Analysts’ Viewpoint on Market Scenario

Increase in number of construction and infrastructure projects worldwide is expected to boost the construction equipment market size in the near future. Construction equipment is widely used in various industries to facilitate the process of building, renovating, and maintaining infrastructure and structures.

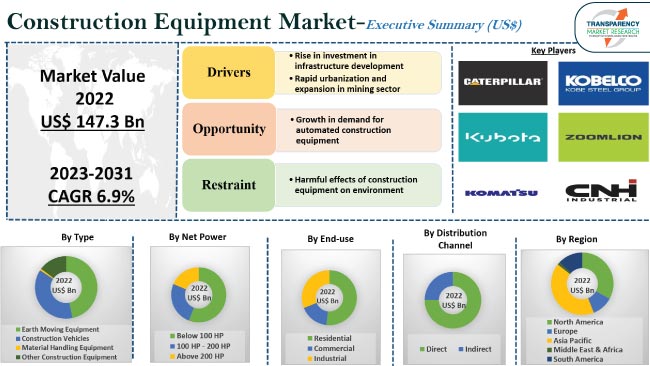

Rise in government investment in infrastructure development is likely to offer lucrative opportunities to vendors in the global construction equipment industry. Automated construction equipment is gaining traction in the market. Vendors are focused on offering advanced equipment to expand their customer base and increase their construction equipment market share. They are also developing sustainable solutions to stay competitive in the market.

Construction equipment refers to a wide variety of tools and machinery used in construction projects. The equipment is specially designed for construction work. Construction equipment includes heavy engineering equipment, material handling equipment, concrete equipment, construction vehicles, and road construction equipment.

Technological advancements are making construction tools and equipment more reliable and safe for use. Every construction site requires one or the other type of construction machinery, as modern construction products are time and profit-driven.

Several countries across the globe are strengthening their infrastructure to facilitate better connectivity in urban, semi-urban, and rural areas. Technological advancements are further fueling construction equipment market development.

Construction equipment companies are focused on manufacturing fuel-efficient construction equipment. They are also offering products that emit low carbon dioxide and greenhouse gases.

Manufacturers are offering automated construction equipment to boost productivity and reduce operating costs. Adoption of advanced construction equipment enables timely completion of projects.

Thus, increase in focus on infrastructure development and technological advancements in construction equipment are expected to spur the construction equipment market growth in the near future.

Increase in urban population is anticipated to fuel the demand for construction equipment in the next few years. According to a 2018 report by the World Bank, around 56% of the population in the world lived in cities. This percentage is expected to double by 2050. Thus, rise in migration of people to cities is projected to drive market expansion in the next few years.

Heavy equipment, such as hydraulic excavators, wheel loaders, bulldozers, dump trucks, and tippers, is extensively used in the mining sector to perform a variety of functions including material handling and ground preparation. Earth moving equipment is widely employed in the sector during mineral extraction. Hence, growth in the mining sector is boosting the construction equipment market revenue.

Sustainable construction equipment is gaining traction in various end-use industries. According to an article published in World Economic Forum in May 2022, the construction sector is responsible for 37.0% of total global energy-related CO2 emissions.

Vendors in the market are investing in R&D of sustainable construction equipment to help meet global carbon emission standards.

According to the latest construction equipment market trends, the earth moving equipment type segment is estimated to dominate the business during the forecast period.

Earth moving equipment is widely employed in various construction projects in building & construction and mining sectors. For instance, earth moving equipment is used for landscaping and grading, digging foundations and trenches, removal of rocks, and demolition of structures.

According to the latest construction equipment market forecast, Asia Pacific is anticipated to account for the largest share from 2023 to 2031.

Rise in number of government infrastructure projects and surge in demand for advanced construction equipment are fueling market dynamics of Asia Pacific. Surge in urban population and the resultant growth in demand for housing units are also boosting market statistics in the region.

