Analysts’ Viewpoint

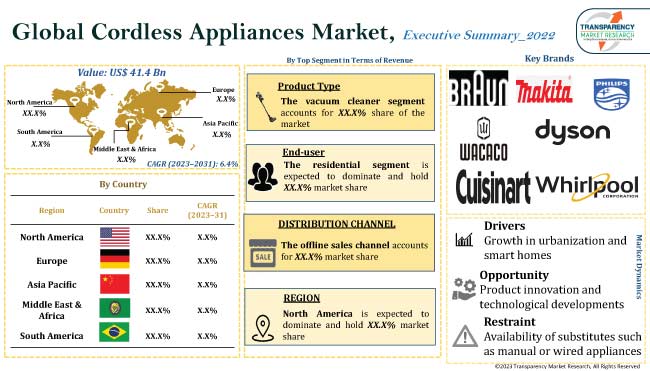

Rise in adoption of convenient and smart appliances owing to growth in number of smart homes is a significant factor driving the cordless appliances market value. Rapid urbanization further drives the usage of cordless appliances due to the surge in demand for space saving gadgets.

However, the usage of manual or powered/wired appliances is hampering market progress. Nevertheless, key players are focusing on introducing innovative appliances and smart connectivity through smartphone apps. They are also offering multiple function options, wireless charging technology, and noise reduction technology to strengthen their industry position. In line with the latest cordless appliances market trends, prominent players are collaborating with different companies to introduce new technologies and advanced products to increase their market share.

Cordless appliances are handheld appliances or wireless appliances that are not connected to any power outlet and are mostly powered by rechargeable batteries. The devices come in different types, price points, designs, and sizes. Cordless appliances, such as vacuum cleaners, blenders, and kettles, have become highly popular across regions. These portable appliances provide flexibility and are equipped with a more modern and compact design.

Steady rise in usage of space-saving products, which mirrors rapid growth in usage of cordless appliances, is driving the cordless appliances market size worldwide, especially in North America. Innovations in the cordless appliances market and their various features, product options, and minimum to maximum price categories are fueling market expansion.

Demand for smart appliances is increasing with the expansion of smart homes. Cordless appliances provide more mobility and flexibility as they are cordless, so end-users can move them anywhere without constraint, particularly in tasks such as cooking, cleaning, and grooming. This is accelerating cordless appliances market development. These appliances are highly convenient and easy to use and eliminate managing cords and the need for a proper power outlet; therefore, customers nowadays are adopting cordless appliances as it is easier to use them and reduces clutter in living spaces. Rapid urbanization is boosting the demand for cord-free appliances as living spaces become smaller and customers increasingly seek more space saving and compact appliances.

Several market players are launching innovative products and focusing on sustainable designs using recyclable materials, which also reduces energy consumption. Products with developed battery technology, such as longer battery life and fast charging options, to meet the rise in demand for these appliances across the globe are fueling the demand for cordless appliances in the market.

The cordless appliances market segmentation in terms of distribution channel includes online and offline. The offline segment held a larger cordless appliances market share in 2022. People still buy mostly from offline or physical stores, as buying appliances physically gives customers more satisfaction and security as they can check the quality, required color, and size, and further get assistance from sales staff regarding different product features, quality, and price differences. It also gives assurance to many customers that they are buying the original product.

However, the online sales channel is steadily rising in terms of growth rate as a number of customers have started buying these appliances through online distribution channels such as company owned websites and e-commerce websites, which is likely to continue in the next few years.

According to the latest cordless appliances market forecast, in terms of region, North America holds significant share globally. The U.S. and Canada are majorly contributing to cordless appliances market expansion in North America. Customers in this region look for more technologically advanced and convenient products, which drives market statistics.

According to the latest cordless appliances market research, Europe and Asia Pacific are also estimated to emerge as lucrative regions for cordless appliances during the forecast period. Countries such as China, Japan, and India are opting for these types of appliances. Rapid urbanization in Asia Pacific is expected to further boost the cordless appliances market growth in the region.

Most of the companies operating in the global landscape are investing in R&D activities, primarily to develop innovative products and come up with the latest innovations in cordless appliances. They are adopting strategies such as expansion of product portfolio and mergers & acquisitions to expand their global footprint and capitalize on cordless appliances market opportunities.

Top manufacturers of cordless appliances are Braun, Philips, Matika Tools, Cuisinart, Dyson, Tineco, Megachef, Wacaco, Keurig, and Whirlpool Corporation. These companies are carrying out advanced improvements in cordless appliances to boost their industry share.

