Analysts’ Viewpoint on Connected Car Devices Market Scenario

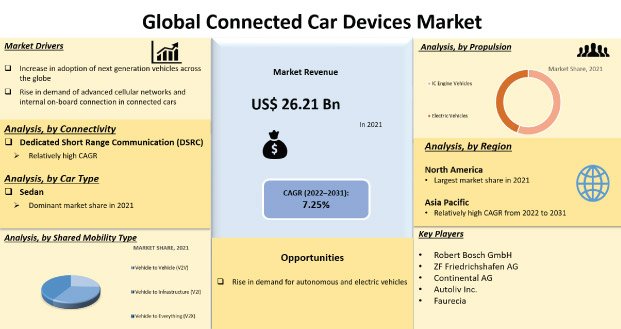

The global connected car devices market is significantly driven by an increase in sales and production of cars across the globe, rise in technological safety features in cars, and growing demand for car infotainment and telematics systems. Moreover, increase in penetration of ADAS (advance driver assistance systems) features for vehicle safety and comfort and surge in collaborative agreements among OEMs and service providers have propelled the connected car devices market. Additionally, government support programs for connected vehicles and infrastructure development across the globe are expected to contribute to the market growth during the forecast period.

The connected car is a system that connects with nearby vehicles, infrastructure, and devices with the help of wireless and cellular networks. Internet of Things (IoT) plays an important role for connected vehicles, as it guides the vehicle devices to create bi-directional communication with several other vehicles on the road and with the driver’s mobile. One of the primary requirements of the connected car system is safety. Connected car technology allows automotive V2X communication, which is also known as vehicle-to-vehicle, or vehicle-to-infrastructure, or vehicle-to-everything communications. Moreover, several active trials are in progress across the globe for connected car solutions. For instance, connected vehicle technology is used as one of the Safety Trends in Traffic Management and is considered a government initiative for Intelligent Transportation Systems, which further helps provide traffic-related information to traffic management departments and drivers on the same road.

Emerging connected car software development services and the incorporation of LTE and 5G networks for car connectivity, offering real-time traffic and safety information, can further optimize vehicle performance and save travel time. However, global connected car devices market is driven by rise in penetration of telecommunication services in the automotive sector, strong competition among connected car manufacturers, several government regulations, and industry compliance supporting automobile connectivity.

Connected vehicles use city infrastructure and smartphones for sharing significant information and on-road events. Such information may include intersection events and city traffic, which continuously send and receive data in real-time for triggering automated vehicle response to avoid further traffic blocks. Connected cars can talk with each other using in-vehicle devices that endlessly share mobility and imperative safety information. Moreover, connected car system also uses wireless communication solutions to communicat with traffic signals, toll booths, school and work zones, and other infrastructure types. However, such vehicle data is anonymous, which restricts it from vehicle tracking and secures the system against data tampering.

Analysis of connected car trends indicate an increase in demand for ADAS features among consumers, which is prompting connected car manufacturers to integrate IoT solutions and devices for high-speed automotive V2X communications. This is for driving the integration of several connected car services including, adaptive cruise control, automatic route planning, vehicle redirection due to traffic congestion, automatic vehicle braking to prevent collisions, and autonomous and semi-autonomous vehicle control, among others. However, such technological upgrade in vehicles is driving the demand for next generation vehicles and further boosting the connected car devices market size.

Rise in demand for long-distance vehicle data transfer fuels the demand for advanced cellular network, while most of the connected car manufacturers are adopting the latest and upcoming 5G network to transmit and receive vehicle data. Such network enables drivers and other users to communicate with infrastructure and vehicles in real-time, which further enhances the vehicle safety and performance. For example, two opposite-direction cars share road and traffic conditions based on their recently visited locations, which will prevent roadblocks, collisions, and accidents. Connected cars are designed to connect with the driver’s or passenger’s smartphone. Connected cars can be turned on and off with the help of smartphones; they can also share diagnostic vehicle data and remind the car owner about different upcoming service requirements in a car and share car location, in case of a stolen car. These internal onboard features are anticipated to boost the connected car devices market.

