Analysts’ Viewpoint

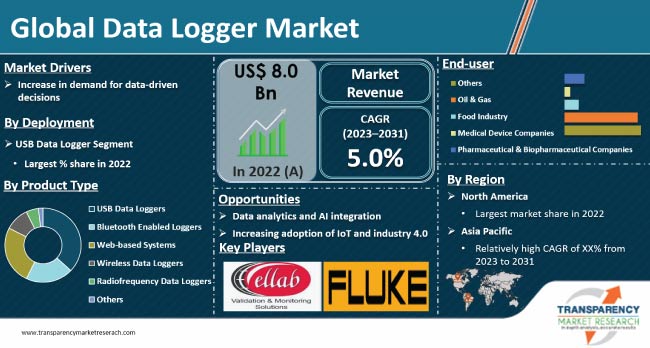

Increase in demand for data-driven decisions is expected to drive the global data Logger market during the forecast period. Data Logger play a crucial role in monitoring and optimizing industrial processes. Rise in utilization of these devices in different industries and scientific fields for data monitoring and analysis is likely to propel market expansion. Furthermore, integration of IoT technologies into data Logger in order to achieve real-time data transmission, remote monitoring, and control is anticipated to bolster the global data Logger market size in the next few years.

Integration of emerging technologies in data Logger in order to enable data-driven decision-making offers lucrative opportunities to market players. Manufacturers are focusing on developing technologically advanced data Logger that enable efficient data analysis, timely decision-making, and automation of processes across various sectors.

Data Logger are electronic devices, which automatically monitor and record environmental variables over time, making it possible to measure, record, analyze, and validate the conditions. A data logger has a computer chip to store data and a sensor to collect it. A computer is used to analyze the data that was recorded in the data logger.

Increase in demand for data-driven decision-making has become a cornerstone of modern business strategies across industries, catalyzing the adoption of technologies such as data Logger. This trend is driven by several factors that emphasize the critical role of data in optimizing operations, enhancing customer experiences, and fostering innovation.

In today's fast-paced and competitive landscape, organizations recognize the need to base their decisions on concrete insights rather than gut feelings. Data-driven decision-making empowers businesses to identify patterns, trends, and correlations that might be overlooked otherwise. Data Logger play a pivotal role in this context by providing real-time and accurate data that helps organizations make informed choices.

The retail sector uses data Logger to monitor foot traffic, purchase patterns, and inventory levels to optimize their product offerings, adjust pricing strategies, and manage supply chains more efficiently. This data-driven approach enhances customer satisfaction while minimizing wastage and operational costs. This in turn is driving global data Logger market demand.

Data Logger are essential in sectors where regulatory compliance is paramount. In the pharmaceutical industry, for example, maintaining specific temperature ranges during storage and transportation is critical to preserve the integrity of drugs. Data Logger equipped with temperature sensors ensure that medicines are stored and transported under optimal conditions, meeting regulatory requirements and ensuring patient safety.

In terms of deployment, the USB data Logger segment accounted for the largest global data Logger market share in 2022. This is ascribed to increase in the number of users of USB data Logger in the past few years. Their user-friendly nature and wide-ranging applications across industries such as manufacturing, agriculture, and transportation have contributed to the segment’s dominance.

USB data Logger provide efficient solutions for real-time data monitoring and analysis, enabling businesses to make informed decisions. With the convenience of plug-and-play functionality, USB data Logger have become integral tools for sectors such as manufacturing, healthcare, and environmental monitoring.

Based on channel, the multi-channel segment dominated the global data Logger market in 2022. Multi-channel data Logger are increasingly used in data acquisition and management. With the capability to simultaneously monitor and record data from multiple sources, these Logger have gained prominence across various industries, including research, manufacturing, and automotive.

In terms of end-user, the oil & gas segment held significant share of the global data Logger industry in 2022. The segment is a cornerstone of data-intensive operations. Real-time data collection and analysis are essential across exploration, production, and distribution processes. As technology advances, effective data utilization remains a key driver of innovation and resilience in the oil & gas sector.

As per data Logger market trends, technological advancements and the ever-expanding array of applications across industries is driving the industry in North America. Data Logger, which facilitate the recording and monitoring of various parameters in real-time, have become indispensable in sectors such as healthcare, transportation, and manufacturing. Surge in demand for data Logger can be ascribed to increase in emphasis on precise data collection, analysis, and adherence to stringent regulations.