Each of these players has been profiled in the global cordless appliances market report in terms of parameters such as company overview, product portfolio, business strategies, financial overview, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 41.4 Bn |

|

Market Forecast Value in 2031 |

US$ 77.2 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key brand analysis, and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 41.4 Bn in 2022

It is expected to reach US$ 77.2 Bn by 2031

It is estimated to grow at a CAGR of 6.4% from 2023 to 2031

Growth in urbanization and smart homes with surge in technological advancement

The residential segment holds major share

North America is a more attractive region for vendors, followed by Europe and Asia Pacific

Braun, Philips, Matika Tools, Cuisinart, Dyson, Tineco, Megachef, Wacaco, Keurig, and Whirlpool Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technology Analysis

5.8. Regulations and Guidelines

5.9. Global Cordless Appliances Market Analysis, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Cordless Appliances Market Analysis and Forecast, By Product Type

6.1. Global Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

6.1.1. Vacuum Cleaner

6.1.1.1. Upto 300 watt

6.1.1.2. 300 to 700 watt

6.1.1.3. Above 700 watt

6.1.2. Mixer

6.1.2.1. Full size mixer

6.1.2.2. Hand Mixer

6.1.3. Blender

6.1.3.1. Full size Blender

6.1.3.2. Hand Blender

6.1.4. Electric Kettle

6.1.4.1. Upto 1 liter

6.1.4.2. 1 to 2 liter

6.1.4.3. Above 2 liter

6.1.5. Coffee maker

6.1.5.1. Upto 240 ml

6.1.5.2. 240 to 500 ml

6.1.5.3. Above 500 ml

6.1.6. Chopper

6.1.7. Electric shaker

6.1.8. Lamp

6.1.9. Table Fan

6.1.10. Iron

6.1.11. Hair Dryer

6.1.12. Portable Speakers

6.1.13. Others

6.2. Incremental Opportunity, By Product Type

7. Global Cordless Appliances Market Analysis and Forecast, By End-user

7.1. Global Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

7.1.1. Residential

7.1.2. Commercial

7.2. Incremental Opportunity, By End user

8. Global Cordless Appliances Market Analysis and Forecast, By Distribution Channel

8.1. Global Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

8.1.1. Online

8.1.1.1. E-commerce Websites

8.1.1.2. Company-owned Websites

8.1.2. Offline

8.1.2.1. Hypermarket/Supermarket

8.1.2.2. Specialty Stores

8.1.2.3. Other retail stores

8.2. Incremental Opportunity, By Distribution Channel

9. Global Cordless Appliances Market Analysis and Forecast, Region

9.1. Global Cordless Appliances Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, By Region

10. North America Cordless Appliances Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. Key Brand Analysis

10.5. Consumer Buying Behavior Analysis

10.6. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

10.6.1. Vacuum Cleaner

10.6.1.1. Upto 300 watt

10.6.1.2. 300 to 700 watt

10.6.1.3. Above 700 watt

10.6.2. Mixer

10.6.2.1. Full size mixer

10.6.2.2. Hand Mixer

10.6.3. Blender

10.6.3.1. Full size Blender

10.6.3.2. Hand Blender

10.6.4. Electric Kettle

10.6.4.1. Upto 1 litre

10.6.4.2. 1 to 2 litres

10.6.4.3. Above 2 litres

10.6.5. Coffee maker

10.6.5.1. Upto 240 ml

10.6.5.2. 240 to 500 ml

10.6.5.3. Above 500 ml

10.6.6. Chopper

10.6.7. Electric shaker

10.6.8. Lamp

10.6.9. Table Fan

10.6.10. Iron

10.6.11. Hair Dryer

10.6.12. Portable Speakers

10.6.13. Others

10.7. Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

10.7.1. Residential

10.7.2. Commercial

10.8. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

10.8.1. Online

10.8.1.1. E-commerce Websites

10.8.1.2. Company-owned Websites

10.8.2. Offline

10.8.2.1. Hypermarket/Supermarket

10.8.2.2. Specialty Stores

10.8.2.3. Other retail stores

10.9. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Cordless Appliances Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Key Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

