Analysts’ Viewpoint

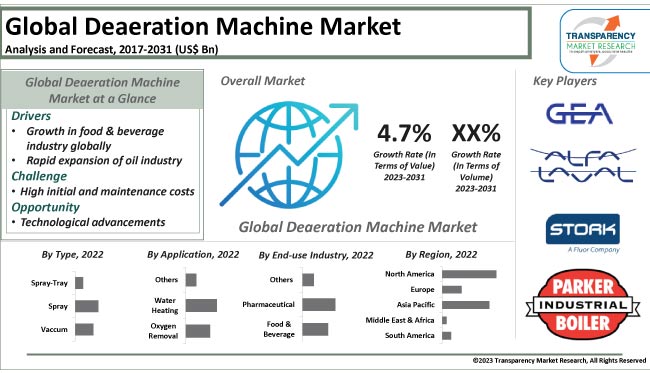

Expansion of various end-use industries, such as beverages, and oil, drives the global deaeration machine market. These industries have high demand for deaeration machines to effectively remove dissolved gases from liquids.

Manufacturers are developing innovative products based on advanced technologies to strengthen their position in the global market. They are also investing significantly in R&D activities to expand their global presence.

Mojonnier, a beverage processing equipment manufacturer, introduced the GasTrans technology, which offers several advantages versus traditional methods to liquid/liquid combination, degasification, and gas/liquid mass transfer processes. Using this technology, the machine is able to generate a large liquid surface area through nano-sized droplets. Such developments are contributing to deaeration machine market growth.

Deaeration is the process of removing air, which has mixed with or dissolved in a substance. It improves the quality and reduces contamination of liquids, soils, and foods. The process also removes oxygen from liquid-filled vessels to slow down corrosion. Uses of deaeration machines include removing oxygen and other dissolved gases from boiler feedwater, and creating clean, deaerated water.

Deaeration machines are used in power plants and chemical processing, to reduce corrosion and extend the life of a steam-generating boiler. A deaerator reduces the level of dissolved oxygen and carbon dioxide in the feedwater, which in turn decreases the amount of corrosive compounds within the steam system over time.

The various types of deaeration machines include vacuum deaerator, air separation unit, and degasifier. The major areas of application of deaerators are within a boiler plant and boiler feedwater systems.

Expansion of the food & beverage industry is driving the deaeration machine market size globally. All beverages are sensitive to dissolved oxygen, which can lead to substantial change of taste and color. Additionally, dissolved oxygen adversely affects the filler performance. Therefore, it is important to use optimally deaerated water using a water deaeration system for the production of beverages such as soft drinks.

According to The Food and Drink Federation of the U.K., in 2021, food and drink manufacturing contributed US$ 37 Bn to the U.K.’s economy, registering a growth of 4.2% than the previous year. The World Economic Forum states that by 2050, the global population of 9.7 billion would need 70% more food than what is currently consumed. In the U.S, the food & beverage industry is one of the largest manufacturing sectors, accounting for over 4% of the GDP.

Deaerating machines effectively separates oxygen or carbon dioxide from the product, maintaining flavors and aromas during processing, thereby improving the quality and shelf-life of the product. Therefore, the expanding food & beverage industry is estimated to create substantial demand for these machines globally during the forecast period.

Crude oil is one of the most valued commodities in the world. It is used in numerous applications such as producing electricity and fueling transport. This makes it one of the most powerful industries to impact the world’s economy. In the oil industry, deaeration machines are employed to remove dissolved gases from seawater before it is injected into an oil reservoir. Therefore, the expanding oil industry is estimated to drive the deaeration machine market demand.

According to International Energy Agency’s (IEA) report of March 2023, global oil production capacity is projected to increase by 5 mb/d by 2026. Asia is likely to continue to dominate the global oil demand, accounting for 90% increase between 2019 and 2026, according to the IEA report.

