Data Analytics Outsourcing Market- Snapshot

Data analytics is the art of analyzing raw data by using quantitative and qualitative techniques and procedures for the purpose of drawing conclusions from the data. For better business decisions, companies make use of data analytics. Data analytics has moved from being just descriptive such as reports, to predictive, predictive modeling, offering statistical analysis, planning for future scenarios, and optimization and forecasting for anticipation. Outsourcing of data analytics provides more flexibility to companies. It also allows companies to use updated tools and have expert opinion on their data. Outsourcing providers offer services that they specialize and excel in. As it is their main business, the providers ensure their service meets global standards. Outsourcing providers offer both vertical and horizontal solutions packed in a variety of configurations. Data analytics spans a wide range of techniques, toolsets, vertical specific expertise, and services. Outsourcing vendors have become more sophisticated as they handle complex projects and datasets. The market for data analytics outsourcing is projected to be valued at US$ 20,681.1 Mn by 2026, recording a CAGR of 29.4%.

Various industries can benefit from data analytics, especially financial services, healthcare, media, communications, and retail. The retail industry can now find opportunities for new products and profit based on market trends that can be researched digitally through observing consumer behavior over social media and their engagement and buying experiences, without going through the traditional ways such as interviews and surveys. Instead of having an in-house software, companies are looking for outsourcing their research to a third party so as to save on costs. The BFSI sector drives the data analytics outsourcing industry with most of the companies targeting this vertical. However, emerging verticals such as manufacturing, healthcare, and IT & telecom also are showing high growth in this market.

Exponential growth in data generation has increased the need for advanced data analytics skills to leverage the same for business benefits. Enterprises are increasing profitability and improving their efficiency by using several business software systems such as customer relationship management (CRM), enterprise resource planning (ERP), and supply chain management (SCM). These systems have resulted in an exponential increase in data related to operations, customers, and suppliers. Increased pressure for regulatory compliance and greater transparency in sectors such as BFSI, healthcare, and IT & telecom are expected to increase the demand for data analytics. Inadequacy of in-house expertise has led to higher demand for third-party service, allowing the enterprises to make effective insight-driven business decisions, provide improved services to customers, and avoid losses and risks. With rise in awareness regarding its advantages and increase in productivity through its use, and also due to lack of in-house expertise and skilled resources, the data analytics outsourcing market is anticipated to grow swiftly in the near future. However, many organizations are reluctant to outsource their data analytics service due to concerns regarding data security. For regulated industry sectors such as banking, insurance, healthcare, and government, security of data is crucial and any failure or gap in it may result in major problems. These may lead to circumstances in which the analytical models can impact on privacy negatively from both an ethical and legal perspective, and hence signify the possible hindrances to the data analytics outsourcing market.

A key trend boosting the growth of the data analytics outsourcing market is the popularity of Internet of things (IoT) as it provides marketers and businesses with opportunities to utilize and create actionable insights regarding consumers. The new technologies vital for successful implementation of IoT drive new business opportunities. Data analytics is swiftly developing as Internet of things (IoT) is helping in better decision making. Analysis of information about connected things is one of the key features of Internet of things. Usage of IoT increases the amount of data in category and quantity, thus presenting the opportunity for development and application of data analytics outsourcing.

The data analytics outsourcing market can be segmented on the basis of application and industry. Based on application, the data analytics outsourcing market can be classified into marketing analytics, sales analytics, fraud detection and risk management, supply chain analytics, process optimization, advisory services, device security solutions, and others. Based on industry, the data analytics outsourcing market can be divided into BFSI, IT & telecom, healthcare, retail, media & entertainment, energy & utilities, hospitality, education, manufacturing, consumer packaged goods, and others.