Continual evolution of connectivity options is a major factor propelling the data Logger market growth in North America. Modern data Logger are equipped with wireless capabilities, enabling seamless data transmission and remote access for monitoring purposes. Moreover, advancements in battery technology have led to extended device lifespans, eliminating the need for frequent replacements.

The global industry is consolidated, with the presence of large number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by the leading players in the global data Logger market.

Ellab A/S, MadgeTech, Inc., Fluke Corporation, Pico Technology, Lives International Corporation, MicroDAQ, Omega Engineering, Inc., Dwyer Instruments Ltd., Mesa Labs, Inc., ThermoWorks, BrainChild Electronic Co., Ltd., Dickson, Erbo (Xylem, Inc.), Eval (Analog Devices, Inc.), Tecnosoft srl, GE Valprobe (KAYE Americas), and TMI Orion are the prominent players in the global market.

Each of these players has been profiled in the data Logger market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 8.0 Bn |

| Forecast (Value) in 2031 | More than US$ 12.0 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 8.0 Bn in 2022

It is projected to reach more than US$ 12.7 Bn by 2031

The CAGR is anticipated to be 5.0% from 2023 to 2031

Increase in demand for data-driven decisions and rise in utilization in different industries & scientific fields for data monitoring and analysis.

North America is likely to account for significant share during the forecast period

Ellab A/S, MadgeTech, Inc., Fluke Corporation, Pico Technology, Lives International Corporation, MicroDAQ, Omega Engineering, Inc., Dwyer Instruments LTD, Mesa Labs, Inc., ThermoWorks, BrainChild Electronic Co., Ltd., Dickson, Erbo (Xylem Inc.), Eval (Analog Devices, Inc.), Tecnosoft srl, GE Valprobe (KAYE Americas) and TMI Orion.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Data Logger Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Data Logger Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Key Industry Events

5.2. Data Logger: Application in Numerous Industries

5.3. Pricing Analysis

5.4. Technological Advancement

5.5. COVID-19 Impact Analysis

6. Global Data Logger Market Analysis and Forecast, by Deployment

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Deployment, 2017–2031

6.3.1. USB Data Logger

6.3.2. Bluetooth Enabled Logger

6.3.3. Web-based System

6.3.4. Wireless Data Logger

6.3.5. Radiofrequency Data Logger

6.3.6. Others (battery-powered data Logger, paperless data Logger, etc.)

6.4. Market Attractiveness, by Deployment

7. Global Data Logger Market Analysis and Forecast, by Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Channel, 2017–2031

7.3.1. Single Channel

7.3.2. Multi-channel

7.4. Market Attractiveness, by Channel

8. Global Data Logger Market Analysis and Forecast, by Measurement

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Measurement, 2017–2031

8.3.1. Humidity

8.3.2. Power

8.3.3. Temperature

8.3.4. Pressure

8.4. Market Attractiveness, by Measurement

9. Global Data Logger Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Pharmaceutical & Biopharmaceutical Companies

9.3.1.1. Cold Storage and Freezers

9.3.1.2. Warehouses

9.3.1.3. Depyrogenation

9.3.1.4. Lyophilization

9.3.1.5. Cleanrooms

9.3.1.6. Laboratories

9.3.1.7. H2O2 Sterilization

9.3.1.8. Ethylene Oxide Sterilization

9.3.1.9. Washer Disinfector

9.3.1.10. Others

9.3.2. Medical Device Industries

9.3.2.1. Steam Sterilization

9.3.2.2. Laboratories

9.3.2.3. Ethylene Oxide

9.3.2.4. H202 Sterilization

9.3.2.5. Warehouse

9.3.2.6. CTU's and TCU's

9.3.2.7. Washer Disinfector

9.3.2.8. Others

9.3.3. Food Industries

9.3.3.1. CTU's and TCU's

9.3.3.2. Retort Sterilization

9.3.3.3. Cooker Coolers

9.3.3.4. Pasteurization

9.3.3.5. Warehouse

9.3.3.6. Cold Chain

9.3.3.7. Others

9.3.4. Oil & Gas

9.3.5. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Data Logger Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Data Logger Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Deployment, 2017–2031