The industry in North America and Europe is expected to grow at a considerable pace in the near future. Rise in investments in real estate and increase in construction of residential and commercial buildings are augmenting market value in these regions.

Detailed profiles of vendors have been provided in the construction equipment market report to evaluate their financials, key product offerings, recent developments, and strategies. The market is highly competitive, with the presence of various global and regional players.

Key players operating in the business include Caterpillar Inc., Deere & Co., Kubota Corp., Komatsu Ltd., CNH Industrial N.V., Zoomlion Heavy Industry Co., Ltd., Kobe Steel Ltd., Sany Heavy Industry Science & Technology Co., Ltd., XCMG Construction Machinery Co., Ltd., Liebherr International AG, AB Volvo, Hitachi, Ltd., and Sandvik AB.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 147.3 Bn |

|

Market Forecast Value in 2031 |

US$ 250.2 Bn |

|

Growth Rate (CAGR) |

6.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 147.3 Bn in 2022

It is projected to grow at a CAGR of 6.9% from 2023 to 2031

Rise in investment in infrastructure development, rapid urbanization, and expansion in the mining sector

The earth moving equipment type segment held the largest share in 2022

Asia Pacific is projected to record the highest demand during the forecast period

Caterpillar Inc., Deere & Co., Kubota Corp., Komatsu Ltd., CNH Industrial N.V., Zoomlion Heavy Industry Co., Ltd., Kobe Steel Ltd., Sany Heavy Industry Science & Technology Co., Ltd., XCMG Construction Machinery Co., Ltd., Liebherr International AG, AB Volvo, Hitachi, Ltd., and Sandvik AB

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Construction Equipment Market Analysis and Forecast, 2017-2031

5.8.1. Market Value Projection (US$ Bn)

5.8.2. Market Volume Projection (Thousand Units)

6. Global Construction Equipment Market Analysis and Forecast, by Type

6.1. Global Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

6.1.1. Earth Moving Equipment

6.1.1.1. Excavators

6.1.1.2. Backhoes

6.1.1.3. Loaders

6.1.1.4. Bulldozers

6.1.1.5. Others (Trenchers, etc. )

6.1.2. Construction Vehicles

6.1.2.1. Dumpers

6.1.2.2. Tippers

6.1.2.3. Trailers

6.1.2.4. Others (Tankers, etc.)

6.1.3. Material Handling Equipment

6.1.3.1. Cranes

6.1.3.2. Conveyors

6.1.3.3. Forklifts

6.1.3.4. Others (Hoists, etc.)

6.1.4. Other Construction Equipment

6.1.4.1. Concrete Mixers

6.1.4.2. Road Rollers

6.1.4.3. Heavy-duty Pumps

6.1.4.4. Others (Stone Crushers, etc.)

6.2. Incremental Opportunity, by Type

7. Global Construction Equipment Market Analysis and Forecast, by Net Power

7.1. Global Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

7.1.1. Below 100 HP

7.1.2. 100 HP -200 HP

7.1.3. Above 200 HP

7.2. Incremental Opportunity, by Net Power

8. Global Construction Equipment Market Analysis and Forecast, by End-use

8.1. Global Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

8.1.1. Residential

8.1.2. Commercial

8.1.3. Industrial

8.2. Incremental Opportunity, by End-use

9. Global Construction Equipment Market Analysis and Forecast, by Distribution Channel

9.1. Global Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Distribution Channel

10. Global Construction Equipment Market Analysis and Forecast, by Region

10.1. Global Construction Equipment Market Size (US$ Bn) (Thousand Units), by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Construction Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply Side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

