Analyst Viewpoint

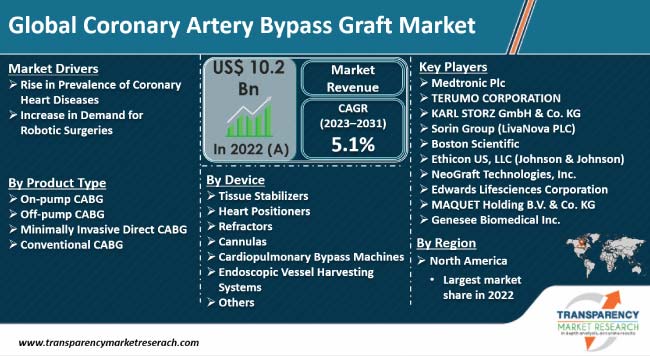

Rise in prevalence of coronary heart disease and growth in geriatric population are some of the key coronary artery bypass graft market drivers. Coronary artery bypass graft allows for the removal of fatty build-up and blockages in arteries through minimally invasive surgeries. Advancements in the surgical sector, including robotic surgeries, are fueling the demand for coronary artery bypass grafts, thereby augmenting market progress.

Growth in technological developments in the global healthcare sector, especially in developing countries, is likely to offer lucrative coronary artery bypass graft market opportunities to companies operating in the industry. Key players are investing substantially in the manufacture of polymer-based restorative devices for cardiovascular treatment. Thus, increase in investments in product development is a vital coronary artery bypass graft marketing strategy adopted by the leading companies.

Coronary artery bypass graft is a surgical procedure conducted for the treatment of heart diseases. The procedure increases blood flow and oxygen supply to the heart by diverting blood around clogged parts of the major arteries.

Coronary artery bypass surgery is performed to create a new path for blood flow to the heart. In this surgery, a healthy blood vessel from another body part is used to redirect blood around the blocked artery.

Adequate blood flow, lower risk of stroke, less possibility of respiratory diseases, and reduced chest pain and shortness of breath are some of the prominent advantages of the coronary artery bypass graft.

Single or multiple grafts are used in coronary surgeries depending on the number of blockages and severity of blood clotting in the arteries. These grafts are extensively employed during minimally invasive surgeries, as these surgeries entail fewer incisions and require less time to operate.

Coronary heart diseases are caused by blocked or interrupted blood supply to the heart due to a build-up of fatty substances in coronary arteries. Obstructive coronary artery diseases, non-obstructive artery diseases, and spontaneous coronary artery dissection are the major types of heart diseases that occur due to interrupted blood supply.

Growth in sedentary lifestyles, changes in eating habits, and increase in obesity are resulting in high prevalence of coronary heart diseases among adults and the geriatric population. Thus, rise in prevalence of coronary heart diseases among the geriatric population is driving the coronary artery bypass graft market revenue.

According to data published by the Journal of the American Heart Association in January 2023, more than 70% of people over 70 years of age are likely to develop cardiovascular diseases, and more than two-thirds would also have associated non-cardiovascular comorbidities. Thus, increase in geriatric population across the globe is driving the need for heart artery bypass, which in turn, is likely to spur the market dynamics.

Robot-assisted surgeries allow surgeons to perform complex procedures with more precision. These are minimally invasive surgeries that are less risky and have smaller surgical cuts. Minimally invasive coronary artery bypass graft surgery ensures fewer incisions, reduced hospitalization period, less blood loss, and high surgical accuracy. Thus, surgeons are increasingly preferring minimally invasive procedures to enhance accuracy and ensure patient safety.

Development of healthcare facilities in emerging countries is augmenting the availability of coronary artery disease surgical treatment, thereby fostering the coronary artery bypass graft market growth.

