Analysts’ Viewpoint

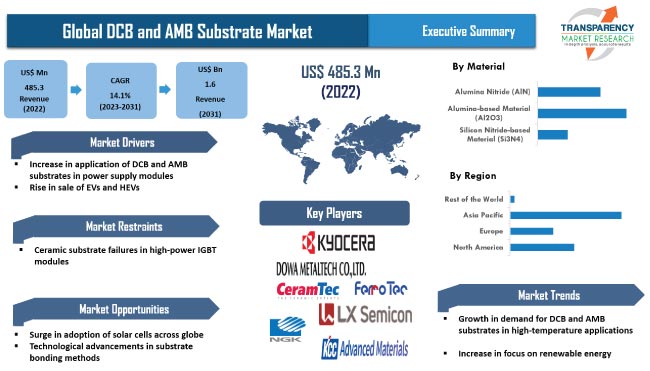

DCB and AMB substrates offer excellent thermal insulation. These substrates can be used in high-power and high-temperature applications across a wide range of industries including automotive, aerospace, and electronics. This is estimated to boost the demand for DCB and AMB substrates in power modules and consequently, fuel DCB and AMB substrate market development during the forecast period. Growth in automotive and transportation industries, rise in sale of electric vehicles, and increase in proliferation of high-speed mobility systems are some of the major factors fueling market progress.

Key manufacturers are focusing on improving the operational life of power modules and systems using DCB and AMB substrates. Increase in effort by OEMs to develop highly efficient electronic components is further contributing to growth of market statistics. Leading players are following the latest trends in the industry to gain incremental DCB and AMB substrate market opportunities.

Direct copper bonding substrates, or DCB substrates, signifies a process in which ceramic material and copper are bonded together at high temperatures. Active metal brazing, or AMB, comprises a metal foil, typically ceramic, that is bonded to copper with a vacuum brazing process. DCB and AMB substrates are used to dissipate the heat generated in the semiconductor.

The primary material used in the manufacturing of these substrates is alumina-based material (Al2O3), silicon nitride-based material (Si3N4), and alumina nitride (AlN). Alumina-based materials and silicon nitride-based materials are assimilated with copper plate through bonding by direct copper bonding (DCB) method and active metal brazing (AMB) method on a ceramic plate.

DCB and AMB substrates are used in power module applications including escalators and elevators. Within the renewable energy space, power modules built on DCB and AMB substrates find applications in solar cells, wind turbines, and other energy generation systems owing to the power and thermal efficiency delivered by these products under high power cycle stress.

The application of DCB (direct copper bonding) and AMB (active metal brazing) substrates in power supply modules is increasing due to their high thermal conductivity and reliability, which provides better heat dissipation and improved performance. Additionally, these substrates offer excellent mechanical strength and can withstand high operating temperatures, making them ideal for usage in several applications.

Power electronic substrates are widely used in applications that convert clean energy, such as wind energy and photovoltaic, into usable commercial power. Power modules are operating under variable wind speeds and experience large power cycling stresses; however, they need to operate for up to 25 years without any failure. Therefore, high-power modules with a baseplate have been developed with robust joining technologies and reliable materials, such as Al2O3 DBC substrates, to achieve the required lifetime.

Growing applications of power modules in various sectors such as industrial, automotive, and transportation, as well as consumer devices, is expected to contribute to the expansion of the global market in the next few years.

Rise in popularity of electric and hybrid electric vehicles is fueling the demand for efficient, reliable, and cost-effective electronic components. This is projected to drive the global DCB and AMB substrate business during the forecast period.

Active metal brazing (AMB) and direct copper bonding (DCB) substrates are used in the manufacture of electronic components in EVs.

In the AMB method, two metal surfaces are joined together using a filler metal, while in the DCB method, the bonding of copper to ceramics or other materials is direct, without using any intermediate layer. These techniques are used in the production of high-performance components such as power modules and electronic control units for electric vehicles. These substrates can help improve the reliability and durability of these components, leading to more efficient and sustainable electric vehicles. Thus, rise in sale of EVs, HEVs, and PHEVs worldwide in contributing to the market growth.

According to the latest DCB and AMB substrate market research report, the alumina-based material (Al2O3) material segment held major share of 48.6% in 2022. This segment is likely to dominate the global market during the forecast period.