11.5.1. Earth Moving Equipment

11.5.1.1. Excavators

11.5.1.2. Backhoes

11.5.1.3. Loaders

11.5.1.4. Bulldozers

11.5.1.5. Others (Trenchers, etc. )

11.5.2. Construction Vehicles

11.5.2.1. Dumpers

11.5.2.2. Tippers

11.5.2.3. Trailers

11.5.2.4. Others (Tankers, etc.)

11.5.3. Material Handling Equipment

11.5.3.1. Cranes

11.5.3.2. Conveyors

11.5.3.3. Forklifts

11.5.3.4. Others (Hoists, etc.)

11.5.4. Other Construction Equipment

11.5.4.1. Concrete Mixers

11.5.4.2. Road Rollers

11.5.4.3. Heavy-duty Pumps

11.5.4.4. Others (Stone Crushers, etc.)

11.6. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

11.6.1. Below 100 HP

11.6.2. 100 HP -200 HP

11.6.3. Above 200 HP

11.7. Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

11.7.1. Residential

11.7.2. Commercial

11.7.3. Industrial

11.8. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

11.8.1. Direct

11.8.2. Indirect

11.9. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Country, 2017-2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Construction Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply Side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

12.5.1. Earth Moving Equipment

12.5.1.1. Excavators

12.5.1.2. Backhoes

12.5.1.3. Loaders

12.5.1.4. Bulldozers

12.5.1.5. Others (Trenchers, etc. )

12.5.2. Construction Vehicles

12.5.2.1. Dumpers

12.5.2.2. Tippers

12.5.2.3. Trailers

12.5.2.4. Others (Tankers, etc.)

12.5.3. Material Handling Equipment

12.5.3.1. Cranes

12.5.3.2. Conveyors

12.5.3.3. Forklifts

12.5.3.4. Others (Hoists, etc.)

12.5.4. Other Construction Equipment

12.5.4.1. Concrete Mixers

12.5.4.2. Road Rollers

12.5.4.3. Heavy-duty Pumps

12.5.4.4. Others (Stone Crushers, etc.)

12.6. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

12.6.1. Below 100 HP

12.6.2. 100 HP -200 HP

12.6.3. Above 200 HP

12.7. Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

12.7.1. Residential

12.7.2. Commercial

12.7.3. Industrial

12.8. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

12.8.1. Direct

12.8.2. Indirect

12.9. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Country, 2017-2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Construction Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

13.5.1. Earth Moving Equipment

13.5.1.1. Excavators

13.5.1.2. Backhoes

13.5.1.3. Loaders

13.5.1.4. Bulldozers

13.5.1.5. Others (Trenchers, etc. )

13.5.2. Construction Vehicles

13.5.2.1. Dumpers

13.5.2.2. Tippers

13.5.2.3. Trailers

13.5.2.4. Others (Tankers, etc.)

13.5.3. Material Handling Equipment

13.5.3.1. Cranes

13.5.3.2. Conveyors

13.5.3.3. Forklifts

13.5.3.4. Others (Hoists, etc.)

13.5.4. Other Construction Equipment

13.5.4.1. Concrete Mixers

13.5.4.2. Road Rollers

13.5.4.3. Heavy-duty Pumps

13.5.4.4. Others (Stone Crushers, etc.)

13.6. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

13.6.1. Below 100 HP

13.6.2. 100 HP -200 HP

13.6.3. Above 200 HP

13.7. Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

13.7.1. Residential

13.7.2. Commercial

13.7.3. Industrial

13.8. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

13.8.1. Direct

13.8.2. Indirect

13.9. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Country, 2017-2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Construction Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

14.5.1. Earth Moving Equipment

14.5.1.1. Excavators

14.5.1.2. Backhoes

14.5.1.3. Loaders

14.5.1.4. Bulldozers

14.5.1.5. Others (Trenchers, etc. )

14.5.2. Construction Vehicles

14.5.2.1. Dumpers

14.5.2.2. Tippers

14.5.2.3. Trailers

14.5.2.4. Others (Tankers, etc.)

14.5.3. Material Handling Equipment

14.5.3.1. Cranes

14.5.3.2. Conveyors

14.5.3.3. Forklifts

14.5.3.4. Others (Hoists, etc.)

14.5.4. Other Construction Equipment

14.5.4.1. Concrete Mixers

14.5.4.2. Road Rollers

14.5.4.3. Heavy-duty Pumps

14.5.4.4. Others (Stone Crushers, etc.)

14.6. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

14.6.1. Below 100 HP

14.6.2. 100 HP -200 HP

14.6.3. Above 200 HP

14.7. Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

14.7.1. Residential

14.7.2. Commercial

14.7.3. Industrial

14.8. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

14.8.1. Direct

14.8.2. Indirect

14.9. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Country, 2017-2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Construction Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply Side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Type, 2017-2031