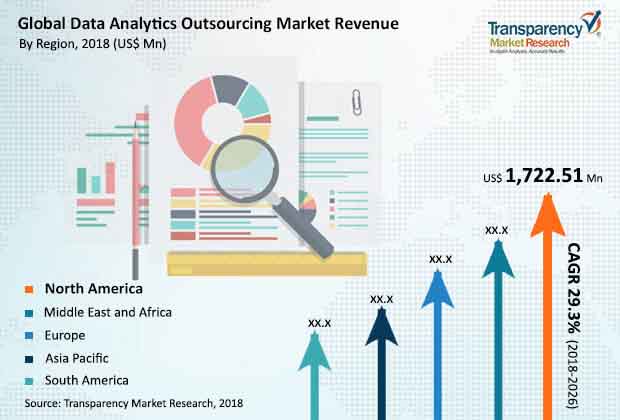

From a geographical standpoint, North America is expected to hold a major share of the data analytics outsourcing market. Growth of the global data analytics outsourcing market in the region can be attributed to the rising demand for advanced data analytics services in industries and the high adoption of marketing analytics by companies as to offer the best possible services to their clients. Asia Pacific is expected to witness lucrative growth as rapid progress is projected for the data analytics market in India. Furthermore, the data analytics outsourcing market in Asia Pacific, Europe, Middle East & Africa, and South America is also expected to grow significantly during the forecast period.

The data analytics outsourcing market is largely driven by mergers and acquisitions. For instance, in June 2017, Fractal Analytics acquired 4i Inc., a Chicago-based analytics company. The acquisition is projected to enable Fractal Analytics offer its services in a more strategic manner. In August 2017, Accenture acquired the data analytics company called Search Technologies. Search Technologies has developed specific unstructured data normalization technologies that Accenture plans to combine with its AI and data analytics capabilities. The acquisition is expected to help Accenture deliver better customer experiences and business outcomes. Vendors in the data analytics outsourcing market offer highly advanced and customized products to strengthen their market presence. The other leading strategies in the market include new product launch; for instance, in January 2017, Mu Sigma launched Meta-software, a new analytical software in order to provide customers with flexible and effective solutions. Key players profiled in the data analytics outsourcing market report include Accenture, Capgemini, Fractal Analytics Ltd, Genpact Ltd., IBM Corporation, Infosys Ltd., Mu Sigma, Inc., Opera Solutions LLC, RSA Security LLC, Sap SE, Tata Consultancy Services Ltd., ThreatMetrix, Wipro Ltd., and ZS Associates, Inc.

Data Analytics Outsourcing Market is projected to reach US$ 20,681.1 Million by 2026

Key vendors in the Data Analytics Outsourcing Market are Fractal Analytics Ltd, Accenture, Infosys Ltd., RSA Security LLC, Capgemini, Tata Consultancy Services Ltd., Wipro Ltd., and IBM Corporation.

The Data Analytics Outsourcing Market is expected to grow at a CAGR of 29.4% during 2018 - 2026

Data Analytics Outsourcing product type, end user, price category, distribution channel, and region.

North America Takes Lead in the Data Analytics Outsourcing Market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Data Analytics Outsourcing Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. Key Regional Socio-political-technological Developments and Their Impact Considerations

