Analysts’ Viewpoint on Diagnostic Imaging Services Market Scenario

Rise in adoption of diagnostic imaging is driving the global diagnostic imaging services market. CT scan is a commonly used technology for the diagnosis of various chronic diseases. Integration of advanced technologies in medical imaging is significantly boosting the efficiency of diagnosis. Major technologies include Artificial Intelligence (AI), 3D imaging, diagnostic wearables, and remote reading solutions. AI in diagnostic imaging helps achieve quicker scans, and provides life-changing insights regarding various diseases. The combined capabilities of hardware miniaturization, AI, and computer vision have allowed diagnostic imaging to be mobile. Companies operating in the global diagnostic imaging services market are focusing on reducing the cost of diagnosis to increase their market share.

Diagnostic imaging services are used to monitor and diagnose any medical condition. Different types of diagnostic imaging services include X-ray imaging procedures, MRI scans, CT scans, ultrasounds, and nuclear imaging. Diagnostic radiology and digital mammography are used in diagnostic imaging centers for cancer diagnostics.

Diagnostic radiology is employed to capture pictures of bones and anatomy within the body during diagnosis. X-rays, ultrasound, CT and MRI scans, and nuclear medicine scans are some examples of diagnostic radiology. Digital mammography records the radiographic image electronically in a digital format using computer-based electronic conductors. It is used in the early screening and diagnosing of breast diseases.

Medical imaging plays a critical role in identification of chronic disorders. Sedentary lifestyle and aging population have resulted in various chronic diseases such as cancer, cardiovascular disease, obesity, and diabetes. Significant decline in fertility and improving longevity are prominent factors that lead to an aging population. According to the United Nations’ 2017 report, the geriatric population is expected to reach 2.1 billion by 2050 from 962 million in 2017. Similarly, the number of elderly people in the U.S. is estimated to increase by 6.3% between 2017 and 2050 to reach 108.4 million by 2050. Furthermore, the population of baby boomers is rising significantly. This age group is susceptible to a wide range of chronic disorders such as cancer, kidney diseases, spinal disorders, and cardiovascular diseases. Demand for diagnostic imaging increases as a person ages. According to the National Institutes of Health, patients above 65 years undergo diagnostic imaging two or more times the rate of younger people. This is boosting the demand for diagnostic imaging services.

Diagnostic imaging performs a key role in the prevention and early diagnosis/treatment of diseases. Governments across the globe allocate substantial annual budgets for reimbursement of these services. Reimbursement for diagnostic imaging services is available in major markets such as the U.S., Western Europe, Japan, Australia, and China. Reimbursement for diagnostic imaging services varies across regions. The Centers for Medicare & Medicaid Services (CMS) covers radiology and other diagnostic services in the U.S., which are billed under Medicare Part B to Medicare carriers. More than 400 million imaging services are provided to Medicare beneficiaries annually in the U.S. According to CMS regulatory update 2019, interventional radiology services are likely to witness a 2% increase in payment by Medicare under the Medicare Physician Fee Schedule (MPFS). Similarly, the Government of China has taken initiatives to provide some form of insurance to nearly 95% of the population in the country. Thus, favorable reimbursement conditions are expected to fuel the global diagnostic imaging services market size during the forecast period.

In terms of imaging modality, the global diagnostic imaging services market has been segmented into X-ray, Magnetic Resonance Imaging (MRI), ultrasound, Computed Tomography (CT), nuclear imaging, and others. The Computed Tomography (CT) segment is anticipated to grow at a rapid pace during the forecast period due to technological advancements and rise in clinical applications across the globe. CT is a technique that employs computerized X-ray imaging to produce cross-sectional images of the body, providing doctors with a highly detailed view of different parts of the body. Technologically-advanced scanners with multi-slice capabilities of 80, 128, 256, 320, and 640-slice systems and higher speeds have been introduced in the market.