In terms of technology, the connected car devices market has been classified into Advance Driver Assistance Systems (ADAS), telematics, and others. The Advance Driver Assistance Systems (ADAS) segment accounted for a dominant share of the connected car devices market in 2021, owing to an increase in awareness about vehicle safety, rise in disposable income, surge in spending capacity of consumers, rapid urbanization, and growth in traffic congestion.

In terms of connectivity, the global connected car devices market has been divided into dedicated short range communication (DSRC), cellular networks, and others. The dedicated short range communication or DSRC segment held major share of the global market in 2021, as it allows cars in the intelligent transportation system (ITS) to communicate with other on-road cars or with city infrastructure. DSRC technology operates on the radio frequency of 5.9 GHz bandwidth and it is much more effective, hence extensively used for short to medium distance communications. DSRC has very little interference, due to high reliability and low latency. It is also considered to be more secure and supports interoperability in extreme weather conditions.

North America held a dominant share of the global connected car devices market owing to the focus on development of connected and autonomous cars by several automakers and government agencies across North America. For Instance, the U.S. DOT (department of transportation) is aggressively engaged in the deployment of automotive V2X (vehicle to everything) communication, which further provides efficiency and safety benefits for cars. Ongoing smart city projects across North America are aimed to creating connected infrastructures, which is estimated to further enable vehicle communications and consequently, boost the connected car device market. Furthermore, the market in Europe is also anticipated to witness significant growth due to rise in government projects and investments by service providers. For instance, the European Union has also initiated the 5G-CORAL project under its Horizon program, where Azcom is focused on the development of automotive V2X capabilities, which in turn is propelling the market in the region.

The global connected car devices market comprises several small and large-scale companies that control majority of the share. Most firms are adopting new technologies and strategies with comprehensive R&D in connected car devices. However, mergers and acquisitions and development in product portfolios by manufacturers and service providers are major strategies implemented by several key players. Moreover, some of the connected car devices companies operating in the global market are Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Autoliv Inc., Faurecia, Delphi Technologies PLC, Azcom, DENSO Corporation, Valeo SA, Harman International Industries Inc., TE Connectivity, and WiTricity Corporation.

Each of these players has been profiled in the connected car devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 26.21 Bn |

|

Market Forecast Value in 2031 |

US$ 52.78 Bn |

|

Growth Rate (CAGR) |

7.25% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The connected car devices market was valued at US$ 26.21 Bn in 2021.

The connected car devices market is expected to expand at a CAGR of 7.25% by 2031.

The connected car devices market is expected to reach US$ 52.78 Bn in 2031.

Increase in sales and production of cars across developed and developing countries, surge in demand for safety features, and increase in adoption of car infotainment and telematics systems.

The advance driver assistance systems (ADAS) segment accounts for 39.8% share of the connected car devices market.

North America is a highly lucrative region of the global connected car devices market.

Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Autoliv Inc., Faurecia, Delphi Technologies PLC, Azcom, DENSO Corporation, Valeo SA, Harman International Industries Inc., TE Connectivity, and WiTricity Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Thousand Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Connected Car Devices Market