4.3. Porter’s Five Forces Analysis - Global Data Analytics Outsourcing

4.4. PESTEL Analysis - Global Data Analytics Outsourcing

4.5. Technology/Product Roadmap

4.6. Ecosystem Analysis - Global Data Analytics Outsourcing

4.7. Market Dynamics

4.7.1. Drivers

4.7.1.1. Supply Side

4.7.1.2. Demand Side

4.7.2. Restraints

4.7.3. Opportunities

4.7.4. Impact Analysis of Drivers & Restraints

4.8. Regulations and Policies – By Region

4.9. Adoption Analysis: By Enterprise Size

4.10. Pricing model Analysis, by:

4.10.1. Pay-as-you-go

4.10.2. Outcome-based

4.10.3. Project-based

4.10.4. Hybrid

4.11. Global Data Analytics Outsourcing Market Analysis and Forecast, 2016 - 2026

4.11.1. Market Revenue Analysis (US$ Mn)

4.11.1.1. Historic Growth Trends, 2012-2017

4.11.1.2. Forecast Trends, 2017-2026

4.12. Market Outlook

4.13. Competitive Scenario and Trends

4.13.1. Data Analytics Outsourcing Concentration Rate

4.13.1.1. List of New Entrants

4.13.1.2. Mergers & Acquisitions, Expansions

5. Global Data Analytics Outsourcing Market Analysis and Forecast, by Application

5.1. Overview & Definitions

5.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Application, 2016-2026

5.2.1. Marketing Analytics

5.2.2. Sales Analytics

5.2.3. Fraud Detection and Risk management

5.2.4. Supply Chain Analytics

5.2.5. Process Optimization

5.2.6. Advisory Services

5.2.7. Device Security Solutions

5.2.7.1. Identity Management

5.2.7.2. Access Management

5.2.8. Others

5.3. Market Attractiveness, by Application

6. Global Data Analytics Outsourcing Market Analysis and Forecast, by Industry

6.1. Overview & Definitions

6.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Industry, 2016-2026

6.2.1. BFSI

6.2.2. IT & Telecom

6.2.3. Healthcare

6.2.4. Retail

6.2.5. Media & Entertainment

6.2.6. Energy & Utilities

6.2.7. Hospitality

6.2.8. Education

6.2.9. Manufacturing

6.2.10. Consumer Packaged Goods

6.2.11. Others (Travel and Logistics, Consulting and Professional Services)

6.3. Market Attractiveness, by Industry

7. Global Data Analytics Outsourcing Market Analysis and Forecast, by Region

7.1. Overview & Definitions

7.2. Key Findings / Developments

7.3. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Region, 2016-2026

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

7.4. Market Attractiveness, by Region

8. North America Data Analytics Outsourcing Market Analysis and Forecast

8.1. Key Findings

8.1.1. Marketing Analytics

8.1.2. Sales Analytics

8.1.3. Fraud Detection and Risk management

8.1.4. Supply Chain Analytics

8.1.5. Process Optimization

8.1.6. Advisory Services

8.1.7. Device Security Solutions

8.1.7.1. Identity Management

8.1.7.2. Access Management

8.1.8. Others

8.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Industry, 2016-2026

8.2.1. BFSI

8.2.2. IT & Telecom

8.2.3. Healthcare

8.2.4. Retail

8.2.5. Media & Entertainment

8.2.6. Energy & Utilities

8.2.7. Hospitality

8.2.8. Education

8.2.9. Manufacturing

8.2.10. Consumer Packaged Goods

8.2.11. Others (Travel and Logistics, Consulting and Professional Services)

8.3. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016-2026

8.3.1. U.S.

8.3.2. Canada

8.3.3. Rest of North America

8.4. Market Attractiveness Analysis

8.4.1. By Country

8.4.2. By Application

8.4.3. By Industry

9. Europe Data Analytics Outsourcing Market Analysis and Forecast

9.1. Key Findings

9.1.1. Marketing Analytics

9.1.2. Sales Analytics

9.1.3. Fraud Detection and Risk management

9.1.4. Supply Chain Analytics

9.1.5. Process Optimization

9.1.6. Advisory Services

9.1.7. Device Security Solutions

9.1.7.1. Identity Management

9.1.7.2. Access Management

9.1.8. Others

9.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Industry, 2016-2026

9.2.1. BFSI

9.2.2. IT & Telecom