11.2.1. USB Data Logger

11.2.2. Bluetooth Enabled Logger

11.2.3. Web-based System

11.2.4. Wireless Data Logger

11.2.5. Radiofrequency Data Logger

11.2.6. Others (battery-powered data Logger, paperless data Logger, etc.)

11.3. Market Value Forecast, by Channel, 2017–2031

11.3.1. Single Channel

11.3.2. Multi-channel

11.4. Market Value Forecast, by Measurement, 2017–2031

11.4.1. Humidity

11.4.2. Power

11.4.3. Temperature

11.4.4. Pressure

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Pharmaceutical & Biopharmaceutical Companies

11.5.1.1. Cold Storage and Freezers

11.5.1.2. Warehouses

11.5.1.3. Depyrogenation

11.5.1.4. Lyophilization

11.5.1.5. Cleanrooms

11.5.1.6. Laboratories

11.5.1.7. H2O2 Sterilization

11.5.1.8. Ethylene Oxide Sterilization

11.5.1.9. Washer Disinfector

11.5.1.10. Others

11.5.2. Medical Devices Industries

11.5.2.1. Steam Sterilization

11.5.2.2. Laboratories

11.5.2.3. Ethylene Oxide

11.5.2.4. H202 Sterilization

11.5.2.5. Warehouse

11.5.2.6. CTU's and TCU's

11.5.2.7. Washer Disinfector

11.5.2.8. Others

11.5.3. Food Industries

11.5.3.1. CTU's and TCU's

11.5.3.2. Retort Sterilization

11.5.3.3. Cooker Coolers

11.5.3.4. Pasteurization

11.5.3.5. Warehouse

11.5.3.6. Cold Chain

11.5.3.7. Others

11.5.4. Oil & Gas

11.5.5. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Deployment

11.7.2. By Channel

11.7.3. By Measurement

11.7.4. By End-user

11.7.5. By Country

12. Europe Data Logger Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Deployment, 2017–2031

12.2.1. USB Data Logger

12.2.2. Bluetooth Enabled Logger

12.2.3. Web-based System

12.2.4. Wireless Data Logger

12.2.5. Radiofrequency Data Logger

12.2.6. Others (battery-powered data Logger, paperless data Logger, etc.)

12.3. Market Value Forecast, by Channel, 2017–2031

12.3.1. Single Channel

12.3.2. Multi-channel

12.4. Market Value Forecast, by Measurement, 2017–2031

12.4.1. Humidity

12.4.2. Power

12.4.3. Temperature

12.4.4. Pressure

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Pharmaceutical & Biopharmaceutical Companies

12.5.1.1. Cold Storage and Freezers

12.5.1.2. Warehouses

12.5.1.3. Depyrogenation

12.5.1.4. Lyophilization

12.5.1.5. Cleanrooms

12.5.1.6. Laboratories

12.5.1.7. H2O2 Sterilization

12.5.1.8. Ethylene Oxide Sterilization

12.5.1.9. Washer Disinfector

12.5.1.10. Others

12.5.2. Medical Devices Industries

12.5.2.1. Steam Sterilization

12.5.2.2. Laboratories

12.5.2.3. Ethylene Oxide

12.5.2.4. H202 Sterilization

12.5.2.5. Warehouse

12.5.2.6. CTU's and TCU's

12.5.2.7. Washer Disinfector

12.5.2.8. Others

12.5.3. Food Industries

12.5.3.1. CTU's and TCU's

12.5.3.2. Retort Sterilization

12.5.3.3. Cooker Coolers

12.5.3.4. Pasteurization

12.5.3.5. Warehouse

12.5.3.6. Cold Chain

12.5.3.7. Others

12.5.4. Oil & Gas

12.5.5. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Deployment

12.7.2. By Channel

12.7.3. By Measurement

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Data Logger Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Deployment, 2017–2031

13.2.1. USB Data Logger

13.2.2. Bluetooth Enabled Logger

13.2.3. Web-based System

13.2.4. Wireless Data Logger

13.2.5. Radiofrequency Data Logger

13.2.6. Others (battery-powered data Logger, paperless data Logger, etc.)

13.3. Market Value Forecast, by Channel, 2017–2031

13.3.1. Single Channel

13.3.2. Multi-channel

13.4. Market Value Forecast, by Measurement, 2017–2031

13.4.1. Humidity

13.4.2. Power

13.4.3. Temperature

13.4.4. Pressure

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Pharmaceutical & Biopharmaceutical Companies