15.5.1. Earth Moving Equipment

15.5.1.1. Excavators

15.5.1.2. Backhoes

15.5.1.3. Loaders

15.5.1.4. Bulldozers

15.5.1.5. Others (Trenchers, etc. )

15.5.2. Construction Vehicles

15.5.2.1. Dumpers

15.5.2.2. Tippers

15.5.2.3. Trailers

15.5.2.4. Others (Tankers, etc.)

15.5.3. Material Handling Equipment

15.5.3.1. Cranes

15.5.3.2. Conveyors

15.5.3.3. Forklifts

15.5.3.4. Others (Hoists, etc.)

15.5.4. Other Construction Equipment

15.5.4.1. Concrete Mixers

15.5.4.2. Road Rollers

15.5.4.3. Heavy-duty Pumps

15.5.4.4. Others (Stone Crushers, etc.)

15.6. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Net Power, 2017-2031

15.6.1. Below 100 HP

15.6.2. 100 HP -200 HP

15.6.3. Above 200 HP

15.7. Construction Equipment Market Size (US$ Bn) (Thousand Units), by End-use, 2017-2031

15.7.1. Residential

15.7.2. Commercial

15.7.3. Industrial

15.8. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017-2031

15.8.1. Direct

15.8.2. Indirect

15.9. Construction Equipment Market Size (US$ Bn) (Thousand Units), by Country, 2017-2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. Caterpillar Inc.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. Deere & Co.

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Kubota Corp.

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Komatsu Ltd.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. CNH Industrial NV

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Zoomlion Heavy Industry Co. Ltd.

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. Kobe Steel Ltd.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. Samy Heavy Industry Science & Technology Co. Ltd.

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. XCMG Construction Machinery Co. Ltd.

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. Liebherr International AG.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

16.3.11. Volvo CE Sweden

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. Financial Information, (Subject to Data Availability)

16.3.11.4. Business Strategies / Recent Developments

16.3.12. Hitachi Japan

16.3.12.1. Company Overview

16.3.12.2. Product Portfolio

16.3.12.3. Financial Information, (Subject to Data Availability)

16.3.12.4. Business Strategies / Recent Developments

16.3.13. Sandvik

16.3.13.1. Company Overview

16.3.13.2. Product Portfolio

16.3.13.3. Financial Information, (Subject to Data Availability)

16.3.13.4. Business Strategies / Recent Developments

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 2: Global Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 3: Global Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 4: Global Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 5: Global Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 6: Global Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 7: Global Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 8: Global Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 9: Global Construction Equipment Market Value (US$ Bn), By Region, 2017-2031

Table 10: Global Construction Equipment Market Volume (Thousand Units), By Region, 2017-2031

Table 11: North America Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 12: North America Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 13: North America Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 14: North America Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 15: North America Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 16: North America Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 17: North America Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 18: North America Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 19: North America Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Table 20: North America Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Table 21: Europe Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 22: Europe Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 23: Europe Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 24: Europe Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 25: Europe Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 26: Europe Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 27: Europe Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 28: Europe Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 29: Europe Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Table 30: Europe Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Table 31: Asia Pacific Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 32: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 33: Asia Pacific Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 34: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 35: Asia Pacific Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 36: Asia Pacific Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 37: Asia Pacific Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 38: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 39: Asia Pacific Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Table 40: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Table 41: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 42: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 43: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 44: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 45: Middle East and Africa Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 46: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 47: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 48: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 49: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Table 50: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Table 51: South America Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Table 52: South America Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Table 53: South America Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Table 54: South America Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Table 55: South America Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Table 56: South America Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Table 57: South America Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Table 58: South America Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Table 59: South America Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Table 60: South America Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

