Analysts’ Viewpoint on Global Market Scenario

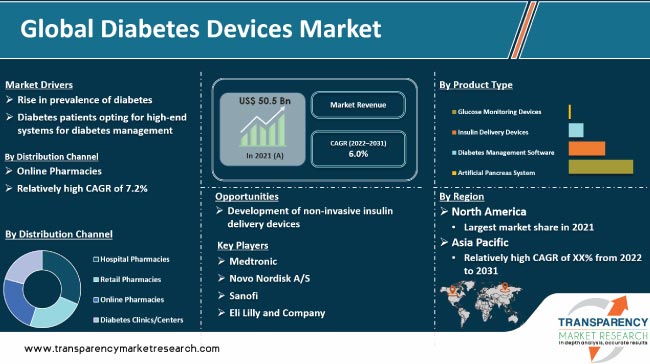

The global market for diabetes devices is estimated to grow at a rapid pace by 2031. Diabetes devices are used to diagnose and monitor blood glucose level in a diabetic patient’s body. Increase in demand for minimally invasive devices has prompted companies to launch patient-convenient blood glucose monitoring devices. Surge in patient pool suffering from diabetes has led to rise in the demand for diabetes lancet devices and diabetes care devices. The geriatric population is highly susceptible to diabetes, which has propelled the demand for diabetes tracker devices. Furthermore, initiatives taken by governments to spread awareness about diabetes devices have fueled the global diabetes care devices market size. Improvement in healthcare infrastructure and economic growth are also propelling the diabetes devices market demand. However, less awareness about the usage of devices in remote and underdeveloped regions, long registration processes, and reimbursement issues are likely to restrain the global market. Nevertheless, companies are focusing on minimizing the cost of diabetes tracker devices, which is likely to increase the demand for these devices.

Diabetes is a global issue affecting millions of people every year. In the last decade, type 1 diabetes has been one of the major healthcare concerns across the world. Countries such as the U.S., China, the U.K., and Germany have witnessed increasing rates of type 1 diabetes incidence. Type 1 diabetes is a form of autoimmune disease that occurs in children and adults, in which the pancreas stops producing insulin. The surge in the incidence of type 1 diabetes among children is one of the major healthcare concerns. According to IDF, in 2015, Europe had 140,000 children (0-14 years) with type-1 diabetes, and 21,600 new cases are diagnosed every year. Type-1 diabetes patients primarily use insulin pens or insulin pumps. Insulin pumps are more expensive than other insulin delivery devices. However, according to diabetes device market trends, the adoption of insulin pumps is increasing at a steady pace in developing and developed countries.

The COVID-19 pandemic has had a negative effect on the global market. The pandemic resulted in stock market turbulence, stringent border controls, and countrywide lockdowns, all taking their toll on various sectors. The pandemic has significantly strained hospital resources, including medical equipment and healthcare professionals. The supply chain of diabetes devices has been hampered, which has negatively affected the diabetes device market. However, diabetes is a chronic disease, and governments have sought to maintain a regular supply of diabetes devices. A large population worked from home during the lockdown, and numerous patients used remote monitoring devices for diabetics. People were more focused on their diet to control diabetes naturally by regulating their food. These factors hampered the market for diabetes devices.

In terms of product type, the global diabetes devices market has been classified into glucose monitoring devices, insulin delivery devices, diabetes monitoring software, and artificial pancreas systems. The glucose monitoring devices segment has been segregated into self-monitoring blood glucose meters, blood glucose testing strips, lancets, and continuous glucose monitoring meters. The insulin delivery devices market segment has been split into insulin syringes, insulin pens, and insulin pumps. The glucose monitoring devices segment dominated the global market for diabetes care devices in 2021. The trend is projected to continue during the forecast period. The wide availability of diabetes tracker devices with advanced sensors for the detection of blood sugar levels is a major driver of the segment. Moreover, the usage of wireless technology in continuous glucose monitoring (CGM) for transmitting glucose readings collected from the interstitial fluid between the patient’s skin cells has become an important tool for diabetes monitoring devices.

