According to Transparency Market Research’s recent report titled “Converting Paper Market Global Industry Analysis, Size, Share, Growth, Trends, Historic Analysis 2014–2018 and Forecast 2019–2027,” the growth of the paper packaging industry is attributed to boost the demand for converting paper during the forecast period. The global market for converting paper was valued at US$ 375.9 Bn in 2018 and is projected to expand at a poor CAGR of 1.9%, during the forecast period (2019-2027).

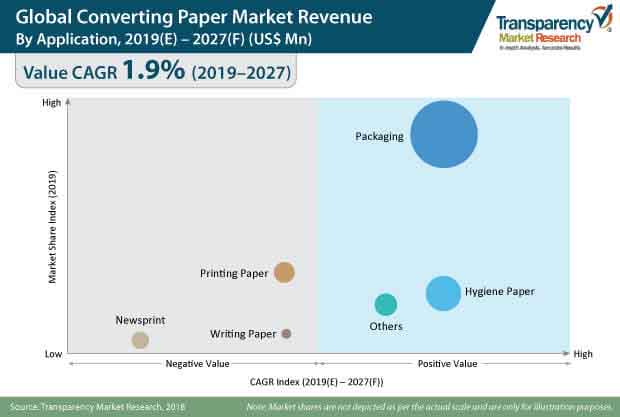

The global converting paper market is segmented on the basis of application, end-use, pulp type, and paper type. In terms of application, the converting paper market is segmented into printing paper, newsprint, writing paper, hygiene paper, packaging, and others. In the packaging segment, converting paper is used for manufacturing carton board, corrugated board, and flexible paper.

More than half of the converting paper is used in the packaging applications owing to low cost and eco-friendly packaging formats. In the global converting paper market, newsprints, printing papers, and writing papers application segments are expected to reduce in market size during the forecast period. The carton board segment is projected to witness fast-paced growth throughout the forecast period.

The consumption of converting paper for tasks apart from writing and printing is increasing across the globe. For example, sanitary and packaging markets are becoming the emerging end users for the converting paper market. The adoption of converting paper for industrial packaging is increasing owing to low cost and sustainability as compared to plastic, metal, and glass. The use of converting paper material for manufacturing of intermediate bulk containers, liners, sacks, and absorbents has considerably increased in the past few years owing to the high-quality products offered by packaging leaders such as Sealed Air, Mondi, DS Smith, and others.

The evolving e-commerce industry is embracing converting paper for shipment packaging owing to the quality expectations of customers and the need for lightweight packaging formats. Penetration of E-Commerce in the retail market is growing at a substantial rate. With this growth, the demand for efficient packaging solutions is also increasing. Packaging is one of the key factors influencing consumer preference. Companies want to stay a step ahead of their competitors to ensure maximum market share, which is why, they are willing to invest in superior packaging solutions. Also, using sturdy corrugated boxes for transit ensures safe delivery of the product.

The growing adoption of digitalization is expected to reduce the demand for printing and writing paper. Digital media and paperless communication are replacing paper, and threatening the traditional market for newsprint and office paper. The market share of printing and writing paper is shifting to packaging paper owing to the growth of the e-commerce market and consumer preference for converting paper packaging formats. Digitalization is negatively affecting printing and writing paper markets, but it still has benefits for converting paper manufacturers and suppliers. With the help of digital tools, converting paper and packaging companies are improving their customer services and manufacturing activities to ensure improved product quality, tracking information of shipped goods, and convenient customer support.

The global converting paper market critically analysed key players during the course of the study. These include Stora Enso Oyj, Georgia-Pacific LLC, Canfor Corporation, International Paper Company, Clearwater Paper Corporation, UPM-Kymmene Oyj, P.H. Glatfelter Co., Domtar Corporation, Mitsubishi Paper Mills Limited, Verso Corporation, BillerudKorsnäs AB, Burgo Group SPA, Twin Rivers Paper Company Inc., American Eagle Paper Mills, Delta Paper Corp., Catalyst Paper Corporation, Asia Pacific Resources International Holdings Ltd., Rolland Enterprises Inc., Alberta Newsprint Company Ltd., and Finch Paper LLC.