Public healthcare organizations and governments are investing significantly in the improvement of healthcare infrastructure to meet the surging demand for advanced treatments for coronary diseases. For instance, Million Hearts, a national initiative by the Department of Health & Human Services, aims to prevent one million heart attacks and strokes within five years. The Million Hearts Cardiac Rehabilitation Collaborative (CRC) is an open forum of multi-disciplinary professionals taking action to help at least 70% of eligible patients participate in cardiac rehabilitation.

As per the regional coronary artery bypass graft market analysis, North America dominated the global landscape in 2022. Increase in awareness about cardiovascular diseases and rise in access to advanced medical facilities are likely to propel the coronary artery bypass graft industry share of the region during the forecast period.

According to the Centers for Disease Control and Prevention, around 695,000 people in the U.S. died from heart disease in 2021. About 1 in 20 adults aged 20 and older has coronary artery disease, and around 375,476 fatalities were recorded in 2021 due to CAD. Increase in prevalence of strokes and coronary heart diseases is fueling the demand for coronary artery bypass graft in North America.

Companies operating in the global landscape are adopting the latest technologies to improve their product portfolio. They are investing substantially in the development of advanced products for usage in robotic surgeries. Leading coronary artery bypass graft market manufacturers are also conducting clinical trials to assess safety and efficacy of products.

Boston Scientific, Medtronic Plc, TERUMO CORPORATION, KARL STORZ GmbH & Co. KG, Sorin Group (LivaNova PLC), Ethicon US, LLC (Johnson & Johnson), NeoGraft Technologies, Inc., Edwards Lifesciences Corporation, MAQUET Holding B.V. & Co. KG, and Genesee Biomedical Inc. are the prominent players operating in the global landscape.

The coronary artery bypass graft market report scope covers these leading companies based on parameters such as company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 10.2 Bn |

| Market Forecast (Value) in 2031 | US$ 15.8 Bn |

| Growth Rate (CAGR) | 5.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 10.2 Bn in 2022

It is projected to register a CAGR of 5.1% from 2023 to 2031

Rise in prevalence of coronary heart diseases and increase in demand for robotic surgeries

North America was the most lucrative region in 2022

Boston Scientific, Medtronic Plc, TERUMO CORPORATION, KARL STORZ GmbH & Co. KG, Sorin Group (LivaNova PLC), Ethicon US, LLC (Johnson & Johnson), NeoGraft Technologies, Inc., Edwards Lifesciences Corporation, MAQUET Holding B.V. & Co. KG, and Genesee Biomedical Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Coronary Artery Bypass Graft Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Coronary Artery Bypass Graft Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Coronary Artery Bypass Graft Market Analysis and Forecast, by Product Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. On-pump CABG

6.3.2. Off-pump CABG

6.3.3. Minimally Invasive Direct CABG

6.3.4. Conventional CABG

6.4. Market Attractiveness, by Product Type

7. Global Coronary Artery Bypass Graft Market Analysis and Forecast, by Device

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Device, 2017–2031

7.3.1. Tissue Stabilizers

7.3.2. Heart Positioners

7.3.3. Refractors

7.3.4. Cannulas

7.3.5. Cardiopulmonary Bypass Machines

7.3.6. Endoscopic Vessel Harvesting Systems

7.3.7. Others

7.3.8. 7.4 Market Attractiveness, by Device

8. Global Coronary Artery Bypass Graft Market Analysis and Forecast, by Technique

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Technique, 2017–2031

8.3.1. Traditional Vessel Harvesting

8.3.2. Endoscopic Vessel Harvesting (EVH)

8.4. Market Attractiveness, by Technique

9. Global Coronary Artery Bypass Graft Market Analysis and Forecast, by End-user

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Cardiology Clinics

9.3.3. Research & Academic Institutions

9.4. Market Attractiveness, by End-user

10. Global Coronary Artery Bypass Graft Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Coronary Artery Bypass Graft Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. On-pump CABG

