As the packaging industry bears the brunt of 'sustainability concerns', manufacturers have no choice but to adhere to the environmental books, and yet, devise innovative solutions in this confined space. Moving a step ahead from plastic material to complete the dual quest for eco-friendliness and recyclability, manufacturers are observed taking an innovative approach to achieve high sales of glass-based solutions for the packaging of cosmetics and perfumes.

Manufacturers in the cosmetic and perfume glass packaging market are realizing the fact that, glass is 100% recyclable with a very low carbon profile, and sizeable efforts are being dedicated to recover more materials for reuse. According to a report published by Transparency Market Research (TMR) on the cosmetic and perfume glass packaging market, quality, visual appeal, and durability will occupy a common spot on the labels of glass bottles, while the recyclability and eco-friendly attributes of glass packaging will remain prominent differentiators.

As consumer preference for packaging solutions changes from aesthetic appeal to functionality, glass performs mediocrely on the scales of 'convenience'. Given the fragile and bulky attributes of glass bottles, consumers need to take ample care while traveling with these bottles, as even a tiny crack can lead to breakage or loss of cosmetics and perfumes.

Innovation is the only constant parameter in the cosmetic and perfume glass packaging market, as manufacturers operating at all scales work towards distinguishing their products. With millennials being the key demography for the cosmetic and perfume market, focus on the development of youth-friendly glass packaging solutions is increasing.

Glass bottles with unique designs stand out on the shelves of supermarkets, which has instigated manufacturers to leverage technology. In recent times, 3D printing technology has been gaining grounds in the cosmetic and perfume glass packaging market, as printing technology offers the desired shape, size, and design to glass bottles.

Also, considering the reluctance of consumers towards the purchase of products contained in a glass bottle, on account of their fragility, manufacturers are investing resources towards the development of unbreakable solutions. A key market player, Verescene, announced the launch of unbreakable glass bottles, which can withstand the impact of falling from a height of 1.8 meters.

In the fragmented cosmetic and perfume glass packaging market, leading players hold a rich product portfolio and huge global mass, while prominent companies boast technological prowess and benefit by catering to local markets.

Given the growing focus of consumers on personality enhancement products, the number of beauty parlors and salons are on the rise, which ensures promising sales opportunities for cosmetic products and fragrances. Market players can enter into a long-term partnership with these end-users, and take into consideration their personalized requirements to enjoy a marginal growth in the landscape.

Since modern businesses operate on the very principles of a circular economy model, manufacturers can collaborate with suppliers that recycle glass materials in order to upkeep the 'sustainability quotient' of their glass packaging solutions.

Cosmetic and Perfume Glass Packaging Market: Analysts’ View

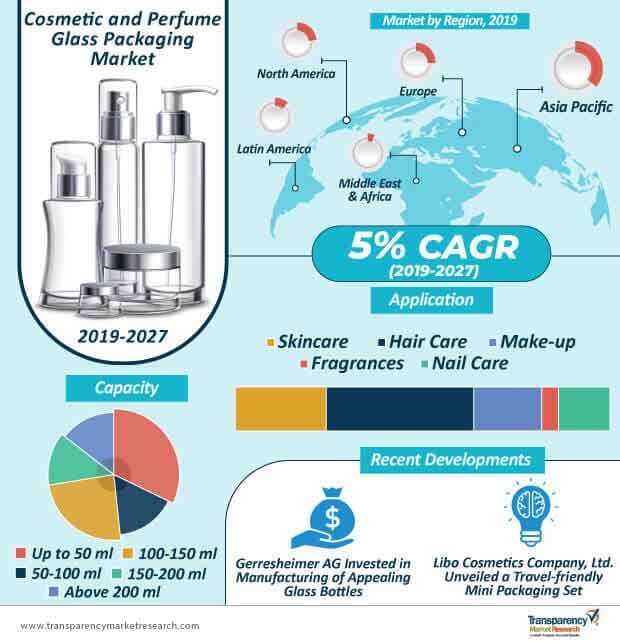

Authors of the report opine that, the cosmetic and perfume glass packaging market will grow from ~US$ 5 Bn in 2019 to ~US$ 7.2 Bn in 2027, and magnified focus on the marketing of products in cosmetics and perfume industries will remain a crucial growth influencer. Investments in the Asia Pacific cosmetic and perfume glass packaging market will offer high RoI potential, as the populace here shows a marked proclivity for grooming products, which will complement the demand for aesthetically-appealing packaging solutions. Besides a wide population to cater to, Asia Pacific is home to a huge millennial population base, which serves as the key demography for end-use industries, thereby creating significant avenues for the penetration of distinguished solutions in the cosmetic and perfume glass packaging market.

