The diamond substrate market has been negatively affected during the coronavirus outbreak. Halted businesses, lockdowns, and disruptions in supply chain have caused tremendous losses for the market players in the diamond substrate market across the globe. It is a challenge for market contributors to survive and create value-grab opportunities to increase revenue. Companies in the diamond substrate market are trying to manage supply chain interruptions. The strong presence of companies operating in the diamond substrate market is contributing to the market growth amid COVID-19 pandemic. With the subsiding coronavirus cases in most of the countries, manufacturers are increasing their efforts to ensure business continuity.

Increasing applications of synthetic diamond in different end-use industries is due to its unmatched chemical, physical, and mechanical properties such as high strength, thermal conductivity, resistance to chemical corrosion, high electrical resistivity, and low thermal expansion. Superior dielectric properties of diamond make it excellent material for electronic component. Diamond being one of the hardest metals on earth is used for various industrial applications, and this demand is continuously rising. Increasing applications of synthetic diamond in electronics & semiconductor industry, optical components, and cutting tools drive the global market. Applications in diamond detectors and optical systems creating lucrative revenue streams for manufacturers.

Lab grown diamonds using CVD and HPHT methods are increasing popular among various end-use industries. Chemical Vapor Deposition (CVD) is a technique wherein diamonds can be grown in a controlled environment from a hydrocarbon gas mixture. In a vacuum chamber, a thin seed diamond is placed, filled with gases such as hydrogen and methane, and then subjected to high temperatures. This heat turns the gases into plasma, which help in binding the layers of the diamonds. The increasing demand for CVD diamond substrate from the optical industry is creating income sources for the market players. The CVD diamond is an important component for manufacturing infrared windows, lenses, X-ray windows, cutting tools, machineries, etc. due to its outstanding properties.

The diamond substrate market is expected to expand at a CAGR of 12.9% during the forecast period. The diamond substrate market is projected to reach the valuation of US$ 282.38 Mn by 2031. This growth is due to the increasing adoption of diamond substrate in various end-use industries such as healthcare, telecommunication, power electronics, defense & aerospace, semiconductor industries, etc. The adoption of diamond substrate in thermal applications, heat spreaders, and ionizing radiation detectors is also contributing to the diamond substrate market growth.

The increasing adoption of diamond substrate in various end-use industries in the U.S. and Canada creates growth opportunities for the manufacturers in the diamond substrate market in North America. The increasing R&D activities in diamond is expected to witness significant growth in the diamond substrate market. Industrialization, well-established market players, technological advancements, and the widespread acceptance of diamond substrate in the aerospace & defense sector, power electronics, health care, mechanical applications, etc. is further driving the diamond substrate market in the region. The diamond substrate market is also driven by the increasing government initiatives by investing in manufacturing units in North America.

Analysts’ Viewpoint

Companies in the diamond substrate market are accelerating their manufacturing processes to unlock revenue opportunities to obtain competitive benefits. Market stakeholders are extending their services to gain a competitive edge after the COVID-19 breakdown. Industrial growth and increasing applications of diamond substrate in various end-use industries such as medical, electronics & semiconductor, cutting tools applications, etc. are driving the growth of the market in the upcoming years. However, huge capital investment, high costs of equipment, and rising manufacturing costs are the factors hampering the growth of the diamond substrate market. Researchers and stakeholders in the global market should join forces to overcome challenges and fulfill the demand from end-users.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 78.01 Mn |

|

Market Forecast Value in 2031 |

US$ 282.38 Mn |

|

Growth Rate (CAGR) |

12.9% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market analysis |

It includes cross segment analysis at global as well as regional level. Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) or word + Excel |