4. Global Connected Car Devices Market, by Technology

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

4.2.1. Advance Driver Assistance Systems (ADAS)

4.2.2. Adaptive cruise control

4.2.3. Lane departure warning

4.2.4. Blind spot detection

4.2.5. Road sign recognition

4.2.6. Park assist

4.2.7. Pedestrian detection system

4.2.8. Telematics

4.2.9. Others

5. Global Connected Car Devices Market, by Communication

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

5.2.1. Vehicle to Vehicle (V2V)

5.2.2. Vehicle to Infrastructure (V2I)

5.2.3. Vehicle to Everything (V2X)

6. Global Connected Car Devices Market, by Connectivity

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Connectivity

6.2.1. Dedicated Short Range Communication (DSRC)

6.2.2. Cellular Network

6.2.3. Others

7. Global Connected Car Devices Market, by Car Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

7.2.1. Hatchback

7.2.2. Sedan

7.2.3. Utility Vehicles

8. Global Connected Car Devices Market, by Propulsion

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

8.2.1. IC Engine Vehicles

8.2.1.1. Gasoline Cars

8.2.1.2. Diesel Cars

8.2.2. Electric Vehicles

8.2.2.1. Battery Electric Car

8.2.2.2. Hybrid Electric Car

9. Global Connected Car Devices Market, by Sales Channel

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

9.2.1. OEM

9.2.2. Aftermarket

10. Global Connected Car Devices Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Connected Car Devices Market

11.1. Market Snapshot

11.2. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

11.2.1. Advance Driver Assistance Systems (ADAS)

11.2.2. Adaptive cruise control

11.2.3. Lane departure warning

11.2.4. Blind spot detection

11.2.5. Road sign recognition

11.2.6. Park assist

11.2.7. Pedestrian detection system

11.2.8. Telematics

11.2.9. Others

11.3. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

11.3.1. Vehicle to Vehicle (V2V)

11.3.2. Vehicle to Infrastructure (V2I)

11.3.3. Vehicle to Everything (V2X)

11.4. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, Connectivity

11.4.1. Dedicated Short Range Communication (DSRC)

11.4.2. Cellular Network

11.4.3. Others

11.5. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

11.5.1. Hatchback

11.5.2. Sedan

11.5.3. Utility Vehicles

11.6. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

11.6.1. IC Engine Vehicles

11.6.1.1. Gasoline Cars

11.6.1.2. Diesel Cars

11.6.2. Electric Vehicles

11.6.2.1. Battery Electric Car

11.6.2.2. Hybrid Electric Car

11.7. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

11.7.1. OEM

11.7.2. Aftermarket

11.8. Key Country Analysis – North America Connected Car Devices Market Size Analysis & Forecast, 2017-2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Mexico

