Analysts’ Viewpoint on Market Scenario

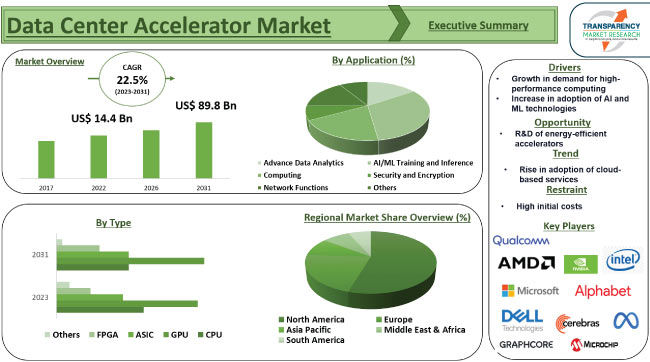

Growth in demand for high-performance computing is expected to propel the data center accelerator market size during the forecast period. Increase in adoption of Artificial intelligence (AI) and machine learning (ML) technologies is also projected to boost demand for high-performance data center accelerators in the near future.

Rapid evolution of technology, especially in AI, data analytics, and cloud computing, has led to significant changes in the design, management, and operation of data centers. Data centers are incorporating specialized hardware, such as Graphics Processing Units (GPUs) and Tensor Processing Units (TPUs) to accelerate AI workloads. Vendors in the global data center accelerator industry are focusing on the development of high-performance GPUs to cater to different types of workloads such as gaming, graphics, AI, and scientific computing.

Data center accelerator is a hardware device that enhances computer performance by processing data. It helps enhance the use of AI-based services, thereby improving the performance of data centers. GPUs supplement and expedite the processing capabilities of Central Processing Units (CPUs), utilizing parallel computing to process large amounts of data more swiftly. Data centers that implement this acceleration can achieve superior economic advantages, offering unprecedented performance with less reliance on servers. This leads to quicker data interpretation and a lessened expense.

High-performance Computing (HPC) involves performing complex computations at very high speeds. These require significant processing power and memory, which large, dedicated data centers can provide. HPC applications often involve large volumes of data, requiring substantial storage capacity. Data centers can offer the storage solutions necessary to handle these data loads. Widespread adoption of AI and autonomous vehicles is boosting the need for powerful processors and accelerators, faster memory, and high-speed networking technologies. This, in turn, is expected to spur the data center accelerator market growth in the near future.

Effective high-speed networking is another important aspect of HPC, allowing for fast data transfer and communication between different nodes in an HPC system. Data centers provide the necessary high-speed interconnections. Accelerators, such as GPUs or Field Programmable Gate Arrays (FPGAs), are specialized hardware designed to accelerate specific workloads such as scientific simulations or machine learning.

Data centers can achieve faster processing times and handle more demanding workloads by offloading compute-intensive tasks to AI-based data center accelerators. This setup is commonly employed in scientific research, AI, and big data analytics. The data center's infrastructure is optimized to support these accelerators, ensuring maximum performance and scalability for high-performance computing tasks. Thus, surge in demand for HPC is boosting the data center accelerator market value.

Complexity and computational demands of AI and ML algorithms require specialized hardware to run effectively and efficiently. AI tools are revolutionizing various sectors, such as healthcare, manufacturing, transportation, and finance, by providing solutions that automate tasks, enhance productivity, and lead to more intelligent applications. Hence, growth in usage of AI and ML technologies is driving the data center accelerator market expansion.

Major cloud providers, including AWS, Google Cloud, and Azure, are offering AI-as-a-service. AWS, Google Cloud, and Azure offer various ML and AI services that require significant computational capabilities. AWS offers SageMaker, a fully managed service that provides developers and data scientists the ability to build, train, and deploy ML models quickly. Google Cloud AI provides user-friendly services for natural language, speech, vision, and prediction while Microsoft Azure includes a suite of AI and ML services including text analytics, computer vision, and custom ML models.

Rise in reliance on such services for business functions across industries is propelling the data center accelerator market progress. Data center accelerators enhance the capabilities of these AI services by speeding up data processing, thereby allowing businesses to generate insights more quickly.

