Analysts’ Viewpoint

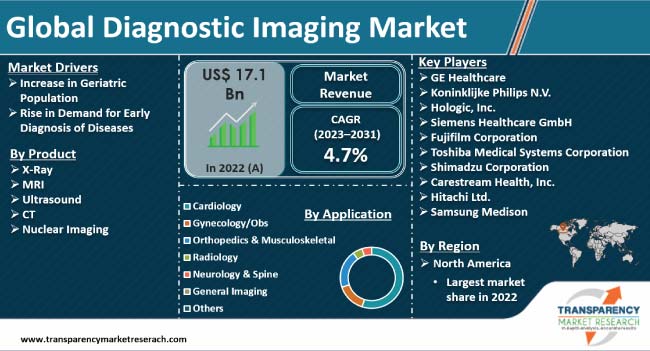

People aged 60 and above are expected to constitute around 25% of the global population by the year 2050. This is projected to significantly boost the diagnostic imaging equipment market demand during the forecast period. The geriatric population is at a greater risk of chronic ailments, which is prompting several government bodies to initiate awareness campaigns about preventive measures to be taken against chronic diseases.

Rise in prevalence of chronic diseases and demand for early detection of diseases is estimated to offer lucrative market opportunities to manufacturers in the next few years. Moreover, rapid innovations in imaging technology and favorable reimbursement policies are estimated to positively impact the diagnostic imaging market forecast in the near future.

Healthcare practitioners are extensively employing diagnostic imaging technologies to examine patients and diagnose their exact medical conditions. Diagnostic imaging is utilized to identify a wide range of issues, which include cardiac abnormalities, broken bones, aneurysms, gastrointestinal issues, and various types of cancer. It is also utilized to monitor the human body's response to treatment.

Diagnostic imaging is painless and offers rapid diagnosis. It also helps in exclusion of therapeutic treatments, thereby resulting in noticeable saving. Growing awareness about the importance of early diagnosis for the effective treatment of cancer is boosting the demand for cancer diagnosis. As per the British Heart Foundation data published in January 2022, coronary (ischemic) heart disease affected 200 million individuals. Peripheral arterial (vascular) disease affected 110 million, atrial fibrillation negatively impacted 60 million, and stroke affected 100 million people, worldwide, during the same period. Therefore, rise in incidence of cardiovascular diseases is likely to drive the diagnostic imaging market development.

Skilled professionals are needed to handle or operate diagnostic equipment. Untrained professionals could increase the hazards or risks associated with certain diagnostic equipment, such as prolonged exposure of patients to ultrasound energy or X-rays during diagnosis. According to the WHO, there is a significant shortage of skilled professionals to use diagnostic equipment. This is expected to hamper the market progress. Furthermore, high cost associated with diagnostic equipment is also anticipated to act as a key diagnostic imaging market restraint in the near future.

As per the World Health Organization (WHO), the year 2030 would see 1.4 billion people aged 60 and above; which would reach 2.1 billion by 2050. It’s a known fact that geriatric population is more prone to chronic ailments as compared to those aged below 60. This factor is expected to drive the diagnostic imaging industry during the forecast period.

The number of surgeries is increasing among the elderly population owing to rising incidence of trauma and injuries. This is driving the use of imaging equipment for effective and rapid medical intervention. Furthermore, rise in prevalence of cancer and cardiovascular diseases in the elderly population is boosting the demand for medical imaging systems across the globe.

As per Statista, in 2019, cardiovascular diseases, cancer, respiratory diseases, and diabetes accounted for 17.9 million, 9.3 million, 4.1 million, and 1.5 million deaths, respectively, worldwide. Growing awareness about these ailments is fueling the demand for early diagnosis. High preference for preventive measures as compared to curative measures, among the patient population, is further driving the demand for diagnostic imaging techniques.

Increase in awareness among the population about the availability of advanced diagnostic devices and rise in healthcare expenditure are driving the adoption of diagnostic imaging across the globe. Moreover, rise in investments by governments to expand and develop sophisticated healthcare infrastructure is projected to propel the diagnostic imaging industry growth during the forecast period.

