The artificial intelligence (AI) wave has captivated the attention of stakeholders operating in an array of industry verticals. Evolving from neural networks to present-day deep learning architectures, AI has come a long way. The soaring demand for deep learning across a host of industrial sectors, including healthcare, aerospace & defense, automotive, and consumer electronics has played an imperative role in boosting the demand for deep learning chipsets in recent years – a trend that is likely to play a key role in the expansion of the deep learning chipset market in the coming years. The uptake of deep learning chipsets is primarily driven by high volumes of data required to run deep learning and machine learning models.

In the current scenario, technological advancements are enabling the development of powerful and cutting-edge deep learning chipsets. Deep learning chipsets are increasingly being used in a range of consumer electronic items, including augmented reality/virtual reality (AR/VR) headsets, smart speakers, smartphones, and a host of other devices that require AI processing. Several companies operating in the deep learning chipset market are focusing on introducing innovations in fabrication and deep learning chipset designs to enable the production of state-of-the-art devices.

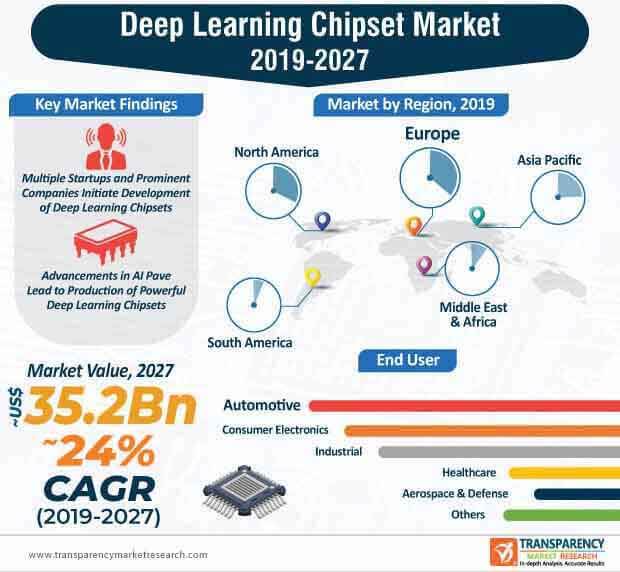

Moreover, progress in the AI domain is expected to streamline and improve a machine’s capacity to carry out cognitive functions linked with humans, including reasoning, learning, and perceiving. Due to these factors, along with widening applications of AI, the deep learning chipset market is expected to reach a value of ~US$ 35.2 Bn by the end of 2027, a five-fold growth from ~US$ 6.4 Bn in 2019.

With the growing need to streamline large volumes of data (training) and computing answers (interference), demand for highly sophisticated deep learning chipsets witnessed unprecedented growth. A large amount of deep learning chipsets was developed for usage across data centers worldwide. However, the trend is gradually expected to shift as stakeholders in the deep learning chipset market are expecting a majority of processing to be carried out at the edge of and closer to sensor arrays.

AI companies are investing resources toward the development of deep learning chipset-based technologies. Although the adoption of deep learning chipsets will continue in data centers, AI processing is expected to be employed in next-generation devices, including security cameras, drones, smartphones, etc.

The first-generation of graphic processing units were primarily developed for desktop gaming. However, the trend witnessed a tectonic shift, particularly in the last decade, as new iterations of graphic processing units were more inclined toward high-resolution images and AI. The significant demand for graphic processing units can be largely attributed to significant progress in low-power technology.

For instance, the Google Brain project, which was initiated in 2011, analyzed millions of images from platforms, such as YouTube to recognize cats. Due to significant progress in technology, the generation of graphical processing units could integrate exceptional graphical capabilities with computational processing components. Furthermore, with continual demand for higher graphical requirements, owing to large volumes of high-resolution images, stakeholders in the deep learning chipset market developed deep learning chipsets with improved functions and capabilities. The demand for graphical processing units was largely influenced by the mounting need for advanced graphical processing. Additionally, as deep learning tasks involve highly complex mathematical computations, the demand for graphics processing units grew at an impressive pace. Within the deep learning chipset market, the graphics processing units (GPUs) segment is estimated to reach a value of ~US$ 2.4 Bn and account for a market share of ~31% in 2020.

