Analysts’ Viewpoint

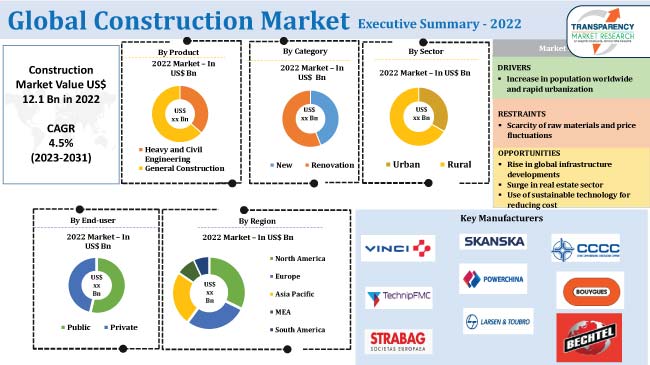

Increase in industrialization, and growth in population in developing regions are major factors fueling the construction market size. Furthermore, the surge in residential and commercial building activities is projected to drive market progress. Rapid urbanization, automation, and government investments in infrastructure projects are anticipated to enhance revenue possibilities in the construction industry.

The latest construction market trends include the use of drones for mapping and surveying, 3D printing for building, and smart infrastructure that can monitor and optimize performance, all of which offer lucrative opportunities for market expansion.

Government spending on public projects and advancements in construction technology play vital roles in shaping construction market demand. Demand for new housing and infrastructure, particularly in urban areas is on the rise. Low-interest rates further stimulate demand by enhancing accessibility to financing.

The process of assembling various components to form a structure, a building, a framework, or a model is known as construction. Every construction project follows a predetermined sequence of distinct phases, including design, manufacturing, and the conversion of raw resources into produced items, before building takes place.

Internal processes and elements from each of these phases come together to complete a building project. Planning, designing, securing permissions & approvals, site preparation, excavation, foundation work, framing, installing utilities & systems, completing the interior and exterior, and conducting a final inspection are some of the other steps that are involved. Building a garden shed is an example of a small project; building a bridge, an airport, or a dam are examples of big industrial construction projects.

Surge in population is one of the primary factors driving the construction market value. As the world's population continues to increase, demand for new and improved infrastructure, such as housing, roads, and public facilities, also rises. According to the United Nations, the global population is projected to reach 9.7 billion by 2050; urban areas are likely to witness the most significant construction industry growth. Rapid population growth, particularly in developing countries, is driving the need for new construction projects to accommodate the growing population.

In response to population growth and rapid urbanization, many governments have launched affordable housing programs, providing incentives for developers to build new homes. Additionally, governments are investing in public infrastructure projects to stimulate economic growth and create jobs.

Building development is also a significant driving factor of the construction market. As countries strive for economic growth, there is a need for improved and expanded infrastructure, such as transportation systems, energy grids, and communication networks. For instance, the global demand for renewable energy is driving the construction of new solar and wind farms, while the rise of e-commerce has led to a surge in demand for large-scale warehouses and distribution centers.

According to the World Economic Forum, the construction industry accounts for 13% of the world's GDP and employs over 7% of the global workforce. In addition to being a key economic driver, the construction market plays a critical role in shaping the physical landscape of cities and countries, providing the necessary infrastructure for industries to thrive and people to live comfortably.

The construction equipment industry has enormous possibilities for implementing digitization, innovative technologies, and new construction techniques. Adoption of new technologies is helping construction companies to evolve and keep pace with industry growth. Improved productivity, greater competitiveness, reduced costs, and faster project delivery are some of the key reasons spurring investment in technology. The construction industry is poised to become more efficient, eco-friendly, and adaptable to changing demands by embracing digital technologies, modern methods of construction, and sustainability measures.

Technology advancements and the use of cutting-edge materials and construction techniques create more robust and efficient infrastructure. The sector is also responding to mounting environmental worries about resource depletion and climate change. By using sustainable practices and technology, construction businesses are now concentrating on urban development, and ensuring that environment-friendly and sustainable construction practices shape the market.

Expansion of infrastructure, population growth, technical breakthroughs, environmental concerns, and economic development, are key factors bolstering the construction market share.

According to the latest construction market forecast, Asia Pacific is expected to witness significant growth during the forecast period. Rapid increase in investments in construction of various commercial and residential complexes and the emerging IT and telecommunications sectors in countries of the region are expected to boost market dynamics. Asia Pacific’s fast growing population is one of the primary market catalysts. The construction industry is expanding in the region due to rise in demand for residential, commercial, and infrastructural properties.

Detailed profiles of companies in the global construction market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Majority of companies are spending significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios, and mergers and acquisitions are the key strategies adopted by construction industry manufacturers. Construction players collaborate and partner with different companies to expand their product portfolio and global reach and keep their businesses growing across regions.

