Analysts’ Viewpoint

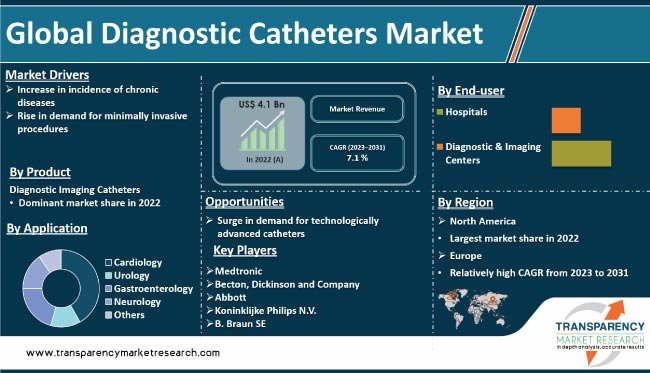

Diagnostic catheters are medical devices that can be inserted in the body to treat diseases or perform a surgical procedure. Rise in prevalence of chronic diseases, technological advancements, increase in geriatric population, and surge in awareness about the benefits of early diagnosis & treatment are driving the global diagnostic catheters market size. Surge in demand for diagnostic and therapeutic procedures due to increase in incidence of cardiovascular diseases, diabetes, and cancer is propelling market progress.

Development of new and advanced diagnostic catheters that are more efficient and less invasive offers significant opportunities for market players. Manufacturers are focusing on research & development of technologically advanced and low cost diagnostic catheters. Increase in government support for improvement in healthcare infrastructure is also fueling market expansion.

Diagnostic catheters are medical devices used to diagnose and treat medical conditions, including heart disease, structural heart disease, and urinary tract infections. These devices are used to navigate through the different parts of the heart, capture vital cardiac information, and deliver precise therapy. These are also used for minimally invasive surgeries.

The global market has witnessed significant technological advancements in the last few years. Miniaturization of diagnostic catheters has made them more precise and less invasive. This has resulted in increase in usage of these devices in medical procedures.

Wireless technology has been integrated into diagnostic catheters, enabling real-time monitoring and data transfer, which has increased the accuracy of diagnostic procedures. Additionally, improved materials for these devices have enhanced durability and flexibility, allowing for better navigation and positioning in the body.

Integration of advanced imaging technologies, such as ultrasound, magnetic resonance imaging (MRI), and computed tomography (CT), into diagnostic catheters has led to more accurate and detailed images of internal organs and tissues. Furthermore, development of smart catheter technology has enabled the integration of sensors and other diagnostic tools into the catheter, providing a more comprehensive diagnostic experience. These technological advancements have made diagnostic catheter procedures more effective and improved patient outcomes.

Increase in incidence of chronic diseases is a major factor propelling global diagnostic catheters market demand. Chronic diseases, such as cardiovascular diseases, respiratory diseases, and gastrointestinal disorders, are becoming more prevalent globally. Therefore, demand for diagnostic and monitoring devices has increased in the last few years.

Diagnostic catheter is a type of medical device used to diagnose various conditions by providing minimally invasive methods of accessing the body's internal organs and tissues. These catheters offer several advantages over traditional diagnostic methods such as lower risk of infection, reduced recovery time, and improved accuracy of diagnostic results.

Diagnostic catheters are essential tools in the medical industry, as these allow doctors to diagnose and treat various diseases by accessing hard-to-reach areas within the body. Technological advancements in these devices, such as the development of smart and connected devices, are expected to drive the global diagnostic catheters market.

Surge in demand for minimally invasive procedures is a major driver of the global market. Minimally invasive procedures, such as catheter-based diagnostics, are gaining preference among patients and doctors due to several benefits they offer over traditional diagnostic methods. These benefits include reduced pain, shorter recovery times, and less scarring. Therefore, increase in number of patients are opting for minimally invasive procedures is fueling the demand for diagnostic catheters.

These devices play a critical role in minimally invasive procedures, providing physicians with a way to access the inside of the body without making a large incision. These devices allow for collection of important diagnostic information, such as blood flow and pressure measurements, without the need for more invasive procedures.

