CRISPR and Cas Genes Market- An Overview

CRISPR-Cas systems are effective and effortlessly programmable nucleic acid-targeting tools. The use of CRISPR-Cas systems in bacterial activities, increase in research and development expenditure by governments in the fields of genome editing, rise in the presence of genetic diseases, and the use of CRISPR technology to advance crop production have been the key drivers of the CRISPR and Cas genes market worldwide.

Some of the potential applications of CRISPR-Cas systems include immunization of cultures, self-targeted cell destruction, and engineering of metabolic pathways for better biochemical synthesis. The use of CRISPR-Cas systems, in recent times, has not been merely restricted to research and therapeutic development and has extended to areas such as the engineering of industrial microbes and the breeding of plants and animals.

One benefit of using CRISPR technology is that it permits genetic material to be added or removed at specific locations in the genome. CRISPR technology has been progressively employed in the study of human diseases, which include the likes of cystic fibrosis, Barth syndrome consequences on the heart, hemophilia, and Duchenne muscular dystrophy.

The introduction of the CRISPR/Cas9 technology can be termed as a revolutionary step in the biomedical research field. The objective behind the use of CRISPR/Cas9 is to fasten the application of the technologies in the treatment of several genetic disorders.

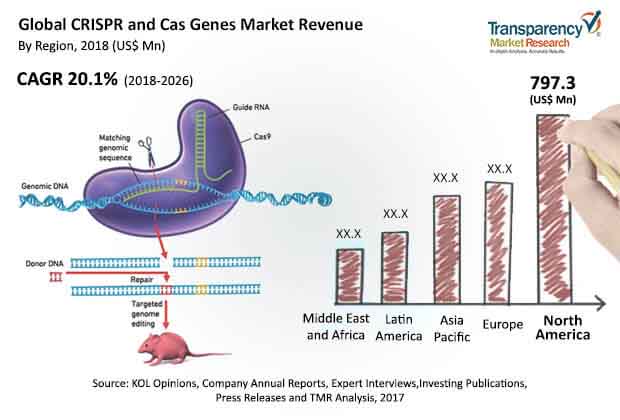

Europe and North America held a combined total of 71% share in the overall CRISPR and Cas genes market in 2017. An increase in research activities, technological innovations are anticipated to drive the CRISPR and Cas genes market in both regions in future. In Europe, specifically, the rise in the acceptance of technology and the presence of important market players are likely to fuel the growth of the CRISPR and Cas genes market, in future.

The CRISPR and Cas genes market faces its own set of challenges as well. Fewer skilled professionals, as well as ethical concerns about CRISPR, could prove restrictive to the growth of the global CRISPR and Cas genes market.

Global CRISPR and Cas Genes Market – Snapshot

CRISPR-Cas systems are efficient and easily programmable nucleic acid-targeting tools, with usage expanding beyond research and therapeutic development to precision breeding of plants and animals and engineering of industrial microbes. CRISPR-Cas systems have potential applications in microbial engineering including bacterial strain typing, immunization of cultures, autoimmunity or self-targeted cell killing, and the engineering or control of metabolic pathways for improved biochemical synthesis. The global CRISPR and Cas genes market was valued at US$ 1,451.6 Mn in 2017 and is anticipated to reach US$ 7,234.5 Mn by 2026, expanding at a CAGR of 20.1% from 2018 to 2026.

Usage of CRISPR-Cas systems in bacteria, rise in government spending on research and development of genome editing, increase in incidence of genetic disorders, and usage of CRISPR/Cas9 technology to improve crop production drive the global CRISPR and Cas genes market. Genome editing technologies such as CRISPR/Cas9 is a revolutionary step in the field of biomedical research. Application of CRISPR/Cas9 focusing on somatic cell genome editing program is aimed at accelerating the use of these technologies to treat various genetic disorders. However, ethical issues concerning CRISPR and lack of skilled professionals restrain the global CRISPR and Cas genes market.