11.6.1. Vacuum Cleaner

11.6.1.1. Upto 300 watt

11.6.1.2. 300 to 700 watt

11.6.1.3. Above 700 watt

11.6.2. Mixer

11.6.2.1. Full size mixer

11.6.2.2. Hand Mixer

11.6.3. Blender

11.6.3.1. Full size Blender

11.6.3.2. Hand Blender

11.6.4. Electric Kettle

11.6.4.1. Upto 1 litre

11.6.4.2. 1 to 2 litres

11.6.4.3. Above 2 litres

11.6.5. Coffee maker

11.6.5.1. Upto 240 ml

11.6.5.2. 240 to 500 ml

11.6.5.3. Above 500 ml

11.6.6. Chopper

11.6.7. Electric shaker

11.6.8. Lamp

11.6.9. Table Fan

11.6.10. Iron

11.6.11. Hair Dryer

11.6.12. Portable Speakers

11.6.13. Others

11.7. Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

11.7.1. Residential

11.7.2. Commercial

11.8. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.8.1. Online

11.8.1.1. E-commerce Websites

11.8.1.2. Company-owned Websites

11.8.2. Offline

11.8.2.1. Hypermarket/Supermarket

11.8.2.2. Specialty Stores

11.8.2.3. Other retail stores

11.9. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

11.9.1. U.K

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Cordless Appliances Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Key Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

12.6.1. Vacuum Cleaner

12.6.1.1. Upto 300 watt

12.6.1.2. 300 to 700 watt

12.6.1.3. Above 700 watt

12.6.2. Mixer

12.6.2.1. Full size mixer

12.6.2.2. Hand Mixer

12.6.3. Blender

12.6.3.1. Full size Blender

12.6.3.2. Hand Blender

12.6.4. Electric Kettle

12.6.4.1. Upto 1 litre

12.6.4.2. 1 to 2 litres

12.6.4.3. Above 2 litres

12.6.5. Coffee maker

12.6.5.1. Upto 240 ml

12.6.5.2. 240 to 500 ml

12.6.5.3. Above 500 ml

12.6.6. Chopper

12.6.7. Electric shaker

12.6.8. Lamp

12.6.9. Table Fan

12.6.10. Iron

12.6.11. Hair Dryer

12.6.12. Portable Speakers

12.6.13. Others

12.7. Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

12.7.1. Residential

12.7.2. Commercial

12.8. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.8.1. Online

12.8.1.1. E-commerce Websites

12.8.1.2. Company-owned Websites

12.8.2. Offline

12.8.2.1. Hypermarket/Supermarket

12.8.2.2. Specialty Stores

12.8.2.3. Other retail stores

12.9. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Cordless Appliances Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (USD)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

13.6.1. Vacuum Cleaner

13.6.1.1. Upto 300 watt

13.6.1.2. 300 to 700 watt

13.6.1.3. Above 700 watt

13.6.2. Mixer

13.6.2.1. Full size mixer

13.6.2.2. Hand Mixer

13.6.3. Blender

13.6.3.1. Full size Blender

13.6.3.2. Hand Blender

13.6.4. Electric Kettle

13.6.4.1. Upto 1 litre

13.6.4.2. 1 to 2 litres

13.6.4.3. Above 2 litres

13.6.5. Coffee maker

13.6.5.1. Upto 240 ml

13.6.5.2. 240 to 500 ml

13.6.5.3. Above 500 ml

13.6.6. Chopper

13.6.7. Electric shaker

13.6.8. Lamp

13.6.9. Table Fan

13.6.10. Iron

13.6.11. Hair Dryer

13.6.12. Portable Speakers

13.6.13. Others

13.7. Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

13.7.1. Residential

13.7.2. Commercial

13.8. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

13.8.1. Online

13.8.1.1. E-commerce Websites

13.8.1.2. Company-owned Websites

13.8.2. Offline

13.8.2.1. Hypermarket/Supermarket

13.8.2.2. Specialty Stores

13.8.2.3. Other retail stores

13.9. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Cordless Appliances Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Product Type, 2017 - 2031