|

Regions Covered |

|

|

Countries Covered |

|

|

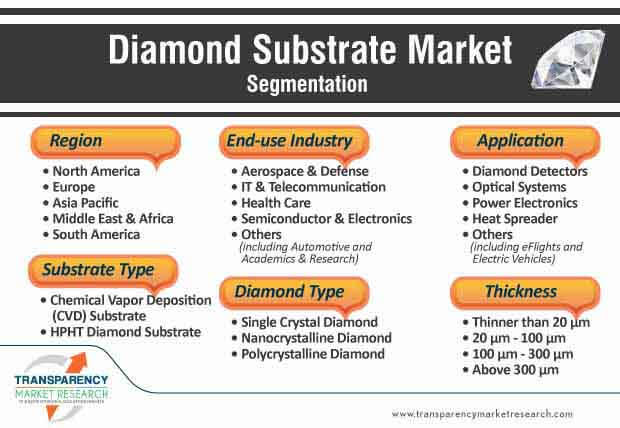

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The Diamond Substrate Market expanding at the CAGR of 12.9% between 2021 and 2031

Increase in Demand for Diamonds in Medical Devices and Equipment is the Key Driver of Diamond Substrate Market.

The Diamond Substrate Market size is estimated to worth US$ 282.38 Mn by 2031.

Major players operating in the global diamond substrate market are Blue Wave Semiconductor, AKHAN Semiconductor Inc., Applied Diamond Inc., CIVIDEC, Diamond Microwave Limited, Diamond SA, Electro Optical Components, Inc., Element Six, IIa Technologies Pte. Ltd., II-VI Incorporated, New Diamond Technology LCC, Seki Diamond Systems, Sumitomo Electric Industries, Ltd, and WD Lab Grown Diamonds.

North America is the leading region with the largest market share.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Diamond Substrate Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macroeconomic Factors

3.2. Key Market Indicators

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.5.1. Demand Side

3.5.2. Supply Side

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Synthetic Diamond Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact Analysis

5. Global Diamond Substrate Market Analysis, by Diamond Type

5.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

5.1.1. Single Crystal Diamond

5.1.2. Nanocrystalline Diamond

5.1.3. Polycrystalline Diamond

5.2. Market Attractiveness Analysis, by Diamond Type

6. Global Diamond Substrate Market Analysis, by Substrate Type

6.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

6.1.1. Chemical Vapor Deposition (CVD) Substrate

6.1.2. HPHT Diamond Substrate

6.2. Market Attractiveness Analysis, by Substrate Type

7. Global Diamond Substrate Market Analysis, by Thickness

7.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

7.1.1. Thinner than 20 µm

7.1.2. 20 µm - 100 µm

7.1.3. 100 µm - 300 µm

7.1.4. Above 300 µm

7.2. Market Attractiveness Analysis, by Thickness

8. Global Diamond Substrate Market Analysis, by Application

8.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

8.1.1. Diamond Detectors

8.1.2. Optical Systems

8.1.2.1. Multi-wavelength Spectroscopy

8.1.2.2. Microwave

8.1.2.3. High Power Laser

8.1.2.4. Optical Windows

8.1.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

8.1.3. Power Electronics

8.1.4. Heat Spreader

8.1.5. Others (including eFlights and Electric Vehicles)

8.2. Market Attractiveness Analysis, by Application

9. Global Diamond Substrate Market Analysis, by End-use Industry

9.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

9.1.1. Aerospace & Defense

9.1.2. IT & Telecommunication

9.1.3. Health Care

9.1.4. Semiconductor & Electronics

9.1.5. Others (Including Automotive and Academics & Research)

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Diamond Substrate Market Analysis and Forecast, by Region

10.1. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Region, 2017 – 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Diamond Substrate Market Analysis and Forecast