Actividades de Construcción y Servicios, Bechtel, Bouygues, ACO Industries k.s., China Communications Construction Company, Larsen and Toubro, PowerChina, Skanska, STRABAG, TechnipFMC, and Vinci are the prominent entities operating in the global construction market.

Each of these players have been profiled in the construction market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 12.1 Bn |

| Market Forecast Value in 2031 | US$ 17.1 Bn |

| Growth Rate (CAGR) | 4.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 12.1 Bn in 2022

It is expected to reach US$ 17.1 Bn by the end of 2031

The CAGR is projected to be 4.5% during the forecast period

Technology advancement in the industry, increase in population worldwide, and rapid urbanization

‘New’ is the prominent category

Asia Pacific currently accounts for largest share

Actividades de Construcción y Servicios, Bechtel, Bouygues, China Communications Construction Company, Larsen & Toubro, PowerChina, Skanska, STRABAG, TechnipFMC, and Vinci

1. Executive Summary: Global Construction Market

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Key Facts and Figures

1.5. Growth Opportunity Analysis

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Key Market Indicator

2.6. Market Dynamics

2.6.1. Drivers

2.6.2. Restraints

2.6.3. Opportunities

2.7. Global Construction Market Analysis and Forecasts, 2020-2031

2.7.1. Global Construction Market Revenue (US$ Mn)

2.8. Porter’s Five Forces Analysis

2.9. Regulatory Framework

2.10. Value Chain Analysis

2.10.1. List of Manufacturers

2.10.2. List of Dealers/Distributors

2.10.3. List of Contract Manufacturers

2.10.4. List of Potential Customers

2.11. Industry SWOT Analysis

2.12. Technology Development Analysis

3. Economic Recovery Analysis Post-COVID-19 Impact

4. Price Trend Analysis and Forecast (US$) by Product and by Region

5. Global Construction Market Analysis and Forecast, By Product

5.1. Key Findings

5.2. Construction Market Size (US$ Mn) Forecast, Product, 2020 - 2031

5.2.1. Heavy and Civil Engineering

5.2.1.1. Bridge

5.2.1.2. Roads

5.2.1.3. Railways

5.2.1.4. Airports

5.2.1.5. Others

5.2.2. General Construction

5.2.2.1. Residential

5.2.2.1.1. Houses

5.2.2.1.2. Apartments

5.2.2.1.3. Others

5.2.2.2. Commercial

5.2.2.2.1. Hotels

5.2.2.2.2. Offices

5.2.2.2.3. Hospitals

5.2.2.2.4. Malls/Multiplexes

5.2.2.2.5. Education Institutes

5.2.2.2.6. Others

5.2.2.3. Industrial

5.2.2.3.1. Chemical & Pharmaceutical

5.2.2.3.2. Metal & Category Processing

5.2.2.3.3. Textile

5.2.2.3.4. Oil & Gas

5.2.2.3.5. Others

5.2.3. Others

5.3. Incremental Opportunity, By Product

6. Global Construction Market Analysis and Forecast, By Sector

6.1. Key Findings

6.2. Construction Market Size (US$ Mn) Forecast, Sector, 2020 - 2031

6.2.1. Urban

6.2.2. Rural

6.3. Incremental Opportunity, By Sector

7. Global Construction Market Analysis and Forecast, By Category

7.1. Key Findings

7.2. Construction Market Size (US$ Mn) Forecast, Category, 2020 - 2031

7.2.1. New

7.2.2. Renovation

7.3. Incremental Opportunity, By Category

8. Global Construction Market Analysis and Forecast, By End-user

8.1. Key Findings

8.2. Construction Market Size (US$ Mn) Forecast, End-user, 2020 - 2031

8.2.1. Public

8.2.2. Private

8.3. Incremental Opportunity, By End-user

9. Global Construction Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size and Forecast (US$ Mn) by Region, 2020-2031