North America held the largest diagnostic imaging market share in 2022, with the U.S. witnessing an increasing demand for advanced healthcare systems due to growing incidences of chronic ailments. According to the American Cancer Society, the U.S. registered 1.9 million new cancer cases in 2022. It further stated that the year 2021 saw 83,750 people getting diagnosed with brain and the other central nervous system-related tumors in the U.S. Moreover, one of the key diagnostic imaging industry trends witnessed in North America is the high rate of adoption of advanced technologies in the healthcare industry in the region.

Europe accounted for a notable share of the total global demand for diagnostic imaging due to increase in incidence of chronic disorders in the region. According to the Organization for Economic Co-Operation and Development, chronic ailments such as diabetes, strokes, heart attacks, and cancer account for more than 550,000 premature fatalities in Europe and cost over US$ 130 Bn to the overall economy.

The diagnostic imaging industry size in Asia Pacific is expected to grow at a rapid pace owing to a surge in incidence of cardiovascular diseases, which accounts for 20-30% of fatalities in Indonesia, Philippines, Thailand, Japan, Hong Kong, Malaysia, Korea, Japan, and urban China.

The global diagnostic imaging business is moderately fragmented. Leading players are emphasizing on various modes of expansion such as new product launch, mergers, acquisitions, partnerships, and joint ventures to consolidate their position in the global market. A few prominent entities operating in the global market include GE Healthcare, Koninklijke Philips N.V., Hologic, Inc., Siemens Healthcare GmbH, Fujifilm Corporation, Toshiba Medical Systems Corporation, Shimadzu Corporation, Carestream Health, Inc., Hitachi Ltd., and Samsung Medison.

Key players in the diagnostic imaging market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 17.1 Bn |

| Market Forecast Value in 2031 | US$ 25.7 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players - Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 17.1 Bn in 2022

It is projected to grow at a CAGR of 4.7% from 2023 to 2031

Increase in geriatric population and rise in demand for early diagnosis of diseases

In terms of application, the cardiology segment held largest share in 2022

North America is estimated to dominate the global business in the next few years

GE Healthcare, Koninklijke Philips N.V., Hologic, Inc., Siemens Healthcare GmbH, Fujifilm Corporation, Toshiba Medical Systems Corporation, Shimadzu Corporation, Carestream Health, Inc., Hitachi Ltd., and Samsung Medison

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diagnostic Imaging Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Diagnostic Imaging Market Analysis and Forecast, 2022-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. List of Types of Diagnostic Imaging Tests

5.3. Disease Prevalence & Incidence Rate Globally With Key Countries

5.4. COVID-19 Pandemic Impact on Industry

6. Diagnostic Imaging Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. X-Ray

6.3.2. MRI

6.3.3. Ultrasound

6.3.4. CT

6.3.5. Nuclear Imaging

6.4. Market Attractiveness, by Product

7. Diagnostic Imaging Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Cardiology

7.3.2. Gynecology/Obs

7.3.3. Orthopedics & Musculoskeletal

7.3.4. Radiology

7.3.5. Neurology & Spine

7.3.6. General Imaging

7.3.7. Others

7.4. Market Attractiveness, by Application

8. Global Diagnostic Imaging Market Analysis and Forecast, by End-user

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Others

8.4. Market Attractiveness, by End-user

9. Global Diagnostic Imaging Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Diagnostic Imaging Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. X-Ray