11.1. Market Snapshot

11.2. Key Trends Analysis

11.3. Drivers and Restraints: Impact Analysis

11.4. Key Regulations

11.5. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

11.5.1. Single Crystal Diamond

11.5.2. Nanocrystalline Diamond

11.5.3. Polycrystalline Diamond

11.6. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

11.6.1. Chemical Vapor Deposition (CVD) Substrate

11.6.2. HPHT Diamond Substrate

11.7. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

11.7.1. Thinner than 20 µm

11.7.2. 20 µm - 100 µm

11.7.3. 100 µm - 300 µm

11.7.4. Above 300 µm

11.8. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

11.8.1. Diamond Detectors

11.8.2. Optical Systems

11.8.2.1. Multi-wavelength Spectroscopy

11.8.2.2. Microwave

11.8.2.3. High Power Laser

11.8.2.4. Optical Windows

11.8.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

11.8.3. Power Electronics

11.8.4. Heat Spreader

11.8.5. Others (including eFlights and Electric Vehicles)

11.9. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

11.9.1. Aerospace & Defense

11.9.2. IT & Telecommunication

11.9.3. Health Care

11.9.4. Semiconductor & Electronics

11.9.5. Others (Including Automotive and Academics & Research)

11.10. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Country, 2017 – 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Market Attractiveness Analysis

11.11.1. By Diamond Type

11.11.2. By Substrate Type

11.11.3. By Thickness

11.11.4. By Application

11.11.5. By End-use Industry

11.11.6. By Country & Sub-region

12. Europe Diamond Substrate Market Analysis and Forecast

12.1. Market Snapshot

12.2. Key Trends Analysis

12.3. Drivers and Restraints: Impact Analysis

12.4. Key Regulations

12.5. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

12.5.1. Single Crystal Diamond

12.5.2. Nanocrystalline Diamond

12.5.3. Polycrystalline Diamond

12.6. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

12.6.1. Chemical Vapor Deposition (CVD) Substrate

12.6.2. HPHT Diamond Substrate

12.7. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

12.7.1. Thinner than 20 µm

12.7.2. 20 µm - 100 µm

12.7.3. 100 µm - 300 µm

12.7.4. Above 300 µm

12.8. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

12.8.1. Diamond Detectors

12.8.2. Optical Systems

12.8.2.1. Multi-wavelength Spectroscopy

12.8.2.2. Microwave

12.8.2.3. High Power Laser

12.8.2.4. Optical Windows

12.8.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

12.8.3. Power Electronics

12.8.4. Heat Spreader

12.8.5. Others (including eFlights and Electric Vehicles)

12.9. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

12.9.1. Aerospace & Defense

12.9.2. IT & Telecommunication

12.9.3. Health Care

12.9.4. Semiconductor & Electronics

12.9.5. Others (Including Automotive and Academics & Research)

12.10. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Country and Sub-region, 2017‒2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Italy

12.10.5. Russia

12.10.6. Rest of Europe

12.11. Market Attractiveness Analysis

12.11.1. By Diamond Type

12.11.2. By Substrate Type

12.11.3. By Thickness

12.11.4. By Application

12.11.5. By End-use Industry

12.11.6. By Country & Sub-region

13. Asia Pacific Diamond Substrate Market Analysis and Forecast

13.1. Market Snapshot

13.2. Key Trends Analysis

13.3. Drivers and Restraints: Impact Analysis

13.4. Key Regulations

13.5. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

13.5.1. Single Crystal Diamond

13.5.2. Nanocrystalline Diamond

13.5.3. Polycrystalline Diamond

13.6. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

13.6.1. Chemical Vapor Deposition (CVD) Substrate

13.6.2. HPHT Diamond Substrate

13.7. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

13.7.1. Thinner than 20 µm

13.7.2. 20 µm - 100 µm

13.7.3. 100 µm - 300 µm

13.7.4. Above 300 µm

13.8. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

13.8.1. Diamond Detectors

13.8.2. Optical Systems

13.8.2.1. Multi-wavelength Spectroscopy

13.8.2.2. Microwave

13.8.2.3. High Power Laser

13.8.2.4. Optical Windows

13.8.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

13.8.3. Power Electronics

13.8.4. Heat Spreader

13.8.5. Others (including eFlights and Electric Vehicles)

13.9. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

13.9.1. Aerospace & Defense

13.9.2. IT & Telecommunication

13.9.3. Health Care

13.9.4. Semiconductor & Electronics

13.9.5. Others (Including Automotive and Academics & Research)

13.10. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Country and Sub-region, 2017 – 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. South Korea