A deaeration machine prevents the formation of hydrate crystals, which can clog pores in the reservoir and reduce the flow of oil. Deaeration also helps improve the efficiency of oil production by reducing the production of gas, which is produced along with the oil. These factors are likely to positively influence deaeration machine market dynamics during the forecast period.

Deaeration machine market research suggests that North America is anticipated to account for major share of the global market during the forecast period. The U.S. is the world’s top oil and natural gas producer. Additionally, agriculture, food, and related industries contributed 5.4% to the country’s GDP and provided 10.5% employment. Expenditure of the American citizens on food was 12% of the household budget on average in 2021, as per USDA. Demand and adoption of deaeration machines in the region remains dominant in the global market owing to the expanding end-use industries.

As per deaeration machine market analysis, demand for the product is rapidly increasing in Europe and the Middle East owing to the flourishing oil industry. New technologies have enabled companies to increase offshore oil and gas extraction, which requires drilling at a high depth underwater. Moreover, technological advancements, presence of prominent manufactures, and expanding end-use industries are additional factors creating lucrative business opportunities for manufacturers in these regions.

According to deaeration machine market insights, the global landscape is highly competitive, with the presence of various global and regional players that control majority of the deaeration machine market share. Product development is a major strategy adopted by top players. Leading companies focus on investments in R&D, product expansion, and mergers & acquisitions to tap incremental opportunities.

Alfa Laval, The Cornell Machine Company, The Fulton Companies, GEA Group, Indeck Power Equipment Company, Jaygo Incorporated, JBT Corporation, NETZSCH, Parker Boiler Co., and Stork are the prominent entities profiled in this market. Manufacturers are following the recent deaeration machine market trends to strengthen their global presence.

Key players have been profiled in the deaeration machine market report based on parameters such as product portfolio, financial overview, latest developments, business strategies, business segments, and company overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 3.9 Bn |

|

Market Forecast Value in 2031 |

US$ 7.1 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.9 Bn in 2022

It is projected to grow at a CAGR of 4.7% from 2023 to 2031

Growth in the food & beverage industry globally and rapid expansion of the oil industry

Vacuum was the major type segment in 2022

Europe is likely to have high demand for deaeration machines in the next few years

Alfa Laval, The Cornell Machine Company, The Fulton Companies, GEA Group, Indeck Power Equipment Company, Jaygo Incorporated, JBT Corporation, NETZSCH, Parker Boiler Co., and Stork

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Technological Overview Analysis

5.8. Global Deaeration Machine Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Bn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Deaeration Machine Market Analysis and Forecast, by Type

6.1. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

6.1.1. Vacuum

6.1.2. Spray

6.1.3. Spray-Tray

6.2. Incremental Opportunity, by Type

7. Global Deaeration Machine Market Analysis and Forecast, by Application

7.1. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

7.1.1. Oxygen Removal

7.1.2. Water Heating

7.1.3. Others

7.2. Incremental Opportunity, by Application

8. Global Deaeration Machine Market Analysis and Forecast, by End-use Industry

8.1. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

8.1.1. Food & Beverage

8.1.2. Pharmaceutical

8.1.3. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global Deaeration Machine Market Analysis and Forecast, by Region

9.1. Deaeration Machine Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Deaeration Machine Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Key Supplier Analysis

10.5. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

10.5.1. Vacuum

10.5.2. Spray

10.5.3. Spray-Tray

10.6. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

10.6.1. Oxygen Removal

10.6.2. Water Heating

10.6.3. Others

10.7. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

10.7.1. Food & Beverage

10.7.2. Pharmaceutical

10.7.3. Others

10.8. Deaeration Machine Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Deaeration Machine Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Supplier Analysis

