Stimulant medications are increasingly gaining credibility for being a safe and effective option for ADHD (Attention Deficit Hyperactivity Disorder) treatment as far as children are concerned. Improved formulations of stimulants have benefitted children in letting them focus their thoughts better and ignore distractions. Companies in the controlled substance market are teaming up with doctors and healthcare providers to combine the treatment of stimulant medications with behavior therapy to treat children suffering from ADHD. This developmental aspect has helped children pay more attention to routine activities and control their behavior.

The application of stimulants in the treatment of ADHD is estimated to increase in the coming years. ADHD accounts for the second-highest revenue amongst all applications in the controlled substance market, with a projected value of ~US$ 25 billion by the end of 2027. Due to these favorable aspects, it has been found that, the right medication of stimulants amongst ADHD patients has shown positive improvements in their behavioral patterns. Two forms of stimulants, namely, immediate release (short-acting) medications and extended release (immediate-acting and long-acting) medications are lately being talked about in the controlled substance market. The former is gaining increased popularity, since the medication is less expensive as compared to other stimulant drugs.

Stimulant drugs are even proving useful for patients with Tourette syndrome. Medications such as atomoxetine or guanfacine are safe and recommended for children to reduce conditions associated with frequent tics and unusual vocal sounds.

Pain management is a necessary aspect for patients associated with advanced cancer. Thus, opioids are highly recommended for cancer patients to reduce the discomfort caused due to a diverse group of pain syndromes. Pain management is estimated to account for the highest revenue amongst all applications in the controlled substance market, with an estimated value of ~US$ 43 billion by the end of 2027. Thus, the increased prescription of opioid for advanced cancer patients is one of the major reasons for the exponential growth of pain management in the controlled substance market.

Although opioids help reduce the severity of pain syndromes, certain drawbacks of the medication are leading to resistance in its adoption amongst advanced cancer patients. Cognitive impairment and delirium are some of the few side effects caused due to the consumption of opioids. To overcome these drawbacks, healthcare companies in the controlled substance market are increasing awareness about screening in the early stages of delirium. Mini Mental State Examination and the Memorial Delirium-Assessment Scale are some of the credible tools that aid the screening procedure to assess the severity of cognitive impairment and delirium in patients.

In order to encourage advanced cancer patients to adopt opioids, companies in the controlled substance market are educating doctors and healthcare providers to thoroughly examine the complex and multi-faceted nature of pain management amongst patients.

The controlled substance market is projected to grow at a healthy CAGR of ~7% during the forecast period. However, on the other hand, the limitations and adverse effects of certain drugs may hamper the growth of the controlled substance market. For instance, tramadol is an effective drug for pain relief, but confounding reasons of patients have led to instances of increased morbidity and mortality.

Tramadol has the potential for abuse and addiction. Although tramadol is being utilized and accepted in medical care, it is tightly regulated. Confounding reasons present ambiguity for the effectiveness of tramadol. Although tramadol is classified as a Schedule IV drug, lack of appropriate prescription for the drug has caused high rates of death in the controlled substance landscape. To overcome these challenges, manufacturers in the controlled substance market are increasing awareness about the judicious prescription of tramadol. They are increasing research & development to help educate doctors and patients about the potential risks of tramadol treatment.

In order to make medical research studies more authentic, companies in the controlled substance market should assess confounders to enhance the credibility of research outcomes. Healthcare companies are increasing the availability of tramadol amongst patients suffering from osteoarthritis and other painful conditions.

Analysts’ Viewpoint

Opioids are efficacious pain-reducing medications. However, strict laws and regulations dictate the prescription of opioids, since these medications are found to cause serious harm to patients, owing to their side effects. As such, healthcare companies need to work in collaboration with health commissions such as the FDA to improve enforcement on the illicit marketing of unapproved opioids, and offer access to improved treatment alternatives for patients suffering from acute and chronic pain.