Changing Industry Dynamics in Converting Paper Market Stimulates Adoption of Cutting-Edge Converter Machines

Converter paper, or the converting process for fiber, has attracted scant attention outside the parlance of the packaging sector, despite the ubiquity of the process in all paper products. A variety of commercial and industrial end users in the converter paper has benefitted from the use of converting process to meet their needs. Some of the common applications in the converting paper market are tissue packaging, nonwoven converting, bag converting, digital printing, writing paper, and hygiene paper. In particular, for the past several years, a rapidly expanding array of use of converting paper in industrial and commercial packaging solutions in the pre-Covid era has lent high lucrativeness to the market. A number of printing techniques have come to the fore that that compatible with the customized demand of end-use industries of the packaging sector. Proliferating demand for corrugated board and flexible paper has spurred consumer demands in the converting paper market. A large proportion of converted paper in the packaging sector is used to offer environmentally friendly solutions to end-use industries such as food services industries. The cost-effectiveness and wide option of economic branding options possible with converted paper in contrast with metal and plastic packaging has spurred the prospects in the converting paper market.

In recent years, the Industry 4.0 has spurred the popularity of automated converting machines, opening new avenues in the converting paper market. Further, there has been a demand for converting paper even in the Covid-19 era to meet the bulk of demand from the e-commerce industry. However, the pandemic-led lockdowns has led to slump in manufacturing especially in the Q2 of 2020. Raw material supply chain also suffered, along with the retail product sales. Thus, stakeholders in the converting paper market, especially in developing economies, lent toward adopting business models that could fit well within their budgets. In the coming months, with the recent emergence of Covid-19 vaccines in healthcare systems, policy makers have been able to paint an optimistic picture of economic growth. Such developments will also expand the horizon of the value chain in the converting paper market.

Converting paper market is anticipated to expand at a CAGR of 1.9% during the forecast period

Converting paper market is driven by rise in demand for consumer paper products, increase in demand for tissue paper and packaging paper

The carton board segment is projected to witness fast-paced growth throughout the forecast period

The United States is estimated to dominate the converting paper market due to the evolving packaging industry and intolerance for plastic products in packaging

Top key players in converting paper market are Canfor Corporation, International Paper Company, Stora Enso Oyj, Georgia-Pacific LLC, Clearwater Paper Corporation, BillerudKorsnäs AB, Burgo Group SPA, Twin Rivers Paper Company Inc.,