For instance,

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Viewpoint

3.1. Global Cosmetics Market

3.2. Global Cosmetic Packaging Market Outlook

3.3. Global Fragrance Packaging Market Outlook

3.4. Trade Flow Analysis of Cosmetic Products

3.5. Porter’s Analysis

3.6. PESTLE Analysis

3.7. Forecast Factors – Relevance & Impact

3.8. Value Chain

3.8.1. Key Participants

3.8.1.1. Raw Material Suppliers

3.8.1.2. Bottles and Jars Manufacturers

3.8.1.3. Distributors/End Users

3.8.2. Profitability Margin

3.9. Market Dynamics

3.9.1. Drivers

3.9.2. Restraints

3.9.3. Opportunities

3.9.4. Trends

4. Global Cosmetic and Perfume Glass Packaging Market Analysis

4.1. Market Value (US$ Mn) and Volume (Tons) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global Cosmetic and Perfume Glass Packaging Market Analysis, by Capacity

5.1. Introduction

5.1.1. Market Value Share Analysis, by Capacity

5.1.2. Y-o-Y Growth Analysis, by Capacity

5.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

5.2.1. Up to 50 ml

5.2.2. 50 ml - 100 ml

5.2.3. 100 ml - 150 ml

5.2.4. 150 ml - 200 ml

5.2.5. Above 200 ml

5.3. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

5.3.1. Up to 50 ml

5.3.2. 50 ml - 100 ml

5.3.3. 100 ml - 150 ml

5.3.4. 150 ml - 200 ml

5.3.5. Above 200 ml

5.4. Market Attractiveness Analysis, by Capacity

6. Global Cosmetic and Perfume Glass Packaging Market Analysis, by Product

6.1. Introduction

6.1.1. Market Value Share Analysis, by Product

6.1.2. Y-o-Y Growth Analysis, by Product

6.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

6.2.1. Bottles

6.2.1.1. Round

6.2.1.2. Rectangular

6.2.1.3. Others

6.2.2. Jars

6.2.2.1. Round

6.2.2.2. Rectangular

6.2.2.3. Others

6.3. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

6.3.1. Bottles

6.3.1.1. Round

6.3.1.2. Rectangular

6.3.1.3. Others

6.3.2. Jars

6.3.2.1. Round

6.3.2.2. Rectangular

6.3.2.3. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Cosmetic and Perfume Glass Packaging Market Analysis, by Application

7.1. Introduction

7.1.1. Market Value Share Analysis, by Application

7.1.2. Y-o-Y Growth Analysis, by Application

7.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

7.2.1. Hair care

7.2.2. Skin care

7.2.3. Make up

7.2.4. Nail Care

7.2.5. Fragrances

7.3. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Application

7.3.1. Hair care

7.3.2. Skin care

7.3.3. Make up

7.3.4. Nail Care

7.3.5. Fragrances

7.4. Market Attractiveness Analysis, by Application

8. Global Cosmetic and Perfume Glass Packaging Market Analysis, by Region

8.1. Introduction

8.1.1. Market Value Share Analysis, by Region

8.1.2. Y-o-Y Growth Analysis, by Region

8.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Region

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa (MEA)

