The manufacturing sector is experiencing a major transition worldwide due to major advancements in technology. At present, as Industry 4.0 continues to make inroads across a range of manufacturing facilities worldwide, the digitalization trend has well and truly set its foot into steel production– a factor that is positively impacting the long rolling space. The demand for cut-to-length line systems is witnessing significant growth, as steel producers continue to rope in significant efforts to fulfill the consumer demand for on-time delivery and product requirements while simultaneously running a lean operation. With advancements in sensor technology, long-rolling facilities are increasingly being designed to improve efficiency and optimize business and operating practices.

Key participants of the cut-to-length line systems market are likely to focus on the design of their product offering and offer customized solutions to their customers as per their requirement. In addition, companies are deploying resources to automate their existing strip feeding line with advanced technologies, including coiler, stamping technology, leveling technology, and shears, among others. Key companies in the cut-to-length line systems market are working on improving the performance of their cut-to-length lines by maximizing the speed of their production processes.

Due to the onset of Industry 4.0, more number of manufacturing facilities are transitioning into smart factories. The sensor technology has evolved at a blazing pace in the past decade and thus, played an important role in hastening production processes. In addition, smart sensors also enable the integration of cutting-edge automatic functions, condition monitoring, and process models. Sensors are gradually becoming an integral part of several production processes and enabling significant improvements in cut-to-length line systems. Laser gauges play an imperative role in measuring product speed. Apart from improving the mill-control system and setup, these insights delivered by sensors play an essential role in optimizing the cut-length accuracy of shears. Moreover, the combination of non-contact laser gauges and vision systems, the mill-control systems tracks the height and width of the product within the mill line. Due to Industry 4.0, the adoption of automatic cut-to-length line systems is expected to remain higher than manual and semi-automatic cut-to-length line systems by a considerable margin. Rising investments and progress in cut-to-length line systems, along with infrastructure development across major manufacturing facilities are some of the major factors that will boost the prospects of the cut-to-length line systems market during the assessment period.

The growing demand for stainless steel from a plethora of industries has directly impacted the demand for cut-to-length line systems. Companies in the current cut-to-length line systems market are likely to focus on cost-efficiency, designs, and the overall performance of their machines to fulfill the evolving requirements of customers. While top tier companies are expected to expand their product portfolio and global presence by eyeing mergers and collaboration opportunities in other regional markets, other established players operating in the current cut-to-length line systems market are focusing on offering customized machinery solutions in accord with the prerequisites of different applications.

For instance, in May 2019, Heinrich Georg GmbH Maschinenfabrik developed a customized solution for Vitkovicke Slevarny, spol.s.r.o. for the supply of a roll lath. The newly developed solution significantly improved the work compliance in the production lines for customers. Several manufacturers operating in the current cut-to-length line systems market are increasingly offering their machinery solutions for projects across the petrochemical, military, nuclear, metallurgy, etc. Expansion of the current production capacity, customization, and product diversification are likely to be the key growth strategies that will continue to gain traction in the cut-to-length line systems market as companies continue to strengthen their foothold in the current market landscape.