13.5.1.1. Cold Storage and Freezers

13.5.1.2. Warehouses

13.5.1.3. Depyrogenation

13.5.1.4. Lyophilization

13.5.1.5. Cleanrooms

13.5.1.6. Laboratories

13.5.1.7. H2O2 Sterilization

13.5.1.8. Ethylene Oxide Sterilization

13.5.1.9. Washer Disinfector

13.5.1.10. Others

13.5.2. Medical Devices Industries

13.5.2.1. Steam Sterilization

13.5.2.2. Laboratories

13.5.2.3. Ethylene Oxide

13.5.2.4. H202 Sterilization

13.5.2.5. Warehouse

13.5.2.6. CTU's and TCU's

13.5.2.7. Washer Disinfector

13.5.2.8. Others

13.5.3. Food Industries

13.5.3.1. CTU's and TCU's

13.5.3.2. Retort Sterilization

13.5.3.3. Cooker Coolers

13.5.3.4. Pasteurization

13.5.3.5. Warehouse

13.5.3.6. Cold Chain

13.5.3.7. Others

13.5.4. Oil & Gas

13.5.5. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Deployment

13.7.2. By Channel

13.7.3. By Measurement

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Data Logger Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Deployment, 2017–2031

14.2.1. USB Data Logger

14.2.2. Bluetooth Enabled Logger

14.2.3. Web-based System

14.2.4. Wireless Data Logger

14.2.5. Radiofrequency Data Logger

14.2.6. Others (battery-powered data Logger, paperless data Logger, etc.)

14.3. Market Value Forecast, by Channel, 2017–2031

14.3.1. Single Channel

14.3.2. Multi-channel

14.4. Market Value Forecast, by Measurement, 2017–2031

14.4.1. Humidity

14.4.2. Power

14.4.3. Temperature

14.4.4. Pressure

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Pharmaceutical & Biopharmaceutical Companies

14.5.1.1. Cold Storage and Freezers

14.5.1.2. Warehouses

14.5.1.3. Depyrogenation

14.5.1.4. Lyophilization

14.5.1.5. Cleanrooms

14.5.1.6. Laboratories

14.5.1.7. H2O2 Sterilization

14.5.1.8. Ethylene Oxide Sterilization

14.5.1.9. Washer Disinfector

14.5.1.10. Others

14.5.2. Medical Devices Industries

14.5.2.1. Steam Sterilization

14.5.2.2. Laboratories

14.5.2.3. Ethylene Oxide

14.5.2.4. H202 Sterilization

14.5.2.5. Warehouse

14.5.2.6. CTU's and TCU's

14.5.2.7. Washer Disinfector

14.5.2.8. Others

14.5.3. Food Industries

14.5.3.1. CTU's and TCU's

14.5.3.2. Retort Sterilization

14.5.3.3. Cooker Coolers

14.5.3.4. Pasteurization

14.5.3.5. Warehouse

14.5.3.6. Cold Chain

14.5.3.7. Others

14.5.4. Oil & Gas

14.5.5. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Deployment

14.7.2. By Channel

14.7.3. By Measurement

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Data Logger Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Deployment, 2017–2031

15.2.1. USB Data Logger

15.2.2. Bluetooth Enabled Logger

15.2.3. Web-based System

15.2.4. Wireless Data Logger

15.2.5. Radiofrequency Data Logger

15.2.6. Others (battery-powered data Logger, paperless data Logger, etc.)

15.3. Market Value Forecast, by Channel, 2017–2031

15.3.1. Single Channel

15.3.2. Multi-channel

15.4. Market Value Forecast, by Measurement, 2017–2031

15.4.1. Humidity

15.4.2. Power

15.4.3. Temperature

15.4.4. Pressure

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Pharmaceutical & Biopharmaceutical Companies

