Analysts’ Viewpoint

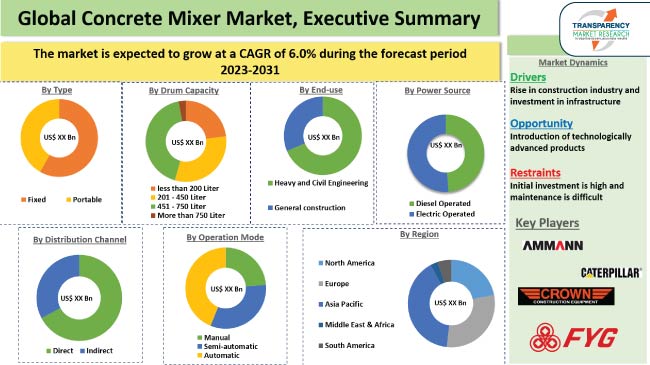

Surge in population, rapid urbanization, strong economic growth, and increase in construction activities in both developed and developing countries is expected to drive the demand for concrete mixers.

Construction of concrete roads, power plants, canals, airports, dams, ports, and other large large-scale venues, fuels the demand for large quantities of concrete. Higher fuel efficiency, intelligent operation, and lower cost of ownership are key features that have enhanced the effectiveness of smart concrete mixers.

Concrete mixer market trends include connected technologies that have penetrated the construction machinery industry; recent years have seen the development of IoT and GPS enabled concrete mixer machines. Self-loading concrete mixers are contributing significantly to the profits of companies owing to their versatility of use, and optimal productivity & reliability, which is expected to increase concrete mixer market demand.

Concrete mixers, commonly known as cement mixers, range from large commercial mixer trucks to small portable mixers, referred to as “mini mixers.” Commercial concrete mixers are typically used to mix and transport large volumes of concrete to construction sites. Portable concrete mixers are sufficient for batches of concrete up to two cubic yards (1.83 m3).

Mobile concrete mixers are used to batch concrete in one area and then move it to another. Mobile mixers, such as cement mixer trucks, are often used for pouring concrete in pavements and other applications where concrete is needed in multiple areas.

Stationary concrete mixers are another option for mixing. This type of mixer is designed to stay in place while the concrete is being poured. The three common types of stationary concrete mixers include twin shaft mixers, vertical axis mixers, and drum mixers. Twin-shaft concrete mixers are known for high mixing intensity and short dosing time.

Concrete mixer emerging markets such as Egypt, India, and Indonesia, are building cities to re-house the population. Egypt is building a new administrative capital at a cost of about US$ 40 Bn. Governments are devising measures to support sustainable communities and housing initiatives in their budgets to offer affordable housing for the homeless and vulnerable families. The housing industry in India is one of the fastest growing sectors with an estimated shortfall of around 18 million housing units, 99% of which are in economically disadvantaged areas.

Growth of construction machinery including concrete mixers is positively influenced by the increase in focus on public-private partnerships (PPP) in countries such as India, Africa, and China. Rapid urbanization globally has increased the demand for building infrastructure such as housing and transportation that is expected to augment the concrete mixer market share. The U.S government has allocated US$110 Bn under its Bipartisan Infrastructure act to repair roads and bridges. The country has earmarked US$ 66 Bn to upgrade its Northeast Rail Corridor along with other related rail projects.

Concrete mixers allow the user to control the amount of concrete needed in one area at a time and provides the ability to add additional media to the batch. Concrete trucks are commonly used for mixing high-strength concrete, often in batches of 2-6 m3. Drum concrete mixers are used for the production of large volumes of concrete. These mixers are characterized by high production speed, low maintenance, and are ideal for slump concrete.

Technological innovations in construction equipment are expected to provide lucrative growth opportunities for players in the global concrete mixer market. Developments in technology have taken place since the invention of modern concrete mixing.

Currently, truck drum mixer, which most closely resembles the original invention of modern mixing, is complemented by additional concrete mixing technologies. Sales of concrete mixers are further significantly supported by increase in customer demand for higher technical standards, faster navigation, and ability to move these devices around construction sites.

The three dominant mixing technologies most widely accepted by today's concrete producers are planetary, horizontal shaft, and drum. In recent years, planetary mixers are increasingly preferred for all types of concrete, and their demand in the concrete mixer industry is expected to increase worldwide.

