Analysts’ Viewpoint on Data Center Cooling Scenario

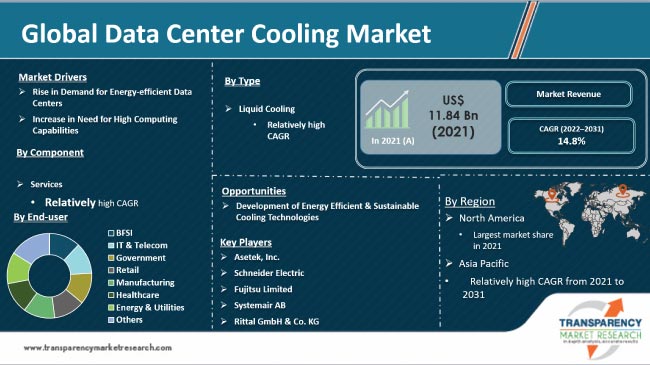

The global data center cooling market is significantly driven by an increase in need for high computing capabilities, rise in demand for energy-efficient data centers, and surge in implementation of immersion cooling. Data center cooling systems are reliable and cost-effective; they consistently monitor the parameters to gain maximum efficiency. Development of digital infrastructure, increase in adoption of advanced technologies, such as AI, ML, IoT, etc., and rise in popularity of sustainable cooling technologies are some of the factors that are anticipated to create lucrative opportunities for market players operating in the global data center cooling market. Moreover, data center cooling system operators are presently moving or planning to deploy energy-efficient immersion cooling systems over traditional cooling methods. Immersion cooling data centers provide a higher density of processing capabilities in smaller space, as they eliminate active cooling components, such as fans and heat sinks, in turn creating room for additional data centers. This is expected to propel the market in the near future.

Data center cooling system is a collection of tools, techniques, and processes to ensure ideal levels of temperature and humidity are maintained in data center premises. The data center cooling system comprises a combination of hardware, software, and services that serve the function. Data center cooling systems maintain an ideal operating environment for all information technology equipment (ITE) by removing the heat generated through some heat sinks. If not maintained, data center operators may face malfunctioning ITE, resulting in downtime and consequent financial losses. Since data centers are reported to be highly energy intensive and may increase their energy consumption owing to rise in number of chips deployed in a cabinet, leading to a lot more heat generation. Rise in energy consumption and increase in demand for data across industry verticals that highly rely on insights and data to run their business-critical applications cannot afford downtime of data center. Therefore, demand for data center liquid cooling systems such as direct-to-chip, rear-door heat exchangers, and immersion cooling is significantly high.

Data centers are major energy consumers, as they need more power to operate servers and other IT equipment. They provide a large amount of computing and data storage capabilities that utilize IT resources such as processors, networking, and storage, which generate heat. Data center operators require robust cooling systems, such as server rack cooling that prevent IT infrastructure from overheating and failure, which may lead to downtime and financial losses. Demand for digital services is rising due to increase in adoption of advanced technologies such as 5G, AI, edge computing, automation, and IoT along with the development of digital infrastructure, especially in developing economies. Consequently, the amount of data that needs to be processed and stored is increasing. Demand for data centers with reduced energy consumption and increased processing and computing efficiencies is rising at a rapid pace to tackle the issue of GHG emissions. Increase in design complexities in computing equipment is also driving the implementation of cooling systems. Modern and advanced servers and computing equipment generate more heat, as they consume more power to process and compute a larger amount of data. Total power consumption by data centers increased from 205 TWh in 2018 to 300-440 TWh in 2020. Energy consumption of data centers doubled in two years during the same period. All these factors are projected to drive the demand for energy-efficient data centers.

Increase in energy consumption is one of the major concerns faced by data center operators across the globe. A major portion of energy consumed is contributed by data center cooling. Rise in demand for new generation processors and applications for the smooth implementation and utilization of various technologies, such as artificial intelligence, machine learning, and analytics programs, is expected to further increase energy consumption. New generation processors consume significant amount of energy and generate heat, which needs to be properly managed in order to keep them running. They might stop working in case they exceed their heat limits. Global e-Sustainability Initiative (GESI), a technology community working on ICT sustainability, stated in its report ‘SMARTer2030’ that data centers consume over 1% of total electricity consumption globally and account for about 0.5% of total CO2 emissions.

