Analysts’ Viewpoint

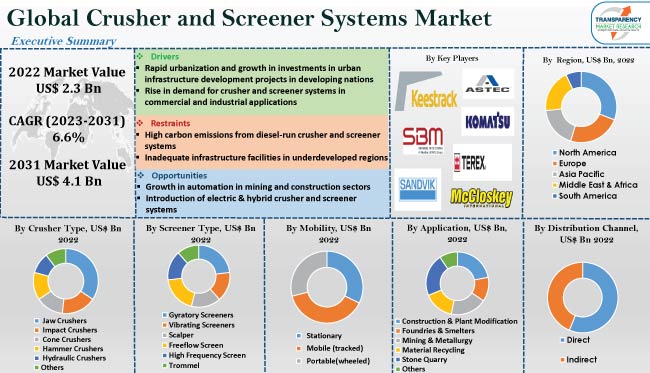

Rapid industrialization, increase in investment in the construction sector, and growth in infrastructure & road development projects are some of the key factors driving the global crusher and screener systems market. For a range of applications, including asphalt recycling, and sand manufacturing, crushers and screeners can be easily calibrated for specific output sizes. The rise in operating costs and shortage of skilled labor is driving market progress.

Manufacturers are investing in R&D to create durable and reliable machinery. According to crusher and screener systems industry trends, diesel-powered machinery and plants currently dominate the market. Manufacturers are focusing on employing newer technologies in machinery to reduce carbon emissions, by launching electric and hybrid models that use green energy, to encourage operations that are environmentally sustainable.

Crushing and screening systems are two critical procedures in mining, construction, quarrying, and recycling industries. Crushers come in a range of shapes and sizes depending on the material being processed or crushed. Raw materials including ore, coal, and rocks, as well as recycled materials such as concrete and asphalt, can be reduced in size using crushers.

Screening involves classifying materials according to their particle size into various categories or grades. Typically, screens or sieves with differently-sized apertures or mesh are used for this purpose. Screening is a crucial process; before materials are used in manufacturing or building processes, they are separated from the mix if they are too small or huge.

Various types of crusher and screener systems such as jaw crushers, impact crushers, cone crushers, hammer crushers, hydraulic crushers, gyratory screeners, vibrating screeners, scalper, and freeflow screens, play a significant role in the extraction and processing of raw materials. They enable the effective utilization of resources and ensure that the finished product complies with the required quality standards.

Several urban infrastructure development projects in developing nations is augmenting market expansion. Another important element driving the market is automation in mining and construction sectors. The use of crusher and screener systems lowers transportation costs and boosts productivity. These factors boost the global crusher and screener systems market size.

As per the crusher and screener systems industry analysis, rapid urbanization is spurring the construction industry and infrastructure development projects such as motorways, airports, national roads, dams, and railways, which has a positive impact on the global market for mobile crushers and screeners.

Large-scale foreign investments in infrastructure development in various regions of Asia Pacific have bolstered the demand for crusher and screener systems. Governments in India, Japan, and China, are increasing their investment in several construction projects.

Over the past ten years, the Middle East and APAC regions have undergone significant urbanization; population growth has fueled this development, primarily in Asia, Oceania, and Africa. The global population is expected to increase by 1.6 billion people over the next 25 years. These factors are expected to fuel market statistics in the next few years.

Usage of portable crushing plants considerably reduces the time and expense of carrying stones or mineral ore to the fixed mobile crushing plant. Expansion of mining and construction projects necessitate the usage of advanced crushing and screening technologies.

As per crusher and screener systems market insights, recent technological innovations have greatly increased productivity while assisting with remote troubleshooting and continuous monitoring of equipment performance over the Internet. For instance, the new QI353 mid-size impactor from Sandvik Mobile Crushers and Screens is ideal for applications connected to quarry, recycling, and contractor markets with a mid-size track platform and a specially designed Prisec impact crusher. It is equipped with a modern fuel-efficient power pack. The new automation system has remote monitoring capabilities for mobile crushing and screening equipment. Thus, advancements in crusher and screener systems optimize operations substantially and drives market share.

According to the crusher and screener systems market analysis, the construction & plant modification segment accounts for major share in terms of applications of crusher and screener systems due to rapid industrialization.

The stone quarry segment is projected to expand at the fastest rate due to rise in infrastructure development in industrial, commercial, and residential sectors. Furthermore, the mining & metallurgy segment contributes significantly to the crusher and screener systems market share. Surge in mining activities (coal, mineral, metal, and iron ore), demand for aggregate processing equipment from the rapidly growing road and rail sectors, expansions in cement and refinery plants, and the need for mobile plants for quicker construction of larger projects are key factors driving the crusher and screener market growth.