As per the latest concrete mixer market forecast, Asia Pacific is expected to dominate the landscape during the forecast period. The market is driven by China, Singapore, and India; Japan is struggling with housing constraints as the country's population shrinks. China's multibillion-dollar "One Belt, One Road" initiative, which aims to connect Southeast Asia with Eastern Europe and Africa, includes 71 countries representing half the world's population and a quarter of global GDP. On the other hand, India is expected to be one of the fastest growing construction markets in the world as the country is on track to replace China as the world's most populous country by 2022.

Furthermore, Asia is home to some of the world's leading construction corporations. Their combined sales account for roughly half of all global construction sector sales. Businesses are increasing their footprint by building new factories and upgrading their existing concrete mixers.

Strong presence of prominent companies such as Caterpillar and SANY America is driving market expansion in North America. Technological development, strategic partnerships, acquisitions, and focus on aftermarket services are expected to positively influence market progress in North America.

Most of the companies in the sector are spending significantly on comprehensive research and development activities, primarily to produce advanced concrete mixers. Ammann Group, Caterpillar Inc., Crown Construction Equipment, Fangyuan Group Co. Ltd, Liebherr-International AG, Lino Sella World, Multiquip Inc., SANY Group Co., Ltd., Terex Corporation, and Zhengzhou Great Wall Machinery Manufacture Co., Ltd., are the prominent concrete mixer manufacturers operating in this market.

Key players have been profiled in the global concrete mixer market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 3.1 Bn |

|

Market Forecast Value in 2031 |

US$ 5.2 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.1 Bn in 2022

The CAGR is projected to be 6.0% from 2023 to 2031

It is expected to reach US$ 5.2 Bn by 2031

Growth in construction industry, rise in investments in infrastructure sector, technologically advanced products, and government support

Asia Pacific accounted for maximum share of the market in 2022

Ammann Group, Caterpillar Inc., Crown Construction Equipment, Fangyuan Group Co. Ltd, Liebherr-International AG, Lino Sella World, Multiquip Inc., Sany Group Co., Ltd., Terex Corporation, and Zhengzhou Great Wall Machinery Manufacture Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Material Analysis

5.9. Technological Overview Analysis

5.10. Global Concrete Mixer Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Concrete Mixer Market Analysis and Forecast, By Type

6.1. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

6.1.1. Fixed

6.1.1.1. Batch Mixers

6.1.1.1.1. Drum Type Mixer

6.1.1.1.1.1. Tilting drum Mixer

6.1.1.1.1.2. Non-tilting Drum Mixer

6.1.1.1.1.3. Reversing Drum Mixer

6.1.1.1.2. Pan Type Mixer

6.1.1.2. Continuous Mixers

6.1.2. Portable

6.1.2.1. Batch Mixers

6.1.2.1.1. Drum Type Mixer

6.1.2.1.1.1. Tilting drum Mixer

6.1.2.1.1.2. Non-tilting Drum Mixer

6.1.2.1.1.3. Reversing Drum Mixer

6.1.2.1.2. Pan Type Mixer

6.1.2.2. Continuous Mixers

6.2. Incremental Opportunity, By Type

7. Global Concrete Mixer Market Analysis and Forecast, By Power Source

7.1. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

7.1.1. Diesel Operated

7.1.2. Electric Operated

7.2. Incremental Opportunity, By Power Source

8. Global Concrete Mixer Market Analysis and Forecast, By Drum Capacity

8.1. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

8.1.1. Less than 200 liter

8.1.2. 201 - 450 liter

8.1.3. 451 - 750 liter

8.1.4. More than 750 liter

8.2. Incremental Opportunity, By Drum Capacity

9. Global Concrete Mixer Market Analysis and Forecast, By Operation Mode

9.1. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

9.1.1. Manual

9.1.2. Semi-automatic

9.1.3. Automatic

9.2. Incremental Opportunity, By Operation Mode

10. Global Concrete Mixer Market Analysis and Forecast, By End-use

10.1. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

10.1.1. Heavy and Civil Engineering

10.1.1.1. Bridge

10.1.1.2. Road

10.1.1.3. Railways

10.1.1.4. Airports

10.1.1.5. Others

10.1.2. General construction

10.2. Incremental Opportunity, By End-use

11. Global Concrete Mixer Market Analysis and Forecast, By Distribution Channel

11.1. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.1.1. Direct

11.1.2. Indirect

11.2. Incremental Opportunity, By Distribution Channel

12. Global Concrete Mixer Market Analysis and Forecast, By Region

12.1. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Concrete Mixer Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