9.2.3. Healthcare

9.2.4. Retail

9.2.5. Media & Entertainment

9.2.6. Energy & Utilities

9.2.7. Hospitality

9.2.8. Education

9.2.9. Manufacturing

9.2.10. Consumer Packaged Goods

9.2.11. Others (Travel and Logistics, Consulting and Professional Services)

9.3. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016-2026

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Country

9.4.2. By Application

9.4.3. By Industry

10. Asia Pacific Data Analytics Outsourcing Market Analysis and Forecast

10.1. Key Findings

10.1.1. Marketing Analytics

10.1.2. Sales Analytics

10.1.3. Fraud Detection and Risk management

10.1.4. Supply Chain Analytics

10.1.5. Process Optimization

10.1.6. Advisory Services

10.1.7. Device Security Solutions

10.1.7.1. Identity Management

10.1.7.2. Access Management

10.1.8. Others

10.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Industry, 2016-2026

10.2.1. BFSI

10.2.2. IT & Telecom

10.2.3. Healthcare

10.2.4. Retail

10.2.5. Media & Entertainment

10.2.6. Energy & Utilities

10.2.7. Hospitality

10.2.8. Education

10.2.9. Manufacturing

10.2.10. Consumer Packaged Goods

10.2.11. Others (Travel and Logistics, Consulting and Professional Services)

10.3. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016-2026

10.3.1. China

10.3.2. India

10.3.3. Japan

10.3.4. Rest of APAC

10.4. Market Attractiveness Analysis

10.4.1. By Country

10.4.2. By Application

10.4.3. By Industry

11. Middle East & Africa (MEA) Data Analytics Outsourcing Market Analysis and Forecast

11.2.5. Media & Entertainment

11.2.6. Energy & Utilities

11.2.7. Hospitality

11.2.8. Education

11.2.9. Manufacturing

11.2.10. Consumer Packaged Goods

11.2.11. Others (Travel and Logistics, Consulting and Professional Services)

11.3. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016-2026

11.3.1. GCC

11.3.2. South Africa

11.3.3. Rest of MEA

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Application

11.4.3. By Industry

12. South America Data Analytics Outsourcing Market Analysis and Forecast

12.1. Key Findings

12.1.1. Marketing Analytics

12.1.2. Sales Analytics

12.1.3. Fraud Detection and Risk management

12.1.4. Supply Chain Analytics

12.1.5. Process Optimization

12.1.6. Advisory Services

12.1.7. Device Security Solutions

12.1.7.1. Identity Management

12.1.7.2. Access Management

12.1.8. Others

12.2. Data Analytics Outsourcing Market Size (US$ Mn) Forecast, by Industry, 2016-2026

12.2.1. BFSI

12.2.2. IT & Telecom

12.2.3. Healthcare

12.2.4. Retail

12.2.5. Media & Entertainment

12.2.6. Energy & Utilities

12.2.7. Hospitality

12.2.8. Education

12.2.9. Manufacturing

12.2.10. Consumer Packaged Goods

12.2.11. Others (Travel and Logistics, Consulting and Professional Services)

12.3. Market Size (US$ Mn) Forecast, by Country, 2016-2026

12.3.1. Brazil

12.3.2. Argentina

12.4. Market Attractiveness Analysis

12.4.1. By Country

12.4.2. By Application

12.4.3. By Industry

13. Competition Landscape

13.1. Market Player – Competition Matrix Market Share Analysis, by Company (2016)

13.2. Market Share Analysis, by Company (2016)

13.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

13.3.1. Accenture

13.3.1.1. Product Portfolio

13.3.1.2. Geographical Presence

13.3.1.3. SWOT

13.3.1.4. Financial Overview

13.3.1.5. Strategy

13.3.2. Capgemini

13.3.2.1. Product Portfolio

13.3.2.2. Geographical Presence

13.3.2.3. SWOT

13.3.2.4. Financial Overview

13.3.2.5. Strategy

13.3.3. Fractal Analytics Ltd.

13.3.3.1. Product Portfolio

13.3.3.2. Geographical Presence

13.3.3.3. SWOT

13.3.3.4. Financial Overview

13.3.3.5. Strategy

13.3.4. Genpact Ltd.

13.3.4.1. Product Portfolio

13.3.4.2. Geographical Presence

13.3.4.3. SWOT

13.3.4.4. Financial Overview

13.3.4.5. Strategy

13.3.5. IBM Corporation