List of Figures

Figure 1: Global Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 2: Global Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 3: Global Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 4: Global Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 5: Global Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 6: Global Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 7: Global Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 8: Global Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 9: Global Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 10: Global Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 11: Global Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 12: Global Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 13: Global Construction Equipment Market Value (US$ Bn), By Region, 2017-2031

Figure 14: Global Construction Equipment Market Volume (Thousand Units), By Region, 2017-2031

Figure 15: Global Construction Equipment Market Incremental Opportunity (US$ Bn), By Region, 2017-2031

Figure 16: North America Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 17: North America Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 18: North America Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 19: North America Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 20: North America Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 21: North America Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 22: North America Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 23: North America Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 24: North America Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 25: North America Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 26: North America Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 27: North America Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 28: North America Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Figure 29: North America Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Figure 30: North America Construction Equipment Market Incremental Opportunity (US$ Bn), By Country, 2017-2031

Figure 31: Europe Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 32: Europe Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 33: Europe Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 34: Europe Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 35: Europe Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 36: Europe Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 37: Europe Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 38: Europe Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 39: Europe Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 40: Europe Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 41: Europe Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 42: Europe Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 43: Europe Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Figure 44: Europe Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Figure 45: Europe Construction Equipment Market Incremental Opportunity (US$ Bn), By Country, 2017-2031

Figure 46: Asia Pacific Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 47: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 48: Asia Pacific Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 49: Asia Pacific Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 50: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 51: Asia Pacific Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 52: Asia Pacific Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 53: Asia Pacific Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 54: Asia Pacific Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 55: Asia Pacific Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 56: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 57: Asia Pacific Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 58: Asia Pacific Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Figure 59: Asia Pacific Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Figure 60: Asia Pacific Construction Equipment Market Incremental Opportunity (US$ Bn), By Country, 2017-2031

Figure 61: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 62: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 63: Middle East and Africa Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 64: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 65: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 66: Middle East and Africa Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 67: Middle East and Africa Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 68: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 69: Middle East and Africa Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 70: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 71: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 72: Middle East and Africa Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 73: Middle East and Africa Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Figure 74: Middle East and Africa Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Figure 75: Middle East and Africa Construction Equipment Market Incremental Opportunity (US$ Bn), By Country, 2017-2031

Figure 76: South America Construction Equipment Market Value (US$ Bn), By Type, 2017-2031

Figure 77: South America Construction Equipment Market Volume (Thousand Units), By Type, 2017-2031

Figure 78: South America Construction Equipment Market Incremental Opportunity (US$ Bn), By Type, 2017-2031

Figure 79: South America Construction Equipment Market Value (US$ Bn), By Net Power, 2017-2031

Figure 80: South America Construction Equipment Market Volume (Thousand Units), By Net Power, 2017-2031

Figure 81: South America Construction Equipment Market Incremental Opportunity (US$ Bn), By Net Power, 2017-2031

Figure 82: South America Construction Equipment Market Value (US$ Bn), By End-use, 2017-2031

Figure 83: South America Construction Equipment Market Volume (Thousand Units), By End-use, 2017-2031

Figure 84: South America Construction Equipment Market Incremental Opportunity (US$ Bn), By End-use, 2017-2031

Figure 85: South America Construction Equipment Market Value (US$ Bn), By Distribution Channel, 2017-2031

Figure 86: South America Construction Equipment Market Volume (Thousand Units), By Distribution Channel, 2017-2031

Figure 87: South America Construction Equipment Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017-2031

Figure 88: South America Construction Equipment Market Value (US$ Bn), By Country, 2017-2031

Figure 89: South America Construction Equipment Market Volume (Thousand Units), By Country, 2017-2031

Figure 90: South America Construction Equipment Market Incremental Opportunity (US$ Bn), By Country, 2017-2031