The deep learning chipset market was largely dominated by NVIDIA for a substantial period. However, in recent times, a large number of companies have turned their attention toward the development of highly advanced deep learning chipsets. For instance, in July 2018, IBM launched a new deep learning chipset, which was predominantly designed to perform high-precision learning as well as low-precision inference.

Analysts’ Viewpoint

The deep learning chipset market is expected to grow at an impressive CAGR of ~24% during the forecast period. The growth of the market can be largely attributed to the rising demand for high graphical requirements in a range of consumer electronic goods, including smartphones, AR/VR headsets, etc. The deep learning chipset market was largely dominated by NVIDIA for several years. However, a flurry of startups to prominent brands, including IBM and Intel Corporation are offering cutting-edge deep learning chipsets. Stakeholders should align their operations with evolving industry requirements and leverage advancements in AI to offer next-generation deep learning chipsets.

Deep Learning Chipset Market: Overview

High Increase in Data Volume and Significantly Improved Algorithms: A Key Driver

Deep Learning for Consumer Application a Key Trend in Deep Learning Chipset Market

Long-term Planning and Algorithmic Data Manipulation Unattainable for Deep Learning Models

Deep Learning Chipset Market: Competition Landscape

Deep Learning Chipset Market: Key Developments

The Deep Learning Chipset Market expanding at the CAGR of 24.0% between 2019 and 2027.

As high increase in data volumes and significantly improved algorithms of deep learning methods are expected to improve IoT security, they are anticipated to contribute to the growth of the deep learning chipset market

The Deep Learning Chipset Market size is estimated to worth US$ 35.2 Bn by 2027.

Key players operating in the global deep learning chipset market are IBM Corporation, Graphcore Ltd, CEVA, Inc., Advanced Micro Devices, Inc., NVIDIA Corporation, Intel Corporation, IBM Corporation, Movidius, XILINX INC., TeraDeep Inc., QUALCOMM Incorporated, and Alphabet Inc.

North America is the leading region with the largest market share.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Deep Learning Chipset Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Market Indicators

4.4. Key Trends Analysis

4.5. Global Deep Learning Chipset Market Analysis and Forecast, 2017–2027

4.5.1. Market Revenue Projection (US$ Mn)

4.5.2. Market Volume Projection (Million Units)

4.6. Porter’s Five Forces Analysis - Global Deep Learning Chipset Market

4.7. Value Chain Analysis - Global Deep Learning Chipset Market

4.8. Market Outlook

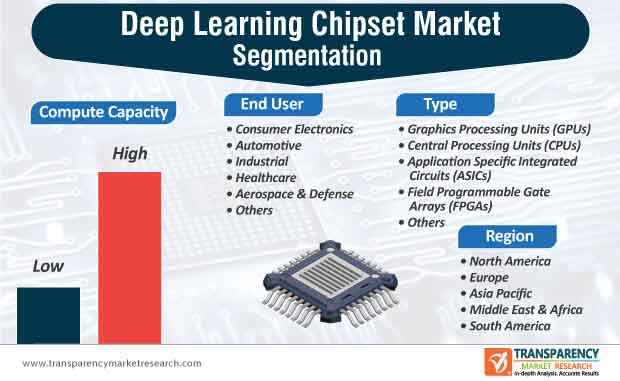

5. Global Deep Learning Chipset Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Global Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

5.2.1. GPU

5.2.2. CPU

5.2.3. ASIC

5.2.4. FPGA

5.2.5. Others

5.3. Type Comparison Matrix

5.4. Global Deep Learning Chipset Market Attractiveness, by Type

6. Global Deep Learning Chipset Market Analysis and Forecast, by Compute Capacity

6.1. Overview & Definitions

6.2. Global Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

6.2.1. Low

6.2.2. High

6.3. Compute Capacity Comparison Matrix

6.4. Global Deep Learning Chipset Market Attractiveness, by Compute Capacity

7. Global Deep Learning Chipset Market Analysis and Forecast, by End-user

7.1. Overview & Definitions

7.2. Global Deep Learning Chipset Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

7.2.1. Consumer Electronics

7.2.2. Automotive

7.2.3. Industrial

7.2.4. Healthcare

7.2.5. Aerospace & Defense

7.2.6. Others

7.3. End-user Comparison Matrix

7.4. Global Deep Learning Chipset Market Attractiveness, by End-user

8. Global Deep Learning Chipset Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Region, 2017–2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Global Deep Learning Chipset Market Attractiveness, by Region