Data centers are adopting advanced cooling technologies, such as geothermal cooling, evaporative cooling, solar cooling, and KyotoCooling (an advanced free cooling method in which a thermal wheel is used to control hot and cold air flows), to reduce electricity consumption and greenhouse gas (GHG) emissions. Data center liquid cooling systems are highly popular, as geothermal cooling is a low-cost and environment-friendly cooling technology. It uses heat pumps and a closed-loop piping system filled with water or a coolant liquid. The coolant liquid flows through underground vertical wells filled with heat-transferring liquid. Geothermal heat pumps consume 25% to 50% less electricity as compared to traditional cooling systems. Evaporative cooling or swamp cooling systems utilize falling temperature when the water transforms from liquid to a gaseous state, absorbing surrounding heat. Additionally, stringent government policies in terms of environmental sustainability have forced data center operators to comply and reduce their carbon footprints. This is attracting data center operators to adopt these environment-friendly cooling mechanisms.

North America dominated the global data center cooling market in 2021, and it is anticipated to hold major share of the global data center cooling market during the forecast period. This is due to the presence of large number of data centers and prominent data center cooling solutions vendors across the region. Rapid adoption of advanced technologies in North America is also expected to drive market. North America has the highest number of data centers, around 3,000. These data centers need to enhance their cooling capacity due to the rapid adoption of new solutions of convergence, edge computing, supercomputers, and high-performance computing (HPC), among others. Asia Pacific is one of the lucrative regions for server cooling systems, anticipated to offer opportunities during the forecast period due to rise in government investments in data centers and increase in penetration of mobile internet in the region. The market in Europe is expected to generate a revenue opportunity of US$ 11.19 Bn by 2031, expanding at a CAGR of 14.2% during the forecast period. Furthermore, rise in investments in data center deployment across Middle East & Africa is primarily ascribed to the increase in adoption of advanced technologies such as IoT, 5G, big data analytics, AI, and ML, in the region.

The global data center cooling market is consolidated, with a few large-scale vendors controlling majority of the share. Most of the companies are investing significantly in comprehensive research and development. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. Asetek, Inc., Schneider Electric, Fujitsu Limited, Systemair AB, Rittal GmbH & Co. KG, Mitsubishi Electric Corporation, Airedale International Air Conditioning Ltd., Nortek Air Solutions, LLC, Seimens, STULZ Gmbh, Vertiv Group Corp., and Belden Inc., are the prominent entities operating in the market.

Each of these players have been profiled in global data center cooling market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size (Value) in 2021 |

US$ 11.84 Bn |

|

Market Forecast Value in 2031 |

US$ 45.49 Bn |

|

Growth Rate (CAGR) |

14.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global data center cooling market is expected to reach US$ 45.49 Bn by 2031

The global data center cooling market is estimated to advance at a CAGR of 14.8% during the forecast period

Rise in demand for energy-efficient data centers and increase in need for high computing capabilities

North America is more attractive region for vendors in the global data center cooling market

Asetek, Inc., Schneider Electric, Fujitsu Limited, Systemair AB, Rittal GmbH & Co. KG, Mitsubishi Electric Corporation, Airedale International Air Conditioning Ltd., Nortek Air Solutions, LLC, Siemens, STULZ Gmbh, Vertiv Group Corp., and Belden Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Data Center Cooling Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Data Center Cooling Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis of Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Trends in Data Center Cooling

4.6. Market Opportunity Assessment – by Region (North America/Europe/Asia Pacific/Middle East and Africa/South America)

4.6.1. By Component

4.6.2. By Type

4.6.3. By End-user

5. Global Data Center Cooling Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/Price Trend Analysis

6. Global Data Center Cooling Market Analysis, by Component

6.1. Key Segment Analysis

6.2. Data Center Cooling Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.2.1. Solution

6.2.1.1. Air Cooling

6.2.1.2. Liquid Cooling

6.2.2. Services

6.2.2.1. Design & Installation

6.2.2.2. Maintenance & Support

7. Global Data Center Cooling Market Analysis, by Type

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Type, 2018 - 2031

7.3.1. Air Cooling

7.3.1.1. Room Cooling

7.3.1.2. In-row Cooling

7.3.1.3. Rack Cooling

7.3.2. Liquid Cooling

7.3.2.1. Direct-to-Chip

7.3.2.2. Rear-door Heat Exchangers

7.3.2.3. Immersion Cooling

8. Global Data Center Cooling Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Data Center Cooling Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.2.1. BFSI

8.2.2. IT & Telecom

8.2.3. Government

8.2.4. Retail

8.2.5. Manufacturing

8.2.6. Healthcare

8.2.7. Energy & Utilities

8.2.8. Others

9. Global Data Center Cooling Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Data Center Cooling Market Analysis and Forecast