In terms of type, the diagnostic imaging catheters segment accounted for leading share of the global diagnostic catheters market in 2022. This is ascribed to increase in demand for minimally invasive diagnostic procedures and advancements in diagnostic imaging technology.

Additionally, advancements in diagnostic imaging technology have made it possible to provide high-quality images of the inside of the body, enabling the early detection and diagnosis of various medical conditions.

Based on application, the cardiology segment held significant share of the diagnostic catheters market in 2022. This is ascribed to high prevalence of cardiovascular diseases and increase in demand for minimally invasive diagnostic procedures.

Cardiovascular diseases are among the most common and debilitating chronic conditions affecting people across the world. Increase in incidence of these diseases has led to rise in demand for diagnostic procedures, such as coronary angiography and peripheral angiography, to accurately diagnose and manage these conditions.

Diagnostic catheters play a crucial role in the diagnosis and management of cardiovascular diseases. Demand for these devices is expected to increase due to rise in aging population and increase in incidence of cardiovascular diseases. Additionally, surge in demand for minimally invasive diagnostic procedures is propelling the cardiology segment, as these procedures are becoming increasingly popular due to numerous benefits they offer over traditional diagnostic methods.

In terms of end-user, the hospitals segment held prominent share of the global market in 2022, according to the diagnostic catheters market report. This is ascribed to high number of diagnostic procedures performed in hospitals, availability of specialized personnel and equipment, and need for inpatient care and monitoring.

Hospitals are the primary healthcare facilities where patients receive diagnostic procedures, such as angiography, electrophysiology studies, and other catheter-based procedures. These procedures require specialized personnel and equipment, such as interventional cardiologists and imaging systems, which are readily available in hospitals. Furthermore, several diagnostic procedures require inpatient care and monitoring, which can only be provided in hospitals. This includes procedures for patients with complex medical conditions, or those who require close monitoring and follow-up care after their procedure.

North America accounted for significant global market share in 2022. This is ascribed to high healthcare expenditure, well-developed healthcare infrastructure, and high prevalence of chronic diseases. Moreover, increase in investment in healthcare has resulted in advanced medical facilities and well-trained medical professionals.

Governments in Europe have implemented favorable policies to support the healthcare industry, including funding for medical research and innovation. This has enabled the development of advanced diagnostic catheter technologies, which has bolstered the diagnostic catheters market value.

Asia Pacific has a large and aging population, which is more susceptible to chronic diseases such as cardiovascular diseases, diabetes, and cancer. This has driven the demand for diagnostic catheters in the region. Governments in Asia Pacific have implemented favorable policies to support the growth of the healthcare industry, including funding for medical research and innovation.

The global diagnostic catheters market is fragmented, with the presence of a large number of manufacturers. Expansion of product portfolio and mergers & acquisitions are key strategies adopted by prominent manufacturers. Key players operating in the market are Medtronic, BD, Terumo Corporation, Teleflex Incorporated, Abbott, Koninklijke Philips N.V., B. Braun SE, Cardinal Health, Johnson & Johnson Services, and Edwards Lifesciences Corporation.

The industry report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 4.1 Bn |

|

Forecast Value in 2031 |

More than US$ 7.7 Bn |

|

CAGR |

7.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 4.1 Bn in 2022

It is projected to reach more than US$ 7.7 Bn by 2031

The CAGR is anticipated to be 7.1% from 2023 to 2031

The diagnostic catheters segment held more than 80.0% share in 2022

North America is expected to account for the largest share from 2023 to 2031

Medtronic, Becton, Dickinson and Company, Terumo Corporation, Teleflex Incorporated, Abbott, Koninklijke Philips N.V., B. Braun SE, Cardinal Health, Johnson & Johnson Services, and Edwards Lifesciences Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diagnostic Catheters Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Diagnostic Catheters Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence and Incidence rate by Region/globally

5.3. Covid-19 Pandemic Impact Analysis

6. Global Diagnostic Catheters Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Diagnostic Imaging Catheters

6.3.1.1. Angiography Catheters

6.3.1.2. Electrophysiology Catheters

6.3.1.3. Ultrasound Catheters

6.3.1.4. Optical Coherence Tomography Catheters

6.3.1.5. Others

6.3.2. Non-imaging Diagnostic Catheters

6.3.2.1. Pressure & Hemodynamic Monitoring Catheters

6.3.2.2. Temperature Monitoring Catheters

6.3.2.3. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Diagnostic Catheters Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Cardiology