15.5.1.1. Cold Storage and Freezers

15.5.1.2. Warehouses

15.5.1.3. Depyrogenation

15.5.1.4. Lyophilization

15.5.1.5. Cleanrooms

15.5.1.6. Laboratories

15.5.1.7. H2O2 Sterilization

15.5.1.8. Ethylene Oxide Sterilization

15.5.1.9. Washer Disinfector

15.5.1.10. Others

15.5.2. Medical Devices Industries

15.5.2.1. Steam Sterilization

15.5.2.2. Laboratories

15.5.2.3. Ethylene Oxide

15.5.2.4. H202 Sterilization

15.5.2.5. Warehouse

15.5.2.6. CTU's and TCU's

15.5.2.7. Washer Disinfector

15.5.2.8. Others

15.5.3. Food Industries

15.5.3.1. CTU's and TCU's

15.5.3.2. Retort Sterilization

15.5.3.3. Cooker Coolers

15.5.3.4. Pasteurization

15.5.3.5. Warehouse

15.5.3.6. Cold Chain

15.5.3.7. Others

15.5.4. Oil & Gas

15.5.5. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of MEA

15.7. Market Attractiveness Analysis

15.7.1. By Deployment

15.7.2. By Channel

15.7.3. By Measurement

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competitive Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Ellab A/S

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. Strategic Overview

16.3.1.5. SWOT Analysis

16.3.2. MadgeTech, Inc.

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. Strategic Overview

16.3.2.5. SWOT Analysis

16.3.3. Fluke Corporation

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. Strategic Overview

16.3.3.5. SWOT Analysis

16.3.4. Pico Technology

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. Strategic Overview

16.3.4.5. SWOT Analysis

16.3.5. Lives International Corporation

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. Strategic Overview

16.3.5.5. SWOT Analysis

16.3.6. MicroDAQ

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. Strategic Overview

16.3.6.5. SWOT Analysis

16.3.7. Omega Engineering, Inc.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. Strategic Overview

16.3.7.5. SWOT Analysis

16.3.8. Dwyer Instruments LTD

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. Strategic Overview

16.3.8.5. SWOT Analysis

16.3.9. Mesa Labs. Inc.

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. Strategic Overview

16.3.9.5. SWOT Analysis

16.3.10. ThermoWorks

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. Strategic Overview

16.3.10.5. SWOT Analysis

16.3.11. BrainChild Electronic Co., Ltd.

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. Strategic Overview

16.3.11.5. SWOT Analysis

16.3.12. Dickson

16.3.12.1. Company Overview

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. Strategic Overview

16.3.12.5. SWOT Analysis

16.3.13. Erbo (Xylem Inc.)

16.3.13.1. Company Overview

16.3.13.2. Product Portfolio

16.3.13.3. Financial Overview

16.3.13.4. Strategic Overview

16.3.13.5. SWOT Analysis

16.3.14. Eval (Analog Devices Inc.)

16.3.14.1. Company Overview

16.3.14.2. Product Portfolio

16.3.14.3. Financial Overview

16.3.14.4. Strategic Overview

16.3.14.5. SWOT Analysis

16.3.15. Tecnosoft srl

16.3.15.1. Company Overview

16.3.15.2. Product Portfolio

16.3.15.3. Financial Overview

16.3.15.4. Strategic Overview

16.3.15.5. SWOT Analysis

16.3.16. GE Valprobe (KAYE Americas)

16.3.16.1. Company Overview

16.3.16.2. Product Portfolio

16.3.16.3. Financial Overview

16.3.16.4. Strategic Overview

16.3.16.5. SWOT Analysis

16.3.17. TMI Orion

16.3.17.1. Company Overview

16.3.17.2. Product Portfolio

16.3.17.3. Financial Overview

16.3.17.4. Strategic Overview

16.3.17.5. SWOT Analysis

List of Tables

Table 1: Global Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 2: Global Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 3: Global Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 4: Global Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 5: Global Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 6: Global Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 7: Global Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 8: Global Data Logger Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 9: North America Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 10: North America Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 11: North America Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 12: North America Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: North America Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 14: North America Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 15: North America Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 16: North America Data Logger Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 17: Europe Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 18: Europe Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 19: Europe Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 20: Europe Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Europe Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 22: Europe Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 23: Europe Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 24: Europe Data Logger Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 26: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 27: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 28: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 29: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 30: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 31: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 32: Asia Pacific Data Logger Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 33: Latin America Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 34: Latin America Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 35: Latin America Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 36: Latin America Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 37: Latin America Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 38: Latin America Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 39: Latin America Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 40: Latin America Data Logger Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 41: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Deployment, 2017–2031

Table 42: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Channel, 2017–2031

Table 43: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Measurement, 2017–2031

Table 44: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 45: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Table 46: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Medical Device Companies, 2017–2031

Table 47: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Food Industry, 2017–2031

Table 48: Middle East & Africa Data Logger Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 02: Global Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 03: Global Data Logger Market Revenue (US$ Mn), by USB Data Logger, 2017–2031