10.1. Regional Outlook

10.2. Data Center Cooling Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Type

10.2.3. By End-user

10.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Data Center Cooling Market Analysis and Forecast

11.1. Regional Outlook

11.2. Data Center Cooling Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Type

11.2.3. By End-user

11.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Data Center Cooling Market Analysis and Forecast

12.1. Regional Outlook

12.2. Data Center Cooling Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Type

12.2.3. By End-user

12.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Data Center Cooling Market Analysis and Forecast

13.1. Regional Outlook

13.2. Data Center Cooling Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Type

13.2.3. By End-user

13.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Data Center Cooling Market Analysis and Forecast

14.1. Regional Outlook

14.2. Data Center Cooling Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Type

14.2.3. By End-user

14.3. Data Center Cooling Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. List of Data Center Cooling Equipment Manufacturers and Distributors

15.4. Competitive Scenario

15.4.1. List of Emerging, Prominent, and Leading Players

15.4.2. Major Mergers & Acquisitions, Expansions, Partnerships, Contracts, Deals, etc.

16. Company Profiles

16.1. Asetek, Inc.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.2. Schneider Electric

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.3. Fujitsu

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.4. Systemair AB

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.5. Rittal GmbH & Co. KG

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.6. Mitsubishi Electric Corporation

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.7. Airedale International Air Conditioning Ltd.

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.8. Nortek Air Solutions, LLC

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.9. Siemens

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.10. STULZ Gmbh

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.11. Vertiv Group Corp.

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.12. Belden Inc.

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.13. Others

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Data Center Cooling Market

Table 2: North America Data Center Cooling Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 3: Europe Data Center Cooling Market Revenue Analysis, by Country & Sub-region, 2022 - 2031 (US$ Bn)

Table 4: Asia Pacific Data Center Cooling Market Revenue Analysis, by Country & Sub-region, 2022 - 2031 (US$ Bn)

Table 5: Middle East & Africa Data Center Cooling Market Revenue Analysis, by Country & Sub-region, 2021 and 2031 (US$ Bn)

Table 6: South America Data Center Cooling Market Revenue Analysis, by Country & Sub-region, 2022 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 11: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 12: Global Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 13: Global Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 14: Global Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 15: Global Data Center Cooling Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 16: North America Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 17: North America Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 18: North America Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 19: North America Data Center Cooling Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 20: U.S. Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Canada Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: Mexico Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Europe Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 24: Europe Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 25: Europe Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 26: Europe Data Center Cooling Market Value (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

Table 27: Germany Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: UK Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: France Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Italy Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: Spain Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Asia Pacific Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 33: Asia Pacific Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 34: Asia Pacific Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 35: Asia Pacific Data Center Cooling Market Value (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

Table 36: China Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: India Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Japan Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: ASEAN Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: Middle East & Africa Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 41: Middle East & Africa Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 42: Middle East & Africa Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 43: Middle East & Africa Data Center Cooling Market Value (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

Table 44: Saudi Arabia Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: The United Arab Emirates Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: South Africa Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 47: South America Data Center Cooling Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 48: South America Data Center Cooling Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 49: South America Data Center Cooling Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 50: South America Data Center Cooling Market Value (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

Table 51: Brazil Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 52: Argentina Data Center Cooling Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: Mergers & Acquisitions, Partnerships (1/2)

Table 54: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Data Center Cooling Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Data Center Cooling Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Data Center Cooling Market

Figure 4: Global Data Center Cooling Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Data Center Cooling Market Attractiveness Assessment, by Component

Figure 6: Global Data Center Cooling Market Attractiveness Assessment, by Type

Figure 7: Global Data Center Cooling Market Attractiveness Assessment, by End-user

Figure 8: Global Data Center Cooling Market Attractiveness Assessment, by Region

Figure 9: Global Data Center Cooling Market Revenue (US$ Bn) Historic Trends, 2016 – 2021

Figure 10: Global Data Center Cooling Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 – 2021

Figure 11: Global Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 12: Global Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 13: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 14: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 15: Global Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 16: Global Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 17: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 18: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 19: Global Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 20: Global Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 21: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 22: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 23: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 24: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 25: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 26: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 27: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 28: Global Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 29: Global Data Center Cooling Market Opportunity (US$ Bn), by Region

Figure 30: Global Data Center Cooling Market Opportunity Share (%), by Region, 2022–2031

Figure 31: Global Data Center Cooling Market Size (US$ Bn), by Region, 2022 & 2031

Figure 32: Global Data Center Cooling Market Value Share Analysis, by Region, 2022

Figure 33: Global Data Center Cooling Market Value Share Analysis, by Region, 2031

Figure 34: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 35: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 36: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 37: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 38: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 39: North America Data Center Cooling Market Revenue Opportunity Share, by Component