According to the latest data center accelerator market trends, the GPU type segment is expected to dominate the industry during the forecast period. GPUs have emerged as the go-to accelerator in modern data centers due to their advantages in processing complex computations and handling large data workloads.

GPUs are designed to perform multiple operations concurrently, as opposed to CPUs that handle a few threads at high speed. This parallel processing is extremely beneficial for AI and ML workloads, which often involve processing large data sets. Most AI and ML frameworks, such as TensorFlow and PyTorch, have robust support for GPU acceleration. This compatibility makes GPUs an attractive choice for learning and inference. Major cloud providers, such as e AWS, Google Cloud, and Azure, use GPUs in their infrastructure to power their AI and ML services.

According to the latest data center accelerator market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Rise in consumption of digital content and surge in data usage in China, India, Japan, and South Korea are fueling the market dynamics of the region.

Presence of tech giants, significant investment in data management, and rapid adoption of new technologies are major factors augmenting market statistics in North America. The U.S. is a key market for data center accelerators in the region.

Major vendors are developing robust and cost-effective accelerators to increase their data center accelerator market share. Data center accelerator companies are differentiating themselves by providing specialized ML services, AI frameworks, and tools. They are also developing energy-efficient data center accelerators.

Advanced Micro Devices, Advantech Co., Ltd., Cisco Systems, Inc., Dell Inc., Enflame Technology, Fujitsu, Alphabet Inc., Graphcore, Gyrfalcon Technology Inc., Huawei Technologies, Intel Corporation, Lattice Semiconductor, Leapmind Inc., Marvell, Meta Inc., Microchip Technology Inc., NEC Corporation, NVIDIA Corporation, Qnap Systems, Inc., Qualcomm Technologies, Inc., Sambanova Systems, Inc., Semptian, and Wave Computing Several are major players operating in this industry.

Each of these players has been profiled in the data center accelerator market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 14.4 Bn |

|

Market Forecast Value in 2031 |

US$ 89.8 Bn |

|

Growth Rate (CAGR) |

22.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 14.4 Bn in 2022

It is projected to advance at a CAGR of 22.5% from 2031 to 2031

It is estimated to reach US$ 89.8 Bn by the end of 2031

Growth in demand for high-performance computing and increase in adoption of AI and ML technologies

Asia Pacific is anticipated to record the highest demand during the forecast period

Advanced Micro Devices, Advantech Co., Ltd., Cisco Systems, Inc., Dell Inc., Enflame Technology, Fujitsu, Alphabet Inc., Graphcore, Gyrfalcon Technology Inc., Huawei Technologies, Intel Corporation, Lattice Semiconductor, Leapmind Inc., Marvell, Meta Inc., Microchip Technology Inc., NEC Corporation, NVIDIA Corporation, Qnap Systems, Inc., Qualcomm Technologies, Inc., Sambanova Systems, Inc., Semptian, and Wave Computing

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Data Center Accelerator Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Data Center Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Data Center Accelerator Market Analysis, by Type