8.3. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific

8.3.5. Middle East & Africa (MEA)

8.4. Market Attractiveness Analysis, by Region

9. North America Cosmetic and Perfume Glass Packaging Market Analysis

9.1. Introduction

9.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Country

9.2.1. U.S.

9.2.2. Canada

9.3. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Country

9.3.1. U.S.

9.3.2. Canada

9.4. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

9.4.1. Up to 50 ml

9.4.2. 50 ml - 100 ml

9.4.3. 100 ml - 150 ml

9.4.4. 150 ml - 200 ml

9.4.5. Above 200 ml

9.5. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

9.5.1. Up to 50 ml

9.5.2. 50 ml - 100 ml

9.5.3. 100 ml - 150 ml

9.5.4. 150 ml - 200 ml

9.5.5. Above 200 ml

9.6. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

9.6.1. Bottles

9.6.1.1. Round

9.6.1.2. Rectangular

9.6.1.3. Others

9.6.2. Jars

9.6.2.1. Round

9.6.2.2. Rectangular

9.6.2.3. Others

9.7. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

9.7.1. Bottles

9.7.1.1. Round

9.7.1.2. Rectangular

9.7.1.3. Others

9.7.2. Jars

9.7.2.1. Round

9.7.2.2. Rectangular

9.7.2.3. Others

9.8. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

9.8.1. Hair care

9.8.2. Skin care

9.8.3. Make up

9.8.4. Nail Care

9.8.5. Fragrances

9.9. Market Value (US$ Mn) and Volume (Tons) Forecast, by Application, 2019-2027

9.9.1. Hair care

9.9.2. Skin care

9.9.3. Make up

9.9.4. Nail Care

9.9.5. Fragrances

9.10. Key Market Participants – Intensity Mapping

10. Latin America Cosmetic and Perfume Glass Packaging Market Analysis

10.1. Introduction

10.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Country

10.2.1. Brazil

10.2.2. Mexico

10.2.3. Argentina

10.2.4. Rest of Latin America

10.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2019-2027

10.3.1. Brazil

10.3.2. Mexico

10.3.3. Argentina

10.3.4. Rest of Latin America

10.4. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

10.4.1. Up to 50 ml

10.4.2. 50 ml - 100 ml

10.4.3. 100 ml - 150 ml

10.4.4. 150 ml - 200 ml

10.4.5. Above 200 ml

10.5. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

10.5.1. Up to 50 ml

10.5.2. 50 ml - 100 ml

10.5.3. 100 ml - 150 ml

10.5.4. 150 ml - 200 ml

10.5.5. Above 200 ml

10.6. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

10.6.1. Bottles

10.6.1.1. Round

10.6.1.2. Rectangular

10.6.1.3. Others

10.6.2. Jars

10.6.2.1. Round

10.6.2.2. Rectangular

10.6.2.3. Others

10.7. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

10.7.1. Bottles

10.7.1.1. Round

10.7.1.2. Rectangular

10.7.1.3. Others

10.7.2. Jars

10.7.2.1. Round

10.7.2.2. Rectangular

10.7.2.3. Others

10.8. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

10.8.1. Hair care

10.8.2. Skin care

10.8.3. Make up

10.8.4. Nail Care

10.8.5. Fragrances

10.9. Market Value (US$ Mn) and Volume (Tons) Forecast, by Application, 2019-2027

10.9.1. Hair care

10.9.2. Skin care

10.9.3. Make up

10.9.4. Nail Care

10.9.5. Fragrances

10.10. Key Market Participants – Intensity Mapping

11. Europe Cosmetic and Perfume Glass Packaging Market Analysis

11.1. Introduction

11.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Country

11.2.1. Germany

11.2.2. Italy

11.2.3. France

11.2.4. U.K.

11.2.5. Spain

11.2.6. Benelux

11.2.7. Nordic

11.2.8. Russia

11.2.9. Poland

11.2.10. Rest of Europe

11.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2019-2027

11.3.1. Germany

11.3.2. Italy

11.3.3. France

