Analysts’ Viewpoint

DevOps is a new strategy for managing and optimizing operations and service delivery from beginning to end. The entire software delivery lifecycle is transformed using a set of principles to bring in new practices made possible by technology.

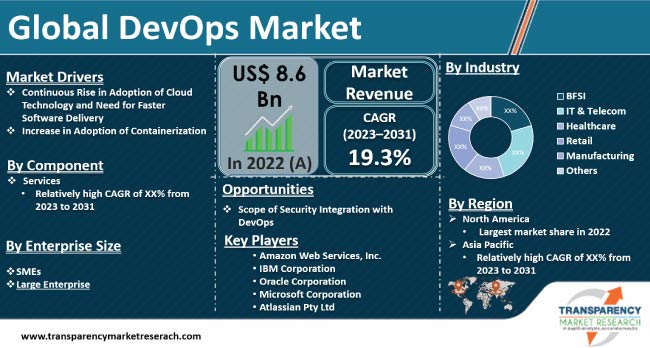

Continuous rise in adoption of cloud technology and need for faster software delivery are playing a key role in DevOps market development. On the other hand, high DevOps deployment costs and legacy systems can hinder market growth.

Meanwhile, the scope of security integration with DevOps is opening up lucrative market Opportunities. DevOps market distributors are investing in R&D to be able to improve the performance of their services and develop new technologies for technology integration.

DevOps combines development and operations practices to enhance collaboration, communication, and automation across the software development lifecycle. Organizations that seek to accelerate software delivery, enhance product quality, and streamline their operations are increasingly investing in DevOps industry solutions and services. The DevOps market includes a wide range of tools, platforms, and consulting services that facilitate the integration of DevOps practices.

The DevOps culture emphasizes continuous learning and improvement, making it an ongoing journey for organizations to adopt and optimize DevOps practices in their workflows.

A cloud platform allows DevOps teams to adapt to changing requirements and collaborate across diverse enterprise environments. The development process is accelerated by the use of cloud services and solutions that help overcome some of the shortcomings of legacy systems. Software developers leverage cloud services for agile development to deliver software and services of higher quality.

Majority of cloud service providers offer CI/CD technologies to automate DevOps procedures. Scalability is made possible by cloud native development, which gives DevOps a significant boost. By providing a consistent platform for the deployment, testing, integration, and release of applications, the cloud reduces latency and facilitates centralized management.

According to O-Reilley, more than 90% of IT organizations use cloud technology. By boosting each stage of the development lifecycle, cloud computing makes it easier to deploy DevOps. Through kernels and virtualization, programs can be created and tested in a variety of settings via clouds. The on-demand nature of cloud technology eliminates the need for physical equipment tests, and thus saves time as well as cost.

DevOps practices address the need for speed by bringing teams together to build, test, and maintain software more quickly and securely than they could with conventional waterfall practices. With the help of DevOps, which combines software development and IT operations, it is possible to provide software continuously while also shortening the development lifecycle.

The DevOps lifecycle includes continuous integration and continuous deployment. These two methods make it possible to integrate and distribute the code immediately, which raises the frequency and caliber of software delivery. It reduces the duration of growth from weeks or months to days or even hours. Application modifications are implemented in the production environment faster and more frequently, thereby shortening the deployment period and speeding up the prototype development cycle. This is expanding the global DevOps market size.

DevOps provides businesses with the ability to release new products and features faster. However, the fast pace and frequency can have complexities with established practices for handling security and compliance. This results in an enterprise paradox, where the aim is to innovate and move quickly while also ensuring security by avoiding setbacks on controls. However, integrating security into DevOps efforts (DevSecOps) throughout the entire product lifecycle as opposed to handling it separately or waiting until the end of the development process after a product is released can significantly lower an organization’s risk posture, increase their agility, and improve the security and dependability of their products.

Companies can develop specialized security solutions for DevOps pipelines, such as automated security testing and vulnerability scanning. DevOps consulting firms can offer expertise in implementing security best practices within DevOps environments. Integrating security automation tools into existing workflows enhances an organization's security posture. Monitoring solutions can provide real-time insights into security threats. Additionally, companies can develop compliance solutions to ensure adherence to regulations while maintaining DevOps speed. They can offer training programs to upskill DevOps teams in security practices.