13.3.5.1. Product Portfolio

13.3.5.2. Geographical Presence

13.3.5.3. SWOT

13.3.5.4. Financial Overview

13.3.5.5. Strategy

13.3.6. Infosys Ltd.

13.3.6.1. Product Portfolio

13.3.6.2. Geographical Presence

13.3.6.3. SWOT

13.3.6.4. Financial Overview

13.3.6.5. Strategy

13.3.7. Mu Sigma, Inc.

13.3.7.1. Product Portfolio

13.3.7.2. Geographical Presence

13.3.7.3. SWOT

13.3.7.4. Financial Overview

13.3.7.5. Strategy

13.3.8. Opera Solutions LLC

13.3.8.1. Product Portfolio

13.3.8.2. Geographical Presence

13.3.8.3. SWOT

13.3.8.4. Financial Overview

13.3.8.5. Strategy

13.3.9. RSA Security LLC

13.3.9.1. Product Portfolio

13.3.9.2. Geographical Presence

13.3.9.3. SWOT

13.3.9.4. Financial Overview

13.3.9.5. Strategy

13.3.10. Sap SE

13.3.10.1. Product Portfolio

13.3.10.2. Geographical Presence

13.3.10.3. SWOT

13.3.10.4. Financial Overview

13.3.10.5. Strategy

13.3.11. Tata Consultancy Services Ltd.

13.3.11.1. Product Portfolio

13.3.11.2. Geographical Presence

13.3.11.3. SWOT

13.3.11.4. Financial Overview

13.3.11.5. Strategy

13.3.12. ThreatMetrix

13.3.12.1. Product Portfolio

13.3.12.2. Geographical Presence

13.3.12.3. SWOT

13.3.12.4. Financial Overview

13.3.12.5. Strategy

13.3.13. Wipro Ltd.

13.3.13.1. Product Portfolio

13.3.13.2. Geographical Presence

13.3.13.3. SWOT

13.3.13.4. Financial Overview

13.3.13.5. Strategy

13.3.14. ZS Associates, Inc.

13.3.14.1. Product Portfolio

13.3.14.2. Geographical Presence

13.3.14.3. SWOT

13.3.14.4. Financial Overview

13.3.14.5. Strategy

14. Key Takeaways

List of Tables

Table 1: An Overview of Selected Acquisition and Merger Transactions in Data Analytics Outsourcing Market

Table 2: Global Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 3: Global Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 4: Global Data Analytics Outsourcing Market Value Share Analysis and Forecast, by Region, 2016 – 2026 (US$ Mn)

Table 5: North America Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 6: North America Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 7: North America Analytics Outsourcing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 – 2026

Table 8: Europe Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 9: Europe Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 10: Europe Analytics Outsourcing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 – 2026

Table 11: Asia Pacific Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 12: Asia Pacific Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 13: Asia Pacific Analytics Outsourcing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 – 2026

Table 14: Middle East & Africa Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 15: Middle East & Africa Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 16: Middle East & Africa Analytics Outsourcing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 – 2026

Table 17: South America Data Analytics Outsourcing Market Forecast, by Application, 2016 – 2026 (US$ Mn)

Table 18: South America Data Analytics Outsourcing Market Forecast, by Industry, 2016 – 2026 (US$ Mn)

Table 19: South America Analytics Outsourcing Market Size (US$ Mn) Forecast, by Country, 2018 – 2026

Table 20: Key Financial Indicators, 2016- 2017

Table 21: Key Financial Indicators, 2016- 2017

Table 22: Key Financial Indicators, 2016- 2017

Table 23: Key Financial Indicators, 2015-2016

Table 24: Key Financial Indicators, 2016- 2017

Table 25: Key Financial Indicators, 2015- 2016

Table 26: Key Financial Indicators, 2015 - 2016 (US$ Mn)

Table 27: Key Financial Indicators, 2015- 2016

Table 28: Key Financial Indicators, 2016 - 2017 (US$ Mn)

List of Figures

Figure 1: Global data analytics outsourcing market is expected to grow from US$ 2,634.1 Mn in 2018 to US$ 20,681.1 Mn in 2026 at a CAGR of 29.4%