14.6.1. Vacuum Cleaner

14.6.1.1. Upto 300 watt

14.6.1.2. 300 to 700 watt

14.6.1.3. Above 700 watt

14.6.2. Mixer

14.6.2.1. Full size mixer

14.6.2.2. Hand Mixer

14.6.3. Blender

14.6.3.1. Full size Blender

14.6.3.2. Hand Blender

14.6.4. Electric Kettle

14.6.4.1. Upto 1 litre

14.6.4.2. 1 to 2 litres

14.6.4.3. Above 2 litres

14.6.5. Coffee maker

14.6.5.1. Upto 240 ml

14.6.5.2. 240 to 500 ml

14.6.5.3. Above 500 ml

14.6.6. Chopper

14.6.7. Electric shaker

14.6.8. Lamp

14.6.9. Table Fan

14.6.10. Iron

14.6.11. Hair Dryer

14.6.12. Portable Speakers

14.6.13. Others

14.7. Cordless Appliances Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

14.7.1. Residential

14.7.2. Commercial

14.8. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

14.8.1. Online

14.8.1.1. E-commerce Websites

14.8.1.2. Company-owned Websites

14.8.2. Offline

14.8.2.1. Hypermarket/Supermarket

14.8.2.2. Specialty Stores

14.8.2.3. Other retail stores

14.9. Cordless Appliances Market Size (US$ Mn and Thousand Units), By Country/Sub-region, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Share Analysis-2022 (%)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue(Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

15.3.1. Braun

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue(Segmental Revenue)

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Product Portfolio & Pricing

15.3.2. Philips

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue(Segmental Revenue)

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Product Portfolio & Pricing

15.3.3. Matika Tools

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue(Segmental Revenue)

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Product Portfolio & Pricing

15.3.4. Cuisinart

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue(Segmental Revenue)

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Product Portfolio & Pricing

15.3.5. Dyson

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue(Segmental Revenue)

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Product Portfolio & Pricing

15.3.6. Tineco

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue(Segmental Revenue)

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Product Portfolio & Pricing

15.3.7. Megachef

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue(Segmental Revenue)

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Product Portfolio & Pricing

15.3.8. Wacaco

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue(Segmental Revenue)

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Product Portfolio & Pricing

15.3.9. Keurig

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue(Segmental Revenue)

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Product Portfolio & Pricing

15.3.10. Whirlpool Corporation

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue(Segmental Revenue)

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Product Portfolio & Pricing

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. End-user

16.1.3. Distribution Channel

16.1.4. Region

16.2. Understanding the Buying Process of Consumers

16.3. Preferred Sales and Marketing Strategy

List of Tables

Table 1: Global Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 2: Global Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 4: Global Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 5: Global Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 6: Global Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 8: Global Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 10: North America Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 11: North America Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 12: North America Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 13: North America Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 14: North America Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 16: North America Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Table 17: Europe Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 18: Europe Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 19: Europe Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 20: Europe Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 21: Europe Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 22: Europe Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 24: Europe Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Table 25: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 26: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 27: Asia Pacific Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 28: Asia Pacific Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 29: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 32: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Table 33: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 34: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 35: Middle East & Africa Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 36: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 37: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 40: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Table 41: South America Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Table 42: South America Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Table 43: South America Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Table 44: South America Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Table 45: South America Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 46: South America Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South America Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Table 48: South America Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Figure 2: Global Cordless Appliances Market Volume (Thousand Units), by Product Type, 2017-2031

Figure 3: Global Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Global Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 5: Global Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 6: Global Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 7: Global Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 8: Global Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 10: Global Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 11: Global Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 13: North America Cordless Appliances Market Value (US$ Mn), by Type, 2017-2031

Figure 14: North America Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Figure 15: North America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 16: North America Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 17: North America Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 18: North America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 19: North America Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 20: North America Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 22: North America Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 23: North America Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 24: North America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 25: Europe Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Figure 26: Europe Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Figure 27: Europe Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 28: Europe Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 29: Europe Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 30: Europe Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 31: Europe Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 32: Europe Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 34: Europe Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 35: Europe Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Europe Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 37: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Figure 38: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Figure 39: Asia Pacific Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 40: Asia Pacific Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 41: Asia Pacific Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 42: Asia Pacific Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 43: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 44: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 46: Asia Pacific Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 47: Asia Pacific Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 48: Asia Pacific Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 49: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Figure 50: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Figure 51: Middle East & Africa Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 52: Middle East & Africa Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 53: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 54: Middle East & Africa Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 55: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 56: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Middle East & Africa Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 59: Middle East & Africa Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Middle East & Africa Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 61: South America Cordless Appliances Market Value (US$ Mn), by Product Type, 2017-2031

Figure 62: South America Cordless Appliances Market Volume (Thousand Units), by Product Type 2017-2031

Figure 63: South America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 64: South America Cordless Appliances Market Value (US$ Mn), By End-user, 2017-2031

Figure 65: South America Cordless Appliances Market Volume (Thousand Units), By End-user 2017-2031

Figure 66: South America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, By End-user, 2023-2031

Figure 67: South America Cordless Appliances Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 68: South America Cordless Appliances Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 70: South America Cordless Appliances Market Value (US$ Mn), by Region, 2017-2031

Figure 71: South America Cordless Appliances Market Volume (Thousand Units), by Region 2017-2031

Figure 72: South America Cordless Appliances Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031