13.5.1. Fixed

13.5.1.1. Batch Mixers

13.5.1.1.1. Drum Type Mixer

13.5.1.1.1.1. Tilting drum Mixer

13.5.1.1.1.2. Non-tilting Drum Mixer

13.5.1.1.1.3. Reversing Drum Mixer

13.5.1.1.2. Pan Type Mixer

13.5.1.2. Continuous Mixers

13.5.2. Portable

13.5.2.1. Batch Mixers

13.5.2.1.1. Drum Type Mixer

13.5.2.1.1.1. Tilting drum Mixer

13.5.2.1.1.2. Non-tilting Drum Mixer

13.5.2.1.1.3. Reversing Drum Mixer

13.5.2.1.2. Pan Type Mixer

13.5.2.2. Continuous Mixers

13.6. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

13.6.1. Diesel Operated

13.6.2. Electric Operated

13.7. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

13.7.1. Less than 200 liter

13.7.2. 201 - 450 liter

13.7.3. 451 - 750 liter

13.7.4. More than 750 liter

13.8. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

13.8.1. Manual

13.8.2. Semi-automatic

13.8.3. Automatic

13.9. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

13.9.1. Heavy and Civil Engineering

13.9.1.1. Bridge

13.9.1.2. Road

13.9.1.3. Railways

13.9.1.4. Airports

13.9.1.5. Others

13.9.2. General construction

13.10. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

13.10.1. Direct

13.10.2. Indirect

13.11. Concrete Mixer Market Size (US$ Mn) (Thousand Units), By Country/Sub-region, 2017 - 2031

13.11.1. U.S.

13.11.2. Canada

13.11.3. Rest of North America

13.12. Incremental Opportunity Analysis

14. Europe Concrete Mixer Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

14.5.1. Fixed

14.5.1.1. Batch Mixers

14.5.1.1.1. Drum Type Mixer

14.5.1.1.1.1. Tilting drum Mixer

14.5.1.1.1.2. Non-tilting Drum Mixer

14.5.1.1.1.3. Reversing Drum Mixer

14.5.1.1.2. Pan Type Mixer

14.5.1.2. Continuous Mixers

14.5.2. Portable

14.5.2.1. Batch Mixers

14.5.2.1.1. Drum Type Mixer

14.5.2.1.1.1. Tilting drum Mixer

14.5.2.1.1.2. Non-tilting Drum Mixer

14.5.2.1.1.3. Reversing Drum Mixer

14.5.2.1.2. Pan Type Mixer

14.5.2.2. Continuous Mixers

14.6. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

14.6.1. Diesel Operated

14.6.2. Electric Operated

14.7. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

14.7.1. Less than 200 liter

14.7.2. 201 - 450 liter

14.7.3. 451 - 750 liter

14.7.4. More than 750 liter

14.8. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

14.8.1. Manual

14.8.2. Semi-automatic

14.8.3. Automatic

14.9. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

14.9.1. Heavy and Civil Engineering

14.9.1.1. Bridge

14.9.1.2. Road

14.9.1.3. Railways

14.9.1.4. Airports

14.9.1.5. Others

14.9.2. General construction

14.10. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

14.10.1. Direct

14.10.2. Indirect

14.11. Concrete Mixer Market Size (US$ Mn) (Thousand Units), By Country/Sub-region, 2017 - 2031

14.11.1. U.K.

14.11.2. Germany

14.11.3. France

14.11.4. Rest of Europe

14.12. Incremental Opportunity Analysis

15. Asia Pacific Concrete Mixer Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

15.5.1. Fixed

15.5.1.1. Batch Mixers

15.5.1.1.1. Drum Type Mixer

15.5.1.1.1.1. Tilting drum Mixer

15.5.1.1.1.2. Non-tilting Drum Mixer

15.5.1.1.1.3. Reversing Drum Mixer

15.5.1.1.2. Pan Type Mixer

15.5.1.2. Continuous Mixers

15.5.2. Portable

15.5.2.1. Batch Mixers

15.5.2.1.1. Drum Type Mixer

15.5.2.1.1.1. Tilting drum Mixer

15.5.2.1.1.2. Non-tilting Drum Mixer

15.5.2.1.1.3. Reversing Drum Mixer

15.5.2.1.2. Pan Type Mixer

15.5.2.2. Continuous Mixers