According to GitLab’s survey conducted in 2021, 60% of rapid development teams had embedded DevSecOps practices in 2021, as opposed to 20% in 2019. DevOps-as-a-Service (DaaS) providers can provide end-to-end DevSecOps solutions for organizations seeking to outsource their security practices. DevOps Market players can create integration capabilities with existing security platforms, making their offerings more attractive to security-conscious organizations. Developing containerization solutions with security best practices addresses potential security risks within container environments.

Overall, DevSecOps offers opportunities to differentiate offerings, cater to security-conscious organizations, and help businesses achieve a balance between speed and security in software development. As security remains a top concern, DevOps market players are likely to find ongoing prospects in this dynamic landscape. This is creating growth prospects for the DevOps market.

According to the latest market research Report, North America is expected to dominate the DevOps market as a large number of technology companies reside in the region, especially in the U.S. These companies are increasingly embracing DevOps to streamline their software development processes, reduce time-to-market, and improve overall efficiency. The region is also seeing advanced improvement in the market.

DevOps market growth in Asia Pacific is expected to be at the highest CAGR during the forecast period. The region has seen rapid expansion of its IT industry, with many companies offering software development, cloud services, and digital solutions. DevOps practices enable these organizations to streamline their software development processes, reduce development cycles, and improve overall efficiency, which is making it the fastest growing market for DevOps.

The DevOps market report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Microsoft Corporation, Broadcom Inc., Atlassian Pty Ltd, IBM Corporation, Amazon Web Services, Inc., Google LLC, GitLab B.V., Open Text Corporation (Micro Focus), Cisco Systems, Inc., Oracle Corporation, Dell Inc. and HashiCorp, Inc. are the key companies in the DevOps market.

Prominent providers are investing in R&D activities to introduce DevOps solutions that can meet the growing DevOps market demand. These service providers are tapping into the latest DevOps market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the DevOps market forecast report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 8.6 Bn |

|

Market Forecast Value in 2031 |

US$ 42.0 Bn |

|

Growth Rate (CAGR) |

19.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 8.6 Bn in 2022

It is anticipated to reach US$ 42.0 Bn by the end of 2031

The CAGR is estimated to be 19.3% from 2023 to 2031

Continuous rise in adoption of cloud technology, increase in adoption of containerization, and need for faster software delivery

North America accounted for leading share in 2022

Microsoft Corporation, Broadcom Inc., Atlassian Pty Ltd, IBM Corporation, Amazon Web Services, Inc., Google LLC, GitLab B.V., Open Text Corporation (Micro Focus), Cisco Systems, Inc., Oracle Corporation, Dell Inc., and HashiCorp, Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global DevOps Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on DevOps Market

4.5. Porter’s Five Forces Analysis

4.6. PEST Analysis

4.7. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.7.1. By Component

4.7.2. By Deployment Mode

4.7.3. By Enterprise Size

4.7.4. By Industry

5. Global DevOps Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2018-2031

5.1.1. Historic Growth Trends, 2018-2022

5.1.2. Forecast Trends, 2023-2031

6. Global DevOps Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. DevOps Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Solutions

6.3.1.1. Management

6.3.1.2. Delivery

6.3.1.2.1. Collaborative Development

6.3.1.2.2. Integration & Testing

6.3.1.3. Operation

6.3.1.3.1. Deployment

6.3.1.3.2. Monitoring & Feedback

6.3.2. Services

6.3.2.1. Professional

6.3.2.2. Managed

7. Global DevOps Market Analysis, by Deployment Mode

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. DevOps Market Size (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

7.3.1. Private Cloud

7.3.2. Public Cloud

7.3.3. Hybrid Cloud

8. Global DevOps Market Analysis, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. DevOps Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

8.3.1. SMEs

8.3.2. Large Enterprise

9. Global DevOps Market Analysis, by Industry

9.1. Key Segment Analysis

9.2. DevOps Market Size (US$ Mn) Forecast, by Industry, 2018 - 2031

9.2.1. BFSI

9.2.2. IT & Telecom

9.2.3. Healthcare

9.2.4. Retail

9.2.5. Manufacturing

9.2.6. Others

10. Global DevOps Market Analysis and Forecasts, by Region

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America DevOps Market Analysis and Forecast