As per the crusher and screener systems market forecast, North America is projected to dominate the market during the forecast period. The U.S. is the key market in the region due to the high demand for crushing and screening systems in the country, where approximately 76% of the crushed stone is utilized for construction material in road construction and maintenance.

The market in Asia Pacific is anticipated to grow steadily during the forecast period owing to increased mineral resource exploration activities. The market for crusher and screener systems in Asia Pacific is also likely to grow as a result of development and infrastructure activities as well as numerous government initiatives. Rapid urbanization brought on by the rising population is contributing to market growth.

As per the global crusher and screener systems market research, the landscape is fragmented due to the presence of several local and international competitors as well as the steep competition among prominent players. Manufacturers continuously launch new products and updated models to maximize plant uptime. To stay competitive and fulfill the needs of customers, manufacturers in the crusher and screener systems industry are including more modern design features, such as flexibility, ease of installation, and transportation options.

Anaconda Equipment Ltd., Astec Industries Inc., Keestrack N.V., Kleemann GmbH, Komatsu Ltd., McCloskey International Ltd., Metso Corporation, Sandvik AB, SBM Mineral Processing GmbH, and Terex Corporation, are some of the prominent players in the global crusher and screener systems market.

Each of these players has been profiled in the global crusher and screener systems market research report based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

US$ 4.1 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 2.3 Bn in 2022

It is projected to grow at a CAGR of 6.6% from 2023 to 2031

Investments in urban infrastructure development projects in developing nations globally, growth in demand for crusher and screener systems in construction and mining sectors, and introduction of technologically advanced crusher and screener systems

The construction & plant modification segment accounted for dominant share in 2022

North America is likely to be the most lucrative region

Anaconda Equipment Ltd., Astec Industries Inc., Keestrack N.V., Kleemann GmbH, Komatsu Ltd., McCloskey International Ltd., Metso Corporation, Sandvik AB, SBM Mineral Processing GmbH, and Terex Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Crusher and Screener Systems Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Regulatory Framework and Standards

5.8. Technology Analysis

5.9. COVID-19 Impact Analysis

5.10. Global Crusher and Screener Systems Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Crusher and Screener Systems Market Analysis and Forecast, By Crusher Type

6.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

6.1.1. Jaw Crushers

6.1.2. Single Toggle

6.1.3. Double Toggle

6.1.4. Impact Crushers

6.1.5. Primary

6.1.6. Secondary

6.1.7. Cone Crushers

6.1.8. Hammer Crushers

6.1.9. Hydraulic Crushers

6.1.10. Others

6.2. Incremental Opportunity, By Crusher Type

7. Global Crusher and Screener Systems Market Analysis and Forecast, By Screener Type

7.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

7.1.1. Gyratory Screeners

7.1.2. Vibrating Screeners

7.1.3. Scalper

7.1.4. Freeflow Screen

7.1.5. High Frequency Screen

7.1.6. Trommel

7.2. Incremental Opportunity, By Screener Type

8. Global Crusher and Screener Systems Market Analysis and Forecast, By Mobility

8.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

8.1.1. Stationary

8.1.2. Mobile (tracked)

8.1.3. Portable (wheeled)

8.2. Incremental Opportunity, By Mobility

9. Global Crusher and Screener Systems Market Analysis and Forecast, By Application

9.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

9.1.1. Construction & Plant Modification

9.1.2. Foundries & Smelters

9.1.3. Mining & Metallurgy

9.1.4. Material Recycling

9.1.5. Stone Quarry

9.1.6. Others

9.2. Incremental Opportunity, By Application

10. Global Crusher and Screener Systems Market Analysis and Forecast, By Distribution Channel

10.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

10.1.1. Direct

10.1.2. Indirect

10.2. Incremental Opportunity, By Distribution Channel

11. Global Crusher and Screener Systems Market, By Region

11.1. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Crusher and Screener Systems Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

