.4. Revenue and Operating Profits

14.3.8.5. SWOT Analysis

14.3.9. Docusign Inc.

14.3.9.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.9.2. Market Presence, By Segment.

14.3.9.3. Strategy

14.3.9.4. Revenue and Operating Profits

14.3.9.5. SWOT Analysis

14.3.10. Identrust, Inc.

14.3.10.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.10.2. Market Presence, By Segment.

14.3.10.3. Strategy

14.3.10.4. Revenue and Operating Profits

14.3.10.5. SWOT Analysis

14.3.11. Kofax Limited (A Lexmark Company)

14.3.11.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.11.2. Market Presence, By Segment.

14.3.11.3. Strategy

14.3.11.4. Revenue and Operating Profits

14.3.11.5. SWOT Analysis

14.3.12. Entrust Datacard Corporation

14.3.12.1. Company Details (HQ, Foundation Year, Employee Strength)

14.3.12.2. Market Presence, By Segment.

14.3.12.3. Strategy

14.3.12.4. Revenue and Operating Profits

14.3.12.5. SWOT Analysis

15. Key Takeaways

List of Tables

Table 1: Global Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015–2025

Table 2: Global Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015–2025

Table 3: Global Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015–2025

Table 4: Global Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 5: North America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015 – 2025

Table 6: North America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015 – 2025

Table 7: North America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015 – 2025

Table 8: North America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Country, 2015 – 2025

Table 9: Europe Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015 – 2025

Table 10: Europe Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015 – 2025

Table 11: Europe Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015 – 2025

Table 12: Europe Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Country, 2015 – 2025

Table 13: Asia Pacific Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015 – 2025

Table 14: Asia Pacific Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015 – 2025

Table 15: Asia Pacific Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015 – 2025

Table 16: Asia Pacific Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Country, 2015 – 2025

Table 17: Middle East and Africa Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015 – 2025

Table 18: Middle East and Africa Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015 – 2025

Table 19: Middle East and Africa Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015 – 2025

Table 20: Middle East and Africa Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Country, 2015 – 2025

Table 21: South America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Solution, 2015 – 2025

Table 22: South America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Deployment Model, 2015 – 2025

Table 23: South America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Application, 2015 – 2025

Table 24: South America Digital Certificates and PKI Revenue (US$ Mn) Forecast and CAGR, by Country, 2015 – 2025

List of Figures

Figure 1: Global Digital Certificates and PKI Market Revenue Projection (US$ Mn), 2015 – 2025

Figure 2: Global Digital Certificates and PKI Market Y-o-Y Growth (%) Forecast, 2016 - 2025

Figure 3: Global Digital Certificates and PKI Market Revenue Share (%),by Region, 2015 – 2025

Figure 4: Global Digital Certificates and Public Key Infrastructure Industry CAGR by Solution (2017 – 2025)

Figure 5: Global Digital Certificates and Public Key Infrastructure Industry CAGR by Deployment Model (2017 – 2025)

Figure 6: Global Digital Certificates and Public Key Infrastructure Industry CAGR by Application, Top 5 (2017 – 2025)

Figure 7: Global Digital Certificates and Public Key Infrastructure Industry CAGR by Region (2017 – 2025)

Figure 8: Global Digital Certificates and PKI Revenue and Y-o-Y Growth, by Region – North America, 2015 – 2025, (US$ Mn & %)

Figure 9: Global Digital Certificates and PKI Revenue and Y-o-Y Growth, by Region – Europe, 2015 – 2025, (US$ Mn & %)

Figure 10: Global Digital Certificates and PKI Revenue and Y-o-Y Growth, by Region – APAC, 2015 – 2025, (US$ Mn & %)

Figure 11: Global Digital Certificates and PKI Revenue and Y-o-Y Growth, by Region – MEA, 2015 – 2025, (US$ Mn & %)

Figure 12: Global Digital Certificates and PKI Revenue and Y-o-Y Growth, by Region – South America, 2015 – 2025, (US$ Mn & %)

Figure 13: Global Digital Certificates and PKI Market Attractiveness Analysis, by Solution (2016)

Figure 14: Global Digital Certificates and PKI Market Attractiveness Analysis, by Deployment Model (2016)

Figure 15: Global Digital Certificates and PKI Market Attractiveness Analysis, by Application (2016)

Figure 16: Global Digital Certificates and PKI Market Attractiveness Analysis, by Region (2016)

Figure 17: North America Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – The U.S., 2015 – 2025, (US$ Mn & %)

Figure 18: North America Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Canada, 2015 – 2025, (US$ Mn & %)

Figure 19: North America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Solution (2016)

Figure 20: North America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Application (2016)

Figure 21: North America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Deployment Model (2016)

Figure 22: North America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Country (2016)

Figure 23: Europe Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – U.K., 2015 – 2025, (US$ Mn & %)

Figure 24: Europe Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – France, 2015 – 2025, (US$ Mn & %)

Figure 25: Europe Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Germany, 2015 – 2025, (US$ Mn & %)

Figure 26: Europe Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Solution (2016)

Figure 27: Europe Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Application (2016)

Figure 28: Europe Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Deployment Model (2016)

Figure 29: Europe Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Country (2016)

Figure 30: Asia Pacific Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – China, 2015 – 2025, (US$ Mn & %)

Figure 31: Asia Pacific Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – India, 2015 – 2025, (US$ Mn & %)

Figure 32: Asia Pacific Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Japan, 2015 – 2025, (US$ Mn & %)

Figure 33: Asia Pacific Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Australia, 2015 – 2025, (US$ Mn & %)

Figure 34: Asia Pacific Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Solution (2016)

Figure 35: Asia Pacific Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Application (2016)

Figure 36: Asia Pacific Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Deployment Model (2016)

Figure 37: Asia Pacific Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Country (2016)

Figure 38: MEA Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – UAE, 2015 – 2025, (US$ Mn & %)

Figure 39: MEA Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Saudi Arabia, 2015 – 2025, (US$ Mn & %)

Figure 40: Middle East and Africa Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – South Africa, 2015 – 2025, (US$ Mn & %)

Figure 41: Middle East and Africa Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Solution (2016)

Figure 42: Middle East and Africa Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Application (2016)

Figure 43: Middle East and Africa Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Deployment Model (2016)

Figure 44: Middle East and Africa Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Country (2016)

Figure 45: South America Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Brazil, 2015 – 2025, (US$ Mn & %)

Figure 46: South America Digital Certificates and Public Key Infrastructure Size and Y-o-Y Growth, by Country – Argentina, 2015 – 2025, (US$ Mn & %)

Figure 47: South America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Solution (2016)

Figure 48: South America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Application (2016)

Figure 49: South America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Deployment Model (2016)

Figure 50: South America Digital Certificates and Public Key Infrastructure Attractiveness Analysis, by Country (2016)

Figure 51: Global Digital Certificate & PKI Market Share Analysis, by Company (2016)