11.1. Regional Outlook

11.2. DevOps Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Deployment Mode

11.2.3. By Enterprise Size

11.2.4. By Industry

11.3. DevOps Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

11.3.1. U.S.

11.3.2. Canada

11.3.3. Mexico

12. Europe DevOps Market Analysis and Forecast

12.1. Regional Outlook

12.2. DevOps Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Deployment Mode

12.2.3. By Enterprise Size

12.2.4. By Industry

12.3. DevOps Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. Germany

12.3.2. UK

12.3.3. France

12.3.4. Italy

12.3.5. Spain

12.3.6. Rest of Europe

13. Asia Pacific DevOps Market Analysis and Forecast

13.1. Regional Outlook

13.2. DevOps Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Deployment Mode

13.2.3. By Enterprise Size

13.2.4. By Industry

13.3. DevOps Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Rest of Asia Pacific

14. Middle East & Africa DevOps Market Analysis and Forecast

14.1. Regional Outlook

14.2. DevOps Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Deployment Mode

14.2.3. By Enterprise Size

14.2.4. By Industry

14.3. DevOps Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Saudi Arabia

14.3.2. United Arab Emirates

14.3.3. South Africa

14.3.4. Rest of Middle East & Africa

15. South America DevOps Market Analysis and Forecast

15.1. Regional Outlook

15.2. DevOps Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

15.2.1. By Component

15.2.2. By Deployment Mode

15.2.3. By Enterprise Size

15.2.4. By Industry

15.3. DevOps Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

15.3.1. Brazil

15.3.2. Argentina

15.3.3. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Competitive Landscape by Tier Structure of Companies