The global CRISPR and Cas genes market has been segmented based on product type, application, end-user, and region. In terms of product type, the global market has been bifurcated into vector-based Cas and DNA-free Cas. Based on application, the global CRISPR and Cas genes market has been classified into genome engineering, disease models, functional genomics, knockout/activation, and others. In terms of end-user, the global market has been categorized into biotechnology & pharmaceutical companies, academic & government research institutes, and contract research organizations. Based on region, the global CRISPR and Cas genes market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

In terms of product type, the vector-based Cas segment dominated the global market in 2017, accounting for 62.1% share. Vector-based Cas expression systems are useful for researchers who focus on enriching Cas9-expressing cells or strive to establish a stable cell line. Vector-based Cas is also available with an inducible promoter that supports the creation of stable cell lines with minimal background expression, or for temporal control over Cas9 expression for wide-ranging experimental applications. The DNA-free Cas segment is anticipated to gain market share during the forecast period. Advantages such as gene editing with DNA-free CRISPR-Cas9 components to reduce potential off-targets and potential usage of CRISPR-Cas9 gene editing to find correlations with human diseases in model systems drive the segment.

Based on application, the genome engineering segment dominated the global CRISPR and Cas genes market in 2017. CRISPR technology allows genetic material to be added, removed, or altered at particular locations in the genome. Cas9 mRNA or purified Cas9 protein is the source for Cas9 nuclease expression in genome engineering experiments. Genomic engineering is the synthetic assembly of complete chromosomal DNA that is more or less derived from natural genomic sequences. Disease models was the second largest segment of the global market. CRISPR/Cas9 gene editing has also been applied in immunology-focused applications such as the targeting of C-C chemokine receptor type 5 and programmed death-1 gene. This technology has been increasingly applied in the study or treatment of human diseases, including Barth syndrome effects on the heart, Duchenne muscular dystrophy, hemophilia, β-thalassemia, and cystic fibrosis.

In terms of end-user, the biotechnology & pharmaceutical companies segment dominated the global CRISPR and Cas Gene market in 2017. Adoption of CRISPR technology by pharmaceutical & biotechnology companies through strategic partnerships with innovators drives the segment. In 2017, CRISPR Therapeutics established a joint venture called Casebia Therapeutics LLP with Bayer HeathCare and its subsidiaries. Academic & government research institutes was the second largest segment of the global market.

Based on region, North America and Europe dominated the global CRISPR and Cas genes market in 2017, accounting for 71% share. Rise in research activities and technological advancements are expected to drive the CRISPR and Cas genes market in the regions during the forecast period. In 2016, a human clinical trial was initiated for the use of CRISPR to treat diseases in the U.S. Increase in adoption of technology and presence of key players in the region are likely to accelerate the growth of the CRISPR and Cas genes market in Europe during the forecast period.

Major players operating in the global CRISPR and Cas genes market include Synthego, Thermo Fisher Scientific, Inc., GenScript, Addgene, Merck KGaA (Sigma-Aldrich), Integrated DNA Technologies, Inc., Transposagen Biopharmaceuticals, Inc., OriGene Technologies, Inc., New England Biolabs, Dharmacon, Cellecta, Inc., Agilent Technologies, and Applied StemCell, Inc. These players adopt organic and in-organic growth strategies to expand product offerings, strengthen geographical reach, increase customer base, and capture market share.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global CRISPR and Cas Genes Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.2.1. Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast, 2016–2026