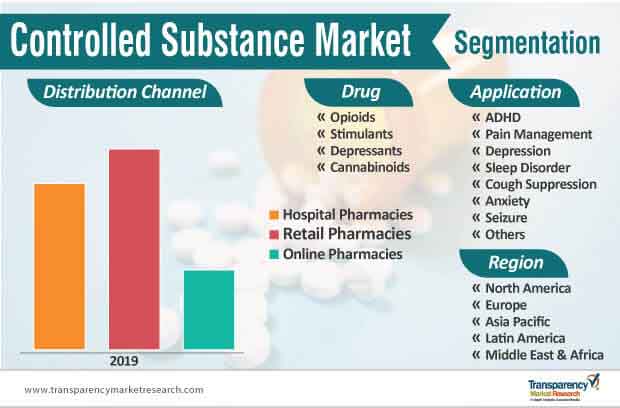

Manufacturers should strengthen their distribution networks through retail and online pharmacies, as these two sectors are projected for high growth in the controlled substance market. Likewise, there is scope for increased market growth in Europe and Asia Pacific, owing to improvements in the healthcare infrastructure in both these regions.

Global Controlled Substance Market: Description

Controlled Substance Market: Drivers

Global Controlled Substance Market: Prominent Segments

Global Controlled Substance Market: Competition Landscape

Controlled substance Market to reach a value of ~US$ 115 Bn by 2027

Controlled substance Market is expected to expand at a CAGR of ~7% during the forecast period of 2019 to 2027

Controlled substance Market is driven by high incidence rate of chronic pain among the geriatric population across the globe

North America accounted for a major share of the global controlled substance market

Key players in the global controlled substance market include F. Hoffmann-La Roche AG, AbbVie, Inc., Mallinckrodt plc, Pfizer, Inc., Sun Pharmaceuticals Ltd

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Controlled Substance Market

4. Market Overview

4.1. Introduction

4.1.1. Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Controlled Substance Market Analysis and Forecasts, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Pipeline Analysis

5.2. Key Merger & Acquisition

5.3. Regulatory Scenario

6. Global Controlled Substance Market Analysis and Forecasts, by Drug, 2017-2027

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug, 2017–2027

6.3.1. Opioids

6.3.1.1. Codeine

6.3.1.2. Morphine

6.3.1.3. Fentanyl

6.3.1.4. Hydrocodone

6.3.1.5. Tramadol

6.3.1.6. Oxycodone

6.3.1.7. Others

6.3.2. Stimulants

6.3.2.1. Amphetamine

6.3.2.2. Methylphenidate

6.3.2.3. Dextroamphetamine

6.3.2.4. Methamphetamine

6.3.2.5. Modafinil

6.3.2.6. Others

6.3.3. Depressants

6.3.3.1. Barbiturates

6.3.3.2. Benzodiazepines

6.3.4. Cannabinoids

6.4. Market Attractiveness, by Drug

7. Global Controlled Substance Market Analysis and Forecasts, by Application, 2017-2027

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2027

7.3.1. ADHD

7.3.2. Pain Management

7.3.3. Depression

7.3.4. Sleep Disorder

7.3.5. Cough Suppression

7.3.6. Anxiety

7.3.7. Seizure

7.3.8. Others

7.4. Market Attractiveness, by Application

8. Global Controlled Substance Market Analysis and Forecasts, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2027

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Application

9. Global Controlled Substance Market Analysis and Forecasts, by Region, 2017-2027

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Controlled Substance Market Analysis and Forecast, 2017-2027

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug, 2017–2027

10.2.1. Opioids

10.2.1.1. Codeine

10.2.1.2. Morphine

10.2.1.3. Fentanyl

10.2.1.4. Hydrocodone

10.2.1.5. Tramadol

10.2.1.6. Oxycodone

10.2.1.7. Others

10.2.2. Stimulants

10.2.2.1. Amphetamine

10.2.2.2. Methylphenidate

10.2.2.3. Dextroamphetamine

10.2.2.4. Methamphetamine

10.2.2.5. Modafinil

10.2.2.6. Others

10.2.3. Depressants

10.2.3.1. Barbiturates

10.2.3.2. Benzodiazepines

10.2.4. Cannabinoids

10.3. Market Value Forecast, by Application, 2017-2027

10.3.1. ADHD

10.3.2. Pain Management

10.3.3. Depression

10.3.4. Sleep Disorder

10.3.5. Cough Suppression

10.3.6. Anxiety

10.3.7. Seizure

10.3.8. Others

10.4. Market Value Forecast, by Distribution Channel, 2017-2027

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017-2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Controlled Substance Market Analysis and Forecast, 2017-2027