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Background

3.1. Global Packaging Industry Outlook

3.2. Global Paper Packaging Industry Outlook

3.3. PESTLE Analysis, by Top 5 Countries

3.4. Porter’s Forces Analysis

3.5. Macro-economic Factors & Correlation Analysis

3.6. Forecast Factors: Relevance and Impact

3.7. Value Chain Analysis

3.7.1. Key Participants

3.7.1.1. Raw Material Suppliers

3.7.1.2. Packaging Manufacturers/Converters

3.7.1.3. Distributors

3.7.1.4. End Users

3.7.2. Profitability Margin

3.8. Market Dynamics

3.8.1. Drivers

3.8.1.1. Supply-side

3.8.1.2. Demand-side

3.8.2. Restraints

3.8.3. Key Trends

3.8.3.1. Product Level Trends

3.8.3.2. Business-level

3.8.4. Opportunities

4. Market Forecast

4.1. Market Volume Projections

4.2. Pricing Analysis

4.3. Market Size Projections

4.3.1. Y-o-Y Projections

4.3.2. Absolute $ Opportunity Analysis

5. Global Converting Paper Market Analysis, by Application

5.1. Introduction

5.1.1. Market Value Share Analysis, by Application

5.1.2. Y-o-Y Growth Analysis, by Application

5.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

5.2.1. Printing Papers

5.2.2. Newsprint

5.2.3. Writing Paper

5.2.4. Hygiene Papers

5.2.5. Packaging

5.2.5.1. Carton Board

5.2.5.2. Corrugated Board

5.2.5.3. Flexible Papers

5.2.6. Others

5.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

5.3.1. Printing Papers

5.3.2. Newsprint

5.3.3. Writing Paper

5.3.4. Hygiene Papers

5.3.5. Packaging

5.3.5.1. Carton Board

5.3.5.2. Corrugated Board

5.3.5.3. Flexible Papers

5.3.6. Others

5.4. Market Attractiveness Analysis, by Application

6. Global Converting Paper Market Analysis, by Pulp Type

6.1. Introduction

6.1.1. Market Value Share Analysis, by Pulp Type

6.1.2. Y-o-Y Growth Analysis, by Pulp Type

6.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

6.2.1. Chemical Wood Pulp

6.2.1.1. Sulphate Pulp

6.2.1.2. Sulphite Pulp

6.2.2. Mechanical Wood Pulp

6.2.3. Non-wood Pulp

6.2.4. Semi-chemical Pulp

6.2.5. Recycled Pulp

6.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

6.3.1. Chemical Wood Pulp

6.3.1.1. Sulphate Pulp

6.3.1.2. Sulphite Pulp

6.3.2. Mechanical Wood Pulp

6.3.3. Non-wood Pulp

6.3.4. Semi-chemical Pulp

6.3.5. Recycled Pulp

6.4. Market Attractiveness Analysis, by Pulp Type

7. Global Converting Paper Market Analysis, by Paper Type

7.1. Introduction

7.1.1. Market Value Share Analysis, by Sealing Type

7.1.2. Y-o-Y Growth Analysis, by Paper Type

7.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

7.2.1. Coated Paper

7.2.2. Uncoated Paper

7.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

7.3.1. Coated Paper

7.3.2. Uncoated Paper

7.4. Market Attractiveness Analysis, by Paper Type

8. Global Converting Paper Market Analysis, by End Use

8.1. Introduction

8.1.1. Market Value Share Analysis, by End Use

8.1.2. Y-o-Y Growth Analysis, by End Use

8.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

8.2.1. Printing

8.2.2. Packing & Wrapping

8.2.3. Consumer Goods

8.2.4. Food Services and Others

8.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

8.3.1. Printing

8.3.2. Packing & Wrapping

8.3.3. Consumer Goods

8.3.4. Food Service and Others

8.4. Market Attractiveness Analysis, by End Use

9. Global Converting Paper Market Analysis, by Region

9.1. Introduction

9.1.1. Market Value Share Analysis, by Region

9.1.2. Y-o-Y Growth Analysis, by Region

9.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific (APAC)

9.2.5. Middle East & Africa (MEA)

9.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific (APAC)

9.3.5. Middle East & Africa (MEA)

9.4. Market Attractiveness Analysis, by Region

10. North America Converting Paper Market Analysis

10.1. Introduction

10.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Country

10.2.1. U.S.

10.2.2. Canada

10.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2028, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