4.2.2. Global CRISPR and Cas Genes Market Outlook

4.2.3. Evolution of CRISPRs

4.2.4. Research institutes involved in CRISPR Research

4.2.5. CRISPR: Funding & Investment

4.2.7. Mergers and Acquisitions

4.3. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

5. Global CRISPR and Cas Genes Market Analysis and Forecasts, by Product

5.1. Introduction & Definition

5.2. Market Value Forecast, by Product, 2016–2026

5.2.1. Vector-based Cas

5.2.2. DNA-free Cas

5.3. Market Attractiveness, by Product

6. Global CRISPR and Cas Genes Market Analysis and Forecasts, by Application

6.1. Introduction & Definition

6.2. Market Value Forecast, by Application, 2016–2026

6.2.1. Genome Engineering

6.2.2. Disease Models

6.2.3. Functional Genomics

6.2.4. Knockdown/activation

6.2.5. Others

6.3. Market Attractiveness, by Application

7. Global CRISPR and Cas Genes Market Analysis and Forecasts, by End-user

7.1. Introduction & Definition

7.2. Market Value Forecast, by End-user, 2016–2026

7.2.1. Biotechnology & Pharmaceutical Companies

7.2.2. Academic & Government Research Institutes

7.2.3. Contract Research Organizations

7.3. Market Attractiveness, by End-user

8. Global CRISPR and Cas Genes Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Country/Region

9. North America CRISPR and Cas Genes Market Analysis and Forecast

9.1. Introduction

9.2. Market Value Forecast, by Product, 2016–2026

9.2.1. Vector-based Cas

9.2.2. DNA-free Cas

9.3. Market Value Forecast, by Application, 2016–2026

9.3.1. Genome Engineering

9.3.2. Disease Models

9.3.3. Functional Genomics

9.3.4. Knockdown/activation

9.3.5. Others

9.4. Market Value Forecast, by End-user, 2016–2026

9.4.1. Biotechnology & Pharmaceutical Companies

9.4.2. Academic & Government Research Institutes

9.4.3. Contract Research Organizations

9.5. Market Value Forecast, by Country, 2016–2026

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product

9.6.2. By Application

9.6.3. By End-user

9.6.4. By Country

10. Europe CRISPR and Cas Genes Market Analysis and Forecast

10.1.Introduction

10.2.Market Value Forecast, by Product, 2016–2026

10.2.1. Vector-based Cas

10.2.2. DNA-free Cas

10.3.Market Value Forecast, by Application, 2016–2026

10.3.1. Genome Engineering

10.3.2. Disease Models

10.3.3. Functional Genomics

10.3.4. Knockdown/activation

10.3.5. Others

10.4.Market Value Forecast, by End-user, 2016–2026

10.4.1. Biotechnology & Pharmaceutical Companies

10.4.2. Academic & Government Research Institutes

10.4.3. Contract Research Organizations

10.5.Market Value Forecast, by Country/Sub-region, 2016–2026

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Spain

10.5.5. Italy

10.5.6. Rest of Europe

10.6.Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country/Sub-region

11. Asia Pacific CRISPR and Cas Genes Market Analysis and Forecast

11.1.Introduction

11.2.Market Value Forecast, by Product, 2016–2026

11.2.1. Vector-based Cas

11.2.2. DNA-free Cas

11.3.Market Value Forecast, by Application, 2016–2026

11.3.1. Genome Engineering

11.3.2. Disease Models

11.3.3. Functional Genomics

11.3.4. Knockdown/activation

11.3.5. Others

11.4.Market Value Forecast, by End-user, 2016–2026

11.4.1. Biotechnology & Pharmaceutical Companies

11.4.2. Academic & Government Research Institutes

11.4.3. Contract Research Organizations

11.5.Market Value Forecast, by Country/Sub-region, 2016–2026

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. Rest of Asia Pacific

11.6.Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Latin America CRISPR and Cas Genes Market Analysis and Forecast

12.1.Introduction

12.2.Market Value Forecast, by Product, 2016–2026

12.2.1. Vector-based Cas

12.2.2. DNA-free Cas

12.3.Market Value Forecast, by Application, 2016–2026

12.3.1. Genome Engineering

12.3.2. Disease Models

12.3.3. Functional Genomics

12.3.4. Knockdown/activation

12.3.5. Others

12.4.Market Value Forecast, by End-user, 2016–2026

12.4.1. Biotechnology & Pharmaceutical Companies

12.4.2. Academic & Government Research Institutes

12.4.3. Contract Research Organizations

12.5.Market Value Forecast, by Country/Sub-region, 2016–2026

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6.Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Middle East & Africa CRISPR and Cas Genes Market Analysis and Forecast

13.1.Introduction

13.2.Market Value Forecast, by Product, 2016–2026

13.2.1. Vector-based Cas

13.2.2. DNA-free Cas

13.3.Market Value Forecast, by Application, 2016–2026

13.3.1. Genome Engineering

13.3.2. Disease Models

13.3.3. Functional Genomics

13.3.4. Knockdown/activation

13.3.5. Others

13.4.Market Value Forecast, by End-user, 2016–2026

13.4.1. Biotechnology & Pharmaceutical Companies

13.4.2. Academic & Government Research Institutes

13.4.3. Contract Research Organizations

13.5.Market Value Forecast, by Country/Sub-region, 2016–2026

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6.Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1.Market Player - Competition Matrix (By Tier and Size of companies)

14.2.Market Share Analysis, by Company (2015)

14.3.Company Profiles (Details - Overview, Financials, Recent Developments, Strategy)

14.3.1. Synthego

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Thermo Fisher Scientific, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. GenScript