5.1. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

5.1.1. CPU

5.1.2. GPU

5.1.3. ASIC

5.1.4. FPGA

5.1.5. Others

5.2. Market Attractiveness Analysis, By Type

6. Global Data Center Accelerator Market Analysis, by Application

6.1. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Advance Data Analytics

6.1.2. AI/ML Training and Inference

6.1.3. Computing

6.1.4. Security and Encryption

6.1.5. Network Functions

6.1.6. Others

6.2. Market Attractiveness Analysis, By Application

7. Global Data Center Accelerator Market Analysis and Forecast, by Region

7.1. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, By Region

8. North America Data Center Accelerator Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

8.3.1. CPU

8.3.2. GPU

8.3.3. ASIC

8.3.4. FPGA

8.3.5. Others

8.4. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

8.4.1. Advance Data Analytics

8.4.2. AI/ML Training and Inference

8.4.3. Computing

8.4.4. Security and Encryption

8.4.5. Network Functions

8.4.6. Others

8.5. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By Application

8.6.3. By Country/Sub-region

9. Europe Data Center Accelerator Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

9.3.1. CPU

9.3.2. GPU

9.3.3. ASIC

9.3.4. FPGA

9.3.5. Others

9.4. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Advance Data Analytics

9.4.2. AI/ML Training and Inference

9.4.3. Computing

9.4.4. Security and Encryption

9.4.5. Network Functions

9.4.6. Others

9.5. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By Application

9.6.3. By Country/Sub-region

10. Asia Pacific Data Center Accelerator Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

10.3.1. CPU

10.3.2. GPU

10.3.3. ASIC

10.3.4. FPGA

10.3.5. Others

10.4. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Advance Data Analytics

10.4.2. AI/ML Training and Inference

10.4.3. Computing

10.4.4. Security and Encryption

10.4.5. Network Functions

10.4.6. Others

10.5. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By Country/Sub-region

11. Middle East & Africa Data Center Accelerator Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

11.3.1. CPU

11.3.2. GPU

11.3.3. ASIC

11.3.4. FPGA

11.3.5. Others

11.4. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Advance Data Analytics

11.4.2. AI/ML Training and Inference

11.4.3. Computing

11.4.4. Security and Encryption

11.4.5. Network Functions

11.4.6. Others

11.5. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By Country/Sub-region

12. South America Data Center Accelerator Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

12.3.1. CPU

12.3.2. GPU

12.3.3. ASIC

12.3.4. FPGA

12.3.5. Others

12.4. Data Center Accelerator Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Advance Data Analytics

12.4.2. AI/ML Training and Inference

12.4.3. Computing

12.4.4. Security and Encryption

12.4.5. Network Functions

12.4.6. Others

12.5. Data Center Accelerator Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Data Center Accelerator Market Competition Matrix - a Dashboard View

13.1.1. Global Data Center Accelerator Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Advanced Micro Devices

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Advantech Co., Ltd.

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Cisco Systems, Inc.

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Dell Inc.

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Enflame Technology

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Fujitsu

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Alphabet Inc.

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Graphcore

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Gyrfalcon Technology Inc.