Analysts’ Viewpoint

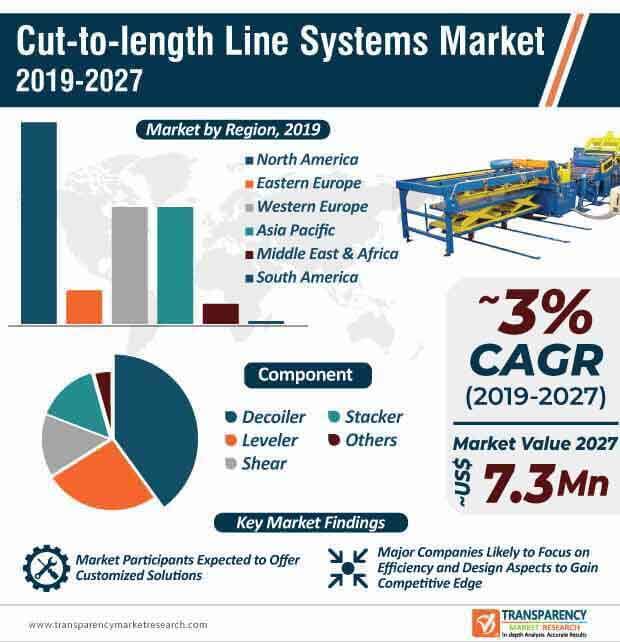

The global cut-to-length line systems market is expected to grow a modest CAGR of ~3%, in terms of value, during the forecast period. The market growth can be primarily attributed to the surge in demand for steel and steel products and large-scale advancements in technology. The advent of Industry 4.0 will provide manufacturers in the cut-to-length line systems market with immense growth opportunities during the forecast period. Key participants of the market for cut-to-length line systems should focus on expanding their product portfolio and offering customized solutions to their customers to gain a competitive edge. On the regional front, North America and Western Europe are expected to witness development in the cut-to-length line systems in the upcoming years.

Cut-to-length Line Systems Market Predicted to 3% CAGR during the Forecast Period.

Cut-to-length Line Systems Market Forecast Till 2027

The Players Involved in the Cut-to-length Line Systems Market are Heinrich Georg GmbH, ACL MACHINE CO., LTD, ANDRITZ AG, ARKU GmbH,, ATHADER S.L. others.

North America Takes Lead in the Cut-to-length Line Systems Market.

The Cut-to-length Line Systems Market Would Be of Significant US$7.3 mn.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cut-to-length Line Systems Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators

4.2.1. Global Installed Base of Cut-to-length Line Systems

4.2.2. Adoption rate of Cut-to-length Line Systems by Industry

4.2.2.1. Automotive

4.2.2.2. Manufacturing

4.2.2.3. Oil & Gas

4.2.2.4. Maritime

4.2.2.5. Aerospace

4.2.2.6. Packaging

4.2.2.7. Construction

4.3. Worldwide Industrial Production Index, by Top Countries

4.4. Import/Export Data, by Top Countries

4.4.1. Top Exporting Countries

4.4.2. Top Importing Countries

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunity

4.6. Global Cut-to-length Line Systems Market Analysis and Forecasts, 2017 - 2027

4.6.1. Global Cut-to-length Line Systems Market Revenue (US$ Mn)

4.6.2. Global Cut-to-length Line Systems Market Volume (Units)

4.7. Porter’s Five Forces Analysis

4.8. PEST Analysis

4.9. Market Outlook

4.10. Regulation & Policies

4.11. Value Chain Analysis

4.11.1. List of Cut-to-length Line Systems Manufacturers

4.11.2. List of Potential Customers

5. Pricing Analysis, 2018

5.1. Price Comparison Analysis, by Region

6. Global Cut-to-length Line Systems Market Analysis and Forecasts, by Component

6.1. Definition & Key Findings

6.2. Market Size (Units) Forecast, by Component, 2017-2027

6.2.1. Decoiler

6.2.2. Leveler

6.2.3. Shear

6.2.4. Stacker

6.2.5. Others (Roller Feeder, Scrap Collection)

7. Global Cut-to-length Line Systems Market Analysis and Forecasts, by Control Type

7.1. Key Findings

7.2. Market Size (Volume %) Forecast, by Control Type, 2017-2027

7.2.1. Manual

7.2.2. Semi-automatic

7.2.3. Automatic

8. Global Cut-to-length Line Systems Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Market Size (Units) (US$ Mn) Forecast, by Region, 2017-2027