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.4. Addgene

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Merck KGaA (Sigma-Aldrich)

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Integrated DNA Technologies, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Transposagen Biopharmaceuticals, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. OriGene Technologies, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. New England Biolabs

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Dharmacon, a Horizon Discovery Group Co.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Financial Overview

14.3.10.3. Product Portfolio

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Cellecta, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Financial Overview

14.3.11.3. Product Portfolio

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Agilent Technologies

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Financial Overview

14.3.12.3. Product Portfolio

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Applied StemCell, Inc.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Financial Overview

14.3.13.3. Product Portfolio

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

List of Tables

Table 01: Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 02: Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application, 2016–2026

Table 03: Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 04: Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Region, 2016–2026

Table 05: North America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 06: North America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 07: North America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application Type, 2016–2026

Table 08: North America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 09: Europe CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 10: Europe CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 11: Europe CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application, 2016–2026

Table 12: Europe CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 13: Asia Pacific CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 14: Asia Pacific CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 15: Asia Pacific CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application Type, 2016–2026

Table 16: Asia Pacific CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 17: Latin America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 18: Latin America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 19: Latin America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application Type, 2016–2026

Table 20: Latin America CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 21: Middle East & Africa CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 22: Middle East & Africa CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 23: Middle East & Africa CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by Application, 2016–2026

Table 24 : Middle East & Africa CRISPR and Cas Genes Market Size (US$ Mn) Forecast, by End-user, 2016–2026

List of Figures

Figure 01: Global CRISPR and Cas Genes Market Size (US$ Mn) and Distribution, by Region, 2017 and 2026

Figure 02: Market Snapshot

Figure 03: Opportunity Map, 2017

Figure 04: Opportunity Map, 2017

Figure 05: Opportunity Map, 2017

Figure 06: Global CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 07: Global CRISPR and Cas Genes Market Value Share, by Product, 2017

Figure 08: Global CRISPR and Cas Genes Market Value Share, by Application, 2017

Figure 09: Global CRISPR and Cas Genes Market Value Share, by End-user, 2017

Figure 10: Global CRISPR and Cas Genes Market Value Share, by Region, 2017

Figure 11: Global CRISPR and Cas Genes Market Value Share, by Product, 2017 and 2026

Figure 12: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vector-based Cas, 2016–2026

Figure 13: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by DNA-free Cas, 2016–2026

Figure 14: Global CRISPR and Cas Genes Market Attractiveness Analysis, by Product, 2018–2026

Figure 15: Global CRISPR and Cas Genes Market Value Share, by Application, 2017 and 2026

Figure 16: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Genome Engineering, 2016–2026

Figure 17: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Disease Models, 2016–2026

Figure 18: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Functional Genomics, 2016–2026

Figure 19: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations, 2016–2026

Figure 20: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Functional Genomics, 2016–2026

Figure 21: Global CRISPR and Cas Genes Market Attractiveness Analysis, by Application, 2018–2026

Figure 22: Global CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 23: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Biotechnology & Pharmaceutical Companies, 2016–2026

Figure 24: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Academic & Government Research Institutes, 2016–2026

Figure 25: Global CRISPR and Cas Genes Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations, 2016–2026

Figure 26: Global CRISPR and Cas Genes Market Attractiveness Analysis, by End-user, 2018–2026

Figure 27: Global CRISPR and Cas Genes Market Value Share, by Region, 2017 and 2026

Figure 28: Global CRISPR and Cas Genes Market Attractiveness Analysis, by Region, 2018–2026

Figure 29: North America CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 30: North America CRISPR and Cas Genes Market Value Share, by Country, 2017 and 2026

Figure 31: North America CRISPR and Cas Genes Market Attractiveness, by Country, 2018–2026

Figure 32: North America CRISPR and Cas Genes Market Value Share, by Product Type, 2017 and 2026

Figure 33: North America CRISPR and Cas Genes Market Attractiveness, by Product Type, 2018–2026

Figure 34: North America CRISPR and Cas Genes Market Value Share, by Application Type, 2017 and 2026

Figure 35: North America CRISPR and Cas Genes Market Attractiveness, by Application Type, 2018–2026

Figure 36: North America CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 37: North America CRISPR and Cas Genes Market Attractiveness, by End-user, 2018–2026