Based on application, the oncology segment dominated the diagnostic imaging services market in 2021. This trend is likely to continue during the forecast period. Growth of the segment can be ascribed to the increase in prevalence of cancer and the subsequent high adoption of diagnostic imaging procedures for the detection of various types of cancers, identification of the stage of cancer, assessment of the effectiveness of the treatment, and identification of the spread of the disease to other organs. Diagnostic imaging procedures, primarily CT scan procedures, are used to detect abnormal cell growth, identify various stages of cancer, and plan the treatment. According to the World Health Organization (WHO), cancer is one of the leading causes of morbidity and mortality across the world. Cancer rates are likely to increase by 50% to 15 million new cases by 2020. Approximately 70% of deaths due to cancer occur in low- and middle-income countries.

Based on end-user, the global diagnostic imaging services market has been classified into hospitals, ambulatory surgical centers, diagnostic centers, and others. Hospitals are the leading end-users of diagnostic imaging services, making them a vital prospect for service providers. Hospitals have a diverse range of diagnostic imaging equipment for patients; therefore, they witness a significant inflow of patients. The hospitals segment held the largest share of the market in 2021 due to the increase in recommendation of diagnostic imaging tests for quick and accurate diagnosis of medical issues in patients.

The diagnostic centers segment is expected to grow significantly during the forecast period. Market players are focusing on adopting various strategies such as joint ventures and acquisitions to increase the number of diagnostic centers that offer one-stop-shop services under one roof for all imaging needs.

According to the diagnostic imaging services market analysis, North America is a lucrative market, wherein the U.S. showcases dominance owing to the increase in technological advancements, growth in prevalence of chronic diseases, and surge in adoption of diagnostic imaging services in the medical industry in the country. North America accounted for the largest share of around 40% of the market in terms of revenue in 2021. Growth of the market in the region can be ascribed to the rise in adoption of low-dose automated CT scanners. The U.S. is expected to dominate the market in North America in the near future due to the high prevalence of chronic diseases in the country. According to a recent research by the Centers for Disease Control and Prevention, more than 80% of older individuals in the U.S. suffer from at least one chronic condition.

Europe held around 26% share of the global market in 2021. The market in the region is expected to grow at a CAGR of 4.2% during the forecast period. Asia Pacific is the fastest-growing region of the global diagnostic imaging services market. Japan, India, and China account for significant market share in the region. Expansion of manufacturing plants for diagnostic imaging tools and equipment, significant growth in healthcare and medical tourism industries, and increase in adoption of new diagnostic imaging services are fueling the diagnostic imaging services market in Asia Pacific.

The global diagnostic imaging services market is consolidated, with the presence of a limited number of service providers. Key players are establishing newer diagnostic centers with high-end diagnostic imaging modalities to meet the rising demand. New entrants must focus on collaborations and service agreements with hospitals to gain initial business growth. Players operating in the market include RadNet, Inc., Center for Diagnostic Imaging (CDI), MedQuest Associates, Inc., Siemens Healthineers, Hitachi, Ltd., Carestream Health, Koninklijke Philips N.V., GE Healthcare, Shimadzu Corporation, and Dignity Health (CommonSpirit Health).

Companies providing diagnostic imaging services are focusing on facility acquisition and formation of joint ventures to increase their geographic presence, particularly in North America. Partnerships and joint ventures allow service providers to collaborate with exceptional radiologists who have been providing patient-centered care in specific regions, enabling them to serve a larger volume of patients. In February 2019, RadNet Inc. signed a definitive agreement to acquire the outpatient radiology practice of Kern Radiology Medical Group, Inc. The firm owns five imaging centers based in California, providing multimodal offerings including MRI, CT, nuclear medicine, ultrasound and bone density, and interventional procedures. The strategy enabled the company to expand its presence in the existing market and broaden its customer base in the U.S.