12.4.1. Jaw Crushers

12.4.2. Single Toggle

12.4.3. Double Toggle

12.4.4. Impact Crushers

12.4.5. Primary

12.4.6. Secondary

12.4.7. Cone Crushers

12.4.8. Hammer Crushers

12.4.9. Hydraulic Crushers

12.4.10. Others

12.5. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

12.5.1. Gyratory Screeners

12.5.2. Vibrating Screeners

12.5.3. Scalper

12.5.4. Freeflow Screen

12.5.5. High Frequency Screen

12.5.6. Trommel

12.6. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

12.6.1. Stationary

12.6.2. Mobile (tracked)

12.6.3. Portable (wheeled)

12.7. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

12.7.1. Construction & Plant Modification

12.7.2. Foundries & Smelters

12.7.3. Mining & Metallurgy

12.7.4. Material Recycling

12.7.5. Stone Quarry

12.7.6. Others

12.8. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Country/Sub-region, 2017 - 2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. Incremental Opportunity Analysis

13. Europe Crusher and Screener Systems Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

13.4.1. Jaw Crushers

13.4.2. Single Toggle

13.4.3. Double Toggle

13.4.4. Impact Crushers

13.4.5. Primary

13.4.6. Secondary

13.4.7. Cone Crushers

13.4.8. Hammer Crushers

13.4.9. Hydraulic Crushers

13.4.10. Others

13.5. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

13.5.1. Gyratory Screeners

13.5.2. Vibrating Screeners

13.5.3. Scalper

13.5.4. Freeflow Screen

13.5.5. High Frequency Screen

13.5.6. Trommel

13.6. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

13.6.1. Stationary

13.6.2. Mobile (tracked)

13.6.3. Portable (wheeled)

13.7. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

13.7.1. Construction & Plant Modification

13.7.2. Foundries & Smelters

13.7.3. Mining & Metallurgy

13.7.4. Material Recycling

13.7.5. Stone Quarry

13.7.6. Others

13.8. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Country/Sub-region, 2017 - 2031

13.9.1. U.K.

13.9.2. Germany

13.9.3. France

13.9.4. Rest of Europe

13.10. Incremental Opportunity Analysis

14. Asia Pacific Crusher and Screener Systems Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

14.4.1. Jaw Crushers

14.4.2. Single Toggle

14.4.3. Double Toggle

14.4.4. Impact Crushers

14.4.5. Primary

14.4.6. Secondary

14.4.7. Cone Crushers

14.4.8. Hammer Crushers

14.4.9. Hydraulic Crushers

14.4.10. Others

14.5. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

14.5.1. Gyratory Screeners

14.5.2. Vibrating Screeners

14.5.3. Scalper

14.5.4. Freeflow Screen

14.5.5. High Frequency Screen

14.5.6. Trommel

14.6. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

14.6.1. Stationary

14.6.2. Mobile (tracked)

14.6.3. Portable (wheeled)

14.7. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

14.7.1. Construction & Plant Modification

14.7.2. Foundries & Smelters

14.7.3. Mining & Metallurgy

14.7.4. Material Recycling

14.7.5. Stone Quarry

14.7.6. Others

14.8. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Country/Sub-region, 2017 - 2031

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Crusher and Screener Systems Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

15.4.1. Jaw Crushers

15.4.2. Single Toggle

15.4.3. Double Toggle

15.4.4. Impact Crushers

15.4.5. Primary

15.4.6. Secondary

15.4.7. Cone Crushers

15.4.8. Hammer Crushers

15.4.9. Hydraulic Crushers

15.4.10. Others

15.5. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

15.5.1. Gyratory Screeners

15.5.2. Vibrating Screeners

15.5.3. Scalper

15.5.4. Freeflow Screen

15.5.5. High Frequency Screen

15.5.6. Trommel

15.6. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

15.6.1. Stationary

15.6.2. Mobile (tracked)

15.6.3. Portable (wheeled)

15.7. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

15.7.1. Construction & Plant Modification

15.7.2. Foundries & Smelters

15.7.3. Mining & Metallurgy

15.7.4. Material Recycling

15.7.5. Stone Quarry

15.7.6. Others

15.8. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Country/Sub-region, 2017 - 2031

15.9.1. GCC

15.9.2. South Africa

15.9.3. Rest of Middle East & Africa

15.10. Incremental Opportunity Analysis

16. South America Crusher and Screener Systems Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Crusher Type, 2017 - 2031

16.4.1. Jaw Crushers

16.4.2. Single Toggle

16.4.3. Double Toggle

16.4.4. Impact Crushers

16.4.5. Primary

16.4.6. Secondary

16.4.7. Cone Crushers

16.4.8. Hammer Crushers

16.4.9. Hydraulic Crushers

16.4.10. Others

16.5. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Screener Type, 2017 - 2031