13.10.5. ASEAN

13.10.6. Rest of Asia Pacific

13.11. Market Attractiveness Analysis

13.11.1. By Diamond Type

13.11.2. By Substrate Type

13.11.3. By Thickness

13.11.4. By Application

13.11.5. By End-use Industry

13.11.6. By Country & Sub-region

14. Middle East & Africa (MEA) Diamond Substrate Market Analysis and Forecast

14.1. Market Snapshot

14.2. Key Trends Analysis

14.3. Drivers and Restraints: Impact Analysis

14.4. Key Regulations

14.5. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

14.5.1. Single Crystal Diamond

14.5.2. Nanocrystalline Diamond

14.5.3. Polycrystalline Diamond

14.6. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

14.6.1. Chemical Vapor Deposition (CVD) Substrate

14.6.2. HPHT Diamond Substrate

14.7. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

14.7.1. Thinner than 20 µm

14.7.2. 20 µm - 100 µm

14.7.3. 100 µm - 300 µm

14.7.4. Above 300 µm

14.8. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

14.8.1. Diamond Detectors

14.8.2. Optical Systems

14.8.2.1. Multi-wavelength Spectroscopy

14.8.2.2. Microwave

14.8.2.3. High Power Laser

14.8.2.4. Optical Windows

14.8.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

14.8.3. Power Electronics

14.8.4. Heat Spreader

14.8.5. Others (including eFlights and Electric Vehicles)

14.9. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

14.9.1. Aerospace & Defense

14.9.2. IT & Telecommunication

14.9.3. Health Care

14.9.4. Semiconductor & Electronics

14.9.5. Others (Including Automotive and Academics & Research)

14.10. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Country and Sub-region, 2017‒2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. South Africa

14.10.4. North Africa

14.10.5. Rest of Middle East & Africa

14.11. Market Attractiveness Analysis

14.11.1. By Diamond Type

14.11.2. By Substrate Type

14.11.3. By Thickness

14.11.4. By Application

14.11.5. By End-use Industry

14.11.6. By Country & Sub-region

15. South America Diamond Substrate Market Analysis and Forecast

15.1. Market Snapshot

15.2. Key Trends Analysis

15.3. Drivers and Restraints: Impact Analysis

15.4. Key Regulations

15.5. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Diamond Type, 2017‒2031

15.5.1. Single Crystal Diamond

15.5.2. Nanocrystalline Diamond

15.5.3. Polycrystalline Diamond

15.6. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Substrate Type, 2017‒2031

15.6.1. Chemical Vapor Deposition (CVD) Substrate

15.6.2. HPHT Diamond Substrate

15.7. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Thickness, 2017‒2031

15.7.1. Thinner than 20 µm

15.7.2. 20 µm - 100 µm

15.7.3. 100 µm - 300 µm

15.7.4. Above 300 µm

15.8. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Application, 2017‒2031

15.8.1. Diamond Detectors

15.8.2. Optical Systems

15.8.2.1. Multi-wavelength Spectroscopy

15.8.2.2. Microwave

15.8.2.3. High Power Laser

15.8.2.4. Optical Windows

15.8.2.5. Others (Including Monochromators, Optical Gyroscopes, and High Energy Research)

15.8.3. Power Electronics

15.8.4. Heat Spreader

15.8.5. Others (including eFlights and Electric Vehicles)

15.9. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by End-use Industry, 2017‒2031