15.6. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

15.6.1. Diesel Operated

15.6.2. Electric Operated

15.7. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

15.7.1. Less than 200 liter

15.7.2. 201 - 450 liter

15.7.3. 451 - 750 liter

15.7.4. More than 750 liter

15.8. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

15.8.1. Manual

15.8.2. Semi-automatic

15.8.3. Automatic

15.9. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

15.9.1. Heavy and Civil Engineering

15.9.1.1. Bridge

15.9.1.2. Road

15.9.1.3. Railways

15.9.1.4. Airports

15.9.1.5. Others

15.9.2. General construction

15.10. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

15.10.1. Direct

15.10.2. Indirect

15.11. Concrete Mixer Market Size (US$ Mn) (Thousand Units), By Country/Sub-region, 2017 - 2031

15.11.1. China

15.11.2. India

15.11.3. Japan

15.11.4. Rest of Asia Pacific

15.12. Incremental Opportunity Analysis

16. Middle East & Africa Concrete Mixer Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

16.5.1. Fixed

16.5.1.1. Batch Mixers

16.5.1.1.1. Drum Type Mixer

16.5.1.1.1.1. Tilting drum Mixer

16.5.1.1.1.2. Non-tilting Drum Mixer

16.5.1.1.1.3. Reversing Drum Mixer

16.5.1.1.2. Pan Type Mixer

16.5.1.2. Continuous Mixers

16.5.2. Portable

16.5.2.1. Batch Mixers

16.5.2.1.1. Drum Type Mixer

16.5.2.1.1.1. Tilting drum Mixer

16.5.2.1.1.2. Non-tilting Drum Mixer

16.5.2.1.1.3. Reversing Drum Mixer

16.5.2.1.2. Pan Type Mixer

16.5.2.2. Continuous Mixers

16.6. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

16.6.1. Diesel Operated

16.6.2. Electric Operated

16.7. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

16.7.1. Less than 200 liter

16.7.2. 201 - 450 liter

16.7.3. 451 - 750 liter

16.7.4. More than 750 liter

16.8. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

16.8.1. Manual

16.8.2. Semi-automatic

16.8.3. Automatic

16.9. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

16.9.1. Heavy and Civil Engineering

16.9.1.1. Bridge

16.9.1.2. Road

16.9.1.3. Railways

16.9.1.4. Airports

16.9.1.5. Others

16.9.2. General construction

16.10. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

16.10.1. Direct

16.10.2. Indirect

16.11. Concrete Mixer Market Size (US$ Mn) (Thousand Units), By Country/Sub-region, 2017 - 2031

16.11.1. GCC

16.11.2. South Africa

16.11.3. Rest of Middle East & Africa

16.12. Incremental Opportunity Analysis

17. South America Concrete Mixer Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Type, 2017 - 2031

17.5.1. Fixed

17.5.1.1. Batch Mixers

17.5.1.1.1. Drum Type Mixer

17.5.1.1.1.1. Tilting drum Mixer

17.5.1.1.1.2. Non-tilting Drum Mixer

17.5.1.1.1.3. Reversing Drum Mixer

17.5.1.1.2. Pan Type Mixer

17.5.1.2. Continuous Mixers

17.5.2. Portable

17.5.2.1. Batch Mixers

17.5.2.1.1. Drum Type Mixer

17.5.2.1.1.1. Tilting drum Mixer

17.5.2.1.1.2. Non-tilting Drum Mixer

17.5.2.1.1.3. Reversing Drum Mixer

17.5.2.1.2. Pan Type Mixer

17.5.2.2. Continuous Mixers

17.6. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Power Source, 2017 - 2031

17.6.1. Diesel Operated

17.6.2. Electric Operated

17.7. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Drum Capacity, 2017 - 2031

17.7.1. Less than 200 liter

17.7.2. 201 - 450 liter

17.7.3. 451 - 750 liter

17.7.4. More than 750 liter

17.8. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By Operation Mode, 2017 - 2031

