Analysts’ Viewpoint

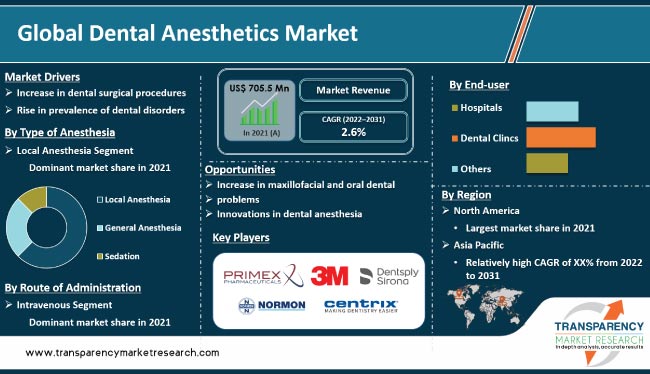

Local anesthesia is the cornerstone of pain control in dentistry. However, researchers continue to seek new and better ways to manage pain. Rise in investment in dental research and introduction of new products are the prominent factors driving the global dental anesthetics market size.

The number of dental disorders among children has increased significantly in the past few years. Rise in awareness about the importance of dental health and increase in government initiatives to offer better dental facilities are expected to create lucrative opportunities in the industry.

Manufacturers are developing newer technologies to enable dentists to provide enhanced pain relief solutions with fewer side effects.

Usage of anesthesia in dentistry is known as dental anesthesia. It includes local anesthetics, sedation, and general anesthesia. Lidocaine is the most widely used local anesthetic in dentistry. The half-life of lidocaine in the body is 1.5 hours to 2 hours.

The most typical application of lidocaine is to numb the region around a tooth during dental procedures. For instance, more lidocaine is needed for root canal therapy than for a straightforward filling.

Advances in sedation and anesthesia have made dental procedures easier and more comfortable. Local anesthesia is achieved by injecting an anesthetic solution near nerves that provide sensation to the area of the oral cavity where treatment is being administered. Usage of anesthesia for tooth extraction is a common practice in dentistry.

The ability to provide safe and effective local anesthesia for teeth extraction is the most important skill for dental practitioners. The injection of local anesthetic is perhaps the most common source of patient anxiety.

Inability to achieve adequate pain control with minimal discomfort continues to be a major concern for dental practitioners.Good local anesthesia necessitates knowledge of the anesthetic agents used, the neuroanatomy involved, and the best techniques and devices available.

Currently, agents and anesthetic delivery equipment provide the practitioner with various options for effectively managing the pain associated with dental procedures.Development of newer, improved devices and techniques for achieving profound anesthesia is projected to boost market progress in the next few years.

A nasal spray that anaesthetizes the maxillary anterior six teeth is being tested in an FDA phase 3 trial, which compares the spray's effectiveness to the current painful anesthesia injections. Syringe micro vibrator (SMV) is a new device in dentistry that reduces pain and anxiety associated with intraoral injections.

Dental implants and tooth extraction, also known as third molar extraction, are the most common oral and maxillofacial surgical procedures. However, oral and maxillofacial surgeries (OMSs) do much more.

These have expanded the scope of practice since the beginning of the specialty to include surgery of the entire maxillofacial complex. OMSs can be used in pain and anxiety management, including general anesthesia and conscious sedation.

Reconstructive procedures that correct deformities of the facial skeleton, jaws, and associated soft tissues are involved in the surgical correction of maxillofacial skeletal deformities. These anomalies could result from trauma, neoplastic conditions, degenerative diseases, and developmental, functional, and/or pathologic aberrations that are acquired at birth or manifested during subsequent growth and development.

The primary objectives of surgical correction of these skeletal deformities are function restoration and/or improvement as well as avoidance of potential complications. This is expected to augment global dental anesthetics market statistics during the forecast period.

In terms of type of anesthesia, the local anesthesia segment accounted for significant market share in 2021. Local anesthetics such as lidocaine, prilocaine, mepivacaine, and bupivacaine are regularly used in dentistry for oral anesthesia.

Amide anesthetic with an ester linkage is called articaine. Ester anesthetics are less frequently used in dentistry, but topical anesthesia could be achieved with the help of medications such as benzocaine.

Effectiveness and safety have made lidocaine the local anesthetic of choice in dentistry and the industry's gold standard. Adrenaline is added to lidocaine in order to counteract the vasodilating effects of lidocaine and delay drug absorption, which lengthens the duration of anesthesia and lowers the risk of toxicity.

Based on route of administration, the intravenous segment dominated the global dental anesthetics market in 2021. This can be ascribed to high flexibility in terms of injection volume, dosing rate, and excipient usage. Plasma profiles can be controlled and kept constant, and infusions offer the highest infusion volumes.

In contrast to intramuscular or subcutaneous dosing, rapid dilution of injected solutions in the blood stream enables higher tolerance of the drug product components with blood components or injection site tolerance. Total intravenous anesthesia is becoming quite common in dental sedation due to the availability of ultra-short acting medications and computerized infusion technology.