9.2.1. North America

9.2.1.1. U.S.

9.2.1.2. Canada

9.2.1.3. Rest of North America

9.2.2. Europe

9.2.2.1. Germany

9.2.2.2. France

9.2.2.3. U.K.

9.2.2.4. Italy

9.2.2.5. Russia & CIS

9.2.2.6. Rest of Europe

9.2.3. Asia Pacific

9.2.3.1. China

9.2.3.2. Japan

9.2.3.3. India

9.2.3.4. ASEAN

9.2.3.5. Rest of Asia Pacific

9.2.4. South America

9.2.4.1. Brazil

9.2.4.2. Rest of South America

9.2.5. Middle East & Africa

9.2.5.1. GCC

9.2.5.2. South Africa

9.2.5.3. Rest of Middle East & Africa

9.3. Incremental Opportunity Analysis

10. North America Construction Market Analysis and Forecasts

10.1. Regional Snapshot

10.2. Construction Market Size (US$ Mn) Forecast, Product, 2020 - 2031

10.2.1. Heavy and Civil Engineering

10.2.1.1. Bridge

10.2.1.2. Roads

10.2.1.3. Railways

10.2.1.4. Airports

10.2.1.5. Others

10.2.2. General Construction

10.2.2.1. Residential

10.2.2.1.1. Houses

10.2.2.1.2. Apartments

10.2.2.1.3. Others

10.2.2.2. Commercial

10.2.2.2.1. Hotels

10.2.2.2.2. Offices

10.2.2.2.3. Hospitals

10.2.2.2.4. Malls/Multiplexes

10.2.2.2.5. Education Institutes

10.2.2.2.6. Others

10.2.2.3. Industrial

10.2.2.3.1. Chemical & Pharmaceutical

10.2.2.3.2. Metal & Category Processing

10.2.2.3.3. Textile

10.2.2.3.4. Oil & Gas

10.2.2.3.5. Others

10.2.3. Others

10.3. Construction Market Size (US$ Mn) Forecast, Sector, 2020 - 2031

10.3.1. Urban

10.3.2. Rural

10.4. Construction Market Size (US$ Mn) Forecast, Category, 2020 - 2031

10.4.1. New

10.4.2. Renovation

10.5. Construction Market Size (US$ Mn) Forecast, End-user, 2020 - 2031

10.5.1. Public

10.5.2. Private

10.6. Construction Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2020 - 2031

10.6.1. U.S

10.6.2. Canada

10.7. Incremental Opportunity Analysis

11. U.S. Construction Market Analysis and Forecasts

11.1. Country Snapshot

11.2. Macroeconomic Scenario

11.3. Key Trend Analysis

11.4. Key Supplier Analysis

11.5. Construction Market Size (US$ Mn) Forecast, Product, 2020 - 2031

11.5.1. Heavy and Civil Engineering

11.5.1.1. Bridge

11.5.1.2. Roads

11.5.1.3. Railways

11.5.1.4. Airports

11.5.1.5. Others

11.5.2. General Construction

11.5.2.1. Residential

11.5.2.1.1. Houses

11.5.2.1.2. Apartments

11.5.2.1.3. Others

11.5.2.2. Commercial

11.5.2.2.1. Hotels

11.5.2.2.2. Offices

11.5.2.2.3. Hospitals

11.5.2.2.4. Malls/Multiplexes

11.5.2.2.5. Education

11.5.2.2.6. Institutes

11.5.2.2.7. Others

11.5.2.3. Industrial

11.5.2.3.1. Chemical & Pharmaceutical

11.5.2.3.2. Metal & Category Processing

11.5.2.3.3. Textile

11.5.2.3.4. Oil & Gas

11.5.2.3.5. Others

11.5.3. Others

11.6. Construction Market Size (US$ Mn) Forecast, Sector, 2020 - 2031

11.6.1. Urban

11.6.2. Rural

11.7. Construction Market Size (US$ Mn) Forecast, Category, 2020 - 2031

11.7.1. New

11.7.2. Renovation

11.8. Construction Market Size (US$ Mn) Forecast, End-user, 2020 - 2031

11.8.1. Public

11.8.2. Private

11.9. Incremental Opportunity Analysis

12. Competition Landscape

12.1. Market Players - Competition Dashboard

12.2. Market Share Analysis, 2022

12.3. Company Profiles

12.3.1. ACO Industries k.s.

12.3.1.1. Company Revenue

12.3.1.2. Business Overview

12.3.1.3. Product Segments

12.3.1.4. Geographic Footprint

12.3.1.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.2. Actividades de Construcción y Servicios

12.3.2.1. Company Revenue

12.3.2.2. Business Overview

12.3.2.3. Product Segments

12.3.2.4. Geographic Footprint

12.3.2.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.3. Bechtel

12.3.3.1. Company Revenue

12.3.3.2. Business Overview

12.3.3.3. Product Segments

12.3.3.4. Geographic Footprint

12.3.3.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.4. Bouygues

12.3.4.1. Company Revenue

12.3.4.2. Business Overview

12.3.4.3. Product Segments

12.3.4.4. Geographic Footprint

12.3.4.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.5. China Communications Construction Company