10.4.1. Printing Papers

10.4.2. Newsprint

10.4.3. Writing Paper

10.4.4. Hygiene Papers

10.4.5. Packaging

10.4.5.1. Carton Board

10.4.5.2. Corrugated Board

10.4.5.3. Flexible Papers

10.4.6. Others

10.5. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

10.5.1. Printing Papers

10.5.2. Newsprint

10.5.3. Writing Paper

10.5.4. Hygiene Papers

10.5.5. Packaging

10.5.5.1. Carton Board

10.5.5.2. Corrugated Board

10.5.5.3. Flexible Papers

10.5.6. Others

10.6. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

10.6.1. Chemical Wood Pulp

10.6.1.1. Sulphate Pulp

10.6.1.2. Sulphite Pulp

10.6.2. Mechanical Wood Pulp

10.6.3. Non-wood Pulp

10.6.4. Semi-chemical Pulp

10.6.5. Recycled Pulp

10.7. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

10.7.1. Chemical Wood Pulp

10.7.1.1. Sulphate Pulp

10.7.1.2. Sulphite Pulp

10.7.2. Mechanical Wood Pulp

10.7.3. Non-wood Pulp

10.7.4. Semi-chemical Pulp

10.7.5. Recycled Pulp

10.8. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

10.8.1. Coated Paper

10.8.2. Uncoated Paper

10.9. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

10.9.1. Coated Paper

10.9.2. Uncoated Paper

10.10. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

10.10.1. Printing

10.10.2. Packing & Wrapping

10.10.3. Consumer Goods

10.10.4. Food Services and Others

10.11. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

10.11.1. Printing

10.11.2. Packing & Wrapping

10.11.3. Consumer Goods

10.11.4. Food Service and Others

11. Latin America Converting Paper Market Analysis

11.1. Introduction

11.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Country

11.2.1. Brazil

11.2.2. Mexico

11.2.3. Argentina

11.2.4. Rest of Latin America

11.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2028, by Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