The deepest level of conscious sedation available in a dental office setting is IV sedation dentistry. Many patients experience anxiety and fear during dental treatment. This is the primary reason why patients avoid visiting a dental care unit.

Most of these patients are able to receive essential dental care with intravenous sedation (IVS). IVS is used to stabilize the hemodynamic condition of patients with circulatory complications while they receive treatment.

In terms of end-user, the dental clinics segment is anticipated to account for significant share of the global dental anesthetics market during the forecast period. Dental clinics offer diagnosis, prevention, and treatment of dental disorders. Most dental patients go to private practices since they are more affordable, and have access to specialists and modern equipment.

The number of independent practices is increasing across the globe. The dental care sector encountered numerous issues during the initial stage of the COVID-19 pandemic, as dentist clinics posed a significant risk of infection spread.

When the pandemic first started, dental clinics were not open. However, the return to normal operations of dental offices and oral surgery centers is likely to augment the dental clinics segment in the next few years.

North America accounted for the largest share for the industry in 2021. Rise in number of oral surgeries and dental surgical procedures is projected to drive market development in the region during the forecast period.

The U.S. has more than 7,500 oral surgeons, and 90% of them practice alone. The market in Asia Pacific is expected to grow a rapid pace in the next few years due to the rise in oral and maxillofacial surgeries associated with medical tourism.

The global dental anesthetics market is fragmented, with the presence of a small number of leading players. Expansion of product portfolio and mergers & acquisitions are key strategies implemented by prominent manufacturers.

Dentsply Sirona, Laboratories Inibsa, Pierrel SPA, Septodont, Laboratories Normon, Primex Pharmaceuticals, Aspen Group, Dentalhitec, Zeyco, Crosstex International, Inc., Southern Anesthesia & Surgical, Inc., Milestone Scientific, Centrix, Inc., 3M, and Cetylite, Inc. are the prominent players in the business.

The market report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 705.5 Mn |

|

Forecast (Value) in 2031 |

More than US$ 904.1 Mn |

|

Growth Rate (CAGR) |

2.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 705.5 Mn in 2021

It is projected to reach more than US$ 904.1 Mn by 2031

The CAGR is anticipated to be 2.6% from 2022 to 2031

Increase in dental surgical procedures and rise in prevalence of dental disorders

North America is projected to account for significant share during the forecast period

Dentsply Sirona, Laboratories Inibsa, Pierrel SPA, Septodont, Laboratories Normon, Primex Pharmaceuticals, Aspen Group, Dentalhitec, Zeyco, Crosstex International, Inc., Centrix, Inc., 3M, Cetylite, Inc., Southern Anesthesia & Surgical, Inc., and Milestone Scientific

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Dental Anesthetics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dental Anesthetics Market Analysis and Forecast, 2017–2031

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Insights on number of dental surgical procedures

5.2. Regulatory Scenario by Region/Globally

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Dental Anesthetics Market Analysis and Forecast, by Type of Anesthesia

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type of Anesthesia, 2017–2031

6.3.1. Local Anesthesia

6.3.1.1. Articaine

6.3.1.2. Bupivacaine

6.3.1.3. Lidocaine

6.3.1.4. Others

6.3.2. General Anesthesia

6.3.3. Sedation

6.4. Market Attractiveness Analysis, by Type of Anesthesia

7. Global Dental Anesthetics Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2031

7.3.1. Oral

7.3.2. Intravenous

7.3.3. Others

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Dental Anesthetics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Dental Clinics

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Dental Anesthetics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America (LATAM)

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Dental Anesthetics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type of Anesthesia, 2017–2031

10.2.1. Local Anesthesia

10.2.1.1. Articaine

10.2.1.2. Bupivacaine

10.2.1.3. Lidocaine

10.2.1.4. Others

10.2.2. General Anesthesia

10.2.3. Sedation

10.3. Market Value Forecast, by Route of Administration, 2017–2031

10.3.1. Oral

10.3.2. Intravenous

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Dental Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type of Anesthesia

10.6.2. By Route of Administration

10.6.3. By End-user

10.6.4. By Country

11. Europe Dental Anesthetics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type of Anesthesia, 2017–2031

11.2.1. Local Anesthesia

11.2.1.1. Articaine

11.2.1.2. Bupivacaine

11.2.1.3. Lidocaine

11.2.1.4. Others

11.2.2. General Anesthesia

11.2.3. Sedation

11.3. Market Value Forecast, by Route of Administration, 2017–2031

11.3.1. Oral

11.3.2. Intravenous

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Dental Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type of Anesthesia

11.6.2. By Route of Administration

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Dental Anesthetics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type of Anesthesia, 2017–2031

12.2.1. Local Anesthesia

12.2.1.1. Articaine

12.2.1.2. Bupivacaine

12.2.1.3. Lidocaine

12.2.1.4. Others

12.2.2. General Anesthesia

12.2.3. Sedation

12.3. Market Value Forecast, by Route of Administration, 2017–2031

12.3.1. Oral

12.3.2. Intravenous

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Dental Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type of Anesthesia