11.3.4. U.K.

11.3.5. Spain

11.3.6. Benelux

11.3.7. Nordic

11.3.8. Russia

11.3.9. Poland

11.3.10. Rest of Europe

11.4. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

11.4.1. Up to 50 ml

11.4.2. 50 ml - 100 ml

11.4.3. 100 ml - 150 ml

11.4.4. 150 ml - 200 ml

11.4.5. Above 200 ml

11.5. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

11.5.1. Up to 50 ml

11.5.2. 50 ml - 100 ml

11.5.3. 100 ml - 150 ml

11.5.4. 150 ml - 200 ml

11.5.5. Above 200 ml

11.6. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

11.6.1. Bottles

11.6.1.1. Round

11.6.1.2. Rectangular

11.6.1.3. Others

11.6.2. Jars

11.6.2.1. Round

11.6.2.2. Rectangular

11.6.2.3. Others

11.7. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

11.7.1. Bottles

11.7.1.1. Round

11.7.1.2. Rectangular

11.7.1.3. Others

11.7.2. Jars

11.7.2.1. Round

11.7.2.2. Rectangular

11.7.2.3. Others

11.8. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

11.8.1. Hair care

11.8.2. Skin care

11.8.3. Make up

11.8.4. Nail Care

11.8.5. Fragrances

11.9. Market Value (US$ Mn) and Volume (Tons) Forecast, by Application, 2019-2027

11.9.1. Hair care

11.9.2. Skin care

11.9.3. Make up

11.9.4. Nail Care

11.9.5. Fragrances

11.10. Key Market Participants – Intensity Mapping

12. Asia Pacific Cosmetic and Perfume Glass Packaging Market Analysis

12.1. Introduction

12.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Country

12.2.1. China

12.2.2. India

12.2.3. ASEAN

12.2.4. Australia and New Zealand

12.2.5. Japan

12.2.6. Rest of Asia Pacific

12.3. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2019-2027

12.3.1. China

12.3.2. India

12.3.3. ASEAN

12.3.4. Australia and New Zealand

12.3.5. Japan

12.3.6. Rest of Asia Pacific

12.4. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

12.4.1. Up to 50 ml

12.4.2. 50 ml - 100 ml

12.4.3. 100 ml - 150 ml

12.4.4. 150 ml - 200 ml

12.4.5. Above 200 ml

12.5. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

12.5.1. Up to 50 ml

12.5.2. 50 ml - 100 ml

12.5.3. 100 ml - 150 ml

12.5.4. 150 ml - 200 ml

12.5.5. Above 200 ml

12.6. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

12.6.1. Bottles

12.6.1.1. Round

12.6.1.2. Rectangular

12.6.1.3. Others

12.6.2. Jars

12.6.2.1. Round

12.6.2.2. Rectangular

12.6.2.3. Others

12.7. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

12.7.1. Bottles

12.7.1.1. Round

12.7.1.2. Rectangular

12.7.1.3. Others

12.7.2. Jars

12.7.2.1. Round

12.7.2.2. Rectangular

12.7.2.3. Others

12.8. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

12.8.1. Hair care

12.8.2. Skin care

12.8.3. Make up

12.8.4. Nail Care

12.8.5. Fragrances

12.9. Market Value (US$ Mn) and Volume (Tons) Forecast, by Application, 2019-2027

12.9.1. Hair care

12.9.2. Skin care

12.9.3. Make up

12.9.4. Nail Care

12.9.5. Fragrances

12.10. Key Market Participants – Intensity Mapping

13. Middle East & Africa Cosmetic and Perfume Glass Packaging Market Analysis

13.1. Introduction

13.2. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Country

13.2.1. GCC Countries

13.2.2. Northern Africa

13.2.3. South Africa

13.2.4. Rest of MEA

13.3. Market Value (US$ Mn) and Volume (Tons) Forecast, by Country, 2019-2027

13.3.1. GCC Countries

13.3.2. Northern Africa

13.3.3. South Africa

13.3.4. Rest of MEA

13.4. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Capacity

13.4.1. Up to 50 ml

13.4.2. 50 ml - 100 ml

13.4.3. 100 ml - 150 ml

13.4.4. 150 ml - 200 ml