11.5. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

11.5.1. Vacuum

11.5.2. Spray

11.5.3. Spray-Tray

11.6. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

11.6.1. Oxygen Removal

11.6.2. Water Heating

11.6.3. Others

11.7. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

11.7.1. Food & Beverage

11.7.2. Pharmaceutical

11.7.3. Others

11.8. Deaeration Machine Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Deaeration Machine Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Supplier Analysis

12.5. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

12.5.1. Vacuum

12.5.2. Spray

12.5.3. Spray-Tray

12.6. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

12.6.1. Oxygen Removal

12.6.2. Water Heating

12.6.3. Others

12.7. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

12.7.1. Food & Beverage

12.7.2. Pharmaceutical

12.7.3. Others

12.8. Deaeration Machine Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Deaeration Machine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Supplier Analysis

13.5. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

13.5.1. Vacuum

13.5.2. Spray

13.5.3. Spray-Tray

13.6. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

13.6.1. Oxygen Removal

13.6.2. Water Heating

13.6.3. Others

13.7. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

13.7.1. Food & Beverage

13.7.2. Pharmaceutical

13.7.3. Others

13.8. Deaeration Machine Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Deaeration Machine Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Supplier Analysis

14.5. Deaeration Machine Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

14.5.1. Vacuum

14.5.2. Spray

14.5.3. Spray-Tray

14.6. Deaeration Machine Market (US$ Bn and Thousand Units), by Application, 2017 - 2031

14.6.1. Oxygen Removal

14.6.2. Water Heating

14.6.3. Others

14.7. Deaeration Machine Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

14.7.1. Food & Beverage

14.7.2. Pharmaceutical

14.7.3. Others

14.8. Deaeration Machine Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2022)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Alfa Laval

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. The Cornell Machine Company

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. The Fulton Companies

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. GEA Group

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Indeck Power Equipment Company

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Jaygo Incorporated

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. JBT Corporation

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. NETZSCH

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Parker Boiler Co.

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Stork

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

15.3.11. Others

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Revenue

15.3.11.4. Strategy & Business Overview

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 4: Global Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 5: Global Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 8: Global Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 10: North America Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 11: North America Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 12: North America Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 13: North America Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 14: North America Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 15: North America Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 16: North America Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Table 17: Europe Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 18: Europe Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 19: Europe Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 20: Europe Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 21: Europe Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 22: Europe Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 23: Europe Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 24: Europe Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Table 25: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 26: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 27: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 28: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 29: Asia Pacific Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 30: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 31: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 32: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Table 33: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 34: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 35: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 36: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 37: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 38: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 39: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 40: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Table 41: South America Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Table 42: South America Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Table 43: South America Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Table 44: South America Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Table 45: South America Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: South America Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: South America Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Table 48: South America Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 5: Global Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 6: Global Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 7: Global Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 11: Global Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 13: North America Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 14: North America Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 15: North America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 16: North America Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 17: North America Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 18: North America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 19: North America Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 20: North America Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 21: North America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 22: North America Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 23: North America Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 24: North America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 25: Europe Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 26: Europe Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 27: Europe Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 28: Europe Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 29: Europe Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 30: Europe Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 31: Europe Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 32: Europe Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 33: Europe Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 34: Europe Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Europe Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Europe Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Asia Pacific Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 41: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 42: Asia Pacific Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 43: Asia Pacific Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 44: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 45: Asia Pacific Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 46: Asia Pacific Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 47: Asia Pacific Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 48: Asia Pacific Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 49: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 50: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 51: Middle East & Africa Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 52: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 53: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 54: Middle East & Africa Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 55: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 56: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 57: Middle East & Africa Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 58: Middle East & Africa Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Middle East & Africa Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Middle East & Africa Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: South America Deaeration Machine Market Value (US$ Bn), by Type, 2017-2031

Figure 62: South America Deaeration Machine Market Volume (Thousand Units), by Type 2017-2031

Figure 63: South America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: South America Deaeration Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 65: South America Deaeration Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 66: South America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 67: South America Deaeration Machine Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: South America Deaeration Machine Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: South America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 70: South America Deaeration Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 71: South America Deaeration Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 72: South America Deaeration Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031