11.4.1. Printing Papers

11.4.2. Newsprint

11.4.3. Writing Paper

11.4.4. Hygiene Papers

11.4.5. Packaging

11.4.5.1. Carton Board

11.4.5.2. Corrugated Board

11.4.5.3. Flexible Papers

11.4.6. Others

11.5. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

11.5.1. Printing Papers

11.5.2. Newsprint

11.5.3. Writing Paper

11.5.4. Hygiene Papers

11.5.5. Packaging

11.5.5.1. Carton Board

11.5.5.2. Corrugated Board

11.5.5.3. Flexible Papers

11.5.6. Others

11.6. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

11.6.1. Chemical Wood Pulp

11.6.1.1. Sulphate Pulp

11.6.1.2. Sulphite Pulp

11.6.2. Mechanical Wood Pulp

11.6.3. Non-wood Pulp

11.6.4. Semi-chemical Pulp

11.6.5. Recycled Pulp

11.7. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

11.7.1. Chemical Wood Pulp

11.7.1.1. Sulphate Pulp

11.7.1.2. Sulphite Pulp

11.7.2. Mechanical Wood Pulp

11.7.3. Non-wood Pulp

11.7.4. Semi-chemical Pulp

11.7.5. Recycled Pulp

11.8. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

11.8.1. Coated Paper

11.8.2. Uncoated Paper

11.9. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

11.9.1. Coated Paper

11.9.2. Uncoated Paper

11.10. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

11.10.1. Printing

11.10.2. Packing & Wrapping

11.10.3. Consumer Goods

11.10.4. Food Services and Others

11.11. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

11.11.1. Printing

11.11.2. Packing & Wrapping

11.11.3. Consumer Goods

11.11.4. Food Service and Others

12. Europe Converting Paper Market Analysis

12.1. Introduction

12.2. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Country

12.2.1. Germany

12.2.2. Italy

12.2.3. France

12.2.4. U.K.

12.2.5. Spain

12.2.6. Benelux

12.2.7. Nordic

12.2.8. Russia

12.2.9. Poland

12.2.10. Rest of Europe

12.3. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2028, by Country

12.3.1. Germany

12.3.2. Italy

12.3.3. France

12.3.4. U.K.

12.3.5. Spain

12.3.6. Benelux

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

12.4.1. Printing Papers

12.4.2. Newsprint

12.4.3. Writing Paper

12.4.4. Hygiene Papers

12.4.5. Packaging

12.4.5.1. Carton Board

12.4.5.2. Corrugated Board

12.4.5.3. Flexible Papers

12.4.6. Others

12.5. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

12.5.1. Printing Papers

12.5.2. Newsprint

12.5.3. Writing Paper

12.5.4. Hygiene Papers

12.5.5. Packaging

12.5.5.1. Carton Board

12.5.5.2. Corrugated Board

12.5.5.3. Flexible Papers

12.5.6. Others

12.6. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

12.6.1. Chemical Wood Pulp

12.6.1.1. Sulphate Pulp

12.6.1.2. Sulphite Pulp

12.6.2. Mechanical Wood Pulp

12.6.3. Non-wood Pulp

12.6.4. Semi-chemical Pulp

12.6.5. Recycled Pulp

12.7. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

12.7.1. Chemical Wood Pulp

12.7.1.1. Sulphate Pulp

12.7.1.2. Sulphite Pulp

12.7.2. Mechanical Wood Pulp

12.7.3. Non-wood Pulp

12.7.4. Semi-chemical Pulp

12.7.5. Recycled Pulp

12.8. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

12.8.1. Coated Paper

12.8.2. Uncoated Paper

12.9. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

12.9.1. Coated Paper

12.9.2. Uncoated Paper

12.10. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

12.10.1. Printing

12.10.2. Packing & Wrapping

12.10.3. Consumer Goods

12.10.4. Food Services and Others

12.11. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

12.11.1. Printing

12.11.2. Packing & Wrapping

12.11.3. Consumer Goods

12.11.4. Food Service and Others

13. APAC Converting Paper Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Country

13.3.1. China

13.3.2. India

13.3.3. ASEAN

13.3.4. Australia and New Zealand

13.3.5. Japan

13.3.6. Rest of APAC

13.4. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2028, by Country

13.4.1. China

13.4.2. India

13.4.3. ASEAN

13.4.4. Australia and New Zealand

13.4.5. Japan

13.4.6. Rest of APAC

13.5. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

13.5.1. Printing Papers

13.5.2. Newsprint

13.5.3. Writing Paper

13.5.4. Hygiene Papers

13.5.5. Packaging

13.5.5.1. Carton Board

13.5.5.2. Corrugated Board

13.5.5.3. Flexible Papers

13.5.6. Others

13.6. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

13.6.1. Printing Papers

13.6.2. Newsprint

13.6.3. Writing Paper

13.6.4. Hygiene Papers

13.6.5. Packaging

13.6.5.1. Carton Board

13.6.5.2. Corrugated Board

13.6.5.3. Flexible Papers

13.6.6. Others

13.7. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

13.7.1. Chemical Wood Pulp

13.7.1.1. Sulphate Pulp

13.7.1.2. Sulphite Pulp

13.7.2. Mechanical Wood Pulp

13.7.3. Non-wood Pulp

13.7.4. Semi-chemical Pulp

13.7.5. Recycled Pulp

13.8. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

13.8.1. Chemical Wood Pulp

13.8.1.1. Sulphate Pulp

13.8.1.2. Sulphite Pulp

13.8.2. Mechanical Wood Pulp

13.8.3. Non-wood Pulp

13.8.4. Semi-chemical Pulp

13.8.5. Recycled Pulp