Based on distribution channels, the global diabetes care devices market has been divided into hospital pharmacies, retail pharmacies, online pharmacies, and diabetes clinics/centers. Hospital pharmacies is projected to be a highly attractive segment during the forecast period. A high prevalence of type 2 and 1 diabetes is anticipated to increase hospital visits. Furthermore, the prevalence of diabetes among hospitalized patients is a major factor that drives the demand for diabetes devices at hospital pharmacies. The hospital pharmacies segment is likely to dominate the diabetes devices market during the forecast period. An increase in investment in R&D and a promising pipeline of artificial pancreas systems are anticipated to fuel the hospital pharmacies segment.

North America accounted for a major share of the global diabetes devices market in 2021. This is ascribed to the large diabetes population, higher awareness, significant healthcare spending in the overall national budget, early availability of advanced technologies, and higher penetration of healthcare services across the country. The U.S. is a major market for diabetes devices in North America. Factors such as the aging population, highly structured healthcare industry, and availability of well-defined reimbursement policies from public and private health insurance firms augment the diabetes care devices market in the U.S. A report published in 2022 stated that the U.S. accounted for 37.3 million people who have diabetes, which is 11.3% of the population of the country. Around 28.7 million people have been diagnosed with diabetes. Among these, 8.5 million people who have diabetes have not been diagnosed and do not know they have it. Diabetes is the leading cause of kidney failure, blindness, and amputations in the U.S.

The market in Asia Pacific is anticipated to grow at a rapid pace during the forecast period due to the rise in the prevalence of infectious diseases. An increase in the geriatric population, a surge in healthcare expenditure, and a rise in patient awareness about diabetes devices are fueling the market in the region. Countries such as China and India are expected to dominate the diabetes devices business in the region in the next few years. Asia Pacific is a relatively untapped market than developed regions. Hence, the region presents better growth opportunities in this market. China and India are the most populous countries in the world and have the maximum number of diabetes patients. According to the International Diabetes Federation 2017, China has the largest number of people with diabetes aged between 20 and 79 years.

The diabetes devices market report includes vital information about leading players in the global market. Companies are adopting product launches, divestiture, mergers & acquisitions, and partnership strategies to enhance their market share. Medtronic, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, Tandem Diabetes Care, Inc., Abbott Laboratories, Cellnovo, Insulet Corporation, LifeScan, Inc., and Owen Mumford Ltd. are the prominent players operating in the global market.

Each of these players has been profiled in the diabetes care devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 50.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 90.2 Bn |

|

Growth Rate (CAGR) for 2022–2031 |

6.0% |

|

Forecast Period |

2022-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 50.5 Bn in 2021

The global market is projected to reach more than US$ 90.2 Bn by 2031

The global market is anticipated to grow at a CAGR of 6.0% from 2022 to 2031

Rise in prevalence of diabetes and increase in adoption of insulin pumps among type 1 diabetes patients are driving the global market

North America is expected to account for a major share of the global market for diabetes devices during the forecast period

Medtronic, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, Tandem Diabetes Care, Inc., Abbott Laboratories, Cellnovo, Insulet Corporation, LifeScan, Inc., and Owen Mumford Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diabetes Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Diabetes Devices Market Analysis and Forecast, 2017-2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Technological Advancements

5.2. Value Chain Analysis

5.3. Estimated Number of People with Diabetes Worldwide and Per Region (Age 20-79 years)

5.4. Emerging Technologies in Diabetes Management

5.5. COVID-19 Impact Analysis

6. Global Diabetes Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Glucose Monitoring Devices

6.3.1.1. Self-monitoring Blood Glucose Meters

6.3.1.2. Blood Glucose Testing Strips

6.3.1.3. Lancets

6.3.1.4. Continuous Glucose Monitoring Meters

6.3.2. Insulin Delivery Devices

6.3.2.1. Insulin Syringes

6.3.2.2. Insulin Pens

6.3.2.3. Insulin Pumps

6.3.3. Diabetes Management Software

6.3.4. Artificial Pancreas System

6.4. Market Attractiveness Analysis, by Product Type

7. Global Diabetes Devices Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017-2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.3.4. Diabetes Clinics/Centers