Al2O3 is preferred because of its cost-effectiveness. This material can also withstand high temperature conditions, which is likely to increase its demand in the near future. Moreover, rise in adoption of consumer electronic products is fueling growth of the segment.

The 0.31 mm to 0.6mm thickness segment accounted for major share of 37.7% of the market in 2022. Growth of this segment is attributable to the rise in adoption of compact and miniature devices. Thinner DCB and AMB substrates for power modules are widely adopted in consumer electronic applications. Thus, demand for 0.31 mm to 0.6mm thin DCB and AMB substrates is anticipated to rise in the near future.

Asia Pacific held prominent share of 49.7% of the global DCB and AMB substrate market in 2022. Increase in rate of adoption of highly advanced home appliances and rise in awareness about the benefits of renewable energy are major factors augmenting market growth in the region. Furthermore, rise in government initiatives to promote electric vehicles is positively impacting the DCB and AMB substrate market share. For instance, in Thailand, the Board of Investment (BOI) sanctioned a promotional scheme for EVs in 2017.

North America held 28.5% share of the global market. The DCB and AMB substrate market size in North America is anticipated to increase during the forecast period due to the rise in investment in renewable energy production in the region. Increase in integration on advanced technologies in end-use industries is further fueling DCB and AMB substrate market dynamics.

The global market is consolidated, with the presence of a few large-medium scale vendors controlling majority of the DCB and AMB substrate industry share. Several manufacturers are spending significantly on comprehensive research and development activities and new product development. Leading players are engaged in implementing innovative strategies to expand their global footprint. These strategies majorly include the expansion of product portfolios and mergers and acquisitions.

Top DCB and AMB substrate companies include Amogreentech, CeramTec GmbH, DALEBA ELECTRONICS LTD, Dowa Metaltech Co., Ltd, Ferrotec (USA) Corporation, KCC CORPORATION. Kyocera Corporation, LX Semicon, Maruwa Co., Ltd, NGK Electronics Devices, Inc., Remtec, Inc., Rogers Corporation, and Tong Hsing Electronic Ind., Ltd.

Key players have been profiled in the DCB and AMB substrate market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 485.3 Mn |

|

Market Forecast Value in 2031 |

US$ 1.6 Bn |

|

Growth Rate (CAGR) |

14.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value and Billion Square Centimeters for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 485.3 Mn in 2022.

The CAGR is anticipated to be 14.1% from 2023 to 2031.

Increase in usage of DCB and AMB substrates in power supply modules and rise in sale of hybrid and electric vehicles.

The automotive electronics segment accounted for the largest share of 23.9% in 2022.

Asia Pacific is a more attractive region for vendors.

Amogreentech, CeramTec GmbH, DALEBA ELECTRONICS LTD, Dowa Metaltech Co., Ltd, Ferrotec (USA) Corporation, KCC CORPORATION. Kyocera Corporation, LX Semicon, Maruwa Co., Ltd, NGK Electronics Devices, Inc., Remtec, Inc., Rogers Corporation, and Tong Hsing Electronic Ind., Ltd.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global DCB and AMB Substrate Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Semiconductor Substrate Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global DCB and AMB Substrate Market Analysis, by Material

5.1. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Material, 2017–2031

5.1.1. Silicon Nitride-based Material (Si3N4)

5.1.2. Alumina-based Material (Al2O3)

5.1.3. Alumina Nitride (AlN)

5.2. Market Attractiveness Analysis, by Material

6. Global DCB and AMB Substrate Market Analysis, by Thickness

6.1. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Thickness, 2017–2031

6.1.1. 0.1 mm to 0.3mm

6.1.2. 0.31 mm to 0.6mm

6.1.3. 0.61 mm to 1 mm

6.1.4. Above 1 mm

6.2. Market Attractiveness Analysis, by Thickness

7. Global DCB and AMB Substrate Market Analysis, by Application

7.1. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Automotive Electronics

7.1.2. Home Appliances

7.1.3. Renewable Energy

7.1.4. High-speed Mobility

7.1.5. Industrial

7.1.6. Aerospace

7.1.7. Telecommunication Centers

7.1.8. Others

7.2. Market Attractiveness Analysis, by Application

8. Global DCB and AMB Substrate Market Analysis and Forecast, by Region

8.1. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Rest of World

8.2. Market Attractiveness Analysis, by Region

9. North America DCB and AMB Substrate Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Material, 2017–2031

9.3.1. Silicon Nitride-based Material (Si3N4)

9.3.2. Alumina-based Material (Al2O3)

9.3.3. Alumina Nitride (AlN)

9.4. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Thickness, 2017–2031

9.4.1. 0.1 mm to 0.3mm

9.4.2. 0.31 mm to 0.6mm

9.4.3. 0.61 mm to 1 mm

9.4.4. Above 1 mm

9.5. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.5.1. Automotive Electronics