Each of these players has been profiled in the diagnostic imaging services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 363.6 Bn |

|

Market Forecast Value in 2031 |

US$ 544.7 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

4.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

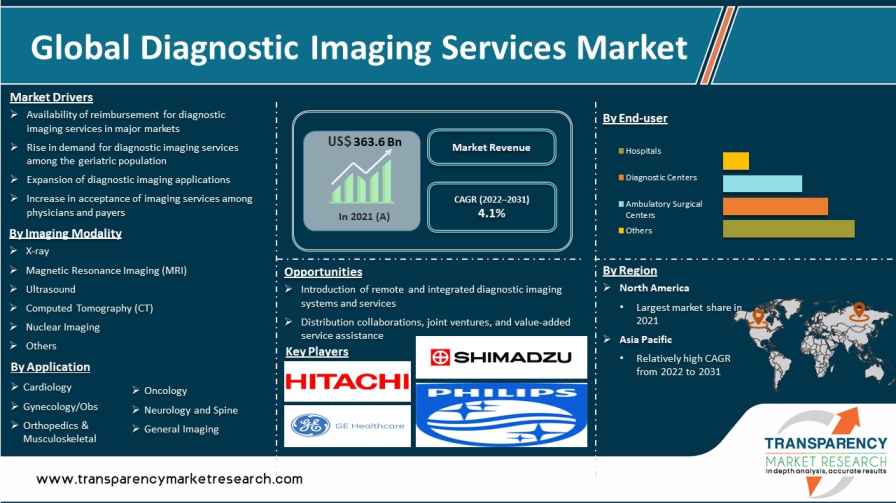

The global diagnostic imaging services market was valued at US$ 363.6 Bn in 2021.

The global market is projected to reach more than US$ 544.7 Bn by 2031.

The global diagnostic imaging services market is anticipated to grow at a CAGR of 4.1% from 2022 to 2031.

Increase in demand for diagnostic imaging services among the geriatric population is a key trend that affects market growth.

RadNet, Inc., Center for Diagnostic Imaging (CDI), MedQuest Associates, Inc., Siemens Healthineers, Hitachi, Ltd., Carestream Health, Koninklijke Philips N.V., GE Healthcare, Shimadzu Corporation, and Dignity Health (CommonSpirit Health).

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diagnostic Imaging Services Market

4. Market Overview

4.1. Introduction

4.1.1. Imaging Modality Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Diagnostic Imaging Services Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Developments

5.2. Installed Base Scenario

5.3. Reimbursement Scenario Assessment

5.4. Regulatory Scenario Assessment

5.5. Key Disease Prevalence Statistics

5.6. List of Private Diagnostic Centers

5.7. Covid-19 Impact Analysis

6. Global Diagnostic Imaging Services Market Analysis and Forecast, By Imaging Modality

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Imaging Modality, 2017 - 2031

6.3.1. X-ray

6.3.2. Magnetic Resonance Imaging (MRI)

6.3.3. Ultrasound

6.3.4. Computed Tomography (CT)

6.3.5. Nuclear Imaging

6.3.6. Others

6.4. Market Attractiveness By Imaging Modality

7. Global Diagnostic Imaging Services Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2017 - 2031

7.3.1. Cardiology

7.3.2. Gynecology/Obs

7.3.3. Oncology

7.3.4. Orthopedics & Musculoskeletal

7.3.5. Neurology & Spine

7.3.6. General Imaging

7.4. Market Attractiveness By Application

8. Global Diagnostic Imaging Services Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Diagnostic Centers

8.3.4. Others

8.4. Market Attractiveness By End-user

9. Global Diagnostic Imaging Services Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Diagnostic Imaging Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Imaging Modality, 2017 - 2031

10.2.1. X-ray

10.2.2. Magnetic Resonance Imaging (MRI)

10.2.3. Ultrasound

10.2.4. Computed Tomography (CT)

10.2.5. Nuclear Imaging

10.2.6. Others

10.3. Market Value Forecast By Application, 2017 - 2031

10.3.1. Cardiology

10.3.2. Gynecology/Obs

10.3.3. Oncology

10.3.4. Orthopedics & Musculoskeletal

10.3.5. Neurology & Spine

10.3.6. General Imaging

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Diagnostic Centers

10.4.4. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Imaging Modality

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Diagnostic Imaging Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Imaging Modality, 2017 - 2031

