Analysts’ Viewpoint

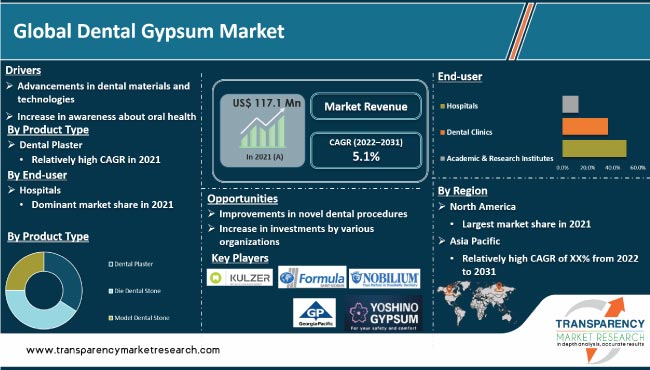

The global dental gypsum market is expected to witness robust growth in the next few years. This is ascribed to increase in dental tourism, rise in demand for cosmetic dentistry, and surge in awareness about oral health. Adoption of digital dentistry technologies, such as CAD/CAM systems and 3D printing, is also expected to drive industry development.

Development of advanced and cost-effective dentistry products presents significant opportunities in the business. Companies focus on inorganic and organic strategies, such as expansion, product launches, acquisitions, collaborations, mergers, and partnerships, to establish a strong market presence and broaden geographical reach.

Dental gypsum is made from gypsum, a naturally occurring mineral that is found in deposits across the world. It is processed and refined to create a consistent and high quality product, a type of plaster, which is suitable for use in the dental industry. It is a fine, white powder that hardens when mixed with water and forms a sturdy, yet pliable material.

Dental gypsum is used to make impressions of teeth, create models of the mouth and teeth, and fabricate dental restorations, such as crowns and bridges. It is employed in various applications in the dental industry, including orthodontics, prosthodontics, and dental education. It is also utilized in the production of dental appliances.

Dental gypsum is widely available and is used by dentists, dental technicians, and dental students across the world. It is a crucial material in the dental industry and is an essential component of numerous dental procedures. The global industry is rapidly expanding owing to increasing demand for dental care and the development of new technologies and materials.

Advancements in dental materials and technologies have played a significant role in driving the global dental gypsum market. It is used in the production of new dental materials and appliances, which are utilized in various dental procedures.

Dental ceramics has been undergoing significant advancements for the last few years. These are used to create crowns, bridges, and veneers, and are known for natural appearance and durability.

Dental gypsum stone is used to create models and molds of the teeth and mouth, which are then used to fabricate dental ceramics. Demand for dental gypsum is likely to increase, as dental ceramics continue to evolve and improve.

Usage of composite materials to fill cavities and repair chips and cracks in teeth is another example of advancements in dental materials. Composite materials are made from a combination of resin and glass or ceramic particles, and they offer a natural-looking and durable solution for dental repairs.

Advancements in dental materials and technologies have led to increase in demand for dental gypsum due to its use in the production of these materials and appliances. Just as the dental gypsum industry continues to advance and evolve, so would the market.

Demand for dental care and dental products is rising owing to increased focus on oral hygiene. This has led to increase in the number of dental clinics and practices, as well as development of new dental technologies and materials.

Dental gypsum is used in various dental procedures, including the production of dental restorations and appliances, and is an essential component of several dental procedures.

According to the World Health Organization (WHO), oral diseases is a major public health concern and are the most common non-communicable diseases globally. Over 3.5 billion people, or almost half of the world's population, were affected by oral diseases in 2022. This highlights the importance of oral hygiene and the need for dental care.

The Global Burden of Disease Study conducted by the Institute for Health Metrics and Evaluation (IHME) found that oral diseases are a leading cause of disability and lost productivity worldwide. The study estimated that oral diseases caused a loss of almost 200 million healthy life years, globally, in 2017, which is driving the demand for dental gypsum.

In terms of product type, the die dental stone plaster segment held major share of the global dental gypsum market in 2021, as it is a strong and the hardest variety of gypsum.

Die dental stone is used in various dental procedures, including the creation of models of teeth and oral structures, the production of dentures, and the fabrication of crowns and bridges. It is also used to make impressions of the teeth and mouth, which can be used to create custom-fit dental appliances or to evaluate the health of the teeth and gums.

Dental stone is an important material in dentistry and has a wide range of applications in the production of dental appliances and models. Its versatility and ability to hold intricate details make it a valuable tool for dentists and dental technicians. These factors are expected to augment the die dental stone segment during the forecast period.

Based on end-user, the hospital segment is likely to account for major share during the forecast period. This is ascribed to introduction of cutting-edge technologies, increase in dental clinics & hospitals across the world, rise in popularity of dental tourism, and rise in number of group dental practices in developed countries.

North America held the largest share of around 40% in 2021. The region is expected to be a highly lucrative destination for dental gypsum during the forecast period. North America's dominance is ascribed to well-established healthcare infrastructure.

The U.S. dominated the region owing to factors such as presence of key players and increase in research & development activities in the dental field. Asia Pacific is projected to be the fastest growing market during the forecast period. It is anticipated to expand at a high CAGR from 2022 to 2031.

