The global cranial implants market is expanding due to an increase in the number of brain cancer and trauma cases and rapid technological advancements for establishing effective and efficient treatment platforms for cranial reconstruction. The global cranial implants market was valued at more than US$ 792.0 Mn in 2017. It is projected to reach a value of US$ 1.4 Bn by 2026, expanding at a CAGR of more than 6.5% from 2018 to 2026. The global market is expanding at a relatively higher growth rate due to an increase in the geriatric population, rise in the prevalence of cancer and trauma cases, increase in the number of cranial surgeries, research and developmental activities in the health care sector in both developed and developing countries

The human head can be subjected to several impactful loadings, such as those taking place due to falls, injuries, road accidents, etc.. These loadings may result in skull fracture, and in some cases, part of the skull may need to be replaced by a biomedical implant. Accidents may also lead to brain swelling, which can be treated by decompressive craniectomy.

Cranioplasty is a neurosurgical procedure that is used to repair cranial defects resulting due to traumatic brain injury (TBI), brain tumors, and hemorrhagic diseases. This procedure is conducted with the aid of cranial implants. Earlier, several different types of materials were used for cranioplasty. With technological advancements, new materials and technological interventions are available, providing specificity for the patient population according to the treatment and surgeon.

Increase in technological advancements, such as implant computer-aided design, 3-D printing, and regenerative medicine has resulted in the advent of 3-D-print patient-specific implants that can be made from a variety of materials, including polymer, ceramic, or metal. They are more effective and accurate for treatment and help surgeons achieve increased success rates. Also, factors such as a rise in the geriatric population, increase in demand for customized cranial implants, and rise in the number of injuries and road accidents are boosting the growth of the cranial implants market. Furthermore, an increase in research and development activities and studies and rise in awareness are also anticipated to boost the cranial implants market.

The global cranial implants market has been segmented based on product, material, end-user, and region. In terms of product, the market has been classified into customized cranial implants and non-customized cranial implants. The non-customized cranial implants segment is expected to hold a significant share of the market, while the customized cranial implants segment is expected to expand at a significant CAGR of 7.1% during the forecast period. Customized cranial implants are considered to be specific and well-fitted according to the cranial defects, save operating room procedure time and aid surgeons, may render the procedure less invasive, and reduce the risk of infection and complications. Generally, non-customized implants comprise traditional methods for cranial implantation. The number of non-customized implant products available in the market is higher.

In terms of material, the global cranial implants market has been classified into polymer, ceramic, and metal. The metal segment is projected to hold a prominent share of the market, while the polymer segment is anticipated to expand at a significant CAGR during the forecast period. The metal segment is estimated to expand at a CAGR of 6.8% during the forecast period. The most commonly used metal is grade 5 surgical titanium (i.e., Ti-6Al-4V), usually referred to as ‘titanium’ or Ti-6-4. Metal is used in the cranium for fixation devices (e.g., plates and screws), solid plates, or mesh, or in combination with other materials such as ceramic components or inert plastic. The availability and long-term success rates of metals such as titanium, specifically related to resistance to infections, have contributed to their leading position in the cranial implants market.

In terms of end-user, the global cranial implants market has been classified into hospitals and neurosurgery specialty centers. The hospitals segment is expected to dominate the market and expand at a CAGR of 6.9% during the forecast period. This is due to a rise in the number of hospitals, high surgery volume, and rise in the number of medical professionals.