7.3.2. Urology

7.3.3. Gastroenterology

7.3.4. Neurology

7.3.5. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Diagnostic Catheters Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostic & Imaging Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Diagnostic Catheters Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Diagnostic Catheters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Diagnostic Imaging Catheters

10.2.1.1. Angiography Catheters

10.2.1.2. Electrophysiology Catheters

10.2.1.3. Ultrasound Catheters

10.2.1.4. Optical Coherence Tomography Catheters

10.2.1.5. Others

10.2.2. Non-imaging Diagnostic Catheters

10.2.2.1. Pressure & Hemodynamic Monitoring Catheters

10.2.2.2. Temperature Monitoring Catheters

10.2.2.3. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Cardiology

10.3.2. Urology

10.3.3. Gastroenterology

10.3.4. Neurology

10.3.5. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Diagnostic & Imaging Centers

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Diagnostic Catheters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Diagnostic Imaging Catheters

11.2.1.1. Angiography Catheters

11.2.1.2. Electrophysiology Catheters

11.2.1.3. Ultrasound Catheters

11.2.1.4. Optical Coherence Tomography Catheters

11.2.1.5. Others

11.2.2. Non-imaging Diagnostic Catheters

11.2.2.1. Pressure & Hemodynamic Monitoring Catheters

11.2.2.2. Temperature Monitoring Catheters

11.2.2.3. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Cardiology

11.3.2. Urology

11.3.3. Gastroenterology

11.3.4. Neurology

11.3.5. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostic & Imaging Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Diagnostic Catheters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Diagnostic Imaging Catheters

12.2.1.1. Angiography Catheters

12.2.1.2. Electrophysiology Catheters

12.2.1.3. Ultrasound Catheters

12.2.1.4. Optical Coherence Tomography Catheters

12.2.1.5. Others

12.2.2. Non-imaging Diagnostic Catheters

12.2.2.1. Pressure & Hemodynamic Monitoring Catheters

12.2.2.2. Temperature Monitoring Catheters

12.2.2.3. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Cardiology

12.3.2. Urology

12.3.3. Gastroenterology

12.3.4. Neurology

12.3.5. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostic & Imaging Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Diagnostic Catheters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Diagnostic Imaging Catheters

13.2.1.1. Angiography Catheters

13.2.1.2. Electrophysiology Catheters

13.2.1.3. Ultrasound Catheters

13.2.1.4. Optical Coherence Tomography Catheters

13.2.1.5. Others

13.2.2. Non-imaging Diagnostic Catheters

13.2.2.1. Pressure & Hemodynamic Monitoring Catheters

13.2.2.2. Temperature Monitoring Catheters

13.2.2.3. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Cardiology

13.3.2. Urology

13.3.3. Gastroenterology

13.3.4. Neurology

13.3.5. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Diagnostic & Imaging Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Diagnostic Catheters Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Diagnostic Imaging Catheters

14.2.1.1. Angiography Catheters

14.2.1.2. Electrophysiology Catheters

14.2.1.3. Ultrasound Catheters

14.2.1.4. Optical Coherence Tomography Catheters

14.2.1.5. Others

14.2.2. Non-imaging Diagnostic Catheters

14.2.2.1. Pressure & Hemodynamic Monitoring Catheters

14.2.2.2. Temperature Monitoring Catheters

14.2.2.3. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Cardiology

14.3.2. Urology

14.3.3. Gastroenterology

14.3.4. Neurology

14.3.5. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Diagnostic & Imaging Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. BD

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Terumo Corporation

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Teleflex Incorporated

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Abbott

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Koninklijke Philips N.V.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. B. Braun SE

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Cardinal Health

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Johnson & Johnson Services

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Edwards Lifesciences Corporation

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Global Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Diagnostic Catheters Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 07: North America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 11: Europe Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 15: Asia Pacific Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 19: Latin America Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Diagnostic Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Diagnostic Catheters Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 23: Middle East & Africa Diagnostic Catheters Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Diagnostic Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Diagnostic Catheters Market Value Share, by Product, 2022