13.4.5. Above 200 ml

13.5. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

13.5.1. Up to 50 ml

13.5.2. 50 ml - 100 ml

13.5.3. 100 ml - 150 ml

13.5.4. 150 ml - 200 ml

13.5.5. Above 200 ml

13.6. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Product

13.6.1. Bottles

13.6.1.1. Round

13.6.1.2. Rectangular

13.6.1.3. Others

13.6.2. Jars

13.6.2.1. Round

13.6.2.2. Rectangular

13.6.2.3. Others

13.7. Market Value (US$ Mn) and Volume (Tons) Analysis, 2019-2027, by Product

13.7.1. Bottles

13.7.1.1. Round

13.7.1.2. Rectangular

13.7.1.3. Others

13.7.2. Jars

13.7.2.1. Round

13.7.2.2. Rectangular

13.7.2.3. Others

13.8. Historical Market Value (US$ Mn) and Volume (Tons), 2003-2018, by Application

13.8.1. Hair care

13.8.2. Skin care

13.8.3. Make up

13.8.4. Nail Care

13.8.5. Fragrances

13.9. Market Value (US$ Mn) and Volume (Tons) Forecast, by Application, 2019-2027

13.9.1. Hair care

13.9.2. Skin care

13.9.3. Make up

13.9.4. Nail Care

13.9.5. Fragrances

13.10. Key Market Participants – Intensity Mapping

14. Market Structure Analysis

14.1. Market Analysis by Tier of Companies

14.1.1. By Large, Medium, and Small

14.2. Market Concentration

14.2.1. By Top 5 and by Top 10

14.3. Market Share Analysis of Top 10 Players

14.3.1. The Americas Market Share Analysis, by Top Players

14.3.2. EMEA Market Share Analysis, by Top Players

14.3.3. Asia Pacific Market Share Analysis, by Top Players

14.4. Market Presence Analysis

14.4.1. By Regional footprint of Players

14.4.2. Product footprint, by Players

14.4.3. Channel footprint, by Players

15. Competition Analysis

15.1. Competition Dashboard

15.2. Profitability and Gross Margin Analysis

15.3. Competition Developments

15.4. Competition Deep Dive (20 Companies)

15.4.1. Gerresheimer AG

15.4.1.1. Overview

15.4.1.2. Capacity Portfolio

15.4.1.3. Profitability

15.4.1.4. Production Footprint

15.4.1.5. Sales Footprint

15.4.1.6. Channel Footprint

15.4.1.7. Competition Benchmarking

15.4.1.8. Strategy

15.4.1.8.1. Marketing Strategy

15.4.1.8.2. Capacity Strategy

15.4.1.8.3. Channel Strategy

15.4.2. Heinz-glass

15.4.2.1. Overview

15.4.2.2. Capacity Portfolio

15.4.2.3. Profitability

15.4.2.4. Production Footprint

15.4.2.5. Sales Footprint

15.4.2.6. Channel Footprint

15.4.2.7. Competition Benchmarking

15.4.2.8. Strategy

15.4.2.8.1. Marketing Strategy

15.4.2.8.2. Capacity Strategy

15.4.2.8.3. Channel Strategy

15.4.3. Piramal Glass

15.4.3.1. Overview

15.4.3.2. Capacity Portfolio

15.4.3.3. Profitability

15.4.3.4. Production Footprint

15.4.3.5. Sales Footprint

15.4.3.6. Channel Footprint

15.4.3.7. Competition Benchmarking

15.4.3.8. Strategy

15.4.3.8.1. Marketing Strategy

15.4.3.8.2. Capacity Strategy

15.4.3.8.3. Channel Strategy

15.4.4. Pochet SAS

15.4.4.1. Overview

15.4.4.2. Capacity Portfolio

15.4.4.3. Profitability

15.4.4.4. Production Footprint

15.4.4.5. Sales Footprint

15.4.4.6. Channel Footprint

15.4.4.7. Competition Benchmarking

15.4.4.8. Strategy

15.4.4.8.1. Marketing Strategy

15.4.4.8.2. Capacity Strategy

15.4.4.8.3. Channel Strategy

15.4.5. Saverglass Sas

15.4.5.1. Overview

15.4.5.2. Capacity Portfolio

15.4.5.3. Profitability

15.4.5.4. Production Footprint

15.4.5.5. Sales Footprint

15.4.5.6. Channel Footprint

15.4.5.7. Competition Benchmarking

15.4.5.8. Strategy

15.4.5.8.1. Marketing Strategy

15.4.5.8.2. Capacity Strategy

15.4.5.8.3. Channel Strategy

15.4.6. Stölzle Glass Group

15.4.6.1. Overview