8.2.1. North America

8.2.2. Eastern Europe

8.2.3. Western Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa

8.2.6. South America

9. North America Cut-to-length Line Systems Market Analysis and Forecasts

9.1. Overview & Key Findings

9.2. Market Size (Units) Forecast, by Component, 2017-2027

9.2.1. Decoiler

9.2.2. Leveler

9.2.3. Shear

9.2.4. Stacker

9.2.5. Others (Roller Feeder, Scrap Collection)

9.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

9.3.1. Manual

9.3.2. Semi-automatic

9.3.3. Automatic

9.4. Market Size Units) (US$ Mn) Forecast by Country, 2017-2027

9.4.1. U.S.

9.4.2. Canada

9.4.3. Mexico

10. Eastern Europe Cut-to-length Line Systems Market Analysis and Forecasts

10.1. Overview & Key Findings

10.2. Market Size (Units) Forecast, by Component, 2017-2027

10.2.1. Decoiler

10.2.2. Leveler

10.2.3. Shear

10.2.4. Stacker

10.2.5. Others (Roller Feeder, Scrap Collection)

10.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

10.3.1. Manual

10.3.2. Semi-automatic

10.3.3. Automatic

10.4. Market Size (Units) (US$ Mn) Forecast by Country and Sub-region, 2017-2027

10.4.1. Russia

10.4.2. Poland

10.4.3. Rest of Eastern Europe

11. Western Europe Cut-to-length Line Systems Market Analysis and Forecasts

11.1. Overview & Key Findings

11.2. Market Size (Units) Forecast, by Component, 2017-2027

11.2.1. Decoiler

11.2.2. Leveler

11.2.3. Shear

11.2.4. Stacker

11.2.5. Others (Roller Feeder, Scrap Collection)

11.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

11.3.1. Manual

11.3.2. Semi-automatic

11.3.3. Automatic

11.4. Market Size (Units) (US$ Mn) Forecast by Country and Sub-region, 2017-2027

11.4.1. Germany

11.4.2. U.K.

11.4.3. France

11.4.4. Nordics

11.4.5. Benelux

11.4.6. Rest of Western Europe

12. Asia Pacific Cut-to-length Line Systems Market Analysis and Forecasts

12.1. Overview & Key Findings

12.2. Market Size (Units) Forecast, by Component, 2017-2027

12.2.1. Decoiler

12.2.2. Leveler

12.2.3. Shear

12.2.4. Stacker

12.2.5. Others (Roller Feeder, Scrap Collection)

12.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

12.3.1. Manual

12.3.2. Semi-automatic

12.3.3. Automatic

12.4. Market Size (Units) (US$ Mn) Forecast, by Country and Sub-region, 2017-2027

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. Rest of Asia Pacific

13. Middle East & Africa Cut-to-length Line Systems Market Analysis and Forecasts

13.1. Overview & Key Findings

13.2. Market Size (Units) Forecast, by Component, 2017-2027

13.2.1. Decoiler

13.2.2. Leveler

13.2.3. Shear

13.2.4. Stacker

13.2.5. Others (Roller Feeder, Scrap Collection)

13.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

13.3.1. Manual

13.3.2. Semi-automatic

13.3.3. Automatic

13.4. Market Size (Units) (US$ Mn) Forecast, by Country and Sub-region, 2017-2027

13.4.1. U.A.E.

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

14. South America Cut-to-length Line Systems Market Analysis and Forecasts

14.1. Overview & Key Findings

14.2. Market Size (Units) Forecast, by Component, 2017-2027

14.2.1. Decoiler

14.2.2. Leveler

14.2.3. Shear

14.2.4. Stacker

14.2.5. Others (Roller Feeder, Scrap Collection)

14.3. Market Size (Volume %) Forecast, by Control Type, 2017-2027

14.3.1. Manual

14.3.2. Semi-automatic

14.3.3. Automatic

14.4. Market Size (Units) (US$ Mn) Forecast, by Country and Sub-region, 2017-2027

14.4.1. Brazil

14.4.2. Rest of South America

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2018

15.3. Company Profiles

15.3.1. Heinrich Georg GmbH

15.3.1.1. Company Revenue

15.3.1.2. Business Overview

15.3.1.3. Product Segments

15.3.1.4. Geographic Footprint & Strategic Overview

15.3.2. ACL MACHINE CO., LTD.

15.3.2.1. Company Revenue

15.3.2.2. Business Overview

15.3.2.3. Product Segments

15.3.2.4. Geographic Footprint & Strategic Overview

15.3.3. ANDRITZ AG

15.3.3.1. Company Revenue

15.3.3.2. Business Overview

15.3.3.3. Product Segments

15.3.3.4. Geographic Footprint & Strategic Overview

15.3.4. ARKU GmbH

15.3.4.1. Company Revenue

15.3.4.2. Business Overview

15.3.4.3. Product Segments

15.3.4.4. Geographic Footprint & Strategic Overview

15.3.5. ATHADER, S.L.

15.3.5.1. Company Revenue

15.3.5.2. Business Overview

15.3.5.3. Product Segments

15.3.5.4. Geographic Footprint & Strategic Overview

15.3.6. Bollina srl

15.3.6.1. Company Revenue

15.3.6.2. Business Overview

15.3.6.3. Product Segments

15.3.6.4. Geographic Footprint & Strategic Overview

15.3.7. Bradbury Co., Inc.

15.3.7.1. Company Revenue