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Huawei Technologies

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Intel Corporation

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Lattice Semiconductor

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

14.13. Leapmind Inc.

14.13.1. Overview

14.13.2. Product Portfolio

14.13.3. Sales Footprint

14.13.4. Key Subsidiaries or Distributors

14.13.5. Strategy and Recent Developments

14.13.6. Key Financials

14.14. Marvell

14.14.1. Overview

14.14.2. Product Portfolio

14.14.3. Sales Footprint

14.14.4. Key Subsidiaries or Distributors

14.14.5. Strategy and Recent Developments

14.14.6. Key Financials

14.15. Meta Inc.

14.15.1. Overview

14.15.2. Product Portfolio

14.15.3. Sales Footprint

14.15.4. Key Subsidiaries or Distributors

14.15.5. Strategy and Recent Developments

14.15.6. Key Financials

14.16. Microchip Technology Inc.

14.16.1. Overview

14.16.2. Product Portfolio

14.16.3. Sales Footprint

14.16.4. Key Subsidiaries or Distributors

14.16.5. Strategy and Recent Developments

14.16.6. Key Financials

14.17. NEC Corporation

14.17.1. Overview

14.17.2. Product Portfolio

14.17.3. Sales Footprint

14.17.4. Key Subsidiaries or Distributors

14.17.5. Strategy and Recent Developments

14.17.6. Key Financials

14.18. NVIDIA Corporation

14.18.1. Overview

14.18.2. Product Portfolio

14.18.3. Sales Footprint

14.18.4. Key Subsidiaries or Distributors

14.18.5. Strategy and Recent Developments

14.18.6. Key Financials

14.19. Qnap Systems, Inc.

14.19.1. Overview

14.19.2. Product Portfolio

14.19.3. Sales Footprint

14.19.4. Key Subsidiaries or Distributors

14.19.5. Strategy and Recent Developments

14.19.6. Key Financials

14.20. Qualcomm Technologies, Inc.

14.20.1. Overview

14.20.2. Product Portfolio

14.20.3. Sales Footprint

14.20.4. Key Subsidiaries or Distributors

14.20.5. Strategy and Recent Developments

14.20.6. Key Financials

14.21. Sambanova Systems, Inc.

14.21.1. Overview

14.21.2. Product Portfolio

14.21.3. Sales Footprint

14.21.4. Key Subsidiaries or Distributors

14.21.5. Strategy and Recent Developments

14.21.6. Key Financials

14.22. Semptian

14.22.1. Overview

14.22.2. Product Portfolio

14.22.3. Sales Footprint

14.22.4. Key Subsidiaries or Distributors

14.22.5. Strategy and Recent Developments

14.22.6. Key Financials

14.23. Wave Computing

14.23.1. Overview

14.23.2. Product Portfolio

14.23.3. Sales Footprint

14.23.4. Key Subsidiaries or Distributors

14.23.5. Strategy and Recent Developments

14.23.6. Key Financials

15. Recommendation

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 2: Global Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 3: Global Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 4: Global Data Center Accelerator Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 5: Global Data Center Accelerator Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 6: North America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 7: North America Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 8: North America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 9: North America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 10: North America Data Center Accelerator Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 11: Europe Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 12: Europe Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 13: Europe Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 14: Europe Data Center Accelerator Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 15: Europe Data Center Accelerator Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 16: Asia Pacific Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 17: Asia Pacific Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 18: Asia Pacific Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 19: Asia Pacific Data Center Accelerator Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 20: Asia Pacific Data Center Accelerator Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 22: Middle East & Africa Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 23: Middle East & Africa Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Data Center Accelerator Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Data Center Accelerator Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 26: South America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Type, 2017-2031

Table 27: South America Data Center Accelerator Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 28: South America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 29: South America Data Center Accelerator Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 30: South America Data Center Accelerator Market Volume (Million Units) & Forecast, by Country, 2017-2031

List of Figures

Figure 01: Global Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 02: Global Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 03: Global Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 04: Global Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 05: Global Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 06: Global Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 08: Global Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 09: Global Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 10: Global Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 11: Global Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 12: Global Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 13: Global Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031

Figure 14: North America Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 15: North America Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 16: North America Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 17: North America Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 18: North America Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 19: North America Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 20: North America Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 21: North America Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 22: North America Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 23: North America Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 24: North America Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 25: North America Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 26: North America Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031

Figure 27: Europe Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 28: Europe Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 29: Europe Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 30: Europe Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 31: Europe Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 32: Europe Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 33: Europe Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 34: Europe Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 35: Europe Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 36: Europe Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 37: Europe Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 38: Europe Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 39: Europe Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031

Figure 40: Asia Pacific Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 41: Asia Pacific Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 42: Asia Pacific Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 43: Asia Pacific Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 44: Asia Pacific Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 45: Asia Pacific Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 46: Asia Pacific Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 47: Asia Pacific Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 48: Asia Pacific Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 49: Asia Pacific Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 50: Asia Pacific Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 51: Asia Pacific Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 52: Asia Pacific Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031

Figure 53: Middle East & Africa Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 54: Middle East & Africa Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 55: Middle East & Africa Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 56: Middle East & Africa Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 57: Middle East & Africa Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 58: Middle East & Africa Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 59: Middle East & Africa Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 60: Middle East & Africa Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 61: Middle East & Africa Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 62: Middle East & Africa Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 63: Middle East & Africa Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 64: Middle East & Africa Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 65: Middle East & Africa Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031

Figure 66: South America Data Center Accelerator Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 67: South America Data Center Accelerator Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 68: South America Data Center Accelerator Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 69: South America Data Center Accelerator Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 70: South America Data Center Accelerator Market Projections by Type, Value (US$ Bn), 2017-2031

Figure 71: South America Data Center Accelerator Market Share Analysis, by Type, 2021 and 2031

Figure 72: South America Data Center Accelerator Market, Incremental Opportunity, by Type, 2021-2031

Figure 73: South America Data Center Accelerator Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 74: South America Data Center Accelerator Market Share Analysis, by Application, 2021 and 2031

Figure 75: South America Data Center Accelerator Market, Incremental Opportunity, by Application, 2021-2031

Figure 76: South America Data Center Accelerator Market Projections by Country and Sub-region, Value (US$ Bn), 2017-2031

Figure 77: South America Data Center Accelerator Market Share Analysis, by Country and Sub-region 2021 and 2031

Figure 78: South America Data Center Accelerator Market, Incremental Opportunity, by Country and Sub-region, 2021-2031