11.1. Introduction

11.1.1. Key Finding

11.2. Market Value Forecast, by Drug, 2017-2027

11.2.1. Opioids

11.2.1.1. Codeine

11.2.1.2. Morphine

11.2.1.3. Fentanyl

11.2.1.4. Hydrocodone

11.2.1.5. Tramadol

11.2.1.6. Oxycodone

11.2.1.7. Others

11.2.2. Stimulants

11.2.2.1. Amphetamine

11.2.2.2. Methylphenidate

11.2.2.3. Dextroamphetamine

11.2.2.4. Methamphetamine

11.2.2.5. Modafinil

11.2.2.6. Others

11.2.3. Depressants

11.2.3.1. Barbiturates

11.2.3.2. Benzodiazepines

11.2.4. Cannabinoids

11.3. Market Value Forecast, by Application, 2017-2027

11.3.1. ADHD

11.3.2. Pain Management

11.3.3. Depression

11.3.4. Sleep Disorder

11.3.5. Cough Suppression

11.3.6. Anxiety

11.3.7. Seizure

11.3.8. Others

11.4. Market Value Forecast, by Distribution Channel, 2017-2027

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017-2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Controlled Substance Market Analysis and Forecast, 2017-2027

12.1. Introduction

12.1.1. Key Finding

12.2. Market Value Forecast, by Drug, 2017-2027

12.2.1. Opioids

12.2.1.1. Codeine

12.2.1.2. Morphine

12.2.1.3. Fentanyl

12.2.1.4. Hydrocodone

12.2.1.5. Tramadol

12.2.1.6. Oxycodone

12.2.1.7. Others

12.2.2. Stimulants

12.2.2.1. Amphetamine

12.2.2.2. Methylphenidate

12.2.2.3. Dextroamphetamine

12.2.2.4. Methamphetamine

12.2.2.5. Modafinil

12.2.2.6. Others

12.2.3. Depressants

12.2.3.1. Barbiturates

12.2.3.2. Benzodiazepines

12.2.4. Cannabinoids

12.3. Market Value Forecast, by Application, 2017-2027

12.3.1. ADHD

12.3.2. Pain Management

12.3.3. Depression

12.3.4. Sleep Disorder

12.3.5. Cough Suppression

12.3.6. Anxiety

12.3.7. Seizure

12.3.8. Others

12.4. Market Value Forecast, by Distribution Channel, 2017-2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017-2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Controlled Substance Market Analysis and Forecast, 2017-2027

13.1. Introduction

13.1.1. Key Finding

13.2. Market Value Forecast, by Drug, 2017-2027

13.2.1. Opioids

13.2.1.1. Codeine

13.2.1.2. Morphine

13.2.1.3. Fentanyl

13.2.1.4. Hydrocodone

13.2.1.5. Tramadol

13.2.1.6. Oxycodone

13.2.1.7. Others

13.2.2. Stimulants

13.2.2.1. Amphetamine

13.2.2.2. Methylphenidate

13.2.2.3. Dextroamphetamine

13.2.2.4. Methamphetamine

13.2.2.5. Modafinil

13.2.2.6. Others

13.2.3. Depressants

13.2.3.1. Barbiturates

13.2.3.2. Benzodiazepines

13.2.4. Cannabinoids

13.3. Market Value Forecast, by Application, 2017-2027

13.3.1. ADHD

13.3.2. Pain Management

13.3.3. Depression

13.3.4. Sleep Disorder

13.3.5. Cough Suppression

13.3.6. Anxiety

13.3.7. Seizure

13.3.8. Others

13.4. Market Value Forecast, by Distribution Channel, 2017-2027

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast by Country/Sub-region, 2017-2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Controlled Substance Market Analysis and Forecast, 2017-2027