9. North America Deep Learning Chipset Market Analysis and Forecast

9.1. Key Findings

9.2. North America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

9.2.1. GPU

9.2.2. CPU

9.2.3. ASIC

9.2.4. FPGA

9.2.5. Others

9.3. North America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

9.3.1. Low

9.3.2. High

9.4. North America Deep Learning Chipset Market Revenue (US$ Mn) Forecast, End-user, 2017–2027

9.4.1. Consumer Electronics

9.4.2. Automotive

9.4.3. Industrial

9.4.4. Healthcare

9.4.5. Aerospace & Defense

9.4.6. Others

9.5. North America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. North America Deep Learning Chipset Market Attractiveness Analysis

9.6.1. by Type

9.6.2. by Compute Capacity

9.6.3. by End-user

9.6.4. by Country/Sub-region

10. Europe Deep Learning Chipset Market Analysis and Forecast

10.1. Key Findings

10.2. Europe Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

10.2.1. GPU

10.2.2. CPU

10.2.3. ASIC

10.2.4. FPGA

10.2.5. Others

10.3. Europe Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

10.3.1. Low

10.3.2. High

10.4. Europe Deep Learning Chipset Market Revenue (US$ Mn) Forecast, End-user, 2017–2027

10.4.1. Consumer Electronics

10.4.2. Automotive

10.4.3. Industrial

10.4.4. Healthcare

10.4.5. Aerospace & Defense

10.4.6. Others

10.5. Europe Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Rest of Europe

10.6. Europe Deep Learning Chipset Market Attractiveness Analysis

10.6.1. by Type

10.6.2. by Compute Capacity

10.6.3. by End-user

10.6.4. by Country/Sub-region

11. Asia Pacific Deep Learning Chipset Market Analysis and Forecast

11.1. Key Findings

11.2. Asia Pacific Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

11.2.1. GPU

11.2.2. CPU

11.2.3. ASIC

11.2.4. FPGA

11.2.5. Others

11.3. Asia Pacific Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

11.3.1. Low

11.3.2. High

11.4. Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn) Forecast, End-user, 2017–2027

11.4.1. Consumer Electronics

11.4.2. Automotive

11.4.3. Industrial

11.4.4. Healthcare

11.4.5. Aerospace & Defense

11.4.6. Others

11.5. Asia Pacific Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast by Country/Sub-region, 2017–2027

11.5.1. China

11.5.2. India

11.5.3. Japan

11.5.4. Rest of Asia Pacific

11.6. Asia Pacific Deep Learning Chipset Market Attractiveness Analysis

11.6.1. by Type

11.6.2. by Compute Capacity

11.6.3. by End-user

11.6.4. by Country/Sub-region

12. Middle East & Africa Deep Learning Chipset Market Analysis and Forecast

12.1. Key Findings

12.2. Middle East & Africa Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

12.2.1. GPU

12.2.2. CPU

12.2.3. ASIC

12.2.4. FPGA

12.2.5. Others

12.3. Middle East & Africa Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

12.3.1. Low

12.3.2. High

12.4. Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn) Forecast,End-user, 2017–2027

12.4.1. Consumer Electronics

12.4.2. Automotive

12.4.3. Industrial

12.4.4. Healthcare

12.4.5. Aerospace & Defense

12.4.6. Others

12.5. Middle East & Africa Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Middle East & Africa Deep Learning Chipset Market Attractiveness Analysis

12.6.1. by Type

12.6.2. by Compute Capacity

12.6.3. by End-user

12.6.4. by Country/Sub-region

13. South America Deep Learning Chipset Market Analysis and Forecast

13.1. Key Findings

13.2. South America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

13.2.1. GPU

13.2.2. CPU

13.2.3. ASIC

13.2.4. FPGA

13.2.5. Others

13.3. South America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Compute Capacity, 2017–2027

13.3.1. Low

13.3.2. High

13.4. South America Deep Learning Chipset Market Revenue (US$ Mn) Forecast, End-user, 2017–2027

13.4.1. Consumer Electronics

13.4.2. Automotive

13.4.3. Industrial

13.4.4. Healthcare

13.4.5. Aerospace & Defense

13.4.6. Others

13.5. South America Deep Learning Chipset Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Rest of South America

13.6. South America Deep Learning Chipset Market Attractiveness Analysis

13.6.1. by Type

13.6.2. by Compute Capacity

13.6.3. by End-user

13.6.4. by Country/Sub-region

14. Competition Landscape

14.1. Market Players – Competition Matrix

14.2. Global Deep Learning Chipset Market Share Analysis, by Company (2018)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Developments, Strategy)