12.6.2. By Route of Administration

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Dental Anesthetics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type of Anesthesia, 2017–2031

13.2.1. Local Anesthesia

13.2.1.1. Articaine

13.2.1.2. Bupivacaine

13.2.1.3. Lidocaine

13.2.1.4. Others

13.2.2. General Anesthesia

13.2.3. Sedation

13.3. Market Value Forecast, by Route of Administration, 2017–2031

13.3.1. Oral

13.3.2. Intravenous

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Dental Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type of Anesthesia

13.6.2. By Route of Administration

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Dental Anesthetics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type of Anesthesia, 2017–2031

14.2.1. Local Anesthesia

14.2.1.1. Articaine

14.2.1.2. Bupivacaine

14.2.1.3. Lidocaine

14.2.1.4. Others

14.2.2. General Anesthesia

14.2.3. Sedation

14.3. Market Value Forecast, by Route of Administration, 2017–2031

14.3.1. Oral

14.3.2. Intravenous

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Dental Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Type of Anesthesia

14.6.2. By Route of Administration

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Dentsply Sirona

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Laboratorios Inibsa

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Pierrel SPA

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Septodont

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Laboratorios Normon

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Primex Pharmaceuticals

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Aspen Group

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Dentalhitec

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Zeyco

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Crosstex International, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. Centrix, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. 3M

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Southern Anesthesia & Surgical, Inc.

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. Milestone Scientific

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

List of Tables

Table 01: Global Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 02: Global Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 03: Global Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Dental Anesthetics Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Dental Anesthetics Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 07: North America Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 08: North America Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Dental Anesthetics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 11: Europe Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 12: Europe Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Dental Anesthetics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 15: Asia Pacific Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 16: Asia Pacific Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Dental Anesthetics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 19: Latin America Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 20: Latin America Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Dental Anesthetics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Dental Anesthetics Market Size (US$ Mn) Forecast, by Type of Anesthesia, 2017–2031

Table 23: Middle East & Africa Dental Anesthetics Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 24: Middle East & Africa Dental Anesthetics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Dental Anesthetics Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global Dental Anesthetics Market Revenue (US$ Mn), by Type of Anesthesia, 2021

Figure 03: Global Dental Anesthetics Market Value Share, by Type of Anesthesia, 2021

Figure 04: Global Dental Anesthetics Market Revenue (US$ Mn), by Route of Administration, 2021

Figure 05: Global Dental Anesthetics Market Value Share, by Route of Administration, 2021

Figure 06: Global Dental Anesthetics Market Revenue (US$ Mn), by End-user, 2021

Figure 07: Global Dental Anesthetics Market Value Share, by End-user, 2021

Figure 08: Global Dental Anesthetics Market Value Share, by Region, 2021

Figure 09: Global Dental Anesthetics Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 11: Global Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022-2031

Figure 12: Global Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 13: Global Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022-2031

Figure 14: Global Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 15: Global Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Dental Anesthetics Market Value Share Analysis, by Region, 2017 and 2031

Figure 17: Global Dental Anesthetics Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Dental Anesthetics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Dental Anesthetics Market Attractiveness Analysis, by Country, 2017–2031

Figure 20: North America Dental Anesthetics Market Value Share Analysis, by Country, 2017 and 2031

Figure 21: North America Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 22: North America Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 23: North America Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 24: North America Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022–2031

Figure 25: North America Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 26:North America Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 27: Europe Dental Anesthetics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Dental Anesthetics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 29: Europe Dental Anesthetics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 30: Europe Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 31: Europe Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 32: Europe Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 33: Europe Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022–2031

Figure 34: Europe Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 35: Europe Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 36: Asia Pacific Dental Anesthetics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Dental Anesthetics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 38: Asia Pacific Dental Anesthetics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 39: Asia Pacific Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 40: Asia Pacific Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 41: Asia Pacific Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 42: Asia Pacific Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022–2031

Figure 43: Asia Pacific Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 44: Asia Pacific Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Latin America Dental Anesthetics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Dental Anesthetics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 47: Latin America Dental Anesthetics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 48: Latin America Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 49: Latin America Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 50: Latin America Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 51: Latin America Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022–2031

Figure 52: Latin America Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 53: Latin America Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 54: Middle East & Africa Dental Anesthetics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Dental Anesthetics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 56: Middle East & Africa Dental Anesthetics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 57: Middle East & Africa Dental Anesthetics Market Value Share Analysis, by Type of Anesthesia, 2017 and 2031

Figure 58: Middle East & Africa Dental Anesthetics Market Value Share Analysis, by Route of Administration, 2017 and 2031

Figure 59: Middle East & Africa Dental Anesthetics Market Value Share Analysis, by End-user, 2017 and 2031

Figure 60: Middle East & Africa Dental Anesthetics Market Attractiveness Analysis, by Type of Anesthesia, 2022–2031

Figure 61: Middle East & Africa Dental Anesthetics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 62: Middle East & Africa Dental Anesthetics Market Attractiveness Analysis, by End-user, 2022–2031