12.3.5.1. Company Revenue

12.3.5.2. Business Overview

12.3.5.3. Product Segments

12.3.5.4. Geographic Footprint

12.3.5.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.6. Larsen & Toubro

12.3.6.1. Company Revenue

12.3.6.2. Business Overview

12.3.6.3. Product Segments

12.3.6.4. Geographic Footprint

12.3.6.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.7. PowerChina

12.3.7.1. Company Revenue

12.3.7.2. Business Overview

12.3.7.3. Product Segments

12.3.7.4. Geographic Footprint

12.3.7.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.8. Skanska

12.3.8.1. Company Revenue

12.3.8.2. Business Overview

12.3.8.3. Product Segments

12.3.8.4. Geographic Footprint

12.3.8.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.9. STRABAG

12.3.9.1. Company Revenue

12.3.9.2. Business Overview

12.3.9.3. Product Segments

12.3.9.4. Geographic Footprint

12.3.9.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.10. TechnipFMC

12.3.10.1. Company Revenue

12.3.10.2. Business Overview

12.3.10.3. Product Segments

12.3.10.4. Geographic Footprint

12.3.10.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.11. Vinci

12.3.11.1. Company Revenue

12.3.11.2. Business Overview

12.3.11.3. Product Segments

12.3.11.4. Geographic Footprint

12.3.11.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.3.12. Other Key Players

12.3.12.1. Company Revenue

12.3.12.2. Business Overview

12.3.12.3. Product Segments

12.3.12.4. Geographic Footprint

12.3.12.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

12.4. List of Players in the Market

12.5. Key Primary Research Insights

13. Go To Market Strategy

14. Appendix

14.1. Assumptions and Acronyms

14.2. Research Methodology

List of Tables

Table 1: Global Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 2: Global Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 3: Global Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 4: Global Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 5: Global Construction Market Value (US$ Mn) Projection By Region 2017-2031

Table 6: North America Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 7: North America Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 8: North America Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 9: North America Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 10: North America Construction Market Value (US$ Mn) Projection By Country 2017-2031

Table 11: Europe Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 12: Europe Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 13: Europe Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 14: Europe Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 15: Europe Construction Market Value (US$ Mn) Projection By Country 2017-2031

Table 16: Asia Pacific Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 17: Asia Pacific Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 18: Asia Pacific Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 19: Asia Pacific Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 20: Asia Pacific Construction Market Value (US$ Mn) Projection By Country 2017-2031

Table 21: Middle East & Africa Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 22: Middle East & Africa Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 23: Middle East & Africa Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 24: Middle East & Africa Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 25: Middle East & Africa Construction Market Value (US$ Mn) Projection By Country 2017-2031

Table 26: South America Construction Market Value (US$ Mn) Projection By Product 2017-2031

Table 27: South America Construction Market Value (US$ Mn) Projection By Sector 2017-2031

Table 28: South America Construction Market Value (US$ Mn) Projection By Category 2017-2031

Table 29: South America Construction Market Value (US$ Mn) Projection By End-user 2017-2031

Table 30: South America Construction Market Value (US$ Mn) Projection By Country 2017-2031

List of Figures

Figure 1: Global Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 2: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product 2023-2031

Figure 3: Global Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 4: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 5: Global Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 6: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 7: Global Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 8: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 9: Global Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 10: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 11: Global Construction Market Value (US$ Mn) Projection, By Region 2017-2031

Figure 12: Global Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Region 2023-2031

Figure 13: North America Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 14: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product, 2023-2031

Figure 15: North America Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 16: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 17: North America Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 18: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 19: North America Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 20: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 21: North America Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 22: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 23: North America Construction Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 24: North America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Country 2023-2031

Figure 25: Europe Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 26: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product 2023-2031

Figure 27: Europe Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 28: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 29: Europe Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 30: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 31: Europe Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 32: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 33: Europe Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 34: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 35: Europe Construction Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 36: Europe Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Country 2023-2031

Figure 37: Asia Pacific Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 38: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product 2023-2031

Figure 39: Asia Pacific Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 40: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 41: Asia Pacific Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 42: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 43: Asia Pacific Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 44: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 45: Asia Pacific Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 46: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 47: Asia Pacific Construction Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 48: Asia Pacific Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Country 2023-2031

Figure 49: Middle East & Africa Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 50: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product 2023-2031

Figure 51: Middle East & Africa Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 52: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 53: Middle East & Africa Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 54: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 55: Middle East & Africa Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 56: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 57: Middle East & Africa Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 58: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 59: Middle East & Africa Construction Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 60: Middle East & Africa Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Country 2023-2031

Figure 61: South America Construction Market Value (US$ Mn) Projection, By Product 2017-2031

Figure 62: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Product 2023-2031

Figure 63: South America Construction Market Value (US$ Mn) Projection, By Sector 2017-2031

Figure 64: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Sector 2023-2031

Figure 65: South America Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 66: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 67: South America Construction Market Value (US$ Mn) Projection, By Category 2017-2031

Figure 68: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Category 2023-2031

Figure 69: South America Construction Market Value (US$ Mn) Projection, By End-user 2017-2031

Figure 70: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By End-user 2023-2031

Figure 71: South America Construction Market Value (US$ Mn) Projection, By Country 2017-2031

Figure 72: South America Construction Market Attractiveness Analysis (US$ Mn), Forecast, By Country 2023-2031