9.5.2. Home Appliances

9.5.3. Renewable Energy

9.5.4. High-speed Mobility

9.5.5. Industrial

9.5.6. Aerospace

9.5.7. Telecommunication Centers

9.5.8. Others

9.6. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Material

9.7.2. By Thickness

9.7.3. By Application

9.7.4. By Country/Sub-region

10. Europe DCB and AMB Substrate Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Material, 2017–2031

10.3.1. Silicon Nitride-based Material (Si3N4)

10.3.2. Alumina-based Material (Al2O3)

10.3.3. Alumina Nitride (AlN)

10.4. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Thickness, 2017–2031

10.4.1. 0.1 mm to 0.3mm

10.4.2. 0.31 mm to 0.6mm

10.4.3. 0.61 mm to 1 mm

10.4.4. Above 1 mm

10.5. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.5.1. Automotive Electronics

10.5.2. Home Appliances

10.5.3. Renewable Energy

10.5.4. High-speed Mobility

10.5.5. Industrial

10.5.6. Aerospace

10.5.7. Telecommunication Centers

10.5.8. Others

10.6. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Material

10.7.2. By Thickness

10.7.3. By Application

10.7.4. By Country/Sub-region

11. Asia Pacific DCB and AMB Substrate Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Material, 2017–2031

11.3.1. Silicon Nitride-based Material (Si3N4)

11.3.2. Alumina-based Material (Al2O3)

11.3.3. Alumina Nitride (AlN)

11.4. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Thickness, 2017–2031

11.4.1. 0.1 mm to 0.3mm

11.4.2. 0.31 mm to 0.6mm

11.4.3. 0.61 mm to 1 mm

11.4.4. Above 1 mm

11.5. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Automotive Electronics

11.5.2. Home Appliances

11.5.3. Renewable Energy

11.5.4. High-speed Mobility

11.5.5. Industrial

11.5.6. Aerospace

11.5.7. Telecommunication Centers

11.5.8. Others

11.6. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Taiwan

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Material

11.7.2. By Thickness

11.7.3. By Application

11.7.4. By Country/Sub-region

12. Rest of World DCB and AMB Substrate Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Material, 2017–2031

12.3.1. Silicon Nitride-based Material (Si3N4)

12.3.2. Alumina-based Material (Al2O3)

12.3.3. Alumina Nitride (AlN)

12.4. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Thickness, 2017–2031

12.4.1. 0.1 mm to 0.3mm

12.4.2. 0.31 mm to 0.6mm

12.4.3. 0.61 mm to 1 mm

12.4.4. Above 1 mm

12.5. DCB and AMB Substrate Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Automotive Electronics

12.5.2. Home Appliances

12.5.3. Renewable Energy

12.5.4. High-speed Mobility

12.5.5. Industrial

12.5.6. Aerospace

12.5.7. Telecommunication Centers

12.5.8. Others

12.6. DCB and AMB Substrate Market Size (US$ Mn) and Volume (Billion Square Centimeters) Analysis & Forecast, by Sub-region, 2017–2031

12.6.1. Middle East & Africa

12.6.2. South America

12.7. Market Attractiveness Analysis

12.7.1. By Material

12.7.2. By Thickness

12.7.3. By Application

12.7.4. By Sub-region

13. Competition Assessment

13.1. Global DCB and AMB Substrate Market Competition Matrix - a Dashboard View

13.1.1. Global DCB and AMB Substrate Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Amogreentech

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. CeramTec GmbH

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Dowa Metaltech Co., Ltd

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Ferrotec (USA) Corporation

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Kyocera Corporation

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Maruwa Co., Ltd

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. NGK Electronics Devices, Inc.

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Remtec, Inc.

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Rogers Corporation

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Tong Hsing Electronic Ind., Ltd.