12. Europe Connected Car Devices Market

12.1. Market Snapshot

12.2. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

12.2.1. Advance Driver Assistance Systems (ADAS)

12.2.2. Adaptive cruise control

12.2.3. Lane departure warning

12.2.4. Blind spot detection

12.2.5. Road sign recognition

12.2.6. Park assist

12.2.7. Pedestrian detection system

12.2.8. Telematics

12.2.9. Others

12.3. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

12.3.1. Vehicle to Vehicle (V2V)

12.3.2. Vehicle to Infrastructure (V2I)

12.3.3. Vehicle to Everything (V2X)

12.4. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, Connectivity

12.4.1. Dedicated Short Range Communication (DSRC)

12.4.2. Cellular Network

12.4.3. Others

12.5. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

12.5.1. Hatchback

12.5.2. Sedan

12.5.3. Utility Vehicles

12.6. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

12.6.1. IC Engine Vehicles

12.6.1.1. Gasoline Cars

12.6.1.2. Diesel Cars

12.6.2. Electric Vehicles

12.6.2.1. Battery Electric Car

12.6.2.2. Hybrid Electric Car

12.7. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

12.7.1. OEM

12.7.2. Aftermarket

12.8. Key Country Analysis – Europe Connected Car Devices Market Size Analysis & Forecast, 2017-2031

12.8.1. Germany

12.8.2. U. K.

12.8.3. France

12.8.4. Italy

12.8.5. Spain

12.8.6. Nordic Countries

12.8.7. Russia & CIS

12.8.8. Rest of Europe

13. Asia Pacific Connected Car Devices Market

13.1. Market Snapshot

13.2. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

13.2.1. Advance Driver Assistance Systems (ADAS)

13.2.2. Adaptive cruise control

13.2.3. Lane departure warning

13.2.4. Blind spot detection

13.2.5. Road sign recognition

13.2.6. Park assist

13.2.7. Pedestrian detection system

13.2.8. Telematics

13.2.9. Others

13.3. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

13.3.1. Vehicle to Vehicle (V2V)

13.3.2. Vehicle to Infrastructure (V2I)

13.3.3. Vehicle to Everything (V2X)

13.4. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, Connectivity

13.4.1. Dedicated Short Range Communication (DSRC)

13.4.2. Cellular Network

13.4.3. Others

13.5. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

13.5.1. Hatchback

13.5.2. Sedan

13.5.3. Utility Vehicles

13.6. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

13.6.1. IC Engine Vehicles

13.6.1.1. Gasoline Cars

13.6.1.2. Diesel Cars

13.6.2. Electric Vehicles

13.6.2.1. Battery Electric Car

13.6.2.2. Hybrid Electric Car

13.7. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

13.7.1. OEM

13.7.2. Aftermarket

13.8. Key Country Analysis – Asia Pacific Connected Car Devices Market Size Analysis & Forecast, 2017-2031

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. ASEAN Countries

13.8.5. South Korea

13.8.6. ANZ

13.8.7. Rest of Asia Pacific

14. Middle East & Africa Connected Car Devices Market

14.1. Market Snapshot

14.2. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

14.2.1. Advance Driver Assistance Systems (ADAS)

14.2.2. Adaptive cruise control

14.2.3. Lane departure warning

14.2.4. Blind spot detection

14.2.5. Road sign recognition

14.2.6. Park assist

14.2.7. Pedestrian detection system

14.2.8. Telematics

14.2.9. Others

14.3. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

14.3.1. Vehicle to Vehicle (V2V)

14.3.2. Vehicle to Infrastructure (V2I)

14.3.3. Vehicle to Everything (V2X)

14.4. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, Connectivity

14.4.1. Dedicated Short Range Communication (DSRC)

14.4.2. Cellular Network

14.4.3. Others

14.5. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

14.5.1. Hatchback

14.5.2. Sedan

14.5.3. Utility Vehicles

14.6. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

14.6.1. IC Engine Vehicles

14.6.1.1. Gasoline Cars

14.6.1.2. Diesel Cars

14.6.2. Electric Vehicles

14.6.2.1. Battery Electric Car

14.6.2.2. Hybrid Electric Car

14.7. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

14.7.1. OEM

14.7.2. Aftermarket

14.8. Key Country Analysis – Middle East & Africa Connected Car Devices Market Size Analysis & Forecast, 2017-2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Turkey

14.8.4. Rest of Middle East & Africa

15. South America Connected Car Devices Market

15.1. Market Snapshot

15.2. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Technology

15.2.1. Advance Driver Assistance Systems (ADAS)

15.2.2. Adaptive cruise control

15.2.3. Lane departure warning

15.2.4. Blind spot detection

15.2.5. Road sign recognition

15.2.6. Park assist

15.2.7. Pedestrian detection system

15.2.8. Telematics

15.2.9. Others

15.3. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Communication

15.3.1. Vehicle to Vehicle (V2V)

15.3.2. Vehicle to Infrastructure (V2I)

15.3.3. Vehicle to Everything (V2X)

15.4. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, Connectivity

15.4.1. Dedicated Short Range Communication (DSRC)

15.4.2. Cellular Network

15.4.3. Others

15.5. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Car Type

15.5.1. Hatchback

15.5.2. Sedan

15.5.3. Utility Vehicles

15.6. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

15.6.1. IC Engine Vehicles

15.6.1.1. Gasoline Cars

15.6.1.2. Diesel Cars

15.6.2. Electric Vehicles

15.6.2.1. Battery Electric Car

15.6.2.2. Hybrid Electric Car

15.7. Connected Car Devices Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

15.7.1. OEM

15.7.2. Aftermarket

15.8. Key Country Analysis – South America Connected Car Devices Market Size Analysis & Forecast, 2017-2031

15.8.1. Brazil

15.8.2. Argentina

15.8.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2020

16.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. Robert Bosch GmbH

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. ZF Friedrichshafen AG

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Continental AG

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Autoliv Inc.

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Faurecia

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Delphi Technologies PLC

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Azcom

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. DENSO Corporation

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Valeo SA

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Harman International Industries Inc.