11.2.2. Off-pump CABG

11.2.3. Minimally Invasive Direct CABG

11.2.4. Conventional CABG

11.3. Market Attractiveness, by Product Type

11.4. Market Value Forecast, by Device, 2017–2031

11.4.1. Tissue Stabilizers

11.4.2. Heart Positioners

11.4.3. Refractors

11.4.4. Cannulas

11.4.5. Cardiopulmonary Bypass Machines

11.4.6. Endoscopic Vessel Harvesting Systems

11.4.7. Others

11.5. Market Attractiveness, by Device

11.6. Market Value Forecast, by Technique, 2017–2031

11.6.1. Traditional Vessel Harvesting

11.6.2. Endoscopic Vessel Harvesting (EVH)

11.7. Market Attractiveness, by Technique

11.8. Market Value Forecast, by End-user, 2017–2031

11.8.1. Hospitals

11.8.2. Cardiology Clinics

11.8.3. Research & Academic Institutions

11.9. Market Attractiveness, by End-user

11.10. Market Value Forecast, by Country/Sub-region, 2017–2031

11.10.1. U.S.

11.10.2. Canada

11.11. Market Attractiveness Analysis

11.11.1. By Product Type

11.11.2. By Device

11.11.3. By Technique

11.11.4. By End-user

11.11.5. By Country

12. Europe Coronary Artery Bypass Graft Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. On-pump CABG

12.2.2. Off-pump CABG

12.2.3. Minimally Invasive Direct CABG

12.2.4. Conventional CABG

12.3. Market Attractiveness, by Product Type

12.4. Market Value Forecast, by Device, 2017–2031

12.4.1. Tissue Stabilizers

12.4.2. Heart Positioners

12.4.3. Refractors

12.4.4. Cannulas

12.4.5. Cardiopulmonary Bypass Machines

12.4.6. Endoscopic Vessel Harvesting Systems

12.4.7. Others

12.5. Market Attractiveness, by Device

12.6. Market Value Forecast, by Technique, 2017–2031

12.6.1. Traditional Vessel Harvesting

12.6.2. Endoscopic Vessel Harvesting (EVH)

12.7. Market Attractiveness, by Technique

12.8. Market Value Forecast, by End-user, 2017–2031

12.8.1. Hospitals

12.8.2. Cardiology Clinics

12.8.3. Research & Academic Institutions

12.9. Market Attractiveness, by End-user

12.10. Market Value Forecast, by Country/Sub-region, 2017–2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Italy

12.10.5. Spain

12.10.6. Rest of Europe

12.11. Market Attractiveness Analysis

12.11.1. By Product Type

12.11.2. By Device

12.11.3. By Technique

12.11.4. By End-user

12.11.5. By Country/Sub-region

13. Asia Pacific Coronary Artery Bypass Graft Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. On-pump CABG

13.2.2. Off-pump CABG

13.2.3. Minimally Invasive Direct CABG

13.2.4. Conventional CABG

13.3. Market Attractiveness, by Product Type

13.4. Market Value Forecast, by Device, 2017–2031

13.4.1. Tissue Stabilizers

13.4.2. Heart Positioners

13.4.3. Refractors

13.4.4. Cannulas

13.4.5. Cardiopulmonary Bypass Machines

13.4.6. Endoscopic Vessel Harvesting Systems

13.4.7. Others

13.5. Market Attractiveness, by Device

13.6. Market Value Forecast, by Technique, 2017–2031

13.6.1. Traditional Vessel Harvesting

13.6.2. Endoscopic Vessel Harvesting (EVH)

13.7. Market Attractiveness, by Technique

13.8. Market Value Forecast, by End-user, 2017–2031

13.8.1. Hospitals

13.8.2. Cardiology Clinics

13.8.3. Research & Academic Institutions

13.9. Market Attractiveness, by End-user

13.10. Market Value Forecast, by Country/Sub-region, 2017–2031

13.10.1. China

13.10.2. Japan

13.10.3. India

13.10.4. Australia & New Zealand

13.10.5. Rest of Asia Pacific

13.11. Market Attractiveness Analysis

13.11.1. By Product Type

13.11.2. By Device

13.11.3. By Technique

13.11.4. By End-user

13.11.5. By Country/Sub-region

14. Latin America Coronary Artery Bypass Graft Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. On-pump CABG

14.2.2. Off-pump CABG

14.2.3. Minimally Invasive Direct CABG

14.2.4. Conventional CABG

14.3. Market Attractiveness, by Product Type

14.4. Market Value Forecast, by Device, 2017–2031

14.4.1. Tissue Stabilizers

14.4.2. Heart Positioners

14.4.3. Refractors

14.4.4. Cannulas

14.4.5. Cardiopulmonary Bypass Machines

14.4.6. Endoscopic Vessel Harvesting Systems

14.4.7. Others

14.5. Market Attractiveness, by Device

14.6. Market Value Forecast, by Technique, 2017–2031