Figure 40: North America Data Center Cooling Market Revenue Opportunity Share, by Type

Figure 41: North America Data Center Cooling Market Revenue Opportunity Share, by End-user

Figure 42: North America Data Center Cooling Market Revenue Opportunity Share, by Country

Figure 43: North America Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 44: North America Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 45: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 46: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 47: North America Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 48: North America Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 49: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 50: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 51: North America Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 52: North America Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 53: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 54: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 55: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 56: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 57: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 58: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 59: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 60: North America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 61: North America Data Center Cooling Market Value Share Analysis, by Country, 2022

Figure 62: North America Data Center Cooling Market Value Share Analysis, by Country, 2031

Figure 63: U.S. Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 64: Canada Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 65: Mexico Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 66: Europe Data Center Cooling Market Revenue Opportunity Share, by Component

Figure 67: Europe Data Center Cooling Market Revenue Opportunity Share, by Type

Figure 68: Europe Data Center Cooling Market Revenue Opportunity Share, by End-user

Figure 69: Europe Data Center Cooling Market Revenue Opportunity Share, by Country & Sub-region

Figure 70: Europe Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 71: Europe Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 72: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 73: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 74: Europe Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 75: Europe Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 76: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 77: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 78: Europe Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 79: Europe Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 80: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 81: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 82: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 83: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 84: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 85: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 86: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 87: Europe Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 88: Europe Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2022

Figure 89: Europe Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2031

Figure 90: Germany Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 91: U.K. Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 92: France Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 93: Italy Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 94: Spain Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 95: Asia Pacific Data Center Cooling Market Revenue Opportunity Share, by Component

Figure 96: Asia Pacific Data Center Cooling Market Revenue Opportunity Share, by Type

Figure 97: Asia Pacific Data Center Cooling Market Revenue Opportunity Share, by End-user

Figure 98: Asia Pacific Data Center Cooling Market Revenue Opportunity Share, by Country & Sub-region

Figure 99: Asia Pacific Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 100: Asia Pacific Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 101: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 102: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 103: Asia Pacific Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 104: Asia Pacific Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 105: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 106: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 107: Asia Pacific Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 108: Asia Pacific Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 109: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 110: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 111: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 112: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 113: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 114: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 115: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 116: Asia Pacific Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 117: Asia Pacific Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2022

Figure 118: Asia Pacific Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2031

Figure 119: China Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 120: India Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 121: Japan Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 122: ASEAN Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 123: Middle East & Africa Data Center Cooling Market Revenue Opportunity Share, by Component

Figure 124: Middle East & Africa Data Center Cooling Market Revenue Opportunity Share, by Type

Figure 125: Middle East & Africa Data Center Cooling Market Revenue Opportunity Share, by End-user

Figure 126: Middle East & Africa Data Center Cooling Market Revenue Opportunity Share, by Country & Sub-region

Figure 127: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 128: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 129: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 130: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 131: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 132: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 133: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 134: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 135: Middle East & Africa Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 136: Middle East & Africa Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 137: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 138: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 139: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 140: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 141: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 142: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 143: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 144: Middle East & Africa Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 145: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2022

Figure 146: Middle East & Africa Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2031

Figure 147: Saudi Arabia Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 148: The United Arab Emirates Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 149: South Africa Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 150: South America Data Center Cooling Market Revenue Opportunity Share, by Component

Figure 151: South America Data Center Cooling Market Revenue Opportunity Share, by Type

Figure 152: South America Data Center Cooling Market Revenue Opportunity Share, by End-user

Figure 153: South America Data Center Cooling Market Revenue Opportunity Share, by Country & Sub-region

Figure 154: South America Data Center Cooling Market Value Share Analysis, by Component, 2022

Figure 155: South America Data Center Cooling Market Value Share Analysis, by Component, 2031

Figure 156: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Solution, 2022 – 2031

Figure 157: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 158: South America Data Center Cooling Market Value Share Analysis, by Type, 2022

Figure 159: South America Data Center Cooling Market Value Share Analysis, by Type, 2031

Figure 160: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Air Cooling, 2022 – 2031

Figure 161: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Liquid Cooling, 2022 – 2031

Figure 162: South America Data Center Cooling Market Value Share Analysis, by End-user, 2022

Figure 163: South America Data Center Cooling Market Value Share Analysis, by End-user, 2031

Figure 164: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 165: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 166: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 167: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 168: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 169: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 170: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2022 – 2031

Figure 171: South America Data Center Cooling Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 172: South America Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2022

Figure 173: South America Data Center Cooling Market Value Share Analysis, by Country & Sub-region, 2031

Figure 174: Brazil Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 175: Argentina Data Center Cooling Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031