India is a preferred dental tourism destination among international patients, as the country provides high quality care and affordable treatment. The country provides patients with the most successful and skilled dentists. Dental education in India has achieved international recognition.

Additionally, rise in awareness about oral health treatment and increase in prevalence of periodontitis in the elderly are expected to augment the dental gypsum market in India.

The global market is fragmented, with the presence of large number of players. Most companies are investing significantly in research & development, primarily to develop innovative plaster techniques.

Expansion of product portfolio and mergers & acquisitions are the strategies adopted by the key players. Gyprock, Heraeus Kulzer, USG, Kerr Dental, Yoshino Gypsum, Whip-Mix, Saint-Gobain Formula, Nobilium, 3M Science, Coltene, ETI Empire Direct, and Georgia-Pacific Gypsum are key players operating in the global industry.

Each of these players has been profiled in the market report based on parameters such as company overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size Value in 2021 |

US$ 117.1 Mn |

|

Forecast Value in 2031 |

More than US$ 180.1 Mn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 117.1 Mn in 2021.

It is projected to reach more than US$ 180.1 Mn by 2031.

The CAGR is expected to be of 5.1% from 2022 to 2031.

Advancements in dental materials & technologies and increase in awareness about oral health.

North America is likely to account for significant share during the forecast period.

Gyprock, Heraeus Kulzer, 3M Science, Coltene, USG, Kerr Dental, Yoshino Gypsum, Whip-Mix, Saint-Gobain Formula, Nobilium, ETI Empire Direct, and Georgia-Pacific Gypsum.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions & Research Methodology

3. Executive Summary: Global Dental Gypsum Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dental Gypsum Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry (value chain and short-/mid-/long-term impact)

6. Global Dental Gypsum Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Dental Plaster

6.3.2. Die Dental Stone

6.3.3. Model Dental Stone

6.4. Market Attractiveness Analysis, by Product Type

7. Global Dental Gypsum Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Dental Clinics

7.3.3. Academic & Research Institutes

7.4. Market Attractiveness Analysis, by End-user

8. Global Dental Gypsum Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Dental Gypsum Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017–2031

9.2.1. Dental Plaster

9.2.2. Die Dental Stone

9.2.3. Model Dental Stone

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Dental Clinics

9.3.3. Academic & Research Institutes

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Dental Gypsum Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Dental Plaster

10.2.2. Die Dental Stone

10.2.3. Model Dental Stone

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Dental Clinics

10.3.3. Academic & Research Institutes

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Dental Gypsum Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Dental Plaster

11.2.2. Die Dental Stone

11.2.3. Model Dental Stone

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Dental Clinics

11.3.3. Academic & Research Institutes

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Dental Gypsum Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Dental Plaster

12.2.2. Die Dental Stone

12.2.3. Model Dental Stone

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Dental Clinics

12.3.3. Academic & Research Institutes

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Dental Gypsum Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Dental Plaster

13.2.2. Die Dental Stone

13.2.3. Model Dental Stone

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Dental Clinics

13.3.3. Academic & Research Institutes

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Heraeus Kulzer

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Kerr Dental

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. USG

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Yoshino Gypsum

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Whip-Mix

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.6. SDMF

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.7. Nobilium

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.8. ETI Empire Direct

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.9. Dentona AG

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.10. Saint-Gobain Formula

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. 3M Science

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.12. Coltene

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

List of Tables

Table 01: Global Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Dental Gypsum Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 05: North America Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Dental Gypsum Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: Europe Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Dental Gypsum Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Asia Pacific Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Dental Gypsum Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Latin America Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America Dental Gypsum Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Dental Gypsum Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Middle East & Africa Dental Gypsum Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa Dental Gypsum Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 03: Global Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 04: Global Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 05: Global Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 06: Global Dental Gypsum Market Value Share Analysis, by Region, 2021 and 2031

Figure 07: Global Dental Gypsum Market Attractiveness Analysis, by Region, 2022–2031

Figure 08: North America Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 10: North America Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 11: North America Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 12: North America Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 13: North America Dental Gypsum Market Value Share Analysis, by Country, 2021 and 2031

Figure 14: North America Dental Gypsum Market Attractiveness Analysis, by Country, 2022–2031

Figure 15: Europe Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 17: Europe Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 18: Europe Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 19: Europe Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 20: Europe Dental Gypsum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 21: Europe Dental Gypsum Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 22: Asia Pacific Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 24: Asia Pacific Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 25: Asia Pacific Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 26: Asia Pacific Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 27: Asia Pacific Dental Gypsum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 28: Asia Pacific Dental Gypsum Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 29: Latin America Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 31: Latin America Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 32: Latin America Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 33: Latin America Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 34: Latin America Dental Gypsum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Latin America Dental Gypsum Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Middle East & Africa Dental Gypsum Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Dental Gypsum Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 38: Middle East & Africa Dental Gypsum Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 39: Middle East & Africa Dental Gypsum Market Value Share Analysis, by End-user, 2021 and 2031

Figure 40: Middle East & Africa Dental Gypsum Market Attractiveness Analysis, by End-user, 2022–2031

Figure 41: Middle East & Africa Dental Gypsum Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Middle East & Africa Dental Gypsum Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Global Dental Gypsum Market Share Analysis, by Company, 2021