14.6.1. Traditional Vessel Harvesting

14.6.2. Endoscopic Vessel Harvesting (EVH)

14.7. Market Attractiveness, by Technique

14.8. Market Value Forecast, by End-user, 2017–2031

14.8.1. Hospitals

14.8.2. Cardiology Clinics

14.8.3. Research & Academic Institutions

14.9. Market Attractiveness, by End-user

14.10. Market Value Forecast, by Country/Sub-region, 2017–2031

14.10.1. Brazil

14.10.2. Mexico

14.10.3. Rest of Latin America

14.11. Market Attractiveness Analysis

14.11.1. By Product Type

14.11.2. By Device

14.11.3. By Technique

14.11.4. By End-user

14.11.5. By Country/Sub-region

15. Middle East & Africa Coronary Artery Bypass Graft Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. On-pump CABG

15.2.2. Off-pump CABG

15.2.3. Minimally Invasive Direct CABG

15.2.4. Conventional CABG

15.3. Market Attractiveness, by Product Type

15.4. Market Value Forecast, by Device, 2017–2031

15.4.1. Tissue Stabilizers

15.4.2. Heart Positioners

15.4.3. Refractors

15.4.4. Cannulas

15.4.5. Cardiopulmonary Bypass Machines

15.4.6. Endoscopic Vessel Harvesting Systems

15.4.7. Others

15.5. Market Attractiveness, by Device

15.6. Market Value Forecast, by Technique, 2017–2031

15.6.1. Traditional Vessel Harvesting

15.6.2. Endoscopic Vessel Harvesting (EVH)

15.7. Market Attractiveness, by Technique

15.8. Market Value Forecast, by End-user, 2017–2031

15.8.1. Hospitals

15.8.2. Cardiology Clinics

15.8.3. Research & Academic Institutions

15.9. Market Attractiveness, by End-user

15.10. Market Value Forecast, by Country/Sub-region, 2017–2031

15.10.1. GCC Countries

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Market Attractiveness Analysis

15.11.1. By Product Type

15.11.2. By Device

15.11.3. By Technique

15.11.4. By End-user

15.11.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Medtronic Plc

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. TERUMO CORPORATION

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. KARL STORZ GmbH & Co. KG

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Sorin Group (LivaNova PLC)

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Boston Scientific

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Ethicon US, LLC (Johnson & Johnson)

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. NeoGraft Technologies, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Edwards Lifesciences Corporation

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. MAQUET Holding B.V. & Co. KG

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Genesee Biomedical Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 03: Global Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 05: Global Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: North America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 9: North America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 10: North America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 13: Europe Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 14: Europe Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 15: Europe Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Asia Pacific Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 19: Asia Pacific Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 20: Asia Pacific Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Latin America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 24: Latin America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 25: Latin America Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 28: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Device, 2017–2031

Table 29: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 30: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Coronary Artery Bypass Graft Market Size (US$ Mn), by Region, 2022 and 2031

Figure 02: Global Coronary Artery Bypass Graft Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Coronary Artery Bypass Graft Market Value Share, by Product Type, 2022

Figure 04: Global Coronary Artery Bypass Graft Market Revenue (US$ Mn), by Device, 2022