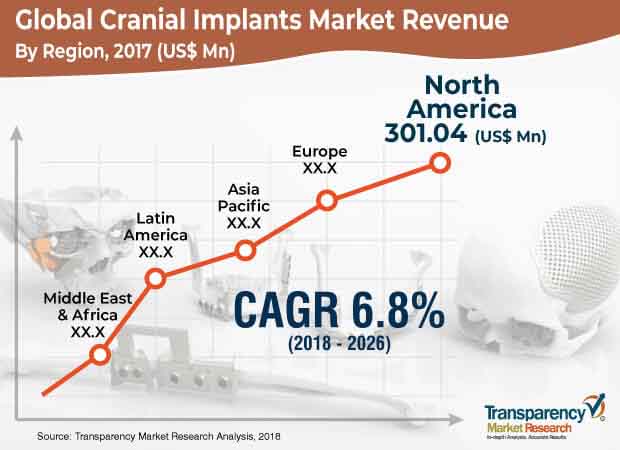

Based on region, the global cranial implants market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America is expected to dominate the global market and account for a prominent share in the coming years. The market in North America is primarily driven by a rapid increase in the geriatric population; rise in the patient population; high prevalence of trauma, injuries, road accidents, and brain cancer cases; and increase in the acceptance of technologically advanced cranial implants. Moreover, increase in awareness among people, rise in the number of players and products, and substantial focus on research and development are anticipated to fuel the global cranial implants market in North America during the forecast period. According to The American Association for the Surgery of Trauma (AAST), in the U.S., traumatic brain Injury (TBI) is the single largest cause of death from injury. The market in Asia Pacific is anticipated to expand at a rapid pace during the forecast period. The market in the region is estimated to be augmented by the presence of a large base of geriatric population, government initiatives in the health care field, expansion in research and development activities, and improving health care infrastructure.

Companies such as Zimmer Biomet, Stryker, Kelyniam Global Inc., accounted for a major share of the global market in 2017. Increase in the number of technological advancements, rise in approvals from government bodies, acquisitions and mergers, and research and development are the key factors strengthening the position of these players in the market. In October, 2018, OssDsign AB, a distributor and manufacturer of regenerative implants for facial and cranial reconstruction, received 510(k) clearance by the U.S. FDA for the marketing and sale of its latest product, OSSDSIGN Cranioplug. Its implant is used during neurosurgical procedures, and it is made from an osteoconductive calcium phosphate ceramic composition reinforced with a titanium mesh plate. In October 2018, Kelyniam Global Inc., , submitted its third 510(k) application to the FDA for expanding its line of custom implants. Companies are adopting the strategies of acquisitions and collaborations with parallel companies in order to improve and strengthen their presence in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Cranial Implants Market

4. Market Overview

4.1. Market Dynamics

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

5. Market Outlook

5.1. Prevalence of Brain Tumors in Key Countries

5.2. Comparative Analysis of Cranial Implants Based on Material

5.3. Regulatory Scenario of Cranial Implants

6. Global Cranial Implants Market Analysis and Forecasts, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2016–2026

6.3.1. Customized Cranial Implants

6.3.2. Non-customized Cranial Implants

6.4. Market Attractiveness, by Product

7. Global Cranial Implants Market Analysis and Forecasts, by Material

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Material, 2016–2026

7.3.1. Polymer

7.3.2. Ceramic

7.3.3. Metal

7.4. Market Attractiveness, by Material

8. Global Cranial Implants Market Analysis and Forecasts, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2016–2026

8.3.1. Hospitals

8.3.2. Neurosurgery Specialty Centers

8.4. Market Attractiveness, by End-user

9. Global Cranial Implants Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Cranial Implants Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2016–2026

10.2.1. Customized Cranial Implants

10.2.2. Non-customized Cranial Implants

10.3. Market Value Forecast, by Material, 2016–2026

10.3.1. Polymer

10.3.2. Ceramic

10.3.3. Metal

10.4. Market Value Forecast, by End-user, 2016–2026

10.4.1. Hospitals

10.4.2. Neurosurgery Specialty Centers

10.5. Market Value Forecast, by Country, 2016–2026

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Material

10.6.3. By End-user

10.6.4. By Country

11. Europe Cranial Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2016–2026

11.2.1. Customized Cranial Implants

11.2.2. Non-customized Cranial Implants

11.3. Market Value Forecast, by Material, 2016–2026

11.3.1. Polymer

11.3.2. Ceramic

11.3.3. Metal

11.4. Market Value Forecast, by End-user, 2016–2026

11.4.1. Hospitals

11.4.2. Neurosurgery Specialty Centers

11.5. Market Value Forecast, by Country, 2016–2026

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Russia

11.5.7. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Material

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Cranial Implants Market Analysis and Forecast