Figure 38: Europe CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 39: Europe CRISPR and Cas Genes Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 40: Europe CRISPR and Cas Genes Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 41: Europe CRISPR and Cas Genes Market Value Share, by Product Type, 2017 and 2026

Figure 42: Europe CRISPR and Cas Genes Market Attractiveness, by Product Type, 2018–2026

Figure 43: Europe CRISPR and Cas Genes Market Value Share, by Application, 2017 and 2026

Figure 44: Europe CRISPR and Cas Genes Market Attractiveness, by Application, 2018–2026

Figure 45: Europe CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 46: Europe CRISPR and Cas Genes Market Attractiveness, by End-user, 2018–2026

Figure 47: Asia Pacific CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 48: Asia Pacific CRISPR and Cas Genes Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 49: Asia Pacific CRISPR and Cas Genes Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 50: Asia Pacific CRISPR and Cas Genes Market Value Share, by Product Type, 2017 and 2026

Figure 51: Asia Pacific CRISPR and Cas Genes Market Attractiveness, by Product Type, 2018–2026

Figure 52: Asia Pacific CRISPR and Cas Genes Market Value Share, by Application Type, 2017 and 2026

Figure 53: Asia Pacific CRISPR and Cas Genes Market Attractiveness, by Application Type, 2018–2026

Figure 54: Asia Pacific CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 55: Asia Pacific CRISPR and Cas Genes Market Attractiveness, by End-user, 2018–2026

Figure 56: Latin America CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 57: Latin America CRISPR and Cas Genes Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 58: Latin America CRISPR and Cas Genes Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 59: Latin America CRISPR and Cas Genes Market Value Share, by Product Type, 2017 and 2026

Figure 60: Latin America CRISPR and Cas Genes Market Attractiveness, by Product Type, 2018–2026

Figure 61: Latin America CRISPR and Cas Genes Market Value Share, by Application Type, 2017 and 2026

Figure 62: Latin America CRISPR and Cas Genes Market Attractiveness, by Application Type, 2018–2026

Figure 63: Latin America CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 64: Latin America CRISPR and Cas Genes Market Attractiveness, by End-user, 2018–2026

Figure 65: Middle East & Africa CRISPR and Cas Genes Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 66: Middle East & Africa CRISPR and Cas Genes Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 67: Middle East & Africa CRISPR and Cas Genes Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 68: Middle East & Africa CRISPR and Cas Genes Market Value Share, by Product, 2017 and 2026

Figure 69: Middle East & Africa CRISPR and Cas Genes Market Attractiveness, by Product, 2018–2026

Figure 70: Middle East & Africa CRISPR and Cas Genes Market Value Share, by Application, 2017 and 2026

Figure 71: Middle East & Africa CRISPR and Cas Genes Market Attractiveness, by Application, 2018–2026

Figure 72: Middle East & Africa CRISPR and Cas Genes Market Value Share, by End-user, 2017 and 2026

Figure 73: Middle East & Africa CRISPR and Cas Genes Market Attractiveness, by End-user, 2018–2026

Figure 74: Thermo Fisher Scientific Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2013–2017

Figure 75: Thermo Fisher Scientific Inc. Breakdown of Net Sales, by Region, 2017

Figure 76: Thermo Fisher Scientific Inc. Breakdown of Net Sales, by Business Segment, 2017

Figure 77: Thermo Fisher Scientific Inc. R&D Expense (US$ Mn) and Y-o-Y Growth (%), 2013–2017

Figure 78: GenScript Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 79: GenScript Breakdown of Net Sales, by Region, 2017

Figure 80: GenScript Breakdown of Net Sales, by Business Segment, 2017

Figure 81: GenScript R&D Expense (US$ Mn) and Selling and Distribution (US$ Mn), 2016–2017

Figure 82: Merck KGaA (Sigma Aldrich) Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2017

Figure 83: Merck KGaA (Sigma Aldrich) Breakdown of Net Sales, by Region, 2017

Figure 84: Merck KGaA (Sigma Aldrich) Breakdown of Net Sales, by Business Segment, 2017

Figure 85: Merck KGaA (Sigma Aldrich) Research & Development Market Share (%), by Business Segment, 2017

Figure 86: Agilent Technologies Breakdown of Net Sales, by Region, 2017

Figure 87: Agilent Technologies Breakdown of Net Sales (US$ Mn), by Segment, 2017

Figure 88: Agilent Technologies Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017