13.9. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

13.9.1. Coated Paper

13.9.2. Uncoated Paper

13.10. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

13.10.1. Coated Paper

13.10.2. Uncoated Paper

13.11. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

13.11.1. Printing

13.11.2. Packing & Wrapping

13.11.3. Consumer Goods

13.11.4. Food Services and Others

13.12. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

13.12.1. Printing

13.12.2. Packing & Wrapping

13.12.3. Consumer Goods

13.12.4. Food Service and Others

14. MEA Converting Paper Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Country

14.3.1. GCC Countries

14.3.2. Northern Africa

14.3.3. South Africa

14.3.4. Turkey

14.3.5. Rest of MEA

14.4. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2028, by Country

14.4.1. GCC Countries

14.4.2. Northern Africa

14.4.3. South Africa

14.4.4. Turkey

14.4.5. Rest of MEA

14.5. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Application

14.5.1. Printing Papers

14.5.2. Newsprint

14.5.3. Writing Paper

14.5.4. Hygiene Papers

14.5.5. Packaging

14.5.5.1. Carton Board

14.5.5.2. Corrugated Board

14.5.5.3. Flexible Papers

14.5.6. Others

14.6. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Application

14.6.1. Printing Papers

14.6.2. Newsprint

14.6.3. Writing Paper

14.6.4. Hygiene Papers

14.6.5. Packaging

14.6.5.1. Carton Board

14.6.5.2. Corrugated Board

14.6.5.3. Flexible Papers

14.6.6. Others

14.7. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Pulp Type

14.7.1. Chemical Wood Pulp

14.7.1.1. Sulphate Pulp

14.7.1.2. Sulphite Pulp

14.7.2. Mechanical Wood Pulp

14.7.3. Non-wood Pulp

14.7.4. Semi-chemical Pulp

14.7.5. Recycled Pulp

14.8. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Pulp Type

14.8.1. Chemical Wood Pulp

14.8.1.1. Sulphate Pulp

14.8.1.2. Sulphite Pulp

14.8.2. Mechanical Wood Pulp

14.8.3. Non-wood Pulp

14.8.4. Semi-chemical Pulp

14.8.5. Recycled Pulp

14.9. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by Paper Type

14.9.1. Coated Paper

14.9.2. Uncoated Paper

14.10. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by Paper Type

14.10.1. Coated Paper

14.10.2. Uncoated Paper

14.11. Market Size (US$ Mn) and Volume (‘000 Tons) Historical Analysis 2014-2018, by End Use

14.11.1. Printing

14.11.2. Packing & Wrapping

14.11.3. Consumer Goods

14.11.4. Food Services and Others

14.12. Market Size (US$ Mn) and Volume (‘000 Tons) Forecast 2019-2027, by End Use

14.12.1. Printing

14.12.2. Packing & Wrapping

14.12.3. Consumer Goods

14.12.4. Food Service and Others

15. Market Structure Analysis

16. Competition Analysis

16.1. Competition Dashboard

16.2. Competition Developments

16.3. Competition Analysis

16.3.1. American Eagle Paper Mills

16.3.2. International Paper Inc.

16.3.3. Delta Paper Corp.

16.3.4. Domtar Inc.

16.3.5. Canfor Corp.

16.3.6. Clearwater Paper Corporation

16.3.7. Georgia-Pacific Corp.

16.3.8. Alberta Newsprint Company

16.3.9. Catalyst Paper

16.3.10. Finch Paper LLC

16.3.11. Asia Pacific Resources International Holdings

16.3.12. Glatfelter

16.3.13. Mitsubishi Paper Mills Ltd.

16.3.14. Verso Corporation

16.3.15. Asia Pulp & Paper

16.3.16. Burgo Group Spa

16.3.17. Stora Enso

16.3.18. Twin Rivers Paper Company

16.3.19. UPM-Kymmene Oyj

16.3.20. Rolland Paper

17. Assumptions and Acronyms

18. Research Methodology

List of Tables

Table 01: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 02: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 03: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Pulp Type, 2014H – 2027F

Table 04: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Paper Type, 2014H – 2027F

Table 05: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by End Use, 2014H – 2027F

Table 06: Global Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Region, 2014H – 2027F

Table 07: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Country, 2014H – 2027F

Table 08: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 09: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 10: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Pulp Type, 2014H – 2027F

Table 11: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Paper Type, 2014H – 2027F

Table 12: North America Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by End Use, 2014H – 2027F

Table 13: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by Country, 2014H – 2027F

Table 14: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by Application, 2014H – 2027F

Table 15: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by Application, 2014H – 2027F

Table 16: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by Pulp Type, 2014H – 2027F

Table 17: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by Paper Type, 2014H – 2027F

Table 18: Latin America Converting Paper Market Value (US$ Mn) and Volume ('000 tons) Forecast, by End Use, 2014H – 2027F