12.1. I ntroduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2016–2026

12.2.1. Customized Cranial Implants

12.2.2. Non-customized Cranial Implants

12.3. Market Value Forecast, by Material, 2016–2026

12.3.1. Polymer

12.3.2. Ceramic

12.3.3. Metal

12.4. Market Value Forecast, by End-user, 2016–2026

12.4.1. Hospitals

12.4.2. Neurosurgery Specialty Centers

12.5. Market Value Forecast, by Country, 2016–2026

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Material

12.6.3. By End-user

12.6.4. By Country

13. Latin America Cranial Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2016–2026

13.2.1. Customized Cranial Implants

13.2.2. Non-customized Cranial Implants

13.3. Market Value Forecast, by Material, 2016–2026

13.3.1. Polymer

13.3.2. Ceramic

13.3.3. Metal

13.4. Market Value Forecast, by End-user, 2016–2026

13.4.1. Hospitals

13.4.2. Neurosurgery Specialty Centers

13.5. Market Value Forecast, by Country, 2016–2026

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Material

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Cranial Implants Market Analysis and Forecast

14.1.Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2016–2026

14.2.1. Customized Cranial Implants

14.2.2. Non-customized Cranial Implants

14.3. Market Value Forecast, by Material, 2016–2026

14.3.1. Polymer

14.3.2. Ceramic

14.3.3. Metal

14.4. Market Value Forecast, by End-user, 2016–2026

14.4.1. Hospitals

14.4.2. Neurosurgery Specialty Centers

14.5. Market Value Forecast, by Country, 2016–2026

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Israel

14.5.4. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Material

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis by Company (2017)

15.3. Company Profiles

15.3.1. Zimmer Biomet

15.3.2. Stryker

15.3.3. Kelyniam Global Inc

15.3.4. Medartis

15.3.5. B. Braun Melsungen AG

15.3.6. DePuy Synthes

15.3.7. KLS Martin Group

15.3.8. Xilloc Medical B.V.

15.3.9. Ortho Baltic

15.3.10. Medtronic

List of Figures

Figure 01 Global Cranial Implants Market Size (US$ Mn) and Distribution (%), by Geography, 2018 and 2026

Figure 02 Global Cranial Implants Market Value (US$ Mn) Forecast, 2016–2026

Figure 03 Global Cranial Implants Market Value Share, by Product (2017)

Figure 04 Global Cranial Implants Market Value Share, by Material (2017)

Figure 05 Global Cranial Implants Market Value Share, by End-user (2017)

Figure 06 Global Cranial Implants Market Value Share (%), by Product, 2018 and 2026

Figure 07 Global Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 08 Global Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Customized Cranial Implants, 2016–2026

Figure 09 Global Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Non-customized Cranial Implants, 2016–2026

Figure 10 Global Cranial Implants Market Value Share, by Material, 2018 and 2026

Figure 11 Global Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 12 Global Cranial Implants Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Polymer, 2016–2026

Figure 13 Global Cranial Implants Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Ceramic, 2016–2026

Figure 14 Global Cranial Implants Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Metal, 2016–2026

Figure 15 Global Cranial Implants Market Value Share, by End-user, 2018 and 2026

Figure 16 Global Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 17 Global Cranial Implants Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Hospitals, 2016–2026

Figure 18 Global Cranial Implants Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Neurosurgery Specialty Centers, 2016–2026

Figure 19 Global Cranial Implants Market Value Share, by Region, 2018 and 2026

Figure 20 Global Cranial Implants Market Attractiveness, by Region, 2018–2026

Figure 21 North America Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 22 North America Cranial Implants Market Value Share (%), by Country, 2018 and 2026

Figure 23 North America Cranial Implants Market Attractiveness, by Country, 2018–2026

Figure 24 North America Cranial implants Market Value Share, by Product, 2018 and 2026

Figure 25 North America Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 26 North America Cranial Implants Market Value Share Analysis, by Material, 2018 and 2026