15.4.6.2. Capacity Portfolio

15.4.6.3. Profitability

15.4.6.4. Production Footprint

15.4.6.5. Sales Footprint

15.4.6.6. Channel Footprint

15.4.6.7. Competition Benchmarking

15.4.6.8. Strategy

15.4.6.8.1. Marketing Strategy

15.4.6.8.2. Capacity Strategy

15.4.6.8.3. Channel Strategy

15.4.7. Aptar Group, Inc.

15.4.7.1. Overview

15.4.7.2. Capacity Portfolio

15.4.7.3. Profitability

15.4.7.4. Production Footprint

15.4.7.5. Sales Footprint

15.4.7.6. Channel Footprint

15.4.7.7. Competition Benchmarking

15.4.7.8. Strategy

15.4.7.8.1. Marketing Strategy

15.4.7.8.2. Capacity Strategy

15.4.7.8.3. Channel Strategy

15.4.8. Quadpack Industries

15.4.8.1. Overview

15.4.8.2. Capacity Portfolio

15.4.8.3. Profitability

15.4.8.4. Production Footprint

15.4.8.5. Sales Footprint

15.4.8.6. Channel Footprint

15.4.8.7. Competition Benchmarking

15.4.8.8. Strategy

15.4.8.8.1. Marketing Strategy

15.4.8.8.2. Capacity Strategy

15.4.8.8.3. Channel Strategy

15.4.9. ZIGNAGO VETRO S.p.A.

15.4.9.1. Overview

15.4.9.2. Capacity Portfolio

15.4.9.3. Profitability

15.4.9.4. Production Footprint

15.4.9.5. Sales Footprint

15.4.9.6. Channel Footprint

15.4.9.7. Competition Benchmarking

15.4.9.8. Strategy

15.4.9.8.1. Marketing Strategy

15.4.9.8.2. Capacity Strategy

15.4.9.8.3. Channel Strategy

15.4.10. Coverpla S.A.

15.4.10.1. Overview

15.4.10.2. Capacity Portfolio

15.4.10.3. Profitability

15.4.10.4. Production Footprint

15.4.10.5. Sales Footprint

15.4.10.6. Channel Footprint

15.4.10.7. Competition Benchmarking

15.4.10.8. Strategy

15.4.10.8.1. Marketing Strategy

15.4.10.8.2. Capacity Strategy

15.4.10.8.3. Channel Strategy

15.4.11. Vitro, S.A.B. de C.V.

15.4.11.1. Overview

15.4.11.2. Capacity Portfolio

15.4.11.3. Profitability

15.4.11.4. Production Footprint

15.4.11.5. Sales Footprint

15.4.11.6. Channel Footprint

15.4.11.7. Competition Benchmarking

15.4.11.8. Strategy

15.4.11.8.1. Marketing Strategy

15.4.11.8.2. Capacity Strategy

15.4.11.8.3. Channel Strategy

15.4.12. iecam Group

15.4.12.1. Overview

15.4.12.2. Capacity Portfolio

15.4.12.3. Profitability

15.4.12.4. Production Footprint

15.4.12.5. Sales Footprint

15.4.12.6. Channel Footprint

15.4.12.7. Competition Benchmarking

15.4.12.8. Strategy

15.4.12.8.1. Marketing Strategy

15.4.12.8.2. Capacity Strategy

15.4.12.8.3. Channel Strategy

15.4.13. Swallowfield Plc

15.4.13.1. Overview

15.4.13.2. Capacity Portfolio

15.4.13.3. Profitability

15.4.13.4. Production Footprint

15.4.13.5. Sales Footprint

15.4.13.6. Channel Footprint

15.4.13.7. Competition Benchmarking

15.4.13.8. Strategy

15.4.13.8.1. Marketing Strategy

15.4.13.8.2. Capacity Strategy

15.4.13.8.3. Channel Strategy

15.4.14. Libo Cosmetics Company, Ltd.

15.4.14.1. Overview

15.4.14.2. Capacity Portfolio

15.4.14.3. Profitability

15.4.14.4. Production Footprint

15.4.14.5. Sales Footprint

15.4.14.6. Channel Footprint

15.4.14.7. Competition Benchmarking

15.4.14.8. Strategy

15.4.14.8.1. Marketing Strategy

15.4.14.8.2. Capacity Strategy

15.4.14.8.3. Channel Strategy

15.4.15. Piramal Glass Private Limited

15.4.15.1. Overview

15.4.15.2. Capacity Portfolio

15.4.15.3. Profitability

15.4.15.4. Production Footprint

15.4.15.5. Sales Footprint

15.4.15.6. Channel Footprint

15.4.15.7. Competition Benchmarking

15.4.15.8. Strategy

15.4.15.8.1. Marketing Strategy

15.4.15.8.2. Capacity Strategy

15.4.15.8.3. Channel Strategy

15.4.16. Albea S.A.

15.4.16.1. Overview

15.4.16.2. Capacity Portfolio