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Diabetes Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Diabetes Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017-2031

9.2.1. Glucose Monitoring Devices

9.2.1.1. Self-monitoring Blood Glucose Meters

9.2.1.2. Blood Glucose Testing Strips

9.2.1.3. Lancets

9.2.1.4. Continuous Glucose Monitoring Meters

9.2.2. Insulin Delivery Devices

9.2.2.1. Insulin Syringes

9.2.2.2. Insulin Pens

9.2.2.3. Insulin Pumps

9.2.3. Diabetes Management Software

9.2.4. Artificial Pancreas System

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.3.4. Diabetes Clinics/Centers

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Diabetes Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Glucose Monitoring Devices

10.2.1.1. Self-monitoring Blood Glucose Meters

10.2.1.2. Blood Glucose Testing Strips

10.2.1.3. Lancets

10.2.1.4. Continuous Glucose Monitoring Meters

10.2.2. Insulin Delivery Devices

10.2.2.1. Insulin Syringes

10.2.2.2. Insulin Pens

10.2.2.3. Insulin Pumps

10.2.3. Diabetes Management Software

10.2.4. Artificial Pancreas System

10.3. Market Value Forecast, by Distribution Channel, 2017-2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.3.4. Diabetes Clinics/Centers

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Diabetes Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Glucose Monitoring Devices

11.2.1.1. Self-monitoring Blood Glucose Meters

11.2.1.2. Blood Glucose Testing Strips

11.2.1.3. Lancets

11.2.1.4. Continuous Glucose Monitoring Meters

11.2.2. Insulin Delivery Devices

11.2.2.1. Insulin Syringes

11.2.2.2. Insulin Pens

11.2.2.3. Insulin Pumps

11.2.3. Diabetes Management Software

11.2.4. Artificial Pancreas System

11.3. Market Value Forecast, by Distribution Channel, 2017-2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.3.4. Diabetes Clinics/Centers

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Diabetes Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Glucose Monitoring Devices

12.2.1.1. Self-monitoring Blood Glucose Meters

12.2.1.2. Blood Glucose Testing Strips

12.2.1.3. Lancets

12.2.1.4. Continuous Glucose Monitoring Meters

12.2.2. Insulin Delivery Devices

12.2.2.1. Insulin Syringes

12.2.2.2. Insulin Pens

12.2.2.3. Insulin Pumps

12.2.3. Diabetes Management Software

12.2.4. Artificial Pancreas System

12.3. Market Value Forecast, by Distribution Channel, 2017-2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Pharmacies

12.3.4. Diabetes Clinics/Centers

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Diabetes Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Glucose Monitoring Devices

13.2.1.1. Self-monitoring Blood Glucose Meters

13.2.1.2. Blood Glucose Testing Strips

13.2.1.3. Lancets

13.2.1.4. Continuous Glucose Monitoring Meters

13.2.2. Insulin Delivery Devices

13.2.2.1. Insulin Syringes

13.2.2.2. Insulin Pens

13.2.2.3. Insulin Pumps

13.2.3. Diabetes Management Software

13.2.4. Artificial Pancreas System

13.3. Market Value Forecast, by Distribution Channel, 2017-2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Pharmacies

13.3.4. Diabetes Clinics/Centers

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Medtronic

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Novo Nordisk A/S

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Sanofi

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Eli Lilly and Company

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. F. Hoffmann-La Roche Ltd.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. Becton Dickinson and Company

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Tandem Diabetes Care, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Abbott Laboratories

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Cellnovo

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Insulet Corporation

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. LifeScan, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

14.3.12. Owen Mumford Ltd.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

List of Tables

Table 01: Global Diabetes Devices Market Size (US$ Mn) Forecast, by Product type, 2017-2031

Table 02: Global Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Glucose Monitoring Devices 2017-2031

Table 03: Global Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Insulin Delivery Devices, 2017-2031

Table 04: Global Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 05: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Diabetes Devices Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 08: North America Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Glucose Monitoring Devices 2017-2031

Table 09: North America Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Insulin Delivery Devices, 2017-2031

Table 10: North America Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 11: Europe Diabetes Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 13: Europe Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Glucose Monitoring Devices, 2017-2031