14.3.1. IBM Corporation

14.3.2. Graphcore Ltd

14.3.3. CEVA, Inc.

14.3.4. Advanced Micro Devices, Inc.

14.3.5. NVIDIA Corporation

14.3.6. Intel Corporation

14.3.7. IBM Corporation

14.3.8. Movidius

14.3.9. XILINX INC.

14.3.10. TeraDeep Inc.

14.3.11. QUALCOMM Incorporated

14.3.12. Alphabet Inc.

15. Key Takeaways

List of Tables

Table 01: Global Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 02: Global Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 03: Global Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 04: Global Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 05: Global Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 06: Global Deep Learning Chipset Market Revenue (US$ Mn), by Region, 2017–2027

Table 07: Global Deep Learning Chipset Market Volume (Million Units), by Region, 2017–2027

Table 08: North America Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 09: North America Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 10: North America Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 11: North America Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 12: North America Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 13: North America Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 14: North America Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 15: Europe Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 16: Europe Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 17: Europe Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 18: Europe Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 19: Europe Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 20: Europe Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 21: Europe Deep Learning Chipset Market Volume (Million Units), by Country/Sub-region, 2017–2027

Table 22: Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 23: Asia Pacific Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 24: Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 25: Asia Pacific Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 26: Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 27: Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 28: Asia Pacific Deep Learning Chipset Market Volume (Million Units), by Country/Sub-region, 2017–2027

Table 29: Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 30: Middle East & Africa Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 31: Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 32: Middle East & Africa Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 33: Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 34: Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 35: Middle East & Africa Deep Learning Chipset Market Volume (Million Units), by Country/Sub-region, 2017–2027

Table 36: South America Deep Learning Chipset Market Revenue (US$ Mn), by Type, 2017–2027

Table 37: South America Deep Learning Chipset Market Volume (Million Units), by Type, 2017–2027

Table 38: South America Deep Learning Chipset Market Revenue (US$ Mn), by Compute Capacity, 2017–2027

Table 39: South America Deep Learning Chipset Market Volume (Million Units), by Compute Capacity, 2017–2027

Table 40: South America Deep Learning Chipset Market Revenue (US$ Mn), by End-user, 2017–2027

Table 41: South America Deep Learning Chipset Market Revenue (US$ Mn), by Country/Sub-region, 2017–2027

Table 42: South America Deep Learning Chipset Market Volume (Million Units), by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Deep Learning Chipset Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 02: Global Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 03: Global Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 04: Porter’s Analysis

Figure 05: Global Deep Learning Chipset Market Value Share (Revenue), by Type (2018)

Figure 06: Global Deep Learning Chipset Market Value Share (Revenue), by Compute Capacity (2018)

Figure 07: Global Deep Learning Chipset Market Value Share (Revenue), by End-user (2018)

Figure 08: Global Deep Learning Chipset Market Value Share (Revenue), by Region (2018)

Figure 09: Global Deep Learning Chipset Market, by Type, Graphics Processing Units (GPUs)

Figure 10: Global Deep Learning Chipset Market, by Type, Central Processing Units (CPUs)

Figure 11: Global Deep Learning Chipset Market, by Type, Application-specific Integrated Circuits (ASICs)

Figure 12: Global Deep Learning Chipset Market, by Type, Field Programmable Gate Arrays (FPGAs)

Figure 13: Global Deep Learning Chipset Market, by Type, Others

Figure 14: Global Deep Learning Chipset Market Comparison Matrix, by Type

Figure 15: Global Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 16: Global Deep Learning Chipset Market, by Compute Capacity, Low

Figure 17: Global Deep Learning Chipset Market, by Compute Capacity, High

Figure 18: Global Deep Learning Chipset Market Comparison Matrix, by Compute Capacity

Figure 19: Global Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 20: Global Deep Learning Chipset Market, by End-user, Consumer Electronics