10.2.2. MRI

10.2.3. Ultrasound

10.2.4. CT

10.2.5. Nuclear Imaging

10.3. Market Attractiveness, by Product

10.4. Market Value Forecast, by Application, 2017-2031

10.4.1. Cardiology

10.4.2. Gynecology/Obs

10.4.3. Orthopedics & Musculoskeletal

10.4.4. Radiology

10.4.5. Neurology & Spine

10.4.6. General Imaging

10.4.7. Others

10.5. Market Attractiveness, by Application

10.6. Market Value Forecast, by End-user, 2017-2031

10.6.1. Hospitals

10.6.2. Diagnostic Centers

10.6.3. Others

10.7. Market Attractiveness, by End-user

10.8. Market Value Forecast, by Country, 2022-2031

10.8.1. U.S.

10.8.2. Canada

10.9. Market Attractiveness Analysis

10.9.1. By Product

10.9.2. By Application

10.9.3. By End-user

10.9.4. By Country

11. Europe Diagnostic Imaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. X-Ray

11.2.2. MRI

11.2.3. Ultrasound

11.2.4. CT

11.2.5. Nuclear Imaging

11.3. Market Attractiveness, by Product

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Cardiology

11.4.2. Gynecology/Obs

11.4.3. Orthopedics & Musculoskeletal

11.4.4. Radiology

11.4.5. Neurology & Spine

11.4.6. General Imaging

11.4.7. Others

11.5. Market Attractiveness, by Application

11.6. Market Value Forecast, by End-user, 2017-2031

11.6.1. Hospitals

11.6.2. Diagnostic Centers

11.6.3. Others

11.7. Market Attractiveness, by End-user

11.8. Market Value Forecast, by Country/Sub-region, 2022-2031

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Rest of Europe

11.9. Market Attractiveness Analysis

11.9.1. By Product

11.9.2. By Application

11.9.3. By End-user

11.9.4. By Country/Sub-region

12. Asia Pacific Diagnostic Imaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. X-Ray

12.2.2. MRI

12.2.3. Ultrasound

12.2.4. CT

12.2.5. Nuclear Imaging

12.3. Market Attractiveness, by Product

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Cardiology

12.4.2. Gynecology/Obs

12.4.3. Orthopedics & Musculoskeletal

12.4.4. Radiology

12.4.5. Neurology & Spine

12.4.6. General Imaging

12.4.7. Others

12.5. Market Attractiveness, by Application

12.6. Market Value Forecast, by End-user, 2017-2031

12.6.1. Hospitals

12.6.2. Diagnostic Centers

12.6.3. Others

12.7. Market Attractiveness, by End-user

12.8. Market Value Forecast, by Country/Sub-region, 2017-2031

12.8.1. China

12.8.2. Japan

12.8.3. India

12.8.4. Australia & New Zealand

12.8.5. Rest of Asia Pacific

12.9. Market Attractiveness Analysis

12.9.1. By Product

12.9.2. By Application

12.9.3. By End-user

12.9.4. By Country/Sub-region

13. Latin America Diagnostic Imaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. X-Ray

13.2.2. MRI

13.2.3. Ultrasound

13.2.4. CT

13.2.5. Nuclear Imaging

13.3. Market Attractiveness, by Product

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Cardiology

13.4.2. Gynecology/Obs

13.4.3. Orthopedics & Musculoskeletal

13.4.4. Radiology

13.4.5. Neurology & Spine

13.4.6. General Imaging

13.4.7. Others

13.5. Market Attractiveness, by Application

13.6. Market Value Forecast, by End-user, 2017-2031

13.6.1. Hospitals

13.6.2. Diagnostic Centers

13.6.3. Others

13.7. Market Attractiveness, by End-user

13.8. Market Value Forecast, by Country/Sub-region, 2017-2031

13.8.1. Brazil

13.8.2. Mexico

13.8.3. Rest of Latin America

13.9. Market Attractiveness Analysis

13.9.1. By Product

13.9.2. By Application

13.9.3. By End-user

13.9.4. By Country/Sub-region

14. Middle East & Africa Diagnostic Imaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. X-Ray

14.2.2. MRI

14.2.3. Ultrasound

14.2.4. CT

14.2.5. Nuclear Imaging

14.3. Market Attractiveness, by Product

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Cardiology

14.4.2. Gynecology/Obs

14.4.3. Orthopedics & Musculoskeletal

14.4.4. Radiology

14.4.5. Neurology & Spine

14.4.6. General Imaging

14.4.7. Others

14.5. Market Attractiveness, by Application

14.6. Market Value Forecast, by End-user, 2017-2031

14.6.1. Hospitals

14.6.2. Diagnostic Centers

14.6.3. Others

14.7. Market Attractiveness, by End-user

14.8. Market Value Forecast, by Country/Sub-region, 2017-2031

14.8.1. GCC Countries

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Product

14.9.2. By Application

14.9.3. By End-user

14.9.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Koninklijke Philips N.V.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Hologic, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Siemens Healthcare GmbH