11.2.1. X-ray

11.2.2. Magnetic Resonance Imaging (MRI)

11.2.3. Ultrasound

11.2.4. Computed Tomography (CT)

11.2.5. Nuclear Imaging

11.2.6. Others

11.3. Market Value Forecast By Application, 2017 - 2031

11.3.1. Cardiology

11.3.2. Gynecology/Obs

11.3.3. Oncology

11.3.4. Orthopedics & Musculoskeletal

11.3.5. Neurology & Spine

11.3.6. General Imaging

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Diagnostic Centers

11.4.4. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Imaging Modality

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Diagnostic Imaging Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Imaging Modality, 2017 - 2031

12.2.1. X-ray

12.2.2. Magnetic Resonance Imaging (MRI)

12.2.3. Ultrasound

12.2.4. Computed Tomography (CT)

12.2.5. Nuclear Imaging

12.2.6. Others

12.3. Market Value Forecast By Application, 2017 - 2031

12.3.1. Cardiology

12.3.2. Gynecology/Obs

12.3.3. Oncology

12.3.4. Orthopedics & Musculoskeletal

12.3.5. Neurology & Spine

12.3.6. General Imaging

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Diagnostic Centers

12.4.4. Others

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Imaging Modality

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country

13. Latin America Diagnostic Imaging Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Imaging Modality, 2017 - 2031

13.2.1. X-ray

13.2.2. Magnetic Resonance Imaging (MRI)

13.2.3. Ultrasound

13.2.4. Computed Tomography (CT)

13.2.5. Nuclear Imaging

13.2.6. Others

13.3. Market Value Forecast By Application, 2017 - 2031

13.3.1. Cardiology

13.3.2. Gynecology/Obs

13.3.3. Oncology

13.3.4. Orthopedics & Musculoskeletal

13.3.5. Neurology & Spine

13.3.6. General Imaging

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Diagnostic Centers

13.4.4. Others

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Imaging Modality

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Diagnostic Imaging Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Imaging Modality, 2017 - 2031

14.2.1. X-ray

14.2.2. Magnetic Resonance Imaging (MRI)

14.2.3. Ultrasound

14.2.4. Computed Tomography (CT)

14.2.5. Nuclear Imaging

14.2.6. Others

14.3. Market Value Forecast By Application, 2017 - 2031

14.3.1. Cardiology

14.3.2. Gynecology/Obs

14.3.3. Oncology

14.3.4. Orthopedics & Musculoskeletal

14.3.5. Neurology & Spine

14.3.6. General Imaging

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Diagnostic Centers

14.4.4. Others

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Imaging Modality

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. RadNet, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Analysis

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Center for Diagnostic Imaging (CDI)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Analysis

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. MedQuest Associates, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Analysis

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Siemens Healthineers

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Analysis

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. Hitachi, Ltd.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Analysis

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Carestream Health

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Analysis

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. Koninklijke Philips N.V.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Analysis

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. GE Healthcare

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Analysis

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. Shimadzu Corporation

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Analysis

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

15.3.10. Dignity Health (CommonSpirit Health)

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Financial Analysis

15.3.10.3. Growth Strategies

15.3.10.4. SWOT Analysis

List of Tables

Table 01: CPT Codes- Diagnostic Imaging Procedures (Snapshot)

Table 02: CPT Codes- Diagnostic Imaging Procedures (Snapshot)

Table 03: List of Private Diagnostic Centers – North America

Table 04: List of Private Diagnostic Centers – Europe

Table 05: List of Private Diagnostic Centers – Europe

Table 06: List of Private Diagnostic Centers – Asia Pacific

Table 07: List of Private Diagnostic Centers – Australia & Brazil

Table 08: List of Private Diagnostic Centers – Dubai

Table 09: Global Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 10: Global Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017–2031