Table 14: Europe Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type - Insulin Delivery Devices, 2017-2031

Table 15: Europe Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 16: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 18: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, by Glucose Monitoring Devices, 2017-2031

Table 19: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, by Insulin Delivery Devices, 2017-2031

Table 20: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 21: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 23: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, by Glucose Monitoring Devices, 2017-2031

Table 24: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, by Insulin Delivery Devices, 2017-2031

Table 25: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 26: Middle East & Africa Diabetes Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 28: Middle East & Africa Diabetes Devices Market Size (US$ Mn) Forecast, by Glucose Monitoring Devices, 2017-2031

Table 29: Middle East & Africa Diabetes Devices Market Size (US$ Mn) Forecast, by Insulin Delivery Devices, 2017-2031

Table 30: Middle East & Africa Diabetes Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Diabetes Devices Market, by Product, Market Size (US$ Mn), 2021 (A)

Figure 02: Global Diabetes Devices Market, by Distribution Channel, Market Share, 2021 (A)

Figure 03: Global Diabetes Devices Market Size (US$ Mn) Forecast, 2017-2031

Figure 04: Company Revenue Share (1)

Figure 05: Company Revenue Share (2)

Figure 06: Estimated Number of People with Diabetes Worldwide and Per Region (Age 20-79 years)

Figure 07: Global Diabetes Devices Market Value Share, by Product Type, 2021 and 2025

Figure 08: Global Diabetes Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 09: Global Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 10: Global America Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2021 and 2031

Figure 11: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Glucose Monitoring Devices, 2017-2031

Figure 12: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Insulin Delivery Devices, 2017-2031

Figure 13: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diabetes Monitoring Software, 2017-2031

Figure 14: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Artificial Pancreas System, 2017-2031

Figure 15: Global Diabetes Devices Market Value Share, by Distribution Channel, 2021 and 2025

Figure16: Global Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 17: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017-2031

Figure 18: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017-2031

Figure 19: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Online Pharmacies, 2017-2031

Figure 20: Global Diabetes Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diabetes Clinics/ Centers, 2017-2031

Figure 21: Global Diabetes Device Market Scenario, by Country (1/1)

Figure 22: Global Diabetes Devices Market Value Share Analysis, by Region, 2021 and 2025

Figure 23: Global Diabetes Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 24: North America Diabetes Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 25: North America Diabetes Devices Market Attractiveness Analysis, by Country, 2022-2031

Figure 26: North America Diabetes Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 27: North America Diabetes Devices Market Value Share, by Product Type, 2021 and 2031

Figure 28: North America Diabetes Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 29: North America Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 30: North America Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2021 and 2031

Figure 31: North America Diabetes Devices Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Fig 32: North America Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 33: Europe Diabetes Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 34: Europe Diabetes Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 35: Europe Diabetes Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Europe Diabetes Devices Market Value Share, by Product Type, 2021 and 2031

Figure 37: Europe Diabetes Devices Market Attractiveness Analysis, by Product Type, 2017-2031

Figure 38: Europe Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 39: Europe Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2017-2031

Figure 40: Europe Diabetes Devices Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 41: Europe Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 42: Asia Pacific Diabetes Devices Market Size (US$ Mn) Forecast, and Y-o-Y Growth (%) Forecast, by region, 2017-2031

Figure 43: Asia Pacific Diabetes Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 44: Asia Pacific Diabetes Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Asia Pacific Diabetes Devices Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 46: Asia Pacific Diabetes Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 47: Asia Pacific Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 48: Asia Pacific Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2017-2031

Figure 48: Asia Pacific Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2017-2031

Figure 49: Asia Pacific Diabetes Devices Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 50: Asia Pacific Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 51: Latin America Diabetes Devices Market Size (US$ Mn) Forecast, and Y-o-Y Growth (%) Forecast, by region, 2017-2031

Figure 52: Latin America Diabetes Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 53: Latin America Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Latin America Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 55: Latin America Diabetes Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 56: Latin America Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 57: Latin America Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2017-2031

Figure 58: Latin America Diabetes Devices Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 59: Latin America Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 60: Middle East & Africa Diabetes Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast 2017-2031