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Fujifilm Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Toshiba Medical Systems Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Shimadzu Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Carestream Health, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Hitachi Ltd.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Samsung Medison

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Diagnostic Imaging Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 07: North America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 08: North America Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Diagnostic Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 11: Europe Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 12: Europe Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user 2017-2031

Table 13: Asia Pacific Diagnostic Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Asia Pacific Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Latin America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 19: Latin America Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 20: Latin America Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user 2017-2031

Table 21: Middle East & Africa Diagnostic Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Diagnostic Imaging Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 23: Middle East & Africa Diagnostic Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Diagnostic Imaging Market Value (US$ Mn) Forecast, by End-user 2017-2031

List of Figures

Figure 01: Global Diagnostic Imaging Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Diagnostic Imaging Market Value Share, by Product, 2022

Figure 03: Global Diagnostic Imaging Market Value Share, by Application, 2022

Figure 04: Global Diagnostic Imaging Market Value Share, by End-user, 2022

Figure 05: Global Diagnostic Imaging Market Value Share Analysis, by Product, 2022 and 2031

Figure 06: Global Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 07: Global Diagnostic Imaging Market Value Share Analysis, by Application, 2022 and 2031

Figure 08: Global Diagnostic Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 09: Global Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 10: Global Diagnostic Imaging Market Attractiveness Analysis, by End-user 2023-2031

Figure 11: Global Diagnostic Imaging Market Value Share Analysis, by Region, 2022 and 2031

Figure 12: Global Diagnostic Imaging Market Attractiveness Analysis, by Region, 2023-2031

Figure 13: North America Diagnostic Imaging Market Value (US$ Mn) Forecast, 2017-2031

Figure 14: North America Diagnostic Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 15: North America Diagnostic Imaging Market Attractiveness Analysis, by Country, 2023-2031

Figure 16: North America Diagnostic Imaging Market Value Share Analysis, by Product, 2022 and 2031

Figure 17: North America Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 18: North America Diagnostic Imaging Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: North America Diagnostic Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 20: North America Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 21: North America Diagnostic Imaging Market Attractiveness Analysis, by End-user 2023-2031

Figure 22: Europe Diagnostic Imaging Market Value (US$ Mn) Forecast, 2017-2031

Figure 23: Europe Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 25: Europe Diagnostic Imaging Market Value Share Analysis, by Product, 2022 and 2031

Figure 26: Europe America Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 27: Europe Diagnostic Imaging Market Value Share Analysis, by Application, 2022 and 2031

Figure 28: Europe Diagnostic Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 29: Europe Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Europe Diagnostic Imaging Market Attractiveness Analysis, by End-user 2023-2031

Figure 31: Asia Pacific Diagnostic Imaging Market Value (US$ Mn) Forecast, 2017-2031

Figure 32: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Product, 2022 and 2031

Figure 35: Asia Pacific America Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 36: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by Application, 2022 and 2031

Figure 37: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 38: Asia Pacific Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 39: Asia Pacific Diagnostic Imaging Market Attractiveness Analysis, by End-user 2023-2031

Figure 40: Latin America Diagnostic Imaging Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Latin America Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Latin America Diagnostic Imaging Market Value Share Analysis, by Product, 2022 and 2031

Figure 44: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 45: Latin America Diagnostic Imaging Market Value Share Analysis, by Application, 2022 and 2031

Figure 46: Latin America Diagnostic Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 47: Latin America Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 48: Latin America Diagnostic Imaging Market Attractiveness Analysis, by End-user, 2023-2031

Figure 49: Middle East & Africa Diagnostic Imaging Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Diagnostic Imaging Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 51: Middle East & Africa America Diagnostic Imaging Market Value Share Analysis, by Product, 2023-2031

Figure 52: Middle East & Africa America Diagnostic Imaging Market Attractiveness Analysis, by Product, 2023-2031

Figure 53: Middle East & Africa Diagnostic Imaging Market Value Share Analysis, by End-user, 2022 and 2031

Figure 54: Middle East & Africa Diagnostic Imaging Market Attractiveness Analysis, by End-user 2023-2031

Figure 55: Global Diagnostic Imaging Market Share Analysis, by Company (2022)