16.3. Scale of Competition at Regional Level, 2022

16.4. Market Revenue Share Analysis/Ranking, by Leading Players (2022)

16.5. Major Mergers & Acquisitions, Expansions, Partnerships, Contacts, Deals, etc.

17. Company Profiles

17.1. Microsoft Corporation

17.1.1. Business Overview

17.1.2. Company Revenue

17.1.3. Product Portfolio

17.1.4. Geographic Footprint

17.1.5. Recent Developments

17.1.6. Impact of COVID-19

17.1.7. TMR View

17.1.8. Competitive Threats and Weakness

17.2. Broadcom Inc.

17.2.1. Business Overview

17.2.2. Company Revenue

17.2.3. Product Portfolio

17.2.4. Geographic Footprint

17.2.5. Recent Developments

17.2.6. Impact of COVID-19

17.2.7. TMR View

17.2.8. Competitive Threats and Weakness

17.3. Atlassian Pty Ltd

17.3.1. Business Overview

17.3.2. Company Revenue

17.3.3. Product Portfolio

17.3.4. Geographic Footprint

17.3.5. Recent Developments

17.3.6. Impact of COVID-19

17.3.7. TMR View

17.3.8. Competitive Threats and Weakness

17.4. IBM Corporation

17.4.1. Business Overview

17.4.2. Company Revenue

17.4.3. Product Portfolio

17.4.4. Geographic Footprint

17.4.5. Recent Developments

17.4.6. Impact of COVID-19

17.4.7. TMR View

17.4.8. Competitive Threats and Weakness

17.5. Amazon Web Services, Inc.

17.5.1. Business Overview

17.5.2. Company Revenue

17.5.3. Product Portfolio

17.5.4. Geographic Footprint

17.5.5. Recent Developments

17.5.6. Impact of COVID-19

17.5.7. TMR View

17.5.8. Competitive Threats and Weakness

17.6. Google LLC

17.6.1. Business Overview

17.6.2. Company Revenue

17.6.3. Product Portfolio

17.6.4. Geographic Footprint

17.6.5. Recent Developments

17.6.6. Impact of COVID-19

17.6.7. TMR View

17.6.8. Competitive Threats and Weakness

17.7. GitLab B.V.

17.7.1. Business Overview

17.7.2. Company Revenue

17.7.3. Product Portfolio

17.7.4. Geographic Footprint

17.7.5. Recent Developments

17.7.6. Impact of COVID-19

17.7.7. TMR View

17.7.8. Competitive Threats and Weakness

17.8. Open Text Corporation (Micro Focus)

17.8.1. Business Overview

17.8.2. Company Revenue

17.8.3. Product Portfolio

17.8.4. Geographic Footprint

17.8.5. Recent Developments

17.8.6. Impact of COVID-19

17.8.7. TMR View

17.8.8. Competitive Threats and Weakness

17.9. Cisco Systems, Inc.

17.9.1. Business Overview

17.9.2. Company Revenue

17.9.3. Product Portfolio

17.9.4. Geographic Footprint

17.9.5. Recent Developments

17.9.6. Impact of COVID-19

17.9.7. TMR View

17.9.8. Competitive Threats and Weakness

17.10. Oracle Corporation

17.10.1. Business Overview

17.10.2. Company Revenue

17.10.3. Product Portfolio

17.10.4. Geographic Footprint

17.10.5. Recent Developments

17.10.6. Impact of COVID-19

17.10.7. TMR View

17.10.8. Competitive Threats and Weakness

17.11. Dell Inc.

17.11.1. Business Overview

17.11.2. Company Revenue

17.11.3. Product Portfolio

17.11.4. Geographic Footprint

17.11.5. Recent Developments

17.11.6. Impact of COVID-19

17.11.7. TMR View

17.11.8. Competitive Threats and Weakness

17.12. HashiCorp, Inc.

17.12.1. Business Overview

17.12.2. Company Revenue

17.12.3. Product Portfolio

17.12.4. Geographic Footprint

17.12.5. Recent Developments

17.12.6. Impact of COVID-19

17.12.7. TMR View

17.12.8. Competitive Threats and Weakness

17.13. Others

17.13.1. Business Overview

17.13.2. Company Revenue

17.13.3. Product Portfolio

17.13.4. Geographic Footprint

17.13.5. Recent Developments

17.13.6. Impact of COVID-19

17.13.7. TMR View

17.13.8. Competitive Threats and Weakness

18. Key Takeaways

List of Tables

Table 1: Acronyms Used in DevOps Market

Table 2: North America DevOps Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3: Europe DevOps Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 4: Asia Pacific DevOps Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 5: Middle East & Africa DevOps Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 6: South America DevOps Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 11: Global DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 12: Global DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 13: Global DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 14: Global DevOps Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 15: North America DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 16: North America DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 17: North America DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 18: North America DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 19: North America DevOps Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 20: U.S. DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Canada DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: Mexico DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Europe DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 24: Europe DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 25: Europe DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 26: Europe DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 27: Europe DevOps Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 28: Germany DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: U.K. DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: France DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: Italy DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Spain DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: Asia Pacific DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 34: Asia Pacific DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 35: Asia Pacific DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 36: Asia Pacific DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 37: Asia Pacific DevOps Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 38: China DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: India DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: Japan DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: ASEAN DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Middle East & Africa DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 43: Middle East & Africa DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 44: Middle East & Africa DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 45: Middle East & Africa DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 46: Middle East & Africa DevOps Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 47: Saudi Arabia DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 48: United Arab Emirates DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: South Africa DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: South America DevOps Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 51: South America DevOps Market Value (US$ Mn) Forecast, by Deployment Mode, 2018 - 2031

Table 52: South America DevOps Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 53: South America DevOps Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 54: South America DevOps Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 55: Brazil DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 56: Argentina DevOps Market Revenue CAGR Breakdown (%), by Growth Term

Table 57: Mergers & Acquisitions, Partnerships (1/2)

Table 58: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global DevOps Market Size (US$ Mn) Forecast, 2018-2031

Figure 2: Global DevOps Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of DevOps Market

Figure 4: Global DevOps Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global DevOps Market Attractiveness Assessment, by Component

Figure 6: Global DevOps Market Attractiveness Assessment, by Deployment Mode

Figure 7: Global DevOps Market Attractiveness Assessment, by Enterprise Size

Figure 8: Global DevOps Market Attractiveness Assessment, by Industry

Figure 9: Global DevOps Market Attractiveness Assessment, by Region

Figure 10: Global DevOps Market Revenue (US$ Mn) Historic Trends, 2017 - 2022

Figure 11: Global DevOps Market Revenue Opportunity (US$ Mn) Historic Trends, 2017 - 2022