Figure 27 North America Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 28 North America Cranial Implants Market Value Share Analysis, by End-user, 2018 and 2026

Figure 29 North America Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 30 Europe Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 31 Europe Cranial Implants Market Value Share (%), by Country, 2018 and 2026

Figure 32 Europe Cranial Implants Market Attractiveness, by Country, 2018–2026

Figure 33 Europe Cranial implants Market Value Share, by Product, 2018 and 2026

Figure 34 Europe Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 35 Europe Cranial Implants Market Value Share Analysis, by Material, 2018 and 2026

Figure 36 Europe Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 37 Europe Cranial Implants Market Value Share Analysis, by End-user, 2018 and 2026

Figure 38 Europe Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 39 Asia Pacific Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 40 Asia Pacific Cranial implants Market Value Share, by Country, 2018 and 2026

Figure 41 Asia Pacific Cranial Implants Market Attractiveness, by Country, 2018–2026

Figure 42 Asia Pacific Cranial implants Market Value Share, by Product, 2018 and 2026

Figure 43 Asia Pacific Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 44 Asia Pacific Cranial Implants Market Value Share Analysis, by Material, 2018 and 2026

Figure 45 Asia Pacific Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 46 Asia Pacific Cranial Implants Market Value Share Analysis, by End-user, 2018 and 2026

Figure 47 Asia Pacific Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 48 Latin America Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 49 Latin America Cranial implants Market Value Share, by Country, 2018 and 2026

Figure 50 Latin America Cranial Implants Market Attractiveness, by Country, 2018–2026

Figure 51 Latin America Cranial implants Market Value Share, by Product, 2018 and 2026

Figure 52 Latin America Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 53 Latin America Cranial Implants Market Value Share Analysis, by Material, 2018 and 2026

Figure 54 Latin America Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 55 Latin America Cranial Implants Market Value Share Analysis, by End-user, 2018 and 2026

Figure 56 Latin America Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 57 Middle East & Africa Cranial Implants Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 58 Middle East & Africa Cranial implants Market Value Share, by Country, 2018 and 2026

Figure 59 Middle East & Africa Cranial Implants Market Attractiveness, by Country, 2018–2026

Figure 60 Middle East & Africa Cranial implants Market Value Share, by Product, 2018 and 2026

Figure 61 Middle East & Africa Cranial Implants Market Attractiveness, by Product, 2018–2026

Figure 62 Middle East & Africa Cranial Implants Market Value Share Analysis, by Material, 2018 and 2026

Figure 63 Middle East & Africa Cranial Implants Market Attractiveness, by Material, 2018–2026

Figure 64 Middle East & Africa Cranial Implants Market Value Share Analysis, by End-user, 2018 and 2026

Figure 65 Middle East & Africa Cranial Implants Market Attractiveness, by End-user, 2018–2026

Figure 66 Cranial Implants Market Share, by Company, 2017

Figure 67 Zimmer Biomet Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 68 Zimmer Biomet Breakdown of Net Sales (%), by Region/Country, 2017

Figure 69 Zimmer Biomet Breakdown of Net Sales (%), by Product Segment, 2017

Figure 70 Zimmer Biomet R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 71 Stryker Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 72 Stryker Breakdown of Net Sales (%), by Region/Country, 2017

Figure 73 Stryker Breakdown of Net Sales (%), by Product Segment, 2017

Figure 74 Stryker R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 75 KELYNIAM GLOBAL INC. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 76 Medtronic Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 77 Medtronic Breakdown of Net Sales (%), by Region/Country, 2017

Figure 78 Medtronic Breakdown of Net Sales (%), by Business Segment, 2017

Figure 79 Medtronic R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 80 Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 81 Breakdown of Net Sales (%), by Region, 2017

Figure 82 Johnson & Johnson Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017

Figure 83 Johnson & Johnson Breakdown of Net Sales (%), by Region/Country, 2017

Figure 84 Johnson & Johnson Breakdown of Net Sales (%), by Business Segment, 2017

Figure 85 Johnson & Johnson R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014–2017