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. LX Semicon

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. DALEBA ELECTRONICS LTD

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. KCC CORPORATION

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Material

15.1.2. By Thickness

15.1.3. By Application

15.1.4. By Country/Sub-region

List of Tables

Table 01: Global DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 02: Global DCB and AMB Substrate Market Size & Forecast, by Material, Volume (Billion Square Centimeters), 2017-2031

Table 03: Global DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Table 04: Global DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 05: Global DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 06: Global DCB and AMB Substrate Market Size & Forecast, by Region, Volume (Billion Square Centimeters), 2017-2031

Table 07: North America DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 08: North America DCB and AMB Substrate Market Size & Forecast, by Material, Volume (Billion Square Centimeters), 2017-2031

Table 09: North America DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Table 10: North America DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 11: North America DCB and AMB Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 12: North America DCB and AMB Substrate Market Size & Forecast, by Country, Volume (Billion Square Centimeters), 2017-2031

Table 13: Europe DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 14: Europe DCB and AMB Substrate Market Size & Forecast, by Material, Volume (Billion Square Centimeters), 2017-2031

Table 15: Europe DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Table 16: Europe DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 17: Europe DCB and AMB Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 18: Europe DCB and AMB Substrate Market Size & Forecast, by Country, Volume (Billion Square Centimeters), 2017-2031

Table 19: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 20: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Material, Volume (Billion Square Centimeters), 2017-2031

Table 21: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Table 22: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 23: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 24: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Region, Volume (Billion Square Centimeters), 2017-2031

Table 25: Rest of World DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Table 26: Rest of World DCB and AMB Substrate Market Size & Forecast, by Material, Volume (Billion Square Centimeters), 2017-2031

Table 27: Rest of World DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Table 28: Rest of World DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 29: Rest of World DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 30: Rest of World DCB and AMB Substrate Market Size & Forecast, by Region, Volume (Billion Square Centimeters), 2017-2031

List of Figures

Figure 01: North America Price Trend Analysis (Price USD/1000 Square Centimeter)) (2020, 2026, 2031)

Figure 02: Europe Price Trend Analysis (Price USD/1000 Square Centimeter)) (2020, 2026, 2031)

Figure 03: Asia Pacific Price Trend Analysis (Price USD/1000 Square Centimeter)) (2020, 2026, 2031)

Figure 04: Rest of World Price Trend Analysis (Price USD/1000 Square Centimeter)) (2020, 2026, 2031)

Figure 05: Global DCB and AMB Substrate Market, Value (US$ Mn), 2017-2031

Figure 06: Global DCB and AMB Substrate Market, Volume (Billion Square Centimeters), 2017-2031

Figure 07: Global DCB and AMB Substrate Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 08: Global DCB and AMB Substrate Market Growth Rate, Volume (Billion Square Centimeters), 2017-2031

Figure 09: Global DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Figure 10: Global DCB and AMB Substrate Market Attractiveness, by Material, Value (US$ Mn), 2023-2031

Figure 11: Global DCB and AMB Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 12: Global DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Figure 13: Global DCB and AMB Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2023-2031

Figure 14: Global DCB and AMB Substrate Market Share Analysis, by Thickness, 2023 and 2031

Figure 15: Global DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Figure 16: Global DCB and AMB Substrate Market Attractiveness, by Application, Value (US$ Mn), 2023-2031

Figure 17: Global DCB and AMB Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Figure 19: Global DCB and AMB Substrate Market Attractiveness, by Region, Value (US$ Mn), 2023-2031

Figure 20: Global DCB and AMB Substrate Market Share Analysis, by Region, 2023 and 2031

Figure 21: Global DCB and AMB Substrate Market, Value (US$ Mn), 2017-2031

Figure 22: North America DCB and AMB Substrate Market, Volume (Billion Square Centimeters), 2017-2031

Figure 23: North America DCB and AMB Substrate Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 24: North America DCB and AMB Substrate Market Growth Rate, Volume (Billion Square Centimeters), 2017-2031

Figure 25: North America DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Figure 26: North America DCB and AMB Substrate Market Attractiveness, by Material, Value (US$ Mn), 2023-2031

Figure 27: North America DCB and AMB Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 28: North America DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Figure 29: North America DCB and AMB Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2023-2031

Figure 30: North America DCB and AMB Substrate Market Share Analysis, by Thickness, 2023 and 2031

Figure 31: North America DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Figure 32: North America DCB and AMB Substrate Market Attractiveness, by Application, Value (US$ Mn), 2023-2031