Figure 12: Global DevOps Market Value Share Analysis, by Component, 2023

Figure 13: Global DevOps Market Value Share Analysis, by Component, 2031

Figure 14: Global DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 15: Global DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 16: Global DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 17: Global DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 18: Global DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 19: Global DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 20: Global DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 21: Global DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 22: Global DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 23: Global DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 24: Global DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 25: Global DevOps Market Value Share Analysis, by Industry, 2023

Figure 26: Global DevOps Market Value Share Analysis, by Industry, 2031

Figure 27: Global DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 28: Global DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 29: Global DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 30: Global DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 31: Global DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 32: Global DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 33: Global DevOps Market Opportunity (US$ Mn), by Region

Figure 34: Global DevOps Market Opportunity Share (%), by Region, 2023-2031

Figure 35: Global DevOps Market Size (US$ Mn), by Region, 2023 & 2031

Figure 36: Global DevOps Market Value Share Analysis, by Region, 2023

Figure 37: Global DevOps Market Value Share Analysis, by Region, 2031

Figure 38: North America DevOps Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 39: Europe DevOps Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 40: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 41: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 42: South America DevOps Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 43: North America DevOps Market Revenue Opportunity Share, by Component

Figure 44: North America DevOps Market Revenue Opportunity Share, by Deployment Mode

Figure 45: North America DevOps Market Revenue Opportunity Share, by Enterprise Size

Figure 46: North America DevOps Market Revenue Opportunity Share, by Industry

Figure 47: North America DevOps Market Revenue Opportunity Share, by Country

Figure 48: North America DevOps Market Value Share Analysis, by Component, 2023

Figure 49: North America DevOps Market Value Share Analysis, by Component, 2031

Figure 50: North America DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 51: North America DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 52: North America DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 53: North America DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 54: North America DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 55: North America DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 56: North America DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 57: North America DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 58: North America DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 59: North America DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 60: North America DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 61: North America DevOps Market Value Share Analysis, by Industry, 2023

Figure 62: North America DevOps Market Value Share Analysis, by Industry, 2031

Figure 63: North America DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 64: North America DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 65: North America DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 66: North America DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 67: North America DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 68: North America DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 69: North America DevOps Market Value Share Analysis, by Country, 2023

Figure 70: North America DevOps Market Value Share Analysis, by Country, 2031

Figure 71: U.S. DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 72: Canada DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 73: Mexico DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 74: Europe DevOps Market Revenue Opportunity Share, by Component

Figure 75: Europe DevOps Market Revenue Opportunity Share, by Deployment Mode

Figure 76: Europe DevOps Market Revenue Opportunity Share, by Enterprise Size

Figure 77: Europe DevOps Market Revenue Opportunity Share, by Industry

Figure 78: Europe DevOps Market Revenue Opportunity Share, by Country

Figure 79: Europe DevOps Market Value Share Analysis, by Component, 2023

Figure 80: Europe DevOps Market Value Share Analysis, by Component, 2031

Figure 81: Europe DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 82: Europe DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 83: Europe DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 84: Europe DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 85: Europe DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 86: Europe DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 87: Europe DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 88: Europe DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 89: Europe DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 90: Europe DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 91: Europe DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 92: Europe DevOps Market Value Share Analysis, by Industry, 2023

Figure 93: Europe DevOps Market Value Share Analysis, by Industry, 2031

Figure 94: Europe DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 95: Europe DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 96: Europe DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 97: Europe DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 98: Europe DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 99: Europe DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 100: Europe DevOps Market Value Share Analysis, by Country, 2023

Figure 101: Europe DevOps Market Value Share Analysis, by Country, 2031

Figure 102: Germany DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 103: U.K. DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 104: France DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 105: Italy DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 106: Spain DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 107: Asia Pacific DevOps Market Revenue Opportunity Share, by Component

Figure 108: Asia Pacific DevOps Market Revenue Opportunity Share, by Deployment Mode

Figure 109: Asia Pacific DevOps Market Revenue Opportunity Share, by Enterprise Size

Figure 110: Asia Pacific DevOps Market Revenue Opportunity Share, by Industry

Figure 111: Asia Pacific DevOps Market Revenue Opportunity Share, by Country

Figure 112: Asia Pacific DevOps Market Value Share Analysis, by Component, 2023

Figure 113: Asia Pacific DevOps Market Value Share Analysis, by Component, 2031

Figure 114: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 115: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 116: Asia Pacific DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 117: Asia Pacific DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 118: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 119: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 120: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 121: Asia Pacific DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 122: Asia Pacific DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 123: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 124: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 125: Asia Pacific DevOps Market Value Share Analysis, by Industry, 2023