Table 19: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Country, 2014H – 2027F

Table 20: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Country, 2014H – 2027F

Table 21: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 22: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 23: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Pulp Type, 2014H – 2027F

Table 24: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Paper Type, 2014H – 2027F

Table 25: Europe Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by End Use, 2014H – 2027F

Table 26: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Country, 2014H – 2027F

Table 27: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 28: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 29: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Pulp Type, 2014H – 2027F

Table 30: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by Paper Type, 2014H – 2027F

Table 31: Asia Pacific Converting Paper Market Value (US$ Bn) and Volume (Mn tons) Forecast, by End Use, 2014H – 2027F

Table 32: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by Country, 2014H – 2027F

Table 33: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 34: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by Application, 2014H – 2027F

Table 35: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by Pulp Type, 2014H – 2027F

Table 36: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by Paper Type, 2014H – 2027F

Table 37: MEA Converting Paper Market Value (US$ Mn) and Volume (Mn tons) Forecast, by End Use, 2014H – 2027F

List of Figures

Figure 01: Global Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 02: Global Converting Paper Market Y-o-Y Growth, by Application, 2014(H)-2027(F)

Figure 03: Global Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 04: Global Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 05: Global Converting Paper Market Y-o-Y Growth, by Pulp Type, 2015(H)-2027(F)

Figure 06: Global Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 07: Global Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 08: Global Converting Paper Market Y-o-Y Growth, by Paper Type, 2014(H)-2027(F)

Figure 09: Global Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 10: Global Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 11: Global Converting Paper Market Y-o-Y Growth, by End Use, 2014(H)-2027(F)

Figure 12: Global Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 13: Global Converting Paper Market Share Analysis, by Region, 2014(H), 2019(E) & 2027(F)

Figure 14: Global Converting Paper Market Y-o-Y Growth, by Region, 2014(H)-2027(F)

Figure 15: Global Converting Paper Attractiveness Index, by Region, 2019(E) – 2027(F)

Figure 16: North America Converting Paper Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 17: North America Converting Paper Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 18: North America Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 19: North America Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 20: North America Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 21: North America Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 22: North America Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 23: North America Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 24: North America Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 25: North America Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 26: Latin America Converting Paper Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 27: Latin America Converting Paper Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 28: Latin America Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 29: Latin America Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 30: Latin America Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 31: Latin America Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 32: Latin America Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 33: Latin America Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 34: Latin America Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 35: Latin America Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 36: Europe Converting Paper Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 37: Europe Converting Paper Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 38: Europe Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 39: Europe Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 40: Europe Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 41: Europe Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 42: Europe Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 43: Europe Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 44: Europe Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 45: Europe Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 46: Asia Pacific Converting Paper Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 47: Asia Pacific Converting Paper Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 48: Asia Pacific Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 49: Asia Pacific Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 50: Asia Pacific Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 51: Asia Pacific Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 52: Asia Pacific Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 53: Asia Pacific Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 54: Asia Pacific Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 55: Asia Pacific Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)

Figure 56: MEA Converting Paper Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 57: MEA Converting Paper Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 58: MEA Converting Paper Market Share Analysis, by Application, 2014(H), 2019(E) & 2027(F)

Figure 59: MEA Converting Paper Attractiveness Index, by Application, 2019(E) – 2027(F)

Figure 60: MEA Converting Paper Market Share Analysis, by Pulp Type, 2014(H), 2019(E) & 2027(F)

Figure 61: MEA Converting Paper Attractiveness Index, by Pulp Type, 2019(E) – 2027(F)

Figure 62: MEA Converting Paper Market Share Analysis, by Paper Type, 2014(H), 2019(E) & 2027(F)

Figure 63: MEA Converting Paper Attractiveness Index, by Paper Type, 2019(E) – 2027(F)

Figure 64: MEA Converting Paper Market Share Analysis, by End Use, 2014(H), 2019(E) & 2027(F)

Figure 65: MEA Converting Paper Attractiveness Index, by End Use, 2019(E) – 2027(F)