17.8.1. Manual

17.8.2. Semi-automatic

17.8.3. Automatic

17.9. Concrete Mixer Market Size (US$ Mn and Thousand Units ), By End-use, 2017 - 2031

17.9.1. Heavy and Civil Engineering

17.9.1.1. Bridge

17.9.1.2. Road

17.9.1.3. Railways

17.9.1.4. Airports

17.9.1.5. Others

17.9.2. General construction

17.10. Concrete Mixer Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

17.10.1. Direct

17.10.2. Indirect

17.11. Concrete Mixer Market Size (US$ Mn) (Thousand Units), By Country/Sub-region, 2017 - 2031

17.11.1. Brazil

17.11.2. Rest of South America

17.12. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis (%), 2022

18.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments)

18.3.1. Ammann Group

18.3.1.1. Company Overview

18.3.1.2. Product Portfolio

18.3.1.3. Financial Information, (Subject to Data Availability)

18.3.1.4. Business Strategies / Recent Developments

18.3.2. Caterpillar Inc.

18.3.2.1. Company Overview

18.3.2.2. Product Portfolio

18.3.2.3. Financial Information, (Subject to Data Availability)

18.3.2.4. Business Strategies / Recent Developments

18.3.3. Crown Construction Equipment

18.3.3.1. Company Overview

18.3.3.2. Product Portfolio

18.3.3.3. Financial Information, (Subject to Data Availability)

18.3.3.4. Business Strategies / Recent Developments

18.3.4. Fangyuan Group Co. Ltd.

18.3.4.1. Company Overview

18.3.4.2. Product Portfolio

18.3.4.3. Financial Information, (Subject to Data Availability)

18.3.4.4. Business Strategies / Recent Developments

18.3.5. Liebherr-International AG

18.3.5.1. Company Overview

18.3.5.2. Product Portfolio

18.3.5.3. Financial Information, (Subject to Data Availability)

18.3.5.4. Business Strategies / Recent Developments

18.3.6. Lino Sella World

18.3.6.1. Company Overview

18.3.6.2. Product Portfolio

18.3.6.3. Financial Information, (Subject to Data Availability)

18.3.6.4. Business Strategies / Recent Developments

18.3.7. Multiquip Inc.

18.3.7.1. Company Overview

18.3.7.2. Product Portfolio

18.3.7.3. Financial Information, (Subject to Data Availability)

18.3.7.4. Business Strategies / Recent Developments

18.3.8. Sany Group Co., Ltd.

18.3.8.1. Company Overview

18.3.8.2. Product Portfolio

18.3.8.3. Financial Information, (Subject to Data Availability)

18.3.8.4. Business Strategies / Recent Developments

18.3.9. Terex Corporation

18.3.9.1. Company Overview

18.3.9.2. Product Portfolio

18.3.9.3. Financial Information, (Subject to Data Availability)

18.3.9.4. Business Strategies / Recent Developments

18.3.10. Zhengzhou Great Wall Machinery Manufacture Co., Ltd.

18.3.10.1. Company Overview

18.3.10.2. Product Portfolio

18.3.10.3. Financial Information, (Subject to Data Availability)

18.3.10.4. Business Strategies / Recent Developments

18.3.11. Other key Players

18.3.11.1. Company Overview

18.3.11.2. Product Portfolio

18.3.11.3. Financial Information, (Subject to Data Availability)

18.3.11.4. Business Strategies / Recent Developments

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding the Buying Process of Customers

List of Tables

Table 1: Global Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 2: Global Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 3: Global Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 4: Global Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 5: Global Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 6: Global Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 7: Global Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 8: Global Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 9: Global Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 10: Global Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 11: Global Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 12: Global Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 13: Global Concrete Mixer Market Volume(Thousand Units) Share, By Region 2017-2031