15.9.1. Aerospace & Defense

15.9.2. IT & Telecommunication

15.9.3. Health Care

15.9.4. Semiconductor & Electronics

15.9.5. Others (Including Automotive and Academics & Research)

15.10. Diamond Substrate Market Size (US$ Mn) Analysis and Forecast, by Country and Sub-region, 2017‒2031

15.10.1. Brazil

15.10.2. Argentina

15.10.3. Rest of South America

15.11. Market Attractiveness Analysis

15.11.1. By Diamond Type

15.11.2. By Substrate Type

15.11.3. By Thickness

15.11.4. By Application

15.11.5. By End-use Industry

15.11.6. By Country & Sub-region

16. Competition Assessment

16.1. Global Diamond Substrate Market Competition Matrix - a Dashboard View

16.1.1. Global Diamond Substrate Market Company Share Analysis, by Value (2020)

16.1.2. Technological Differentiator

17. Company Profiles (Manufacturers/Suppliers)

17.1. AKHAN Semiconductor Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Financial Analysis

17.2. Applied Diamond Inc.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Financial Analysis

17.3. Blue Wave Semiconductor

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Financial Analysis

17.4. CIVIDEC

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Financial Analysis

17.5. Diamond Microwave Limited

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Financial Analysis

17.6. Diamond SA

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Financial Analysis

17.7. Electro Optical Components, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Financial Analysis

17.8. Element Six

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Financial Analysis

17.9. IIa Technologies Pte. Ltd.

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Financial Analysis

17.10. II-VI Incorporated

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Financial Analysis

17.11. New Diamond Technology LCC.

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Financial Analysis

17.12. Seki Diamond Systems

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Financial Analysis

17.13. Sumitomo Electric Industries, Ltd

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Financial Analysis

17.14. WD Lab Grown Diamonds

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Financial Analysis

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Diamond Type

18.1.2. By Substrate Type

18.1.3. By Thickness

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 01: Global Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 02: Global Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 03: Global Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 04: Global Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 05: Global Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 06: Global Diamond Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 07: North America Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 08: North America Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 09: North America Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 10: North America Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 11: North America Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 12: North America Diamond Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 13: Europe Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 14: Europe Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 15: Europe Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 16: Europe Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 17: Europe Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 18: Europe Diamond Substrate Market Size & Forecast, by Country, Volume (Million Units), 2017‒2031

Table 19: Asia Pacific Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 20: Asia Pacific Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 21: Asia Pacific Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 22: Asia Pacific Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 23: Asia Pacific Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 24: Asia Pacific Diamond Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 25: Middle East & Africa Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 26: Middle East & Africa Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 27: Middle East & Africa Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 28: Middle East & Africa Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 29: Middle East & Africa Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 30: Middle East and Africa Diamond Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 31: South America Diamond Substrate Market Size & Forecast, by Diamond Type, Value (US$ Mn), 2017‒2031

Table 32: South America Diamond Substrate Market Size & Forecast, by Substrate Type, Value (US$ Mn), 2017‒2031

Table 33: South America Diamond Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017‒2031

Table 34: South America Diamond Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 35: South America Diamond Substrate Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 36: South America Diamond Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017‒2031

List of Figures

Figure 01: Global Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 02: Global Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 03: Global Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 04: Global Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 05: Global Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 06: Global Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 07: Global Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 08: Global Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 09: Global Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 10: Global Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 11: Global Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 12: Global Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 13: Global Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 14: Global Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 15: Global Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 16: Global Diamond Substrate Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 18: Global Diamond Substrate Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 19: Global Diamond Substrate Market Share Analysis, by Region, 2021 and 2031

Figure 20: Global Diamond Substrate Market Attractiveness, by Region, Value (US$ Mn), 2021-2031

Figure 21: North America Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 22: North America Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 23: North America Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 24: North America Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 25: North America Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 26: North America Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 27: North America Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 28: North America Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 29: North America Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 30: North America Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 31: North America Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 32: North America Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 33: North America Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 34: North America Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 35: North America Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 36: North America Diamond Substrate Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 37: North America Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 38: North America Diamond Substrate Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 39: North America Diamond Substrate Market Share Analysis, by Country, 2021 and 2031