Figure 2: Data Analytics Outsourcing Market Historic Revenue Projections and Growth Trends, 2012 – 2017

Figure 3: Data Analytics Outsourcing Market Revenue Projections and Growth Trends, 2017 – 2026 (US$ Mn)

Figure 4: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 5: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 6: Data Analytics Outsourcing Market Value Share, by Region (2018)

Figure 7: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 8: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 9: Global Data Analytics Outsourcing Matrix

Figure 10: Global Data Analytics Outsourcing Market Attractiveness Analysis, by Application

Figure 11: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 12: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 13: Global Data Analytics Outsourcing Matrix

Figure 14: Global Data Analytics Outsourcing Market Attractiveness Analysis, by Industry

Figure 15: Data Analytics Outsourcing Market Value Share, by Region (2018)

Figure 16: Data Analytics Outsourcing Market Value Share, by Region (2026)

Figure 17: Global Data Analytics Outsourcing Market- Market Attractiveness Analysis, by Region

Figure 18: North America Data Analytics Outsourcing Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2026

Figure 19: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 20: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 21: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 22: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 23: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2018)

Figure 24: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2026)

Figure 25: North America Market Attractiveness Analysis, by Application

Figure 26: North America Market Attractiveness Analysis, by Industry

Figure 27: Europe Data Analytics Outsourcing Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2026

Figure 28: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 29: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 30: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 31: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 32: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2018)

Figure 33: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2026)

Figure 34: Europe Market Attractiveness Analysis, by Application

Figure 35: Europe Market Attractiveness Analysis, by Industry

Figure 36: Asia Pacific Data Analytics Outsourcing Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2026

Figure 37: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 38: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 39: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 40: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 41: Data Analytics Outsourcing Market Value Share, Country/Sub-region (2018)

Figure 42: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2026)

Figure 43: Asia Pacific Market Attractiveness Analysis, by Application

Figure 44: Asia Pacific Market Attractiveness Analysis, by Industry

Figure 45: Middle East & Africa Data Analytics Outsourcing Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2026

Figure 46: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 47: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 48: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 49: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 50: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2018)

Figure 51: Data Analytics Outsourcing Market Value Share, by Country/Sub-region (2026)

Figure 52: Middle East & Africa Market Attractiveness Analysis, by Application

Figure 53: Middle East & Africa Market Attractiveness Analysis, by Industry

Figure 54: South America Data Analytics Outsourcing Market Revenue (US$ Mn) and Y-o-Y Forecast, 2016 – 2026

Figure 55: Data Analytics Outsourcing Market Value Share, by Application (2018)

Figure 56: Data Analytics Outsourcing Market Value Share, by Application (2026)

Figure 57: Data Analytics Outsourcing Market Value Share, by Industry (2018)

Figure 58: Data Analytics Outsourcing Market Value Share, by Industry (2026)

Figure 59: Data Analytics Outsourcing Market Value Share, by Country (2018)

Figure 60: Data Analytics Outsourcing Market Value Share, by Country (2026)

Figure 61: South America Market Attractiveness Analysis, by Application

Figure 62: South America Market Attractiveness Analysis, by Industry

Figure 63: Breakdown of Net Sales, by Geography, 2017

Figure 64: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 65: Breakdown of Net Sales, by Geography, 2017

Figure 66: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017

Figure 67: Breakdown of Net Sales, by Geography, 2017

Figure 68: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 69: Breakdown of Net Sales, by Geography, 2016

Figure 70: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2016

Figure 71: Breakdown of Net Sales, by Geography, 2017

Figure 72: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017

Figure 73: Breakdown of Net Sales, by Geography, 2016

Figure74: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2016

Figure 75: Net Sales, by Region (2016)

Figure 76: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2016

Figure 77: Net Sales, by Region (2016)

Figure 78: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2016

Figure 79: Net Sales, by Region (2017)

Figure 80: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017