Table 14: Global Concrete Mixer Market Value(US$ Mn) Share, By Region 2017-2031

Table 15: North America Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 16: North America Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 17: North America Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 18: North America Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 19: North America Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 20: North America Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 21: North America Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 22: North America Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 23: North America Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 24: North America Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 25: North America Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 26: North America Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 27: North America Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Table 28: North America Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Table 29: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 30: Europe Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 31: Europe Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 32: Europe Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 33: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 34: Europe Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 35: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 36: Europe Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 37: Europe Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 38: Europe Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 39: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 40: Europe Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 41: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Table 42: Europe Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Table 43: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 44: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 45: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 46: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 47: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 48: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 49: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 50: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 51: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 52: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 53: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 54: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 55: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Table 56: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Table 57: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 58: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 59: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 60: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 61: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 62: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 63: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 64: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 65: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 66: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 67: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 68: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 69: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Table 70: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Table 71: South America Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Table 72: South America Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Table 73: South America Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Table 74: South America Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Table 75: South America Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Table 76: South America Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Table 77: South America Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Table 78: South America Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Table 79: South America Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Table 80: South America Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Table 81: South America Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Table 82: South America Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Table 83: South America Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Table 84: South America Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

List of Figures

Figures 1: Global Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 2: Global Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 3: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 4: Global Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 5: Global Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 6: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 7: Global Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 8: Global Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 9: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 10: Global Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 11: Global Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 12: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 13: Global Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 14: Global Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 15: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 16: Global Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 17: Global Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 18: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 19: Global Concrete Mixer Market Volume(Thousand Units) Share, By Region 2017-2031

Figures 20: Global Concrete Mixer Market Value(US$ Mn) Share, By Region 2017-2031

Figures 21: Global Concrete Mixer Market Incremental Opportunity (US$ Mn),By Region 2017-2031

Figures 22: North America Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 23: North America Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 24: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 25: North America Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 26: North America Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 27: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 28: North America Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 29: North America Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 30: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 31: North America Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 32: North America Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 33: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 34: North America Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 35: North America Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 36: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 37: North America Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 38: North America Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 39: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 40: North America Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 41: North America Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Figures 42: North America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figures 43: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 44: Europe Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 45: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 46: Europe Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 47: Europe Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 48: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 49: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 50: Europe Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 51: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 52: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 53: Europe Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 54: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 55: Europe Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 56: Europe Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 57: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 58: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 59: Europe Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 60: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 61: Europe Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 62: Europe Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Figures 63: Europe Concrete Mixer Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figures 64: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 65: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 66: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 67: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 68: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 69: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 70: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 71: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 72: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 73: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 74: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 75: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 76: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 77: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 78: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 79: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 80: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 81: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 82: Asia Pacific Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 83: Asia Pacific Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Figures 84: Asia Pacific Concrete Mixer Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figures 85: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 86: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 87: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 88: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 89: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 90: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 91: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 92: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 93: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 94: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 95: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 96: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 97: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 98: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 99: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 100: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 101: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 102: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 103: Middle East & Africa Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 104: Middle East & Africa Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Figures 105: Middle East & Africa Concrete Mixer Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figures 106: South America Concrete Mixer Market Volume(Thousand Units) Share, By Type 2017-2031

Figures 107: South America Concrete Mixer Market Value(US$ Mn) Share, By Type 2017-2031

Figures 108: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Type 2017-2031

Figures 109: South America Concrete Mixer Market Volume(Thousand Units) Share, by Power Source 2017-2031

Figures 110: South America Concrete Mixer Market Value(US$ Mn) Share, by Power Source 2017-2031

Figures 111: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),by Power Source 2017-2031

Figures 112: South America Concrete Mixer Market Volume(Thousand Units) Share, By Drum Capacity 2017-2031

Figures 113: South America Concrete Mixer Market Value(US$ Mn) Share, By Drum Capacity 2017-2031

Figures 114: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Drum Capacity 2017-2031

Figures 115: South America Concrete Mixer Market Volume(Thousand Units) Share, By Operation Mode 2017-2031

Figures 116: South America Concrete Mixer Market Value(US$ Mn) Share, By Operation Mode 2017-2031

Figures 117: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Operation Mode 2017-2031

Figures 118: South America Concrete Mixer Market Volume(Thousand Units) Share, By End-use 2017-2031

Figures 119: South America Concrete Mixer Market Value(US$ Mn) Share, By End-use 2017-2031

Figures 120: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By End-use 2017-2031

Figures 121: South America Concrete Mixer Market Volume(Thousand Units) Share, By Distribution Channel 2017-2031

Figures 122: South America Concrete Mixer Market Value(US$ Mn) Share, By Distribution Channel 2017-2031

Figures 123: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Distribution Channel 2017-2031

Figures 124: South America Concrete Mixer Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 125: South America Concrete Mixer Market Value(US$ Mn) Share, By Country 2017-2031

Figures 126: South America Concrete Mixer Market Incremental Opportunity (US$ Mn),By Country 2017-2031