16.5.1. Gyratory Screeners

16.5.2. Vibrating Screeners

16.5.3. Scalper

16.5.4. Freeflow Screen

16.5.5. High Frequency Screen

16.5.6. Trommel

16.6. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Mobility, 2017 - 2031

16.6.1. Stationary

16.6.2. Mobile (tracked)

16.6.3. Portable (wheeled)

16.7. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

16.7.1. Construction & Plant Modification

16.7.2. Foundries & Smelters

16.7.3. Mining & Metallurgy

16.7.4. Material Recycling

16.7.5. Stone Quarry

16.7.6. Others

16.8. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

16.8.1. Direct

16.8.2. Indirect

16.9. Crusher and Screener Systems Market Size (US$ Bn and Thousand Units), By Country/Sub-region, 2017 - 2031

16.9.1. Brazil

16.9.2. Rest of South America

16.10. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis (%), 2022

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

17.3.1. Anaconda Equipment Ltd.

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Size Portfolio

17.3.2. Astec Industries Inc.

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Size Portfolio

17.3.3. Keestrack N.V.

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Size Portfolio

17.3.4. Kleemann GmbH

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Size Portfolio

17.3.5. Komatsu Ltd.

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Size Portfolio

17.3.6. McCloskey International Ltd.

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Size Portfolio

17.3.7. Metso Corporation

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Size Portfolio

17.3.8. Sandvik AB

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Size Portfolio

17.3.9. SBM Mineral Processing GmbH

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Size Portfolio

17.3.10. Terex Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Financial/Revenue

17.3.10.4. Strategy & Business Overview

17.3.10.5. Sales Channel Analysis

17.3.10.6. Size Portfolio

18. Go To Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 2: Global Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 3: Global Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 4: Global Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 5: Global Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 6: Global Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 7: Global Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 8: Global Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 9: Global Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 11: Global Crusher and Screener Systems Market, by Region, Thousand Units, 2017-2031

Table 12: Global Crusher and Screener Systems Market, by Region, US$ Bn, 2017-2031

Table 13: North America Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 14: North America Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 15: North America Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 16: North America Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 17: North America Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 18: North America Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 19: North America Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 20: North America Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 21: North America Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 23: North America Crusher and Screener Systems Market, by Country, Thousand Units, 2017-2031

Table 24: North America Crusher and Screener Systems Market, by Country, US$ Bn, 2017-2031

Table 25: Europe Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 26: Europe Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 27: Europe Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 28: Europe Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 29: Europe Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 30: Europe Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 31: Europe Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 32: Europe Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 33: Europe Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 34: Europe Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 35: Europe Crusher and Screener Systems Market, by Country, Thousand Units, 2017-2031

Table 36: Europe Crusher and Screener Systems Market, by Country, US$ Bn, 2017-2031

Table 37: Asia Pacific Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 38: Asia Pacific Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 39: Asia Pacific Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 40: Asia Pacific Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 41: Asia Pacific Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 42: Asia Pacific Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 43: Asia Pacific Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 44: Asia Pacific Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 45: Asia Pacific Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 46: Asia Pacific Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 47: Asia Pacific Crusher and Screener Systems Market, by Country, Thousand Units, 2017-2031

Table 48: Asia Pacific Crusher and Screener Systems Market, by Country, US$ Bn, 2017-2031

Table 49: Middle East & Africa Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 50: Middle East & Africa Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 51: Middle East & Africa Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 52: Middle East & Africa Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 53: Middle East & Africa Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 54: Middle East & Africa Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 55: Middle East & Africa Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 56: Middle East & Africa Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 57: Middle East & Africa Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: Middle East & Africa Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 59: Middle East & Africa Crusher and Screener Systems Market, by Country, Thousand Units, 2017-2031

Table 60: Middle East & Africa Crusher and Screener Systems Market, by Country, US$ Bn, 2017-2031

Table 61: South America Crusher and Screener Systems Market, by Crusher Type, Thousand Units, 2017-2031

Table 62: South America Crusher and Screener Systems Market, by Crusher Type, US$ Bn, 2017-2031

Table 63: South America Crusher and Screener Systems Market, by Screener Type, Thousand Units, 2017-2031

Table 64: South America Crusher and Screener Systems Market, by Screener Type, US$ Bn, 2017-2031

Table 65: South America Crusher and Screener Systems Market, by Mobility, Thousand Units, 2017-2031

Table 66: South America Crusher and Screener Systems Market, by Mobility, US$ Bn, 2017-2031

Table 67: South America Crusher and Screener Systems Market, by Application, Thousand Units, 2017-2031

Table 68: South America Crusher and Screener Systems Market, by Application, US$ Bn, 2017-2031

Table 69: South America Crusher and Screener Systems Market, by Distribution Channel, Thousand Units, 2017-2031