Figure 61: Middle East & Africa Diabetes Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 62: Middle East & Africa Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 63: Middle East & Africa Market Value Share Analysis, by Product Type, 2022-2031

Figure 64: Middle Diabetes Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 65: Middle East & Africa Diabetes Devices Market Value Share, by Glucose Monitoring Devices, 2021 and 2031

Figure 66: Middle East & Africa Diabetes Devices Market Value Share, by Insulin Delivery Devices, 2017-2031

Figure 67: Middle East & Africa Diabetes Devices Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 68: Middle East & Africa Diabetes Devices Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 69: Medtronic, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 70: Medtronic, R&D Intensity and Sales & Marketing Intensity (%) - Company Level or Segment Level, 2017-2021

Figure 71: Medtronic, Breakdown of Net Sales, by Region 2017

Figure 72: Medtronic, Breakdown of Net Sales, by Business Segments, 2017

Figure 73: Novo Nordisk A/S, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 74: Novo Nordisk A/S, R&D Intensity and Sales & Marketing Intensity (%), 2017-2021

Figure 75: Novo Nordisk A/S, Breakdown of Net Sales, by Region 2021

Figure 76: Novo Nordisk A/S, Breakdown of Net Sales, by Business Segments, 2021

Figure 77: Sanofi, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 78: Sanofi, R&D Intensity and Sales & Marketing Intensity (US$ Bn), 2017-2021

Figure 79: Sanofi, Breakdown of Net Sales, by Region 2021

Figure 80: Sanofi, Breakdown of Net Sales, by Business Segments, 2021

Figure 81: Eli Lilly and Company, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 82: Eli Lilly and Company, R&D Intensity and Sales & Marketing Intensity - Company Level, 2017-2021

Figure 83: Eli Lilly and Company, Breakdown of Net Sales, by Region 2017

Figure 84: Eli Lilly and Company, Breakdown of Net Sales, by Endocrinology Segment, 2021

Figure 85: F. Hoffmann-La Roche Ltd., Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 86: F. Hoffmann-La Roche Ltd., R&D Intensity (US$ Bn), 2017-2021

Figure 87: F. Hoffmann-La Roche Ltd., Breakdown of Net Sales of Diabetes Care Business Area, by Region 2021

Figure 88: F. Hoffmann-La Roche Ltd., Breakdown of Net Sales, by Diagnostic Division, 2021

Figure 89: Becton, Dickinson and Company, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 90: Becton, Dickinson and Company, R&D Expense (US$ Mn), 2017-2021

Figure 91: Becton, Dickinson and Company, Breakdown of Net Sales, by Region 2021

Figure 92: Becton, Dickinson and Company, Breakdown of Net Sales, by BD Medical Business segment, 2021

Figure 93: Tandem Diabetes Care, Inc., Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2021

Figure 94: Tandem Diabetes Care, Inc., R&D Expense (US$ Mn), 2017-2021

Figure 95: Abbott Laboratories, Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 96: Abbott Laboratories, R&D Intensity and Sales & Marketing Intensity - Company Level, 2017-2021

Figure 97: Abbott Laboratories, Breakdown of Net Sales, by Region 2021

Figure 98: Abbott Laboratories, Breakdown of Net Sales, by Business Segment, 2021

Figure 99: Cellnovo, Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2021

Figure 100: Insulet Corporation, Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2021

Figure 101: Insulet Corporation, R&D Intensity and Sales & Marketing Intensity (US$ Mn) - Company Level, 2017-2021

Figure 102: Insulet Corporation, Breakdown of Net Sales, by Region, 2021

Figure 103: Insulet Corporation, Breakdown of Net Sales, by Business Segments 2021

Figure 104: LifeScan, Inc., Concerned Company Revenue (US$ Bn) & Y-o-Y Growth (%), 2017-2021

Figure 105: LifeScan, Inc., R&D Intensity and Sales & Marketing Intensity - Company Level, 2017-2021

Figure 106: LifeScan, Inc., Breakdown of Net Sales, by Region (Company Level), 2021

Figure 107: LifeScan, Inc., Breakdown of Net Sales, (By Business And Business Segment Level), 2021