Table 11: Global Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by End-user, 2017–2031

Table 12: Global Diagnostic Imaging Services Market Size (US$ Bn) Forecast, by Region, 2017–2031

Table 13: North America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Country, 2017–2031

Table 14: North America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 15: North America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017‒2027

Table 17: Europe Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Country, 2017–2031

Table 18: Europe Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 19: Europe Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017‒2027

Table 20: Europe Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by End-user, 2017‒2027

Table 21: Asia Pacific Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 23: Asia Pacific Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017‒2027

Table 24: Asia Pacific Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by End-user, 2017‒2027

Table 25: Latin America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 27: Latin America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017‒2027

Table 28: Latin America Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by End-user, 2017‒2027

Table 29: Middle East & Africa Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 30: Middle East & Africa Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Imaging Modality, 2017–2031

Table 31: Middle East & Africa Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by Application, 2017‒2027

Table 32: Middle East & Africa Diagnostic Imaging Services Market Value (US$ Bn) Forecast, by End-user, 2017‒2027

List of Figures

Figure 01: Global Diagnostic Imaging Services Market Snapshot

Figure 02: Global Diagnostic Imaging Services Market Value (US$ Bn) and Distribution (%), by Region, 2021 and 2031

Figure 03: Global Diagnostic Imaging Services Market Value (US$ Bn) Forecast, 2017–2031

Figure 04: Global Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021

Figure 05: Global Diagnostic Imaging Services Market Value Share (%), by Application, 2021

Figure 06: Global Diagnostic Imaging Services Market Value Share (%), by End-user, 2021

Figure 07: Global Diagnostic Imaging Services Market Value Share (%), by Region, 2021

Figure 08: Diagnostic Imaging Services Market – Key Mergers and Acquisitions

Figure 09: Diagnostic Imaging Services Market – Joint Ventures and Partnerships

Figure 10: Installed Base – CT Scanners

Figure 11: Installed Base – Magnetic Resonance Imaging Units

Figure 12: Installed Base – PET Scanners

Figure 13: MIS Standards - India

Figure 14: Global Prevalence of Cancer, Age-standardized Number of Cases, per 100,000 population

Figure 15: Global Cancer Estimations (Number of people), by New Cases & Deaths

Figure 16: U.S. Cancer Prevalence (%), By Type of Cancer

Figure 17: Global Prevalence of CVD, Number of Deaths, per 100,000

Figure 18: U.S. Prevalence of CVD (%), by Age

Figure 19: Global Diagnostic Imaging Services Market Value Share Analysis, by Imaging Modality, 2021 and 2031

Figure 20: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by X-ray, 2017–2031

Figure 21: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Magnetic Resonance Imaging, 2017–2031

Figure 22: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Ultrasound, 2017–2031

Figure 23: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Computed Tomography (CT), 2017–2031

Figure 24: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Nuclear Imaging, 2017–2031

Figure 25: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 26: Global Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022‒2031

Figure 27: Global Diagnostic Imaging Services Market - Imaging Modality Trends

Figure 28: Global Diagnostic Imaging Services Market Value Share Analysis, by Application, 2021 and 2031

Figure 29: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Cardiology, 2017–2031

Figure 30: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Gynecology/Obs, 2017–2031

Figure 31: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Orthopedics & Musculoskeletal, 2017–2031

Figure 32: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Oncology, 2017–2031

Figure 33: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Neurology & Spine, 2017–2031

Figure 34: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by General Imaging, 2017–2031

Figure 35: Global Diagnostic Imaging Services Market Attractiveness, by Application, 2022‒2031

Figure 36: Global Diagnostic Imaging Services Market - Application Trends

Figure 37: Global Diagnostic Imaging Services Market Value Share Analysis, by End-user, 2021 and 2027

Figure 38: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Hospitals, 2017–2031

Figure 39: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Diagnostic Imaging Centers, 2017–2031

Figure 40: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Ambulatory Surgical Centers, 2017–2031