Figure 40: North America Diamond Substrate Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 41: Europe Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 42: Europe Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 43: Europe Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 44: Europe Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 45: Europe Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 46: Europe Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 47: Europe Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 48: Europe Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 49: Europe Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 50: Europe Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 51: Europe Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 52: Europe Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 53: Europe Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 54: Europe Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 55: Europe Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 56: Europe Diamond Substrate Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 57: Europe Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 58: Europe Diamond Substrate Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 59: Europe Diamond Substrate Market Share Analysis, by Country, 2021 and 2031

Figure 60: Europe Diamond Substrate Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 61: Asia Pacific Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 62: Asia Pacific Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 64: Asia Pacific Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 65: Asia Pacific Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 66: Asia Pacific Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 67: Asia Pacific Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 68: Asia Pacific Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 69: Asia Pacific Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 70: Asia Pacific Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 71: Asia Pacific Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 72: Asia Pacific Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 73: Asia Pacific Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 74: Asia Pacific Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 75: Asia Pacific Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 76: Asia Pacific Diamond Substrate Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 77: Asia Pacific Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 78: Asia Pacific Diamond Substrate Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 79: Asia Pacific Diamond Substrate Market Share Analysis, by Country, 2021 and 2031

Figure 80: Asia Pacific Diamond Substrate Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 81: Middle East & Africa Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 82: Middle East & Africa Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 83: Middle East & Africa Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 84: Middle East & Africa Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 85: Middle East & Africa Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 86: Middle East & Africa Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 87: Middle East & Africa Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 88: Middle East & Africa Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 89: Middle East & Africa Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 90: Middle East & Africa Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 91: Middle East & Africa Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 92: Middle East & Africa Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 93: Middle East & Africa Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 94: Middle East & Africa Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 95: Middle East & Africa Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 96: Middle East & Africa Diamond Substrate Market Share Analysis, by End-use Industry, 2020 and 2031

Figure 97: Middle East & Africa Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 98: Middle East & Africa Diamond Substrate Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 99: Middle East & Africa Diamond Substrate Market Share Analysis, by Country, 2021 and 2031

Figure 100: Middle East & Africa Diamond Substrate Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 101: South America Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 102: South America Diamond Substrate Market, Value (US$ Mn), 2017‒2031

Figure 103: South America Diamond Substrate Market Size & Forecast, by Diamond Type, Revenue (US$ Mn), 2017‒2031

Figure 104: South America Diamond Substrate Market Share Analysis, by Diamond Type, 2021 and 2031

Figure 105: South America Diamond Substrate Market Attractiveness, by Diamond Type, Value (US$ Mn), 2021-2031

Figure 106: South America Diamond Substrate Market Size & Forecast, by Substrate Type, Revenue (US$ Mn), 2017‒2031

Figure 107: South America Diamond Substrate Market Share Analysis, by Substrate Type, 2021 and 2031

Figure 108: South America Diamond Substrate Market Attractiveness, by Substrate Type, Value (US$ Mn), 2021-2031

Figure 109: South America Diamond Substrate Market Size & Forecast, by Thickness, Revenue (US$ Mn), 2017‒2031

Figure 110: South America Diamond Substrate Market Share Analysis, by Thickness, 2021 and 2031

Figure 111: South America Diamond Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2021-2031

Figure 112: South America Diamond Substrate Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 113: South America Diamond Substrate Market Share Analysis, by Application, 2021 and 2031

Figure 114: South America Diamond Substrate Market Attractiveness, by Application, Value (US$ Mn), 2021-2031

Figure 115: South America Diamond Substrate Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 116: South America Diamond Substrate Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 117: South America Diamond Substrate Market Attractiveness, by End-use Industry, Value (US$ Mn), 2021-2031

Figure 118: South America Diamond Substrate Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 119: South America Diamond Substrate Market Share Analysis, by Country, 2021 and 2031

Figure 120: South America Diamond Substrate Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 121: Global Diamond Substrate Market (2020) Share Analysis