15.4.16.3. Profitability

15.4.16.4. Production Footprint

15.4.16.5. Sales Footprint

15.4.16.6. Channel Footprint

15.4.16.7. Competition Benchmarking

15.4.16.8. Strategy

15.4.16.8.1. Marketing Strategy

15.4.16.8.2. Capacity Strategy

15.4.16.8.3. Channel Strategy

15.4.17. Verescence France SASU

15.4.17.1. Overview

15.4.17.2. Capacity Portfolio

15.4.17.3. Profitability

15.4.17.4. Production Footprint

15.4.17.5. Sales Footprint

15.4.17.6. Channel Footprint

15.4.17.7. Competition Benchmarking

15.4.17.8. Strategy

15.4.17.8.1. Marketing Strategy

15.4.17.8.2. Capacity Strategy

15.4.17.8.3. Channel Strategy

15.4.18. Fusion Packaging

15.4.18.1. Overview

15.4.18.2. Capacity Portfolio

15.4.18.3. Profitability

15.4.18.4. Production Footprint

15.4.18.5. Sales Footprint

15.4.18.6. Channel Footprint

15.4.18.7. Competition Benchmarking

15.4.18.8. Strategy

15.4.18.8.1. Marketing Strategy

15.4.18.8.2. Capacity Strategy

15.4.18.8.3. Channel Strategy

15.4.19. HCP Packaging

15.4.19.1. Overview

15.4.19.2. Capacity Portfolio

15.4.19.3. Profitability

15.4.19.4. Production Footprint

15.4.19.5. Sales Footprint

15.4.19.6. Channel Footprint

15.4.19.7. Competition Benchmarking

15.4.19.8. Strategy

15.4.19.8.1. Marketing Strategy

15.4.19.8.2. Capacity Strategy

15.4.19.8.3. Channel Strategy

15.4.20. Premi spa

15.4.20.1. Overview

15.4.20.2. Capacity Portfolio

15.4.20.3. Profitability

15.4.20.4. Production Footprint

15.4.20.5. Sales Footprint

15.4.20.6. Channel Footprint

15.4.20.7. Competition Benchmarking

15.4.20.8. Strategy

15.4.20.8.1. Marketing Strategy

15.4.20.8.2. Capacity Strategy

15.4.20.8.3. Channel Strategy

16. Assumptions and Acronyms Used

17. Research Methodology

List of Tables

Table 01: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tonnes), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 02: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tonnes), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 03: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 04: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

Table 05: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Region, 2014 (A) – 2027 (F)

Table 06: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F)

Table 07: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 08: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 09: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 10: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

Table 11: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F)

Table 12: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 13: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 14: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 15: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

Table 16: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F) (1/2)

Table 17: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F) (2/2)

Table 18: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 19: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 20: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 21: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

Table 22: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F) (1/2)

Table 23: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 24: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 25: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 26: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