15.3.7.2. Business Overview

15.3.7.3. Product Segments

15.3.7.4. Geographic Footprint & Strategic Overview

15.3.8. Burghardt+Schmidt GmbH

15.3.8.1. Company Revenue

15.3.8.2. Business Overview

15.3.8.3. Product Segments

15.3.8.4. Geographic Footprint & Strategic Overview

15.3.9. COE Press Equipment Corp.

15.3.9.1. Company Revenue

15.3.9.2. Business Overview

15.3.9.3. Product Segments

15.3.9.4. Geographic Footprint & Strategic Overview

15.3.10. Delta Steel Technologies

15.3.10.1. Company Revenue

15.3.10.2. Business Overview

15.3.10.3. Product Segments

15.3.10.4. Geographic Footprint & Strategic Overview

15.3.11. Dimeco Group

15.3.11.1. Company Revenue

15.3.11.2. Business Overview

15.3.11.3. Product Segments

15.3.11.4. Geographic Footprint & Strategic Overview

15.3.12. F.I.M.I. FABBRICA IMPIANTI MACCHINE INDUSTRIALI SPA

15.3.12.1. Company Revenue

15.3.12.2. Business Overview

15.3.12.3. Product Segments

15.3.12.4. Geographic Footprint & Strategic Overview

15.3.13. KOHLER Maschinenbau GmbH

15.3.13.1. Company Revenue

15.3.13.2. Business Overview

15.3.13.3. Product Segments

15.3.13.4. Geographic Footprint & Strategic Overview

15.3.14. Primetals Technologies Ltd.

15.3.14.1. Company Revenue

15.3.14.2. Business Overview

15.3.14.3. Product Segments

15.3.14.4. Geographic Footprint & Strategic Overview

15.3.15. Shijiazhuang Teneng Electrical & Mechanical Equipment Co., Ltd.

15.3.15.1. Company Revenue

15.3.15.2. Business Overview

15.3.15.3. Product Segments

15.3.15.4. Geographic Footprint & Strategic Overview

15.3.16. Sacform

15.3.16.1. Company Revenue

15.3.16.2. Business Overview

15.3.16.3. Product Segments

15.3.16.4. Geographic Footprint & Strategic Overview

15.3.17. Fagor Arrasate

15.3.17.1. Company Revenue

15.3.17.2. Business Overview

15.3.17.3. Product Segments

15.3.17.4. Geographic Footprint & Strategic Overview

15.3.18. Other Vendor Profile

List of Tables

Table 1: Acronyms Used

Table 2: Total Production of Steel & Aluminum (Mn MT)

Table 3: Aluminum Plant Details (2019)

Table 4: Steel Plant Details (2019)

Table 5: Adoption of CTL Systems across Industries

Table 6: Number of Components, by CTL Systems Type

Table 7: Worldwide Industrial Production Index, by Top Countries (1/2)

Table 8: Worldwide Industrial Production Index, by Top Countries (2/2)

Table 9: Global Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 10: Global Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 11: Global Cut-to-length Line Systems Market Volume (Units) Forecast, by Region, 2017 - 2027

Table 12: Global Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table 13: North America Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 14: North America Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 15: North America Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 16: North America Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 17: Eastern Europe Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 18: Eastern Europe Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 19: Eastern Europe Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 20: Eastern Europe Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 21: Western Europe Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 22: Western Europe Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 23: Western Europe Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 24: Western Europe Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 25: Asia Pacific Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 26: Asia Pacific Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 27: Asia Pacific Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 28: Asia Pacific Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 29: Middle East & Africa Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 30: Middle East & Africa Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 31: Middle East & Africa Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 32: Middle East & Africa Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 33: South America Cut-to-length Line Systems Market Volume (Units) Forecast, by Component, 2017 - 2027

Table 34: South America Cut-to-length Line Systems Market Volume (%) Forecast, by Control Type, 2017 - 2027

Table 35: South America Cut-to-length Line Systems Market Volume (Units) Forecast, by Country, 2017 - 2027

Table 36: South America Cut-to-length Line Systems Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 37: Other Vendor Profile