Figure 126: Asia Pacific DevOps Market Value Share Analysis, by Industry, 2031

Figure 127: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 128: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 129: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 130: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 131: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 132: Asia Pacific DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 133: Asia Pacific DevOps Market Value Share Analysis, by Country, 2023

Figure 134: Asia Pacific DevOps Market Value Share Analysis, by Country, 2031

Figure 135: China DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 136: India DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 137: Japan DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 138: ASEAN DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 139: Middle East & Africa DevOps Market Revenue Opportunity Share, by Component

Figure 140: Middle East & Africa DevOps Market Revenue Opportunity Share, by Deployment Mode

Figure 141: Middle East & Africa DevOps Market Revenue Opportunity Share, by Enterprise Size

Figure 142: Middle East & Africa DevOps Market Revenue Opportunity Share, by Industry

Figure 143: Middle East & Africa DevOps Market Revenue Opportunity Share, by Country

Figure 144: Middle East & Africa DevOps Market Value Share Analysis, by Component, 2023

Figure 145: Middle East & Africa DevOps Market Value Share Analysis, by Component, 2031

Figure 146: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 147: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 148: Middle East & Africa DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 149: Middle East & Africa DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 150: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 151: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 152: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 153: Middle East & Africa DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 154: Middle East & Africa DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 155: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 156: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 157: Middle East & Africa DevOps Market Value Share Analysis, by Industry, 2023

Figure 158: Middle East & Africa DevOps Market Value Share Analysis, by Industry, 2031

Figure 159: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 160: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 161: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 162: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 163: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 164: Middle East & Africa DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 165: Middle East & Africa East & Africa East & Africa DevOps Market Value Share Analysis, by Country, 2023

Figure 166: Middle East & Africa DevOps Market Value Share Analysis, by Country, 2031

Figure 167: Saudi Arabia DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 168: United Arab Emirates DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 169: South Africa DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 170: South America DevOps Market Revenue Opportunity Share, by Component

Figure 171: South America DevOps Market Revenue Opportunity Share, by Deployment Mode

Figure 172: South America DevOps Market Revenue Opportunity Share, by Enterprise Size

Figure 173: South America DevOps Market Revenue Opportunity Share, by Industry

Figure 174: South America DevOps Market Revenue Opportunity Share, by Country

Figure 175: South America DevOps Market Value Share Analysis, by Component, 2023

Figure 176: South America DevOps Market Value Share Analysis, by Component, 2031

Figure 177: South America DevOps Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 178: South America DevOps Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 179: South America DevOps Market Value Share Analysis, by Deployment Mode, 2023

Figure 180: South America DevOps Market Value Share Analysis, by Deployment Mode, 2031

Figure 181: South America DevOps Market Absolute Opportunity (US$ Mn), by Private Cloud, 2023 - 2031

Figure 182: South America DevOps Market Absolute Opportunity (US$ Mn), by Public Cloud, 2023 - 2031

Figure 183: South America DevOps Market Absolute Opportunity (US$ Mn), by Hybrid Cloud, 2023 - 2031

Figure 184: South America DevOps Market Value Share Analysis, by Enterprise Size, 2023

Figure 185: South America DevOps Market Value Share Analysis, by Enterprise Size, 2031

Figure 186: South America DevOps Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 187: South America DevOps Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2023 - 2031

Figure 188: South America DevOps Market Value Share Analysis, by Industry, 2023

Figure 189: South America DevOps Market Value Share Analysis, by Industry, 2031

Figure 190: South America DevOps Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 191: South America DevOps Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 192: South America DevOps Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 193: South America DevOps Market Absolute Opportunity (US$ Mn), by Retail, 2023 - 2031

Figure 194: South America DevOps Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 195: South America DevOps Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 196: South America DevOps Market Value Share Analysis, by Country, 2023

Figure 197: South America DevOps Market Value Share Analysis, by Country, 2031

Figure 198: Brazil DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 199: Argentina DevOps Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031