Table 27: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Country, 2014 (H) – 2027 (F)

Table 28: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (1/2)

Table 29: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Product, 2014 (A) – 2027 (F) (2/2)

Table 30: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Capacity, 2014 (A) – 2027 (F)

Table 31: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), Historical & Forecast, by Application, 2014 (A) – 2027 (F)

List of Figures

Figure 01: Global Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018 (A) – 2027 (F)

Figure 02: Global Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 03: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y growth, by Capacity, 2015 & 2027

Figure 04: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y growth, by Product, 2015 & 2027

Figure 05: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y growth, by Application, 2015 & 2027

Figure 06: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y growth, by Region, 2015 & 2027

Figure 07: Global Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 08: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 09: Global Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 10: Global Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 11: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 12: Global Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 13: Global Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 14: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 15: Global Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027

Figure 16: Global Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Region, 2019 (E) & 2027 (F)

Figure 17: Global Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Region, 2019 (E) – 2027 (F)

Figure 18: Global Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Region, 2019-2027

Figure 19: North America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018–2027

Figure 20: North America Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018–2027

Figure 21: North America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Country, 2019 (E) & 2027 (F)

Figure 22: North America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Country, 2019 (E) – 2027 (F)

Figure 23: North America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Country, 2019-2027

Figure 24: North America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 25: North America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 26: North America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 27: North America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 28: North America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 29: North America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 30: North America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 31: North America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 32: North America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027

Figure 33: Latin America Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018–2027

Figure 34: Latin America Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018–2027

Figure 35: Latin America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Country, 2019 (E) & 2027 (F)

Figure 36: Latin America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Country, 2019 (E) – 2027 (F)

Figure 37: Latin America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Country, 2019-2027

Figure 38: Latin America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 39: Latin America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 40: Latin America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 41: Latin America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 42: Latin America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 43: Latin America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 44: Latin America Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 45: Latin America Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 46: Latin America Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027

Figure 47: Europe Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018–2027

Figure 48: Europe Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018–2027

Figure 49: Europe Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Country, 2019 (E) & 2027 (F)

Figure 50: Europe Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Country, 2019 (E) – 2027 (F)

Figure 51: Europe Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Country, 2019-2027

Figure 52: Europe Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 53: Europe Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 54: Europe Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 55: Europe Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 56: Europe Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 57: Europe Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 58: Europe Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 59: Europe Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 60: Europe Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027

Figure 61: Asia Pacific Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018–2027

Figure 62: Asia Pacific Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018–2027

Figure 63: Asia Pacific Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Country, 2019 (E) & 2027 (F)

Figure 64: Asia Pacific Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Country, 2019 (E) – 2027 (F)

Figure 65: Asia Pacific Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Country, 2019-2027

Figure 66: Asia Pacific Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 67: Asia Pacific Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 68: Asia Pacific Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 69: Asia Pacific Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 70: Asia Pacific Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 71: Asia Pacific Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 72: Asia Pacific Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 73: Asia Pacific Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 74: Asia Pacific Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027

Figure 75: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Value (US$ Mn) and Volume (Tons), 2018–2027

Figure 76: Middle East & Africa Cosmetic and Perfume Glass Packaging Market, Absolute $ Opportunity Analysis, 2018–2027

Figure 77: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Market Share & Basis Points (BPS) Analysis, by Country, 2019 (E) & 2027 (F)

Figure 78: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Country, 2019 (E) – 2027 (F)

Figure 79: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Country, 2019-2027

Figure 80: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Product, 2019 (E) & 2027 (F)

Figure 81: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Product, 2019 (E) – 2027 (F)

Figure 82: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Product, 2019-2027

Figure 83: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Capacity, 2019 (E) & 2027 (F)

Figure 84: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Capacity, 2019 (E) – 2027 (F)

Figure 85: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Capacity, 2019-2027

Figure 86: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Share & Basis Points (BPS) Analysis, by Application, 2019 (E) & 2027 (F)

Figure 87: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Y-o-Y Growth, by Application, 2019 (E) – 2027 (F)

Figure 88: Middle East & Africa Cosmetic and Perfume Glass Packaging Market Attractiveness Index, by Application, 2019-2027