List of Figures

Figure 1: Systematic Research Approach

Figure 2: Research Mix

Figure 3: Research Methodology (Demand Side Analysis) – Approach 1

Figure 4: Research Methodology – Supply Side Analysis – Approach 2

Figure 5: Base Number Calculation Approach, Manufacturer's Side

Figure 6: Global Cut-to-length Line Systems Market Size (US$ Mn) and Volume (Units) Forecast, 2017 – 2027

Figure 7: Global Cut-to-length Line Systems Market

Figure 8: Cut-to-length Line Systems Market Dynamics

Figure 9: Global Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027, by Region

Figure 10: Global Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027, by Region

Figure 11: Cut-to-length Line Systems Market Forecast – Revenue Market Share, 2027 (%)

Figure 12: Cut-to-length Line Systems Market Forecast – Volume Market Share, 2027 (%)

Figure 13: Adoption rate of Cut-to-length Line Systems, by Industry

Figure 14: Global Installed Base of Cut-to-length Line System

Figure 15: Global Trade Export-Import

Figure 16: Global CTL Systems Market Volume (Units) Forecast, 2017 - 2027

Figure 17: Global CTL Systems Market Size (US$ Mn) Forecast, 2017 - 2027

Figure 18: Porter’s Five Forces Analysis

Figure 19: Global CTL Systems Market Outlook, by Control Type (Volume) 2019

Figure 20: Global CTL Systems Market Outlook, by Control Type (Volume), 2027

Figure 21: Global Cut-to-length Line Systems Market Outlook, by Region (Volume) 2019

Figure 22: Global Cut-to-length Line Systems Market Outlook, by Region (Volume), 2027

Figure 23: Global Cut-to-length Line Systems Market Outlook, by Region (Revenue) 2019

Figure 24: Global Cut-to-length Line Systems Market Outlook, by Region (Revenue), 2027

Figure 25: Value Chain Analysis of Cut-to-length Line Systems Market

Figure 26: Global Cut-to-length Line (CTL) Systems Price Comparison Analysis, by Region (US$ Mn)

Figure 27: North America Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 28: North America Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 29: North America Cut-to-length Line Systems Market Opportunity (%)

Figure 30: Eastern Europe Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 31: Eastern Europe Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 32: Eastern Europe Cut-to-length Line Systems Market Opportunity (%)

Figure 33: Western Europe Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 34: Western Europe Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 35: Western Europe Cut-to-length Line Systems Market Opportunity (%)

Figure 36: Asia Pacific Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 37: Asia Pacific Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 38: Asia Pacific Cut-to-length Line Systems Market Opportunity (%)

Figure 39: Middle East & Africa Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 40: Middle East & Africa Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 41: Middle East & Africa Cut-to-length Line Systems Market Opportunity (%)

Figure 42: South America Cut-to-length Line Systems Market Volume (Units) Forecast, 2017–2027

Figure 43: South America Cut-to-length Line Systems Market Size (US$ Mn) Forecast, 2017–2027

Figure 44: South America Cut-to-length Line Systems Market Opportunity (%)

Figure 45: Competition Matrix

Figure 46: Market Revenue Share Analysis (%)

Figure 47: Heinrich Georg GmbH Maschinenfabrik Regional Presence

Figure 48: ACL Machine Co., Ltd. Regional Presence

Figure 49: Andritz AG Regional Presence

Figure 50: Andritz AG Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 51: Andritz AG Breakdown of Revenue, by Geography, 2018

Figure 52: ARKU GmbH Regional Presence

Figure 53: Athader SL Regional Presence

Figure 54: Bollina srl Regional Presence

Figure 55: Bradbury Co., Inc. Regional Presence

Figure 56: Burghardt+Schmidt GmbH Regional Presence

Figure 57: COE Press Equipment Regional Presence

Figure 58: Delta Steel Technologies Regional Presence

Figure 59: Dimeco Group Regional Presence

Figure 60: FIMI Fabbrica Impianti Macchine Industriali SpA Regional Presence

Figure 61: KOHLER Maschinenbau GmbH Regional Presence

Figure 62: Primetals Technologies Ltd. Regional Presence

Figure 63: Shijiazhuang Teneng Mechanical & Electrical Equipment Co., Ltd Regional Presence

Figure 64: Sacform Regional Presence

Figure 65: Fagor Arrasate Regional Presence