Figure 04: Global Data Logger Market Revenue (US$ Mn), by Bluetooth Enabled Logger, 2017–2031

Figure 05: Global Data Logger Market Revenue (US$ Mn), by Web-based Systems, 2017–2031

Figure 06: Global Data Logger Market Revenue (US$ Mn), by Wireless Data Logger, 2017–2031

Figure 07: Global Data Logger Market Revenue (US$ Mn), by Radiofrequency Data Logger, 2017–2031

Figure 08: Global Data Logger Market Revenue (US$ Mn), by Others, 2017–2031

Figure 09: Global Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 09: North America Data Logger Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 11: Global Data Logger Market Revenue (US$ Mn), by Single Channel, 2017–2031

Figure 12: Global Data Logger Market Revenue (US$ Mn), by Multi-channel, 2017–2031

Figure 13: Global Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 14: Global Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 15: Global Data Logger Market Revenue (US$ Mn), by Temperature, 2017–2031

Figure 16: Global Data Logger Market Revenue (US$ Mn), by Pressure, 2017–2031

Figure 17: Global Data Logger Market Revenue (US$ Mn), by Humidity, 2017–2031

Figure 18: Global Data Logger Market Revenue (US$ Mn), by Power, 2017–2031

Figure 19: Global Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 20: Global Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 21: Global Data Logger Market Revenue (US$ Mn), by Pharmaceutical & Biopharmaceutical Companies, 2017–2031

Figure 22: Global Data Logger Market Revenue (US$ Mn), by Medical Device Companies, 2017–2031

Figure 23: Global Data Logger Market Revenue (US$ Mn), by Food Industry, 2017–2031

Figure 24: Global Data Logger Market Revenue (US$ Mn), by Oil & Gas, 2017–2031

Figure 25: Global Data Logger Market Revenue (US$ Mn), by Others, 2017–2031

Figure 26: Global Data Logger Market Value Share Analysis, by Region, 2022 and 2031

Figure 27: Global Data Logger Market Attractiveness Analysis, by Region, 2023–2031

Figure 29: North America Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 30: North America Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 31: North America Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 32: North America Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 33: North America Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 34: North America Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 35: North America Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 36: North America Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 37: North America Data Logger Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: North America Data Logger Market Attractiveness Analysis, by Country, 2023–2031

Figure 39: Europe Data Logger Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Europe Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 41: Europe Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 42: Europe Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 43: Europe Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 44: Europe Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 45: Europe Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 46: Europe Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Europe Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 48: Europe Data Logger Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 49: Europe Data Logger Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 50: Asia Pacific Data Logger Market Value (US$ Mn) Forecast, 2017–2031

Figure 51: Asia Pacific Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 52: Asia Pacific Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 53: Asia Pacific Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 54: Asia Pacific Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 55: Asia Pacific Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 56: Asia Pacific Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 57: Asia Pacific Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 58: Asia Pacific Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 59: Asia Pacific Data Logger Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 60: Asia Pacific Data Logger Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 61: Latin America Data Logger Market Value (US$ Mn) Forecast, 2017–2031

Figure 62: Latin America Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 63: Latin America Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 64: Latin America Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 65: Latin America Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 66: Latin America Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 67: Latin America Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 68: Latin America Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 69: Latin America Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 70: Latin America Data Logger Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 71: Latin America Data Logger Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 72: Middle East & Africa Data Logger Market Value (US$ Mn) Forecast, 2017–2031

Figure 73: Middle East & Africa Data Logger Market Value Share Analysis, by Deployment, 2022 and 2031

Figure 74: Middle East & Africa Data Logger Market Attractiveness Analysis, by Deployment, 2023–2031

Figure 75: Middle East & Africa Data Logger Market Value Share Analysis, by Channel, 2022 and 2031

Figure 76: Middle East & Africa Data Logger Market Attractiveness Analysis, by Channel, 2023–2031

Figure 77: Middle East & Africa Data Logger Market Value Share Analysis, by Measurement, 2022 and 2031

Figure 78: Middle East & Africa Data Logger Market Attractiveness Analysis, by Measurement, 2023–2031

Figure 79: Middle East & Africa Data Logger Market Value Share Analysis, by End-user, 2022 and 2031

Figure 80: Middle East & Africa Data Logger Market Attractiveness Analysis, by End-user, 2023–2031

Figure 81: Middle East & Africa Data Logger Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 82: Middle East & Africa Data Logger Market Attractiveness Analysis, by Country/Sub-region, 2023–2031