Figure 05: Global Coronary Artery Bypass Graft Market Value Share, by Device, 2022

Figure 06: Global Coronary Artery Bypass Graft Market Revenue (US$ Mn), by Technique, 2022

Figure 07: Global Coronary Artery Bypass Graft Market Value Share, by Technique, 2022

Figure 08: Global Coronary Artery Bypass Graft Market Revenue (US$ Mn), by End-user, 2022

Figure 09: Global Coronary Artery Bypass Graft Market Value Share, by End-user, 2022

Figure 10: Global Coronary Artery Bypass Graft Market Value Share, by Region, 2022

Figure 11: Global Coronary Artery Bypass Graft Market Value (US$ Mn) Forecast, 2017–2031

Figure 12: Global Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 13: Global Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 14: Global Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 15: Global Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023-2031

Figure 16: Global Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 17: Global Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023-2031

Figure 18: Global Coronary Artery Bypass Graft Market Revenue (US$ Mn), by End-user, 2022

Figure 19: Global Coronary Artery Bypass Graft Market Value Share, by End-user, 2022

Figure 20: Global Coronary Artery Bypass Graft Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Coronary Artery Bypass Graft Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Coronary Artery Bypass Graft Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 23: North America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Country, 2023–2031

Figure 24: North America Coronary Artery Bypass Graft Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 26: North America Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 27: North America Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 28: North America Coronary Artery Bypass Graft Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: North America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 30: North America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023–2031

Figure 31: North America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023–2031

Figure 32: North America Coronary Artery Bypass Graft Market Attractiveness Analysis, by End-user, 2023–2031

Figure 33: Europe Coronary Artery Bypass Graft Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 34: Europe Coronary Artery Bypass Graft Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 35: Europe Coronary Artery Bypass Graft Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 37: Europe Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 38: Europe Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 39: Europe Coronary Artery Bypass Graft Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Europe Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 41: Europe Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023–2031

Figure 42: Europe Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023–2031

Figure 43: Europe Coronary Artery Bypass Graft Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Asia Pacific Coronary Artery Bypass Graft Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 45: Asia Pacific Coronary Artery Bypass Graft Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Asia Pacific Coronary Artery Bypass Graft Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 48: Asia Pacific Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 49: Asia Pacific Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 50: Asia Pacific Coronary Artery Bypass Graft Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Asia Pacific Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 52: Asia Pacific Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023–2031

Figure 53: Asia Pacific Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023–2031

Figure 54: Asia Pacific Coronary Artery Bypass Graft Market Attractiveness Analysis, by End-user, 2022–2031

Figure 55: Latin America Coronary Artery Bypass Graft Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 56: Latin America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 57: Latin America Coronary Artery Bypass Graft Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Latin America Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 59: Latin America Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 60: Latin America Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 61: Latin America Coronary Artery Bypass Graft Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 63: Latin America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023–2031

Figure 64: Latin America Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023–2031

Figure 65: Latin America Coronary Artery Bypass Graft Market Attractiveness Analysis, by End-user, 2023–2031

Figure 66: Middle East & Africa Coronary Artery Bypass Graft Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 67: Middle East & Africa Coronary Artery Bypass Graft Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 68: Middle East & Africa Coronary Artery Bypass Graft Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Middle East & Africa Coronary Artery Bypass Graft Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 70: Middle East & Africa Coronary Artery Bypass Graft Market Value Share Analysis, by Device, 2022 and 2031

Figure 71: Middle East & Africa Coronary Artery Bypass Graft Market Value Share Analysis, by Technique, 2022 and 2031

Figure 72: Middle East & Africa Coronary Artery Bypass Graft Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Middle East & Africa Coronary Artery Bypass Graft Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 74: Middle East & Africa Coronary Artery Bypass Graft Market Attractiveness Analysis, by Device, 2023–2031

Figure 75: Middle East & Africa Coronary Artery Bypass Graft Market Attractiveness Analysis, by Technique, 2023–2031

Figure 76: Middle East & Africa Coronary Artery Bypass Graft Market Attractiveness Analysis, by End-user, 2023–2031