Figure 21: Global Deep Learning Chipset Market, by End-user, Automotive

Figure 22: Global Deep Learning Chipset Market, by End-user, Industrial

Figure 23: Global Deep Learning Chipset Market, by End-user, Healthcare

Figure 24: Global Deep Learning Chipset Market, by End-user, Aerospace & Defense

Figure 25: Global Deep Learning Chipset Market, by End-user, Others

Figure 26: Global Deep Learning Chipset Market Comparison Matrix, by End-user

Figure 27: Global Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 28: Global Deep Learning Chipset Market, by Region, North America

Figure 29: Global Deep Learning Chipset Market, by Region, Europe

Figure 30: Global Deep Learning Chipset Market, by Region, APAC

Figure 31: Global Deep Learning Chipset Market, by Region, MEA

Figure 32: Global Deep Learning Chipset Market, by Region, South America

Figure 33: Global Deep Learning Chipset Market Attractiveness Analysis, by Region**

Figure 34: North America Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 35: North America Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 36: North America Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 37: North America Deep Learning Chipset Market Revenue Share Analysis, by Type

Figure 38: North America Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 39: North America Deep Learning Chipset Market Revenue Share Analysis, by Compute Capacity

Figure 40: North America Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 41: North America Deep Learning Chipset Market Revenue Share Analysis, by End-user

Figure 42: North America Deep Learning Chipset Market Attractiveness Analysis, by Country/Sub-region**

Figure 43: North America Deep Learning Chipset Market Revenue Share Analysis, by Country/Sub-region

Figure 44: Europe Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 45: Europe Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 46: Europe Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 47: Europe Deep Learning Chipset Market Revenue Share Analysis, by Type

Figure 48: Europe Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 49: Europe Deep Learning Chipset Market Revenue Share Analysis, by Compute Capacity

Figure 50: Europe Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 51: Europe Deep Learning Chipset Market Revenue Share Analysis, by End-user

Figure 52: Europe Deep Learning Chipset Market Attractiveness Analysis, by Country/Sub-region **

Figure 53: Europe Deep Learning Chipset Market Revenue Share Analysis, by Country/Sub-region

Figure 54: Asia Pacific Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 55: Asia Pacific Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 56: Asia Pacific Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 57: Asia Pacific Deep Learning Chipset Market Revenue Share Analysis, by Type

Figure 58: Asia Pacific Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 59: Asia Pacific Deep Learning Chipset Market Revenue Share Analysis, by Compute Capacity

Figure 60: Asia Pacific Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 61: Asia Pacific Deep Learning Chipset Market Revenue Share Analysis, by End-user

Figure 62: Asia Pacific Deep Learning Chipset Market Attractiveness Analysis, by Country/Sub-region**

Figure 63: Asia Pacific Deep Learning Chipset Market Revenue Share Analysis, by Country/Sub-region

Figure 64: Middle East & Africa Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 65: Middle East & Africa Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 66: Middle East & Africa Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 67: Middle East & Africa Deep Learning Chipset Market Revenue Share Analysis, by Type

Figure 68: Middle East & Africa Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 69: Middle East & Africa Deep Learning Chipset Market Revenue Share Analysis, by Compute Capacity

Figure 70: Middle East & Africa Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 71: Middle East & Africa Deep Learning Chipset Market Revenue Share Analysis, by End-user

Figure 72: Middle East & Africa Deep Learning Chipset Market Attractiveness Analysis, by Country/Sub-region**

Figure 73: Middle East & Africa Deep Learning Chipset Market Revenue Share Analysis, by Country/Sub-region

Figure 74: South America Deep Learning Chipset Market Revenue (US$ Mn), 2017–2027

Figure 75: South America Deep Learning Chipset Market Volume (Million Units), 2017–2027

Figure 76: South America Deep Learning Chipset Market Attractiveness Analysis, by Type**

Figure 77: South America Deep Learning Chipset Market Revenue Share Analysis, by Type

Figure 78: South America Deep Learning Chipset Market Attractiveness Analysis, by Compute Capacity**

Figure 79: South America Deep Learning Chipset Market Revenue Share Analysis, by Compute Capacity

Figure 80: South America Deep Learning Chipset Market Attractiveness Analysis, by End-user**

Figure 81: South America Deep Learning Chipset Market Revenue Share Analysis, by End-user

Figure 82: South America Deep Learning Chipset Market Attractiveness Analysis, by Country/Sub-region**

Figure 83: South America Deep Learning Chipset Market Revenue Share Analysis, by Country/Sub-region

Figure 84: Global Deep Learning Chipset Market Share Analysis, by Company (2018)