14.1. Introduction

14.1.1. Key Finding

14.2. Market Value Forecast, by Drug, 2017-2027

14.2.1. Opioids

14.2.1.1. Codeine

14.2.1.2. Morphine

14.2.1.3. Fentanyl

14.2.1.4. Hydrocodone

14.2.1.5. Tramadol

14.2.1.6. Oxycodone

14.2.1.7. Others

14.2.2. Stimulants

14.2.2.1. Amphetamine

14.2.2.2. Methylphenidate

14.2.2.3. Dextroamphetamine

14.2.2.4. Methamphetamine

14.2.2.5. Modafinil

14.2.2.6. Others

14.2.3. Depressants

14.2.3.1. Barbiturates

14.2.3.2. Benzodiazepines

14.2.4. Cannabinoids

14.3. Market Value Forecast, by Application, 2017-2027

14.3.1. ADHD

14.3.2. Pain Management

14.3.3. Depression

14.3.4. Sleep Disorder

14.3.5. Cough Suppression

14.3.6. Anxiety

14.3.7. Seizure

14.3.8. Others

14.4. Market Value Forecast, by Distribution Channel, 2017-2027

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017-2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Position/Ranking Analysis by Company (2018)

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche AG

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. AbbVie, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. Mallinckrodt plc

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Pfizer, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. Sun Pharmaceutical Ltd.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Ampac Fine Chemicals

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. GW Pharmaceuticals plc

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. Merck & Co., Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

List of Tables

Table 01: Global Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 02: Global Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 03: Global Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 04: Global Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 05: Global Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 06: Global Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 07: Global Controlled Substance Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Controlled Substance Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09: North America Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 10: North America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 11: North America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 12: North America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 13: North America Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 14: North America Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 15: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 17: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 18: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 19: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 20: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 21: Europe Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 22: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 24: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 25: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 26: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 27: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 28: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 29: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 30: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 31: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 32: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 33: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 34: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 35: Latin America Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 36: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 37: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Drug, 2017–2027

Table 38: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Opioids), 2017–2027

Table 39: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Stimulants), 2017–2027

Table 40: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Drug (Depressants), 2017–2027

Table 41: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 42: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Controlled Substance Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Market Opportunity Map, by Drug Type, 2018

Figure 03: Global Controlled Substance Market Value (US$ Mn) Forecast, 2017–2027

Figure 04: Global Controlled Substance Market Value Share, by Drug (2018)

Figure 05: Global Controlled Substance Market Value Share, by Application (2018)

Figure 06: Global Controlled Substance Market Value Share, by Distribution Channels (2018)

Figure 07: Global Controlled Substance Market Value Share, by Region (2018)

Figure 08: Global Controlled Substance Market Value Share Analysis, by Drug, 2018 and 2027

Figure 09: Global Controlled Substance Market Revenue (US$ Mn) by Opioids, 2017-2027

Figure 10: Global Controlled Substance Market Revenue (US$ Mn) by Stimulants, 2017-2027

Figure 11: Global Controlled Substance Market Revenue (US$ Mn) by Depressants, 2017-2027

Figure 12: Global Controlled Substance Market Revenue (US$ Mn) by Cannabinoids, 2017-2027

Figure 13: Global Controlled Substance Market Attractiveness Analysis, by Drug, 2019–2027

Figure 14: Global Controlled Substance Market Value Share Analysis, by Application, 2018 and 2027

Figure 15: Global Controlled Substance Market Value (US$ Mn), by ADHD, 2017–2027

Figure 16: Global Controlled Substance Market Value (US$ Mn), by Pain Management, 2017–2027

Figure 17: Global Controlled Substance Market Value (US$ Mn), by Depression, 2017–2027

Figure 18: Global Controlled Substance Market Value (US$ Mn), by Sleep Disorder, 2017–2027

Figure 19: Global Controlled Substance Market Value (US$ Mn), by Cough Suppression, 2017–2027

Figure 20: Global Controlled Substance Market Value (US$ Mn), by Anxiety, 2017–2027

Figure 21: Global Controlled Substance Market Value (US$ Mn), by Seizure, 2017–2027

Figure 22: Global Controlled Substance Market Value (US$ Mn), by Others, 2017–2027