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. TE Connectivity

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. WiTricity Corporation

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Other Key Players

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

18. Key Takeaways

18.1. Market Attractiveness Opportunity

18.2. Manufacturer’s Perspective

List of Tables

Table 1: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 2: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 3: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 4: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 5: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 6: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 7: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 8: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 9: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 10: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 11: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 12: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 13: Global Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Region, 2017-2031

Table 14: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Region, 2017-2031

Table 15: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 16: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 17: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 18: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 19: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 20: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 21: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 22: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 23: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 24: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 25: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 26: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 27: North America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 28: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Table 29: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 30: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 31: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 32: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 33: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 34: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 35: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 36: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 37: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 38: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 39: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 40: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 41: Europe Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 42: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Table 43: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 44: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 45: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 46: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 47: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 48: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 49: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 50: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 51: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 52: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 53: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 54: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 55: Asia Pacific Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 56: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Table 57: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 58: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 59: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 60: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 61: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 62: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 63: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 64: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 65: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 66: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 67: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 68: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 69: Middle East & Africa Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 70: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Table 71: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Technology, 2017-2031

Table 72: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Table 73: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Communication, 2017-2031

Table 74: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Table 75: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Connectivity, 2017-2031

Table 76: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Table 77: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Car Type, 2017-2031

Table 78: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Table 79: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 80: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 81: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Sales Channel, 2017-2031

Table 82: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Table 83: South America Connected Car Devices Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 84: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

List of Figures

Figure 1: Global Connected Car Devices Market Volume (Thousand Units) Forecast, 2017–2031

Figure 2: Global Connected Car Devices Market Value (US$ Bn) Forecast, 2017–2031

Figure 3: Key Segment Analysis for Global

Figure 4: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 5: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 6: Global Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 7: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 8: Global Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 9: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 10: Global Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 11: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 12: Global Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 13: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 14: Global Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 15: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 16: Global Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 17: Global Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Region, 2017-2031

Figure 18: Global Market Attractiveness, Value (US$ Bn), by Region, 2022-2031

Figure 19: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 20: North America Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 21: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 22: North America Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 23: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 24: North America Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 25: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 26: North America Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 27: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 28: North America Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 29: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 30: North America Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 31: North America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 32: North America Market Attractiveness, Value (US$ Bn), by Country, 2022-2031

Figure 33: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 34: Europe Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 35: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 36: Europe Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 37: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 38: Europe Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 39: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 40: Europe Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 41: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 42: Europe Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 43: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 44: Europe Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 45: Europe Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 46: Europe Market Attractiveness, Value (US$ Bn), by Country, 2022-2031

Figure 47: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 48: Asia Pacific Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 49: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 50: Asia Pacific Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 51: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 52: Asia Pacific Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 53: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 54: Asia Pacific Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 55: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 56: Asia Pacific Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 57: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 58: Asia Pacific Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 59: Asia Pacific Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 60: Asia Pacific Market Attractiveness, Value (US$ Bn), by Country, 2022-2031

Figure 61: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 62: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 63: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 64: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 65: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 66: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 67: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 68: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 69: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 70: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 71: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 73: Middle East & Africa Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 74: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Country, 2022-2031

Figure 75: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Technology, 2017-2031

Figure 76: South America Market Attractiveness, Value (US$ Bn), by Technology, 2022-2031

Figure 77: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Communication, 2017-2031

Figure 78: South America Market Attractiveness, Value (US$ Bn), by Communication, 2022-2031

Figure 79: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Connectivity, 2017-2031

Figure 80: South America Market Attractiveness, Value (US$ Bn), by Connectivity, 2022-2031

Figure 81: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Car Type, 2017-2031

Figure 82: South America Market Attractiveness, Value (US$ Bn), by Car Type, 2022-2031

Figure 83: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 84: South America Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 85: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Sales Channel, 2017-2031

Figure 86: South America Market Attractiveness, Value (US$ Bn), by Sales Channel, 2022-2031

Figure 87: South America Connected Car Devices Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 88: South America Market Attractiveness, Value (US$ Bn), by Country, 2022-2031