Figure 33: North America DCB and AMB Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 34: North America DCB and AMB Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 34: North America DCB and AMB Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 36: North America DCB and AMB Substrate Market Share Analysis, by Country, 2023 and 2031

Figure 37: Europe DCB and AMB Substrate Market, Value (US$ Mn), 2017-2031

Figure 38: Europe DCB and AMB Substrate Market, Volume (Billion Square Centimeters), 2017-2031

Figure 39: Europe DCB and AMB Substrate Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 40: Europe DCB and AMB Substrate Market Growth Rate, Volume (Billion Square Centimeters), 2017-2031

Figure 41: Europe DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Figure 42: Europe DCB and AMB Substrate Market Attractiveness, by Material, Value (US$ Mn), 2023-2031

Figure 43: Europe DCB and AMB Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 44: Europe DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Figure 45: Europe DCB and AMB Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2023-2031

Figure 46: Europe DCB and AMB Substrate Market Share Analysis, by Thickness, 2023 and 2031

Figure 47: Europe DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Figure 48: Europe DCB and AMB Substrate Market Attractiveness, by Application, Value (US$ Mn), 2023-2031

Figure 49: Europe DCB and AMB Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 50: Europe DCB and AMB Substrate Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 51: Europe DCB and AMB Substrate Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 52: Europe DCB and AMB Substrate Market Share Analysis, by Country, 2023 and 2031

Figure 53: Asia Pacific DCB and AMB Substrate Market, Value (US$ Mn), 2017-2031

Figure 54: Asia Pacific DCB and AMB Substrate Market, Volume (Billion Square Centimeters), 2017-2031

Figure 55: Asia Pacific DCB and AMB Substrate Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 56: Asia Pacific DCB and AMB Substrate Market Growth Rate, Volume (Billion Square Centimeters), 2017-2031

Figure 57: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific DCB and AMB Substrate Market Attractiveness, by Material, Value (US$ Mn), 2023-2031

Figure 59: Asia Pacific DCB and AMB Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 60: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Figure 61: Asia Pacific DCB and AMB Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2023-2031

Figure 62: Asia Pacific DCB and AMB Substrate Market Share Analysis, by Thickness, 2023 and 2031

Figure 63: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Figure 64: Asia Pacific DCB and AMB Substrate Market Attractiveness, by Application, Value (US$ Mn), 2023-2031

Figure 65: Asia Pacific DCB and AMB Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 66: Asia Pacific DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Figure 67: Asia Pacific DCB and AMB Substrate Market Attractiveness, by Region, Value (US$ Mn), 2023-2031

Figure 68: Asia Pacific DCB and AMB Substrate Market Share Analysis, by Region, 2023 and 2031

Figure 69: Rest of World DCB and AMB Substrate Market, Value (US$ Mn), 2017-2031

Figure 70: Rest of World DCB and AMB Substrate Market, Volume (Billion Square Centimeters), 2017-2031

Figure 71: Rest of World DCB and AMB Substrate Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 72: Rest of World DCB and AMB Substrate Market Growth Rate, Volume (Billion Square Centimeters), 2017-2031

Figure 73: Rest of World DCB and AMB Substrate Market Size & Forecast, by Material, Value (US$ Mn), 2017-2031

Figure 74: Rest of World DCB and AMB Substrate Market Attractiveness, by Material, Value (US$ Mn), 2023-2031

Figure 75: Rest of World DCB and AMB Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 76: Rest of World DCB and AMB Substrate Market Size & Forecast, by Thickness, Value (US$ Mn), 2017-2031

Figure 77: Rest of World DCB and AMB Substrate Market Attractiveness, by Thickness, Value (US$ Mn), 2023-2031

Figure 78: Rest of World DCB and AMB Substrate Market Share Analysis, by Thickness, 2023 and 2031

Figure 79: Rest of World DCB and AMB Substrate Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Figure 80: Rest of World DCB and AMB Substrate Market Attractiveness, by Application, Value (US$ Mn), 2023-2031

Figure 81: Rest of World DCB and AMB Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 82: Rest of World DCB and AMB Substrate Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Figure 83: Rest of World DCB and AMB Substrate Market Attractiveness, by Region, Value (US$ Mn), 2023-2031

Figure 84: Rest of World DCB and AMB Substrate Market Share Analysis, by Region, 2023 and 2031