Figure 03: Global Diagnostic Catheters Market Value Share, by Application, 2022

Figure 04: Global Diagnostic Catheters Market Value Share, by End-user, 2022

Figure 05: Global Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 06: Global Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 07: Global Diagnostic Catheters Market Value (US$ Mn), by Diagnostic Imaging Catheters, 2017‒2031

Figure 08: Global Diagnostic Catheters Market Value (US$ Mn), by Angiography Catheters, 2017‒2031

Figure 09: Global Diagnostic Catheters Market Value (US$ Mn), by Electrophysiology Catheters, 2017‒2031

Figure 10: Global Diagnostic Catheters Market Value (US$ Mn), by Ultrasound Catheters, 2017‒2031

Figure 11: Global Diagnostic Catheters Market Value (US$ Mn), by Optical Coherence Tomography Catheters, 2017‒2031

Figure 12: Global Diagnostic Catheters Market Value (US$ Mn), by Others, 2017‒2031

Figure 13: Global Diagnostic Catheters Market Value (US$ Mn), by Non-Imaging Diagnostic Catheters, 2017‒2031

Figure 14: Global Diagnostic Catheters Market Value (US$ Mn), by Pressure and Hemodynamic Monitoring Catheters, 2017‒2031

Figure 15: Global Diagnostic Catheters Market Value (US$ Mn), by Temperature Monitoring Catheters, 2017‒2031

Figure 16: Global Diagnostic Catheters Market Value (US$ Mn), by Others, 2017‒2031

Figure 17: Global Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 18: Global Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 19: Global Diagnostic Catheters Market Revenue (US$ Mn), by Cardiology, 2017–2031

Figure 20: Global Diagnostic Catheters Market Revenue (US$ Mn), by Urology, 2017–2031

Figure 21: Global Diagnostic Catheters Market Revenue (US$ Mn), by Gastroenterology, 2017–2031

Figure 22: Global Diagnostic Catheters Market Revenue (US$ Mn), by Neurology, 2017–2031

Figure 23: Global Diagnostic Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 24: Global Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: Global Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 26: Global Diagnostic Catheters Market Revenue (US$ Mn), by Hospitals 2017–2031

Figure 27: Global Diagnostic Catheters Market Revenue (US$ Mn), by Diagnostic & Imaging Centers, 2017–2031

Figure 28: Global Diagnostic Catheters Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Diagnostic Catheters Market Attractiveness Analysis, by Region, 2023–2031

Figure 30: North America Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 31: North America Diagnostic Catheters Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America Diagnostic Catheters Market Attractiveness Analysis, by Country, 2023–2031

Figure 33: North America Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 34: North America Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 35: North America Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 36: North America Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 37: North America Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 38: North America Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 39: Europe Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Europe Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 41: Europe Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 42: Europe Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 43: Europe Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 44: Europe Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 45: Europe Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 46: Europe Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Europe Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 48: Asia Pacific Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Asia Pacific Diagnostic Catheters Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Asia Pacific Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 51: Asia Pacific Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 52: Asia Pacific Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 53: Asia Pacific Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 54: Asia Pacific Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 55: Asia Pacific Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 56: Asia Pacific Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 57: Latin America Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 58: Latin America Diagnostic Catheters Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 59: Latin America Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 60: Latin America Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 61: Latin America Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 62: Latin America Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 63: Latin America Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 64: Latin America Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 65: Latin America Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 66: Middle East & Africa Diagnostic Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 67: Middle East & Africa Diagnostic Catheters Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 68: Middle East & Africa Diagnostic Catheters Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 69: Middle East & Africa Diagnostic Catheters Market Value Share Analysis, by Product, 2022 and 2031

Figure 70: Middle East & Africa Diagnostic Catheters Market Attractiveness Analysis, by Product, 2023–2031

Figure 71: Middle East & Africa Diagnostic Catheters Market Value Share Analysis, by Application, 2022 and 2031

Figure 72: Middle East & Africa Diagnostic Catheters Market Attractiveness Analysis, by Application, 2023–2031

Figure 73: Middle East & Africa Diagnostic Catheters Market Value Share Analysis, by End-user, 2022 and 2031

Figure 74: Middle East & Africa Diagnostic Catheters Market Attractiveness Analysis, by End-user, 2023–2031

Figure 75: Company Share Analysis, 2022