Table 70: South America Crusher and Screener Systems Market, by Distribution Channel, US$ Bn, 2017-2031

Table 71: South America Crusher and Screener Systems Market, by Country, Thousand Units, 2017-2031

Table 72: South America Crusher and Screener Systems Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 2: Global Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 3: Global Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 4: Global Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 5: Global Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 6: Global Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 7: Global Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 8: Global Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 9: Global Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 10: Global Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 11: Global Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 12: Global Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 13: Global Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 15: Global Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 16: Global Crusher and Screener Systems Market Projections by Region, Thousand Units, 2017-2031

Figure 17: Global Crusher and Screener Systems Market Projections by Region, US$ Bn, 2017-2031

Figure 18: Global Crusher and Screener Systems Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 19: North America Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 20: North America Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 21: North America Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 22: North America Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 23: North America Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 24: North America Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 25: North America Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 26: North America Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 27: North America Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 28: North America Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 29: North America Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 30: North America Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 31: North America Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 33: North America Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 34: North America Crusher and Screener Systems Market Projections by Country, Thousand Units, 2017-2031

Figure 35: North America Crusher and Screener Systems Market Projections by Country, US$ Bn, 2017-2031

Figure 36: North America Crusher and Screener Systems Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 37: Europe Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 38: Europe Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 39: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 40: Europe Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 41: Europe Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 42: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 43: Europe Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 44: Europe Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 45: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 46: Europe Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 47: Europe Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 48: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 49: Europe Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 50: Europe Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 51: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 52: Europe Crusher and Screener Systems Market Projections by Country, Thousand Units, 2017-2031

Figure 53: Europe Crusher and Screener Systems Market Projections by Country, US$ Bn, 2017-2031

Figure 54: Europe Crusher and Screener Systems Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 55: Asia Pacific Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 56: Asia Pacific Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 57: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 58: Asia Pacific Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 59: Asia Pacific Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 60: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 61: Asia Pacific Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 62: Asia Pacific Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 63: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 64: Asia Pacific Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 65: Asia Pacific Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 66: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 67: Asia Pacific Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 68: Asia Pacific Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 69: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 70: Asia Pacific Crusher and Screener Systems Market Projections by Country, Thousand Units, 2017-2031

Figure 71: Asia Pacific Crusher and Screener Systems Market Projections by Country, US$ Bn, 2017-2031

Figure 72: Asia Pacific Crusher and Screener Systems Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 76: Middle East & Africa Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 78: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 79: Middle East & Africa Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 80: Middle East & Africa Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 81: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 82: Middle East & Africa Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 83: Middle East & Africa Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 84: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 85: Middle East & Africa Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 87: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 88: Middle East & Africa Crusher and Screener Systems Market Projections by Country, Thousand Units, 2017-2031

Figure 89: Middle East & Africa Crusher and Screener Systems Market Projections by Country, US$ Bn, 2017-2031

Figure 90: Middle East & Africa Crusher and Screener Systems Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 91: South America Crusher and Screener Systems Market Projections by Crusher Type, Thousand Units, 2017-2031

Figure 92: South America Crusher and Screener Systems Market Projections by Crusher Type, US$ Bn, 2017-2031

Figure 93: South America Crusher and Screener Systems Market, Incremental Opportunity, by Crusher Type, US$ Bn, 2017-2031

Figure 94: South America Crusher and Screener Systems Market Projections by Screener Type, Thousand Units, 2017-2031

Figure 95: South America Crusher and Screener Systems Market Projections by Screener Type, US$ Bn, 2017-2031

Figure 96: South America Crusher and Screener Systems Market, Incremental Opportunity, by Screener Type, US$ Bn, 2017-2031

Figure 97: South America Crusher and Screener Systems Market Projections by Mobility, Thousand Units, 2017-2031

Figure 98: South America Crusher and Screener Systems Market Projections by Mobility, US$ Bn, 2017-2031

Figure 99: South America Crusher and Screener Systems Market, Incremental Opportunity, by Mobility, US$ Bn, 2017-2031

Figure 100: South America Crusher and Screener Systems Market Projections by Application, Thousand Units, 2017-2031

Figure 101: South America Crusher and Screener Systems Market Projections by Application, US$ Bn, 2017-2031

Figure 102: South America Crusher and Screener Systems Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 103: South America Crusher and Screener Systems Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 104: South America Crusher and Screener Systems Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 105: South America Crusher and Screener Systems Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 106: South America Crusher and Screener Systems Market Projections by Country, Thousand Units, 2017-2031

Figure 107: South America Crusher and Screener Systems Market Projections by Country, US$ Bn, 2017-2031

Figure 108: South America Crusher and Screener Systems Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031