Figure 23: Global Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 24: Global Controlled Substance Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 25: Global Controlled Substance Market Revenue (US$ Mn) by Hospital Pharmacies, 2017-2027

Figure 26: Global Controlled Substance Market Revenue (US$ Mn) Retail Pharmacies, 2017-2027

Figure 27: Global Controlled Substance Market Revenue (US$ Mn) Online Pharmacies, 2017-2027

Figure 28: Global Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 29: Global Controlled Substance Market Value Share Analysis, by Region, 2018 and 2027

Figure 30: Global Controlled Substance Market Attractiveness Analysis, by Region, 2019–2027

Figure 31: North America Controlled Substance Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 32: North America Controlled Substance Market Value Share, by Country, 2018 and 2027

Figure 33: North America Controlled Substance Market Attractiveness, by Country, 2019–2027

Figure 34: North America Controlled Substance Market Value Share, by Drug, 2018 and 2027

Figure 35: North America Controlled Substance Market Attractiveness, by Drug, 2019–2027

Figure 36: North America Controlled Substance Market Value Share, by Application, 2018 and 2027

Figure 37: North America Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 38: North America Controlled Substance Market Value Share, by Distribution Channel, 2018 and 2027

Figure 39: North America Controlled Substance Market Attractiveness, by Distribution Channel, 2019–2027

Figure 40: Europe Controlled Substance Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 41: Europe Controlled Substance Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 42: Europe Controlled Substance Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 43: Europe Controlled Substance Market Value Share, by Drug, 2018 and 2027

Figure 44: Europe Controlled Substance Market Attractiveness, by Drug, 2019–2027

Figure 45: Europe Controlled Substance Market Value Share, by Application, 2018 and 2027

Figure 46: Europe Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 47: Europe Controlled Substance Market Value Share, by Distribution Channel, 2018 and 2027

Figure 48: Europe Controlled Substance Market Attractiveness, by Distribution Channel, 2019–2027

Figure 49: Asia Pacific Controlled Substance Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 50: Asia Pacific Controlled Substance Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 51: Asia Pacific Controlled Substance Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 52: Asia Pacific Controlled Substance Market Value Share, by Drug, 2018 and 2027

Figure 53: Asia Pacific Controlled Substance Market Attractiveness, by Drug, 2019–2027

Figure 54: Asia Pacific Controlled Substance Market Value Share, by Application, 2018 and 2027

Figure 55: Asia Pacific Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 56: Asia Pacific Controlled Substance Market Value Share, by Distribution Channel, 2018 and 2027

Figure 57: Asia Pacific Controlled Substance Market Attractiveness, by Distribution Channel, 2019–2027

Figure 58: Latin America Controlled Substance Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 59: Latin America Controlled Substance Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 60: Latin America Controlled Substance Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 61: Latin America Controlled Substance Market Value Share, by Drug, 2018 and 2027

Figure 62: Latin America Controlled Substance Market Attractiveness, by Drug, 2019–2027

Figure 63: Latin America Controlled Substance Market Value Share, by Application, 2018 and 2027

Figure 64: Latin America Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 65: Latin America Controlled Substance Market Value Share, by Distribution Channel, 2018 and 2027

Figure 66: Latin America Controlled Substance Market Attractiveness, by Distribution Channel, 2019–2027

Figure 67: Middle East & Africa Controlled Substance Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 68: Middle East & Africa Controlled Substance Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 69: Middle East & Africa Controlled Substance Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 70: Middle East & Africa Controlled Substance Market Value Share, by Drug, 2018 and 2027

Figure 71: Middle East & Africa Controlled Substance Market Attractiveness, by Drug, 2019–2027

Figure 72: Middle East & Africa Controlled Substance Market Value Share, by Application, 2018 and 2027

Figure 73: Middle East & Africa Controlled Substance Market Attractiveness, by Application, 2019–2027

Figure 74: Middle East & Africa Controlled Substance Market Value Share, by Distribution Channel, 2018 and 2027

Figure 75: Middle East & Africa Controlled Substance Market Attractiveness, by Distribution Channel, 2019–2027

Figure 76: Market Position/Ranking Analysis, 2018, by Tier and Size of the Company