Figure 41: Global Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 42: Global Diagnostic Imaging Services Market Attractiveness, by End-user, 2022‒2031

Figure 43: Global Diagnostic Imaging Services Market - End-user Trends

Figure 44: Global Diagnostic Imaging Services Treatment Market Value Share Analysis, by Region, 2021 and 2031

Figure 45: Global Diagnostic Imaging Services Market Attractiveness, by Region, 2022–2031

Figure 46: North America Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 47: North America Diagnostic Imaging Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 48: North America Diagnostic Imaging Services Market Attractiveness Analysis, by Country, 2022–2031

Figure 49: North America Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021 and 2031

Figure 50: North America Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022–2031

Figure 51: North America Diagnostic Imaging Services Market Value Share (%), by Application, 2021 and 2031

Figure 52: North America Diagnostic Imaging Services Market Attractiveness, by Application, 2022–2031

Figure 53: North America Diagnostic Imaging Services Market Value Share (%), by End-user, 2021 and 2031

Figure 54: North America Diagnostic Imaging Services Market Attractiveness, by End-user, 2022–2031

Figure 55: Europe Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 56: Europe Diagnostic Imaging Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 57: Europe Diagnostic Imaging Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 58: Europe Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021 and 2031

Figure 59: Europe Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022–2031

Figure 60: Europe Diagnostic Imaging Services Market Value Share (%), by Application, 2021 and 2031

Figure 61: Europe Diagnostic Imaging Services Market Attractiveness, by Application, 2022–2031

Figure 62: Europe Diagnostic Imaging Services Market Value Share (%), by End-user, 2021 and 2031

Figure 63: Europe Diagnostic Imaging Services Market Attractiveness, by End-user, 2022–2031

Figure 64: Asia Pacific Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 64: Asia Pacific Diagnostic Imaging Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 65: Asia Pacific Diagnostic Imaging Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 66: Asia Pacific Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021 and 2031

Figure 67: Asia Pacific Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022–2031

Figure 68: Asia Pacific Diagnostic Imaging Services Market Value Share (%), by Application, 2021 and 2031

Figure 69: Asia Pacific Diagnostic Imaging Services Market Attractiveness, by Application, 2022–2031

Figure 70: Asia Pacific Diagnostic Imaging Services Market Value Share (%), by End-user, 2021 and 2031

Figure 71: Asia Pacific Diagnostic Imaging Services Market Attractiveness, by End-user, 2022–2031

Figure 72: Latin America Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 73: Latin America Diagnostic Imaging Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 74: Latin America Diagnostic Imaging Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 75: Latin America Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021 and 2031

Figure 76: Latin America Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022–2031

Figure 77: Latin America Diagnostic Imaging Services Market Value Share (%), by Application, 2021 and 2031

Figure 78: Latin America Diagnostic Imaging Services Market Attractiveness, by Application, 2022–2031

Figure 79: Latin America Diagnostic Imaging Services Market Value Share (%), by End-user, 2021 and 2031

Figure 80: Latin America Diagnostic Imaging Services Market Attractiveness, by End-user, 2022–2031

Figure 81: Middle East & Africa Diagnostic Imaging Services Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 82: Middle East & Africa Diagnostic Imaging Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 83: Middle East & Africa Diagnostic Imaging Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 84: Middle East & Africa Diagnostic Imaging Services Market Value Share (%), by Imaging Modality, 2021 and 2031

Figure 85: Middle East & Africa Diagnostic Imaging Services Market Attractiveness, by Imaging Modality, 2022–2031

Figure 86: Middle East & Africa Diagnostic Imaging Services Market Value Share (%), by Application, 2021 and 2031

Figure 87: Middle East & Africa Diagnostic Imaging Services Market Attractiveness, by Application, 2022–2031

Figure 88: Middle East & Africa Diagnostic Imaging Services Market Value Share (%), by End-user, 2021 and 2031

Figure 89: Middle East & Africa Diagnostic Imaging Services Market Attractiveness, by End-user, 2022–2031